Overview

August 2024 was a landmark month for India’s startup ecosystem, with an impressive total funding of ₹14,659 crores across 121 deals.

This represents a remarkable 65% increase in total deal value compared to July 2024, and an astonishing 297% rise from August 2023.

The increased activity from venture capital and private equity firms is a clear indicator of the high-growth potential seen in Indian startups.

August 2024 Startup Funding Figures;

- Most Active Investors: Alteria Capital – 5 deals | Chiratae Ventures – 4 deals | Inflection Point Ventures – 4 deals | Kalaari Capital – 4 deals

- Top 3 Deals: DMI Finance ₹2,798 cr | Fourth Partner Energy ₹2,306 cr | OYO Rooms ₹1,457 cr

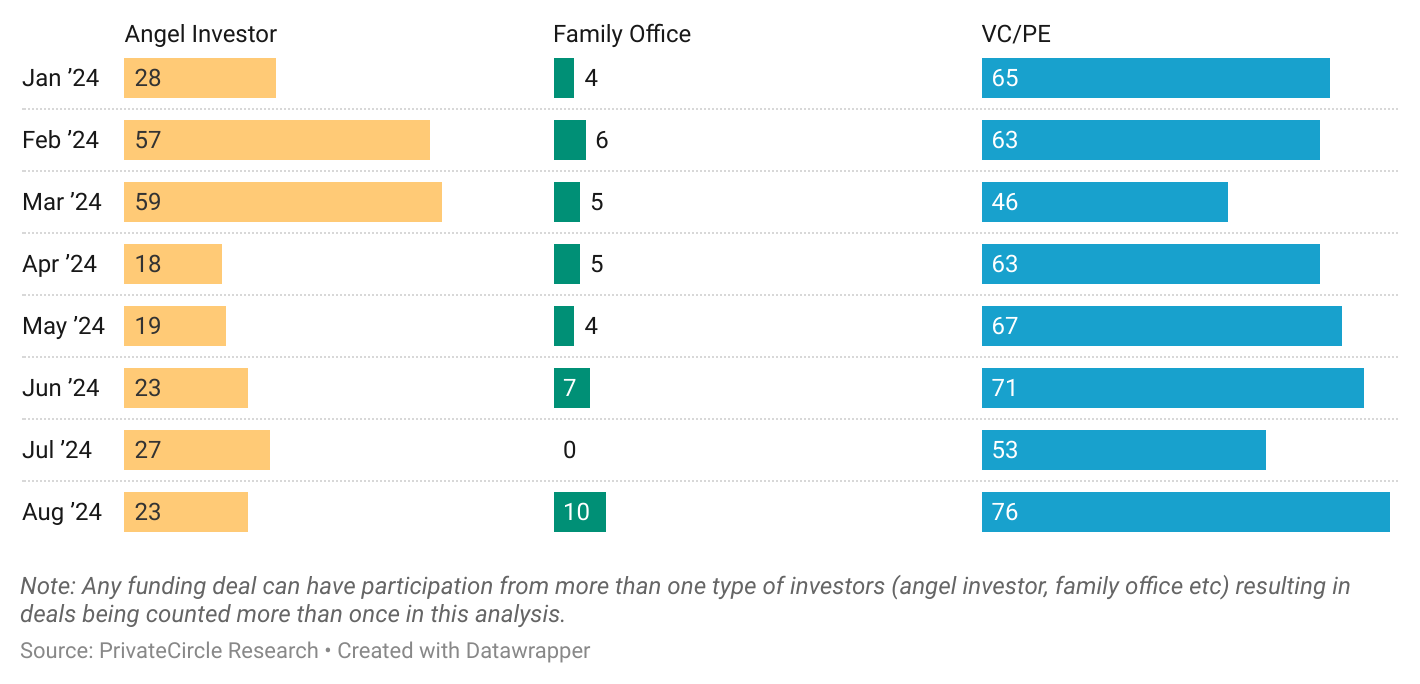

- Investor Type Deal Volume: Angel Investors – 23 deals | Family Offices – 10 deals | VC/PE – 76 deals

Blog Outline; Data and Insights by PrivateCircle Research.

- Deal Volume

- Total Deal Value

- Top 3 Deals

- Top Investors

- Investor Type Deal Volume

- Job Creation & Economic Impact

- Comparative Analysis – Monthly Performance | Investor Activity

- In-Depth Insights

- Funding Dynamics

- Strategic Investments

- Future Outlook

- Conclusion

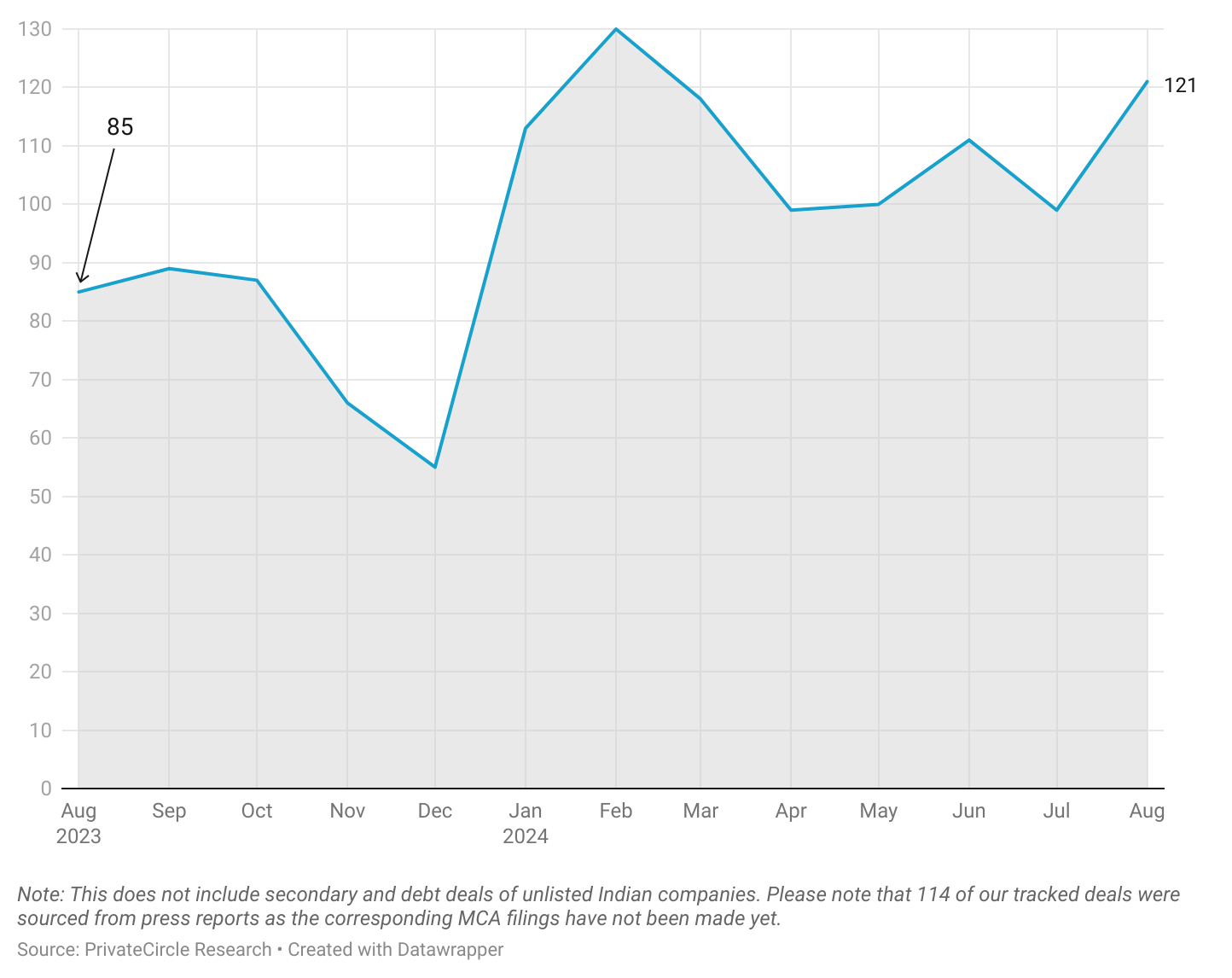

Deal Volume

Deal volumes saw a notable increase of 22% compared to July 2024. This represents a substantial 42% rise from the 85 deals recorded in August 2023.

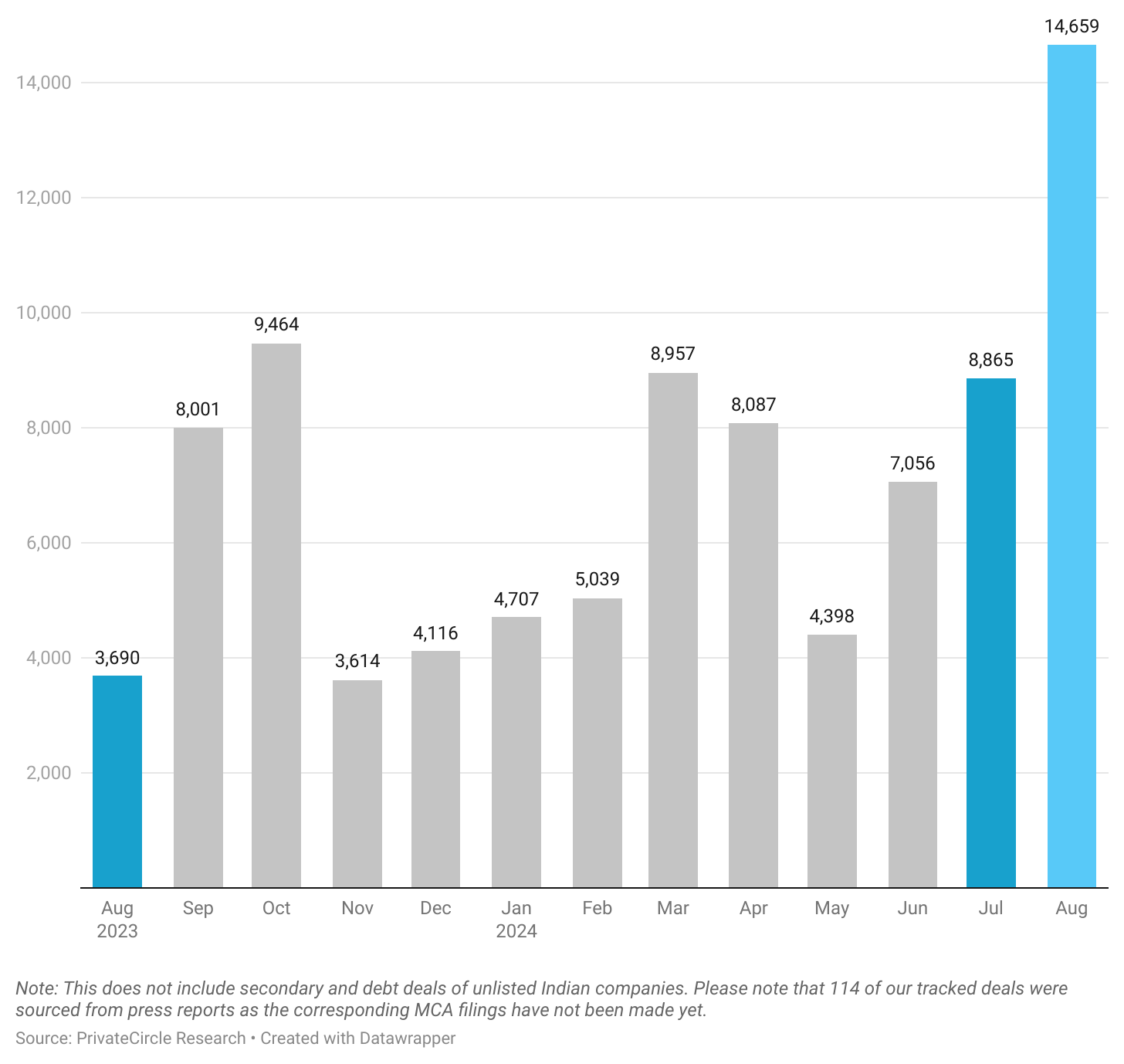

Total Deal Value (₹ cr)

The total amount raised by the startup ecosystem surged to ₹14,659 crores, marking a significant 65% increase from July 2024. This represents a substantial 297% rise compared to ₹3,690 crores raised in August 2023.

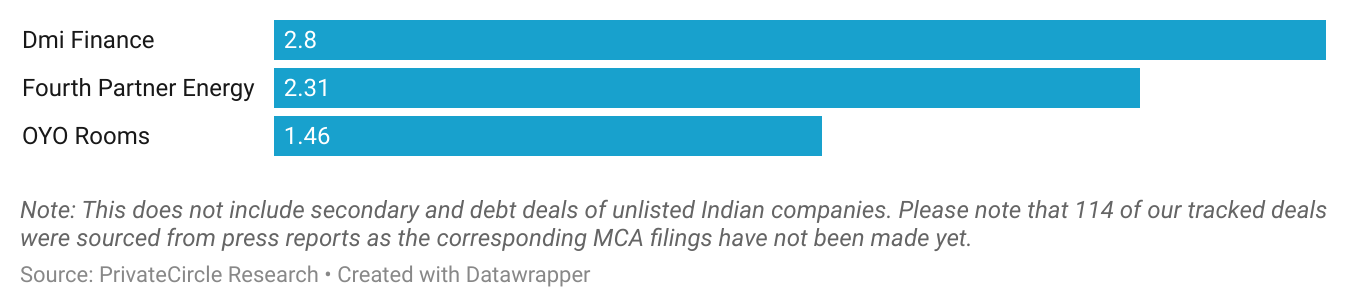

Top 3 Deals (₹ cr)

Dmi Finance secured the largest funding round in Aug 2024, raising ₹2,798 crores. Fourth Partner Energy followed with ₹2,306 crores, while OYO Rooms raised ₹1,457 crores.

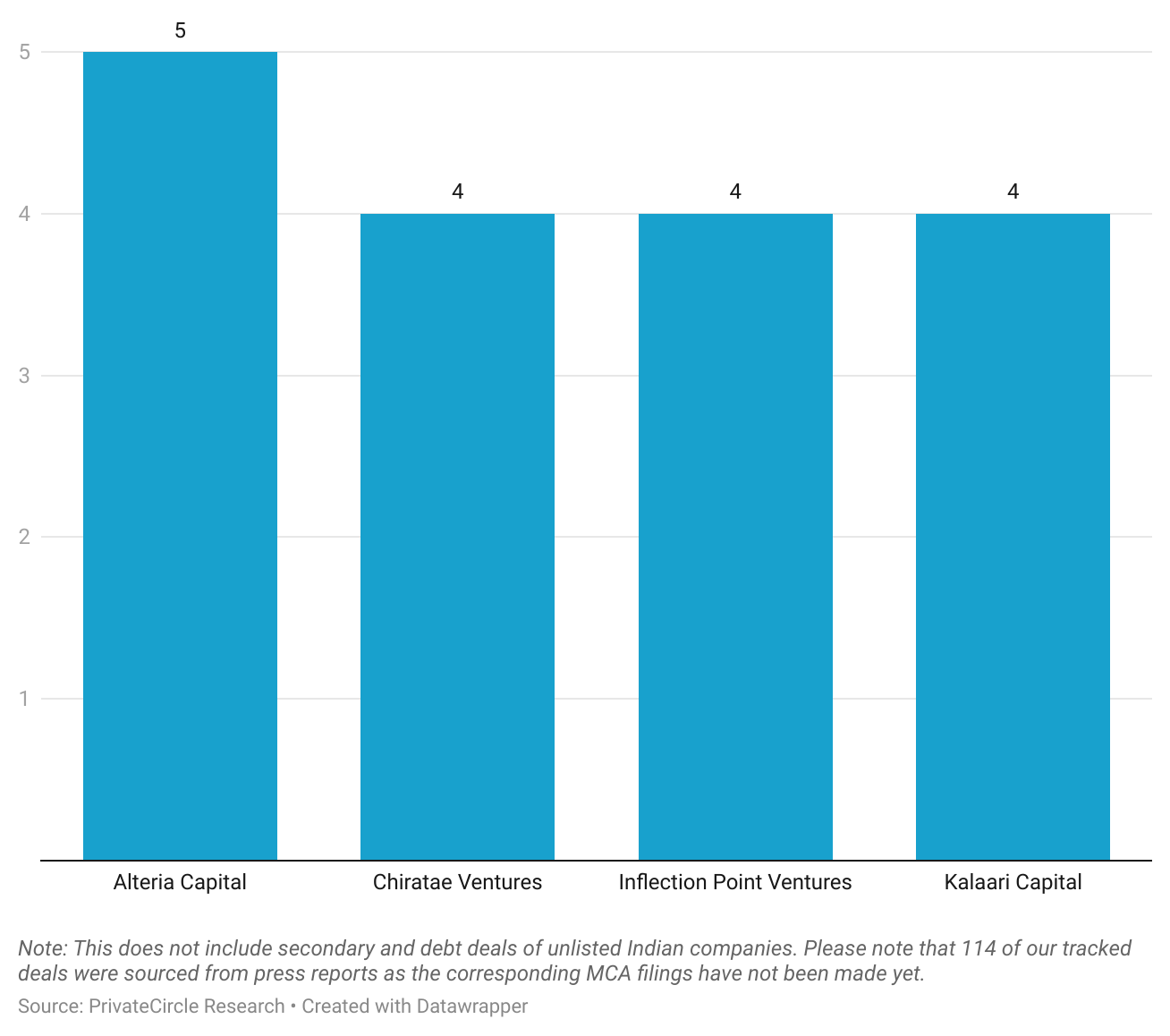

Top Investors

Alteria Capital led with 5 deals, the highest deal volume recorded for a single investor in the month. They were closely followed by Chiratae Ventures, Inflection Point Ventures and Kalaari Capital with 4 deals.

Investor Type Deal Volume

Angel Investor deals slightly decreased to 23, down from 27 in July 2024. Family Office deals saw a notable increase to 10, compared to 0 in July 2024.

VC/PE deals surged to 76, up from 53 in July 2024, highlighting increased activity from venture capital and private equity firms.

Job Creation & Economic Impact

The infusion of such large sums into the startup ecosystem is more than just a financial transaction; it represents a catalyst for job creation and economic growth.

The sectors attracting the most investment, such as fintech, renewable energy, and hospitality, are poised to expand rapidly, bringing in new opportunities for skilled labor and contributing to economic development.

With startups often driving innovation, this funding surge could also lead to the development of new technologies and services that further stimulate the economy.

Comparative Analysis

Monthly Performance

August 2024 outperformed July 2024 by a significant margin, not only in total deal value but also in the number of deals. The month saw a 22% increase in deal volume, indicating a higher frequency of transactions and a broader interest across various sectors.

This uptick in activity suggests a healthy pipeline of startups seeking capital, as well as investors actively looking to deploy funds in promising ventures.

Investor Activity

Investor activity in August 2024 was dominated by venture capital and private equity firms, which participated in 76 deals, a sharp rise from 53 in the previous month. Angel investors, while still active, saw a slight decline in deal volume, with 23 deals compared to 27 in July 2024.

Family offices made a strong comeback, participating in 10 deals after being inactive the previous month.

This shift highlights the varied strategies investors are employing, with institutional investors increasingly taking the lead in larger, more strategic funding rounds.

In-Depth Insights

A deeper dive into the data reveals that the surge in funding was not uniform across all sectors. Fintech and energy sectors were the biggest beneficiaries, with companies like Dmi Finance and Fourth Partner Energy securing the largest rounds.

This trend underscores the growing importance of financial services and sustainable energy in India’s economic future. Additionally, the hospitality sector, represented by OYO Rooms, continues to attract significant capital despite the challenges posed by the post-pandemic recovery.

Funding Dynamics

The dynamics of funding in August 2024 were shaped by a few large deals that accounted for a significant portion of the total capital raised.

The top three deals alone contributed ₹6,561 crores, nearly 45% of the total funding for the month. This concentration of capital in a few high-profile startups is indicative of a maturing ecosystem where investors are placing bigger bets on proven companies with clear growth trajectories.

Strategic Investments

Strategic investments in August 2024 were not limited to capital alone. Investors also provided startups with critical support in areas like market expansion, talent acquisition, and technology development.

For example, the investment in Fourth Partner Energy is expected to drive the company’s expansion into new markets and accelerate the deployment of renewable energy solutions across India.

Such strategic moves not only enhance the growth prospects of individual startups but also contribute to the broader industry’s evolution.

Future Outlook

Looking ahead, the momentum seen in August 2024 is likely to continue, with sustained interest from both domestic and international investors. The focus will likely remain on sectors like fintech, energy, and technology, which are at the forefront of India’s economic transformation.

As the ecosystem continues to evolve, we can expect to see more mega-deals, increased participation from global investors, and a continued emphasis on innovation and scalability.

Conclusion

August 2024 stands out as a pivotal month for Indian startups, marking a period of significant growth and investment. The record-breaking funding and deal volumes are a testament to the resilience and potential of the Indian startup ecosystem.

As we move forward, the insights gained from this month’s activity will serve as a valuable guide for investors, entrepreneurs, and policymakers looking to capitalise on the opportunities within this dynamic landscape.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Data Curation by Chethan Gowda Mahesh Kumar Nishmitha Devadiga and Vidhath Alva from the PrivateCircle team.

Explore More Startup Funding Recaps:

Monthly Funding Summary Report: January 2024

Monthly Funding Summary Report: February 2024

Monthly Funding Summary Report: March 2024

Startup Funding Recap: April 2024

Startup Funding Recap: May 2024