Overview

July 2024 marked a dynamic month for the Indian startup ecosystem, showcasing a notable increase in both deal volume and total funding raised.

With ₹8,865 crores in total funding across 99 deals, the month exhibited a strong recovery and growth compared to previous periods.

Let’s delve into the highlights of the month, key trends, and insights into the Indian investment landscape in July 2024.

Highlights to explore; Data and Insights by PrivateCircle Research.

- Deal Volume

- Total Deal Value

- Top 3 Deals

- Top Investors

- Investor Type

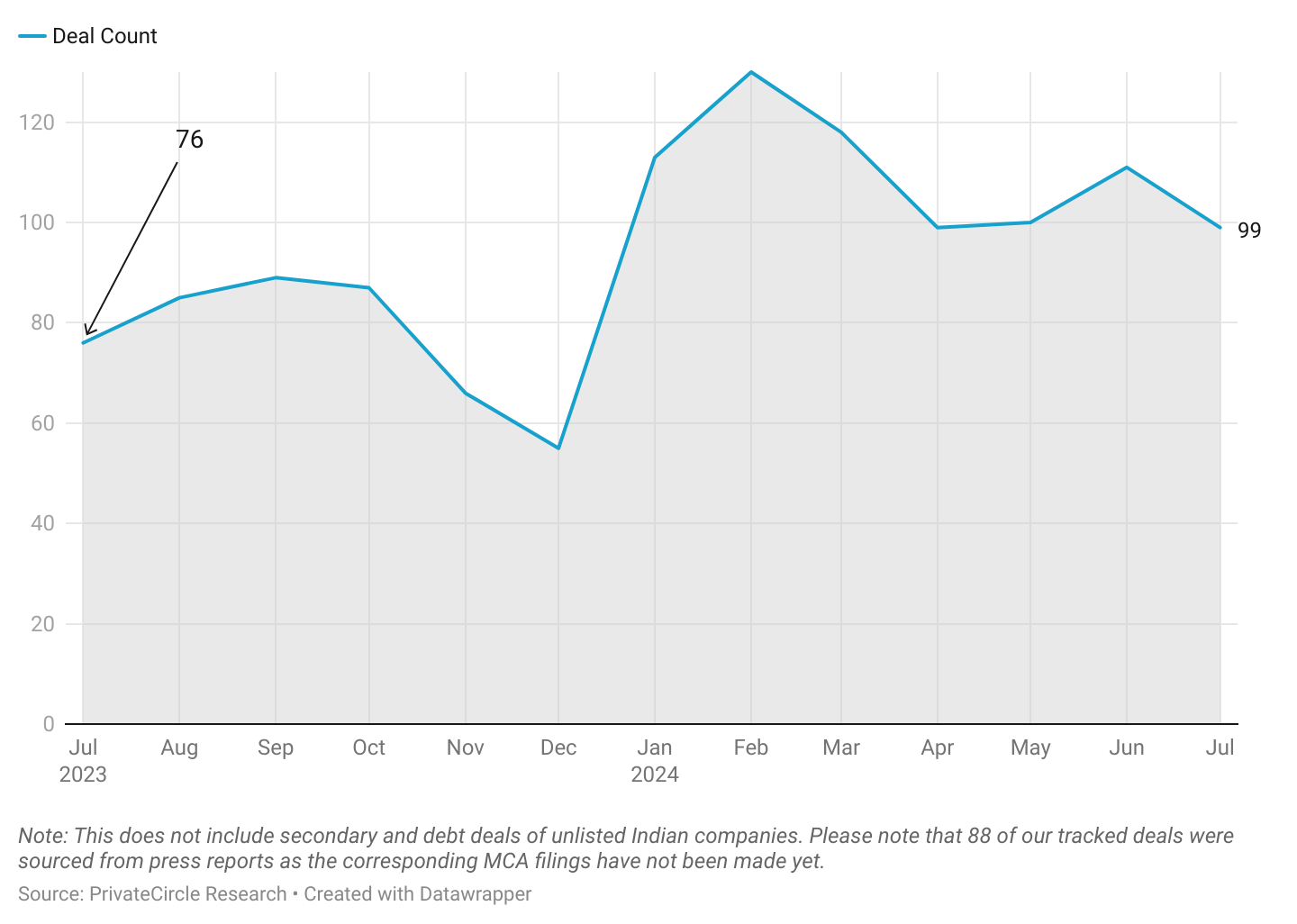

Deal Volume (July 2023 – July 2024)

Deal volumes were slightly lower (11% drop) than June 2024.

However, there was a significant increase of 32% compared to the 76 deals in July 2023.

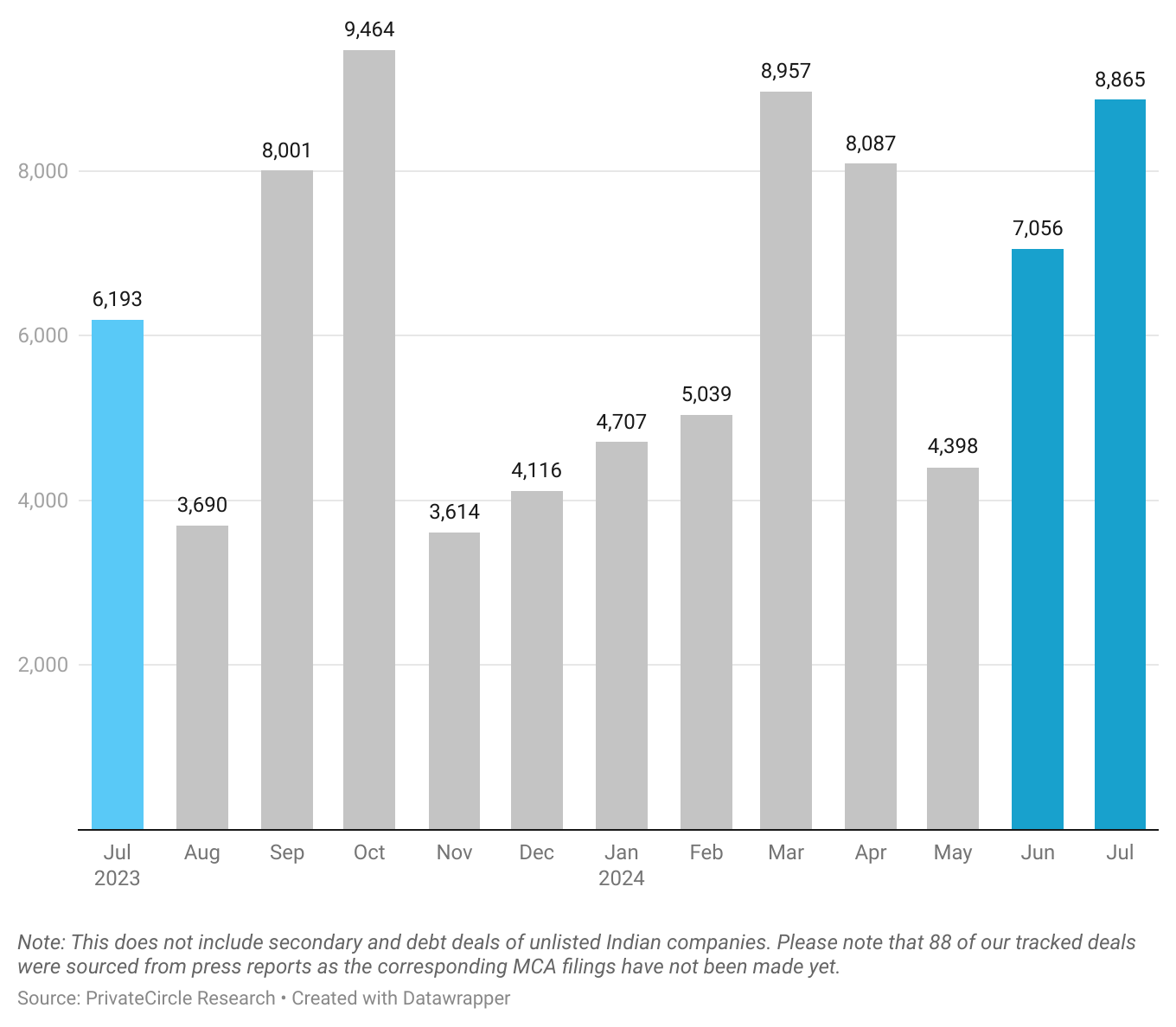

Deal Value (July 2023 – July 2024) (₹ cr)

The amount raised by the startup ecosystem was 26% higher than last month, reaching ₹8,865 crores.

Compared to July 2023, the amount raised saw a substantial increase of 43%.

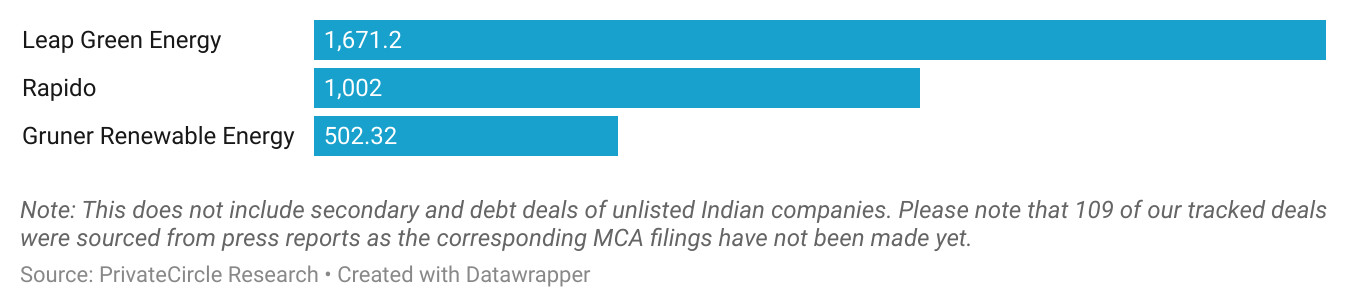

Top 3 Deals (₹ cr)

Leap Green Energy raised the biggest funding round in July 2024 at ₹1,671.20 crores from Brookfield.

Rapido and Gruner Renewable Energy followed close, with ₹1,002 cr and ₹502 cr respectively.

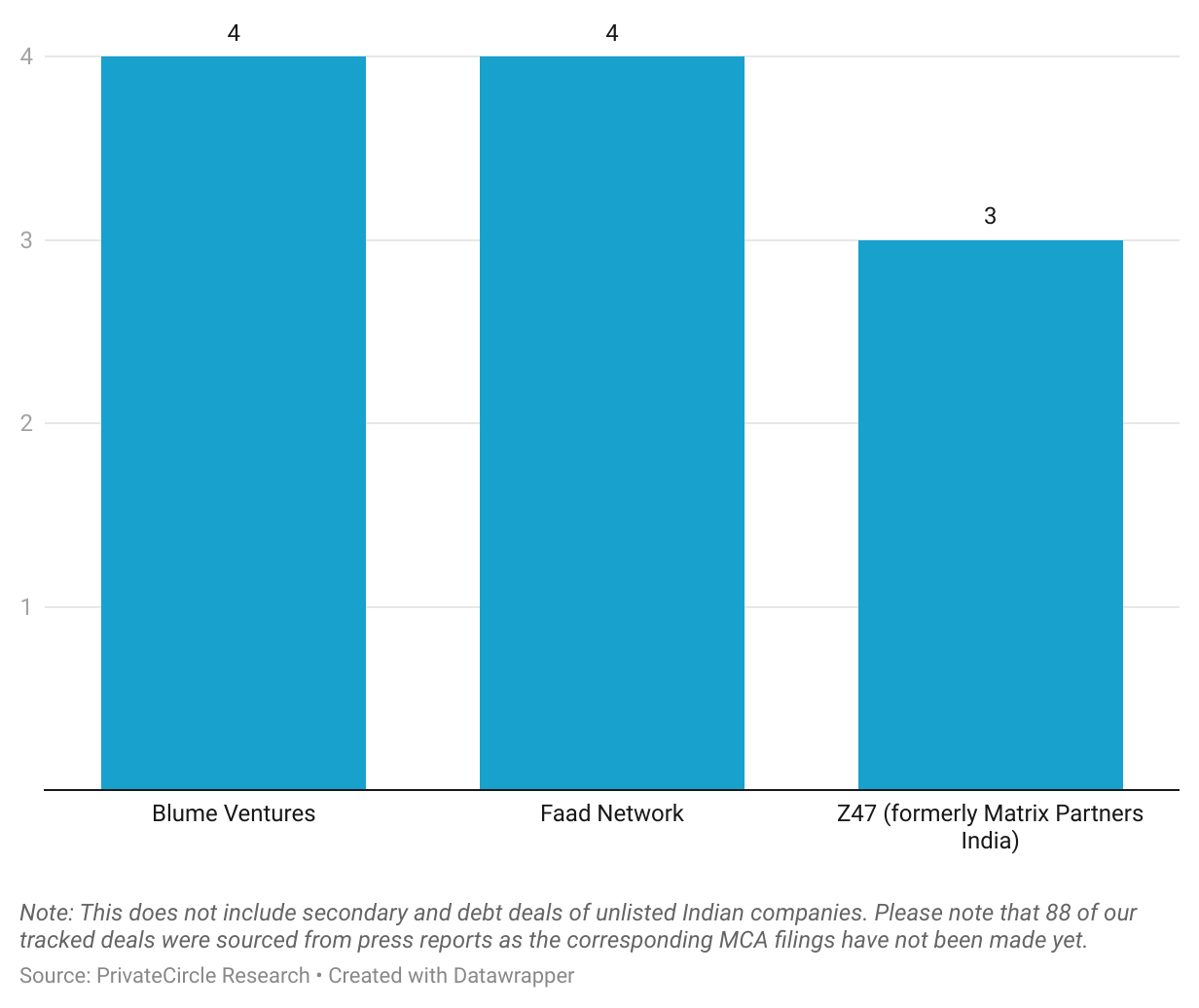

Top Investors (Deal Volume)

Blume Ventures and Faad Network each closed 4 deals, making them the highest deal volume recorded for single investors in the month.

Followed closely by Z47 (formerly Matrix Partners India) with 3 deals.

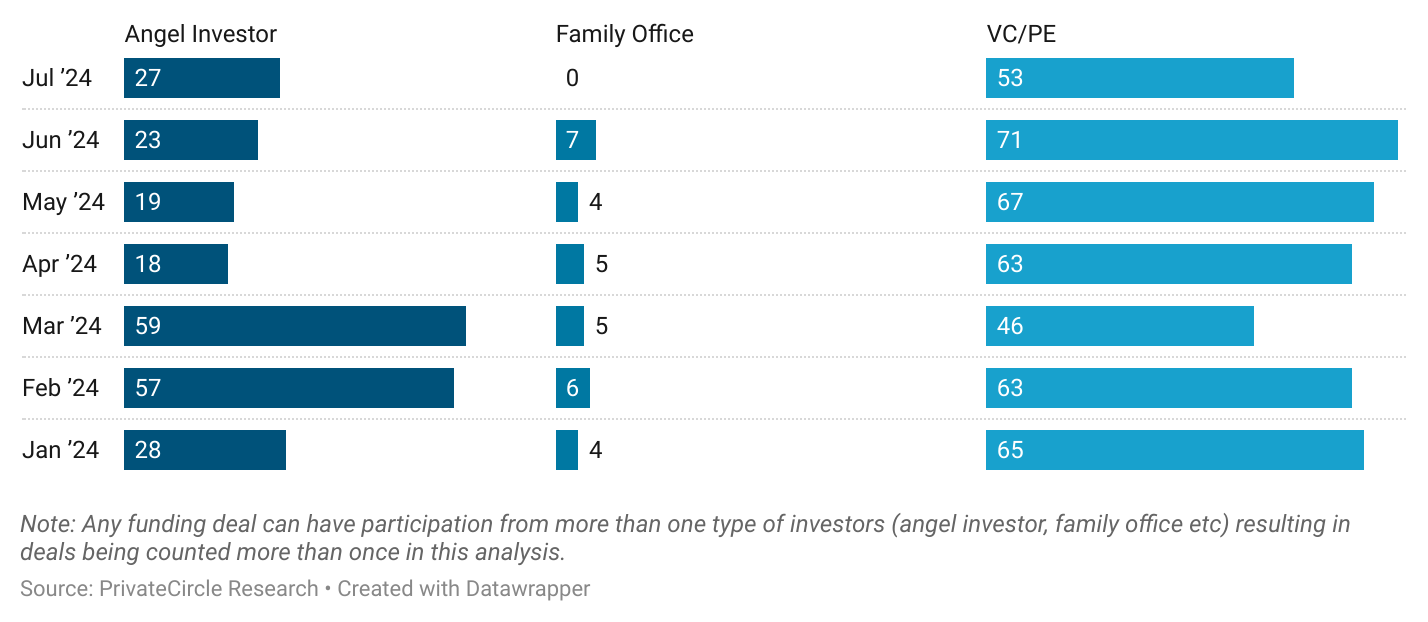

Investor Type (Deal Volume) (CY 2024 Till Date)

Angel Investors’ deals increased to 33%, up from 23% in June 2024, indicating a rising interest from individual investors.

Family Office deals saw a drop to 0, compared to 7% in June 2024.

Job Creation and Economic Impact

The significant funding rounds, especially in sectors like renewable energy and transportation, are expected to generate numerous employment opportunities.

For instance, Leap Green Energy’s investment is likely to spur job creation in the renewable energy sector, contributing to India’s sustainable development goals.

Similarly, Rapido’s funding can lead to an expansion in the gig economy, providing flexible job opportunities to a large workforce.

Comparative Analysis

A comparative analysis of the deal volume indicates that investors were more inclined towards larger deals, focusing on well-established startups with proven business models.

When compared to July 2023, the growth is even more pronounced, with a 43% increase in the total funding raised.

This growth underscores the resilience and attractiveness of the Indian startup ecosystem, even amid global economic uncertainties.

Monthly Performance

The rise in deal value suggests a shift towards quality over quantity, with investors being more selective yet willing to invest larger sums in promising ventures.

The month also saw a diverse range of sectors receiving funding, from renewable energy to tech-driven solutions, reflecting the broadening horizon of the startup landscape in India.

Investor Activity

The investor activity highlights the growing involvement of domestic investors, who are increasingly taking center stage in the funding rounds.

Moreover, the increased participation of angel investors, accounting for 33% of the deals, signifies a burgeoning interest in nurturing early-stage startups.

In-depth Insights

The absence of family office deals, compared to a 7% share in June 2024, suggests a shift in investment strategies. This could be attributed to the rising risk appetite among other investor types, such as venture capital and private equity firms.

The data also indicates a preference for sectors with high growth potential and scalability, such as renewable energy and technology-driven solutions.

Strategic Investments

The strategic investments observed in July 2024 underline a clear focus on sustainability and technology.

The top deals in renewable energy and transportation sectors align with India’s long-term goals of achieving energy independence and reducing carbon emissions.

Such investments not only contribute to the country’s economic growth but also align with global ESG (Environmental, Social, and Governance) trends, attracting international investors.

Future Outlook

The future outlook for the Indian startup ecosystem remains optimistic. The consistent growth in funding and deal volumes suggests a resilient market with a strong appetite for innovation.

As the global economy navigates through uncertainties, the Indian startup landscape is poised to attract both domestic and international investors, seeking high-growth opportunities.

The focus on sectors like renewable energy, technology, and digital services will likely continue, driven by government initiatives and market demand.

Conclusion

July 2024 has been a remarkable month for the Indian startup ecosystem, marked by significant funding rounds, active investor participation, and strategic investments.

The insights from this month’s activities highlight a promising future, with a focus on quality investments and sustainable growth. As the ecosystem evolves, it will be interesting to see how these trends shape the landscape and contribute to India’s economic growth and development.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Data Curation by Chethan K Mahesh Kumar and Nishmitha Devadiga

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Explore More Startup Funding Recaps:

Monthly Funding Summary Report: January 2024

Monthly Funding Summary Report: February 2024

Monthly Funding Summary Report: March 2024

Startup Funding Recap: April 2024