Rainmatter, backed by Zerodha, exemplifies the convergence of patient capital and impactful mentorship in driving innovation within India’s entrepreneurial ecosystem.

With an emphasis on fintech, health, climate action, and storytelling, Rainmatter nurtures startups along with funding.

The latest insights reveal how strategic investments are creating ripples across multiple sectors, reinforcing Rainmatter’s mission of sustainable, long-term growth.

Key Metrics

- Portfolio’s Combined Revenue – ₹2,991 Cr

- Investment Range – ₹0.05 cr to 50 Cr

- Total Investments – 111

- Total Investments – FY23 – ₹115 Cr, FY24 – ₹153 Cr, FY25 – ₹155 Cr

- Invested Sectors – Finance (17%), Software (16%), Media & Social (6%), Food Products (6%) and others (56%).

Interestingly, Rainmatter’s exclusion of foreign and Zerodha-linked entities from its revenue tally underscores its transparency, offering a clear lens into its India-focused impact.

Blog Highlights:

- Combined Revenue of Portfolio Companies

- Year-On-Year Investment

- Sector Investments

- Portfolio Founders’ Alma Mater

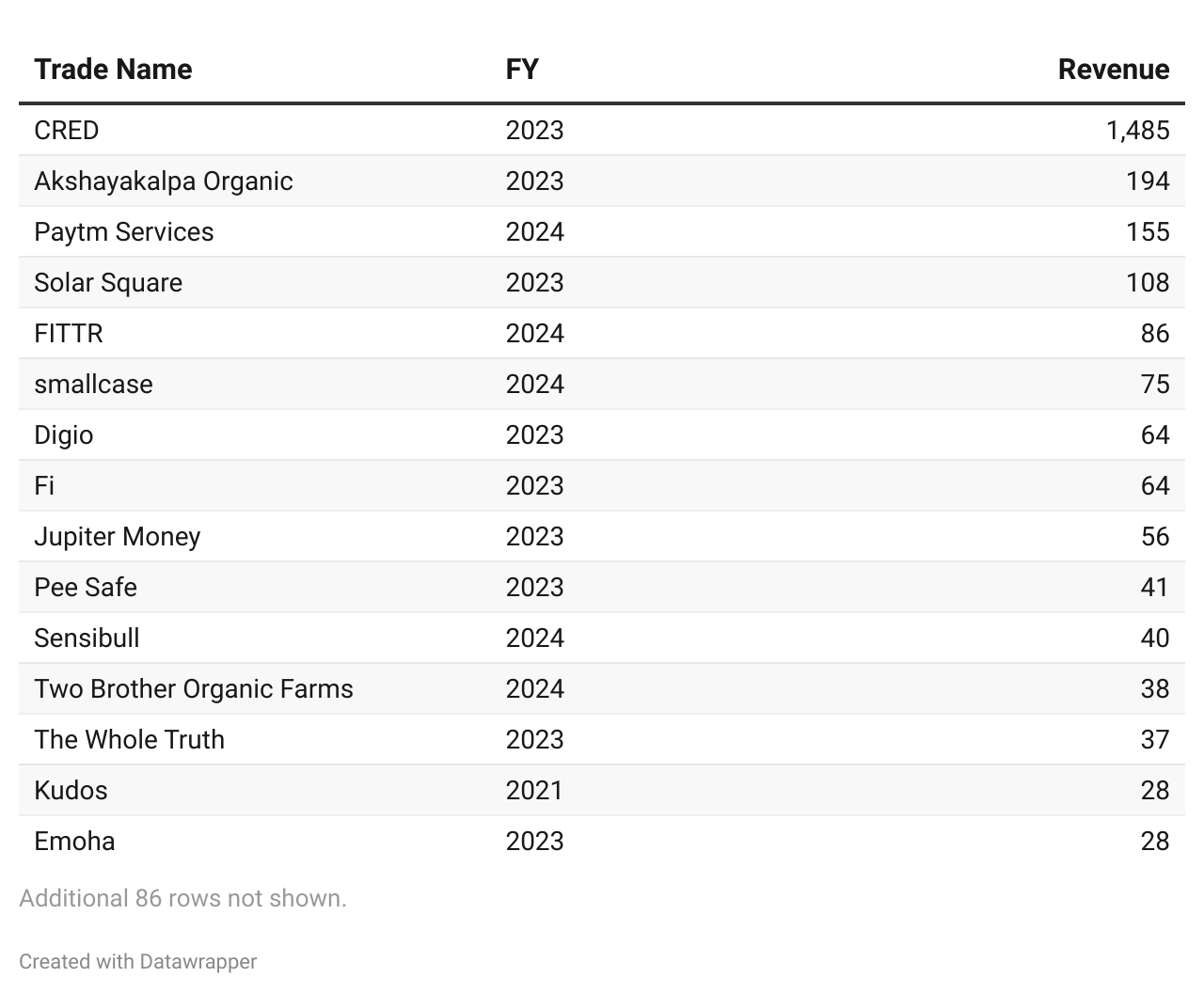

Combined Revenue of Portfolio Companies (₹ Cr)

The combined revenue of Rainmatter’s portfolio stood at ₹2991.40 cr, with CRED and Akshayakalpa Organic being the major contributors.

Note: Foreign Companies and Zerodha Group companies investments are not considered in the Portfolio’s Combined Revenue. Zerodha Group Companies: ETS Securities Private Limited, Rainmatter Land Development Private Limited, Opentrade Investment Advisors Private Limited, Zerodha Capital Private Limited, Zerodha Technology Private Limited, Zerodha Broking Limited, Hanging Gardens India LLP, and Foss United Foundation. Foreign Companies: Terra.do Inc. and Climes Inc.

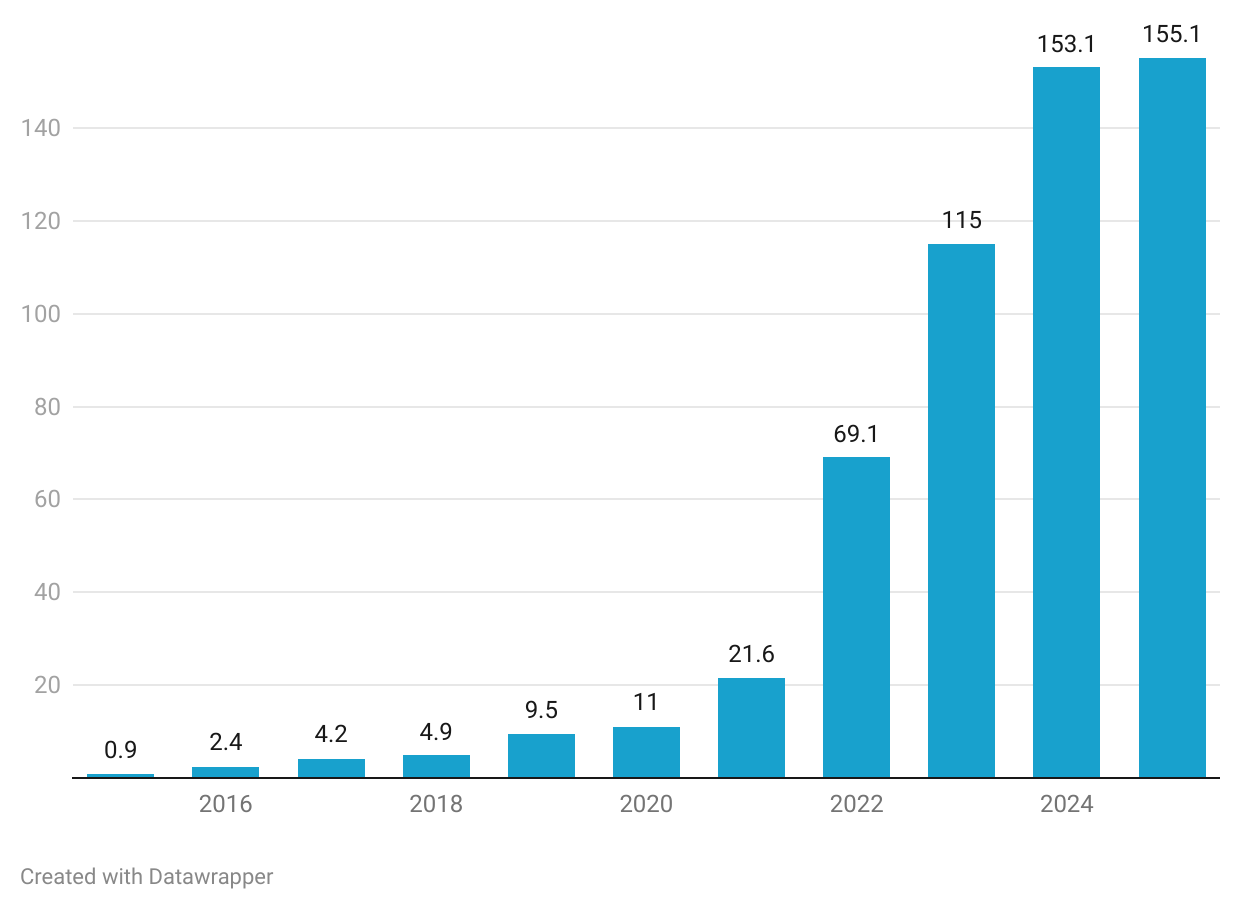

Year-On-Year Investment (₹ Cr)

Rainmatter has invested a total of ₹546.74 crores since 2015, with the highest investment of ₹155.08 cr in FY25 YTD.

Note: Foreign Companies and Zerodha Group companies investments are not considered in the Portfolio’s Combined Revenue. Zerodha Group Companies: ETS Securities Private Limited, Rainmatter Land Development Private Limited, Opentrade Investment Advisors Private Limited, Zerodha Capital Private Limited, Zerodha Technology Private Limited, Zerodha Broking Limited, Hanging Gardens India LLP, and Foss United Foundation. Foreign Companies: Terra.do Inc. and Climes Inc.

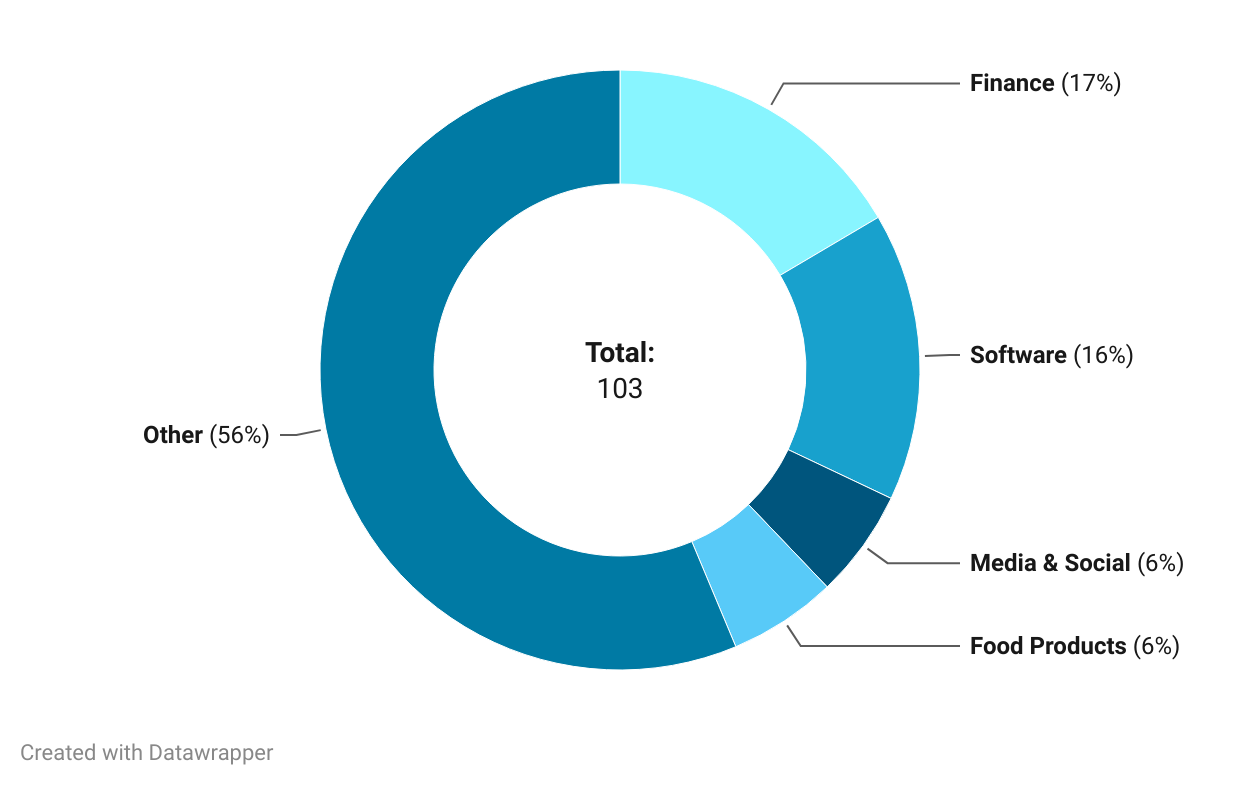

Sector Investments

Rainmatter has invested in a range of sectors with the highest number of investments in Finance, Software, Media & Social and Food Products.

Note: Zerodha Group companies investments are not considered in the Portfolio’s Combined Revenue. Zerodha Group Companies: ETS Securities Private Limited, Rainmatter Land Development Private Limited, Opentrade Investment Advisors Private Limited, Zerodha Capital Private Limited, Zerodha Technology Private Limited, Zerodha Broking Limited, Hanging Gardens India LLP, and Foss United Foundation.

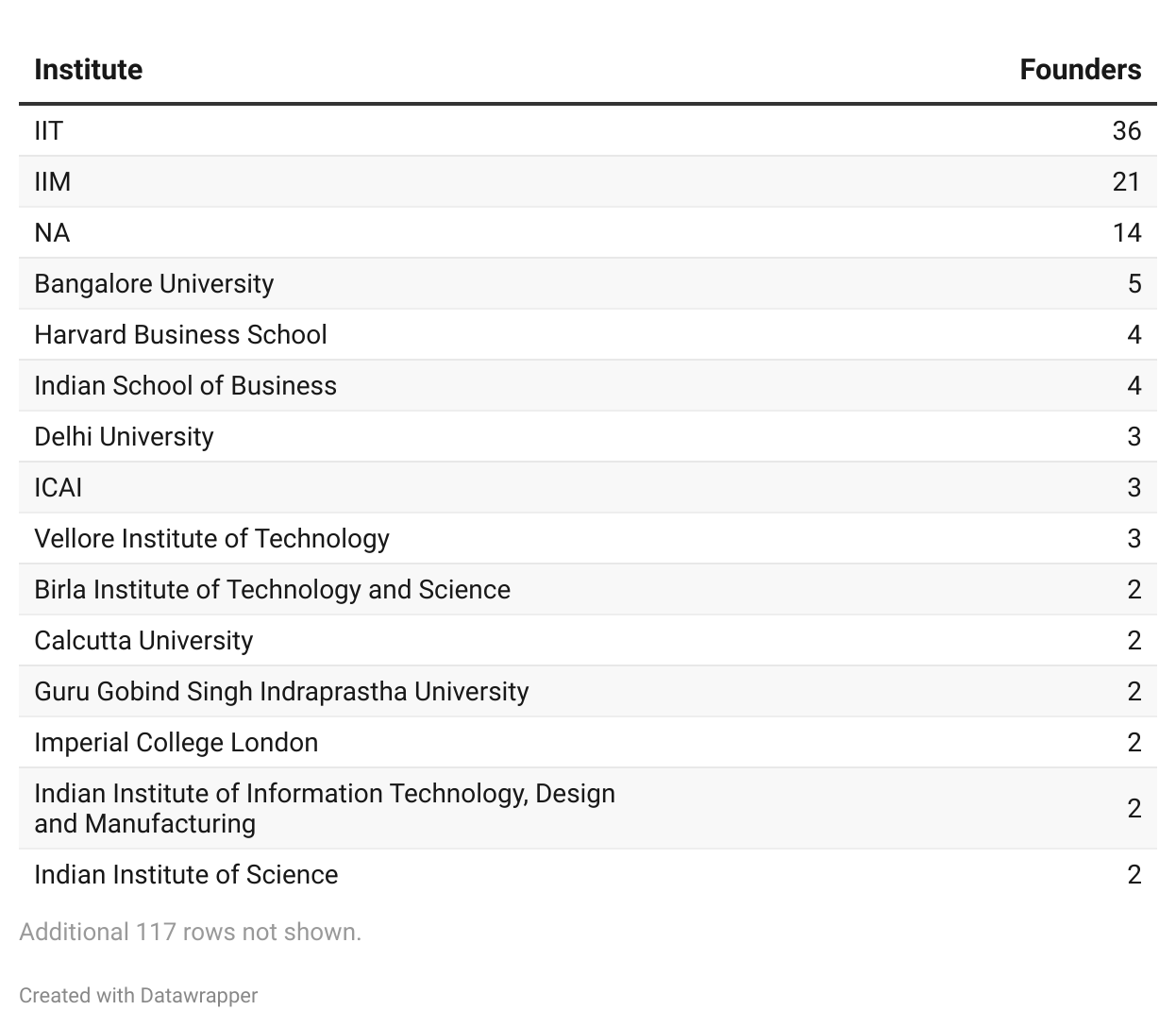

Portfolio Founders’ Alma Mater

Only 26% of Rainmatter’s portfolio founders come from Tier 1 institutes like IITs and IIMs. While the majority 74% founders are graduates from other state and private universities.

Rainmatter’s Unique Value Proposition

Beyond funding, Rainmatter’s differentiator lies in its approach:

- Offering APIs and ecosystem access to startups amplifies their capabilities.

- Focus on patient capital ensures founders aren’t rushed into decisions, promoting innovation at a natural pace.

- Commitment to climate action and sustainability aligns with global trends, fostering scalable green ventures.

Additional Insights

Rainmatter’s strategy resonates with India’s evolving consumer and regulatory landscapes:

- In fintech, its portfolio aligns with India’s push for financial inclusion and digital payments, potentially dovetailing with initiatives like UPI 2.0.

- Health startups gain an edge as India’s healthcare market is projected to grow to $372 billion by 2025, driven by telemedicine and preventive care.

- Climate-conscious investments are timely, given India’s ambitious renewable energy targets and increasing focus on ESG-compliant businesses.

Conclusion

Rainmatter Ventures goes beyond traditional funding, providing startups with capital, mentorship, and access to APIs and networks to foster impactful solutions in fintech, health, climate action, and sustainability.

With a portfolio revenue of ₹2,991 Cr and over 111 investments ranging from ₹0.05 Cr to ₹50 Cr, it supports startups addressing real-world challenges.

Data Curation by Ganesh Lokesh, Krishna Bhattad, Sakshi Joshi & Nandini Gangadhar of PrivateCircle.

Sign up on PrivateCircle Research for a free trial to access comprehensive data on 1.7 million Indian private unlisted companies across 500+ categories.

Speed up your research and analysis time from weeks to minutes and empower your investment journey today!

Follow us on social media for latest updates and insights from Indian Private Markets.