PrivateCircle Research offers an in-depth look at India’s private market in 2024-a year defined by strategic investments, record-breaking deals, and a maturing startup ecosystem.

Here are the key highlights:

Startup Funding Soars to ₹1,00,154 Cr

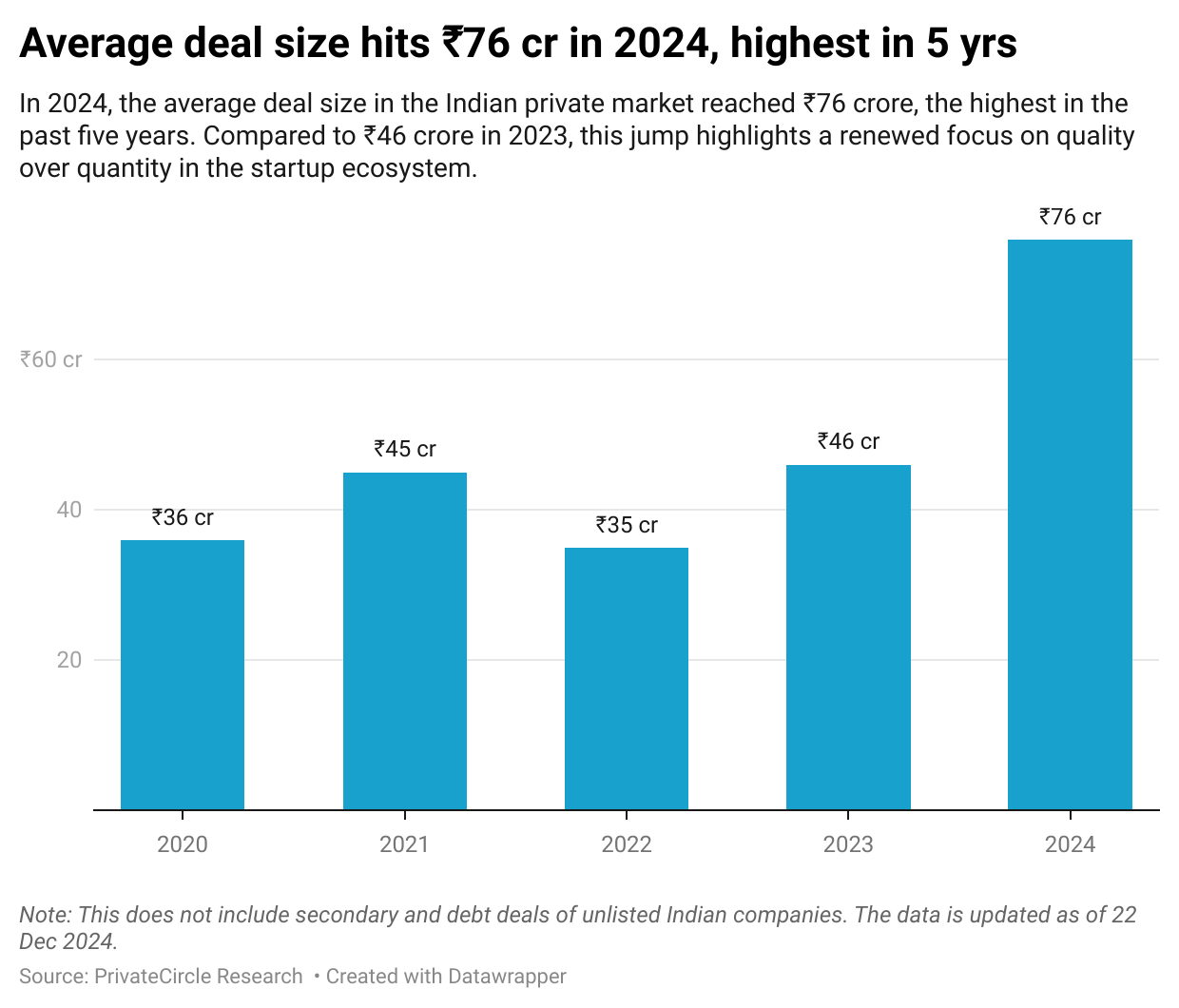

In 2024, Indian startups raised an impressive ₹1,00,154 crore, even as the total deal count dipped to 1,321. This reflects a shift in investor priorities toward quality over quantity, signaling a more thoughtful and strategic funding approach.

Note: This does not include secondary and debt deals of unlisted Indian companies. The data is updated as of 22 Dec 2024.

The recovery from 2023’s challenges has been remarkable, driven by sectors such as fintech, healthcare, and edtech. These industries continue to attract significant attention, reinforcing their role as key pillars of India’s innovation economy.

For entrepreneurs, this year’s funding trends highlight the importance of resilience and adaptability in navigating market dynamics.

Note: This does not include secondary and debt deals of unlisted Indian companies. The data is updated as of 22 Dec 2024.

This shift also reflects the increasing sophistication of Indian startups. Founders are leveraging data-driven strategies and innovative solutions to address pressing market needs.

As a result, investors are willing to bet bigger on companies that demonstrate potential for long-term growth and profitability.

The growth in deal size is not just about numbers; it’s a sign of the ecosystem’s evolution. Startups are now better prepared to scale, thanks to stronger support networks, improved access to mentorship, and a growing pool of skilled talent.

Note: Any funding deal can have participation from more than one type of investors (angel investor, family office etc) resulting in deals being counted more than once in this analysis. This does not include debt and secondary deals. Data is updated as of 22 Dec 2024.

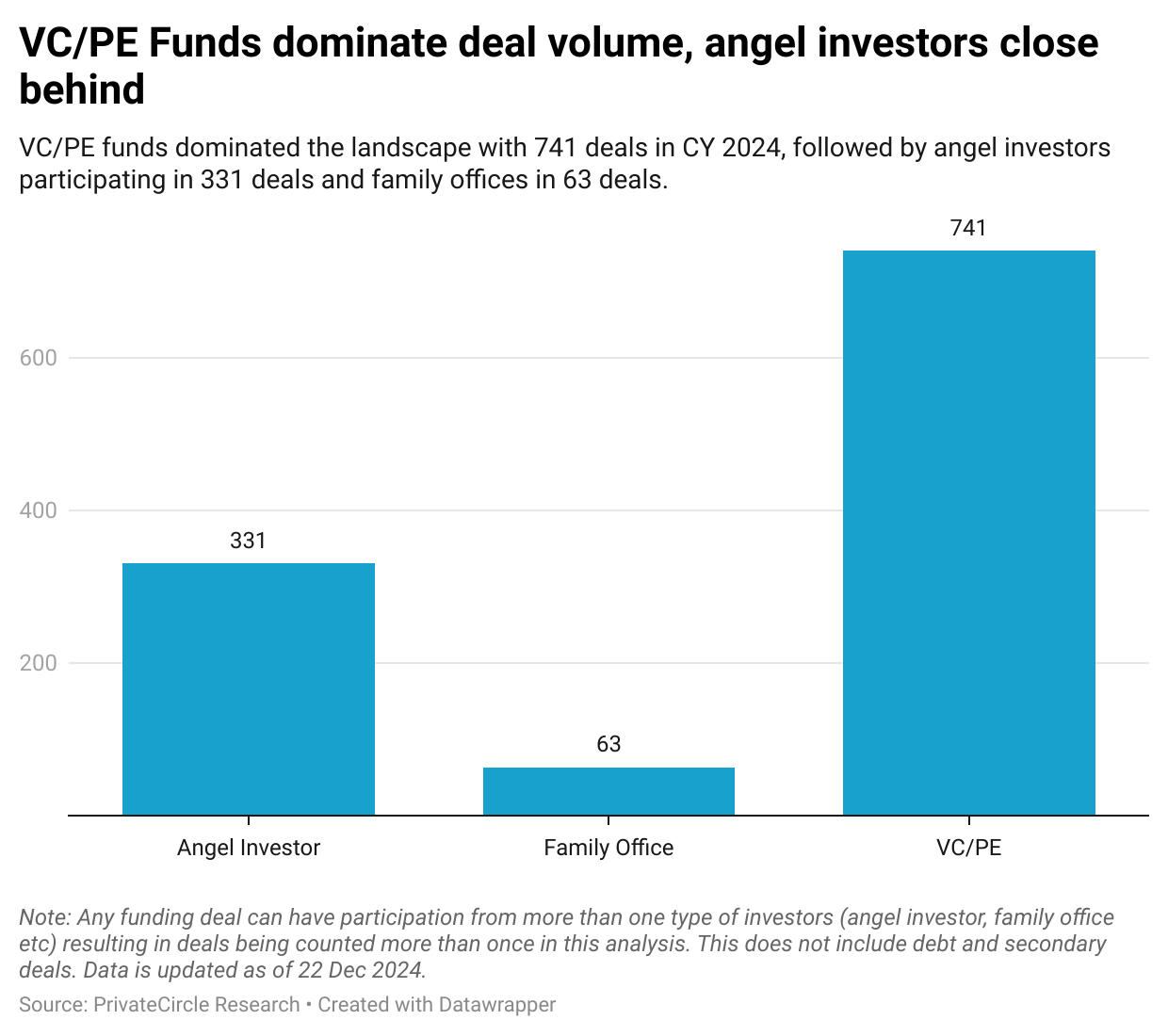

VC and PE funds’ dominance highlights their role as critical enablers of growth, particularly for mid-to-late-stage startups. Meanwhile, angel investors remain vital for early-stage companies, providing the initial push needed to get innovative ideas off the ground.

The rise of family offices is another notable trend. These investors bring a long-term perspective, often prioritizing sustainable growth over quick returns.

Their involvement adds diversity to the funding landscape, benefiting startups at various stages of their journey.

Note: This does not include secondary and debt deals of unlisted Indian companies. The data is updated as of 22 Dec 2024.

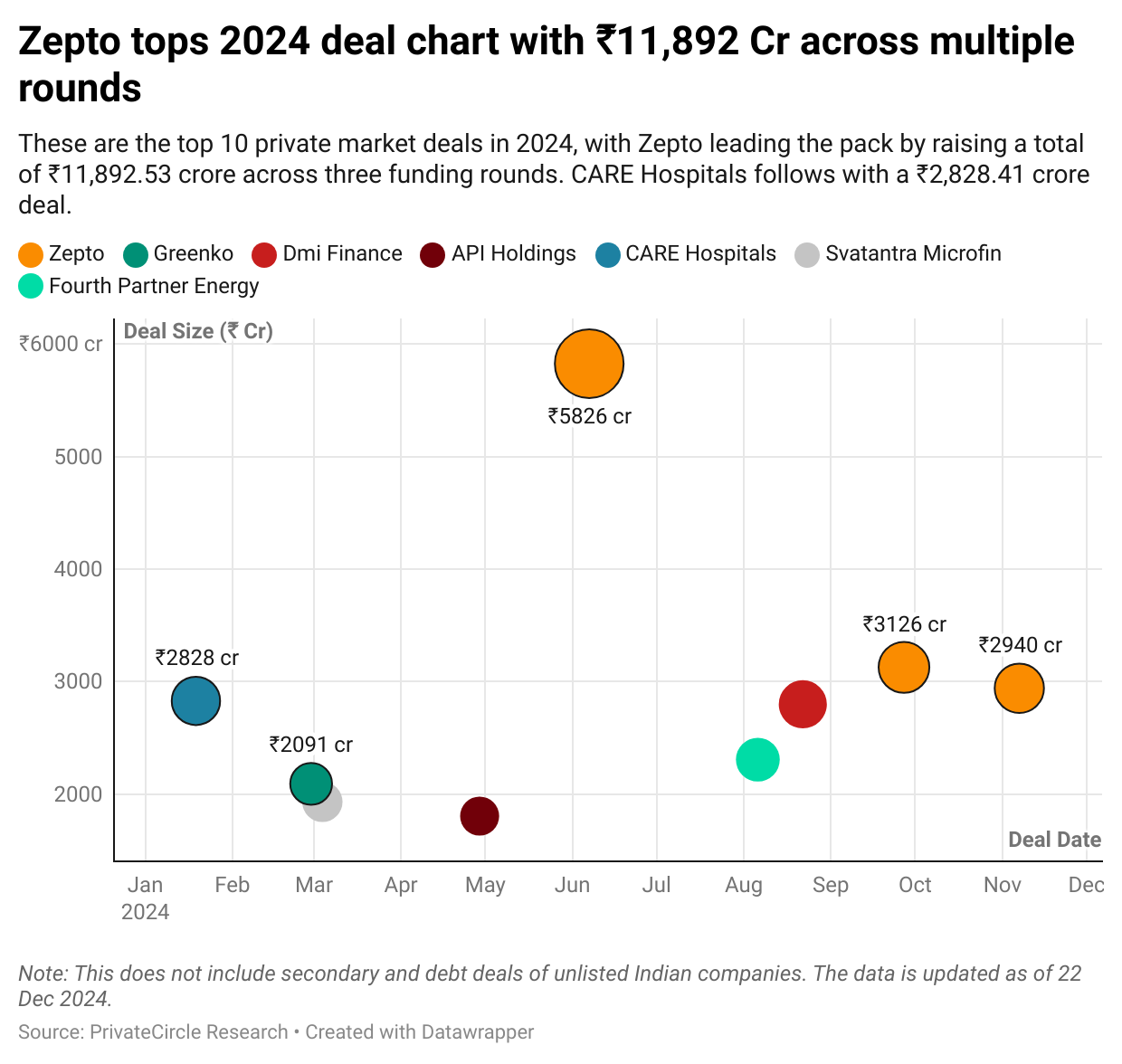

Zepto’s success story is a masterclass in innovation and execution. By addressing unmet consumer needs with precision and speed, the company has carved out a dominant position in its market. Such success stories inspire other startups to aim higher, fostering a culture of ambition and excellence.

The healthcare sector’s strong showing, exemplified by CARE Hospitals, underscores the growing importance of health tech in India. With rising demand for accessible and affordable healthcare solutions, this sector is poised for sustained growth in the years to come.

Note: This does not include secondary and debt deals of unlisted Indian companies. The data is updated as of 22 Dec 2024.

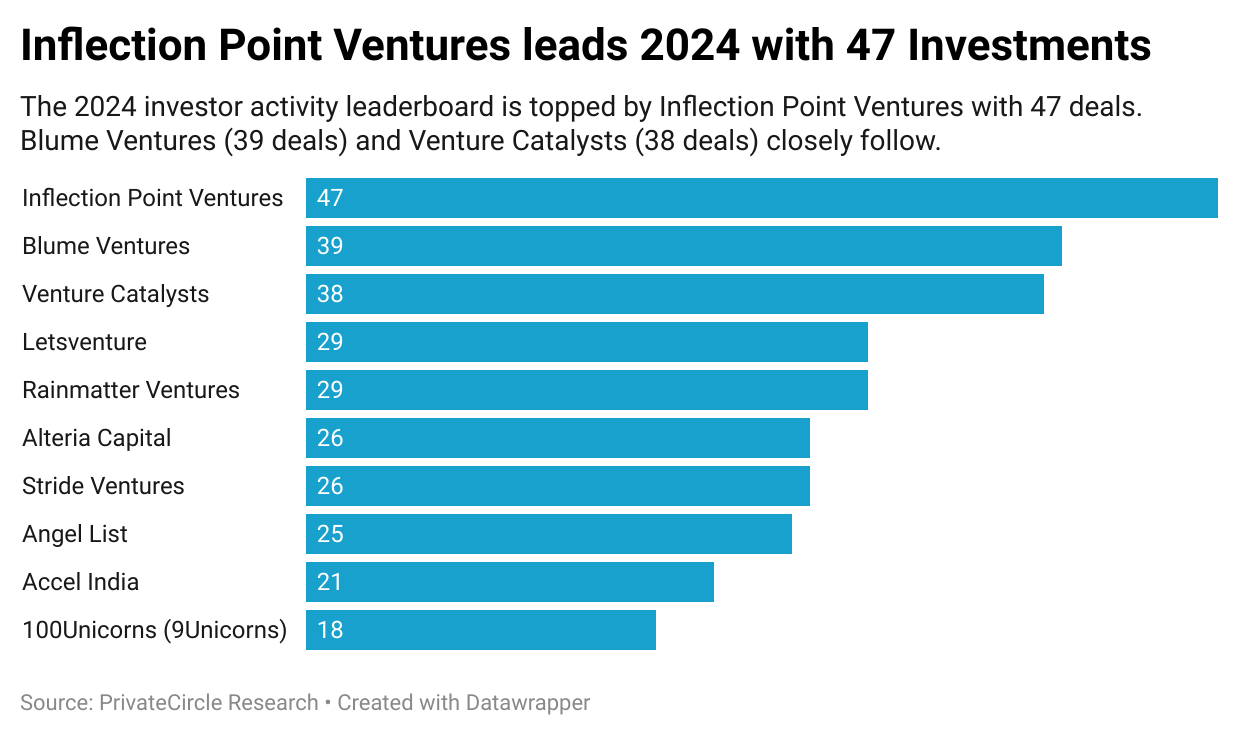

What sets these investors apart is their commitment to not just funding but also mentoring startups. By providing access to networks, expertise, and resources, they help founders navigate challenges and unlock their full potential.

This hands-on approach is invaluable in a competitive market where execution often makes the difference between success and failure.

The increasing activity of these investors also reflects the rising confidence in India’s entrepreneurial talent. With a growing number of success stories, the ecosystem is attracting attention from global players, further fueling its growth.

Closing Thoughts

2024 set new benchmarks for India’s private market, highlighting a clear pivot toward quality investments and collaborative growth. The rise in deal sizes, the dominance of VC/PE funds, and the success of startups like Zepto signal a maturing ecosystem ready for global recognition.

As the year concludes, one thing is certain: India’s startup landscape is evolving rapidly, and the best is yet to come. With strong foundations laid in 2024, the stage is set for another year of groundbreaking innovation and growth.

Stay tuned for more insights and updates!

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Explore More Startup Funding Recaps:

Monthly Funding Summary Report: January 2024

Monthly Funding Summary Report: February 2024

Monthly Funding Summary Report: March 2024

Startup Funding Recap: April 2024

Startup Funding Recap: May 2024

Startup Funding Recap: June 2024

Startup Funding Recap: July 2024

Startup Funding Recap: August 2024

Startup + CityWise Funding Recap: September 2024