As April bids farewell, let’s look the ups and lows in the Indian startup ecosystem throughout the month. As we set the context, the numbers speak for themselves.

Highlights that we will be exploring;

- Deal Volume

- Total Value

- Top 3 Deals

- Top Investors

- Deal Volume (Investor Type)

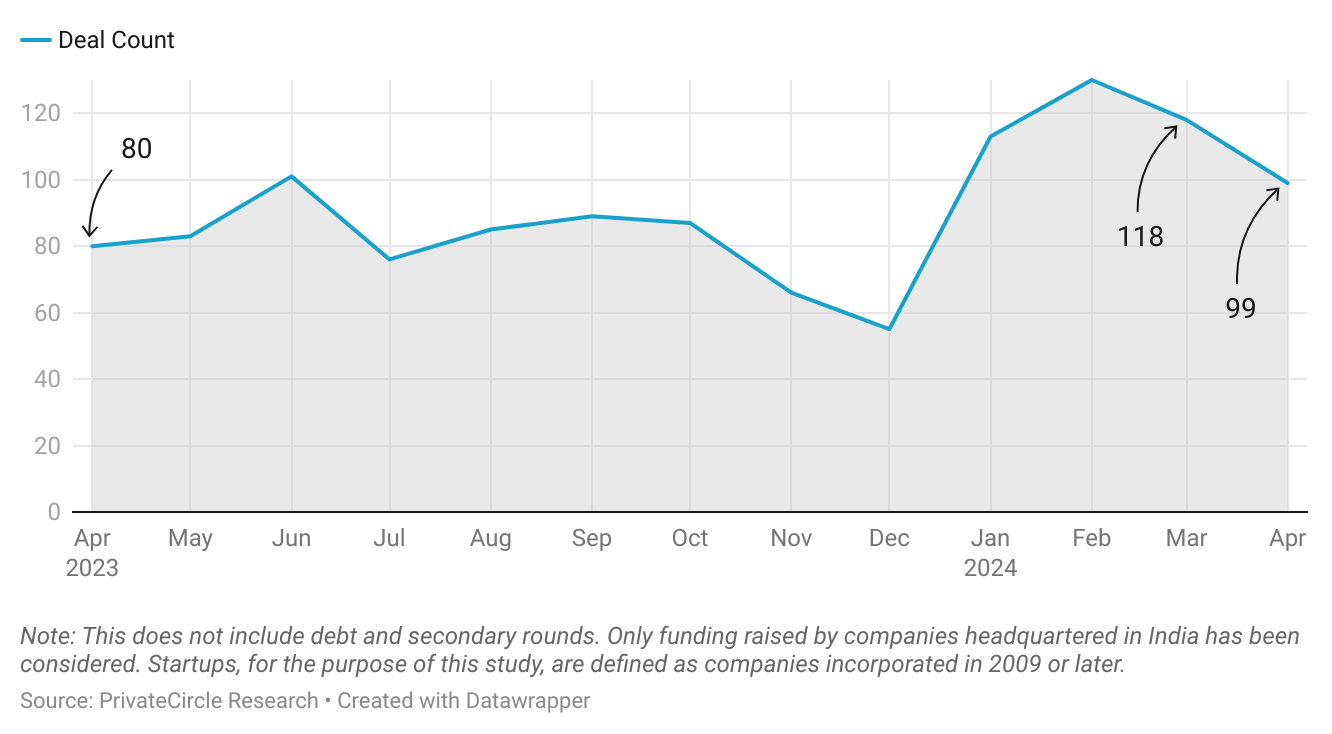

Startup Funding Deal Volume (Apr 2023 – Apr 2024)

April 2024 witnessed a 16% drop in deal volumes compared to the previous month.

However, there’s a silver lining – deal volumes soared by a remarkable 24% compared to April 2023, showcasing resilience amidst challenges.

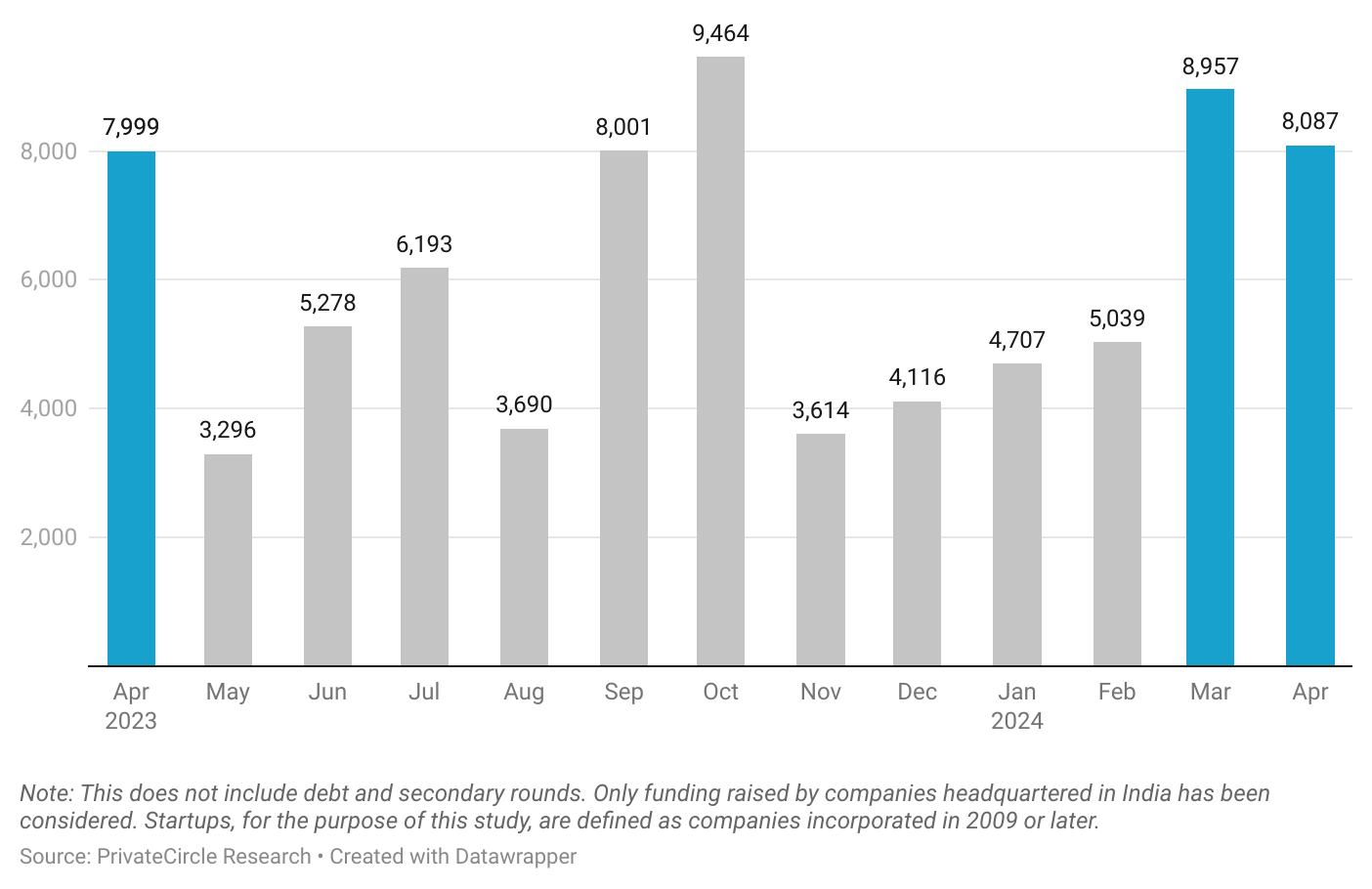

Startup Funding Total Value (Apr 2023 – Apr 2024) (₹ cr)

While the amount raised took a slight dip of 10% from the previous month of March, April 2024 echoed the rhythms of April 2023, with a 1% increase in the total funding value.

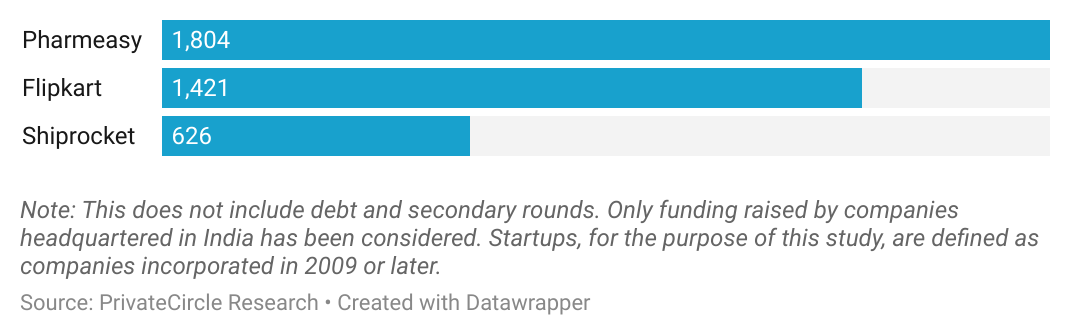

Startup Funding Top 3 Deals (₹ cr)

Pharmeasy emerges as the champion of April with a monumental raise of ₹1,800 crores.

With support from MEMG Family Office, Prosus, and others. Pharmeasy sets the bar high for innovation and growth in the healthcare sector.

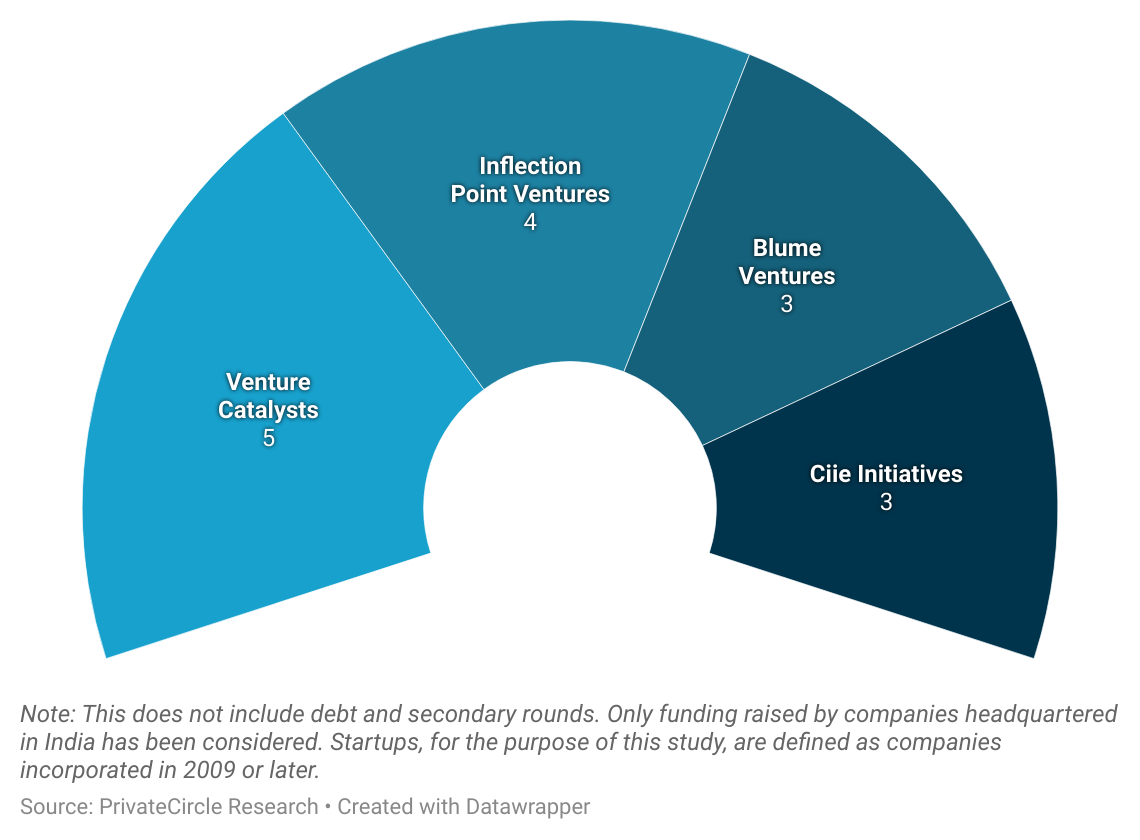

Startup Funding Top Investors (Deal Volume)

Venture Catalysts steals the spotlight as the top investor in April 2024, spearheading early-stage investments. Followed by Inflection Point Ventures, Blume Ventures, Ciie Initiatives, and others.

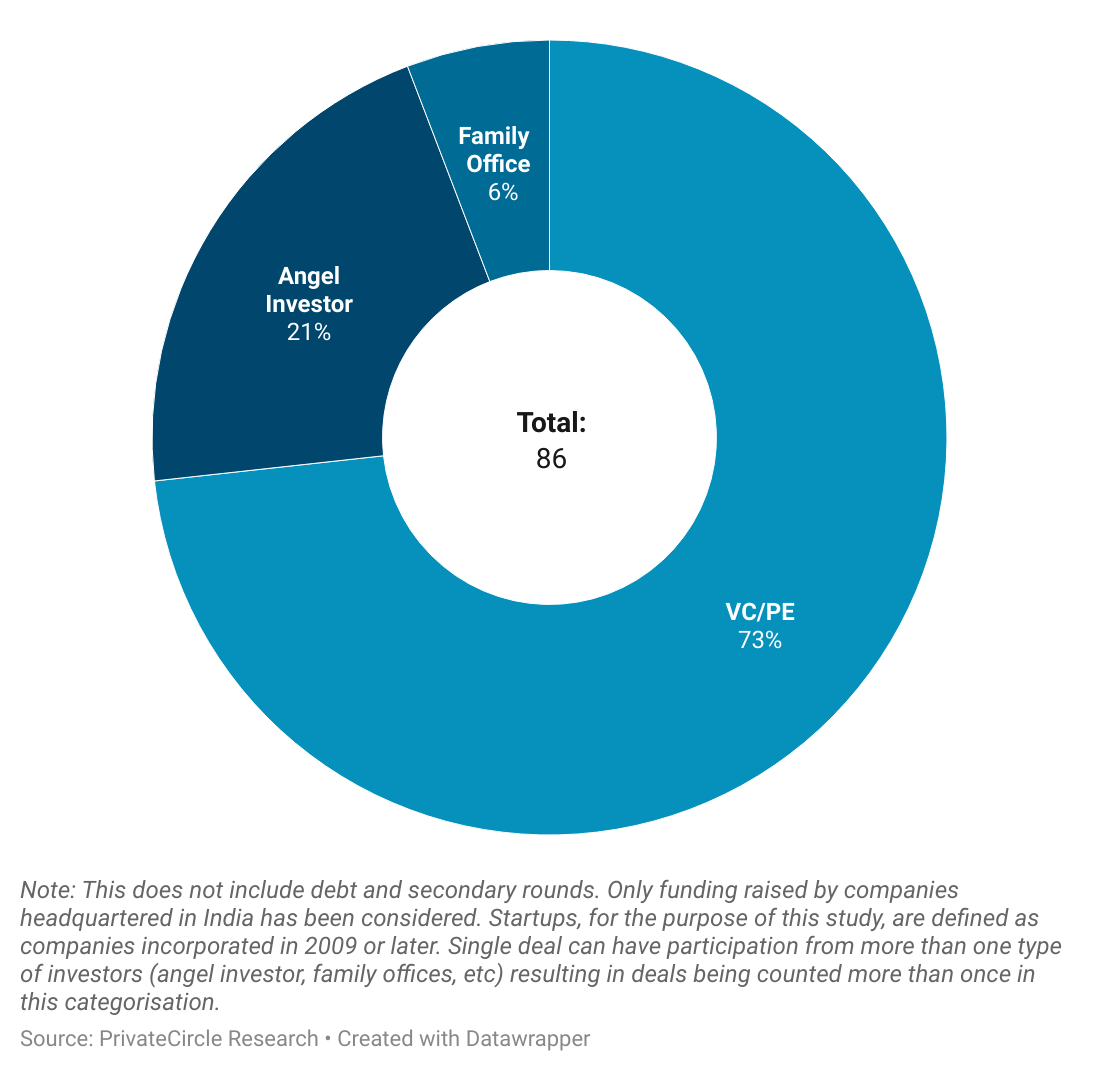

Startup Funding Deal Volume (Investor Type)

VC/PE deals reign supreme, constituting 56% of the total deal volume in April 2024.

Angel investors, strategic investors, and family offices follow suit, painting a diverse tapestry of funding sources.

Stay tuned for more insights and revelations from the ever-evolving world of India private markets!

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Explore More Startup Funding Recaps:

Monthly Funding Summary Report: January 2024