Welcome to an insightful journey into the dazzling world of the Indian Apparel & Luxury Goods sector. As of 2023, the Indian Apparel & Luxury Goods sector has experienced notable growth and transformation, positioning itself as a key player in the global luxury market.

With a strong economy and a growing affluent middle class, India has become an attractive market for both domestic and international luxury brands.

Highlights

- India is the world’s second-largest producer of textiles and garments and the fifth-largest exporter of textiles, contributing significantly to the country’s economy.

- The textiles and apparel industry accounts for 2.3% of India’s GDP, 13% of industrial production, and 12% of exports.

- Around 45 million people are employed in the textile business, including 3.5 million people working on handlooms.

- India’s textile and apparel exports, including handicrafts, witnessed a 41% YoY increase to reach US$ 44.4 billion in FY22.

- The textiles industry received foreign direct investment (FDI) worth US$ 4.03 billion from April 2000 to June 2022.

- The Ready-Made Garment (RMG) exports are expected to exceed US$ 30 billion by 2027, growing at a CAGR of 12-13%.

In this blog, we take a closer look at the Indian Apparel & Luxury Goods deals summary report that scoops the deals in the sector from CY Q2 2022 to Q1 2023. You will be able to get an overview of the sector, understand the deal dimensions, explore the trends, influences, market dynamics from the read.

Report Scope

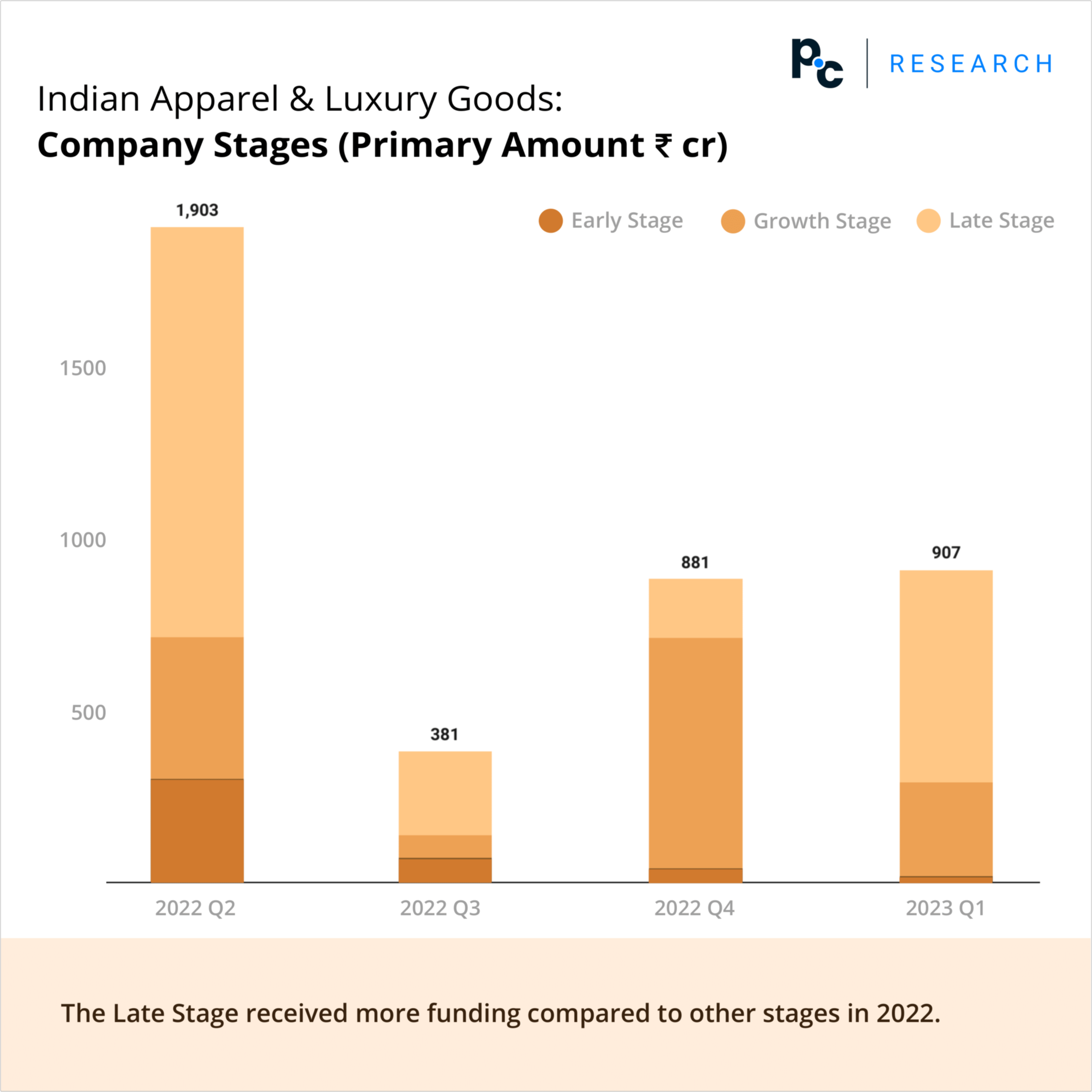

- Company Stages

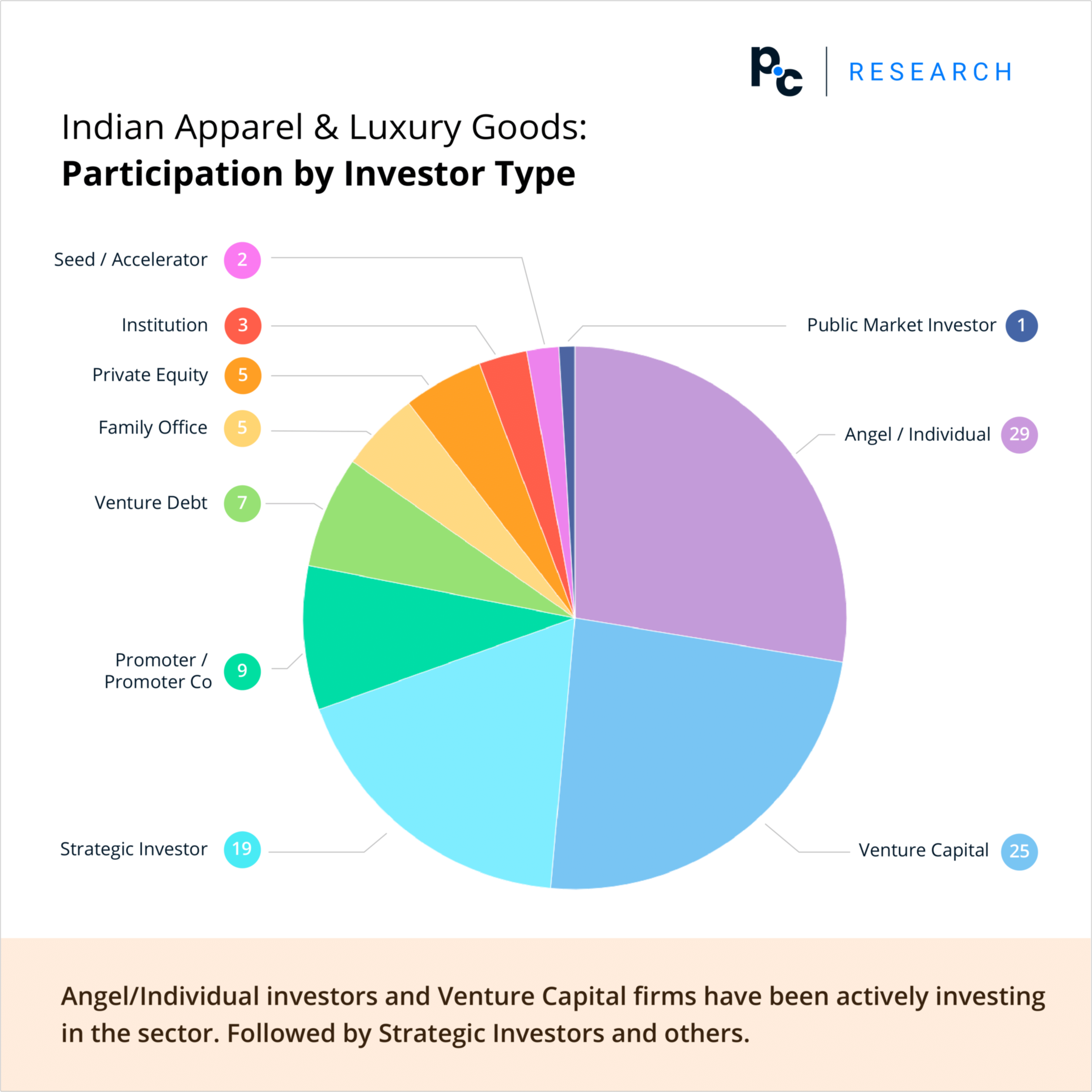

- Types of Investors with Participation

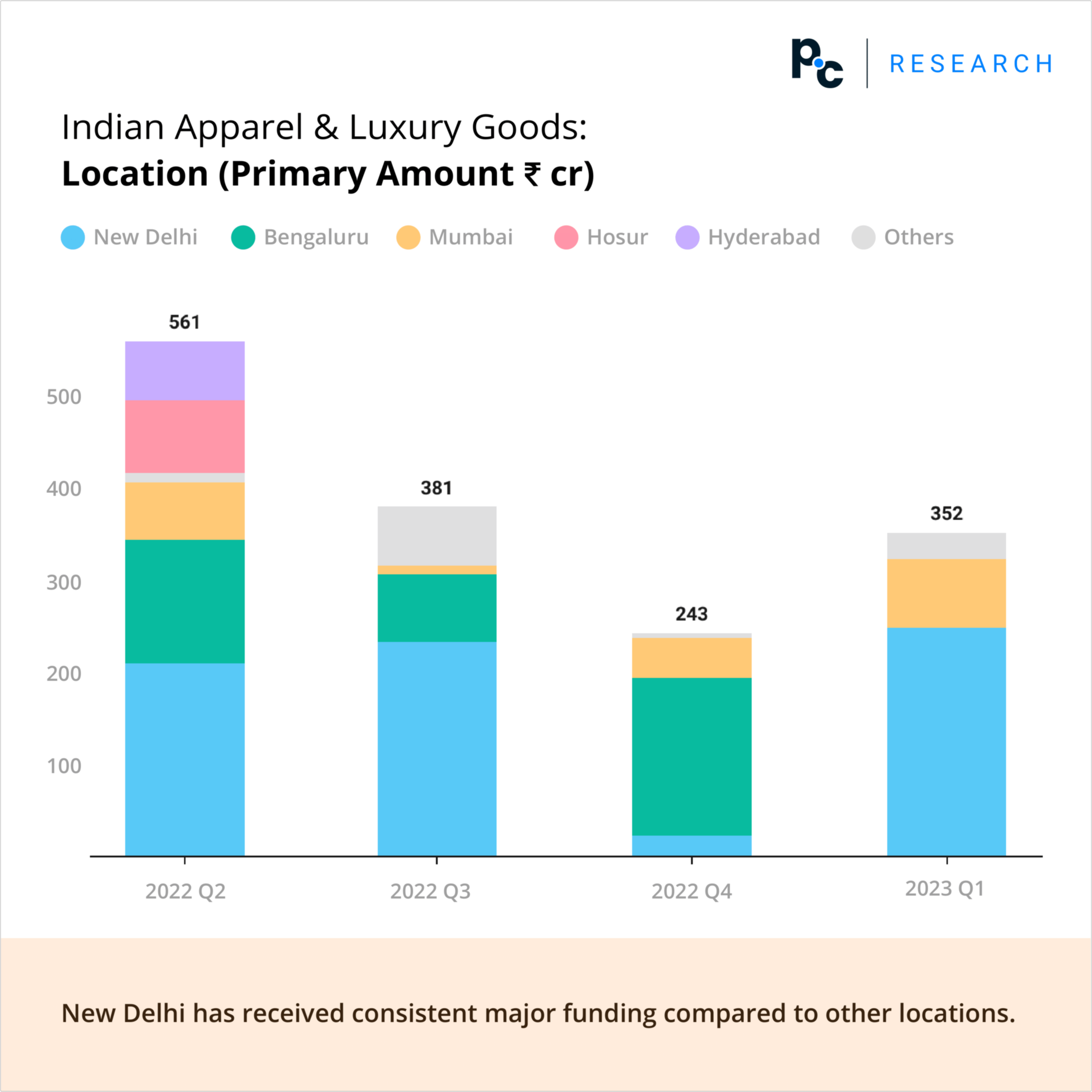

- Locations

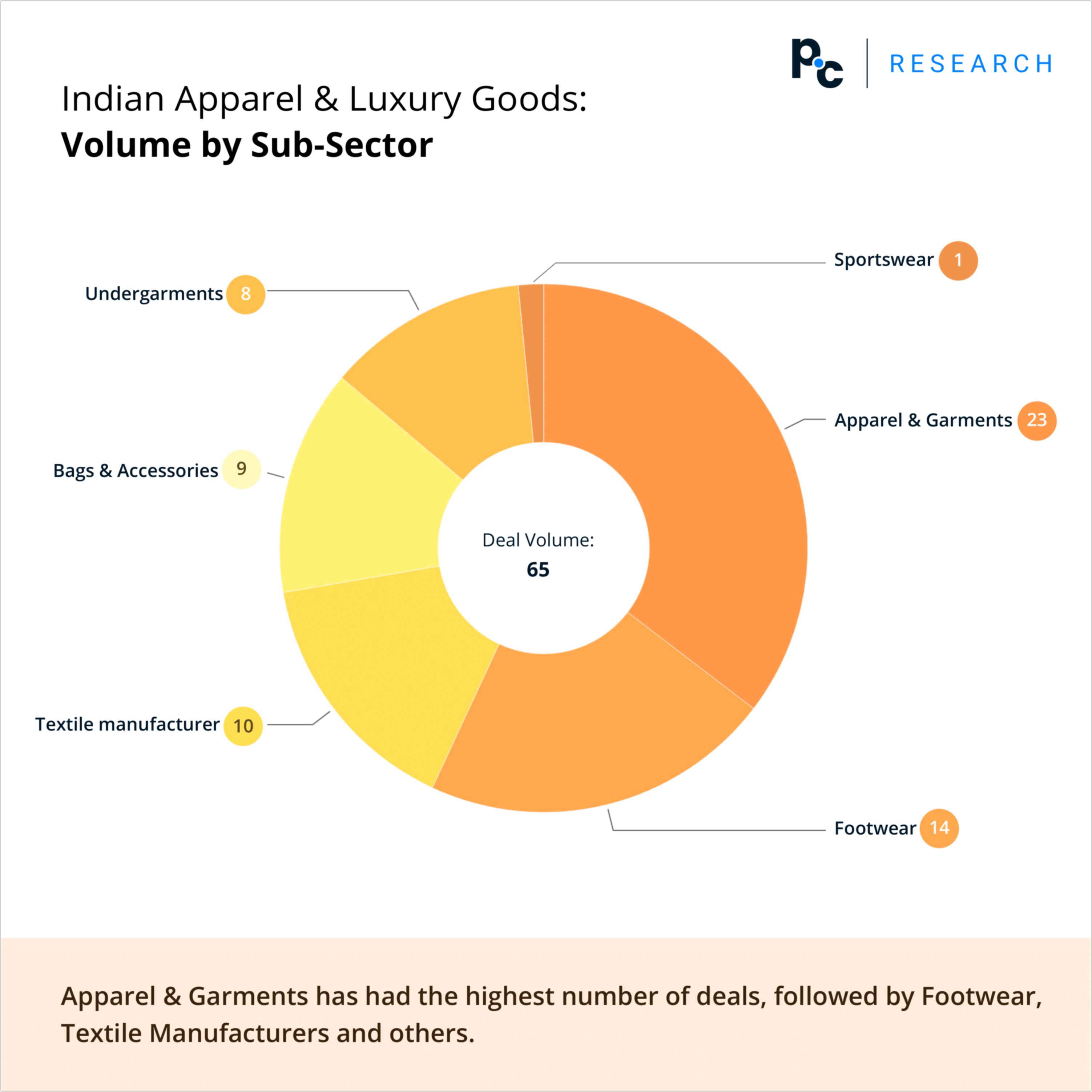

- Volume by Sub-Sector

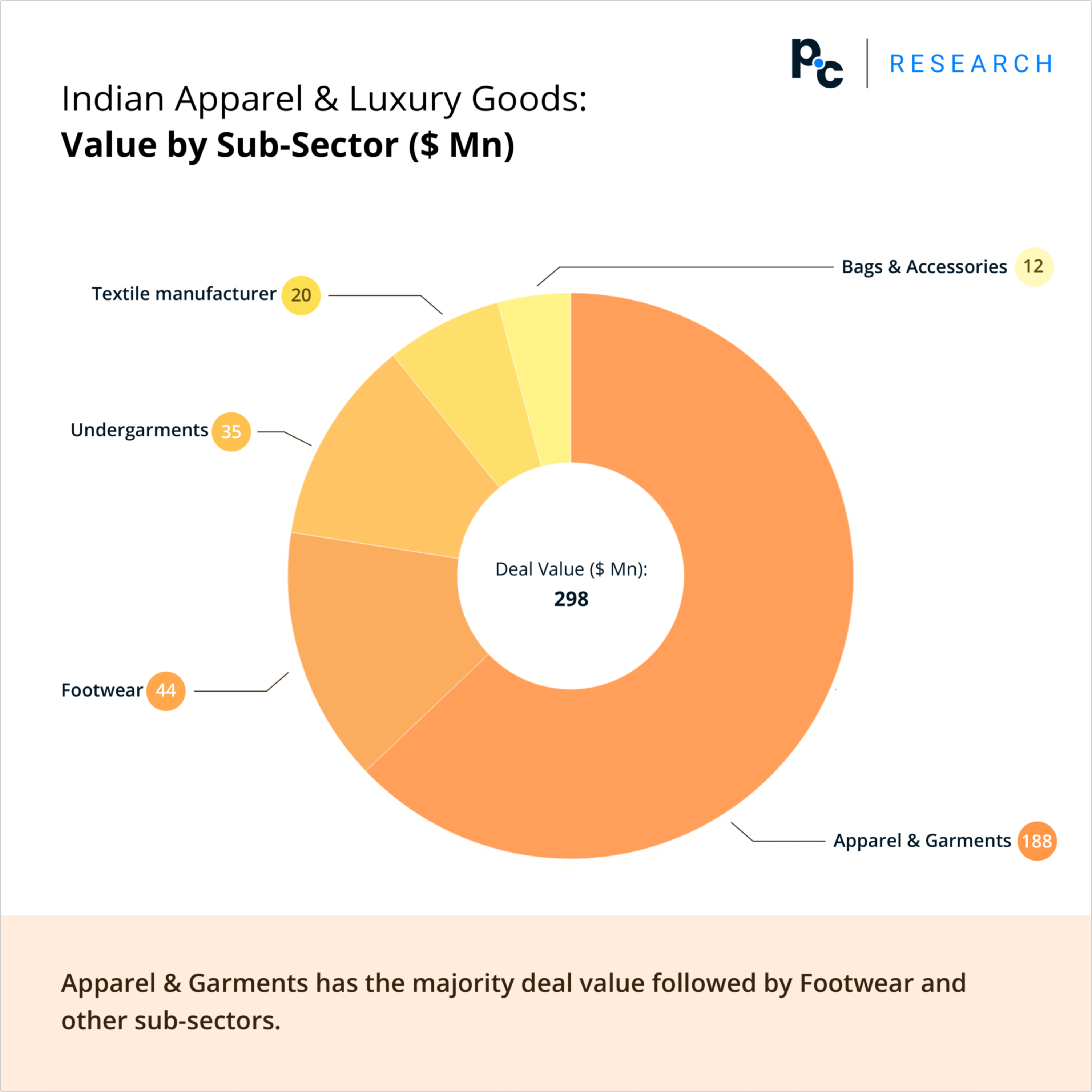

- Value by Sub-Sector

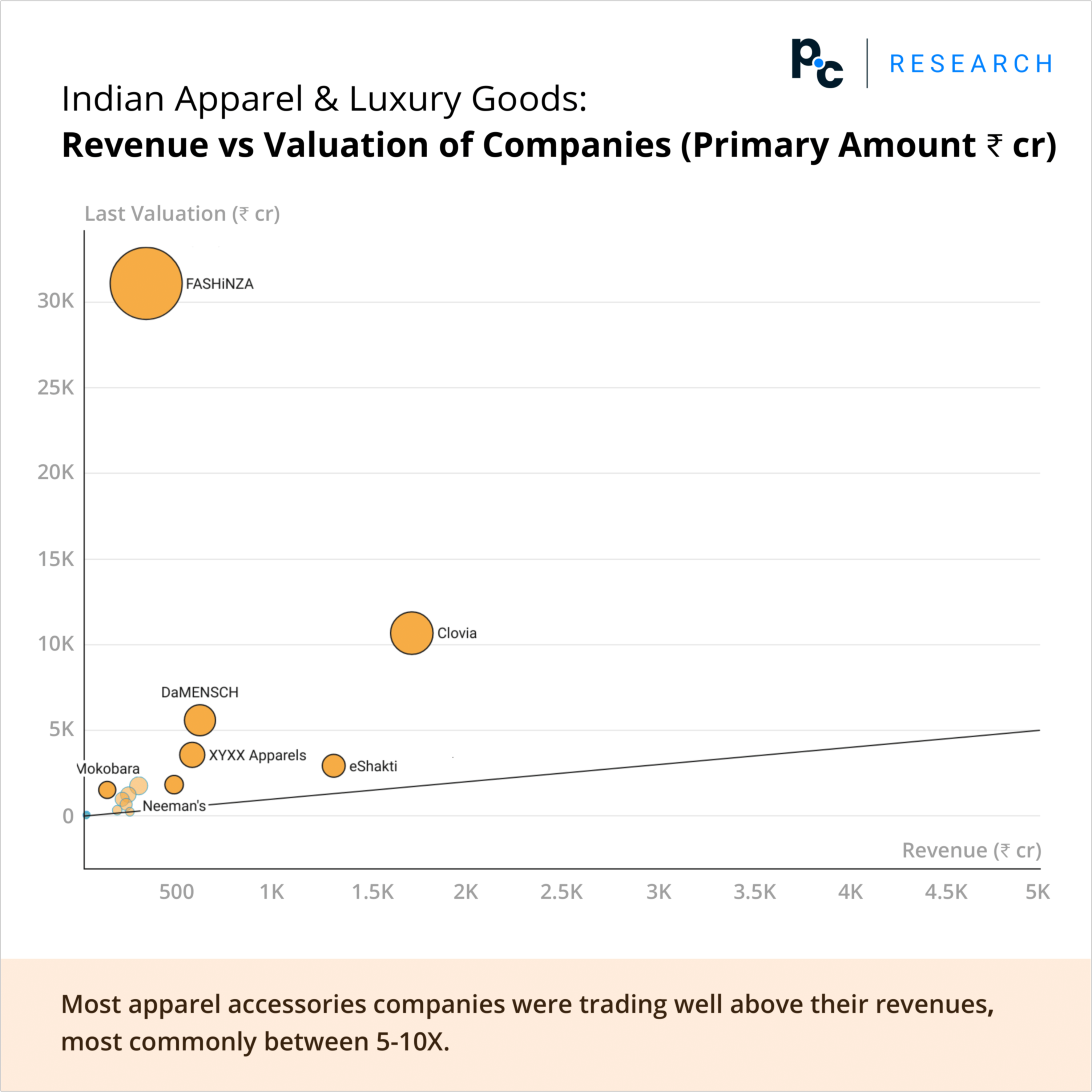

- Revenue vs Valuation of the companies

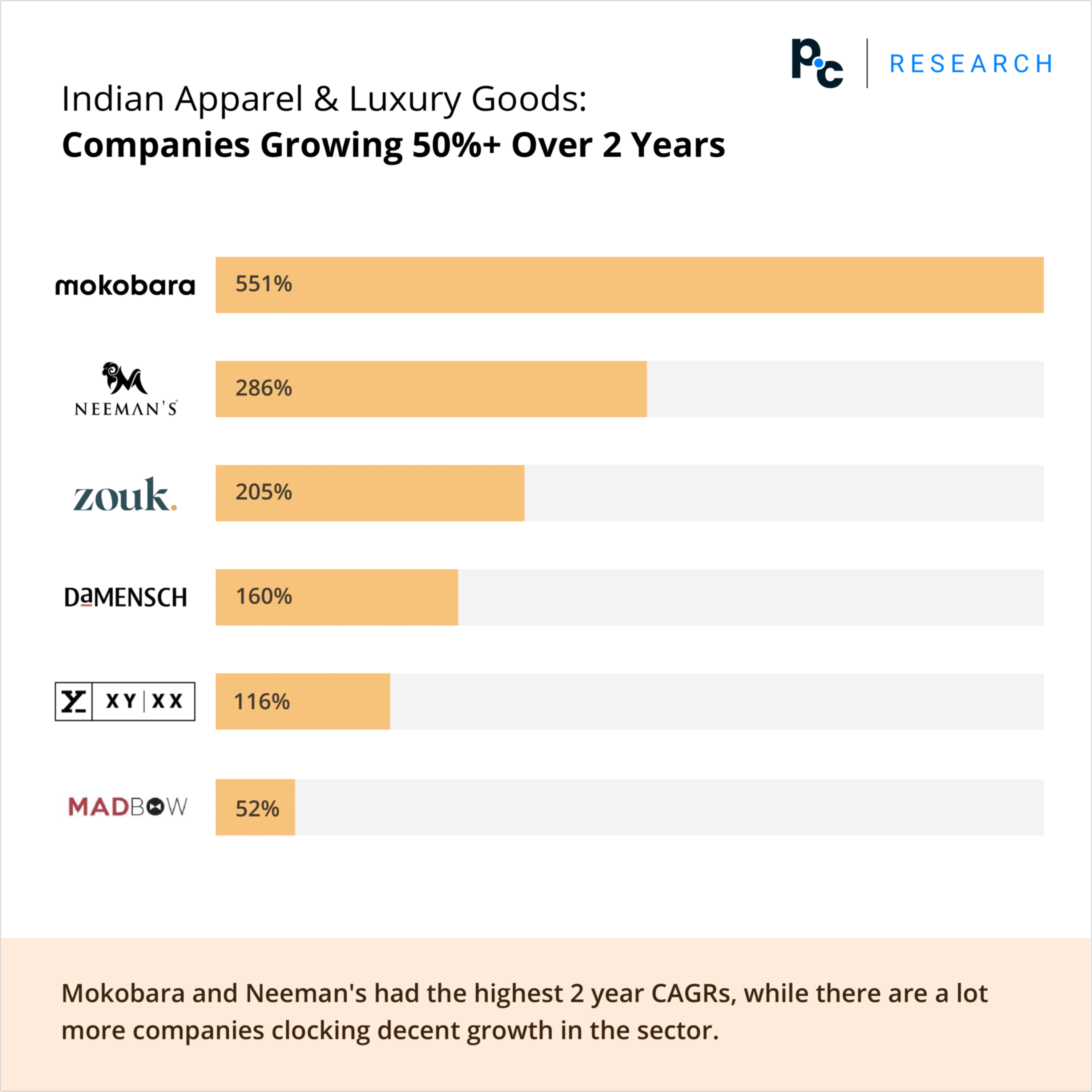

- Companies Growing 50%+ over 2 years

Market Size and Growth: The Indian Apparel & Luxury Goods sector has experienced substantial growth, reaching an estimated value of $30 billion in 2023.

This growth can be attributed to factors such as rising disposable incomes and an expanding middle-class population with a growing inclination towards luxury products.

E-commerce Transformation: The sector has witnessed a significant shift towards online shopping, with luxury e-commerce gaining momentum.

As internet penetration increases and consumers become more digitally savvy, luxury brands have capitalized on this trend by establishing online platforms, making luxury goods more accessible to a wider audience.

Factors Driving the Sector

Middle-Class Expansion Driving Demand: India’s burgeoning middle-class has been a driving force behind the growth of the luxury goods market.

With more disposable income and changing consumer aspirations, this segment seeks premium apparel, accessories, and cosmetics, propelling the sector’s expansion.

International Brands’ Foothold: Leading international luxury brands have recognized India’s potential and established a presence in the country. These brands have either opened exclusive stores or collaborated with established retailers.

This strategic approach has enabled them to tap into the growing market and capture the attention of affluent consumers.

Sustainable Fashion on the Rise: Sustainability has emerged as a significant trend in the Indian luxury goods industry. Consumers, especially the younger generation, are increasingly conscious of the environmental impact of their purchases.

As a result, luxury brands are incorporating sustainable practices and promoting eco-friendly fashion lines.

Regional Market Dynamics: While Tier-1 cities remain the primary market for luxury goods, Tier-2 and Tier-3 cities are becoming increasingly important growth areas. The rapid urbanization and rising disposable incomes in these regions have led to an upsurge in luxury brand presence and consumer demand.

Homegrown Luxury Brands: Indian luxury brands have stepped into the spotlight, gaining recognition both domestically and internationally.

These brands leverage India’s rich cultural heritage and craftsmanship to create unique and exclusive luxury products, appealing to consumers seeking authenticity and distinctiveness.

COVID-19 Impact and Recovery: The COVID-19 pandemic posed challenges to the Indian Apparel & Luxury Goods sector, causing temporary setbacks in sales and operations due to lockdowns and restrictions.

However, the industry demonstrated resilience and adaptability, bouncing back as restrictions eased and consumer confidence returned.

Future Outlook and Opportunities

The future of the Indian Apparel & Luxury Goods sector appears promising, with several opportunities for growth.

Continued Middle-Class Expansion: As India’s middle-class continues to grow, it will be a key driver of luxury goods demand. Luxury brands should tailor their offerings to cater to the preferences and aspirations of this evolving consumer segment.

Expanding E-commerce Landscape: The surge in online luxury shopping is expected to continue, presenting opportunities for brands to enhance their digital presence and offer seamless and personalized shopping experiences.

Embracing Sustainability: Brands that prioritize sustainability will gain a competitive edge as eco-consciousness becomes an integral part of consumer decision-making.

Exploring Untapped Markets: Tier-2 and Tier-3 cities hold immense potential for luxury brands to expand their reach and capitalize on the rising affluence in these regions.

Government Initiatives

The Indian government has implemented several schemes to boost the Apparel & Luxury Goods sector, fostering its growth and competitiveness in the global market.

Some of the key initiatives are;

- The Production-Linked Incentive (PLI) scheme,

- Mega Integrated Textile Region and Apparel (MITRA) Park scheme,

- Handloom Export Promotion Council (HEPC),

- Handloom Marketing Assistance (HMA),

- Amended Technology Upgradation Fund Scheme (A-TUFS), and other such initiatives for skilled manpower and ease of doing business.

These initiatives aim to boost manufacturing, promote exports, support handloom weavers, upgrade technology, and attract foreign investments, fostering the sector’s growth and competitiveness.

Conclusion

The Indian Apparel & Luxury Goods sector in 2023 showcases robust growth, driven by increasing disposable incomes, expanding middle-class aspirations, and a shift towards digitalization.

The industry’s future success will depend on brands’ ability to adapt to evolving consumer preferences, embrace sustainability, and explore untapped opportunities across diverse market segments.

References

More Deals Summary Reports

Indian Healthcare Tech | CY Q2 2022 – Q1 2023

Snacks & Savory Deals Summary | Q4 2021 – Q3 2022

Indian Co-Working Space Companies’ Deals Overview | 2015 – 2022

Indian AI-Based Solutions Companies’ Deals Overview | Q4 2021 – Q3 2022