Introduction

India embodies one of the world’s most diverse power sectors, encompassing a wide range of sources, from conventional ones like coal, oil, and nuclear power, to innovative options such as wind, solar, and waste utilization.

The country’s electricity demand has surged and is projected to climb further. To meet this escalating need, substantial increases in installed generating capacity are imperative.

As of 2021, India holds impressive global ranks: fourth in both wind and solar power capacity, and fourth in overall renewable power installations. Remarkably, among G20 nations, India is the sole country making significant progress towards fulfilling its commitments under the Paris Agreement.

The global push towards sustainability and cleaner energy sources has propelled companies like CleanMax into the spotlight in the country. As Asia’s largest provider of renewable power to commercial and industrial customers, CleanMax has established itself as a key player in the Energy Equipment & Services sector.

Sector Highlights

- India ranks third globally in electricity production and consumption, boasting an installed capacity of 416.59 GW as of April 30, 2023.

- Power usage surged by 9.5% in FY23, reaching 1,503.65 billion units (BU).

- The Union Budget 2023-24 allocated US$ 885 million (₹ 7,327 cr) for solar power, encompassing grid, off-grid, and PM-KUSUM projects.

- FY23 marked India’s fastest power generation growth in over 30 years, with an 8.87% rise to 1,624.15 billion kWh. April 2023 saw power consumption at 130.57 BU.

- The target for electricity generation (including Renewable Energy) in 2023-24 is set at 1,750 BU, reflecting a 7.2% increase over the previous year’s actual output.

- April 2023 witnessed a peak power demand of 226.87 GW across the country.

- The power sector’s 100% FDI allowance has spurred a significant inflow of foreign investment.

- The energy sector claims the largest share (24%) of the projected US$ 1.4 trillion (₹ 111 lakh cr) capital expenditure in the National Infrastructure Pipeline 2019-25.

- Total FDI inflow into the power sector reached US$ 16.57 billion during April-December 2022.

This blog provides an overview of CleanMax’s remarkable journey and its significant contributions to the renewable energy landscape based on Historical Performance Summary Report: CleanMax 2023 by PrivateCircle Research.

Report Scope

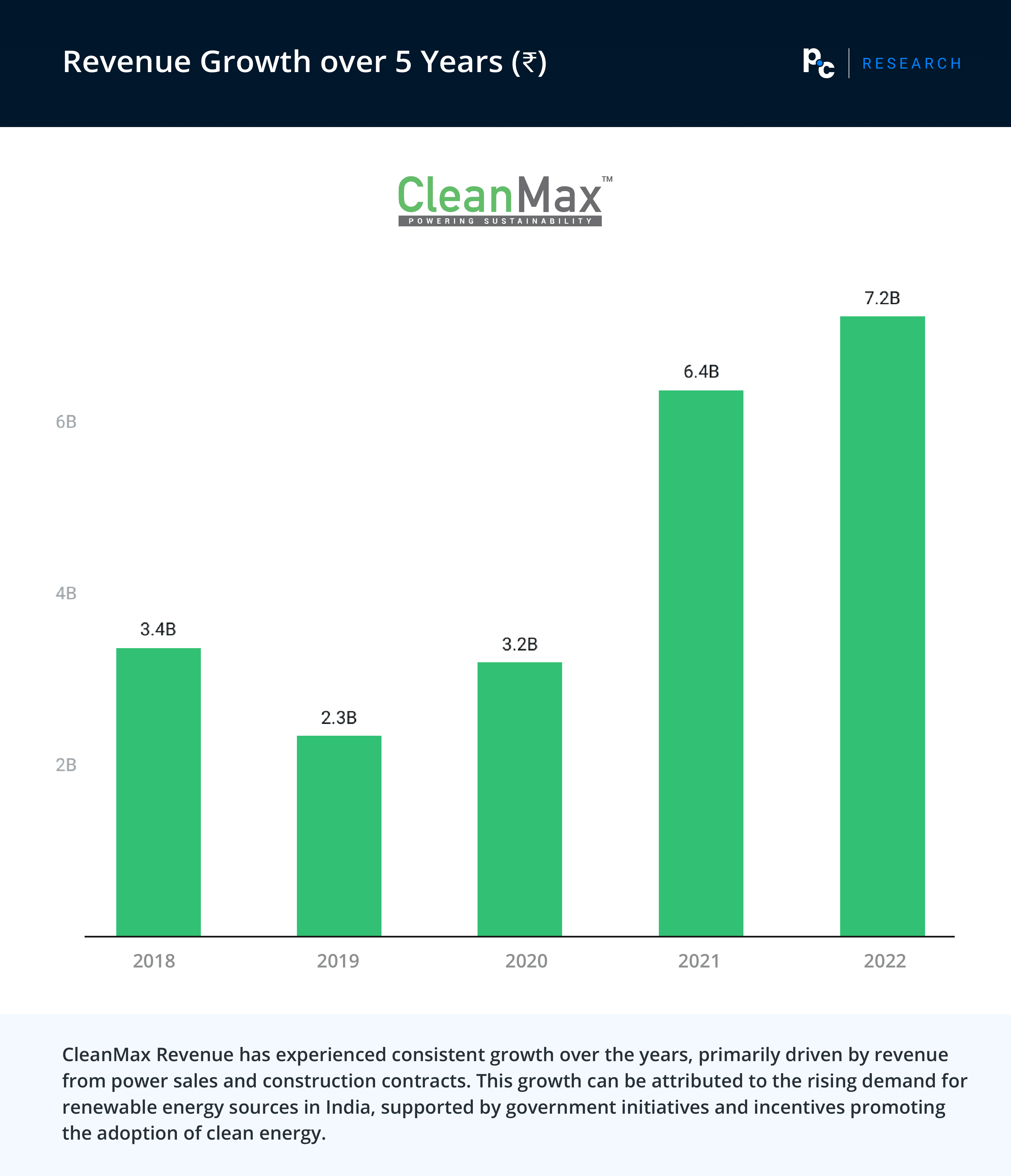

- Revenue Growth over 5 Years (₹)

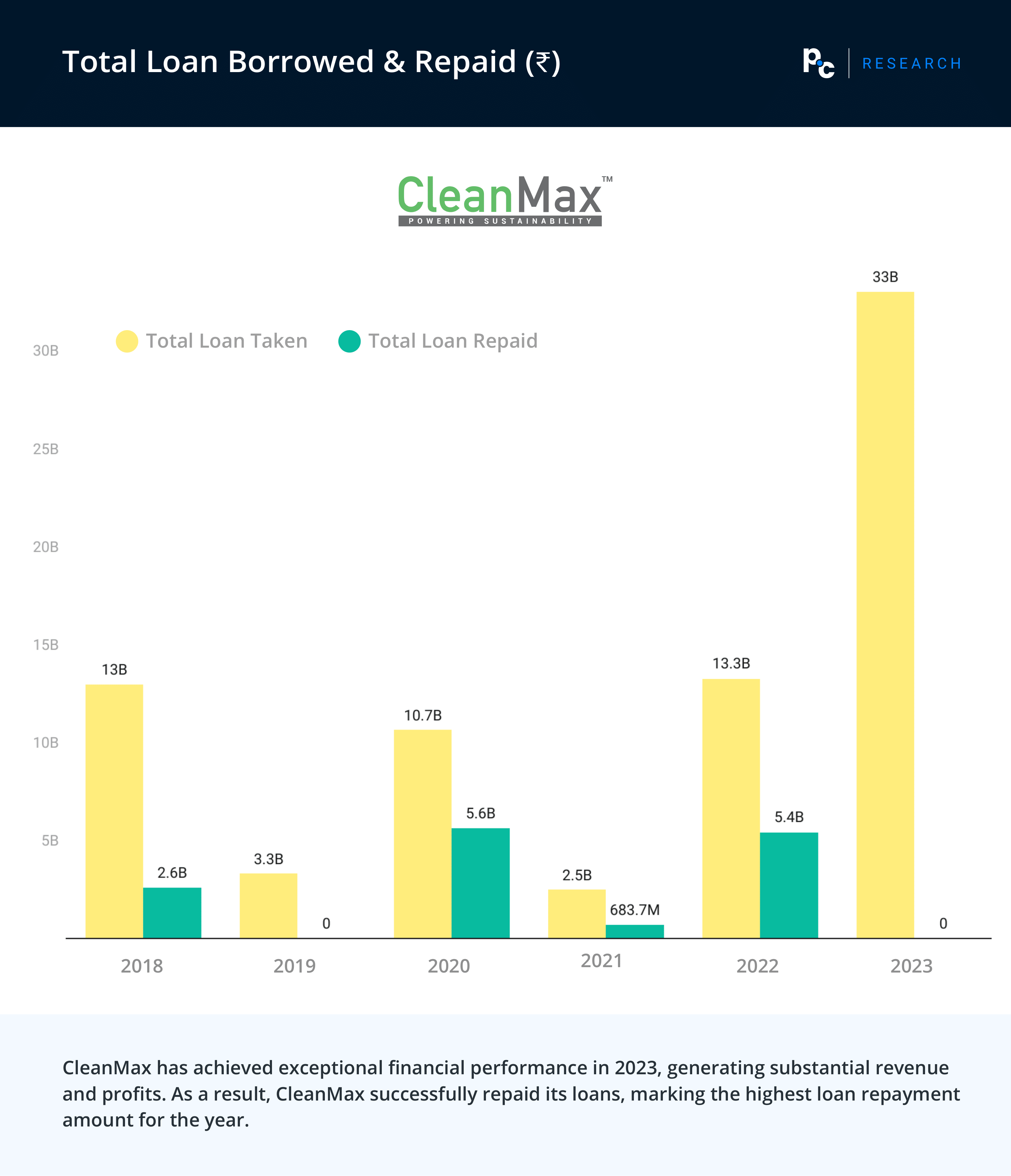

- Total Loan Borrowed & Repaid (₹)

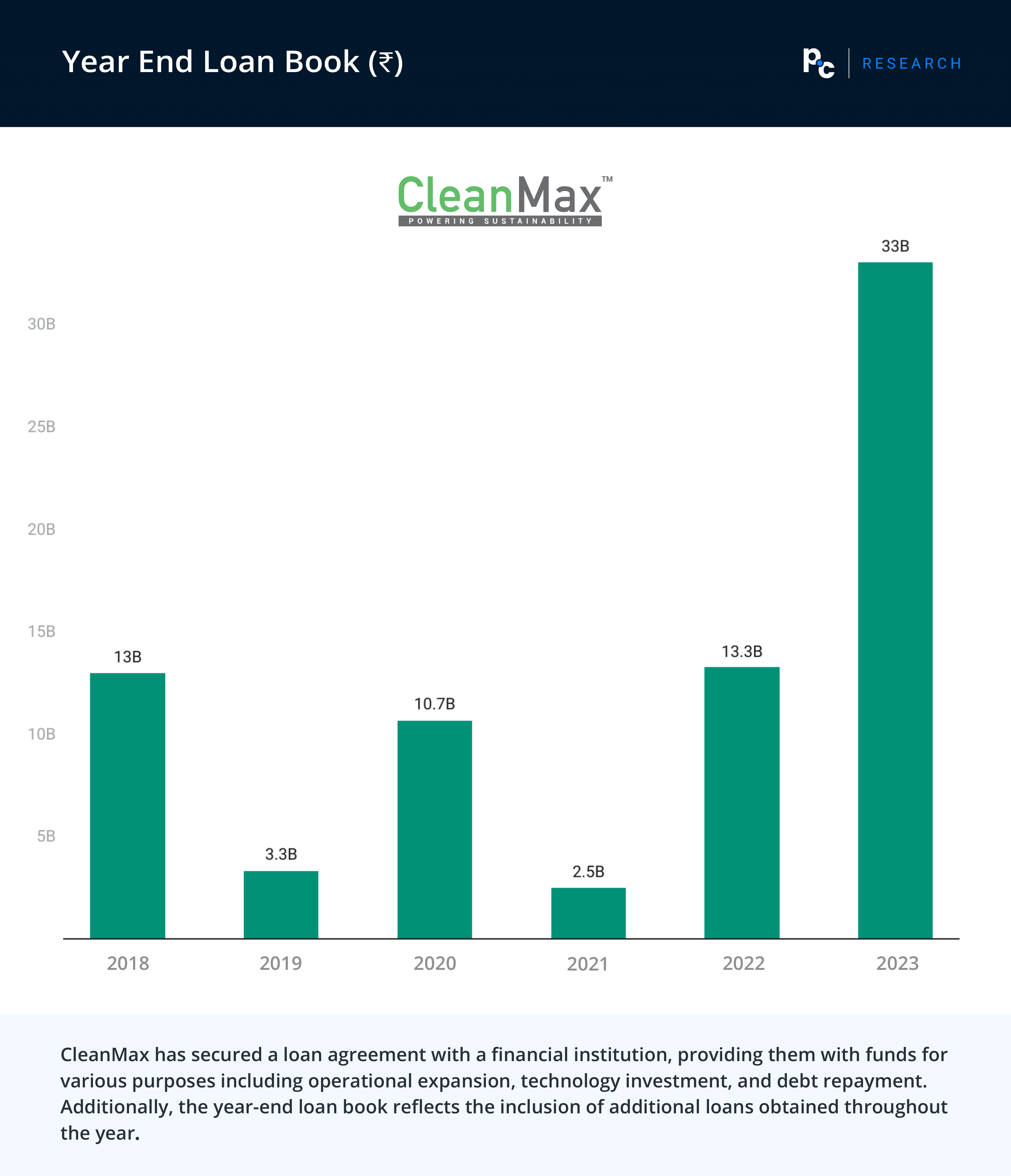

- Year End Loan Book (₹)

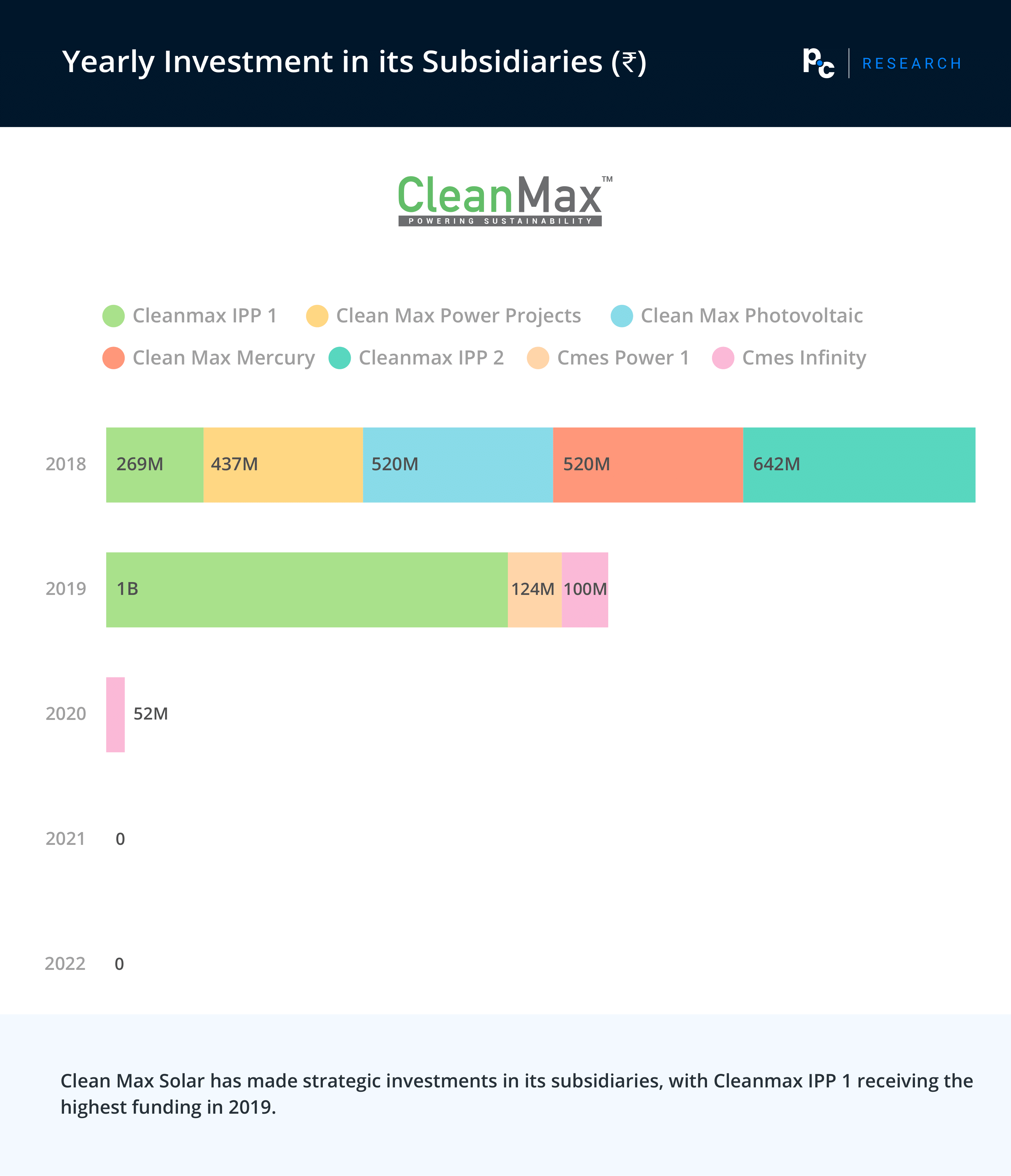

- Yearly Investment in its Subsidiaries (₹)

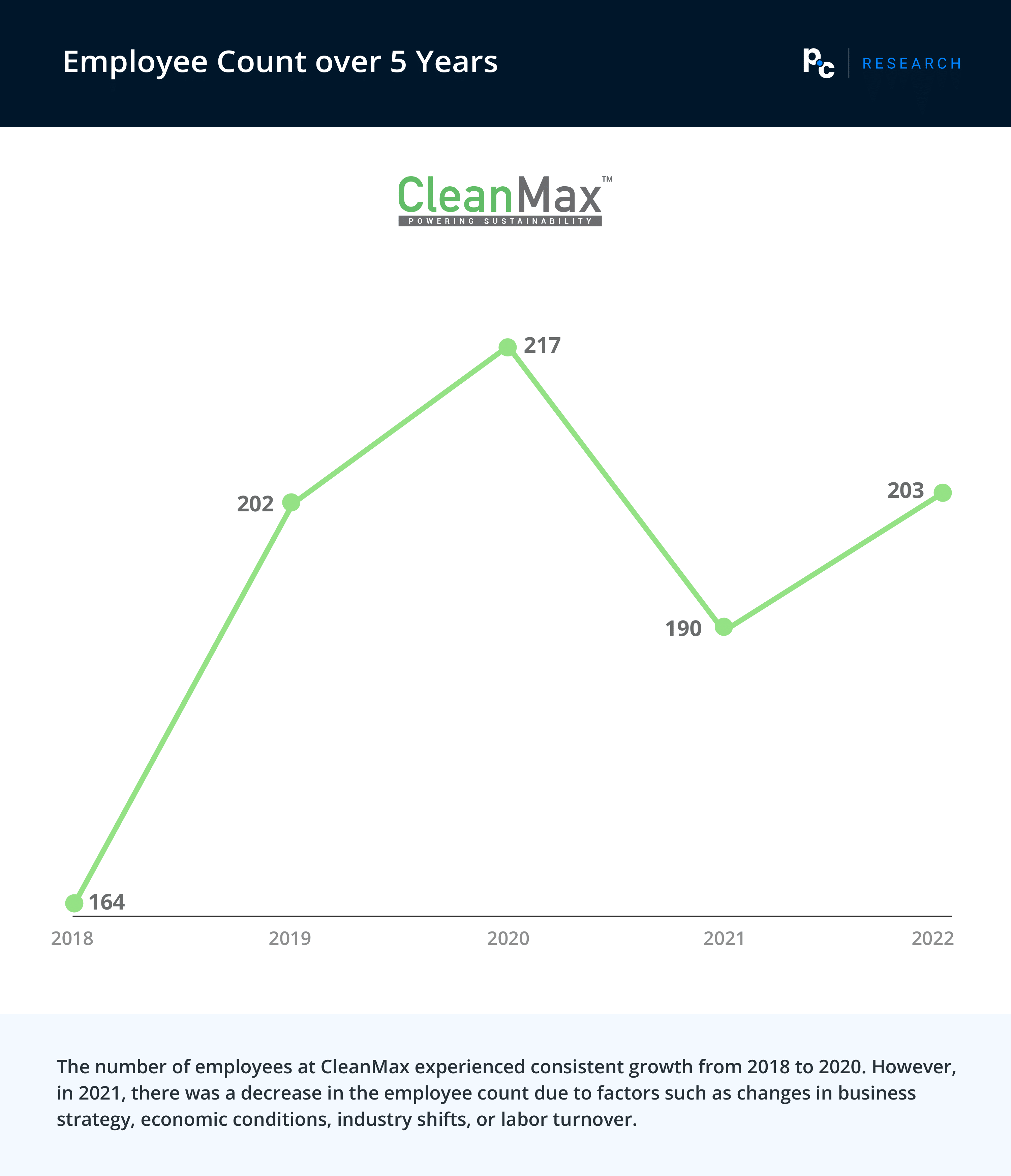

- Employee Count over 5 Years

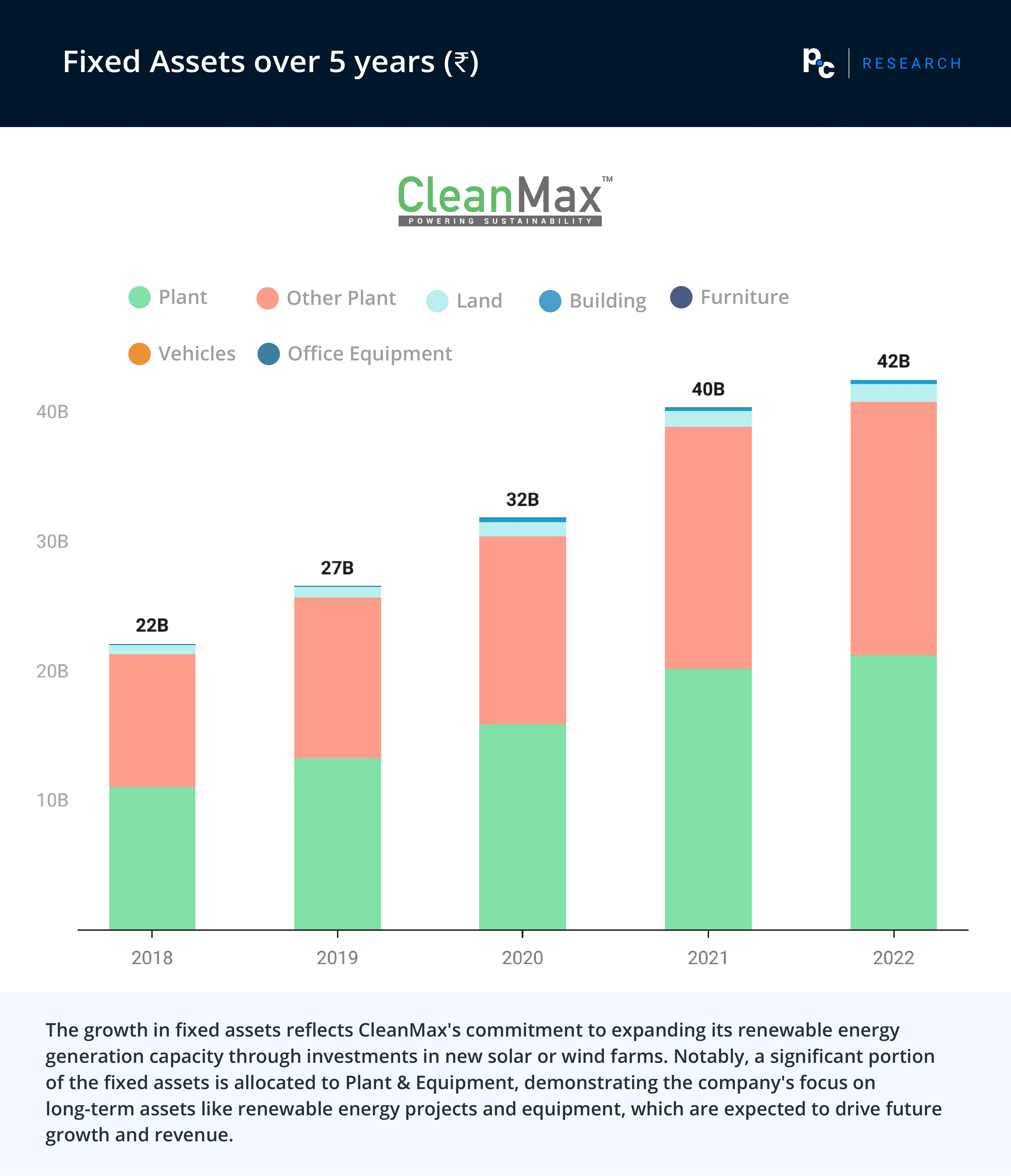

- Fixed Assets over 5 years (₹)

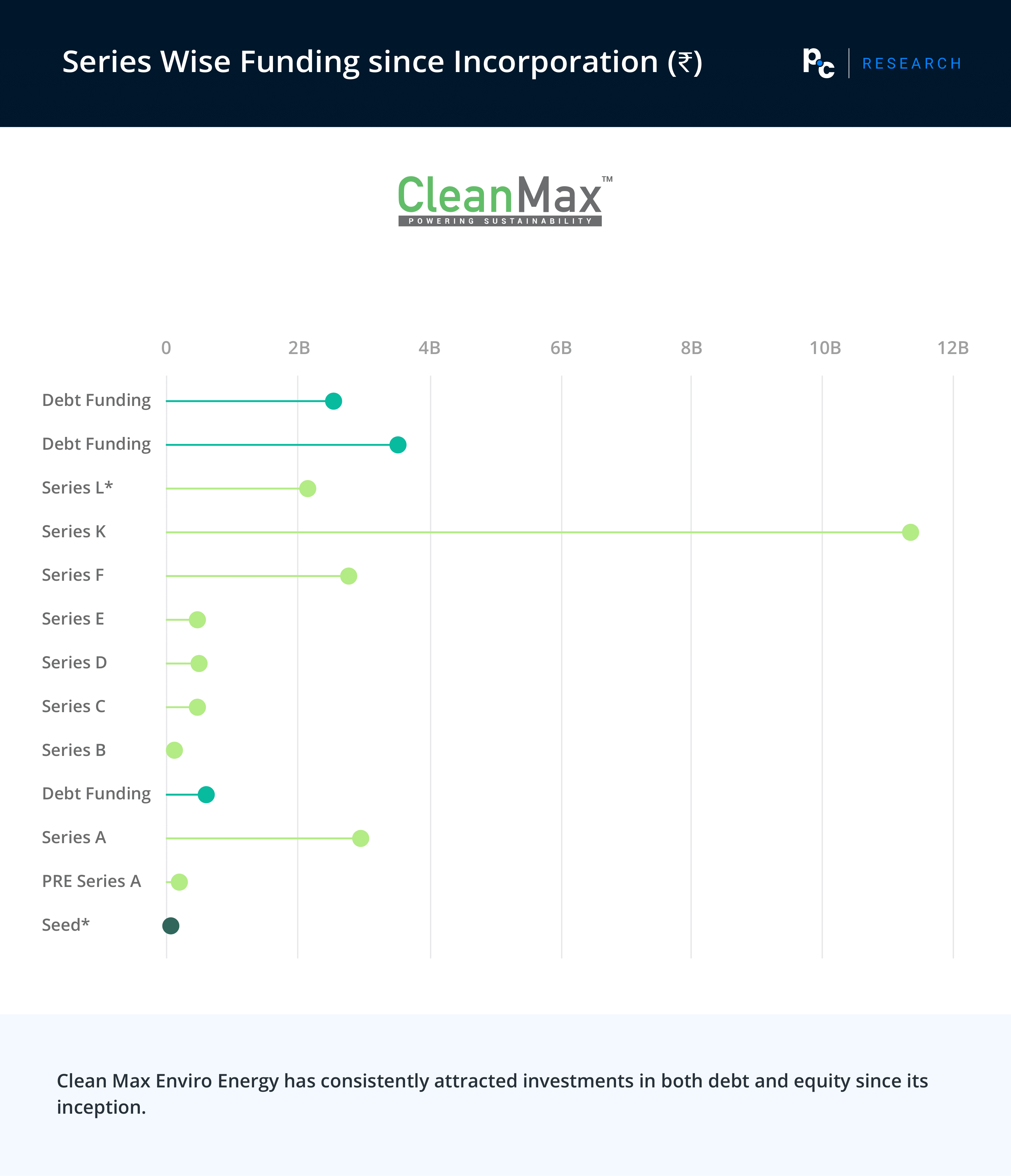

- Series Wise Funding since Incorporation (₹)

CleanMax’s Core Business

CleanMax specializes in offering renewable power solutions to a diverse range of commercial and industrial customers across sectors including Automotive, Industrial Manufacturing, Education, Pharmaceuticals, FMCG, Real Estate, and Information Technology.

With an impressive operating capacity of over 600 MW, CleanMax has successfully completed more than 500 renewable energy projects globally, providing cheaper-than-grid solar power without upfront investment from its clients.

Let’s look at the different historical market dimensions of the company over the recent years.

CleanMax Peers

- Premier Energies Limited (Premier Energies) with Revenue ₹ 7.7 Bn and 3-yr CAGR 7.26% FY 2022

- Mahindra Susten Private Limited (Susten) with Revenue ₹ 6.6 Bn and 3-yr CAGR -37.22% FY 2022

Conclusion

CleanMax Enviro Energy Solutions Private Limited’s journey in the Energy Equipment & Services sector showcases the strength of innovation, strategic acumen, and a steadfast commitment to sustainability.

As a frontrunner in delivering renewable power solutions to commercial and industrial clients, CleanMax not only promotes a greener future but also significantly influences the energy sector’s direction. Their dedication to expansion, technology, and responsible business practices establishes CleanMax as a promising catalyst in the ongoing shift towards cleaner energy alternatives.

References

Report Based Blogs by PrivateCircle Research

Indian Healthcare Tech | CY Q2 2022 – Q1 2023

Snacks & Savory Deals Summary | Q4 2021 – Q3 2022

Indian Co-Working Space Companies’ Deals Overview | 2015 – 2022

Indian AI-Based Solutions Companies’ Deals Overview | Q4 2021 – Q3 2022

Deals Summary Report: Indian Apparel & Luxury Goods 2023

Comparable Company Analysis Report: Indian EV Two-Wheeler OEMs 2022

Comparable Company Analysis Report: Indian Food Aggregators, 2022