November 2024 was a mixed bag of trends in the Indian startup ecosystem. With total funding amounting to ₹4,791 crore across 93 deals, the month showcased resilience amidst a fluctuating funding environment.

While deal volumes decreased by 14% from October 2024, they marked an impressive 41% growth compared to November 2023.

Similarly, the total funding value witnessed a sharp month-on-month decline of 40%, down from ₹7,948 crore in October, but still reflected a significant year-on-year growth of 33%.

November 2024 Startup Funding Figures:

- Investor Type Deal Volume: Angel Investors – 19 deals | Family Offices – 05 deals | VC/PE – 61 deals

- Most Active Investors: Blume Ventures – 05 deals | Info Edge Ventures – 05 deals | Elevation Capital – 04 deals | Speciale Invest – 04 deals | Unicorn India Ventures – 04 deals | Venture Catalysts – 04 deals

- Top 3 Deals: HealthKart ₹ 1,291 cr | SarvaGram ₹ 565 cr | Easy Home Finance ₹ 295 cr

Blog Outline: Data and Insights by PrivateCircle Research

- Deal Volume

- Monthly Performance

- Total Deal Value

- Top 3 Deals

- Top Investors

- Investor Type Deal Volume

- Investor Activity

- Job Creation & Economic Impact

- In-Depth Insights

- Funding Dynamics

- Strategic Investments

- Conclusion

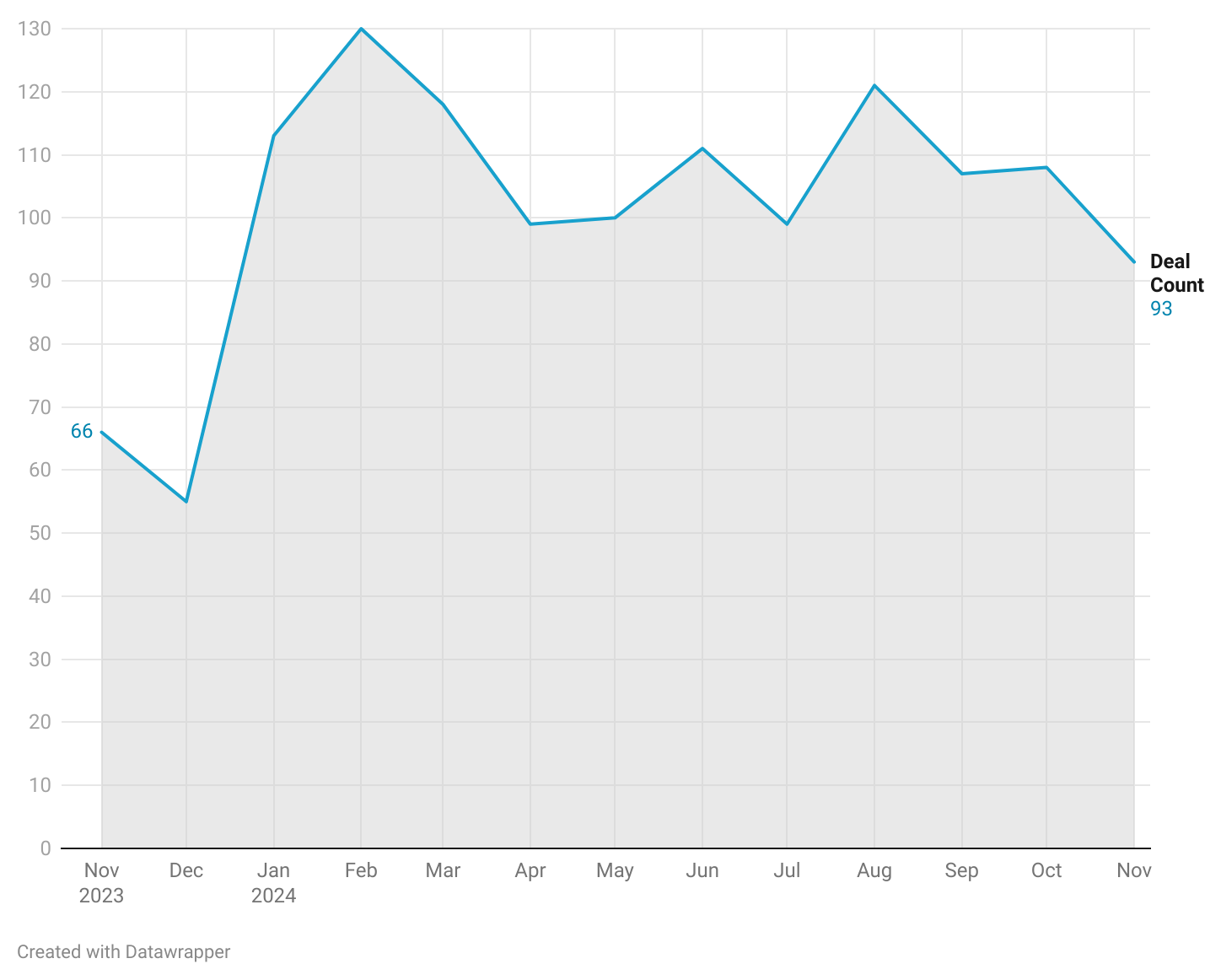

Deal Volume

In November 2024, deal volumes saw a decline of 14% compared to the previous month of October 2024, but they represented a 41% increase compared to November 2023.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 88 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

Monthly Performance

November’s funding landscape presented a shift compared to October 2024.

While Tier 1 cities remained dominant, accounting for the bulk of deals, the month highlighted a strategic tightening in funding allocations, as investors leaned toward fewer but higher-quality opportunities.

The 14% drop in deal volumes was accompanied by a sharper decline in deal value, suggesting a more cautious approach by investors amid global macroeconomic uncertainties.

Yet, compared to November 2023, the ecosystem demonstrated significant improvement, showcasing its growing maturity and attractiveness.

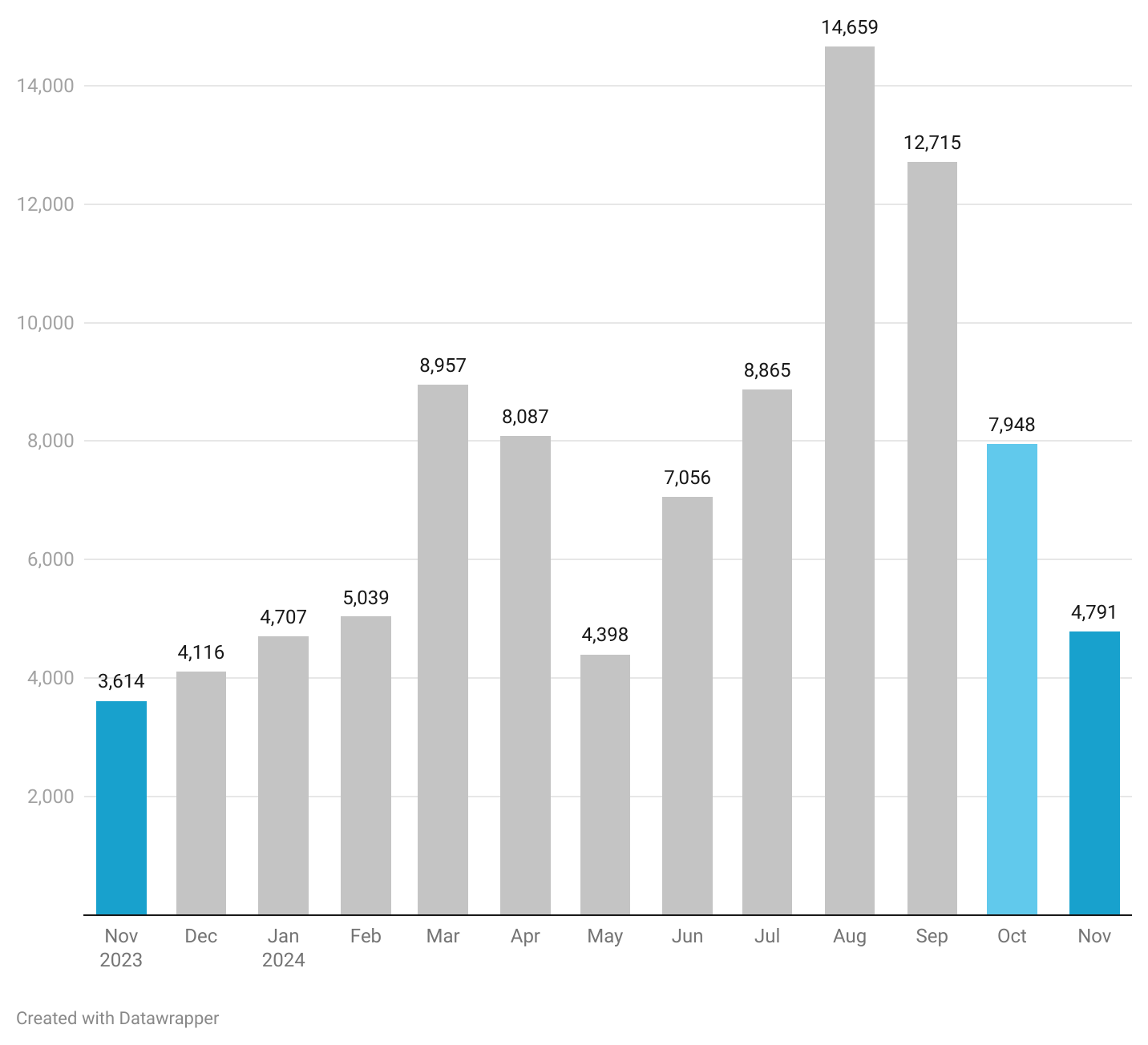

Total Deal Value (₹ cr)

The amount raised by the startup ecosystem totaled ₹4,791 crores, reflecting a significant 40% decline from ₹7,948 crores in October 2024 and a 33% increase compared to ₹3,614 crores in November 2023.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 88 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

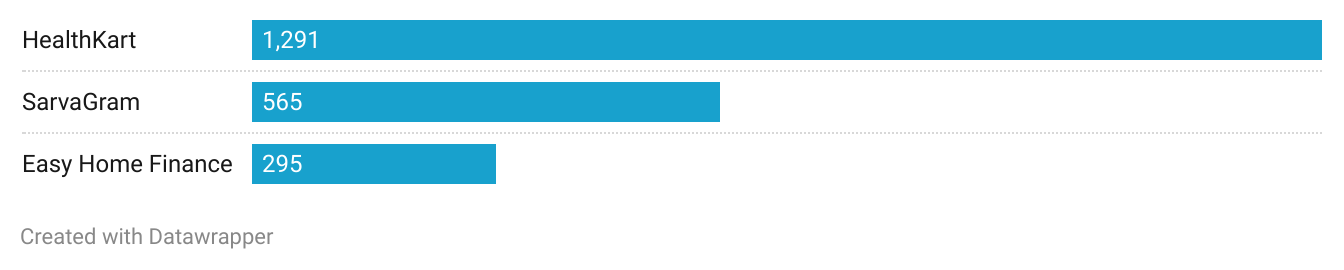

Top 3 Deals (₹ cr)

The largest deal in November was raised by HealthKart, securing ₹1,291 cr, followed by SarvaGram with ₹565 cr and Easy Home Finance at ₹295 cr.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 88 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

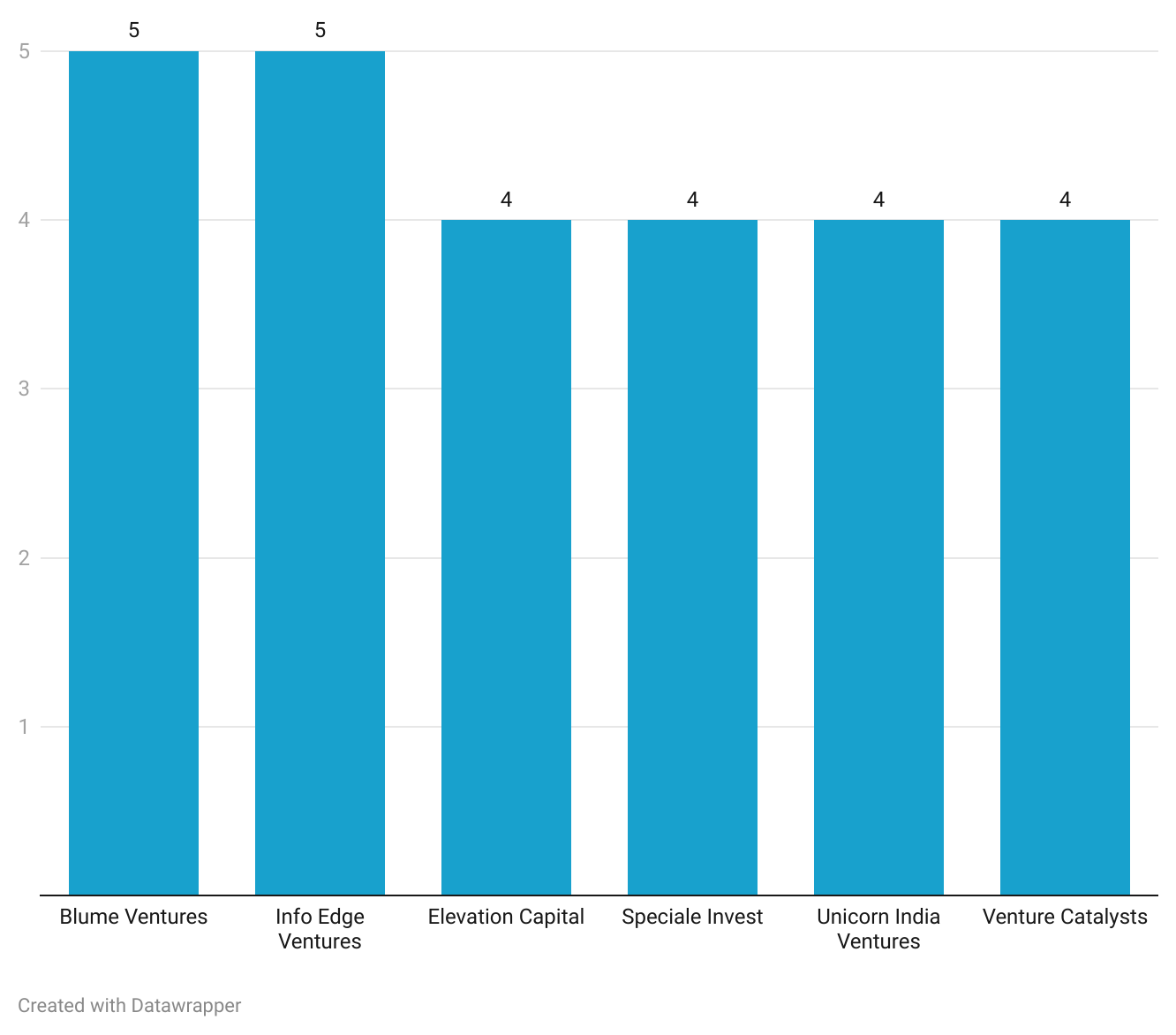

Top Investors

Blume Ventures and Info Edge Ventures led with 5 deals each, achieving the highest deal volume for single investors. They were closely followed by Elevation Capital, Speciale Invest, Unicorn India Ventures, and Venture Catalysts, each completing 4 deals.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 88 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

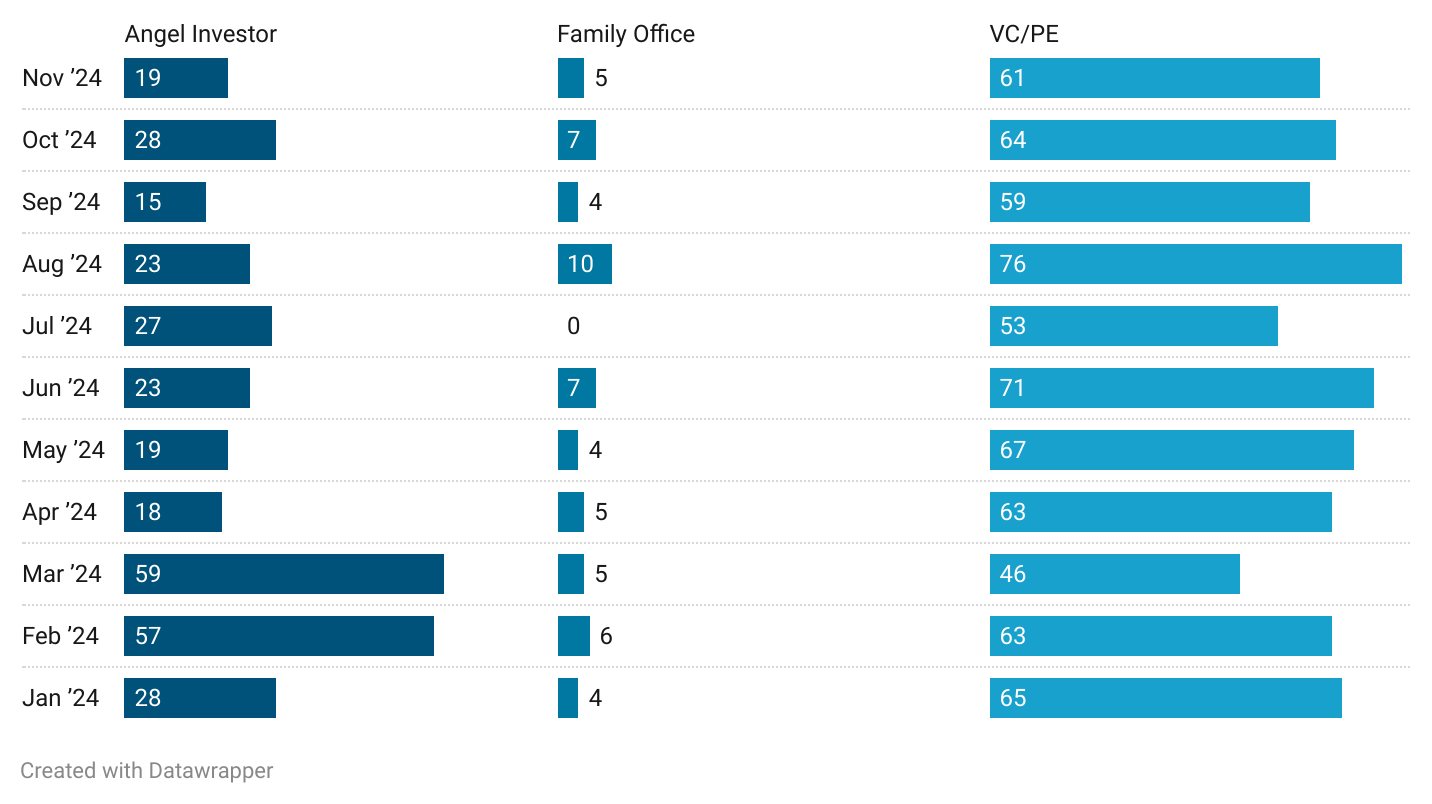

Investor Type Deal Volume

There was a mixed trend in investments across investor types. Angel Investor deals dropped to 19 from 28 in October 2024. Family Office deals also saw a slight decline, falling to 5 from 7 in October. Meanwhile, VC/PE deals held relatively steady at 61, compared to 64 in October.

Note: Any funding deal can have participation from more than one type of investors (angel investor, family office etc) resulting in deals being counted more than once in this analysis.

Investor Activity

Blume Ventures and Info Edge Ventures emerged as the most active investors in November, with five deals each.

Elevation Capital, Speciale Invest, Unicorn India Ventures, and Venture Catalysts followed closely, completing four deals each. The distribution of deals among angel investors, family offices, and VC/PE firms reflected a stable focus on larger institutional funding, with VC/PE deals constituting 61 of the total.

However, angel investor participation dipped from 28 in October to 19 in November, potentially signaling a recalibration of risk tolerance at the seed stage.

Job Creation & Economic Impact

Funding in the startup ecosystem plays a crucial role in driving innovation and creating employment opportunities.

The financial backing secured in November 2024 is expected to create thousands of direct and indirect jobs, especially in high-growth sectors such as healthtech, fintech, and agri-fintech.

For instance, HealthKart’s ₹1,291 crore funding round – November’s largest – could fuel expansion plans, product development, and hiring, directly impacting the health and wellness sector.

Similarly, SarvaGram’s ₹565 crore infusion in rural fintech and Easy Home Finance’s ₹295 crore for housing loans highlight investments that could boost financial inclusion and regional economic growth.

In-Depth Insights

The top three deals – HealthKart (₹1,291 crore), SarvaGram (₹565 crore), and Easy Home Finance (₹295 crore) – together accounted for over 46% of the total funding raised.

These investments highlight a strategic focus on high-growth, high-impact sectors. HealthKart, a leader in the health and wellness segment, likely benefited from the increasing consumer focus on preventive healthcare.

SarvaGram’s significant funding underscores the potential of rural-focused fintech solutions, while Easy Home Finance’s round reflects the growing demand for affordable housing solutions in India’s urban and semi-urban areas.

Funding Dynamics

The distribution of funding across investor types offered insights into market sentiment.

VC/PE firms continued to dominate, showcasing their confidence in scaling startups, while the decline in angel and family office deals hinted at a cautious approach among smaller investors.

This trend aligns with a broader market sentiment influenced by global interest rate hikes and geopolitical uncertainties, leading investors to prioritize more established ventures over nascent ones.

Strategic Investments

The focus on sectors like healthtech, rural fintech, and affordable housing aligns with India’s long-term growth story.

HealthKart’s funding positions it to capitalize on the rising demand for health and wellness products, a market projected to grow exponentially over the next decade.

Similarly, SarvaGram’s funding supports the digital transformation of rural India, which is a cornerstone of the country’s development agenda.

Easy Home Finance’s investment highlights the ongoing push for financial inclusion in real estate, catering to the unmet needs of middle-income households.

Conclusion

November 2024’s funding snapshot reveals a dynamic and evolving Indian startup ecosystem.

Despite a slowdown in deal activity compared to the previous month, the year-on-year growth signals investor confidence in India’s entrepreneurial landscape. With strategic investments in high-impact sectors and a continued influx of institutional funding, the ecosystem is poised for sustained growth.

However, the dip in seed-stage activity raises questions about the long-term pipeline of innovative startups, necessitating a balanced approach from investors to ensure both immediate and future growth.

The coming months will be crucial in shaping the trajectory of India’s startups, as they navigate an increasingly competitive and resource-conscious funding environment.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Credits

Nishmitha Devadiga and Subrahmanya U R from the PrivateCircle Team.

Explore More Startup Funding Recaps:

Monthly Funding Summary Report: January 2024

Monthly Funding Summary Report: February 2024

Monthly Funding Summary Report: March 2024

Startup Funding Recap: April 2024

Startup Funding Recap: May 2024

Startup Funding Recap: June 2024

Startup Funding Recap: July 2024

Startup Funding Recap: August 2024