India’s self-drive car rental market is shifting into high gear.

With rising demand for flexible travel options, declining car ownership, and a growing “access over ownership” mindset among urban millennials, companies like Zoomcar and Revv are racing to capture the market.

But their roadmaps to success look very different. Let’s take a data-driven ride through their business models, pricing strategies, customer sentiment, and financial performance to see who could dominate India’s roads in the years ahead.

The Indian Self-Drive Market – Opportunities & Challenges

India’s self-drive segment remains in a growth phase but is accelerating post-pandemic. This momentum reflects the evolving mobility habits of urban consumers, especially younger, tech-savvy users.

Market Size & Projections

- 2024 Valuation (Entire Car Rental Market) – USD 2.742 billion (₹23,350 crore), forecast to reach USD 9.287 billion by 2033, at a 14.5% CAGR.

- Self-Drive Share Estimate – While exact India-specific figures are proprietary, global data suggests self-drive accounts for 30–35% of total rental value, indicating a significant domestic share.

Key Growth Drivers

- Rising Millennial Workforce – 34% of India’s population in 2022, projected to reach 50% by 2030.

- Tourism Surge – Foreign tourist arrivals grew by over 300% year-on-year in 2022–23.

- Urbanisation & Infrastructure – Expansion of Tier-2/Tier-3 connectivity via highways and airports.

- EV Integration – Rental companies are introducing electric vehicles to cut operating costs and meet sustainability goals.

Market Trends

- Mobile-First Booking – Instant KYC, real-time pricing, keyless access.

- Early EV Partnerships – Tie-ups with Tata Motors, MG, and Hyundai for fleet trials.

- Geographic Expansion – Growing penetration beyond metros.

- Subscriptions over Ownership – Long-term, flexible plans are gaining traction.

Challenges

- High Operating Costs – Fleet upkeep, insurance, logistics.

- Price Competition – Deep discounts eroding margins.

- Regulatory Fragmentation – State-level variations in rental and P2P licensing rules.

Company Overview

| Attribute | Zoomcar | Revv |

| Legal Entity | Zoomcar India Private Limited | Primemover Mobility Technologies Private Limited |

| Founded | 2012 | 2015 |

| HQ Location | Bengaluru | Gurgaon |

| Parent Company | Zoomcar Inc. | Girnar Software Pvt. Ltd. (CarDekho Group) |

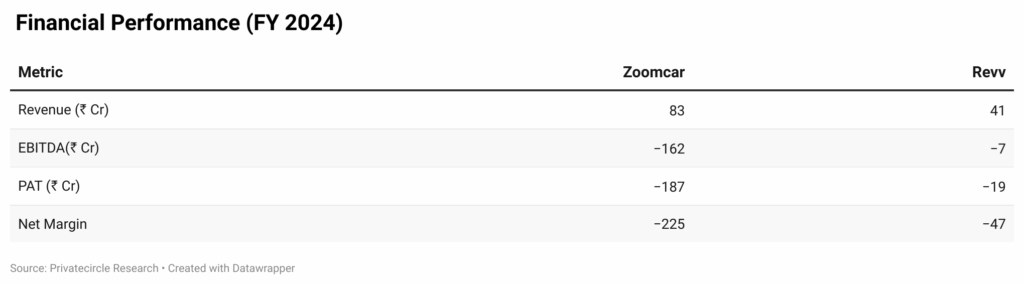

Financial Performance

Quick Analysis:

- Revenue – Zoomcar earns almost 2× Revv, thanks to a larger reach.

- Losses – Both are loss-making, but Revv’s tighter cost control reflects in a smaller negative margin.

- Takeaway – Zoomcar is prioritizing aggressive scale; Revv is banking on sustainable, subscription-led growth.

Operational Metrics

| Metric | Zoomcar | Revv |

| Operating Model | Asset-light marketplace (hosts list their cars) | Hybrid fleet (owned + leased + partner cars) |

| Key Offerings | Short-to-medium self-drive rentals | Hourly, daily rentals, long-term subscriptions (OPEN, SWITCH, Hyundai Subscription) |

| Workforce Size | 278 (Jun 2025) | 204 (Jun 2025) |

| Footprint | 99 Cities, 25K+ Cars | 22+ Cities, 50 Mn+ Kms Travelled |

| Total Users | 10 Mn+ Users | 1 Mn+ Revvers |

Pricing Strategy Comparison

| Plan Type | Zoomcar (Avg.) | Revv (Avg.) |

| Hourly Rental | ₹120–₹200/hour | ₹110–₹180/hour |

| Daily Rental | ₹1,800–₹2,500/day | ₹1,700–₹2,400/day |

| Long-Term Subscription (Monthly) | Limited options | ₹18,000–₹24,000 |

| Security Deposit | ₹5,000–₹10,000 | ₹3,000–₹5,000 |

| Doorstep Delivery | Available in some major cities | Available |

Insights:

- Zoomcar offers more variety but requires a pick-up and doorstep delivery in major cities

- Revv has doorstep delivery & flexible subscription rates, which build loyalty.

Customer Sentiment Analysis

| Metric | Zoomcar | Revv |

| Play Store Rating | 3.9/5 | 4.7/5 |

| Top Positive Feedback | Variety of car models, app UX | Hassle-free delivery, subscription flexibility |

| Top Complaints | Host reliability, deposit refunds | Limited city coverage |

| Repeat Users Estimate | 35–40% | 45–50% |

EV Strategy

| Factor | Zoomcar | Revv |

| EV Fleet Share (2024) | ~8% | ~5% |

| Partnerships | Collaborations with Tata Motors, MG | Piloting with Hyundai EV models |

| EV Goal by 2026 | 25% of the fleet | 20% of the fleet |

Business Model Comparison

| Aspect | Zoomcar | Revv |

| Core Model | Asset-light car-sharing marketplace | Hybrid fleet + subscriptions |

| Primary Revenue | Commission & fees | Rental income & subscription fees |

| Fleet Ownership | None | Partly owned/leased |

| Target Audience | Short-to-medium-term renters | Both short-term renters & long-term subscribers |

| Service Delivery | Pick-up from host/hub | Doorstep delivery |

| Key Differentiator | Scale & variety | Subscription convenience |

Conclusion

India’s self-drive rental industry is still on the fast track, supported by urbanisation, EV adoption, and shifting consumer habits. Zoomcar holds an edge in scale and variety, while Revv is stronger on subscriptions, convenience, and loyalty.

The financials, operational insights, and compliance signals in this report are prepared using PrivateCircle data, combined with publicly available research. As many self-drive players are unlisted, these figures should be viewed as indicative, data-driven estimates, not audited financials.