Overview

June 2024 was a dynamic month for Indian startups, with significant funding activity. The month saw a total of ₹7,056 crores raised across 111 deals. This represents a robust ecosystem that continues to attract substantial investor interest despite broader economic uncertainties.

Notably, most of the reported deals were sourced from press reports, as the corresponding Ministry of Corporate Affairs (MCA) filings were pending.

Highlights to explore; Data and Insights by PrivateCircle Research.

- Deal Volume

- Total Deal Value

- Top 3 Deals

- Top Investors

- Investor Type

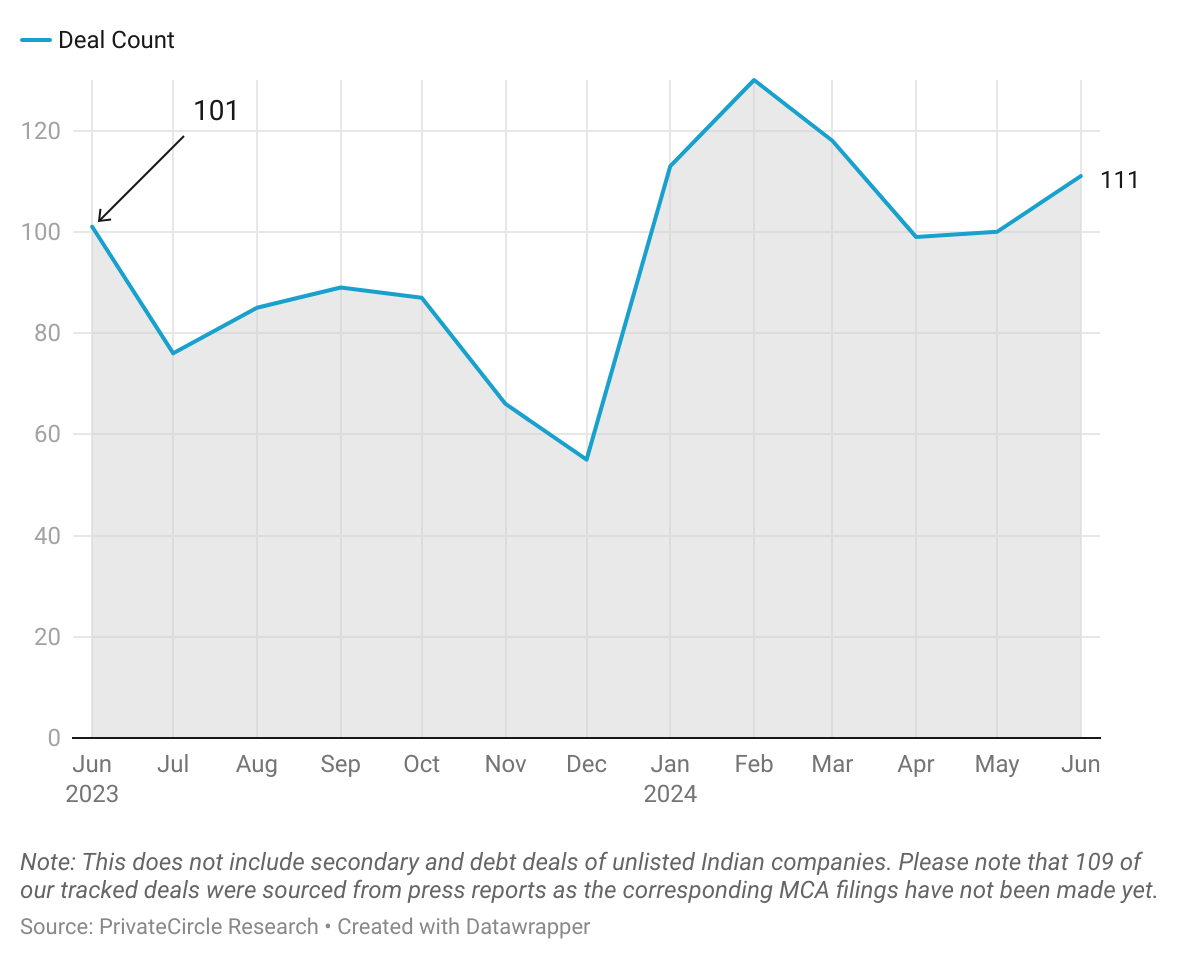

Deal Volume (June 2023 – June 2024)

In June 2024, deal volumes were 11% more than last month and a similar 10% jump from June 2023.

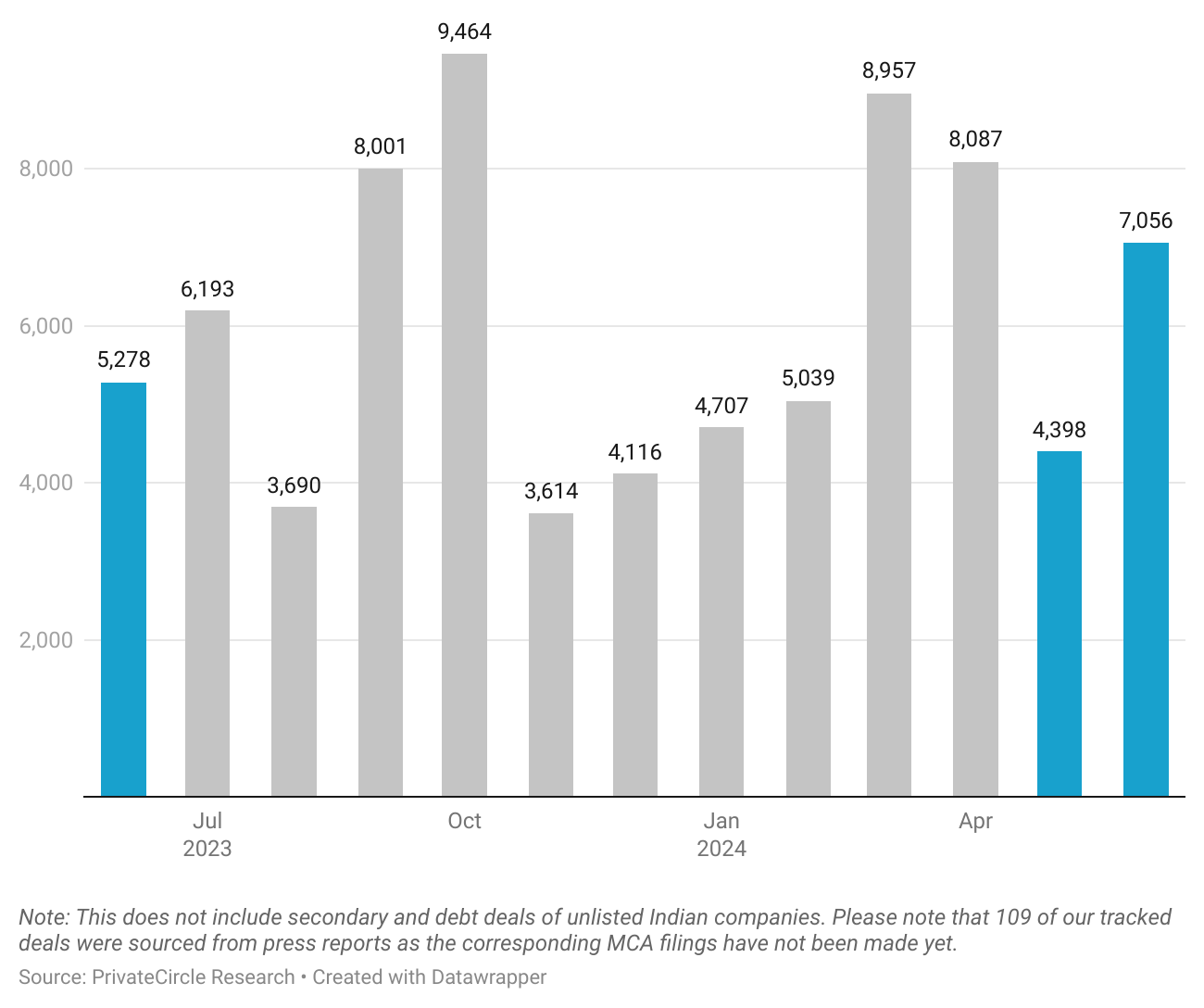

Total Deal Value (June 2023 – June 2024) (₹ cr)

In June 2024, the amount raised by the startup ecosystem was 60% higher than last month. In comparison to June 2023 also, the amount raised was 34% higher.

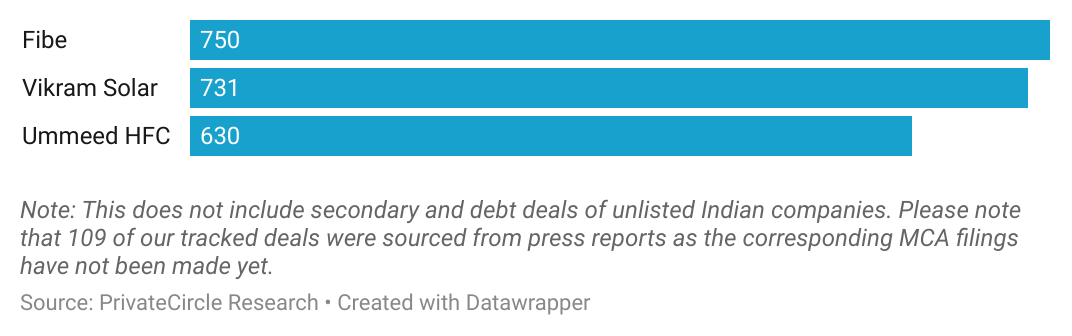

Top 3 Deals (₹ cr)

Fibe raised the biggest funding round this month at ₹750 crores. Participating investors included Kabira Holdings, Chiratae Ventures, Norwest Venture Partners, Trifecta Capital and others.

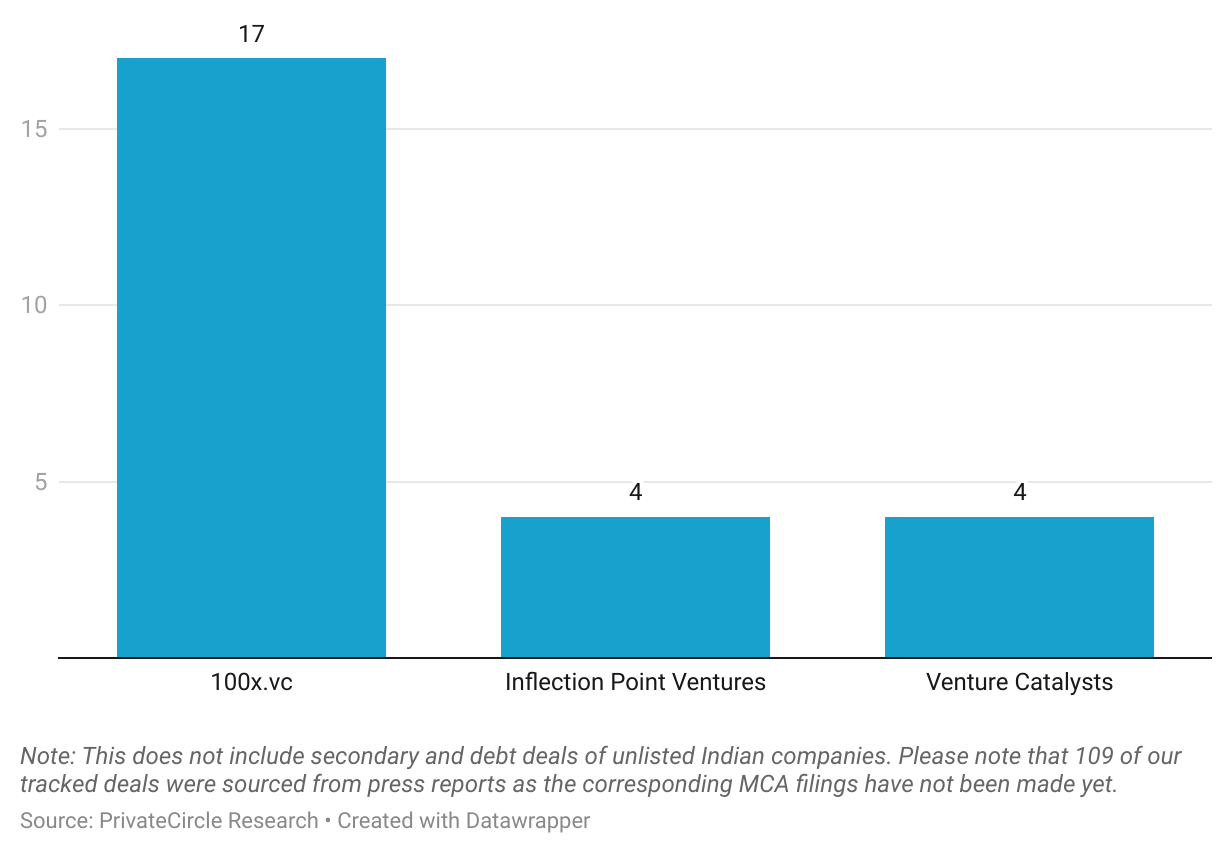

Top Investors (Deal Volume)

100x.vc closed 17 deals in June 2024, highest deal volume recorded for a single investor in the month.

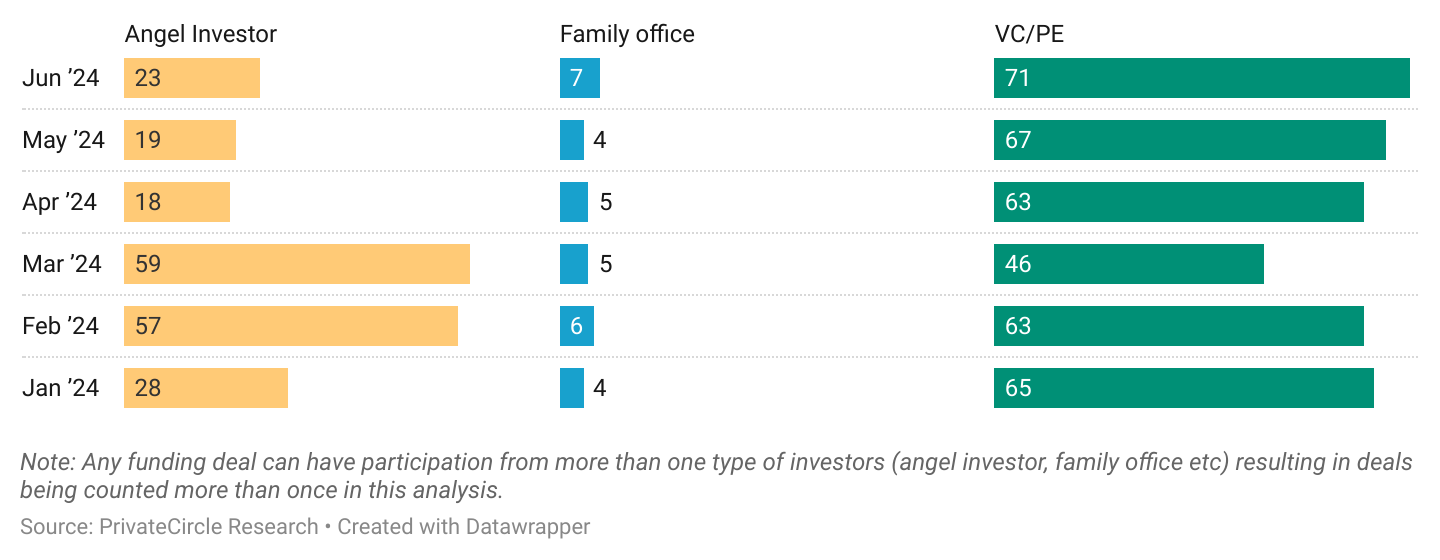

Investor Type (Deal Volume) (CY 2024 Till Date)

VC/PE deals made about 64% of the total deals in June 2024 as compared to their 67% share in May 2024.

This indicates a continued strong presence of venture capital and private equity in the funding landscape.

Job Creation and Economic Impact

The substantial funding has a cascading effect on job creation and economic growth.

Startups like Fibe, Vikram Solar, and Ummeed HFC not only secure financial backing but also drive innovation, create jobs, and contribute to the economic dynamism of their respective sectors.

Comparative Analysis

Monthly Performance

June 2023 vs. June 2024: The amount raised in June 2024 was 34% higher than in June 2023, reflecting the resilience and growth of the Indian startup ecosystem.

May 2024 vs. June 2024: June saw a 60% increase in total deal value compared to May 2024, indicating a surge in high-value deals.

Investor Activity

100x.vc’s dominance with 17 deals underscores the aggressive investment strategy of certain venture funds. The significant activity from Inflection Point Ventures and Venture Catalysts also highlights the competitive landscape of startup investments in India.

In-depth Insights

Funding Dynamics

The notable rise in funding value and volume suggests a growing maturity in the Indian startup ecosystem.

Investors are increasingly confident in backing startups with substantial capital, likely due to improved business models, market readiness, and innovative solutions addressing critical market needs.

Strategic Investments

The top deals, especially those involving Fibe and Vikram Solar, indicate a strategic focus on sectors poised for significant growth. Renewable energy, fintech, and housing finance are sectors attracting considerable interest, reflecting broader economic and policy trends.

Future Outlook

The current trends suggest a positive outlook for Indian startups.

As more deals get finalized and MCA filings are completed, the transparency and attractiveness of the Indian market will likely improve. Investors should continue to watch for emerging trends and sectors that promise high returns and transformative impacts.

Conclusion

June 2024 was a landmark month for Indian startups, with significant increases in funding and deal volumes. The active participation of investors like 100x.vc, Inflection Point Ventures, and Venture Catalysts underscores the vibrant and competitive nature of the ecosystem.

As the startup landscape continues to evolve, the focus on strategic sectors and high-value deals will likely drive further growth and innovation.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Data Curation by Mahesh Kumar and Nishmitha Devadiga of PrivateCircle.

Explore More Startup Funding Recaps:

Monthly Funding Summary Report: January 2024

Monthly Funding Summary Report: February 2024

Monthly Funding Summary Report: March 2024