The Indian retail market is booming, undergoing a seismic shift in consumer preferences. Gone are the days of in-store shopping; today, contactless and convenient delivery reign supreme in the digital realm of e-commerce.

Amidst this evolution, hyperlocal delivery is quietly disrupting access to goods and services. Part of the vast Internet industry, it’s become a dynamic force within retail while bridging the gap between consumers and local businesses.

In an age of instant gratification, hyperlocal delivery is the lifeline for swift access to essentials, from groceries to medicines.

Hyperlocal Convenience

Standing out in this subsector is the Reliance and Google backed startup, Dunzo Digital Private Limited. Based in Bengaluru, Dunzo embodies hyperlocal convenience, leveraging technology to reshape urban day-to-day shopping practices.

Besides delivery orders, you can also send and receive hyperlocal couriers and track them in real time on Dunzo.

Why Dunzo?

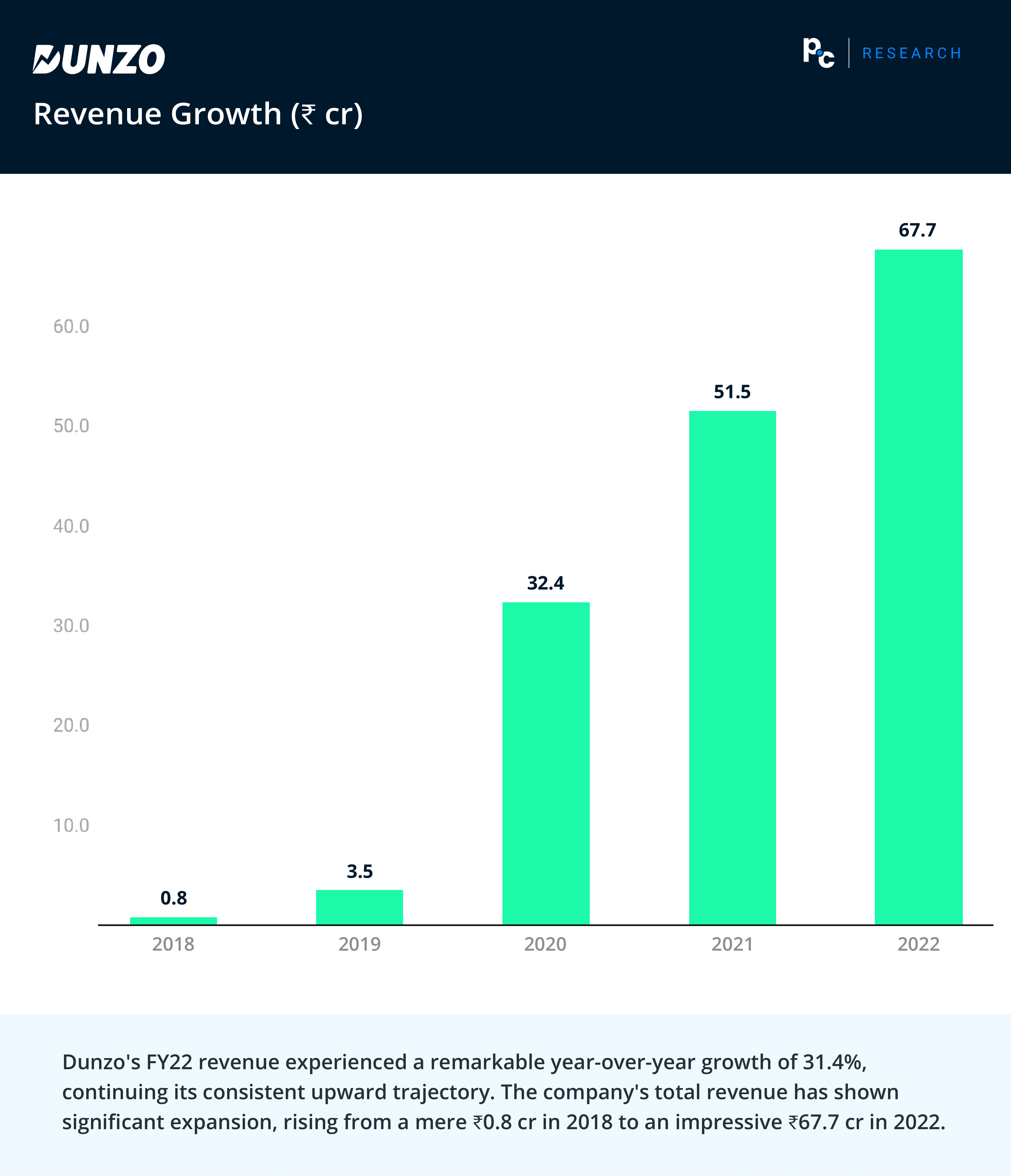

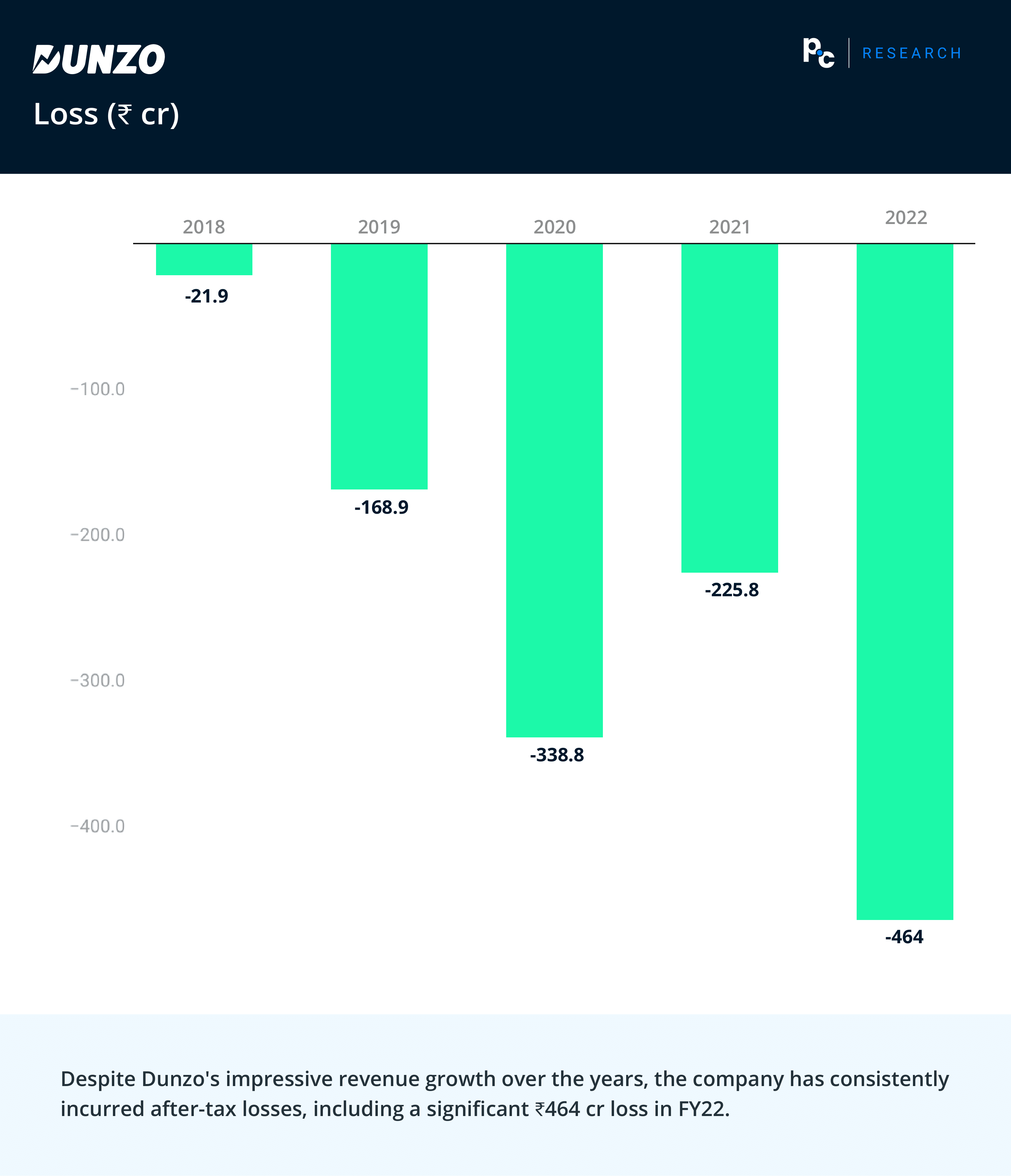

As Dunzo navigates financial challenges, there is a growing interest towards the startup. The company’s financial trajectory is a tale of striking revenue growth, from 0.8 cr in 2018 to 67.7 cr in 2022, coupled with persistent after-tax losses, including a substantial ₹464 cr loss in FY22.

These figures underscore the complexities of scaling in the competitive hyperlocal delivery market. Moreover, Dunzo’s adaptable resource allocation and fluctuating workforce numbers reflect its strategic responsiveness to market dynamics and competition, making its financials an intriguing subject of analysis and discussion.

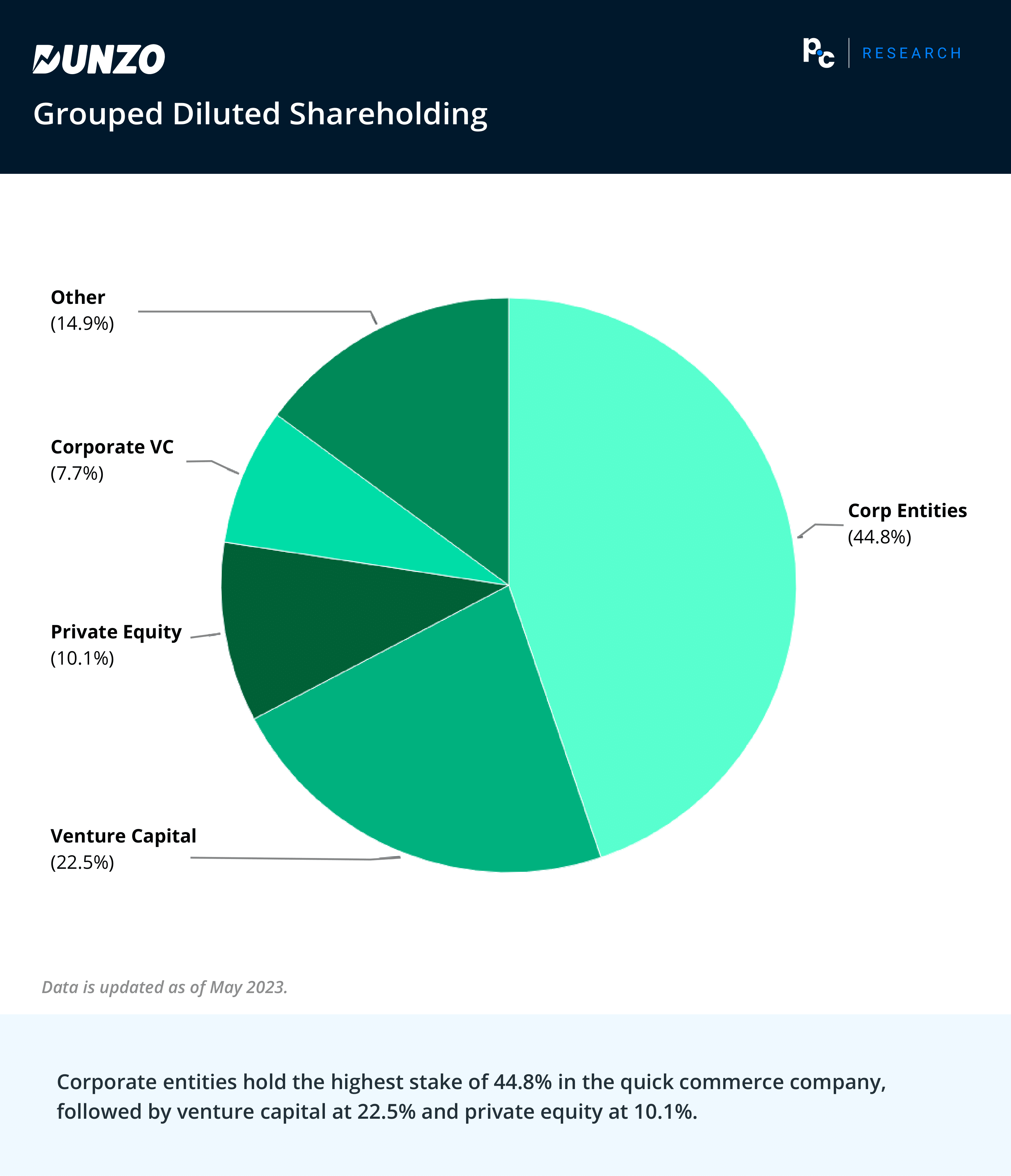

This blog explores a long term financial outlook of the hyperlocal delivery platform. The report consists of the following metrics; Revenue Growth, Marketing Spend, Loss, Grouped Diluted Shareholding, and Series Wise Funding.

These metrics not only provide a window into the company’s recent developments but also offer a peek into its long-term historical performance.

What is the Historical Performance Summary Report?

Historical Performance Summary Report is our endeavor to delve deeper into a company’s market performance across several years, all through the lens of data. As a robust data intelligence platform, these reports serve as a testament to the capabilities of the PrivateCircle Research dashboard.

Dunzo’s Classification Highlights

Industry – Internet

- India’s Internet economy is expected to increase from US$ 175 billion in 2022 to US$ 1 trillion by 2030.

- The share of the Internet economy in India’s technology sector will increase from 48% in 2022 to 62% in 2030. Further, it was claimed that it will also make up 12-13% of India’s GDP, up from 4-5% in 2022.

Sector – Retail

- Indian retail market size – $883 bn in 2020, expected to reach $1000 bn by 2025.

- Food & grocery compromises of 63.30% of the total retail market.

- Indian E-commerce market valued at $38 bn in 2021.

- India’s retail trading sector attracted $4.68 bn FDIs between April 2000 – September 2022.

Subsector – Hyperlocal

- India will have 214 million hyperlocal e-commerce shoppers by the end of calendar 2022 with a growth rate of 52% from the estimated 141 million as of May, 2022 – WATConsult report.

- Usage of hyperlocal services – local food delivery 52%, local logistics 40%, and groceries and vegetables 38%.

- Reasons to use hyperlocal services – quick services 33%, unique product and services 27%, and easy to return products 26%.

- Concerns with hyperlocal apps – Data security and privacy 33%, less personalized experience 32%, lacks better customers query resolution 31%.

One of Dunzo’s standout achievements is its consistent revenue growth. This growth underscores the increasing reliance of consumers on hyperlocal delivery services.

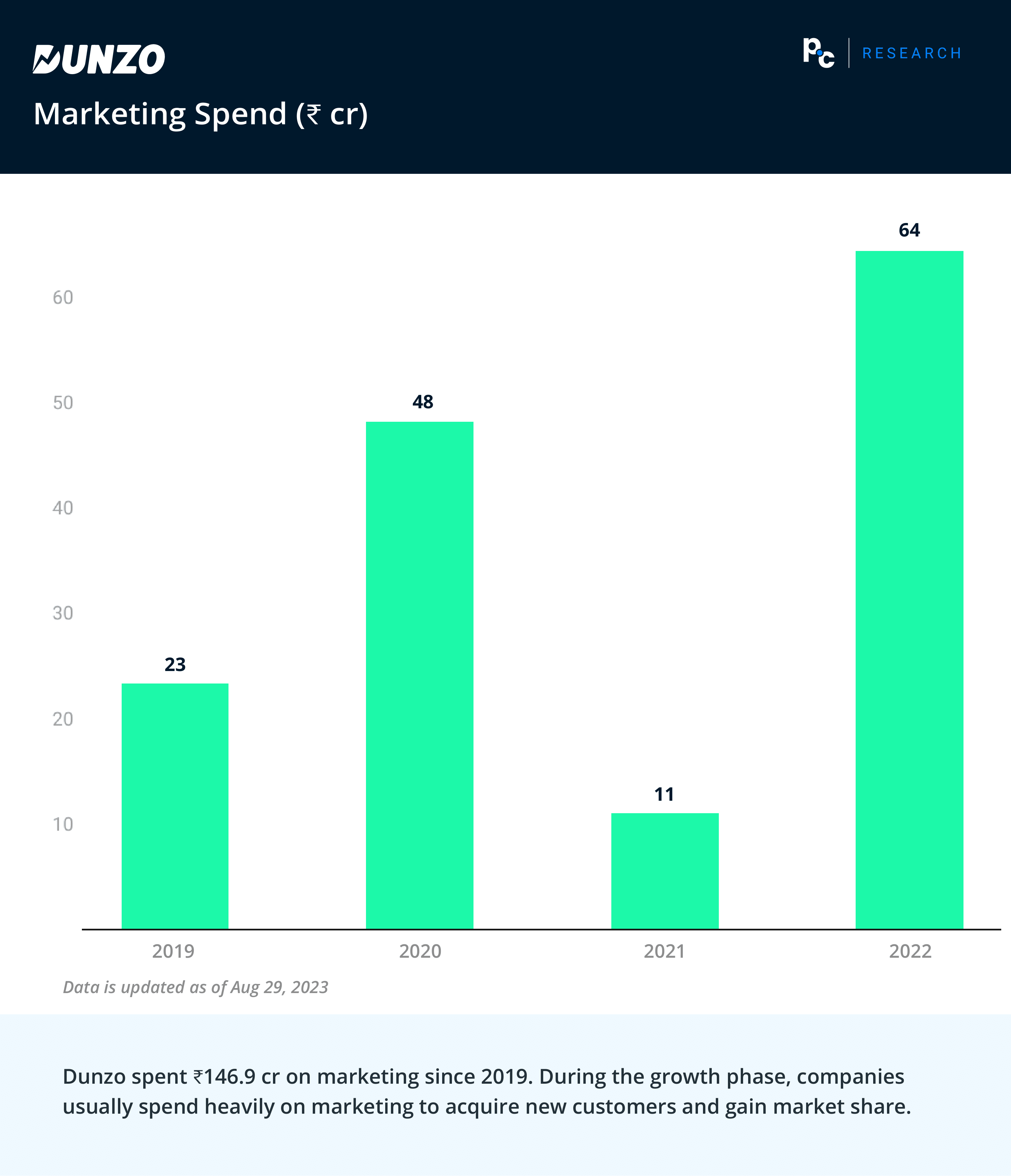

Marketing plays a pivotal role in Dunzo’s growth strategy. Notably, there was a reduction in marketing expenses in 2021, followed by a substantial increase in 2022.

Dunzo allocated a substantial budget to marketing in order to acquire a vast customer base during its growth phase. Presently, as the company prioritizes profitability, Dunzo says it has shifted its focus to achieving organic growth at a rate of 2-4% per month.

These losses underscore the formidable challenges and expenses associated with expanding and competing in India’s hyperlocal delivery market.

Dunzo’s focus on growth and market presence has led to substantial investments and incurred losses in the short term. In fact none of the quick commerce companies have managed to achieve profitability thus far.

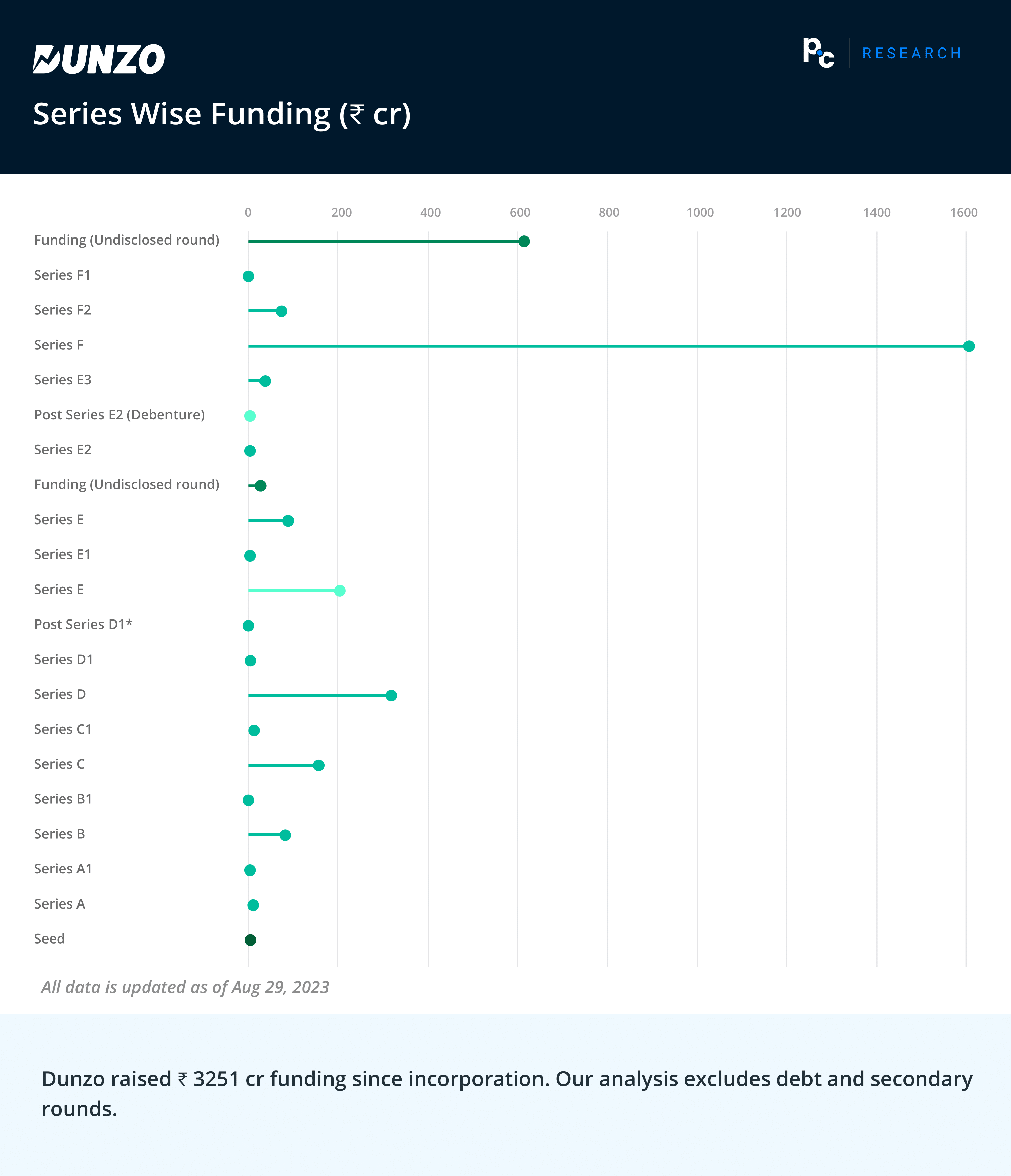

Dunzo’s funding history is a testament to investor confidence. Since its inception, Dunzo has raised an impressive ₹3,251 cr in funding, highlighting its potential and the recognition of its disruptive role in the hyperlocal delivery sector.

Dunzo Peers

- Kiranakart Technologies Private Limited (Zepto) with Revenue ₹1.4 Bn FY 2022 and CAGR 2636357.41% FY 2022.

- Blink Commerce Private Limited (blinkit) with Revenue of ₹2.4 Bn FY 2022 and 3-yr CAGR 42.6% FY 2022.

Conclusion

Dunzo’s journey represents the evolution of hyperlocal delivery in India. Its growth trajectory, coupled with challenges faced along the way, underscores the dynamism of the industry, the significance of the retail sector, and the emergence of hyperlocal delivery as a crucial sub sector within the broader digital landscape.

As Dunzo continues to innovate and expand, it remains a key player reshaping how we experience convenience in our daily lives.

Note: All our insights are collated from the public disclosures made by the company, however Dunzo has broadly denied our report findings.

Sign up on our platform – privatecircle.co/research and do such in-depth analysis in minutes.

Try our FREE trial/demo to access reliable data, intelligence, and insights. Lead your research on 1.7 million private unlisted companies across 500+ data categories with confidence.

References

Report Based Blogs by PrivateCircle Research

Historical Performance Summary Report: CleanMax 2023

Indian Healthcare Tech | CY Q2 2022 – Q1 2023

Snacks & Savory Deals Summary | Q4 2021 – Q3 2022

Indian Co-Working Space Companies’ Deals Overview | 2015 – 2022

Indian AI-Based Solutions Companies’ Deals Overview | Q4 2021 – Q3 2022

Deals Summary Report: Indian Apparel & Luxury Goods 2023

Comparable Company Analysis Report: Indian EV Two-Wheeler OEMs 2022

Comparable Company Analysis Report: Indian Food Aggregators, 2022