Challenging the status quo and setting new benchmarks in the industry, Swiggy has emerged as a dominant player in the fast-paced world of food delivery.

About Swiggy

Swiggy Limited (formerly Bundl Technologies Private Limited) is a key player in India’s food delivery sector, offering a seamless platform for customers to order from nearby restaurants. Swiggy’s dedicated delivery fleet, real-time tracking, and no minimum order requirements have revolutionized food delivery in India.

Quick Facts

- Industry: Internet, Sector: Travel & Hospitality, Sub Sector: FoodTech

- Founded – 2013

- Headquarters – Bengaluru, Karnataka, India

- Operational Cities: Major Indian cities including Bengaluru, Hyderabad, & Gurugram

- Key investors are Prosus (Naspers), Softbank, Accel India & DST Global Investments

- Team is managed by Sriharsha Majety & Nandan Reddy

- Competitors: Zomato

Financial Snapshot

FY 2023 (Consolidated). Source: Filing.

- Revenue ₹8,715 Cr

- EBITDA -₹3,829 Cr (-43.90%)

- PAT -₹4,179 Cr (-47.96%)

- 3-yr CAGR 32.72%

- Total Amount Raised As of 05-Mar-2024 ₹24,861 cr

What is the Historical Performance Analysis?

Historical Performance Summary Report is our endeavor to delve deeper into a company’s performance over the years, all through the lens of data.

As a data intelligence platform, these reports serve as a testament to the capabilities of the PrivateCircle Research dashboard.

Why Swiggy?

Swiggy recently filed for its initial public offering (IPO) through the confidential route. Given this significant development, we chose to do a historical performance analysis on the Indian food delivery major. This report offers a comprehensive overview of Swiggy’s journey as it prepares to enter the public market.

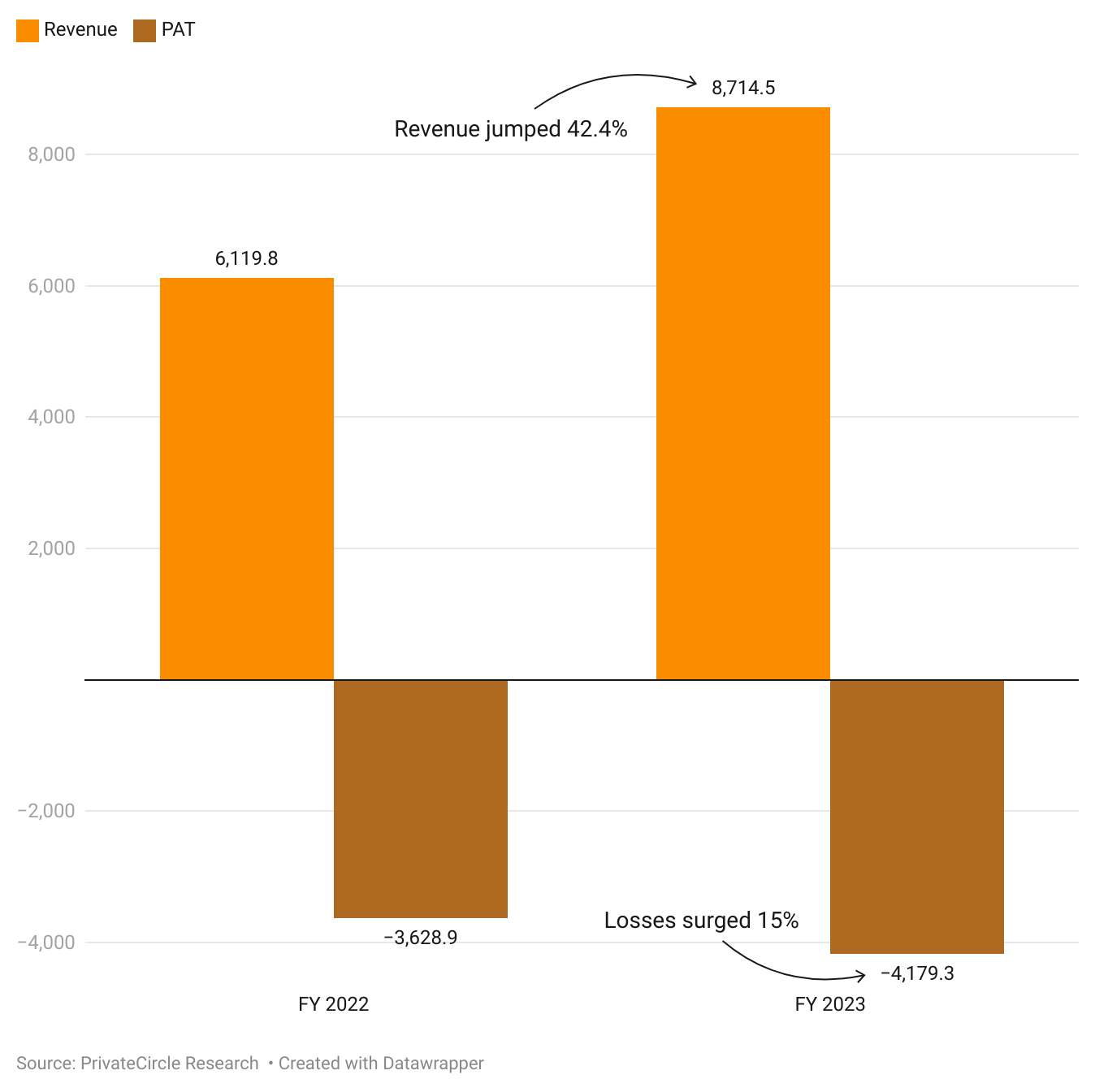

Revenue & Profitability (₹Cr)

Swiggy’s revenue from sale of traded goods has grown by almost 58% in FY23 over FY22, showing growth in the company’s business in the financial year.

The total revenue for FY23 stood at ₹8,715 Cr, up from ₹6119.80 cr in FY22. This growth highlights Swiggy’s efforts to expand its market share and addition of new offerings.

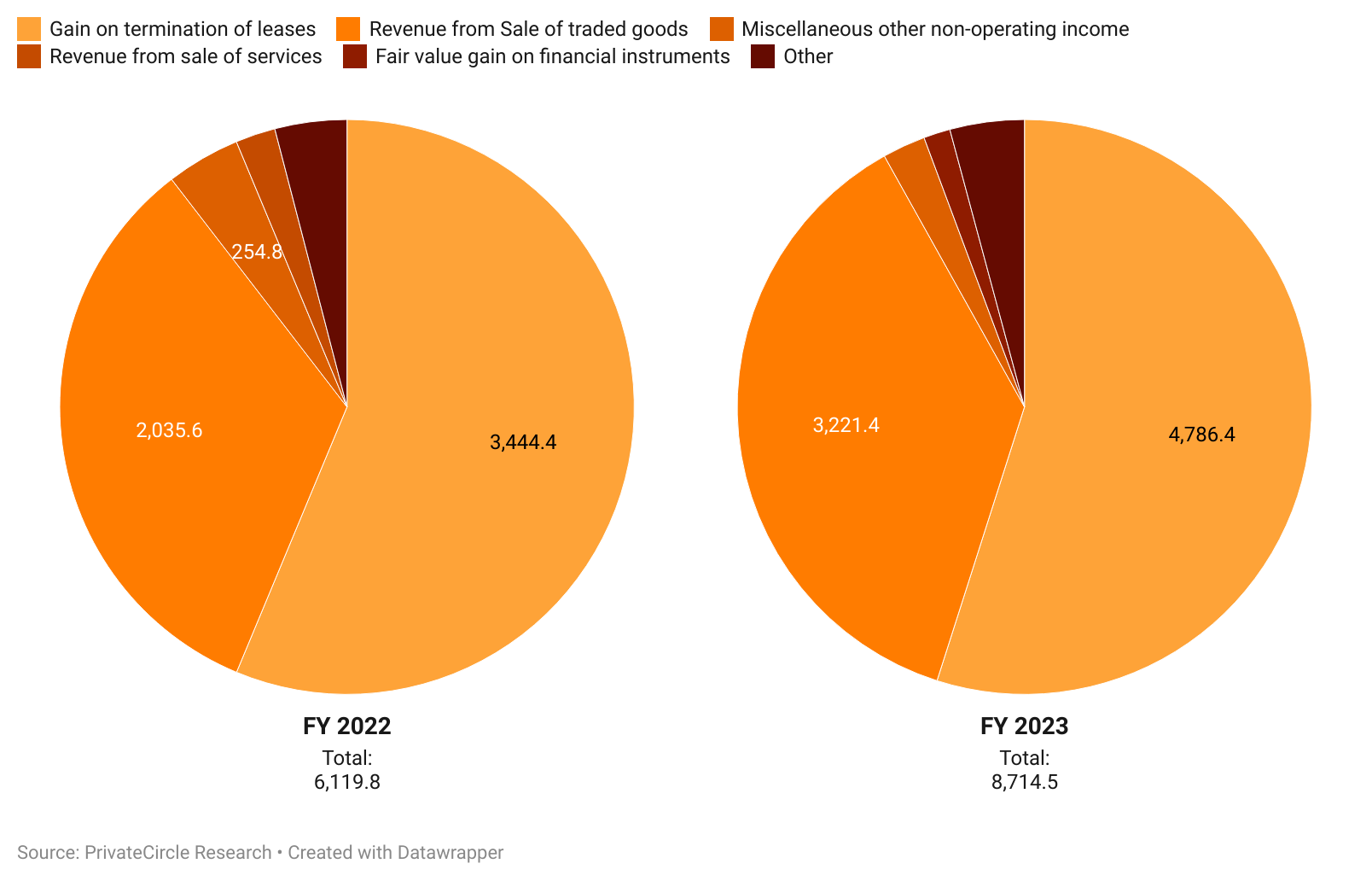

Revenue Breakdown (₹Cr)

Swiggy’s revenue from sale of traded goods has grown by almost 58% in FY23 over FY22, showing growth in the company’s business in the financial year.

The total revenue for FY23 stood at ₹8,715 Cr, up from ₹6119.80 cr in FY22. This growth highlights Swiggy’s efforts to expand its market share and addition of new offerings.

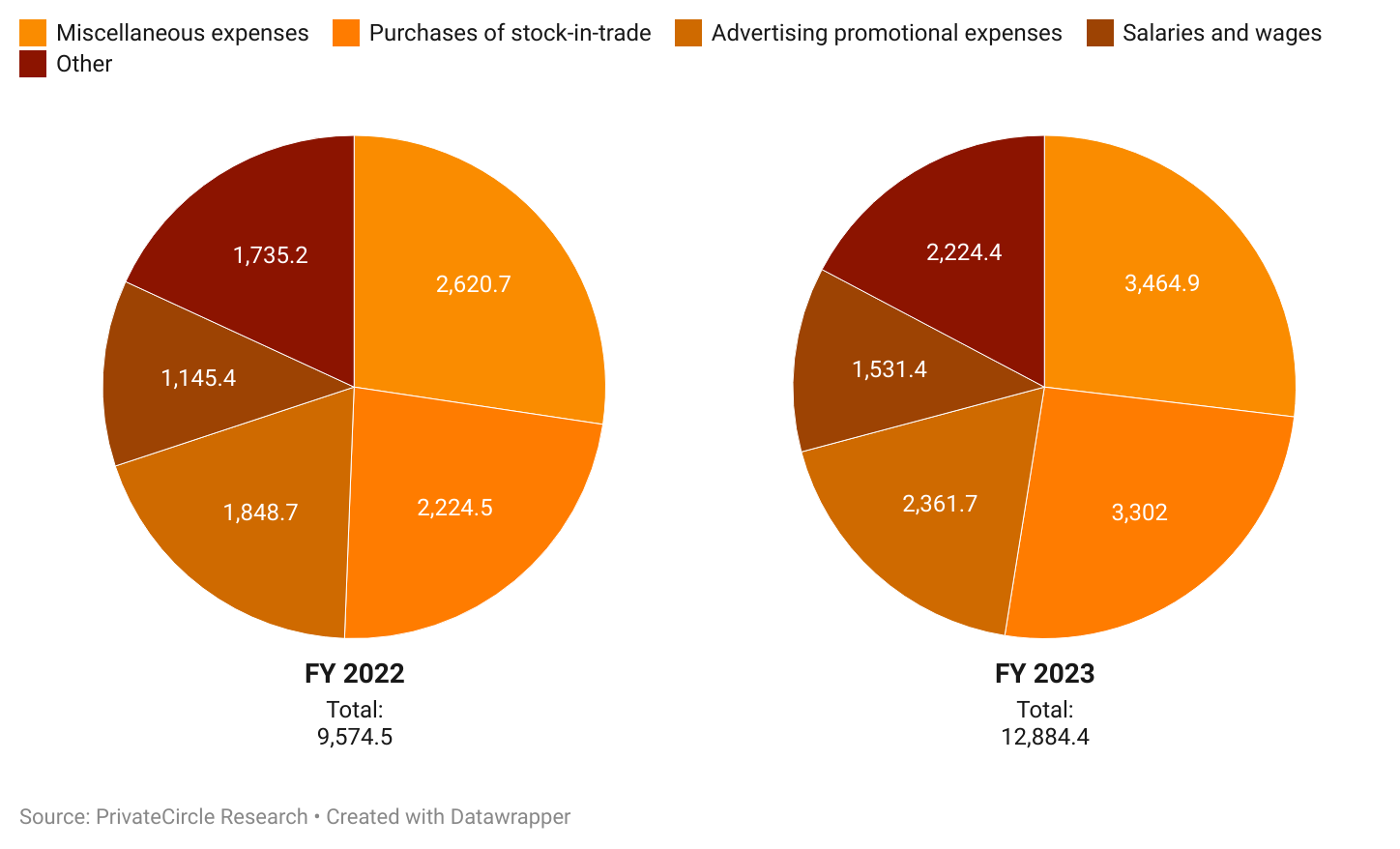

Expenses Breakdown (₹Cr)

Advertising expenses emerged as the second largest expense for Swiggy in FY23, reflecting its aggressive marketing strategy to outpace competitors.

The advertising spend increased by about 28% over FY22. Employee salaries and ESOP buybacks were the third and fourth largest expenses, underscoring Swiggy’s investment in talent retention and employee satisfaction.

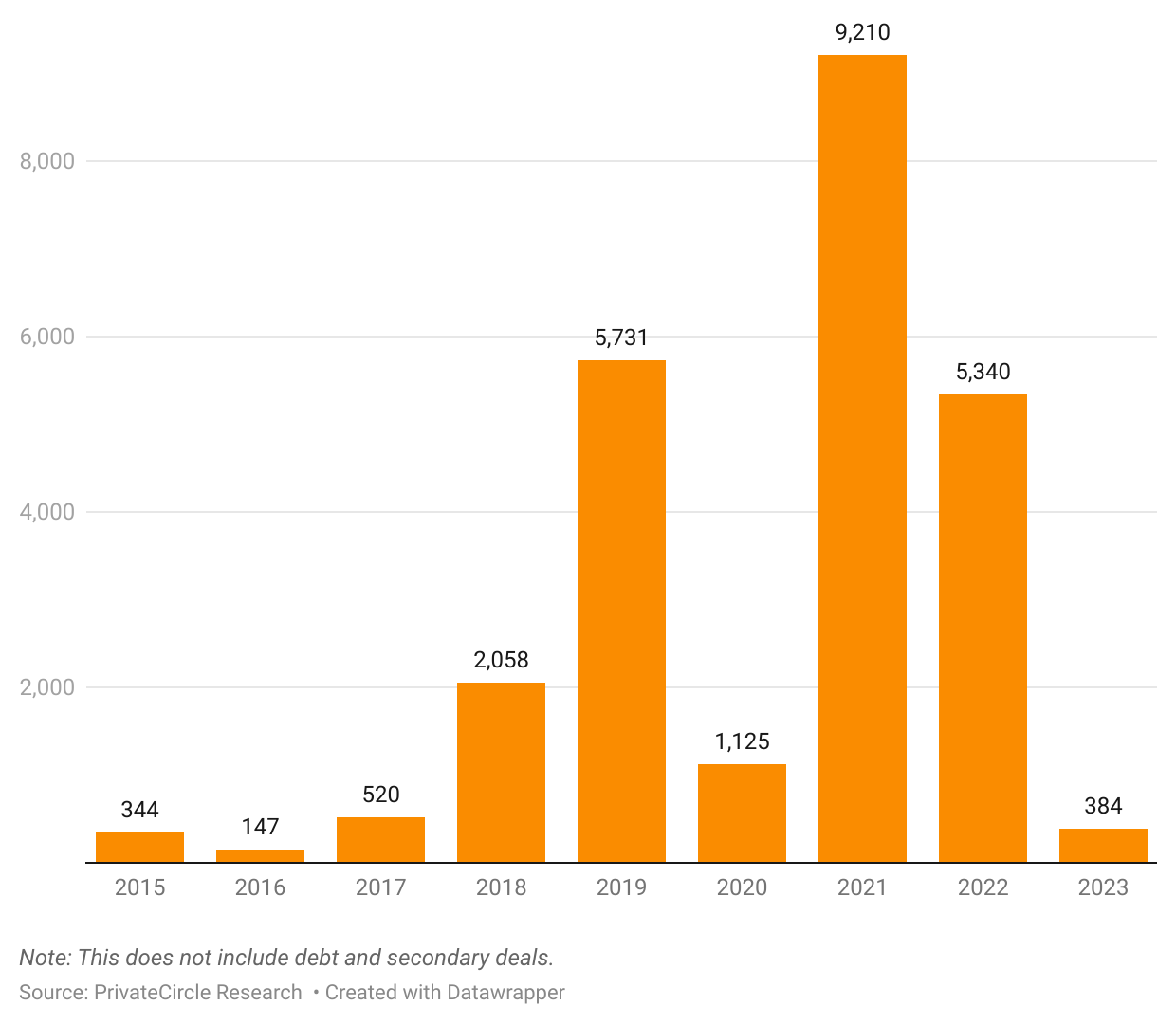

Funding Raised (₹Cr)

Swiggy raised a remarkable ₹9,210 Cr in calendar year 2021, during a peak period for startup fundraising.

The funding landscape has since evolved, but this significant capital influx has enabled Swiggy to scale its operations, innovate, and strengthen its market position.

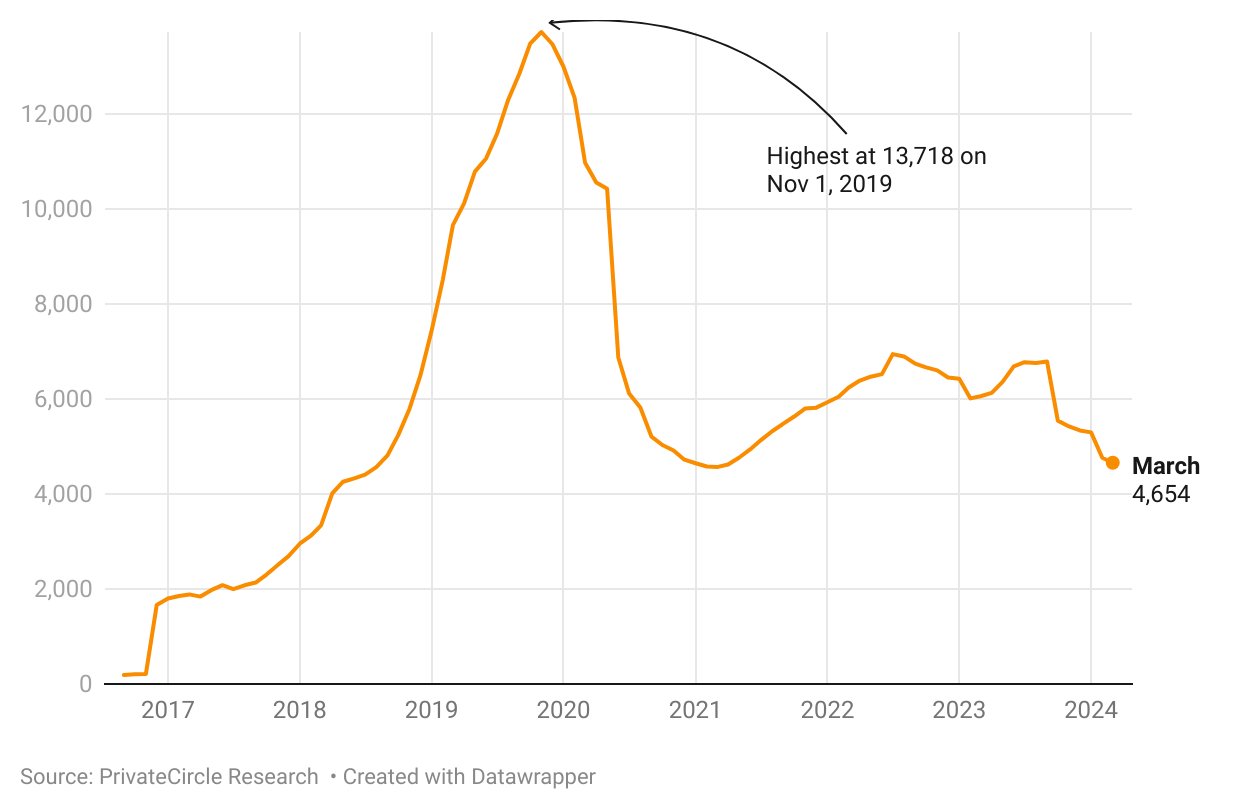

Employee Count

Swiggy’s workforce peaked in November 2019, followed by a slight decline during the COVID-19 pandemic. Since then, the company has maintained a steady employee count of around 5000-6000.

As of March 2024, Swiggy employs 4,654 people, reflecting a stable workforce despite the industry’s dynamic nature.

Swiggy Peers

- Zomato (Zomato Limited): Revenue (FY 2023) ₹7,760 Cr, EBITDA (FY 2023) -₹530 Cr (-6.81%), PAT (FY 2023) -₹970 Cr (-12.51%), 1-yr CAGR (FY 2023) 65.57%, Total Amount Raised As of 10-Aug-2022 ₹26,310 Cr

Analysis & Insights

Growth Trajectory

Swiggy’s substantial revenue growth is a testament to its strong market presence and effective business strategies. However, the increasing losses highlight the challenges of scaling in a highly competitive market. Balancing growth with profitability will be crucial as Swiggy approaches its IPO.

Strategic Investments

Swiggy’s significant expenditure on advertising and employee compensation underscores its commitment to market expansion and talent retention. These investments are strategic moves to ensure long-term growth and competitive advantage.

Funding and Financial Health

The substantial funding raised in 2021 provided Swiggy with the financial muscle to innovate and expand. However, the focus on managing operational efficiency and reducing losses will be critical for investor confidence in the IPO.

Conclusion

Swiggy’s historical performance reflects a company that has successfully navigated the complexities of the food delivery market, leveraging substantial investments to drive growth and innovation.

As Swiggy prepares for its IPO, the insights from this analysis provide a comprehensive understanding of its financial health, strategic priorities, and market potential. Investors and stakeholders will be keenly watching Swiggy’s next moves as it steps into the public market arena.

In the dynamic landscape of food delivery, Swiggy’s journey offers valuable lessons on growth, competition, and resilience. The upcoming IPO marks a new chapter, promising exciting developments for one of India’s leading food tech companies.

Curious about how you can effortlessly uncover such comprehensive analyses in a matter of minutes? Sign up on our platform – privatecircle.co/research – and discover firsthand.

Take advantage of our FREE trial/demo to gain access to dependable data, intelligence, and insights. Empower your research across 3 million+ private unlisted companies spanning 500+ data categories with unwavering confidence.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

More Historical Performace Reports from PrivateCircle Research

Historical Performance Summary Report: CleanMax 2023

Historical Performance Summary Report: WayCool 2023

Historical Performance Summary Report: Dunzo 2023

Historical Performance Summary Report: Zerodha 2023

Historical Performance Summary Report: XpressBees 2023