Welcome to another It’s-a-big-deal blog powered by PrivateCircle Research. In this episode we delve into the top private market deals from India between 15 July – 20 August, 2023.

Watch this Episode 8 available on Linkedin and YouTube.

In this episode, we’ll be exploring an acquisition deal in the Indian private market. But first, let’s clarify what an acquisition means in the context of private markets.

An acquisition occurs when one company purchases most or all shares of another company. While we often hear about acquisitions involving large, well-known companies, it’s worth noting that mergers and acquisitions (M&A) are more frequent among small and medium-sized firms.

Infact, many corporate clients are using PC Research to identify M&A targets, particularly in sectors like FMCG (Fast-Moving Consumer Goods) and Fashion.

Simplified for ease of use, PC Research plays a pivotal role in accessing such comprehensive and data-rich research, providing a 360° perspective. With the use of powerful filters, you can not only unlock the list of companies relevant to your requirement but also deep dive in the company financials like income statement, balance sheet, cash flow, along with 500+ other data points.

Needless to say, all of this is presented in an elegant user interface, ensuring a smooth and engaging experience like never before.

Unveiling the Kurlon-Sheela Acquisition

It is intriguing to discover that the top deal during this period (15 Jul – 20 Aug, 2023) involves Kurlon Enterprise Limited being acquired by Sheela Foam Limited.

The deal size is a substantial ₹2000 cr, which translates to approximately $248 million, with a 95% stake acquired. This acquisition places Kurlon’s valuation at around ₹2150 cr.

Kurlon Enterprises Limited: A Glimpse

Kurlon Enterprises Limited is a leading company specializing in mattresses and other furnishing products. Despite being a relatively young entity of just a decade, the business itself has a history spanning over half a century.

In their last reported financials for FY22, Kurlon recorded a revenue of approximately ₹810 cr, accompanied by a net loss of around ₹5 cr. Notably, their three-year CAGR reflects a negative trend of approximately -9%.

It’s evident that their revenue has seen fluctuations, with a decline from over ₹1100 cr in FY18 to approximately ₹770 cr in FY21, followed by a slight recovery in FY22.

The Story of Motilal Oswal and Kurlon

What adds intrigue to this acquisition is the involvement of Motilal Oswal Private Equity. They had entered Kurlon’s cap-table in 2015 when the company was valued at ₹550 cr.

The recent sale of shares to Kurlon Enterprises Limited and its promoters marks a partial exit for Motilal Oswal, resulting in a significant return on investment – a remarkable 4x return.

Sheela Foam Limited: A Robust Player

On the other side of the acquisition, we have Sheela Foam Limited, also known as SFL. SFL is a publicly listed company and the proud owner of the renowned mattress brand Sleepwell.

With over five decades of business experience, SFL achieved a substantial revenue of about ₹3000 cr by the end of FY23 – nearly four times that of Kurlon.

Additionally, SFL had previously ventured into the world of acquisitions by acquiring a 35% stake in Furlenco, an online furniture rental platform, for ₹300 cr or $36 million.

Market Dominance and Forward-Thinking

This acquisition between Kurlon and Sheela Foam solidifies their market presence in the organized mattress industry. Post-acquisition, the combined entity will command approximately 35-40% market share.

Furthermore, Sheela Foam’s investment in Furlenco underscores the willingness of traditional businesses to invest in new-age models, especially when these investments align with their strengths.

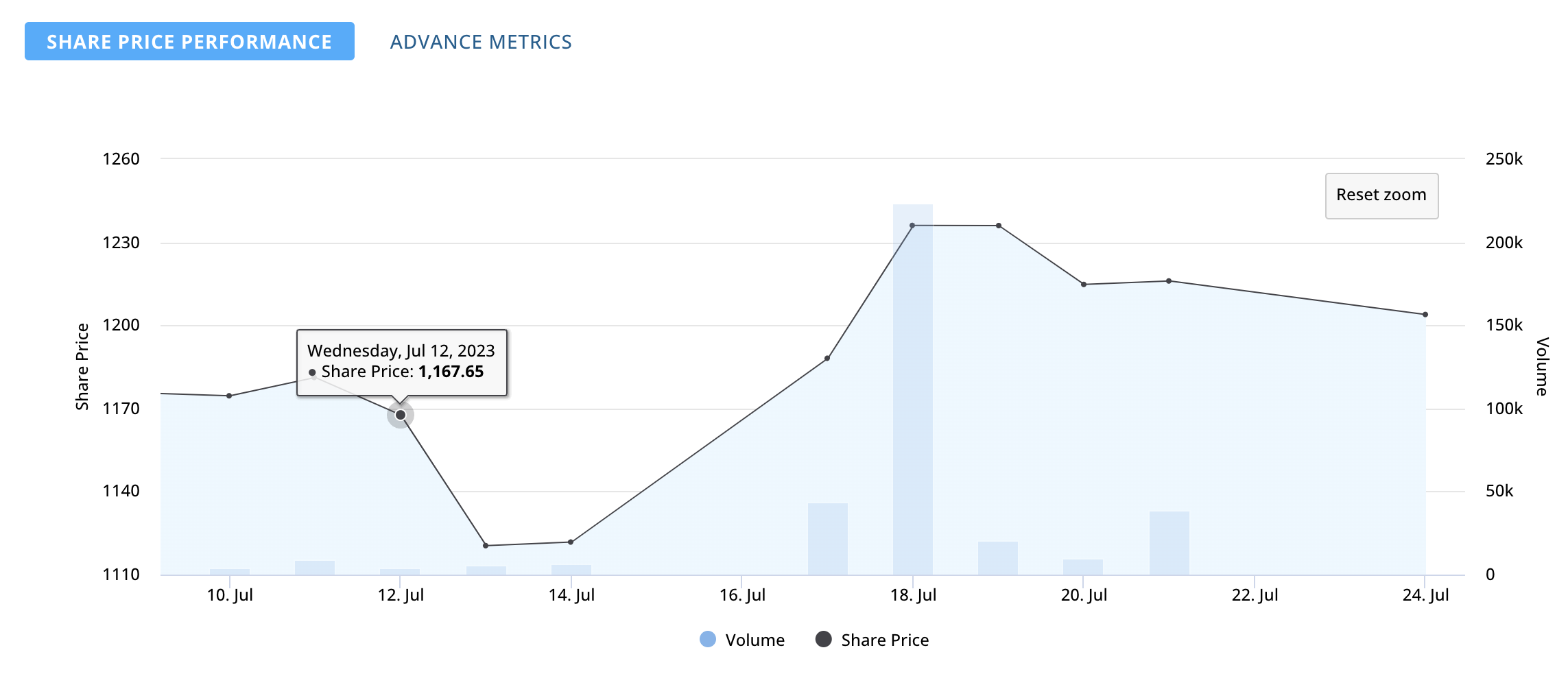

It’s noteworthy that the stock market responded positively to these acquisition deals when they were announced, reflecting optimism about the synergies and growth potential they bring.

In the dynamic landscape of private markets, opportunities and transformations like the Kurlon-Sheela acquisition constantly reshape the business world. Don’t miss out on staying informed and engaged with the latest developments.

We hope you found this analysis informative and insightful. Your feedback is precious, so please share your thoughts with us. Stay tuned for more It’s-a-big-deal blogs, where we’ll continue to unravel fascinating private market deals.

Venture on an exciting journey into the realm of Indian private markets and take the lead in your research with PrivateCircle Research. Get started with our complimentary trial and even schedule a product demo for an immersive experience.

Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute professional financial advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of the company / organization. Please consult a qualified financial professional prior to making any financial decisions.

Read more blogs of It’s-a-big-deal series:

Epsiode 1 | 27 Feb – 05 Mar 2023

Episode 3 | 13 Mar -15 Apr 2023

Episode 4 | 16 Apr – 02 May 2023

Episode 6 | 25 May – 17 June 2023

Episode 7 | 18 Jun – 14 Jul 2023