The Indian healthcare tech market has witnessed significant growth and transformation in recent years, and in 2023, it continues to evolve rapidly.

Technological advancements, accelerated digitalization, and increasing demand for accessible and affordable healthcare services have been key drivers shaping the healthcare landscape.

In this blog we will take a closer look at the Indian Healthcare Tech deals summary covering deals from CY Q2 2022 to Q1 2023. Additionally we will also explore an overview of the Indian healthcare tech market.

Highlights

- The Indian healthcare tech sector is is valued at $2 billion.

- The sector is expected to grow at a 39% compounded annual growth rate (CAGR) over FY 2020-FY 2023 and is expected to reach US $50 billion by 2033.

- The Indian e-health industry is projected to reach a gross merchandise value (GMV) of US $9-12 billion by 2025, and an estimated GMV of US $40 billion by 2040.

- In the Economic Survey of 2022, India’s public expenditure on healthcare stood at 2.1% of GDP in 2021-22 against 1.8% in 2020-21 and 1.3% in 2019-20.

Table of Contents

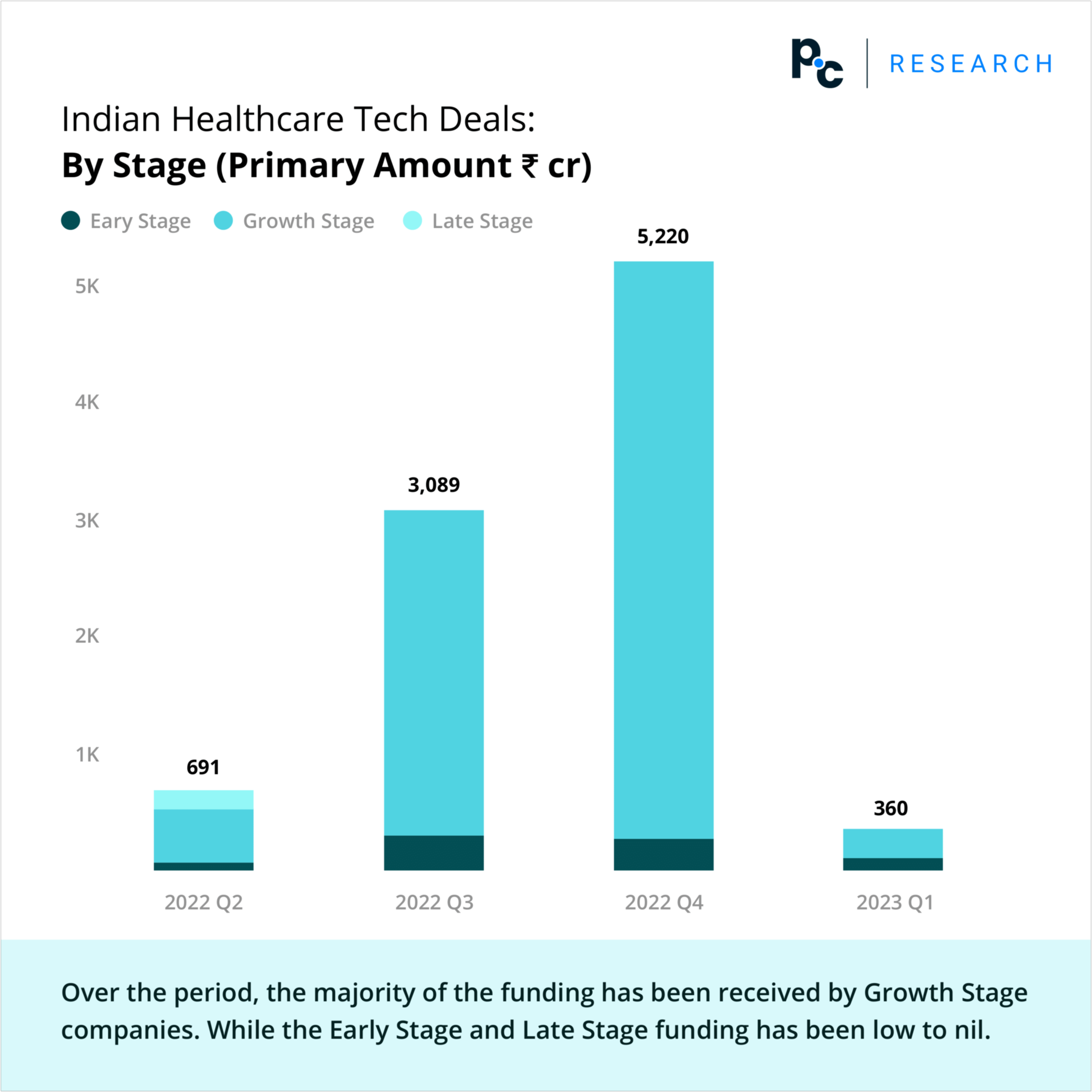

- Deals by Company Stages

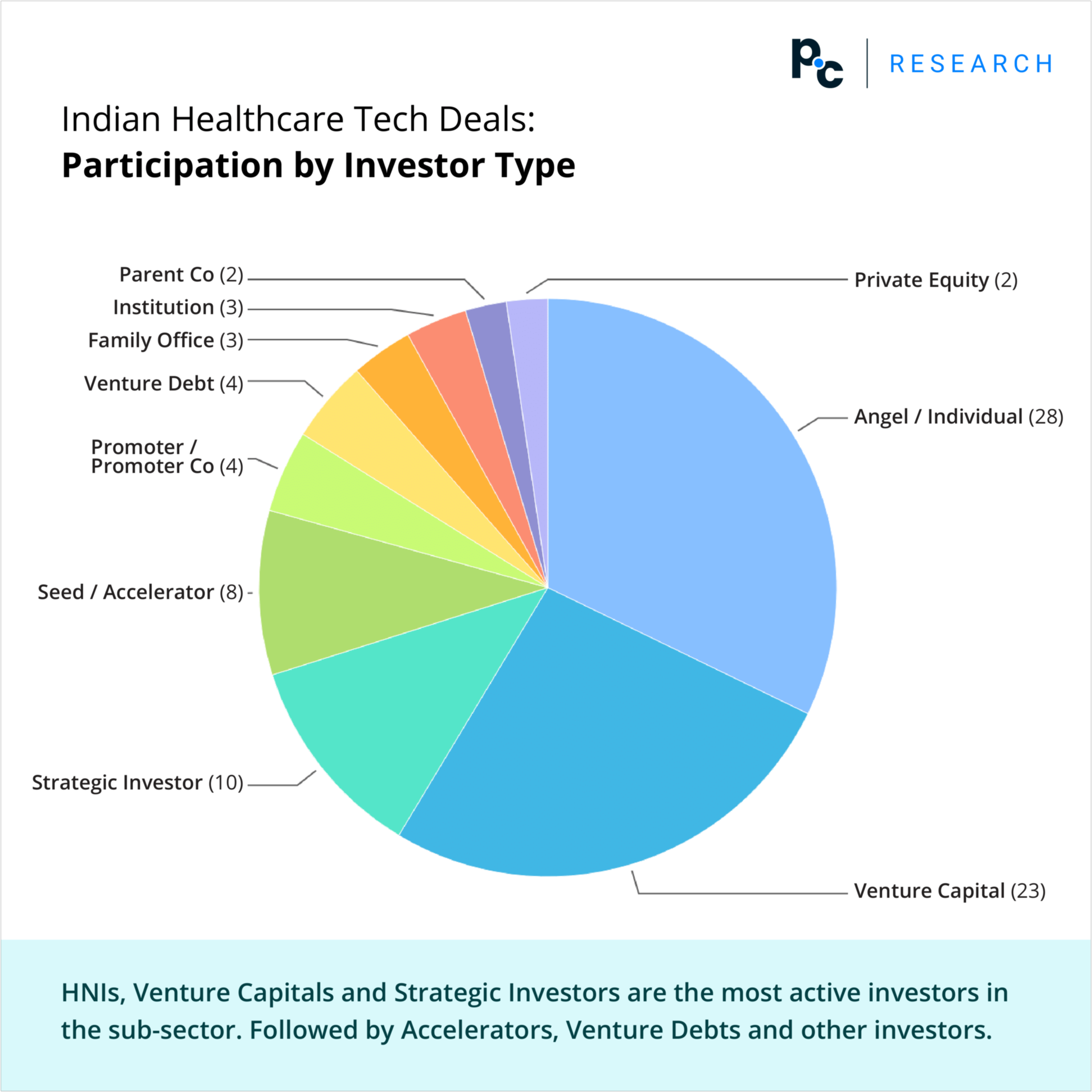

- Participation by Types of Investors

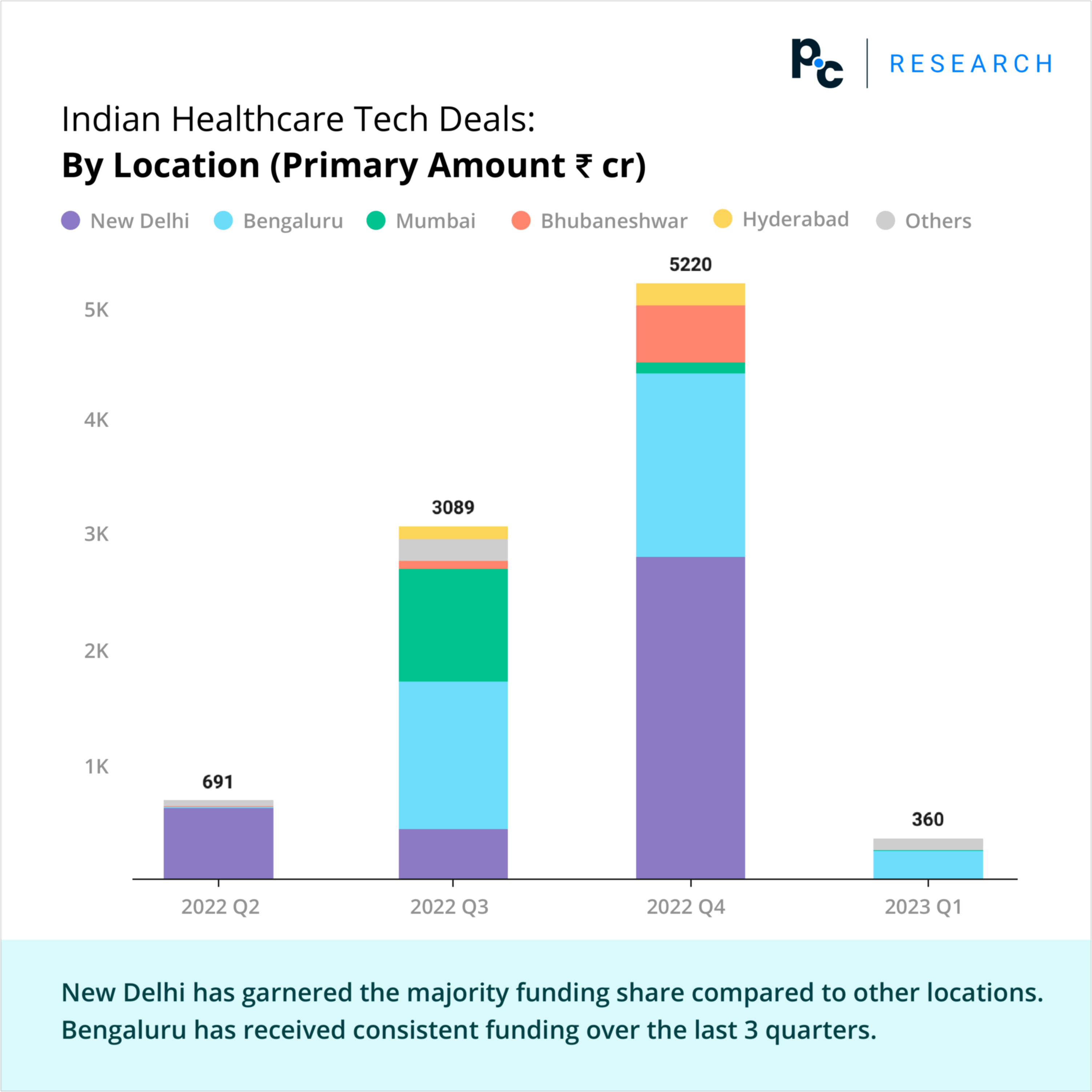

- Deals by Location

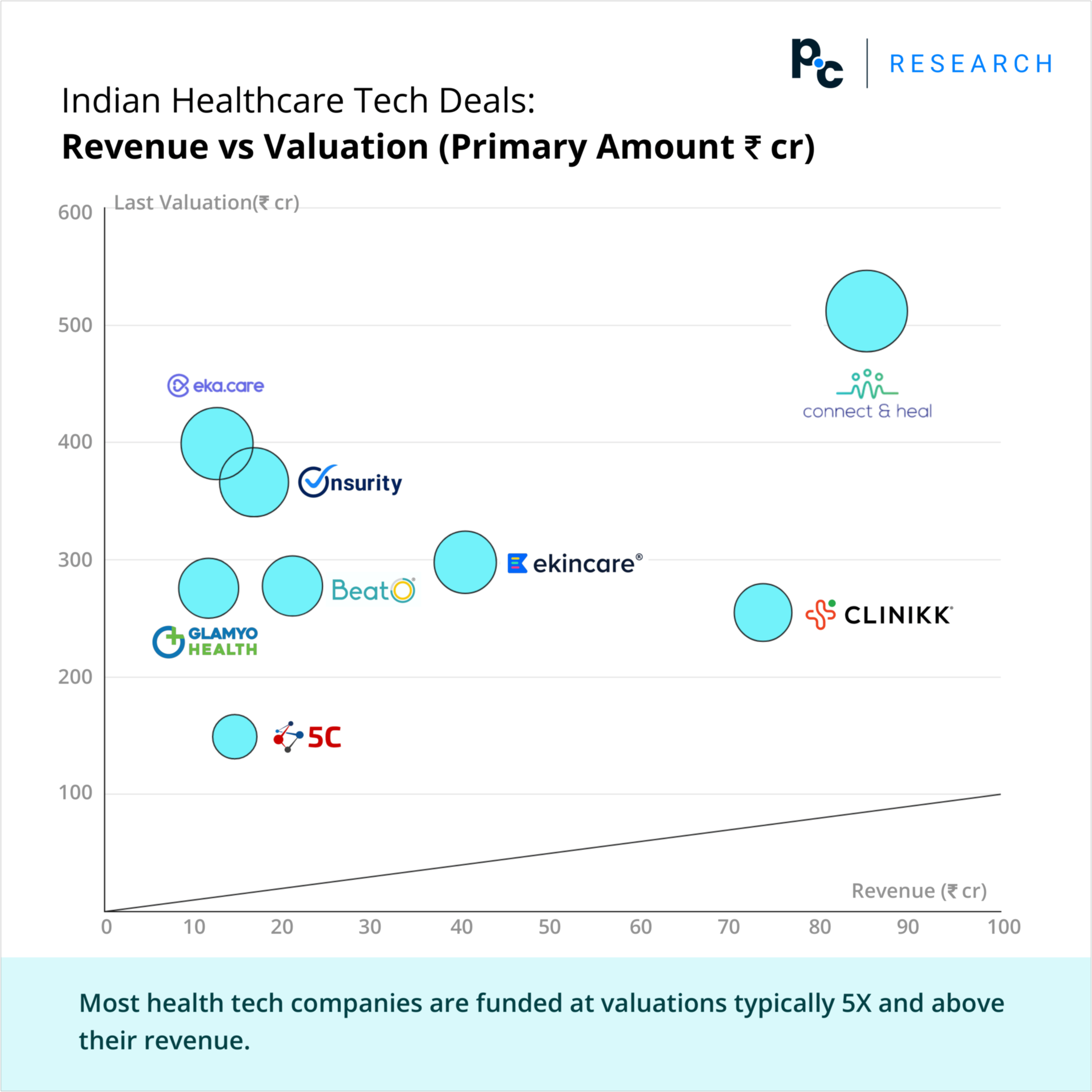

- Revenue vs Valuation of The Companies

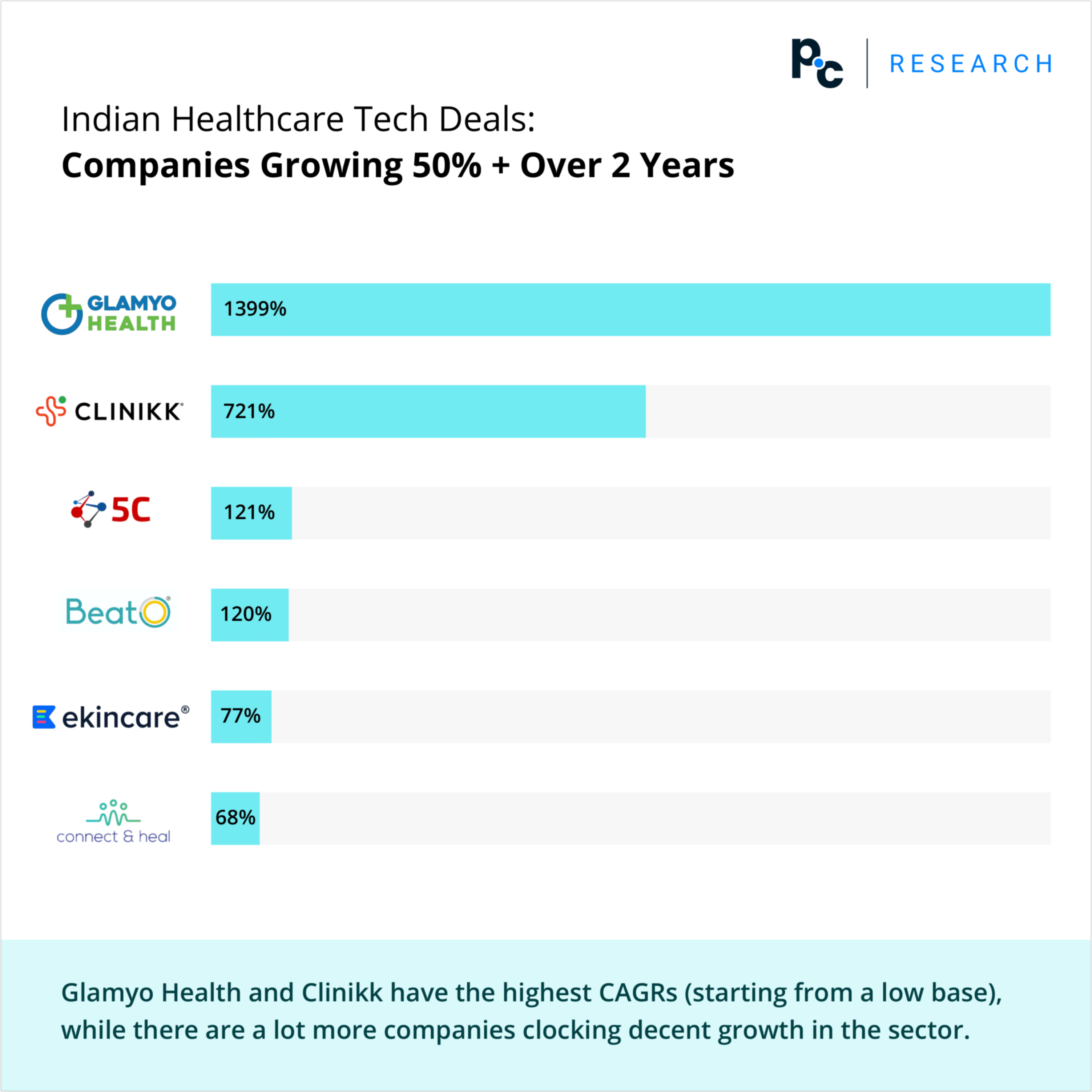

- Companies Growing 50%+ in 2 years

The Indian healthcare tech market is made up of six distinct segments, namely telemedicine, e-pharmacy, fitness and wellness, IT and analytics, home healthcare, and personal health management.

These segments represent different applications of the healthcare technology in India, showcasing the diverse range of solutions and services available to cater to different healthcare needs.

In 2021, India’s healthcare tech industry witnessed a significant increase in private equity and venture capital investments, totaling nearly US $1,740 million. This marked a substantial leap from the US $1.4 million investments recorded in 2014.

Among the healthcare tech companies, Pharmeasy, an online pharmacy and medical store, attracted the highest investment inflow, amounting to approximately US $650 million in 2021.

The sector’s landscape is dynamic, and new investors continue to enter the market as the sector experiences significant growth and potential.

Prominent Investors

- Peak XV Partners (Formerly Sequoia Capital India & SEA): A leading venture capital firm that has invested in various Indian healthcare Tech companies, including Practo, 1mg, and HealthifyMe.

- Accel Partners: Another well-known venture capital firm that has made investments in healthcare tech startups such as Portea Medical, PharmEasy, Cult.fit, PlusPin, Dailyrounds, Cure Joy, and more.

- Nexus Venture Partners: This VC has invested in companies like Lybrate – a telemedicine platform, and CitiusTech – a healthcare technology provider.

- Chiratae Ventures: Formerly known as IDG Ventures India, this firm has invested in companies such as HealthifyMe and Mfine.

- Matrix Partners India: An investor in Practo and Mfine.

- India Quotient: This early-stage VC has backed startups like NewMedd – which offers on-demand diagnostics services.

- Info Edge: A prominent investor in online ventures, Info Edge has invested in 1mg.

The majority of these investments were concentrated in metropolitan cities. New Delhi (Delhi-NCR) saw the highest percentage of deals, accounting to 41.46%, Bengaluru (Karnataka) accounting for 33.76%, followed by Mumbai (Maharashtra) with 11.64%, following by others.

Other cities that have emerged as notable players in the sector include Pune (Maharashtra), Chennai (Tamil Nadu), and Hyderabad (Telangana).

A noteworthy trend is the appeal of business-to-business and business-to-consumer (B2B-B2C) models to investors. While B2B-B2C healthcare tech startups raised a total of US $756 million during 2014-2020, the B2B segment received the least funding in India.

In 2020, B2C-based healthcare tech startups secured funding of US $194.8 million, whereas B2B startups received only US $6.8 million.

The traditional healthcare system in India has faced challenges in terms of equitable access and affordability of quality care. However, the digitized healthcare system provided by emerging Healthcare Tech businesses is offering convenient, accessible, and affordable services.

Companies are leveraging automation, digitization, and technology to address supply-demand gaps in the healthcare sector. Efforts are to bring services such as quick access to updated medical information, early disease detection, mental stress reduction, prevention of hereditary abnormalities, and lifestyle enhancement, faster to the consumers, accelerating effective and efficient treatment.

Industry Trends

- Digital infrastructure expansion: There has been a substantial growth in the digital infrastructure supporting healthcare tech services.

- Para-telemedicine solutions: The industry has witnessed the emergence of solutions that combine telemedicine and in-person consultations.

- AI-integrated software: Healthcare tech companies are incorporating artificial intelligence into their software to enhance healthcare delivery.

- Increased insurance coverage for remote health services: Remote health services are being increasingly covered by insurance, making them more accessible to individuals.

- One-stop healthcare solutions: Healthcare tech platforms are providing comprehensive and integrated solutions, catering to various healthcare needs.

- Growing consumer health awareness: Consumers are becoming more aware of their health and seeking out healthcare tech solutions accordingly.

References

Ibef.org |

Pwc.in |