Overview

September 2024 witnessed a dynamic yet slightly declining phase for the Indian startup ecosystem in terms of funding activity. With total funding reaching ₹12,715 crores across 107 deals, the figures indicate a 13% dip from the previous month of August.

However, compared to September 2023, both the deal volume and the total value represent a significant uptick, marking a 20% rise in deal count and a staggering 59% increase in funding value.

These fluctuations demonstrate the unpredictability of startup funding, where the overall market appears robust despite short-term volatility.

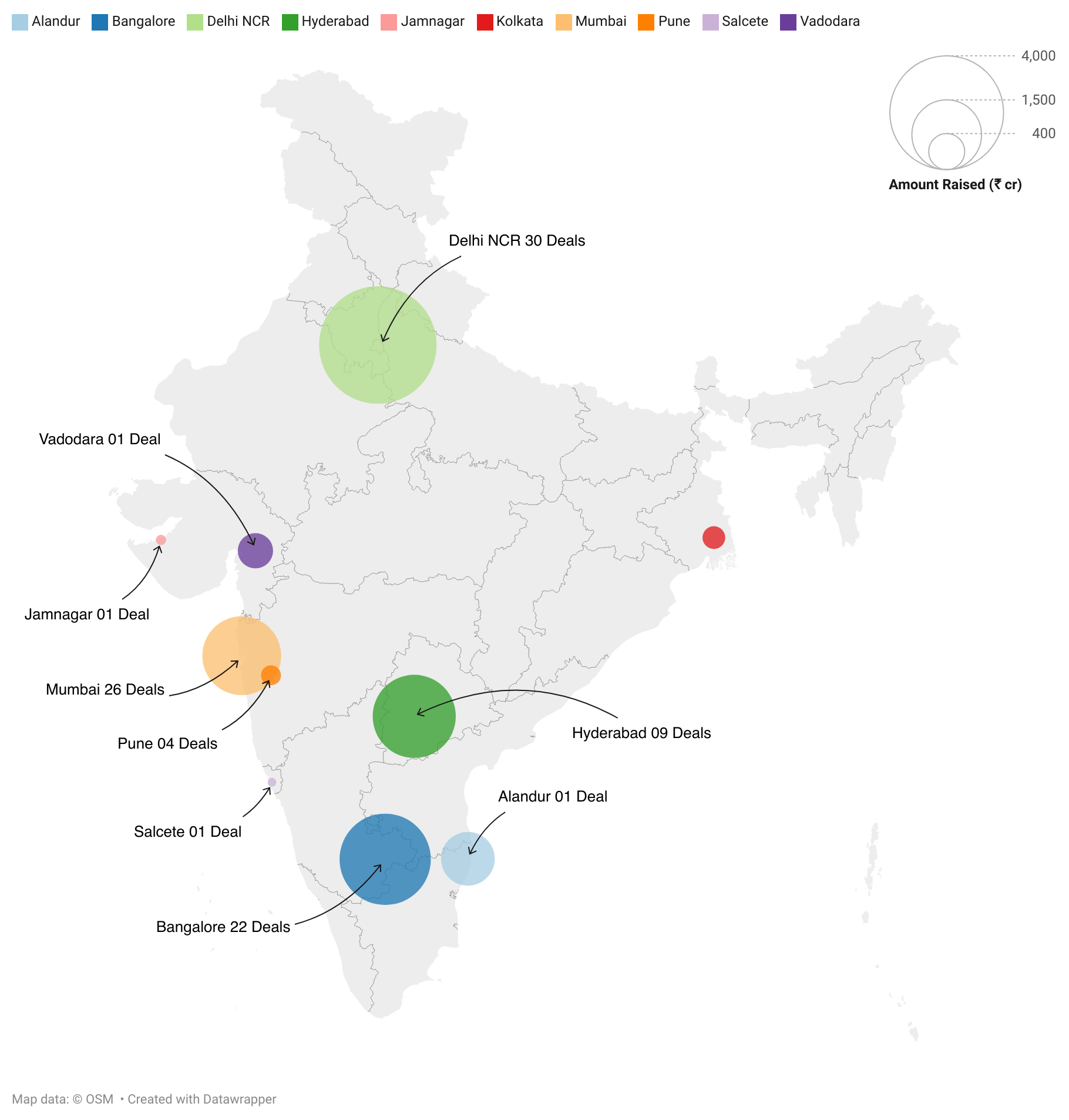

Viewed through a city-wise lens, while Tier 1 cities dominated the funding charts, with Delhi NCR and Bangalore leading the pack, Tier 2 and 3 cities experienced remarkable growth in deal value and volume.

This contrast between metro and smaller cities signals shifts in investor sentiment and the emerging allure of innovation hubs outside major urban centres.

September 2024 Startup + CityWise Funding Figures;

- Investor Type Deal Volume: Angel Investors – 28 deals | Family Offices – 04 deals | VC/PE – 65 deals

- Most Active Investors: Venture Catalysts – 5 deals | Thinkuvate – 4 deals | Westbridge Capital Partners – 4 deals

- Top 3 Deals: PhysicsWallah ₹1,755 cr | Rapido ₹1,680 cr | Whatfix ₹1,044 cr

- Delhi NCR startups raised the highest funding totalling to ₹4270 cr (30 deals), followed by Bangalore with ₹2547 cr (22 deals) and Hyderabad at ₹2101 crores (9 deals).

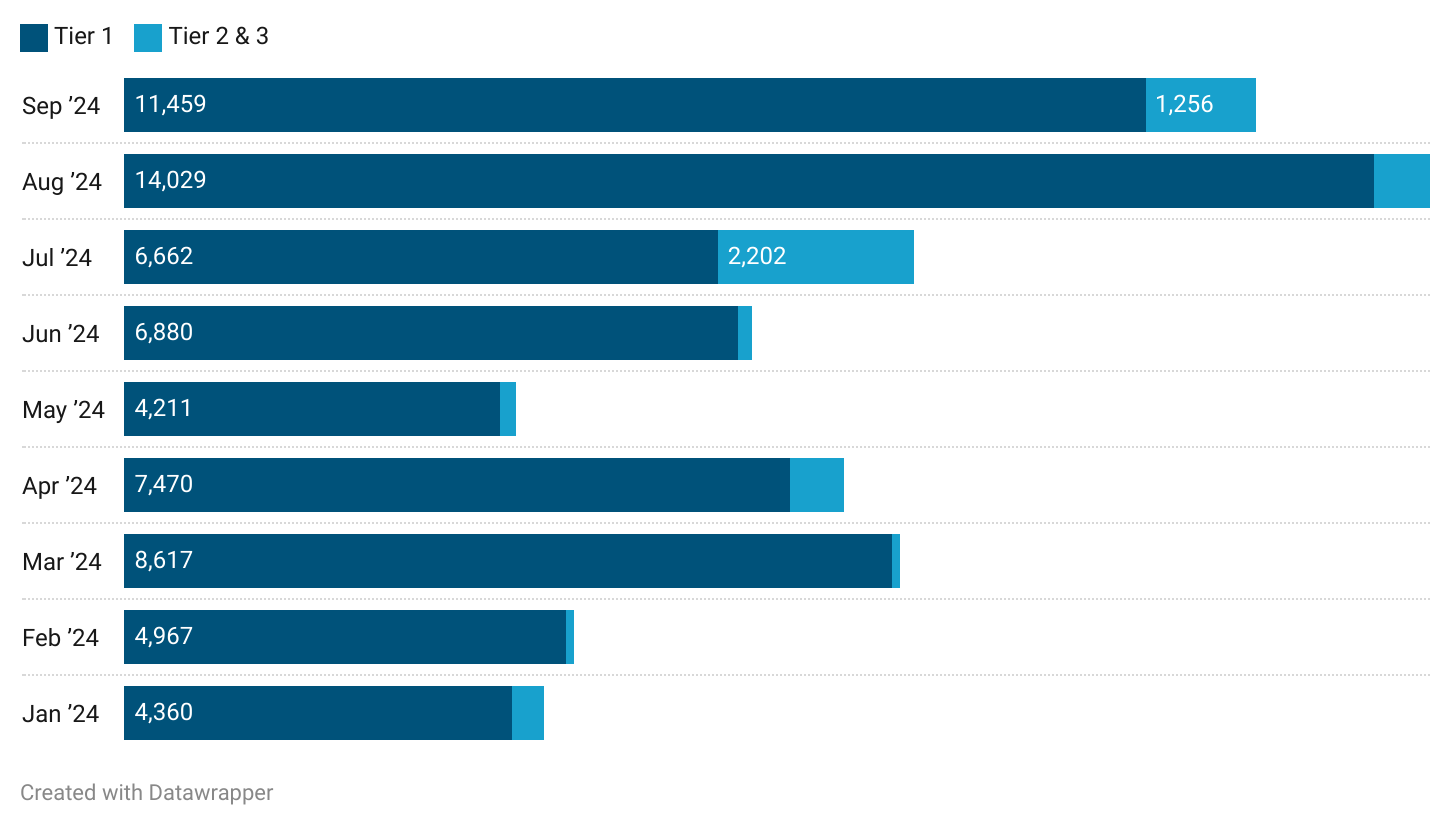

- Tier 1 cities raised ₹11,459 cr and Tier 2 raised ₹1,256 cr.

Blog Outline; Data and Insights by PrivateCircle Research.

- Deal Volume

- Total Deal Value

- Top 3 Deals

- Top Investors

- Investor Type Deal Volume

- City-Wise Deal Size

- Funding Across Tier 1, 2 & 3 Cities

- Avg. Deal Size for Tier 1-3 City Startups

- Investor Type by City Tier

- Job Creation & Economic Impact

- Comparative Analysis – Monthly Performance | Investor Activity

- In-Depth Insights

- Funding Dynamics

- Strategic Investments

- Conclusion

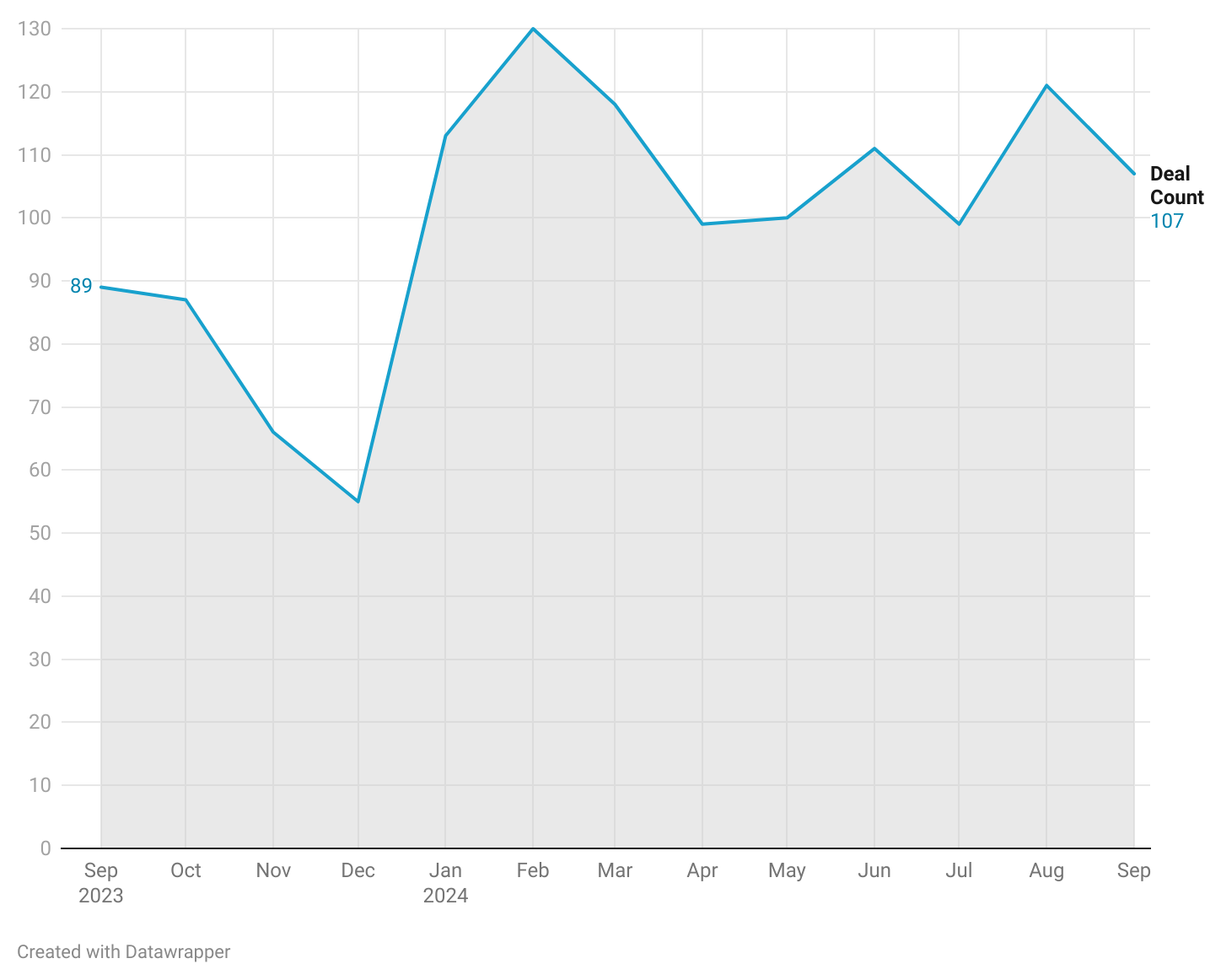

Deal Volume

In September 2024, deal volumes recorded a slight decline of 12% compared to the previous month of August 2024.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 103 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

Despite this dip, the 107 deals registered in September 2024 still represent a significant 20% increase from the 89 deals seen in September 2023.

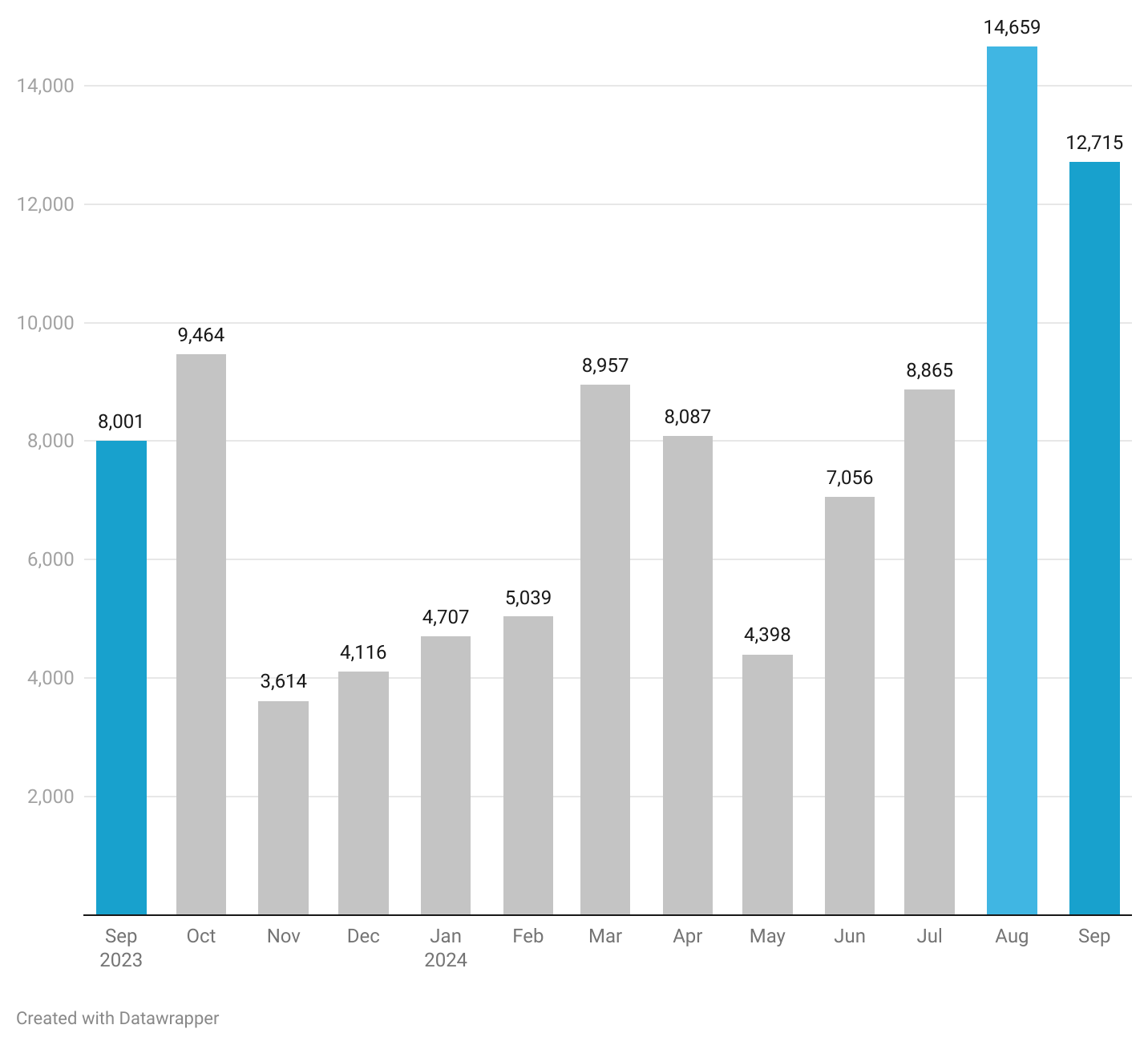

Total Deal Value (₹ cr)

The amount raised by the startup ecosystem totalled ₹12,715 crores, reflecting a 13% decrease from the peak in August 2024.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 103 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

However, this still marks an impressive 59% increase compared to the ₹8,001 crores raised in September 2023.

Top 3 Deals (₹ cr)

Edtech unicorn PhysicsWallah’s ₹1,755 crores Series B round was the biggest deal in September, followed by Rapido’s unicorn round of ₹1,680 crores and Whatfix’s ₹1,044 crore funding round.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 103 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

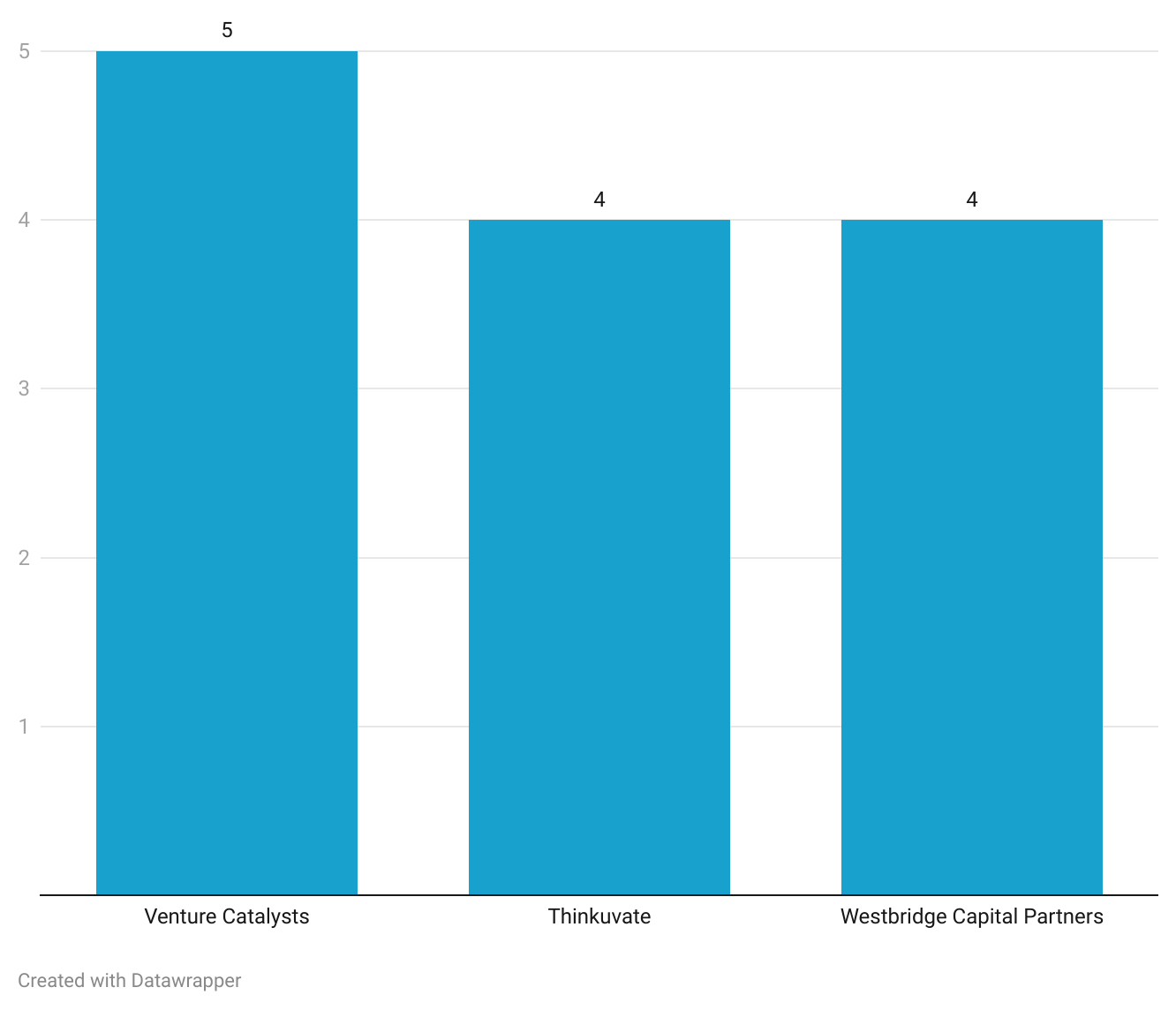

Top Investors

Venture Catalysts led with 5 deals, marking the highest deal volume for a single investor during the month.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 103 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

They were closely followed by Thinkuvate and Westbridge Capital Partners, each recording 4 deals.

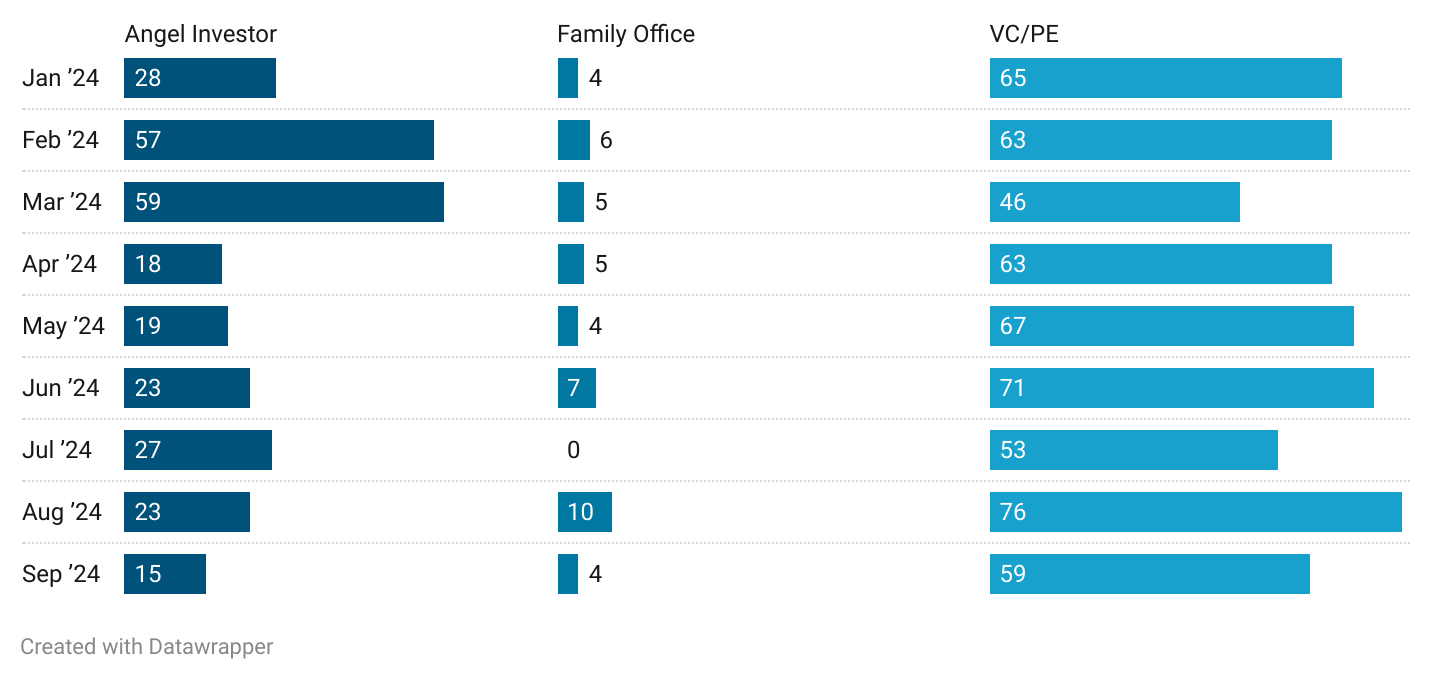

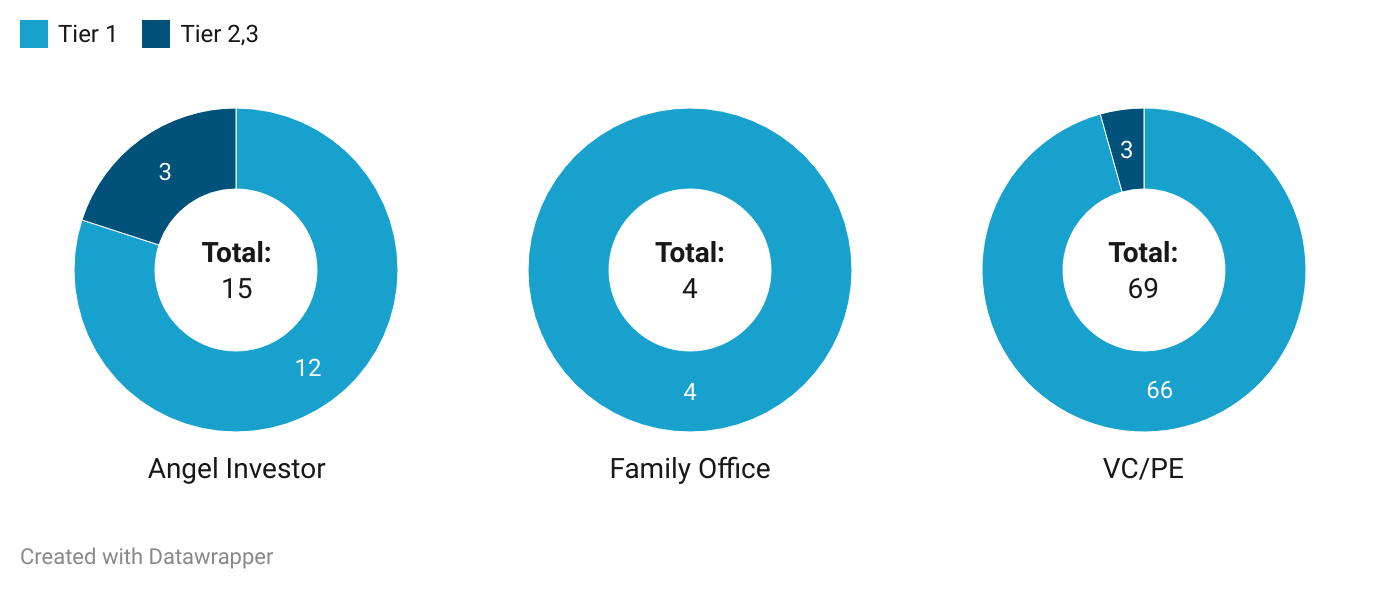

Investor Type Deal Volume

Angel Investor deals saw a significant drop to 15, down from 23 in August 2024, continuing a downward trend since July. Family Office deals also decreased to 4, following a peak of 10 deals in August 2024.

Note: Any funding deal can have participation from more than one type of investors (angel investor, family office etc) resulting in deals being counted more than once in this analysis.

Meanwhile, VC/PE deals fell to 59, down from 76 in August 2024, marking a cooling off after the heightened activity seen in the previous month.

City-Wise Deal Size (₹ Cr)

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 114 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

Funding Across Tier 1, 2 & 3 Cities (₹ Cr)

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 114 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

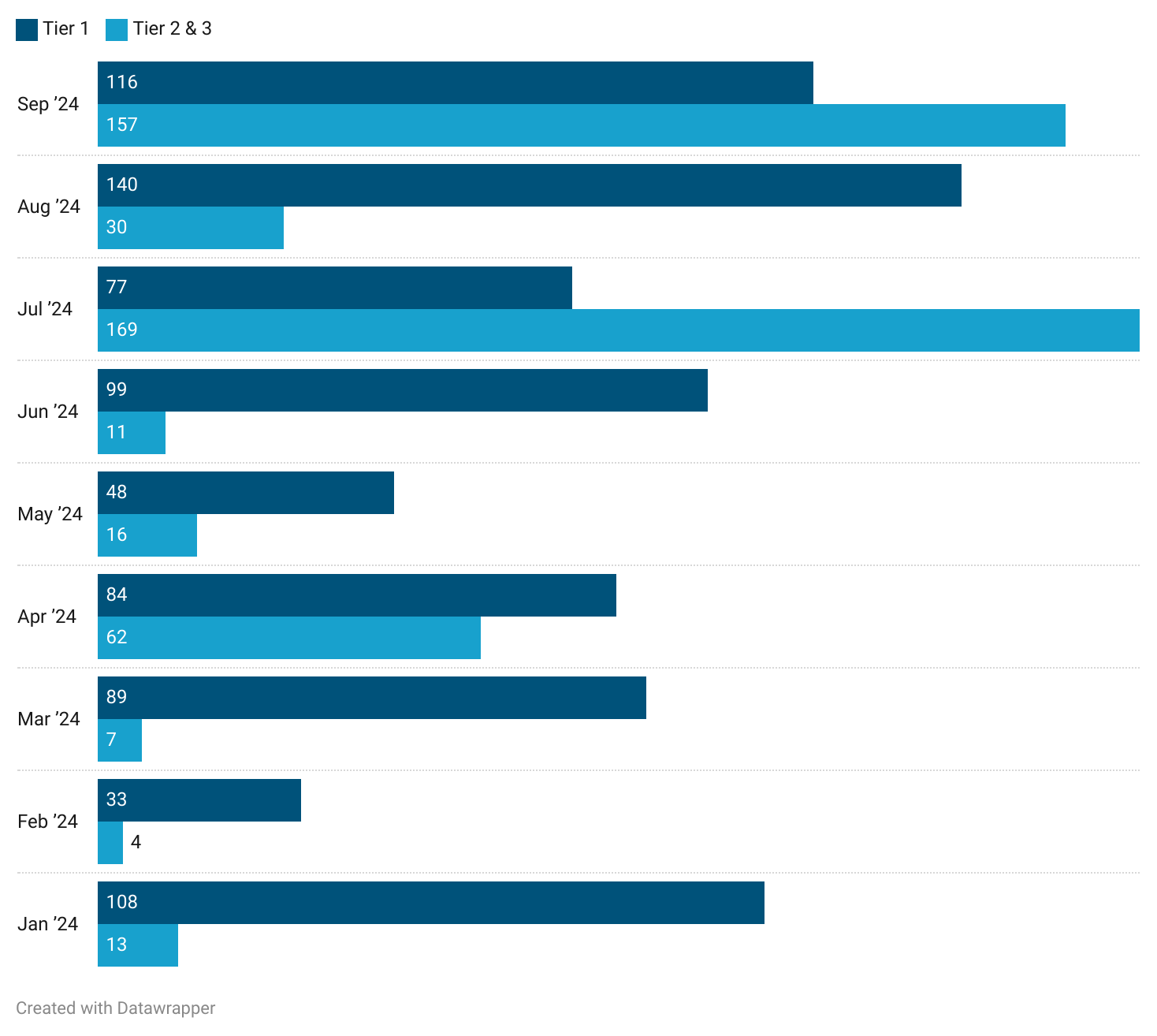

Avg. Deal Size for Tier 1-3 City Startups (₹ Cr)

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 103 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

Investor Type by City Tier

Note: Any funding deal can have participation from more than one type of investors(angel investor, family office etc) resulting in deals being counted more than once in this analysis.

Job Creation and Economic Impact

The funding rounds of major startups like PhysicsWallah and Rapido, which primarily operate in education and transportation, respectively, are not just about scaling operations but also about job creation and economic stimulus.

Edtech and mobility, key sectors during this period, saw significant expansions, promising to hire for roles ranging from technology development to customer support.

Historically, significant rounds like these result in hundreds or even thousands of new jobs, directly or indirectly impacting various economic facets, including real estate, logistics, and consumer spending.

CityWise

The funding influx into Tier 1 cities like Delhi NCR, Bangalore, and Hyderabad continues to fuel job growth and urban development in these tech-centric regions. Meanwhile, the surge in Tier 2 and 3 city investments is a promising sign for job creation in non-metro areas.

This diversification not only spreads economic benefits more evenly but also strengthens regional economies, potentially reducing migration pressures on Tier 1 cities.

Comparative Analysis

Monthly Performance

A key takeaway from the month’s performance is that the September 2024 startup funding total of ₹12,715 crores reflects continued resilience despite a 13% drop from August.

The previous month saw a more substantial peak, but this is still a far cry from a slowdown. On a year-over-year basis, the startup ecosystem continues to thrive with higher deal values and funding rounds compared to September 2023.

The drop in angel investor deals (from 23 in August to 15 in September) suggests growing caution among early-stage backers, while the rise of later-stage funding shows confidence in more mature companies.

CityWise

Tier 1 cities saw an average deal size increase to ₹116 crores, slight drop from the August’s average of ₹140 crores.

Meanwhile, Tier 2 & 3 cities experienced a surge in average deal size, reaching ₹157 cr, majorly driven by Alandur-based M2P’s ₹850 cr funding round.

Investor Activity

Venture Catalysts emerged as the most active player with five deals, reflecting their broad reach across multiple sectors. Thinkuvate and Westbridge Capital Partners followed closely with four deals each, further solidifying their position in the startup funding ecosystem.

While angel investors and family offices saw a noticeable dip in activity, venture capital and private equity funds remained the dominant forces, with a total of 59 deals in September.

This investor diversity underscores the different strategies at play: angels and family offices may be more risk-averse amid uncertain market conditions, while VCs and PEs are doubling down on startups with strong growth potential.

CityWise

VC/PE firms continued to favor Tier 1 cities, with 66 deals, while Tier 2 and 3 cities attracted only 3 deals. Angel investors also leaned towards Tier 1 cities, participating in 12 deals. Interestingly, family offices focused exclusively on Tier 1 cities, with no presence in smaller markets.

This trend highlights the continued appeal of metro regions among larger and more risk-averse institutional investors.

In-depth Insights

The most significant deals of the month highlight the ongoing strength of the edtech and mobility sectors. PhysicsWallah, an edtech unicorn, raised ₹1,755 crores in its Series B round, signaling continued investor faith in education as a sector capable of both scale and innovation.

Similarly, Rapido’s ₹1,680 crores round underscores the increasing demand for alternative urban transportation solutions, particularly as Indian cities grapple with congestion and inadequate public transit systems.

Furthermore, the funding landscape also saw growing participation from international investors, further globalising the Indian startup ecosystem.

This trend not only boosts the profile of Indian startups but also opens doors for more cross-border collaborations and potential exits.

CityWise

Despite these overarching trends, the data suggests a budding interest in expanding investment focus to emerging cities.

M2P’s substantial funding in Alandur, for example, reflects how strategic investments are beginning to venture beyond metro borders, particularly for industries less reliant on urban infrastructures, such as financial services and certain tech sectors.

Funding Dynamics

The data reveals a shift in investor priorities, where early-stage deals, particularly angel and family office investments, have slowed down, while later-stage rounds continue to attract significant capital.

The cooling off of early-stage deal activity may be attributed to concerns over valuations, profitability, and macroeconomic factors like inflation and rising interest rates.

On the other hand, established startups with proven business models continue to raise funds to scale operations, acquire talent, and expand into new markets.

One interesting observation is that the participation of multiple investor types (angel, VC, family office) in a single deal often leads to an overlap in the data.

This indicates the collaborative nature of startup financing, where investors from different stages of the growth cycle are working together to fuel innovation and expansion.

CityWise

The distribution of funds across cities showcases how traditional tech hubs continue to thrive. However, smaller cities, fueled by lower operational costs and favourable government incentives, are slowly attracting attention from investors.

This shift could lead to a more diversified and resilient startup ecosystem across India, capable of weathering economic fluctuations and leveraging regional strengths.

Strategic Investments

The month’s top deals also underscore the strategic nature of investments. For example, PhysicsWallah’s expansion into offline tutoring centers across India demonstrates its hybrid strategy of combining digital and physical assets to reach a broader audience.

Similarly, Rapido’s funding will likely fuel further penetration into Tier 2 and Tier 3 cities, where demand for affordable ride-sharing services is rapidly growing.

These moves represent not only a scaling opportunity for these startups but also a deepening of their business models to cater to evolving consumer needs.

CityWise

Notably, sectors like EdTech and FinTech, typically dominated by Tier 1 cities, are witnessing growing competition from smaller markets. This diversification within the investor portfolio is crucial as it demonstrates a willingness to explore beyond established metro hubs, potentially leading to more balanced growth.

Conclusion

September 2024 has been a testament to the resilience of the Indian startup ecosystem. Despite a slight decline in deal volume and value compared to August, the market remains robust, with a noticeable increase in year-over-year performance.

As the funding landscape continues to evolve, strategic investments in established sectors like edtech and mobility will play a crucial role in shaping the future. Investors are likely to maintain their cautious optimism, focusing on sustainable growth and long-term potential.

The remainder of 2024 will be pivotal as the ecosystem navigates its way through both challenges and opportunities, setting the stage for a dynamic and transformative 2025.

CityWise

The September 2024 city-wise funding recap highlights a dynamic startup landscape in India, where the familiar strength of Tier 1 cities coexists with the budding potential of smaller cities.

As investments spread, a more robust and inclusive innovation ecosystem is forming, promising diversified growth and opportunity across India’s cities.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Credits

Chethan K Nishmitha Devadiga and Vidharth Alva K from the PrivateCircle team.

Explore More Startup Funding Recaps:

Monthly Funding Summary Report: January 2024

Monthly Funding Summary Report: February 2024

Monthly Funding Summary Report: March 2024

Startup Funding Recap: April 2024

Startup Funding Recap: May 2024

Startup Funding Recap: June 2024