Overview

In October 2024, India’s startup ecosystem saw a funding flow of ₹7,948 crores across 108 deals, reflecting resilience in the face of global economic headwinds.

This marks a 1% month-on-month increase in deal volume, although the deal value saw a 37% decline from the September high of ₹12,715 crores, indicating a shift in investor priorities toward fewer, high-impact investments.

The top three deals alone accounted for over ₹3,000 crores, underscoring concentrated investments in select high-growth sectors.

October 2024 Startup Funding Figures:

- Investor Type Deal Volume: Angel Investors – 28 deals | Family Offices – 07 deals | VC/PE – 64 deals

- Most Active Investors: Inflection Point Ventures – 05 deals | Accel India – 03 deals | Alpha Wave Global – 03 deals

- Top 3 Deals: Elan ₹1,200 cr | Finova Capital ₹1,135 cr | Onesource ₹801 cr

Blog Outline; Data and Insights by PrivateCircle Research.

- Deal Volume

- Total Deal Value

- Top 3 Deals

- Top Investors

- Investor Type Deal Volume

- Job Creation & Economic Impact

- Comparative Analysis – Monthly Performance | Investor Activity

- In-Depth Insights

- Funding Dynamics

- Strategic Investments

- Conclusion

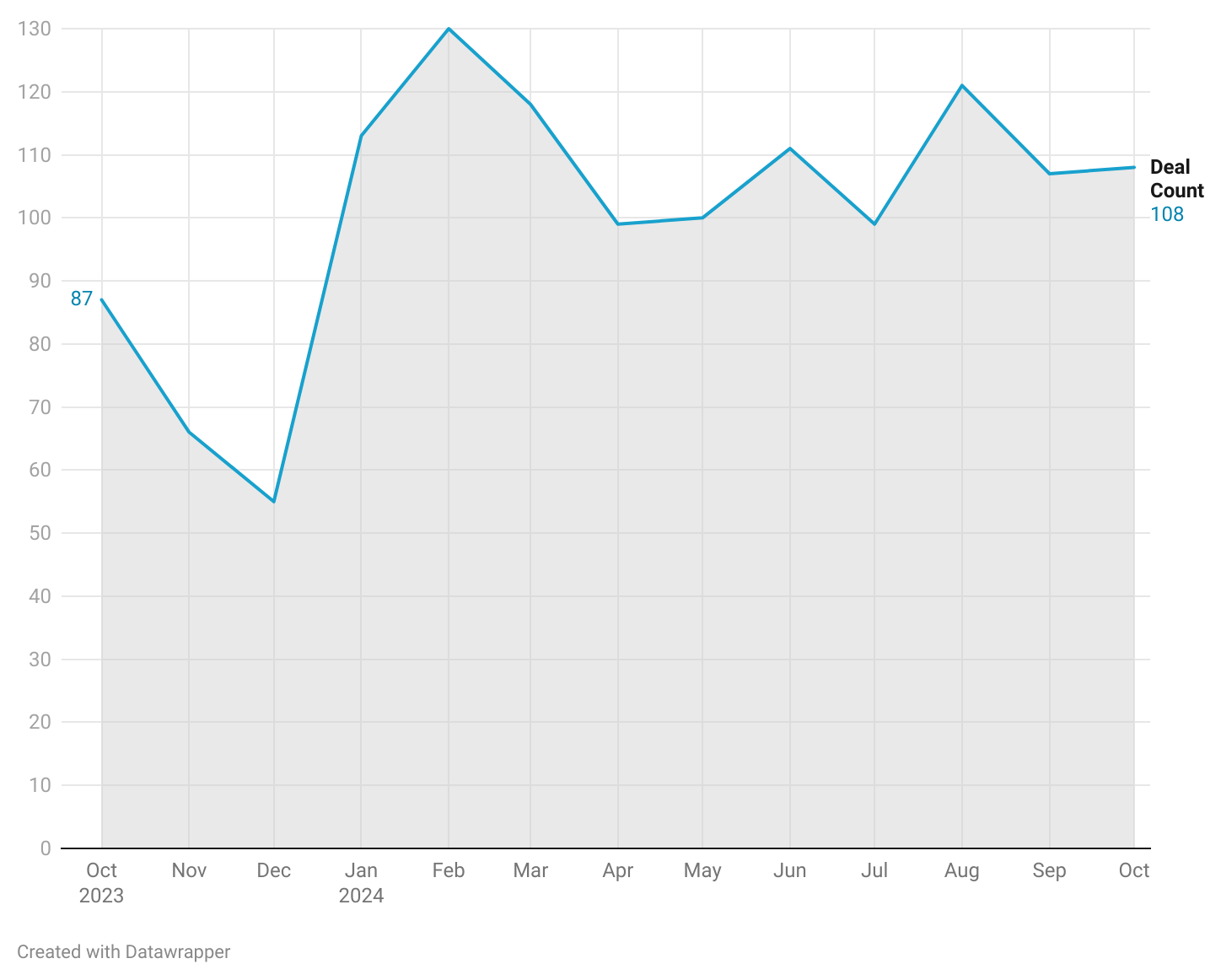

Deal Volume

In October 2024, deal volumes experienced a modest increase of 1% compared to the previous month of September 2024 and a notable 24% increase compared to October 2023.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 102 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

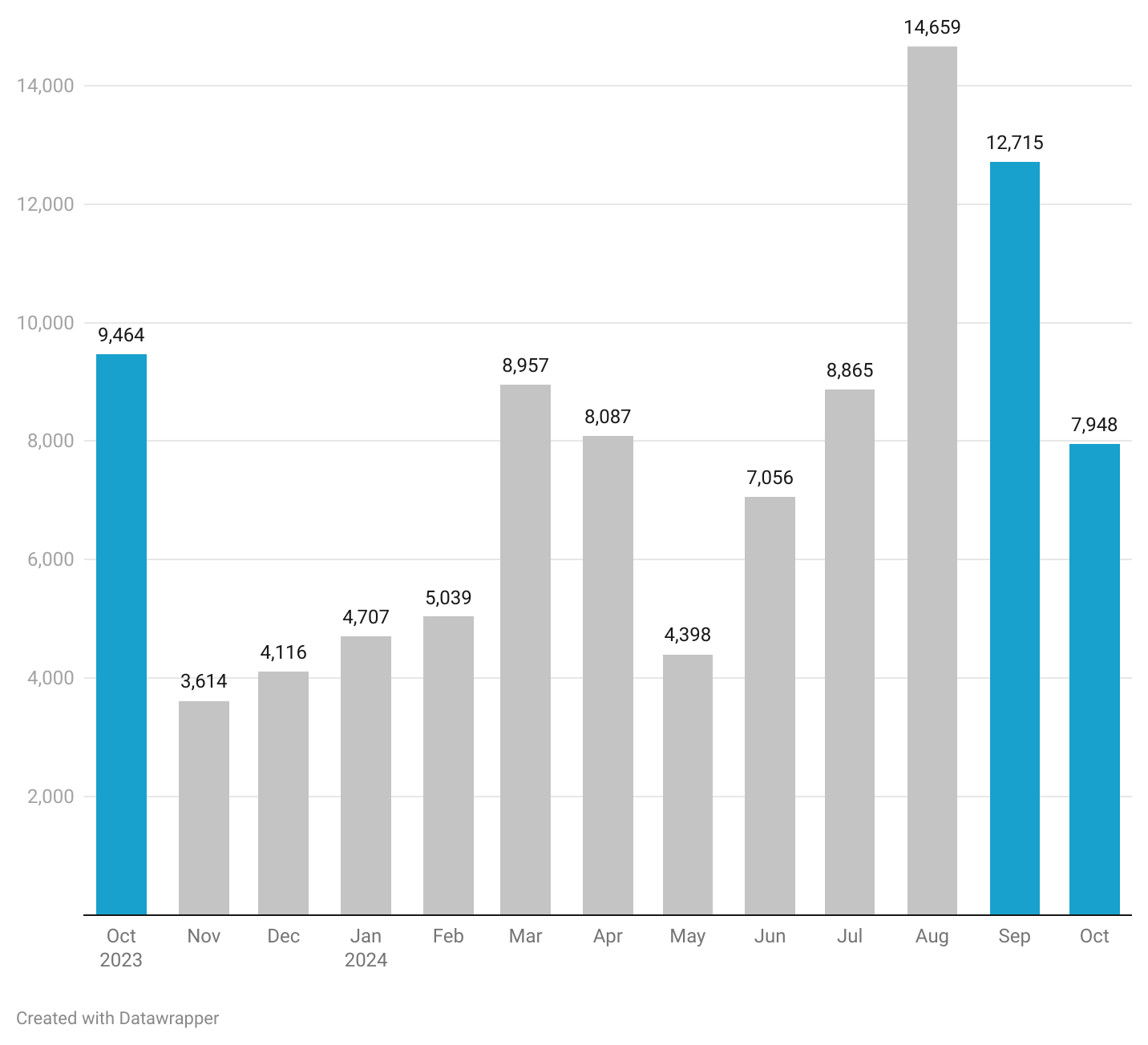

Total Deal Value (₹ cr)

In October 2024, the amount raised by the startup ecosystem totalled ₹7,948 crores, reflecting a 37% decline from the peak of ₹12,715 crores in September 2024.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 102 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

Top 3 Deals (₹ cr)

The largest deal in October was raised by Elan, securing ₹1,200 crores, followed closely by Finova Capital with ₹1,135 crores and Onesource at ₹801 crores.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 102 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

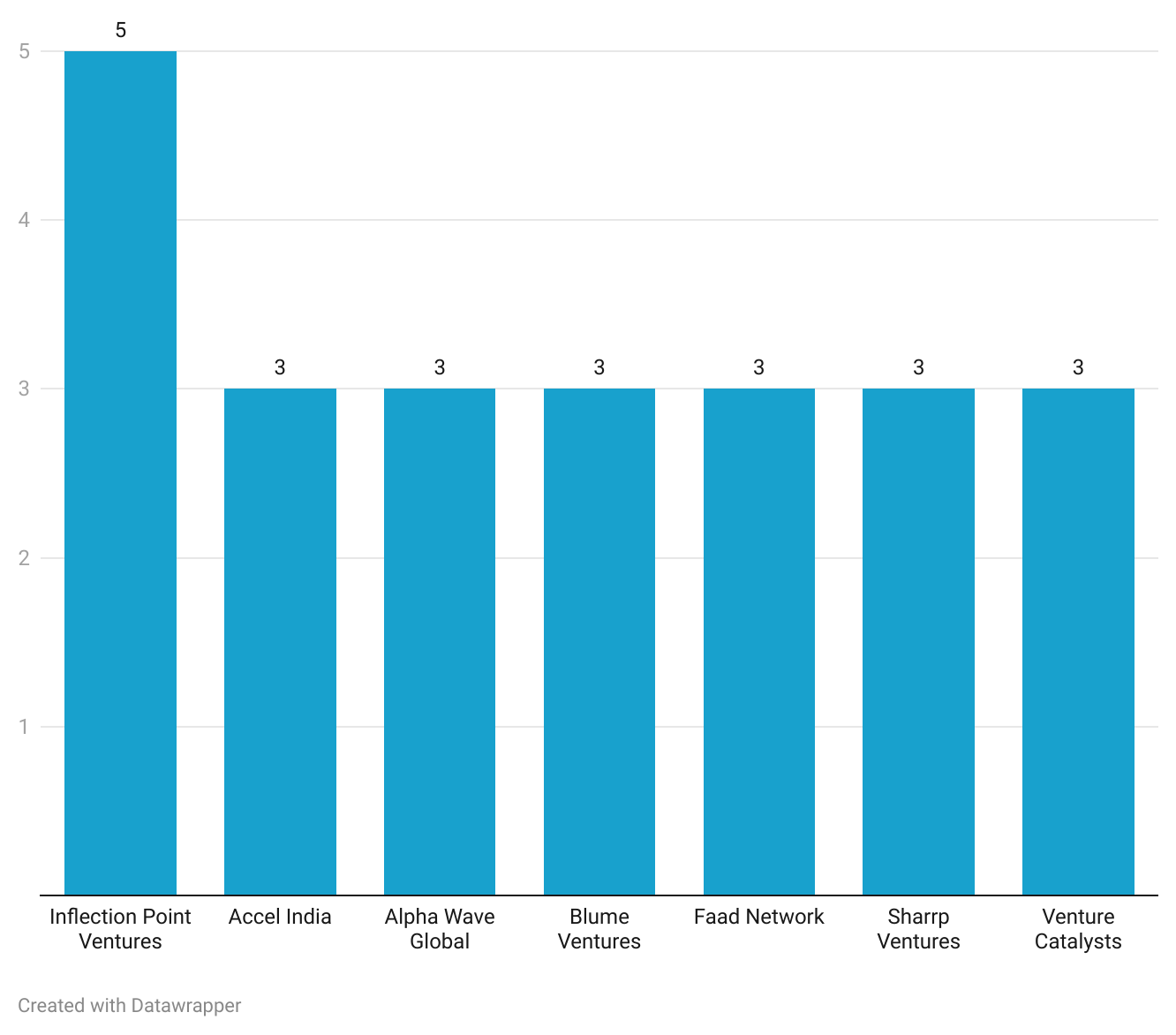

Top Investors

In October 2024, Inflection Point Ventures led with 5 deals, achieving the highest deal volume for a single investor during the month.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 102 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

They were closely followed by Accel India, Alpha Wave Global, Blume Ventures, Faad Network, Sharrp Ventures, and Venture Catalysts, each completing 3 deals.

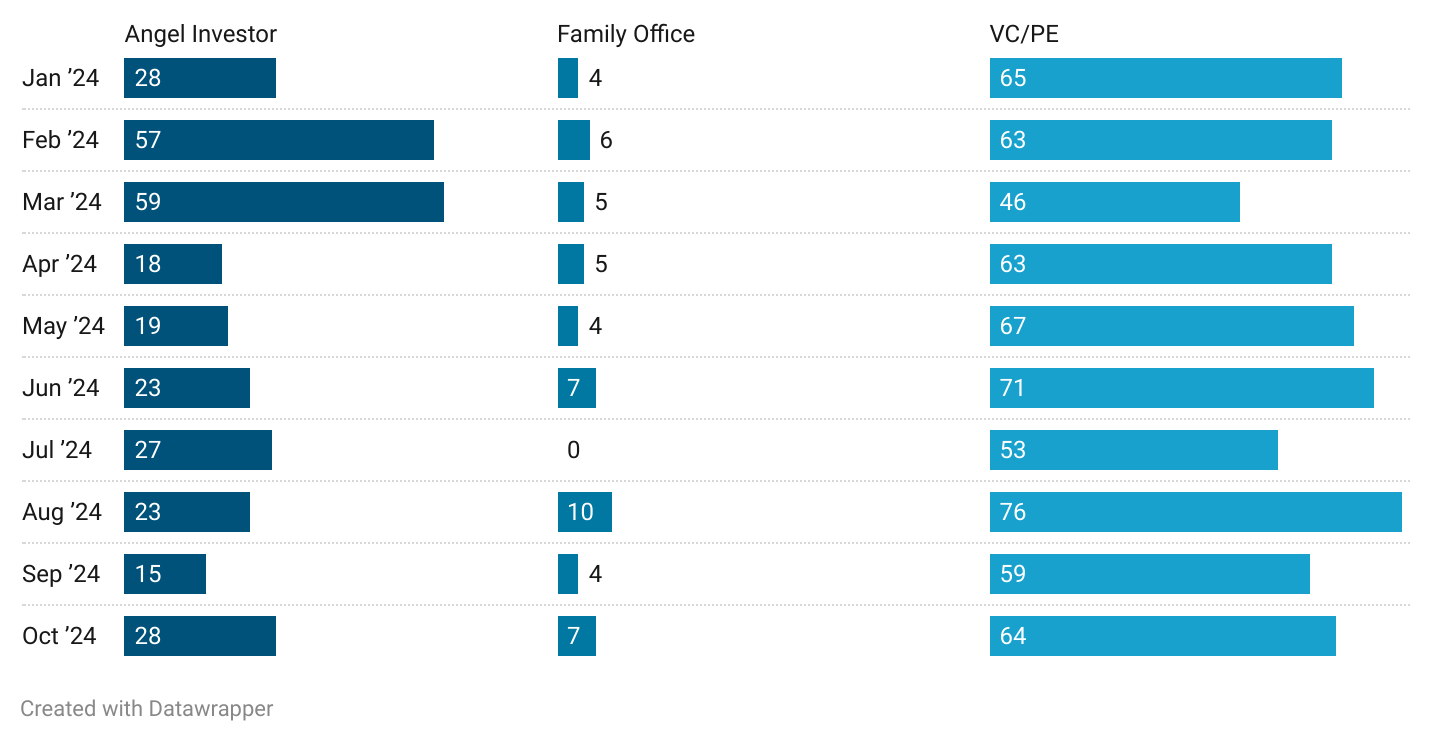

Investor Type Deal Volume

In October 2024, there was an uptick in investments across all investor types. Angel Investor deals jumped to 28 from 15 in September 2024.

Note: Any funding deal can have participation from more than one type of investors (angel investor, family office etc) resulting in deals being counted more than once in this analysis.

Family Office deals increased to 7 from 4 in September and VC/PE deals edged up to 64, compared to 59 in September.

Job Creation and Economic Impact

The October funding patterns point to significant job creation, particularly within high-investment sectors like fintech, health tech, and consumer tech.

With large funding rounds backing startups like Elan and Finova Capital, which specialize in financial services and healthcare, the growth in these areas promises to contribute to robust job creation across the tech, service, and operations segments.

Large-scale investments are projected to sustain not only direct employment but also fuel the gig economy through contractual and freelance opportunities, further stimulating India’s economic ecosystem.

Comparative Analysis

Compared to the same period in 2023, the Indian startup ecosystem has grown substantially, with a 24% year-over-year increase in deal volume.

The dip in funding value from September’s peak, however, reflects strategic recalibration, as investors concentrate capital in startups demonstrating stable growth potential amid market volatility.

This month’s data showcases the resilience of Indian startups, especially compared to more muted global markets where rising inflation and higher interest rates have dampened funding activities.

October’s numbers indicate that investors continue to see India as a high-growth market, justifying sustained inflows despite the downturn.

Monthly Performance

October’s modest rise in deal volume and dip in funding totals signify shifting investor focus towards capital-efficient, high-return sectors.

Angel investors exhibited notable activity with 28 deals, a significant increase from 15 deals in September, suggesting heightened interest in early-stage startups. Furthermore, venture capital and private equity deals also rose to 64, up from 59 in the previous month.

This performance shift reflects the continued momentum in India’s startup landscape, balancing cautious optimism with strategic fund allocations.

Investor Activity

Inflection Point Ventures led investor activity in October with five deals, indicating a bullish stance on India’s early and growth-stage startups.

Close followers—Accel India, Alpha Wave Global, Blume Ventures, and others—each closed three deals, demonstrating sustained interest in market-disrupting solutions.

Family offices and angel investors have been integral in nurturing early-stage startups, reflecting a risk-tolerant approach to high-potential ventures.

Such diversification across investor types emphasizes their confidence in India’s burgeoning market, evidenced by the continued funding flow from both local and global players.

In-depth Insights

October’s funding data provides unique insights into investor sentiment and sector focus. While fintech and healthcare attracted the largest deals, sectors like consumer tech and sustainability gained traction among angel and family office investors.

This shift toward smaller yet scalable investments signals a cautious yet strategic approach. Family offices and angel investors prioritize stable returns and long-term gains, evidenced by their selective engagement in high-growth markets.

VC/PE firms, representing 64 deals, have recalibrated their strategies to focus on sectors demonstrating sustainable profitability and market adaptability.

Funding Dynamics

The funding dynamics in October 2024 reflect a nuanced approach among investors. Rather than chasing volume, many are prioritizing quality investments with the potential for long-term scalability.

The concentration of capital within fewer high-profile deals, especially in sectors like fintech and healthcare, points to a maturing ecosystem where capital efficiency and sustainability are increasingly valued.

These dynamics underscore a trend of concentrated, strategic funding over more dispersed capital injections, with investors keen on startups that can withstand market challenges while continuing to innovate.

Strategic Investments

October’s top investments highlight strategic choices by investors focusing on sectors with high scalability potential.

Elan, for instance, secured the largest funding round at ₹1,200 crores, followed by Finova Capital and Onesource, each raising over ₹800 crores. These deals reveal investors’ preferences for scalable, market-ready models capable of penetrating underserved demographics.

Investors are targeting startups with robust market validation and solid growth trajectories, aligning with a vision for long-term resilience over short-term gains.

These strategic bets indicate that investors see India’s startup landscape as a fertile ground for pioneering tech-driven solutions.

Conclusion

October’s funding snapshot highlights a maturing Indian startup ecosystem characterized by selective yet high-value investments.

Despite a dip in funding totals from the previous month, the consistency in deal volume suggests that investor confidence in India’s market resilience remains strong.

The focus on concentrated, strategic investments across scalable sectors underscores a shift towards capital efficiency, indicating a preference for quality over quantity. This trend sets a foundation for sustainable growth, with India’s startups well-positioned to weather market fluctuations and drive economic progress.

As we move into the year’s final quarter, the outlook remains optimistic, with investors and startups alike adapting to an evolving landscape, setting the stage for continued innovation and economic impact.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Credits

Nishmitha Devadiga and Subrahmanya U R from PrivateCircle Team.

Explore More Startup Funding Recaps:

Monthly Funding Summary Report: January 2024

Monthly Funding Summary Report: February 2024

Monthly Funding Summary Report: March 2024

Startup Funding Recap: April 2024

Startup Funding Recap: May 2024

Startup Funding Recap: June 2024

Startup Funding Recap: July 2024