The startup ecosystem experienced significant fluctuations in May 2024.

While total funding reached ₹4,398 crores across 100 deals, there was a notable 46% decline in amount raised from the previous month. However, this downturn is offset by a year-over-year growth of 33%, indicating a robust increase in funding activity over the past 12 months.

Highlights to explore; Data and Insights by PrivateCircle Research.

- Deal Volume

- Total Value

- Top 3 Deals

- Top Investors

- Investor Type

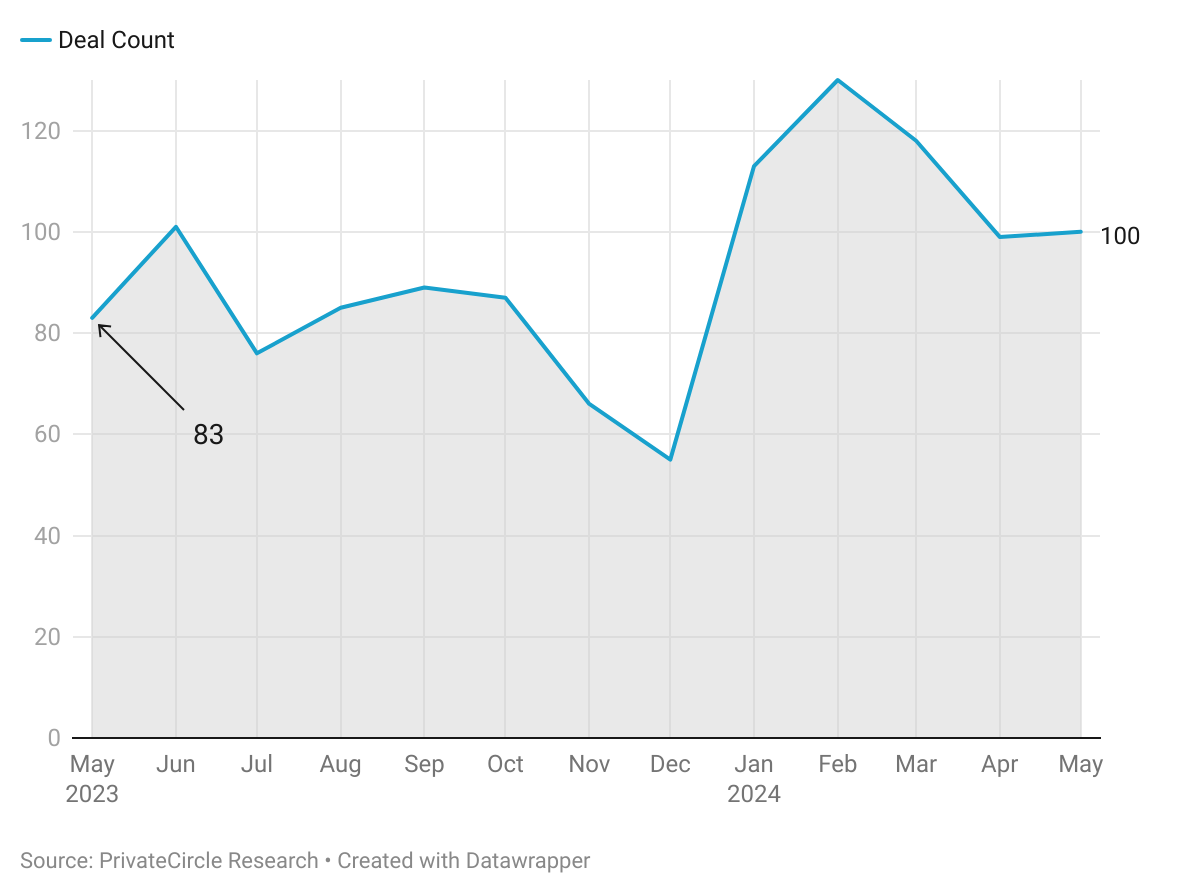

Startup Funding Deal Volume (May 2023 – May 2024)

Despite the monthly drop in funding value, deal volumes remained stable compared to April 2024, showing a 20% increase from May 2023.

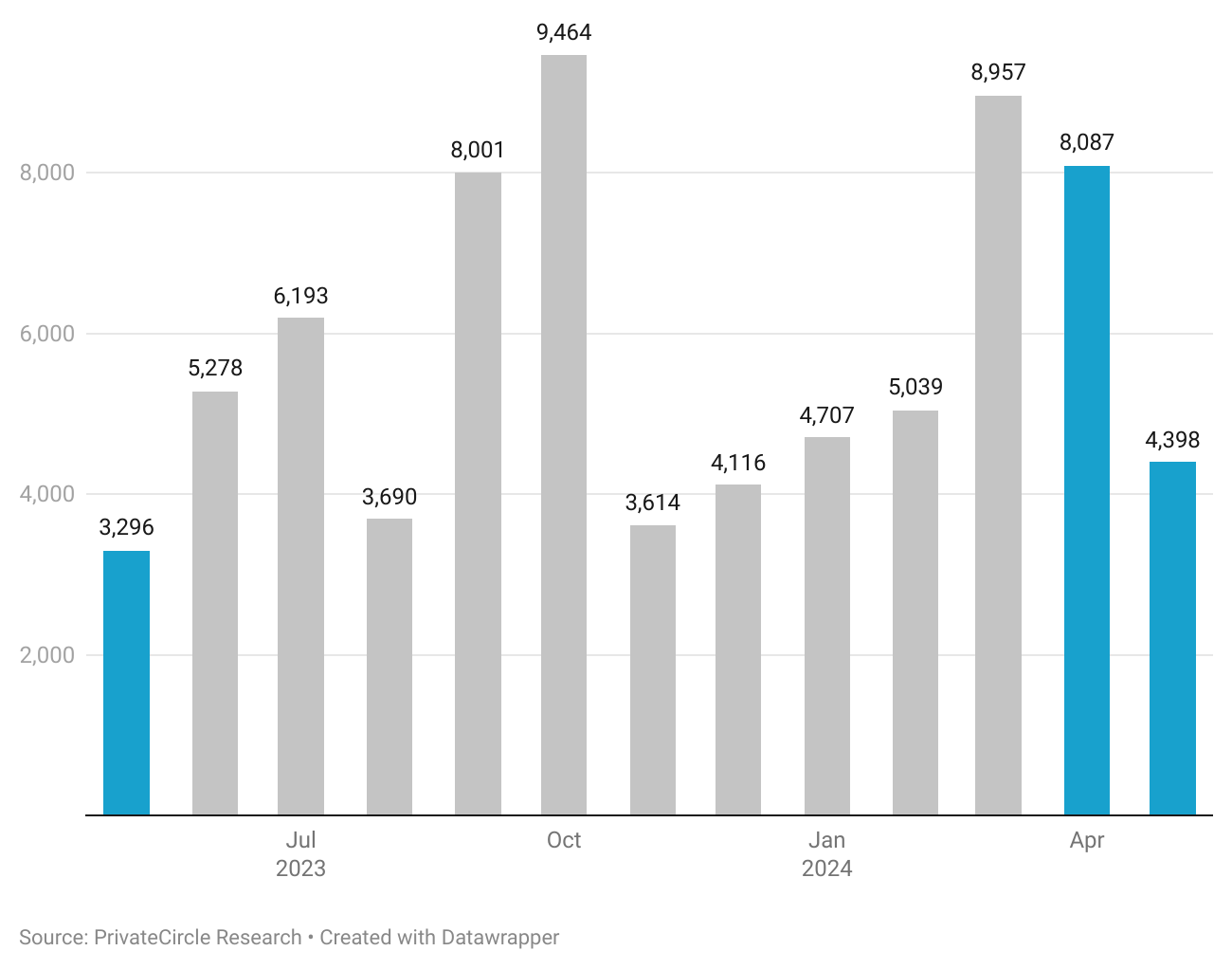

Startup Funding Total Value (May 2023 – May 2024) (₹ cr)

In May 2024, startup funding dropped by 46% compared to the previous month.

However, looking at the past 12 months, there’s a positive trend with a 33% increase in funding activity compared to May 2023, highlighting substantial growth.

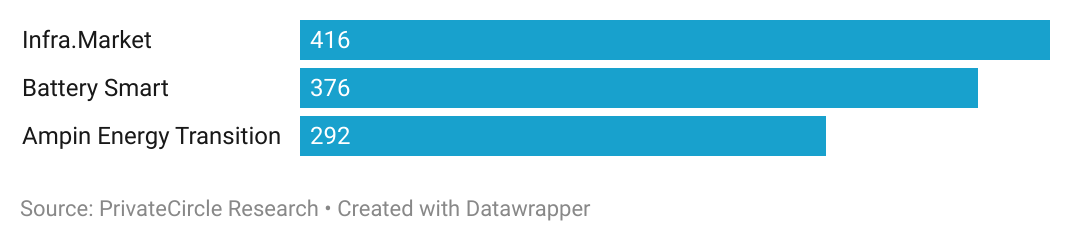

Top 3 Deals (₹ cr)

Infra.Market raised the highest funding round of ₹416 crores from MUFG Innovation Partners.

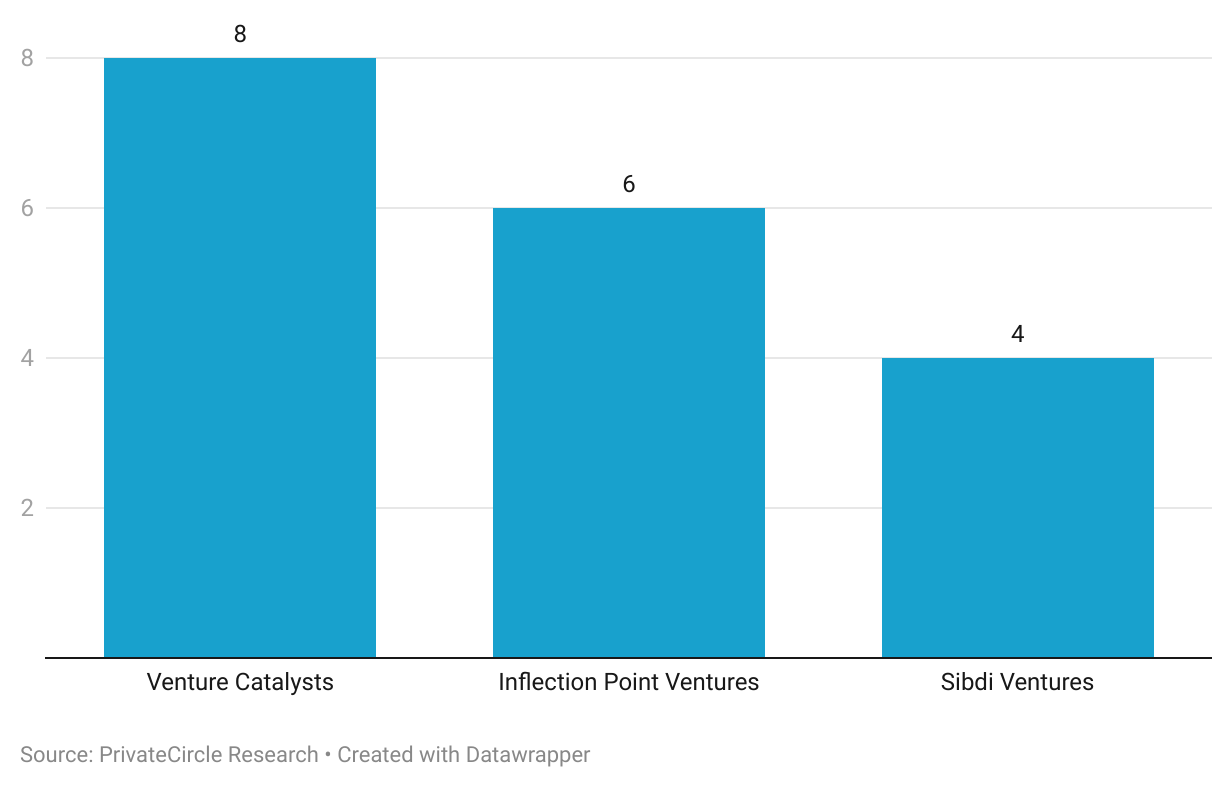

Top Investors (Deal Volume)

Early stage investor Venture Catalysts closed 8 deals in May 2024, highest deal volume recorded for a single investor in the month.

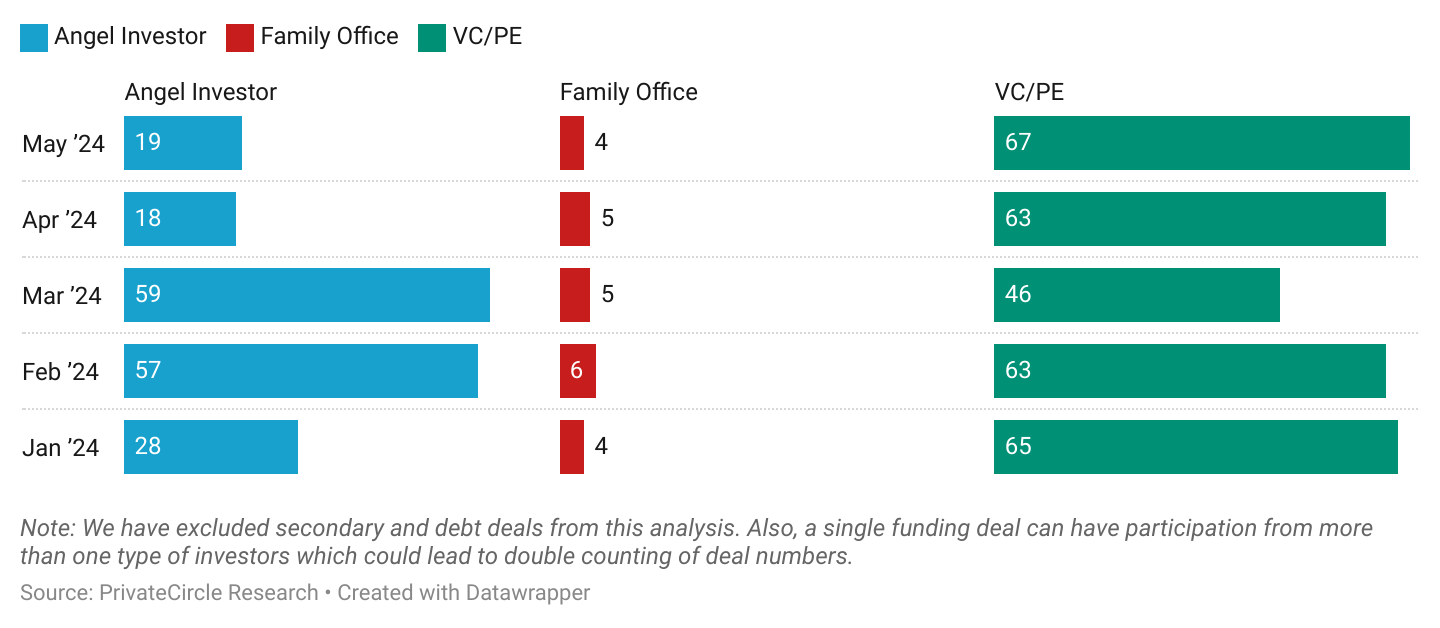

Investor Type (Deal Volume) (CY 2024 till date)

There was a slight growth in the share of deals closed by VC/PE in May 2024 as compared to April 2024. However, the angel rounds have been on the decline since March 2024.

Stability Amidst Volatility

May 2024’s funding landscape demonstrates resilience despite a significant month-over-month drop. The consistent deal volume highlights investor confidence and sustained interest in emerging startups.

This pattern suggests that while individual funding amounts may vary, the underlying investment activity remains robust.

Sectoral Highlights

Infra.Market’s substantial raise underscores the growing focus on infrastructure and construction technology in India. Battery Smart’s funding reflects the escalating interest in sustainable and renewable energy solutions, while Ampin Energy Transition‘s raise signifies a commitment to energy transition and sustainability initiatives.

Investor Dynamics

Venture Catalysts’ dominance in deal volume illustrates the increasing role of early-stage investors in nurturing startups.

The activity from Inflection Point Ventures and SIDBI Ventures also points to a diversified investment landscape where multiple players are actively contributing to the ecosystem.

Strategic Shifts

The reduction in advertising expenditure by Meesho, as detailed in the earlier report, mirrors broader cost-optimization strategies adopted by startups.

This approach aligns with the need to balance growth with sustainability, especially in a competitive market environment. We did a deep dive on Meesho’s recent $275 mn funding round, its explosive user growth, and latest financials, check it out here 👇🏼

Real-World Implications

The trends observed in May 2024 reflect a dynamic startup ecosystem adapting to evolving market conditions. The focus on sectors like infrastructure, energy, and technology indicates strategic priorities aligned with national development goals and global sustainability trends.

Additionally, the increase in funding activity over the past year signals a positive outlook for startups, encouraging innovation and economic growth.

Conclusion

May 2024 was a mixed bag for the Indian startup ecosystem, with significant month-over-month funding declines offset by impressive year-over-year growth. The data underscores the resilience and adaptability of startups and investors alike.

As the ecosystem continues to evolve, the focus on strategic sectors and sustainable growth will likely drive future funding trends.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Explore More Startup Funding Recaps:

Monthly Funding Summary Report: January 2024

Monthly Funding Summary Report: February 2024