Introduction

Welcome to a riveting episode of It’s-a-Big-Deal, where we delve into the intricacies of the latest happenings in the Indian startup scene.

In today’s spotlight is InCred Finance, the newly-anointed unicorn that recently secured an impressive ₹500 cr in its Series D funding round.

Watch the Episode 11 available on YouTube.

About InCred

InCred Finance, a cutting-edge lending tech startup, has carved its niche by offering an array of financial solutions, including Personal Loans, Education Loans, and SME Business Loans, catering to credit-worthy individuals.

In a market flooded with over 200 lending startups, the question arises: Why did investors place their bets on InCred Finance? Especially in an environment where growth rounds have been a rarity.

Let’s dissect the numbers.

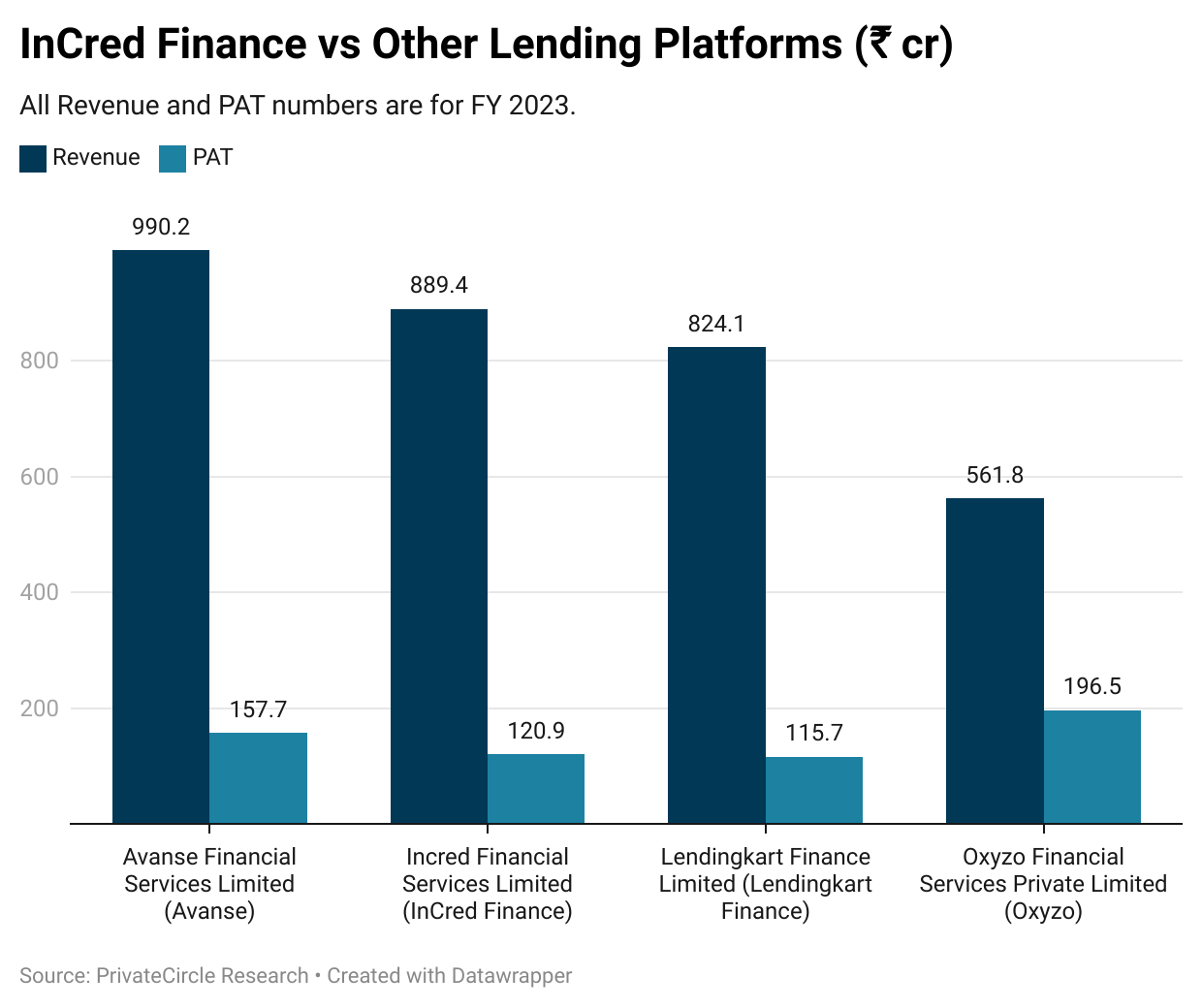

Upon scrutinizing InCred’s latest financials, a remarkable story unfolds. The company boasts a total revenue of ₹889.4 cr, coupled with a net profit of ₹120.9 cr. What sets InCred apart is its sustained profitability, with FY2023 marking its second consecutive year in the black.

Notably, the one-year revenue growth rate stands at an impressive 69.65%.

To provide context, a comparative analysis with other lending startups reveals InCred’s robust standing. While Avanse reports a marginally higher total revenue at ₹990.2 cr, and LendingKart follows closely at ₹824.1 cr, InCred holds its ground.

Both Avanse and LendingKart are PAT positive, with net profits of ₹157.7 cr and ₹115.7 cr, respectively.

An intriguing insight emerges when we consider Oxyzo, with a net profit of ₹196.5 cr in FY 2023, surpassing InCred and Avanse. However, Oxyzo’s revenue is nearly half of its counterparts.

InCred, therefore, stands tall among its peers, justifying the premium it commands from investors.

Decoding the Deals

The recent funding round, a substantial ₹500 cr, propels InCred Finance to a post-money valuation of ₹88.0 Bn. A staggering 141% increase from its ₹36.4 Bn valuation in 2017. This places the current valuation at approximately 10 times InCred’s revenue and an impressive 34.27 times its EBITDA on a trailing basis.

However, it comes at the cost of a 5.68% stake dilution in the company’s shareholding.

Closing Remarks

InCred Finance’s meteoric rise is affirmed by its recent unicorn status, joining the elite club of 115 unicorn startups in India. Founder & Group CEO Bhupinder Singh envisions taking the business public in the coming years, setting the stage for another phase of growth.

As we conclude today’s episode, we extend our best wishes to InCred Finance on its exciting journey ahead. Stay tuned to PrivateCircle for more intriguing insights into the dynamic landscape of Indian startups and the VC ecosystem.

We hope you found this analysis insightful. Thank you for joining us on It’s-a-Big-Deal.

Sign up on our platform – privatecircle.co/research and do such in-depth analysis in minutes.

Try our FREE trial/demo to access reliable data, intelligence, and insights. Lead your research on 1.7 million private unlisted companies across 500+ data categories with confidence.

Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute professional financial advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of the company / organization. Please consult a qualified financial professional prior to making any financial decisions.

Read more blogs of It’s-a-Big-Deal series:

Epsiode 1 | 27 Feb – 05 Mar 2023

Episode 3 | 13 Mar -15 Apr 2023

Episode 4 | 16 Apr – 02 May 2023

Episode 6 | 25 May – 17 June 2023

Episode 7 | 18 Jun – 14 Jul 2023

Episode 8 | 15 Jul – 20 Aug, 2023

Episode 9 | 21 Aug – 24 Sep, 2023

Episode 10 | 25 Sep – 15 Oct 2023