Rainmatter, backed by Zerodha, exemplifies the convergence of patient capital and impactful mentorship in driving innovation within India’s entrepreneurial ecosystem. With an emphasis on fintech, health, climate action, and storytelling, Rainmatter nurtures startups along with funding. The latest insights reveal how strategic investments are creating ripples across multiple sectors, reinforcing Rainmatter’s mission of sustainable, long-term…

Read moreTag: Sector Investments

Aroa Ventures’s Portfolio Overview 2024

Aroa Ventures is the family office of OYO’s founder Ritesh Agarwal, focused on growth-stage businesses. With assets under management totalling ₹418 Cr and a portfolio boasting combined revenues of ₹23,858 Cr, Aroa Ventures is a key player in the industry. The firm focuses on investments ranging from ₹4 Cr – ₹41 Cr, having made 45…

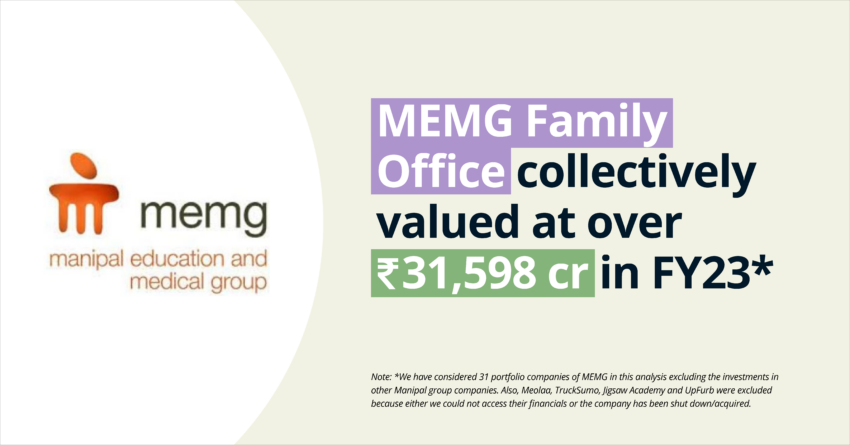

Read moreMEMG Family Office’s Portfolio Overview 2024

The Manipal Education and Medical Group family office, lead by chairman Dr. Ranjan Pai is a Venture Capital fund founded in 2016. It is primarily based out of Bengaluru, India. MEMG family office 2024 report highlights; Combined Revenue The portfolio generated a combined revenue of over ₹31,598 cr with Quesscorp, Pharmeasy and FirstCry topping the list. Year-On-Year Investment Trend…

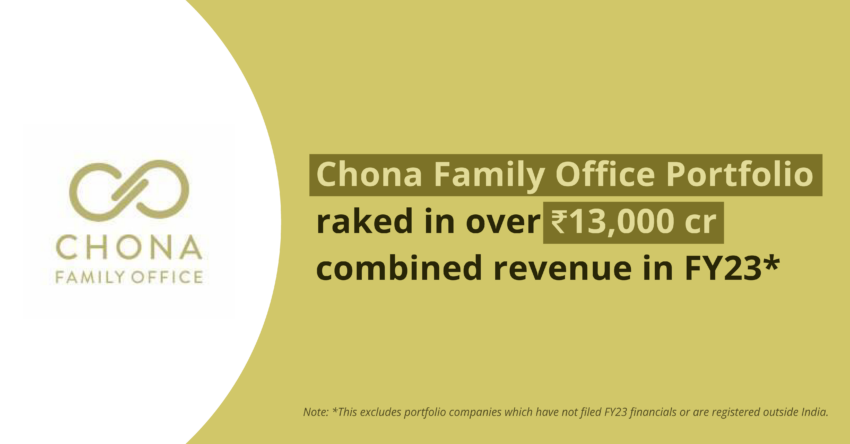

Read moreChona Family Office’s Portfolio Overview 2024

Led by Ankit Chona, Chona Family Office has been expanding its portfolio across diverse sectors and become a significant force in the investment arena. Let’s explore the pivotal insights extracted from their 2024 investment report. Let’s dive into the full report covering; In 2024, the Chona Family Office’s portfolio exhibits strong performance with a total…

Read more