The startup ecosystem in India continues to evolve, and the first month of 2024 has brought some interesting trends.

Let’s delve into the data for January 2024 to understand the dynamics of startup funding in India. We cover startup funding deal volume along with deal value, top 3 deals, and top investors by deal volume.

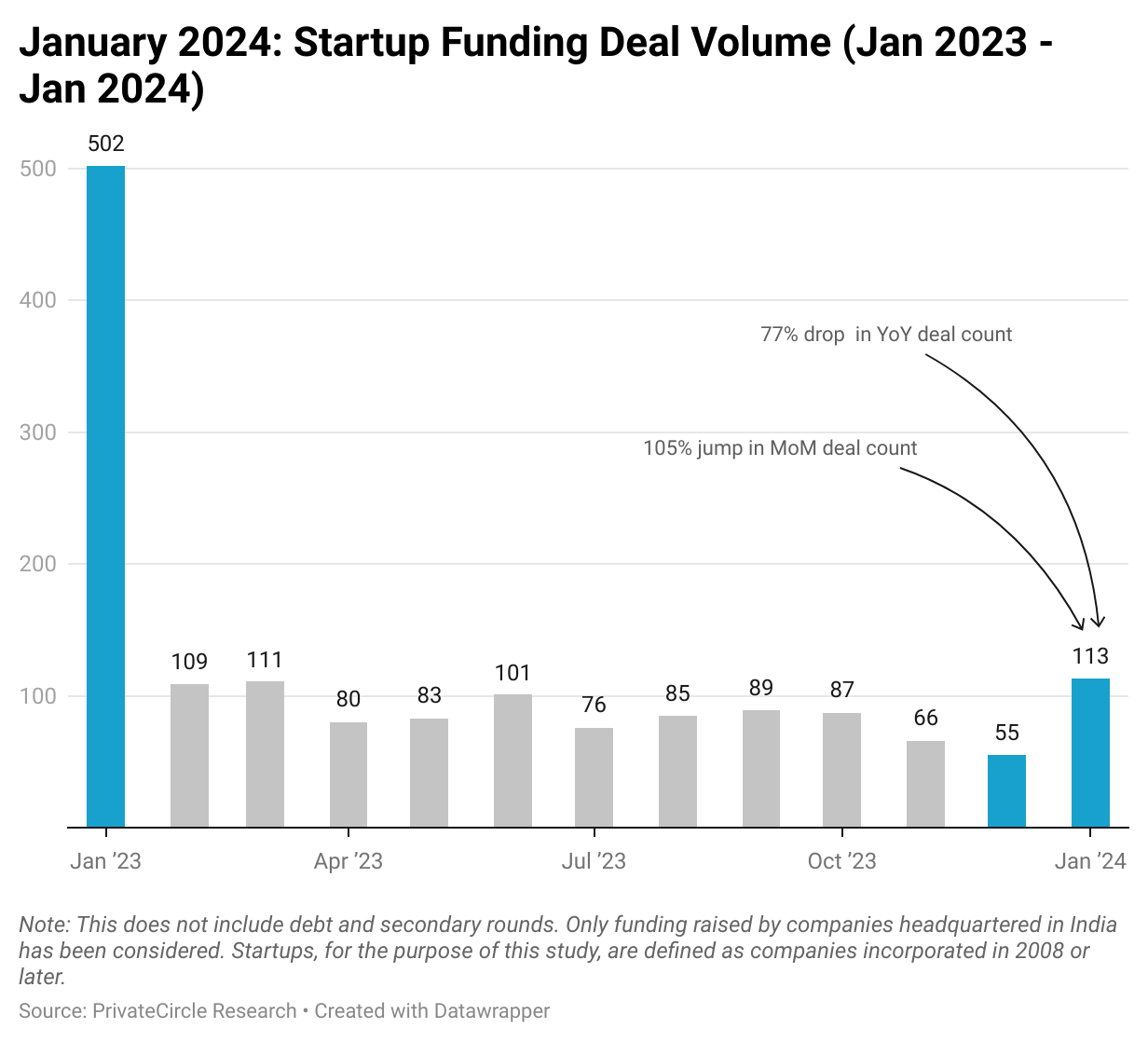

The deal volume in January 2024 has witnessed a remarkable surge, shooting up by 105% when compared to December 2023.

However, juxtaposed against January 2023, there has been a significant decline of 77%. This data suggests a dynamic and possibly volatile market, where short-term fluctuations coexist with long-term growth patterns.

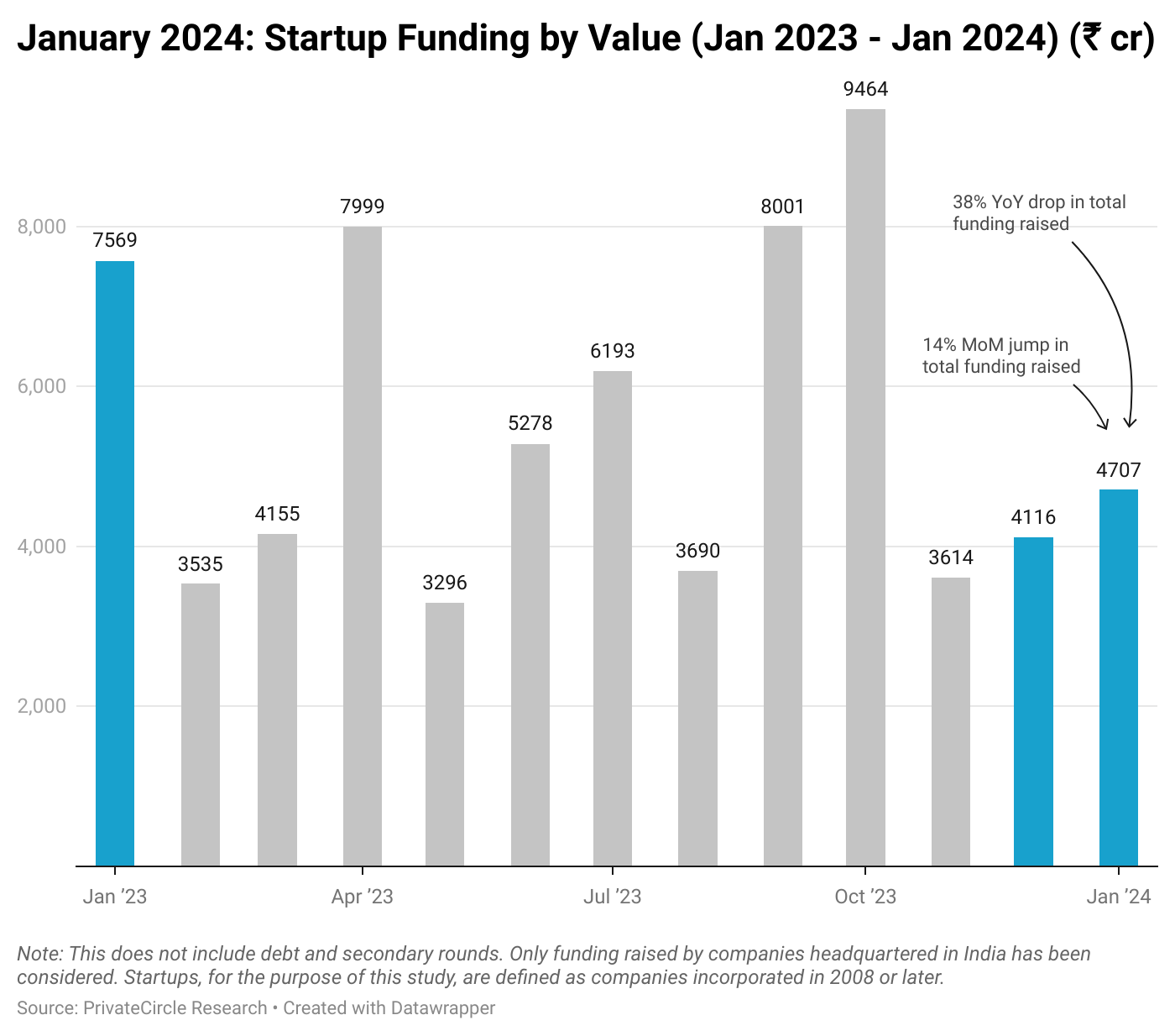

While the deal volume has experienced a surge, the funding value in January 2024 witnessed a 14% increase compared to the previous month. However, the amount raised is 38% lower than the funding in January last year.

This indicates that while more startups are securing funding, the individual amounts raised are not reaching the heights observed in the previous year.

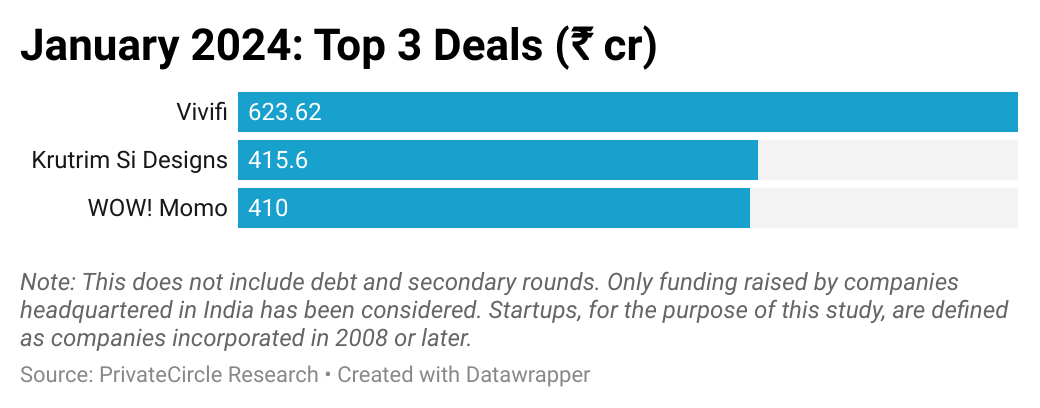

Highlighting specific success stories, Hyderabad-based Vivifi took the lead by securing ₹623.62 cr in funding from BP IN VPF LLC in a Series B round.

This showcases the diverse sectors attracting significant investments and the presence of global players in the Indian startup ecosystem.

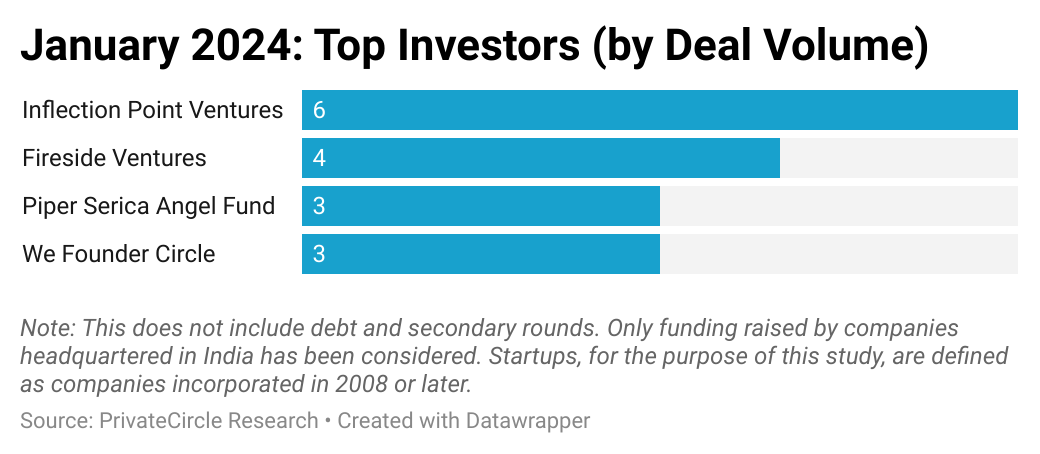

Inflection Point Ventures emerged as the top investor in January 2024, making the highest number of investments.

This sheds light on the investor landscape, indicating which firms are actively participating in funding rounds. This information can be crucial for startups seeking funding and investors exploring potential opportunities.

Conclusion

January 2024 has set the tone for the startup funding landscape in India, showcasing both positive and challenging trends. The substantial increase in deal volume reflects the vibrancy of the ecosystem, while the decrease in funding value raises questions about the average ticket size for startups.

Investors, entrepreneurs, and enthusiasts can leverage this data to gain insights into market dynamics, identify emerging trends, and make informed decisions.

As the year unfolds, these initial trends will likely shape the trajectory of the Indian startup ecosystem, making it an exciting space to watch.