A fresh wave of Indian startups is lining up to hit the public markets. As you compile your IPO Watchlist, here’s what investors need to know from who’s next to who’s winning.

The startup party is changing venues from private rounds to public markets.

After years of VC funding and growth at all costs, many Indian startups are now chasing profitability, governance, and scale. An Initial Public Offering (IPO) helps them:

- Raise fresh capital

- Give early investors an exit

- Boost brand credibility with retail and institutional investors

But IPOs aren’t just fundraising events. They’re also milestones where startup founders are tested on numbers, not narratives. As the market matures, public investors now want clear profit paths, not just promises.

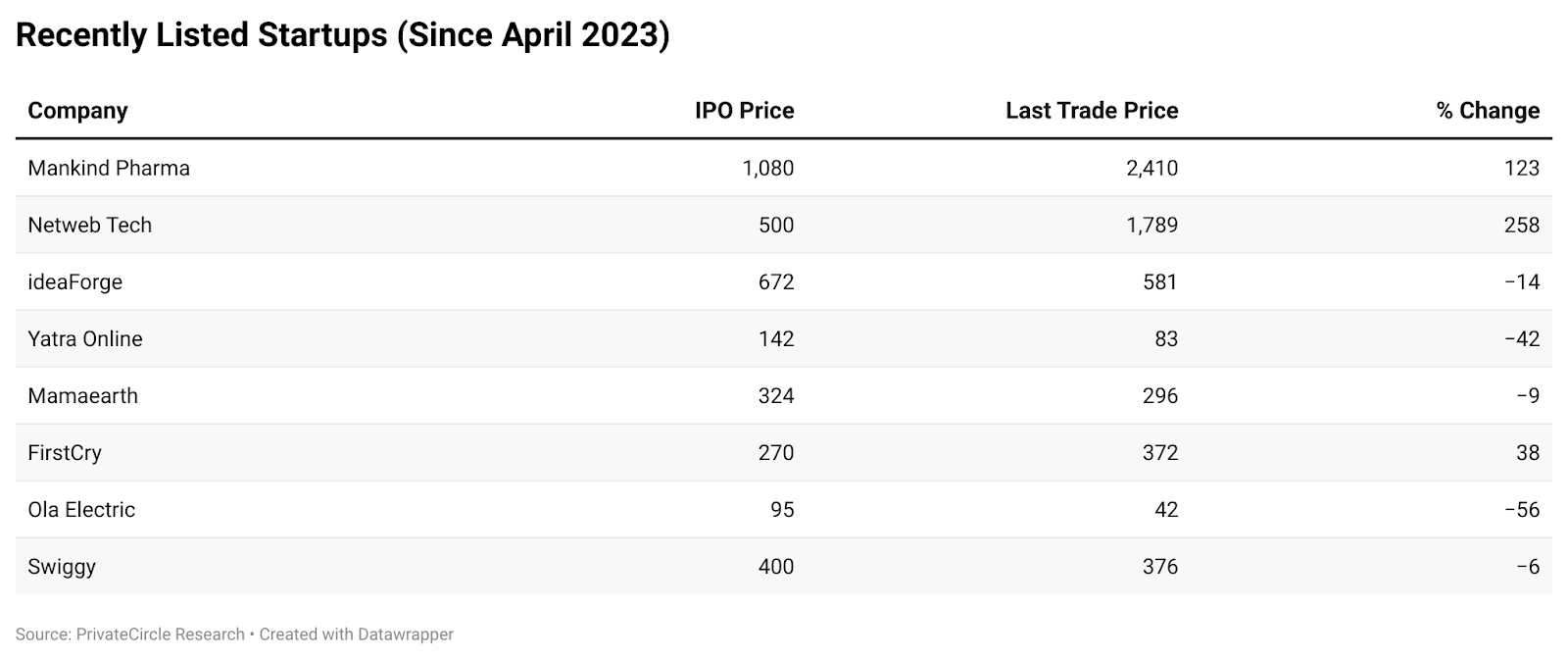

Recently Listed Startups (Since April 2023): A Mixed Bag

Here’s how some recent IPOs have performed and what that means for investors:

Note: The last traded price is based on data as of July 7, 2025.

Key Insight:

Profitable companies (like Mankind and Netweb) rewarded investors. Consumer tech startups had a mixed run. Early buzz doesn’t always mean long-term returns.

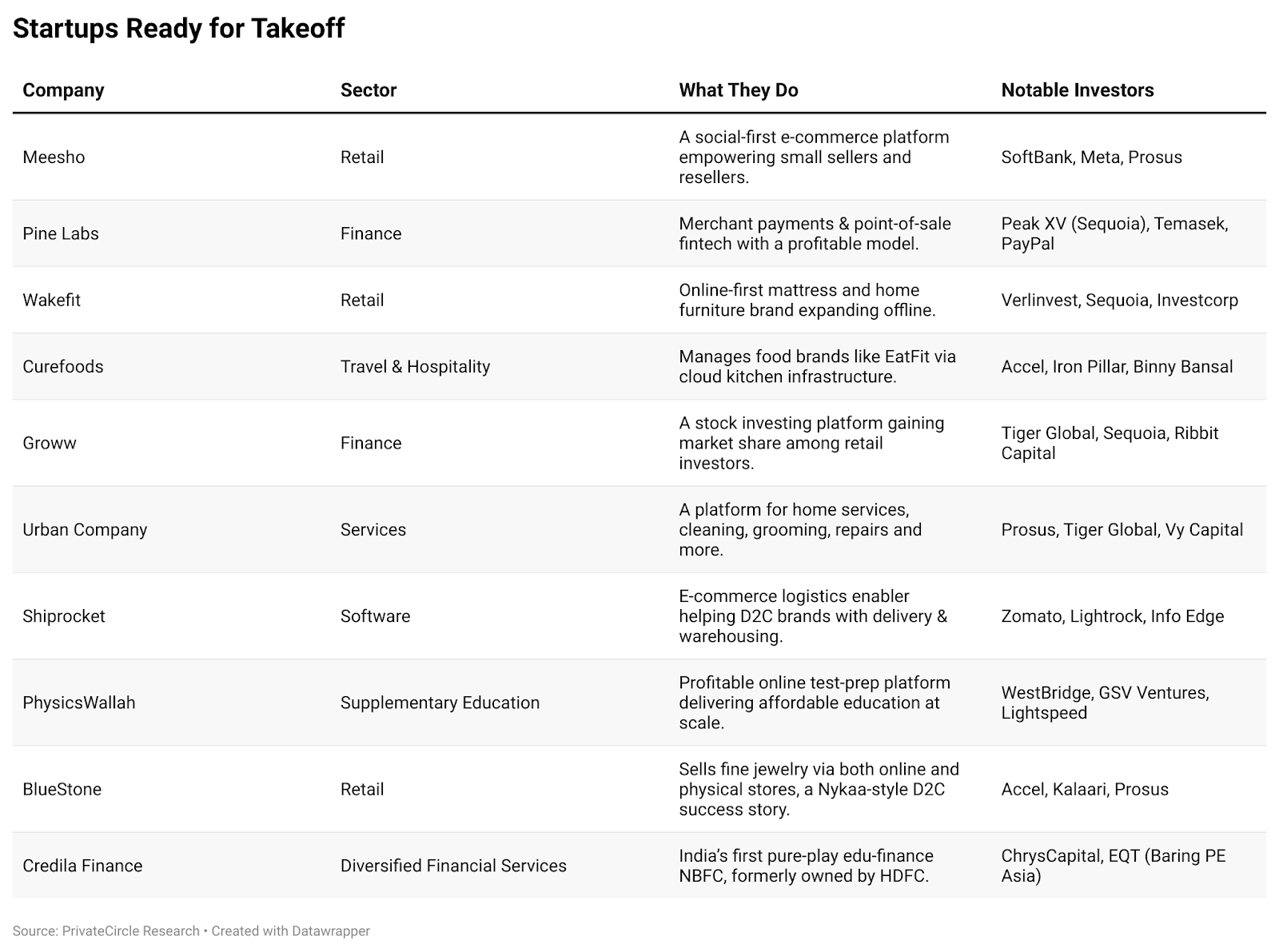

DRHPs Filed: Startups Ready for Takeoff

These Indian startups have already filed Draft Red Herring Prospectuses (DRHPs) with SEBI and are preparing to go public in 2025. Here’s who they are, and who’s backing them.

Most of these are VC/PE backed, and many will include Offer-for-Sale (OFS), where early investors partially exit.

Future IPO Prospects (Not Yet Filed)

These high-profile Indian startups haven’t filed DRHPs yet, but all signs point to public market ambitions:

Razorpay – A fintech leader offering a payment gateway and embedded finance for SMBs. Profitable. It’s one of India’s strongest IPO candidates.

Lenskart – Omnichannel eyewear brand with global expansion plans. Backed by ADIA and Temasek, Lenskart is eyeing a listing post scaling its international business.

boAt (Imagine Marketing) – India’s top D2C audio and wearables brand. After deferring its 2022 IPO, it’s now preparing a fresh attempt amid strong offline growth.

OYO – Hospitality and budget hotel aggregator backed by SoftBank. Multiple IPO attempts were delayed due to restructuring and financial clean-up, but a 2025–26 listing is likely.

BYJU’s – Edtech giant navigating a turbulent phase. Once India’s most valued startup, its IPO hinges on debt resolution and governance reforms.

Aakash (Byju’s) – Test-prep subsidiary of BYJU, operating profitably in offline coaching. Could pursue a separate IPO independent of BYJU’s core edtech brand.

PhonePe – A leading digital payments and financial services platform. Backed by Walmart and already a decoupled Flipkart entity, IPO is likely in 2025–26.

Flipkart – India’s top e-commerce marketplace. A US listing via Walmart has long been speculated and may materialize in the next 1–2 years.

Who’s Backing These IPOs?

Let’s decode the institutional power players behind India’s IPO wave. These are not just early backers; many are also preparing for partial exits through Offer for Sale (OFS).

| Investor | Backing These IPOs |

| SoftBank | Meesho, FirstCry, OYO, Ola Electric |

| Peak XV (Sequoia) | Pine Labs, Wakefit, Groww, PhysicsWallah |

| Tiger Global | Urban Company, Razorpay, Groww |

| Temasek | Pine Labs, Shiprocket, Lenskart |

| Prosus (Naspers) | Meesho, Urban Company, Swiggy |

Investor Insight:

- SoftBank has been a dominant force in India’s startup ecosystem for the past decade. With IPOs like Meesho, FirstCry, and Ola Electric lined up, it’s seeking large-scale liquidity across sectors, e-commerce, EVs, and hospitality. Expect sizable stake sales.

- Peak XV (formerly Sequoia India) has made early bets on multiple IPO-bound companies. Its portfolio includes fintech (Groww, Pine Labs), consumer tech (Wakefit), and edtech (PhysicsWallah), all showing signs of maturity. Sequoia often stays post-IPO, but trims exposure via OFS.

- Tiger Global has consistently backed India’s internet economy. With positions in Urban Company, Groww, and Razorpay, Tiger could unlock exits across verticals, services, wealthtech, and payments.

- Temasek, Singapore’s sovereign fund, is a quiet yet influential player. Its bets in Pine Labs, Shiprocket, and Lenskart highlight a long-term play on fintech, logistics, and consumer tech. Temasek may partially exit but typically retains a strong long-term presence.

- Prosus (Naspers) is one of the most active global investors in the Indian consumer internet. It’s now preparing IPO exits in Meesho, Urban Company, and Swiggy, each of which holds a strong market position but varying profit trajectories.

Why this matters:

OFS (Offer for Sale) is when existing investors cash out during the IPO. A large OFS could signal a planned exit, while smaller sales suggest continued belief. As an investor, watching who’s selling and how much is often more important than who’s listed in the cap table.

Conclusion: What Should Investors Watch?

India’s IPO cycle is not just making a comeback, it’s doing so with greater maturity, discipline, and investor scrutiny. The startup ecosystem has evolved beyond vanity metrics and hyper-growth narratives. Today, founders and backers are prioritizing sustainable, capital-efficient business models with clearer revenue paths and stronger governance.

Startups preparing to go public are now expected to deliver more than scale, they must demonstrate profitability, sound unit economics, and credible leadership. Retail and institutional investors are asking smarter questions and demanding transparency.

But not every IPO will be a success. While companies like Mankind Pharma and Netweb Technologies delivered strong shareholder returns, others like Paytm and ideaForge serve as reminders that a good debut doesn’t always mean long-term value. Execution post-listing, profit visibility, and stakeholder confidence remain the true differentiators.

So, how should investors navigate this IPO wave?

Read the DRHP, it’s the company’s public blueprint.

Track the OFS size, is it early investors exiting or founders cashing out?

Look for profitability or a visible path to it not just revenue hype.

This IPO Watchlist report has been compiled using insights and data from PrivateCircle, offering a data-driven lens into India’s evolving startup IPO landscape.

Which IPO are you tracking in 2025?

Meesho’s social commerce journey, Pine Labs’ fintech evolution, or Groww’s push in retail investing?

Explore detailed IPO breakdowns: