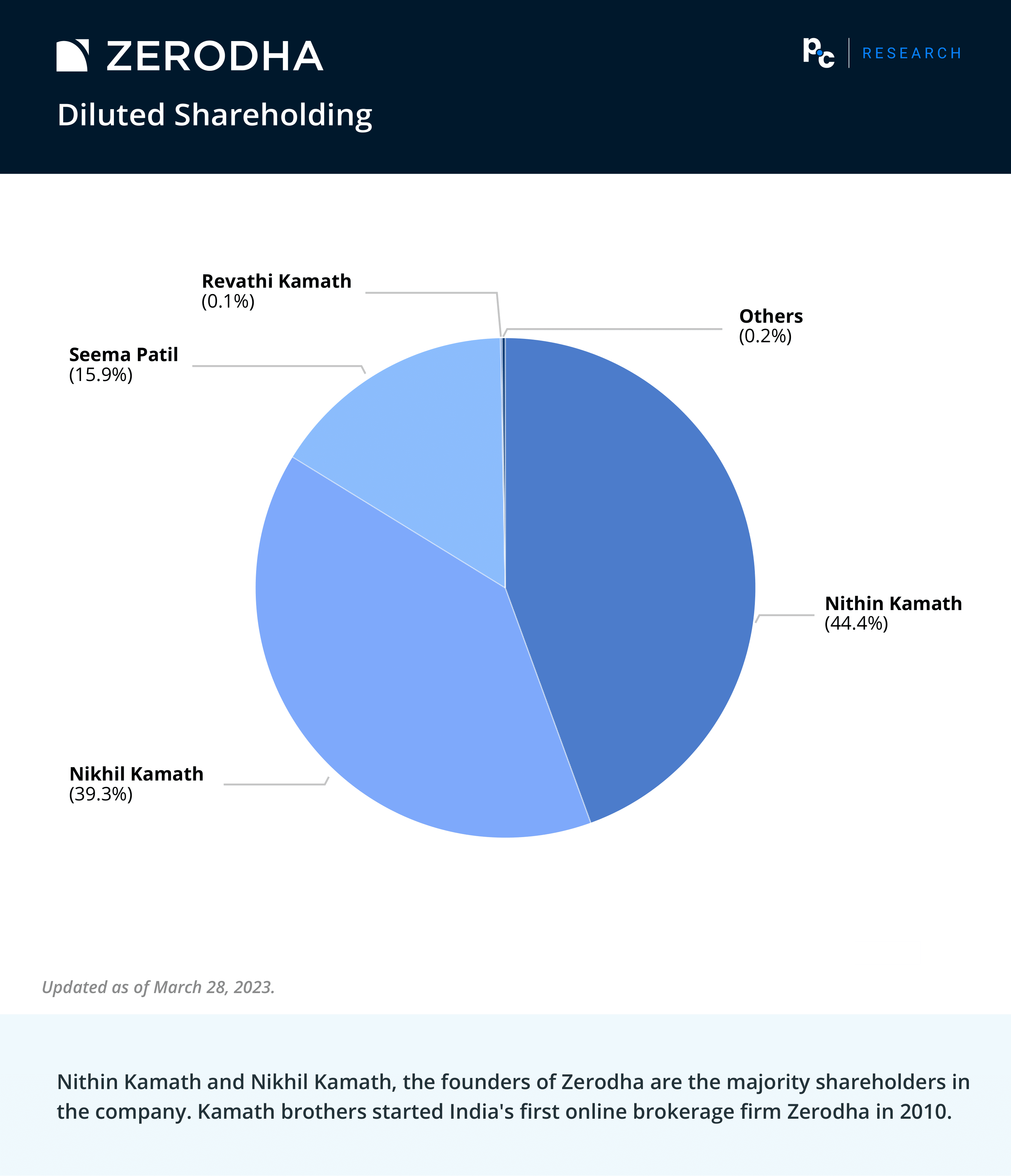

In the ever-changing domain of India’s financial sector, Zerodha emerges as a notable exemplar of innovation and transformation. Founded in 2010 by Nithin Kamath and Nikhil Kamath, Zerodha has significantly influenced traditional brokerage models.

The Zerodha story is not just about the company itself but also symbolizes the broader entrepreneurial dynamism within India’s financial markets.

As we explore Zerodha’s historical performance in greater depth, we will examine how it fits among its peers and competitors, influencing the financial services industry’s evolving standards.

What is the Historical Performance Summary Report?

Historical Performance Summary Report is our endeavor to delve deeper into a company’s market performance across the years, all through the lens of data. As a robust data intelligence platform, these reports serve as a testament to the capabilities of the PrivateCircle Research.

Why Zerodha?

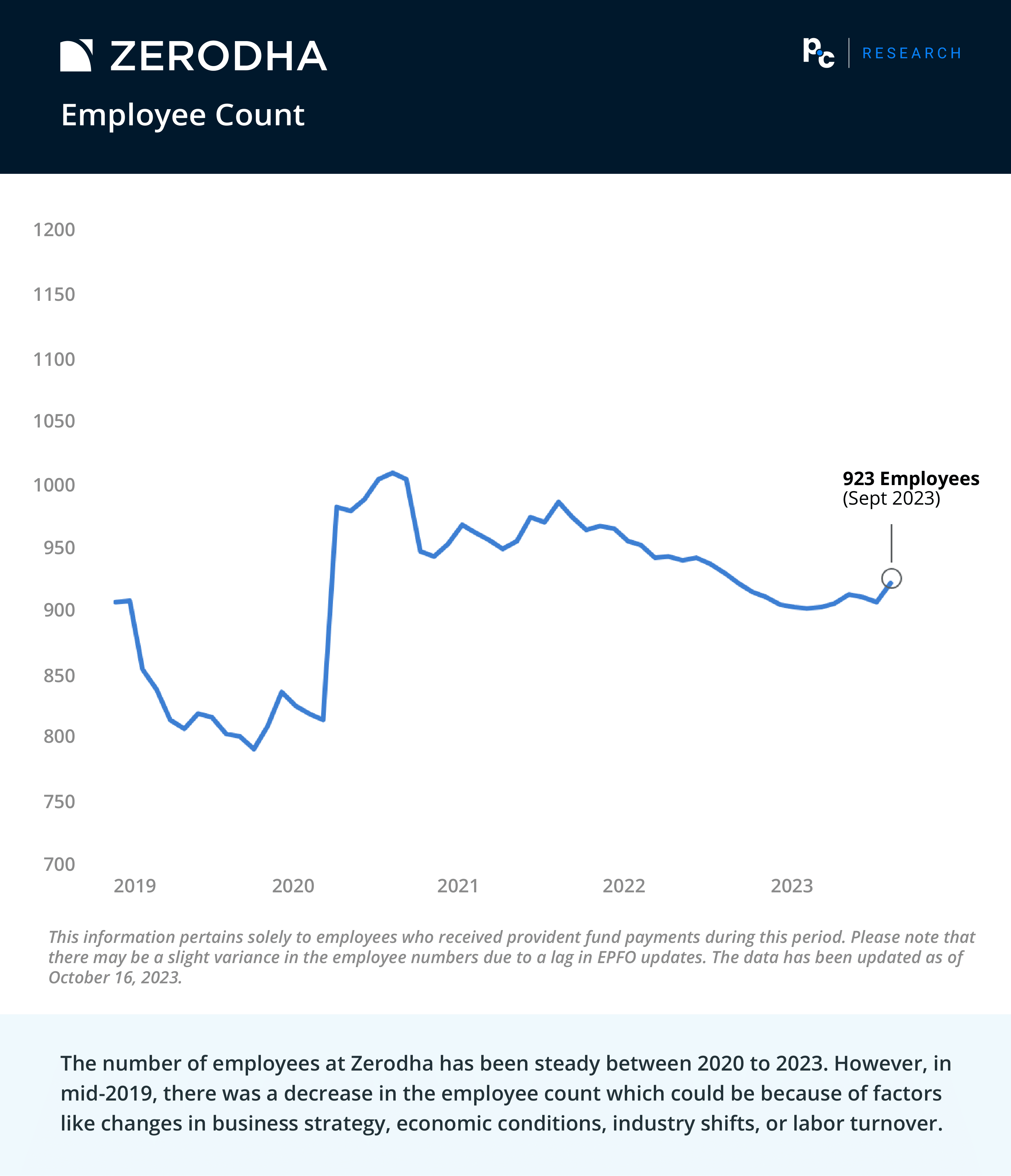

The Indian broking startup completed 13 years of operations in late September 2023. This anniversary was also the first instance when Zerodha’s founder estimated the company’s valuation at ₹30,000 cr along with reporting another profitable financial year.

Zerodha’s journey mirrors the broader transformation occurring within India’s financial services sector. The firm’s introduction of brokerage-free equity investments marked a shift towards democratizing market access.

Innovative platforms like Kite, Connect, and APIs have reshaped the landscape of trading and investment in India.

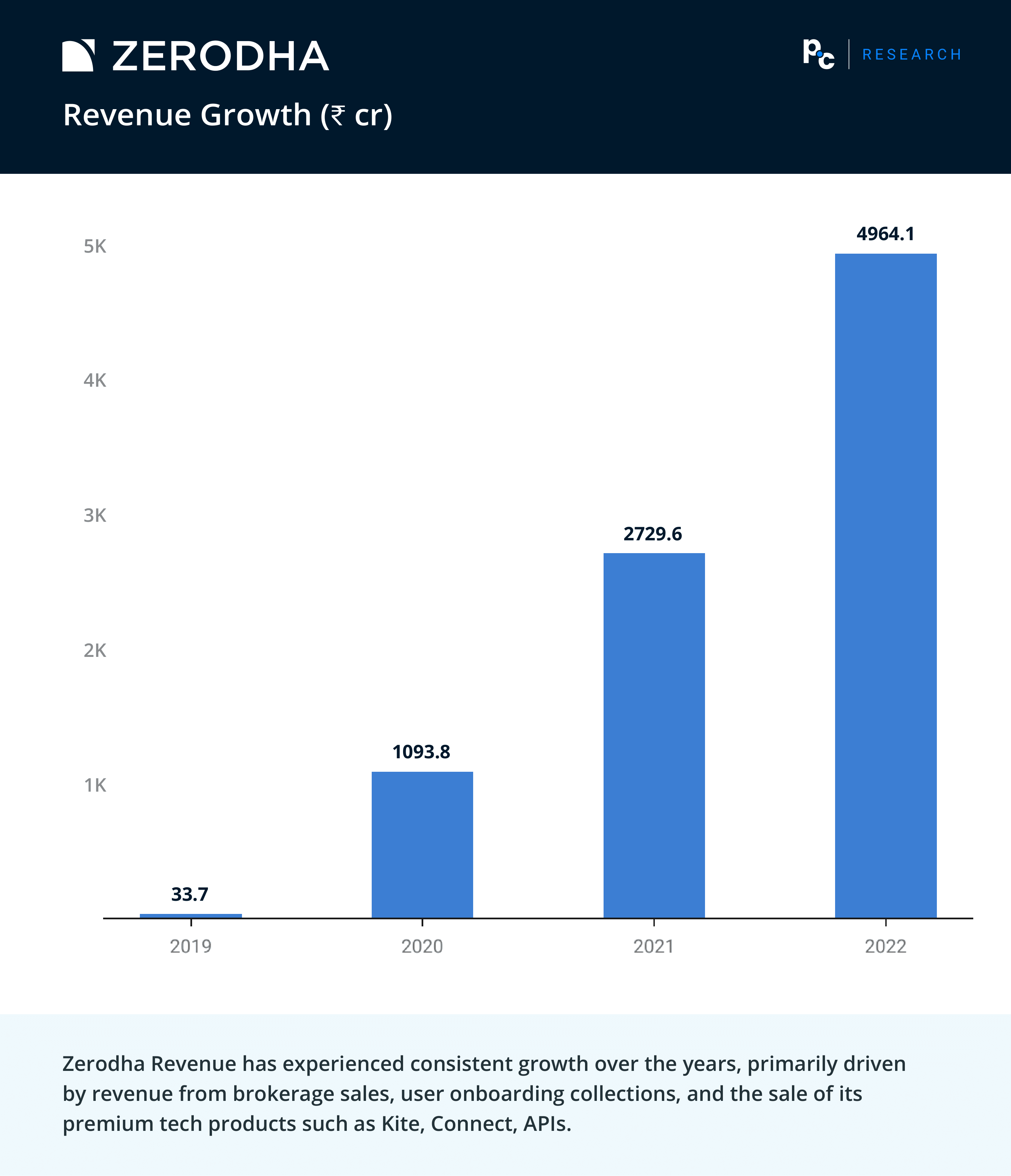

Presently, Zerodha holds the distinction of being India’s largest discount brokerage by revenue, contributing 15% of all retail trading volumes and boasting over 6.48 million customers as of September 2023.

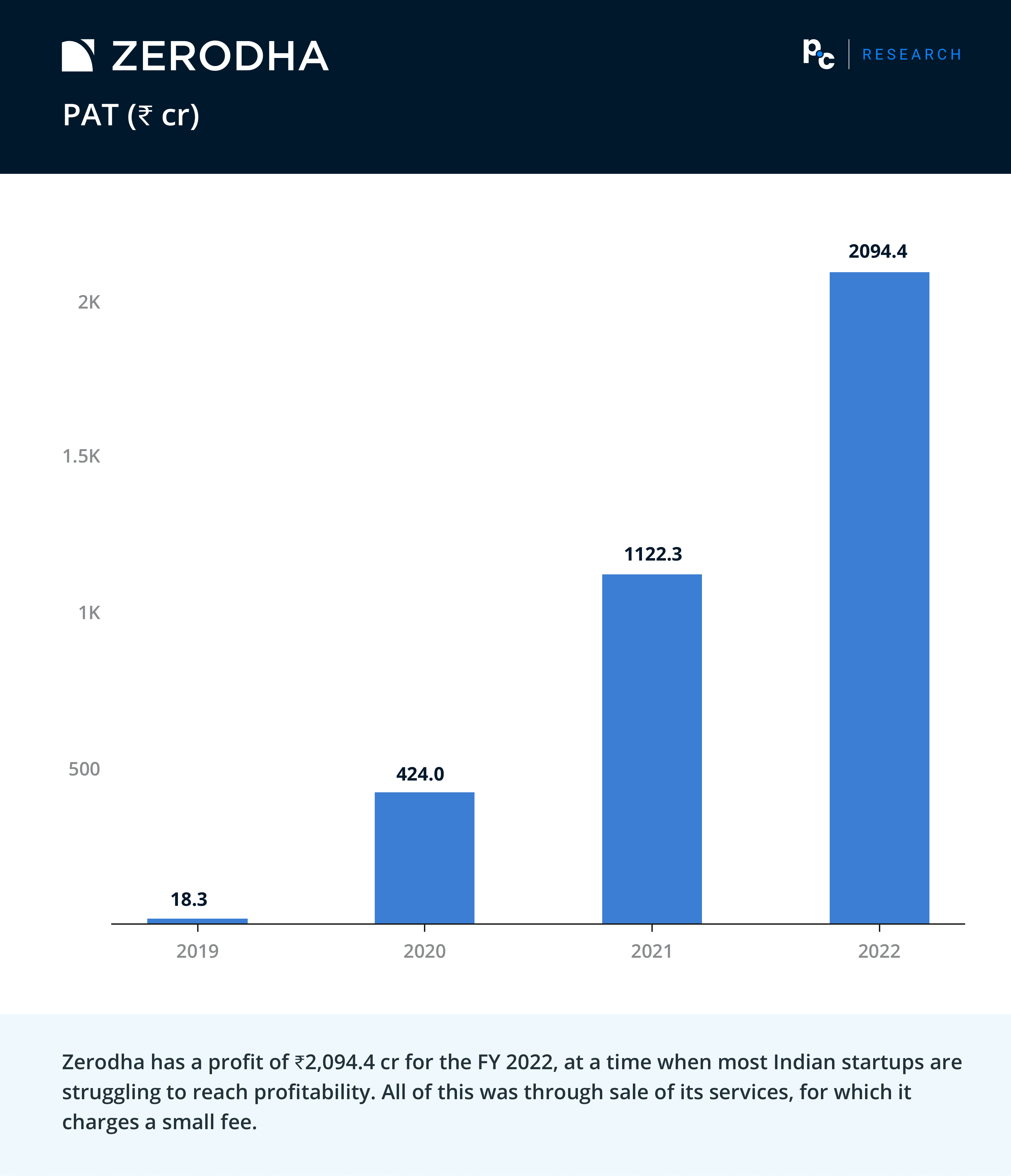

The company’s ability to maintain profitability in an environment where many startups grapple with financial sustainability underscores its business acumen.

The Kamath brothers, who continue to lead the company, maintain majority shares, reflecting their vision and dedication.

Zerodha’s impact extends beyond profitability, with initiatives like Rainmatter promoting fintech innovation and supporting pioneering startups.

Zerodha Peers

- Billionbrains Garage Ventures Private Limited (Groww) with Revenue ₹14.3 Bn FY 2023 and 3-yr CAGR 536.22% FY 2023

- RKSV Securities India Private Limited (Upstox) with Revenue ₹7.8 Bn FY 2022 and 3-yr CAGR 115.57% FY 2022

Conclusion

Looking ahead, India’s financial sector is poised for continuous transformation. Innovation, accessibility, and sustainability will be the key drivers.

As Zerodha stands among its peers and competitors, its journey will be closely watched for insights into the evolving standards and trends within the industry. The dynamic nature of the sector promises exciting developments and opportunities for entrepreneurs, investors, and market participants.

We eagerly anticipate the unfolding chapters in this remarkable narrative and the enduring impact of Zerodha in India’s financial landscape.

Join us on our platform at privatecircle.co/research and experience the power of in-depth analysis at your fingertips, all in a matter of minutes.

Take advantage of our FREE trial/demo to unlock a world of reliable data, intelligence, and insights. Lead your research with confidence as you explore over 1.7 million private, unlisted companies across more than 500 data categories.

Don’t miss out on the opportunity to transform your research into a seamless and efficient experience. Join us today and discover the wealth of knowledge and information waiting for you on PrivateCircle Research.

References

Blogs by PrivateCircle Research

Historical Performance Summary Report: CleanMax 2023

Indian Healthcare Tech | CY Q2 2022 – Q1 2023

Snacks & Savory Deals Summary | Q4 2021 – Q3 2022

Indian Co-Working Space Companies’ Deals Overview | 2015 – 2022

Indian AI-Based Solutions Companies’ Deals Overview | Q4 2021 – Q3 2022

Deals Summary Report: Indian Apparel & Luxury Goods 2023

Comparable Company Analysis Report: Indian EV Two-Wheeler OEMs 2022

Comparable Company Analysis Report: Indian Food Aggregators, 2022