Welcome to another It’s-a-big-deal blog powered by PrivateCircle Research. In this episode we delve into the top private market deals from India between 18 June and 14 July, 2023.

Watch the Episode 7 available on Linkedin and YouTube.

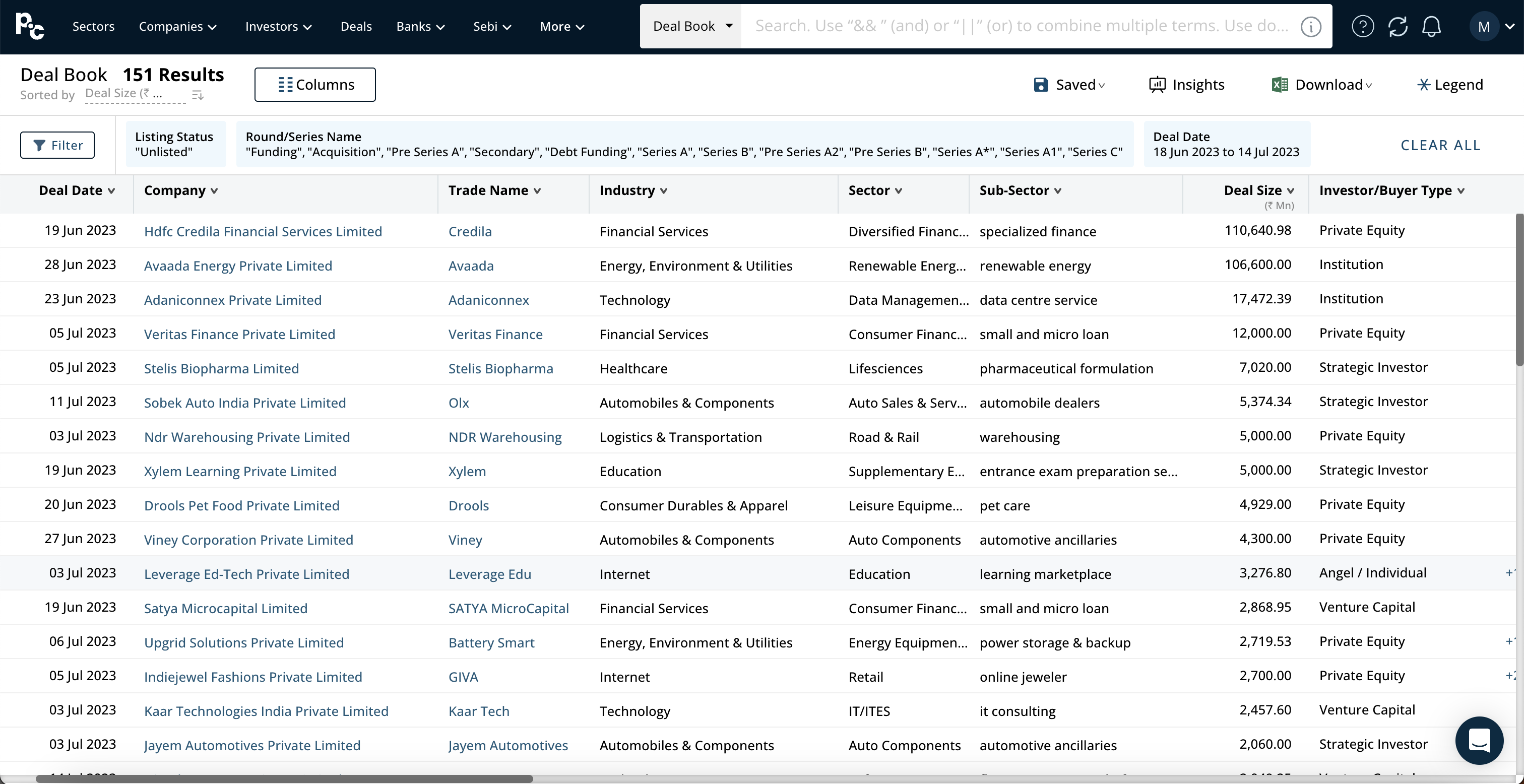

Going through the deals that happened over the last one month. We apply the date-filter, and a few more filters in the Deal Book – and here we get a list of all the private market deals from the past 4 weeks.

In this analysis, we will be trying something different. Instead of picking the highest value deal and focusing on that, we will be digging deeper on something that caught our eye in the past few weeks.

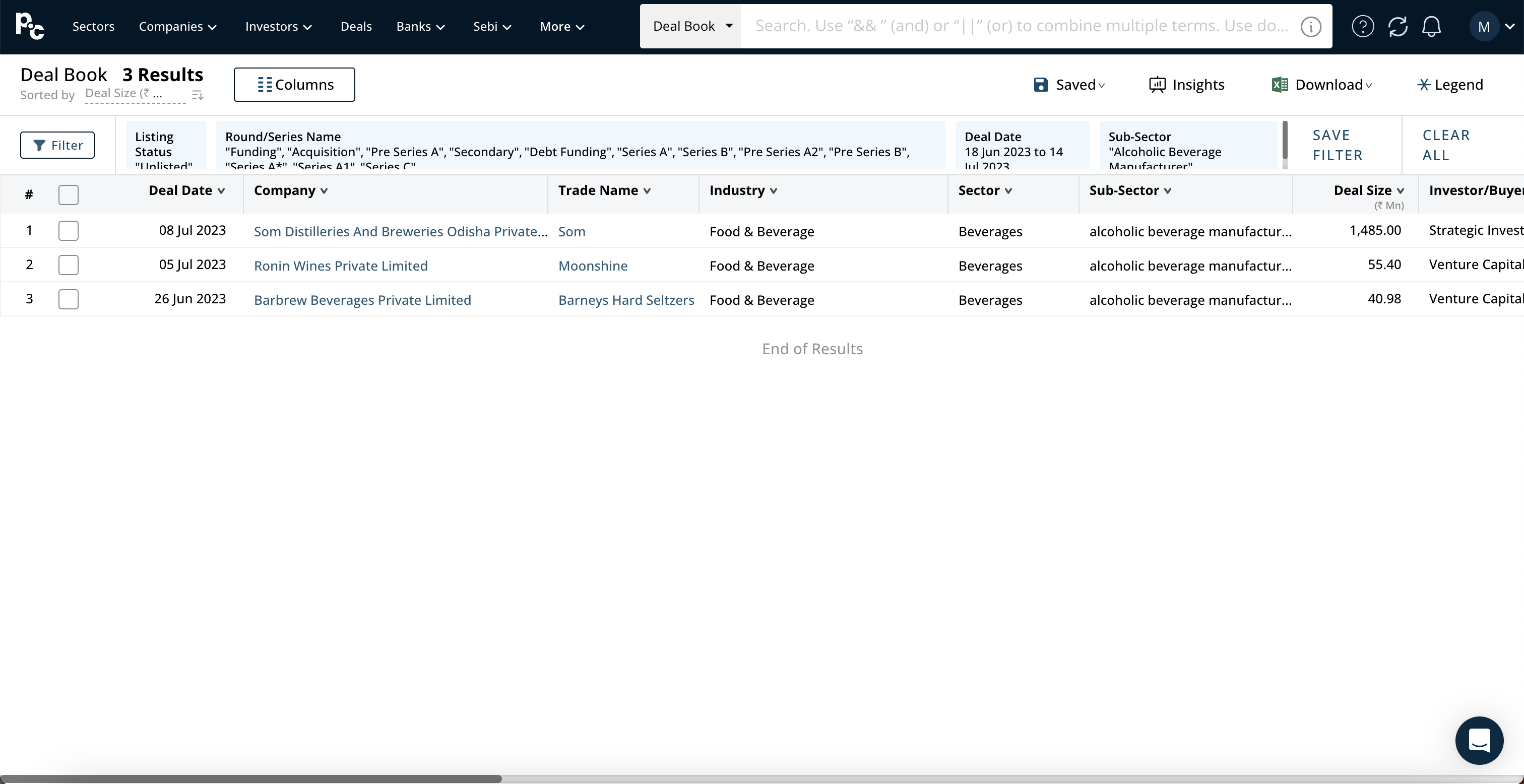

Recently we came across a few alcohol based startups and companies raising their primary rounds on our private market transaction marketplace, PrivateCircle Markets. Considering that, we are curious to explore this vibrant sector.

Taking a closer look at the Indian alco-bev startups, we find the top one – Som Distilleries and Breweries Odisha Pvt Ltd – received about ₹150 cr funding. But it has come from its own promoters. The other two however, are VC funded.

Picking the higher one among them, we get the deal from Ronin Wines Pvt Ltd. It operates with the brand Moonshine.

A Glimpse into the Private Market Deals

Before we delve into Ronin Wines’ captivating journey, let’s explore the broader alco-bev ecosystem in India. When faced with such need for targeted research and analysis based on specific criteria, PrivateCircle Research becomes an invaluable tool that can be of reliable assistance.

Since 1st January 2020, there have been a whopping 162 deals in the alcohol sub-sector involving unlisted companies. The name that frequently appears in this space is none other than Bira91, a brand well-known to many of us.

Delving deeper into the data, we uncovered seven deals surpassing the ₹100 cr mark, 40 deals crossing ₹10 cr, and around 90 deals ranging between ₹1 to ₹10 cr. The diversity and activity in this sector are truly remarkable, reflecting the dynamic nature of India’s evolving liquor market.

Ronin Wines Pvt Ltd

Incorporated in January 2016 by Rohit Rehani and Nitin Vishwas, Ronin Wines has been making waves in the industry. Their recent deal, raising a substantial ₹148 cr, showcases the potential and appeal of alcohol-based startups to investors.

Series A Funding and Growth Trajectory

Analyzing Ronin Wines’ funding history, we discovered that this recent capital infusion appears to be an extension of their Series A funding round.

Last year, in September, the company had raised $720 thousand, equivalent to about ₹10 million, at that time’s valuation.

Now, with an additional $675 thousand secured, totaling around ₹23 cr in funding so far, the company is well-positioned for growth and expansion.

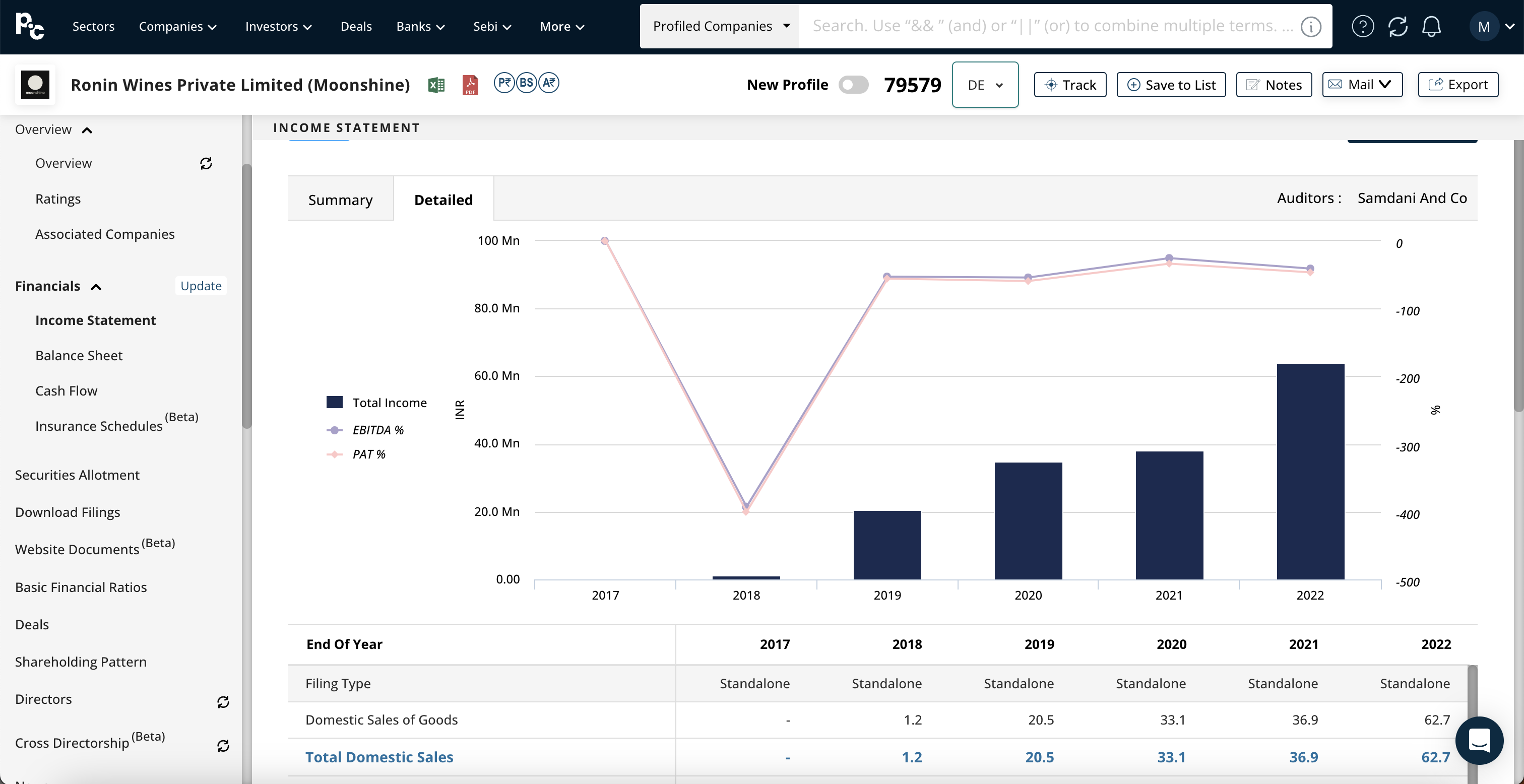

Analyzing Ronin Wines’ Performance

Taking a closer look at Ronin Wines’ financials, we observe that their EBITDA has been fluctuating between a negative 25% to 50% range over the last three financial years.

Considering their growth and scaling phase, such fluctuations can be expected as the company invests in marketing, hiring, and other expansion activities.

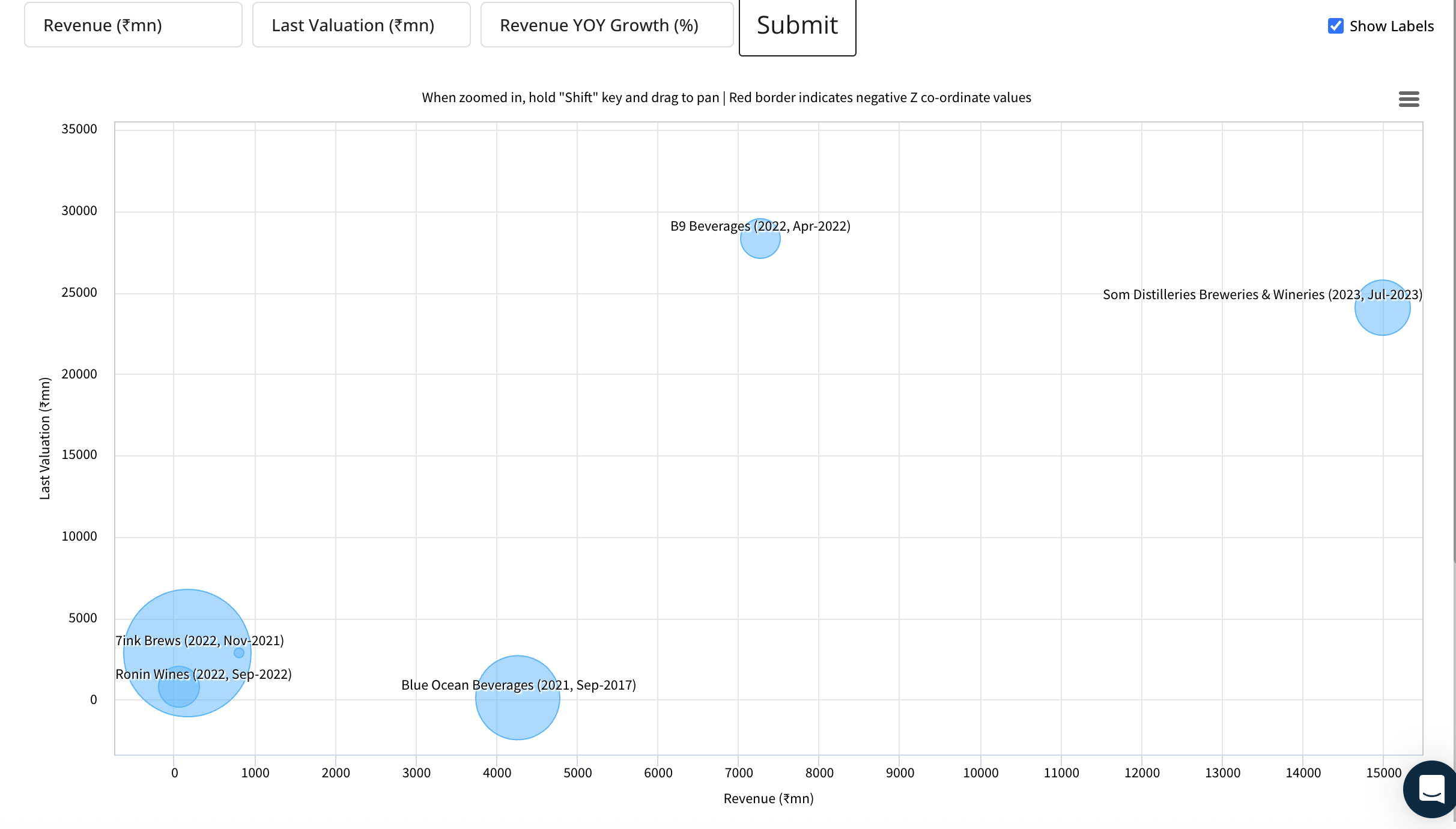

Placing Ronin Wines on the Chart

To better understand Ronin Wines’ position in the alco-bev landscape, we plotted some of the leading unlisted companies in this sub-sector on an aggregate chart. We measured their valuation on the Y-axis, revenue on the X-axis, and year-on-year growth as the bubble size.

Ronin Wines appears at the bottom left corner of the chart, indicating immense potential for growth in the future.

The Evolution of India’s Liquor Market

India’s liquor market has witnessed a significant transformation, driven by various factors. On one hand, the supply side has seen the emergence of affordable premium labels, catering to diverse consumer preferences.

On the other hand, the demand side has been influenced by changing drinking habits, particularly among the younger generation.

Concluding Cheers

As we wrap up this episode, we hope you found this analysis insightful and captivating. Ronin Wines Pvt Ltd’s journey exemplifies the dynamism and potential within India’s alco-bev startup landscape.

If you’re a fund or an individual investor interested in this exciting sector, don’t forget to explore active deals curated on our fundraising platform – PrivateCircle Markets.

Stay informed about the latest trends in the Indian private markets by signing up for our newsletter and experience the power of PrivateCircle Research‘s trial/demo to make informed investment decisions effortlessly.

Cheers to exciting opportunities and the pursuit of success in the ever-evolving world of Indian private markets!

Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute professional financial advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of the company / organization. Please consult a qualified financial professional prior to making any financial decisions.

Read more blogs of this series:

Epsiode 1 | 27 Feb – 05 Mar 2023

Episode 3 | 13 Mar -15 Apr 2023

Episode 4 | 16 Apr – 02 May 2023

Episode 6 | 25 May – 17 June 2023