The New-Age Student’s Global Aspirations Today’s students don’t just want degrees, they want direction. Gen Z is ambitious, digital-native, and career-driven. But between rising competition, confusing admission processes, and lack of guidance, their global dreams often stall. Enter Leverage Edu, an edtech startup that doesn’t just help students study abroad. It mentors students through every…

Read moreTag: edtech

Annual Deal Summary Report 2024

PrivateCircle Research offers an in-depth look at India’s private market in 2024-a year defined by strategic investments, record-breaking deals, and a maturing startup ecosystem. Here are the key highlights: Startup Funding Soars to ₹1,00,154 Cr In 2024, Indian startups raised an impressive ₹1,00,154 crore, even as the total deal count dipped to 1,321. This reflects…

Read moreCity-Wise Startup Funding Recap: August 2024

Overview The startup ecosystem in India continues to evolve dynamically, with significant fluctuations in funding patterns across various city tiers. In August 2024, the landscape showcased a blend of traditional powerhouses and emerging hubs, with notable shifts in investor activity and deal sizes. This blog inquires into the city-wise startup funding recap for August 2024,…

Read moreHow long does it take Indian startups to become a unicorn?

Indian startups typically take a median of 7 years from incorporation to achieve unicorn status (companies with a valuation of $1 billion or more). However, each business is different and so are their growth trajectories. For instance, Ananth Narayanan-led Mensa Brands became a unicorn in just 6 months, while Five Star Business Finance took over…

Read moreZoho Mafia 2024: The Rising Titans of the Indian Startup Ecosystem

In the dynamic world of Indian startups, a unique group known as the “Zoho Mafia” has emerged as a force to be reckoned with. Much like the PayPal Mafia in Silicon Valley, this cohort comprises former Zoho employees who have ventured out to create their own successful enterprises. Let’s dive into the fascinating journey of…

Read moreUnicorn Founder Salaries in 4 Charts

Your startup has just hit over a billion dollars in valuation and there are a couple of million dollars in the bank – how much do you pay yourself? Let’s see what the data says. The median annual salary for Indian unicorn founders in FY23 was Rs 1.5 crores. Of course, there are some outliers…

Read moreMEMG Family Office’s Portfolio Overview 2024

The Manipal Education and Medical Group family office, lead by chairman Dr. Ranjan Pai is a Venture Capital fund founded in 2016. It is primarily based out of Bengaluru, India. MEMG family office 2024 report highlights; Combined Revenue The portfolio generated a combined revenue of over ₹31,598 cr with Quesscorp, Pharmeasy and FirstCry topping the list. Year-On-Year Investment Trend…

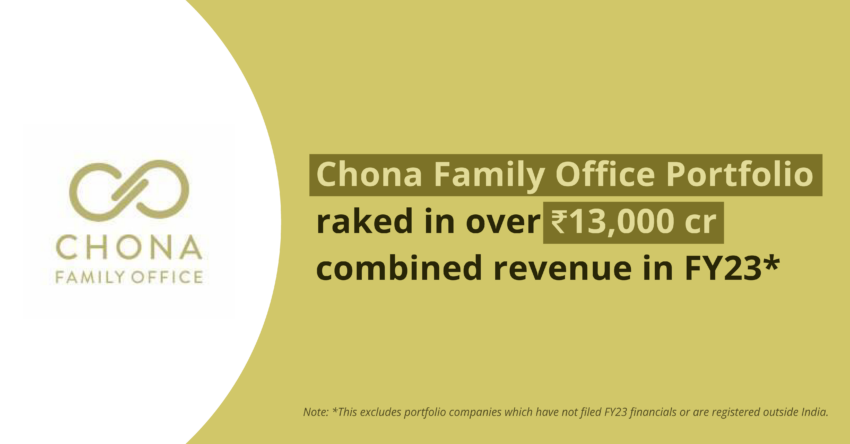

Read moreChona Family Office’s Portfolio Overview 2024

Led by Ankit Chona, Chona Family Office has been expanding its portfolio across diverse sectors and become a significant force in the investment arena. Let’s explore the pivotal insights extracted from their 2024 investment report. Let’s dive into the full report covering; In 2024, the Chona Family Office’s portfolio exhibits strong performance with a total…

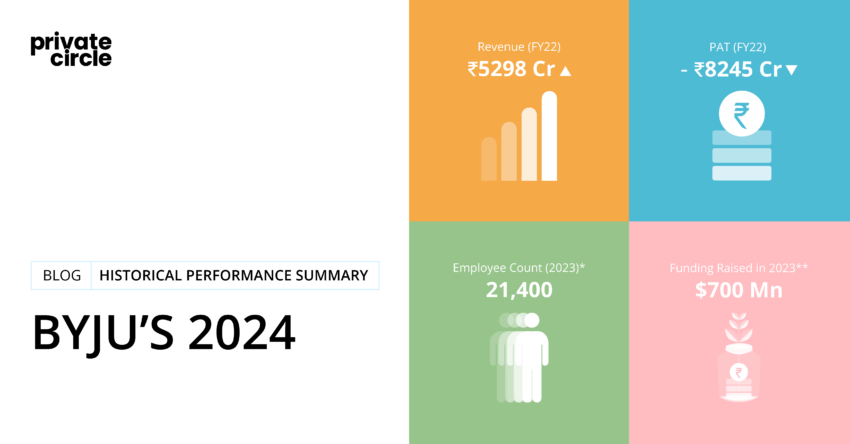

Read moreHistorical Performance Summary Report: Byju’s 2024

Introduction Byju’s, India’s leading edtech company, has been the subject of much scrutiny and interest, particularly regarding its performance in the fiscal year 2022-23. Let’s delve into some key aspects of Byju’s operations and financials to gain a comprehensive understanding. What is the Historical Performance Summary Report? Historical Performance Summary Report is our endeavor to…

Read moreComparable Company Analysis Report: Indian E-Commerce Companies FY 2022

Introduction Welcome to another Comparable Company Analysis, where we delve into the vast expanse of data and insights to bring forth a intriguing exploration of the Indian E-Commerce (electronic commerce) ecosystem. India, boasting over 800 million internet users, ranks as the second-largest global online market. E-Commerce, contributing 7% to the total retail market at $55…

Read more