Introduction

In the latest episode of It’s-a-Big-Deal, we delve into the intricate details of our Startup Deals Report: India 2023.

The report offers valuable insights into the challenging landscape faced by the Indian startup ecosystem. Let’s unravel the trends, crunch the numbers, and explore the highs and lows of 2023.

Watch the Episode 12 available on YouTube.

The Funding Winter: A Grueling Reality

Since the middle of 2022, the Indian startup ecosystem has been experiencing a challenging period of reduced funding, witnessing a continuous decline in funding amounts each month.

This downturn is evident in the stark contrast between the two unicorns announced in 2023, as opposed to the significant numbers of 22 in the preceding year and 45 in 2021.

Analyzing the Funding Trends

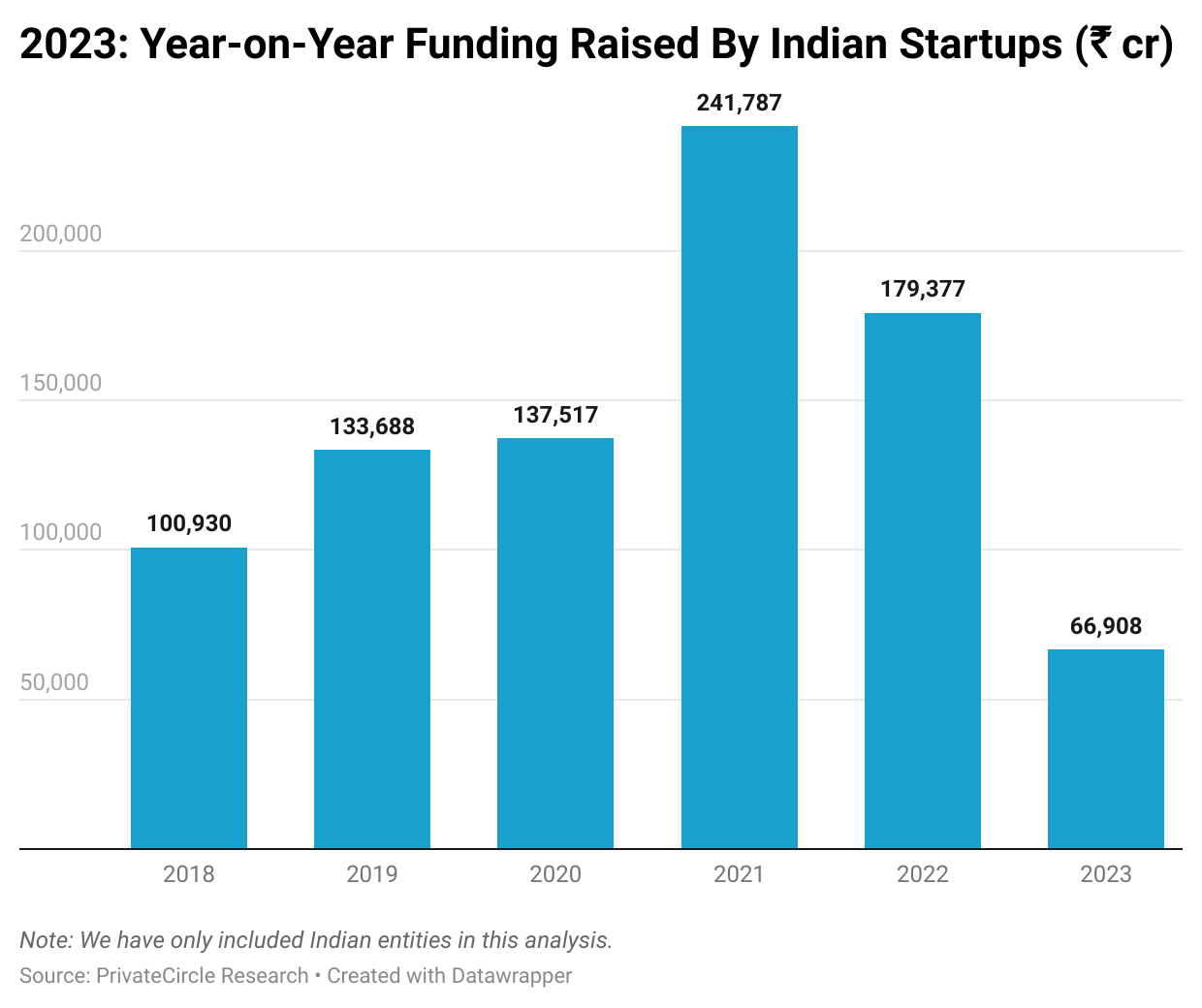

In 2023, the Indian startup ecosystem witnessed a substantial 62% year-on-year decline in funding, with the total amount raised reaching ₹67,000 cr.

This marked a significant drop from the ₹180,000 cr recorded in 2022 and the peak of ₹242,000 cr in 2021, which was a high point for the Indian startup landscape. Notably, 2023 represented a six-year low for startup funding, falling below the levels seen in 2018.

Despite these challenges, the strength of the Indian economy is evident in the gross GST revenue collections of ₹1,64,882 crore in December 2023.

This resilience in the broader economy suggests that founders may identify new business opportunities, instilling hope for a potential upswing in private market deal activity in the upcoming months.

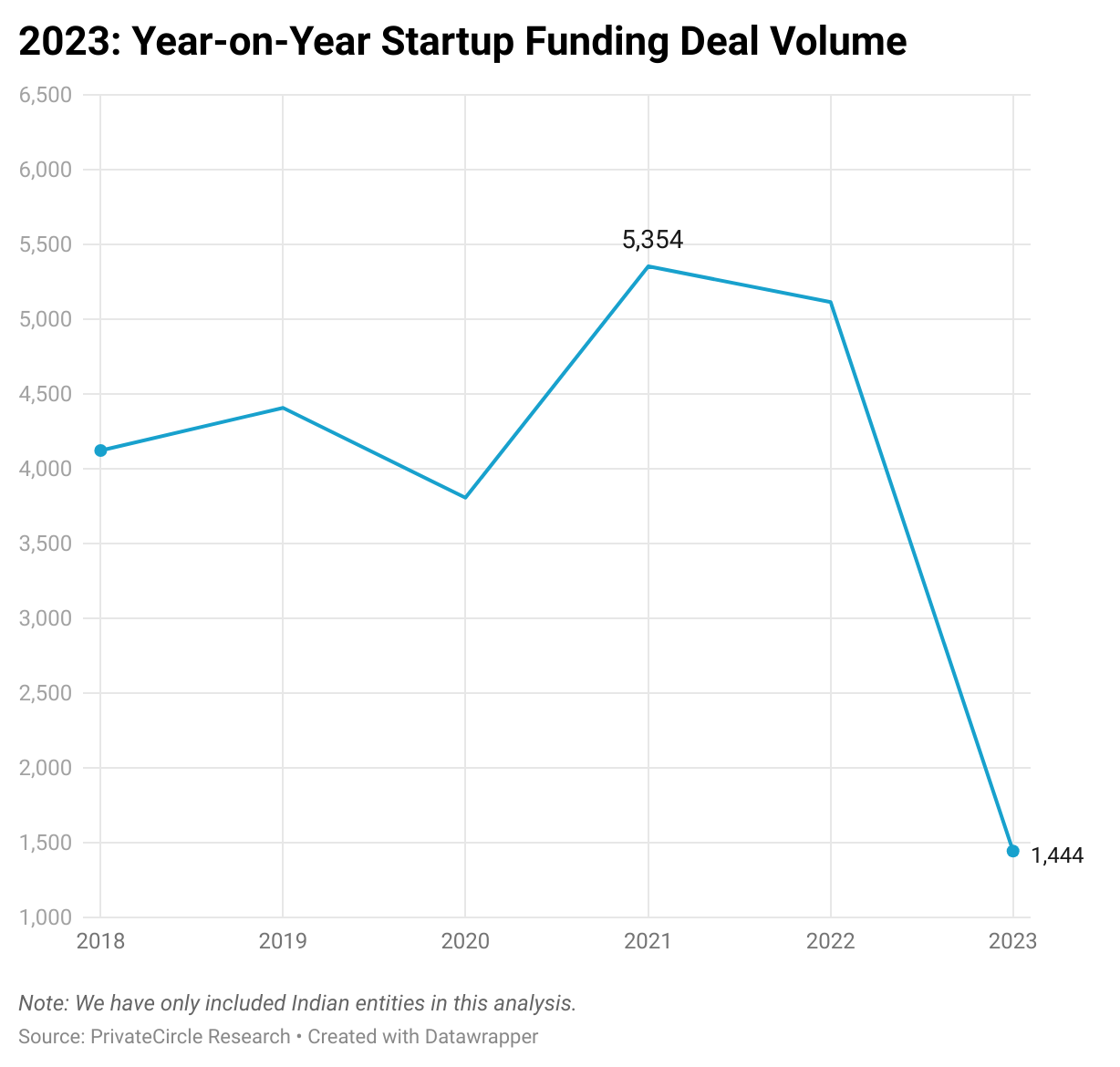

The reduction in the total amount raised has not only impacted the funding amounts but has also led to a significant decline in deal counts in 2023. We see a comparable year-on-year drop of 72% in the number of deals compared to the preceding years.

Specifically, primary funding rounds amounted to 1,444 deals in 2023, a substantial decrease from the approximately 5,354 deals recorded in 2022.

Mega Funding Deals: A Rarity in 2023

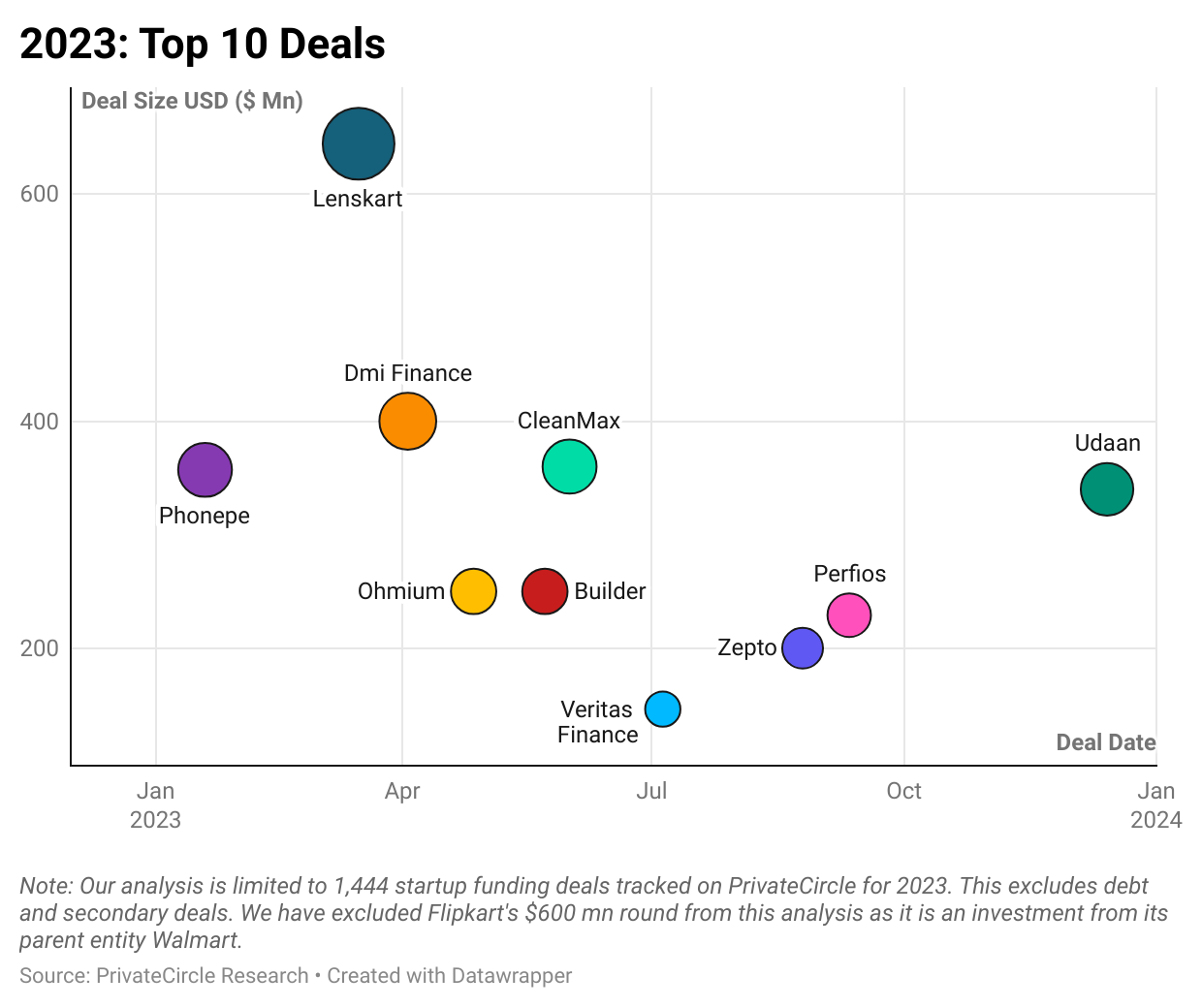

Securing mega $100 million deals proved to be a rarity in 2023, and the emergence of new unicorns was equally scarce.

However, companies with robust business fundamentals and a solid foundation did succeed in securing substantial funding amounts.

Highlighting Top Deals

The largest funding round of 2023 was achieved by eyewear retailer Lenskart, securing an impressive $500 million investment from the Abu Dhabi Investment Authority.

Following closely were notable funding rounds from companies such as DMI Finance, PhonePe, CleanMax, Udaan, and others. It’s worth noting that we have omitted the $600 million fundraising by Flipkart, as the round was led by its parent entity, Walmart.

Focus on Revenue and Profits: A Paradigm Shift

In 2023, there has been a heightened emphasis on revenue and profits. Notably, Unacademy managed to reduce its losses by 41%, and companies like Meesho, MobiKwik, and Oyo have all disclosed profitable quarters in the fiscal year 2024.

This trend could potentially signify their preparation for initial public offerings (IPOs) or an effort to attract investors in the thriving public markets.

Insights from PrivateCircle Markets

Startups within the ecosystem are placing a greater emphasis on revenue growth. Presently, founders with ample runways, exceeding 12 months, are expressing eagerness to cultivate enduring relationships with investors, driven by uncertainty regarding the duration of the ongoing funding winter.

It has become a prevailing practice to extend prior funding rounds at consistent valuations, all the while witnessing fundamental business growth and enhanced profit margins.

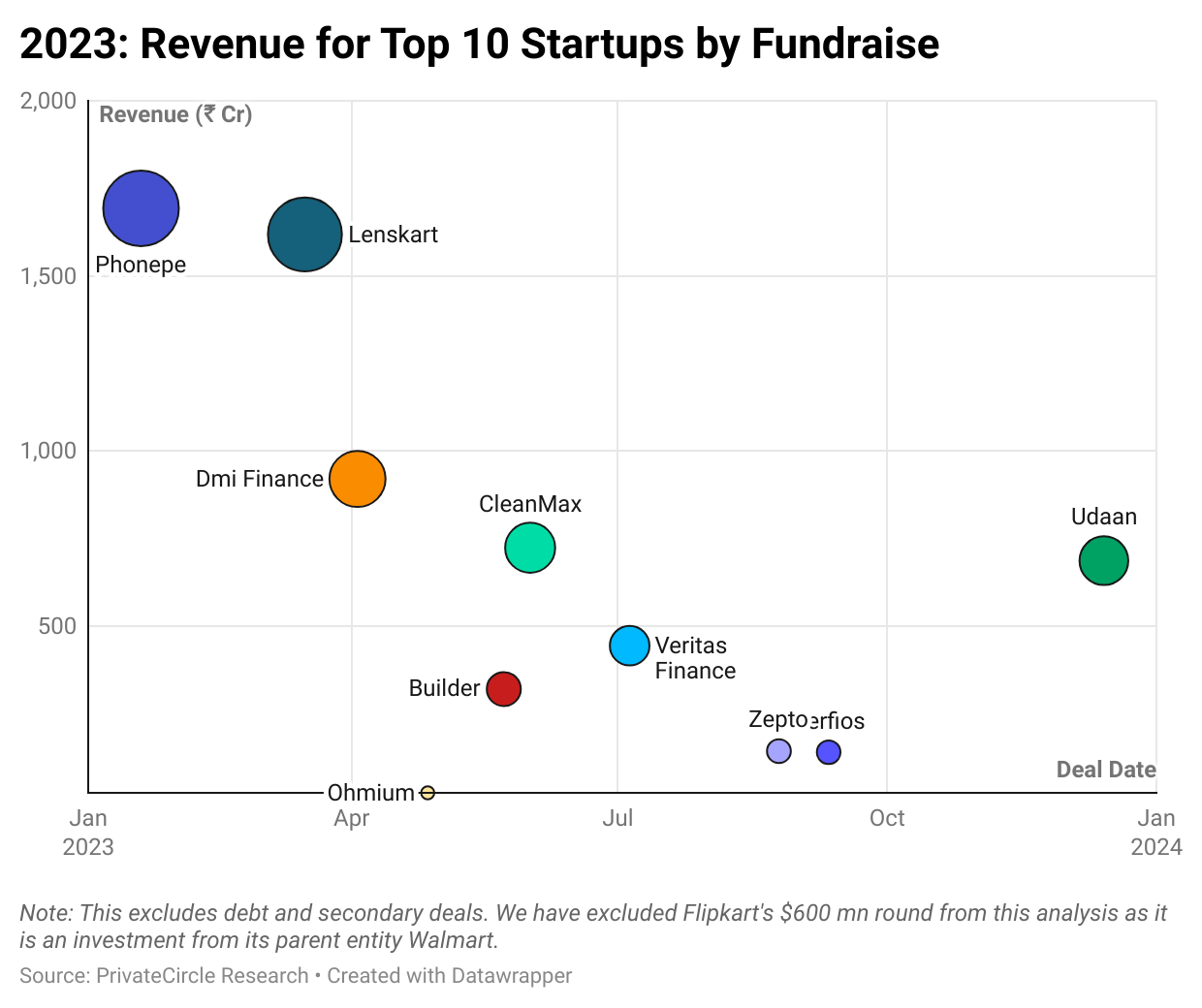

Here we see the revenue for the top 10 startups, showcasing a positive correlation between revenue and the ability to secure mega funding rounds.

It has become common to extend previous rounds at the same valuation, while seeing their business grow fundamentally with improved margins.

Impact on Early Stage Entrepreneurs: Navigating the Downturn

Starting new businesses has become notably easier today compared to a decade ago, facilitated by significant advancements in digital, AI, physical, and financial infrastructure.

Bootstrapping is now more accessible than ever, as investors can afford to wait for businesses to discover product-market fit, resulting in a decline in early-stage funding deals.

Indeed, early signs of this trend have been observed, as indicated by a recent report from Business Standard, wherein a 60% revenue increase in 2023 was reported by startup founders.

Secondary Rounds: A Cautious Approach

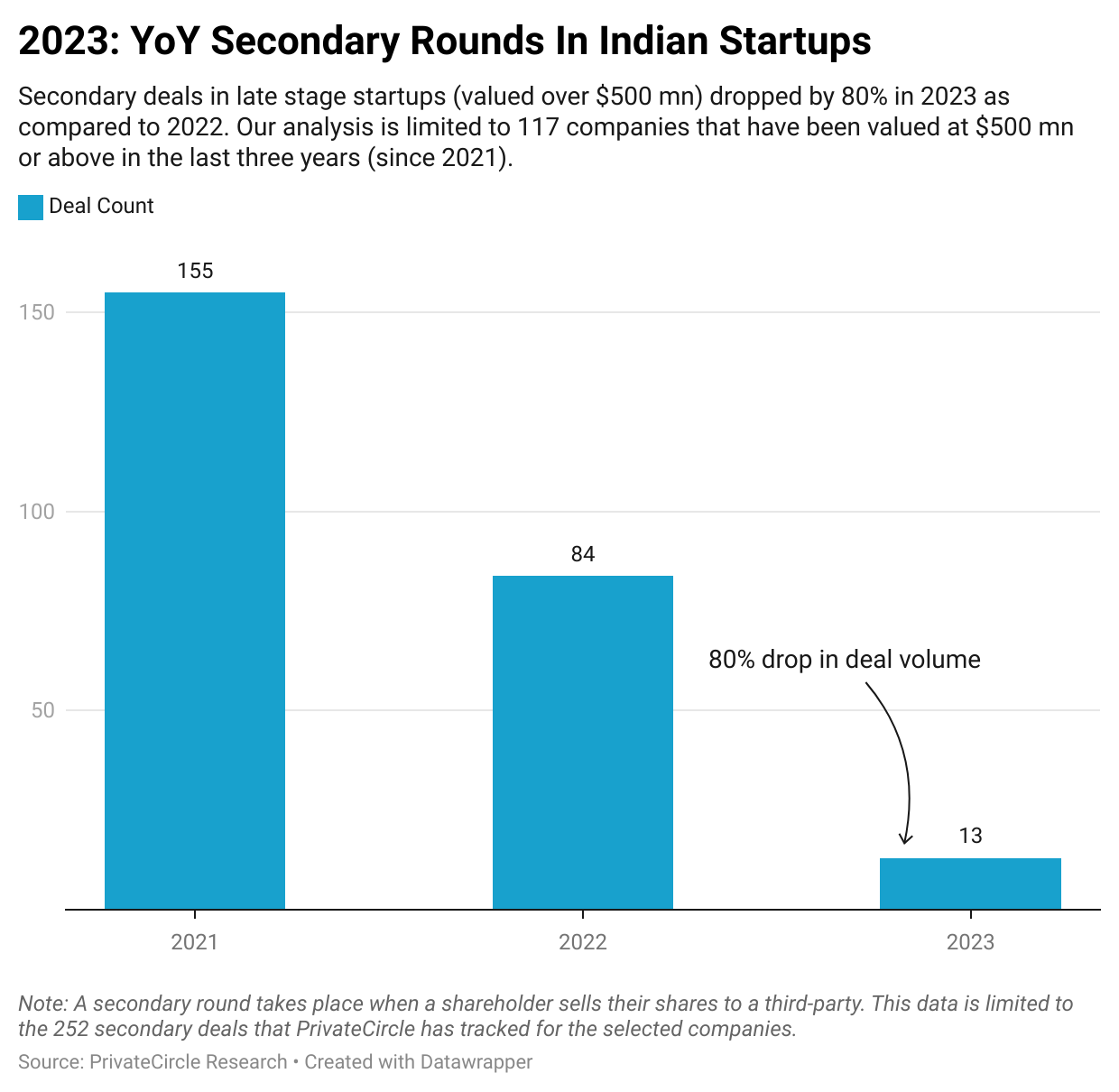

For our annual startup deal report, we analysed companies that have been valued at $500 mn or above in the last three years. In this universe, we tracked 252 secondary deals in the past three years.

We filtered this list by the year to arrive at 13 secondary deals in 2023, 84 deals in 2022 and 155 in 2021. Showing a clear drop in secondary deal count in the last three years.

Sector-wise Trends

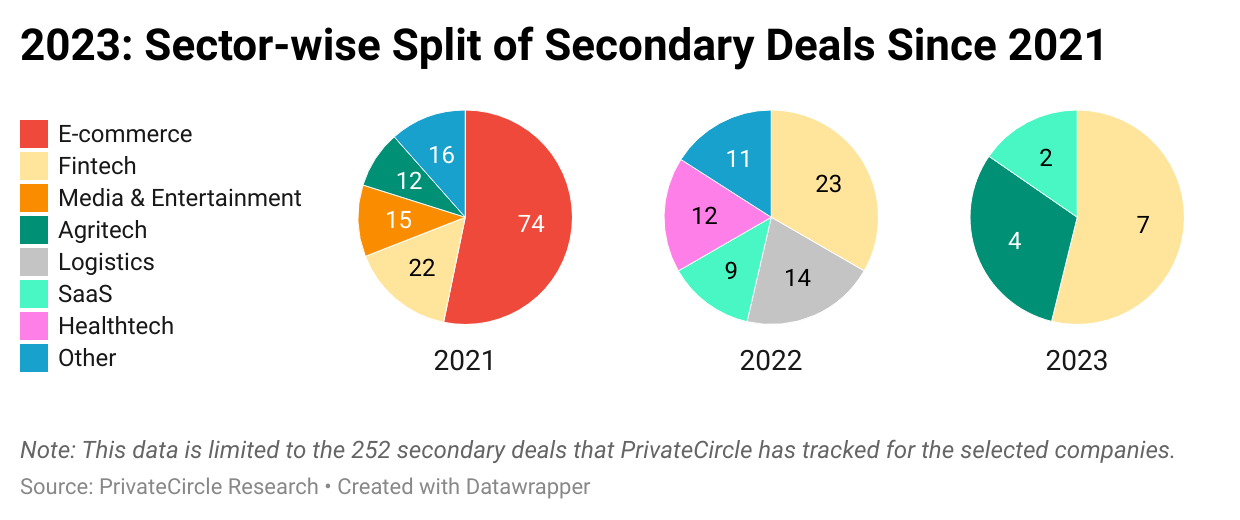

In terms of sectors, we saw a dominance of Fintech in 2023 and 2022 secondary deals, whereas e-commerce was dominant in 2021.

We can see fintech and coming up in all three years, showing the sector’s ability to provide exits to investors. SaaS is also common in both 2022 and 2023 showing the sector’s resilience in providing exits to investors.

Most Active VCs of 2023: A Silver Lining

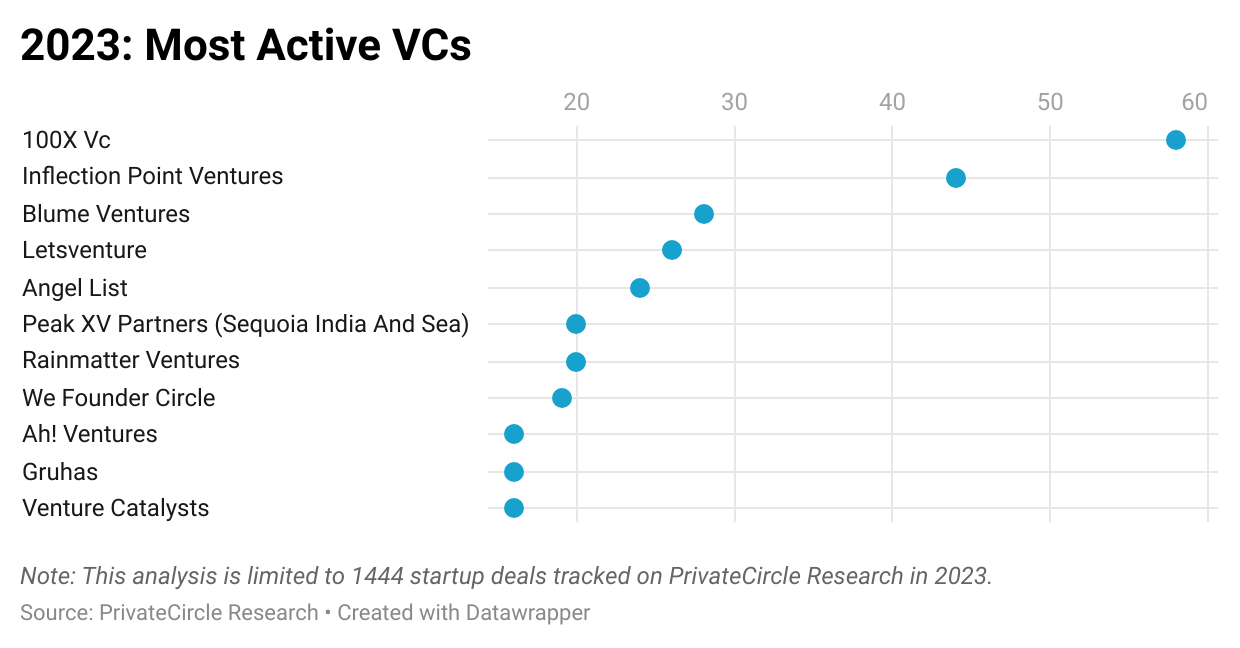

Much has been said about the slow investor activity in 2023. Let’s end this blog on a positive note by looking at the most active VCs of 2023 who continued to invest in this market.

Leading the pack in deal volume, 100X.VC took the top spot as the most active investor, followed closely by other notable names such as Inflection Point Ventures, Blume Ventures, PeakXV Partners, and Rainmatter Ventures.

Conclusion

Despite the trials and tribulations of 2023, the blog post ends on a hopeful note. The funding scarcity, startup shutdowns, and employee layoffs have paved the way for resilient companies with strong fundamentals to shine.

As the startup ecosystem steps into 2024, the anticipation of new IPOs instills hope for a brighter future. Stay tuned to PrivateCircle for continuous insights into the dynamic landscape of Indian startups and the VC ecosystem.

We hope you found this analysis insightful. Thank you for joining us on It’s-a-Big-Deal.

Sign up on our platform – privatecircle.co/research and do such in-depth analysis in minutes.

Try our FREE trial/demo to access reliable data, intelligence, and insights. Lead your research on 1.7 million private unlisted companies across 500+ data categories with confidence.

Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute professional financial advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of the company / organization.

Read more blogs of It’s-a-Big-Deal series:

Epsiode 1 | 27 Feb – 05 Mar 2023

Episode 3 | 13 Mar -15 Apr 2023

Episode 4 | 16 Apr – 02 May 2023

Episode 6 | 25 May – 17 June 2023

Episode 7 | 18 Jun – 14 Jul 2023

Episode 8 | 15 Jul – 20 Aug, 2023

Episode 9 | 21 Aug – 24 Sep, 2023

Episode 10 | 25 Sep – 15 Oct 2023

Episode 11 | 16 Oct – 15 Nov 2023