The year 2024 ended with some exciting developments in India’s startup world. December 2024 showcased the resilience and strategic growth of the ecosystem, setting a strong tone for 2025.

Let’s break it down:

Blog Outline | Data and Insights by PrivateCircle Research

- City-Wise Deal Numbers & Size (₹ Cr)

- Deal Volume

- Total Deal Value (₹ cr)

- Top 3 Deals (₹ cr)

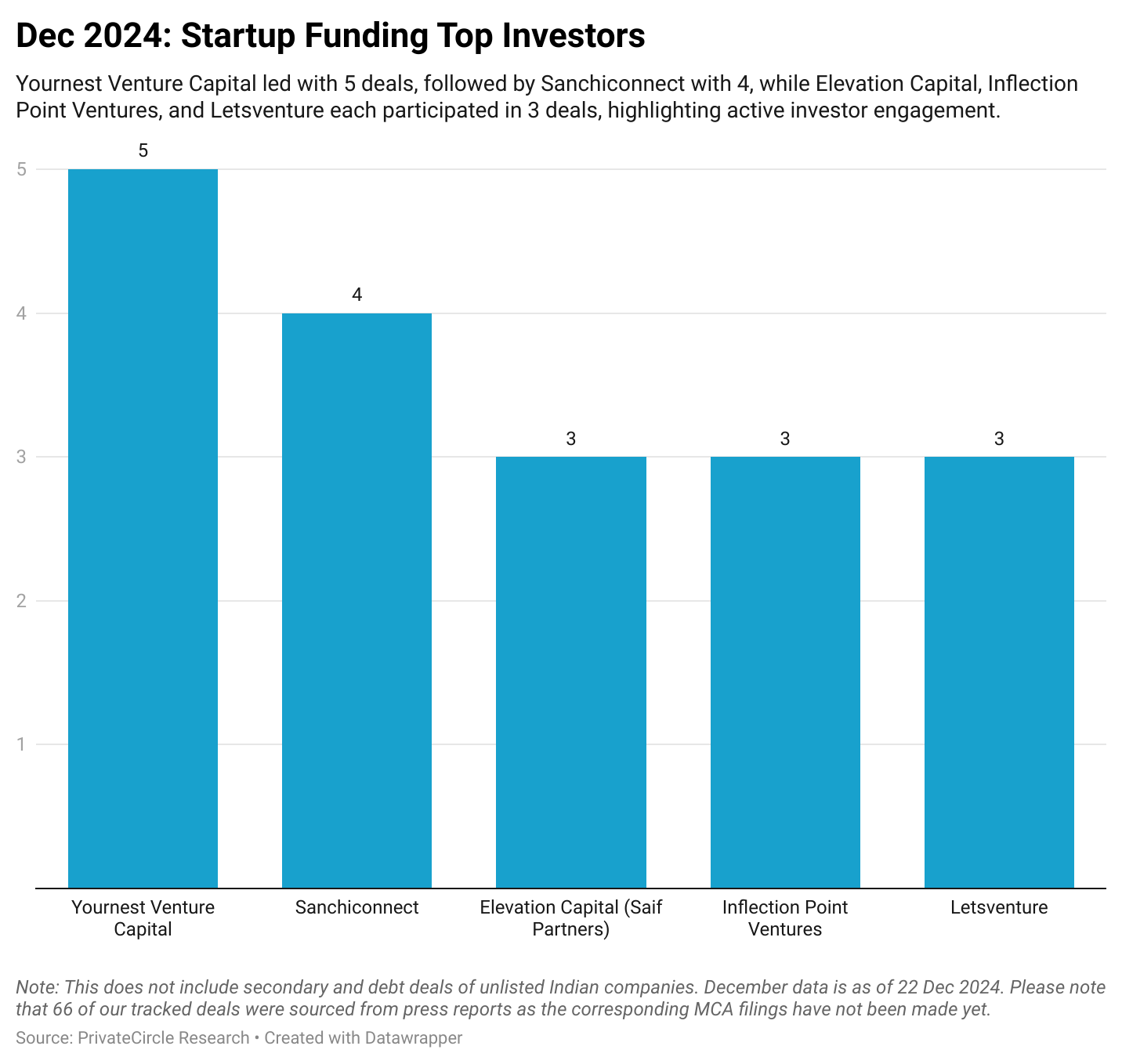

- Top Investors

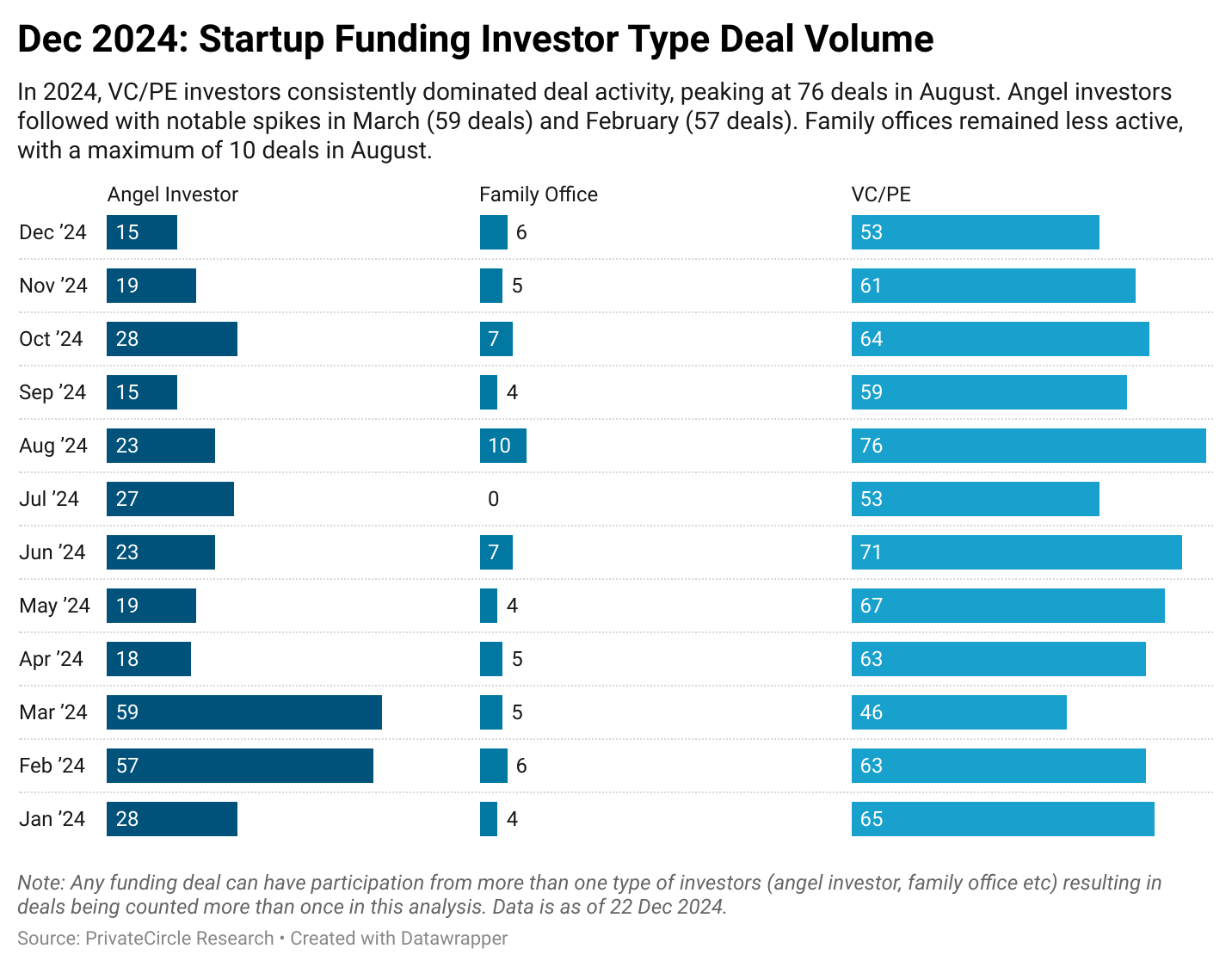

- Investor Type Deal Volume

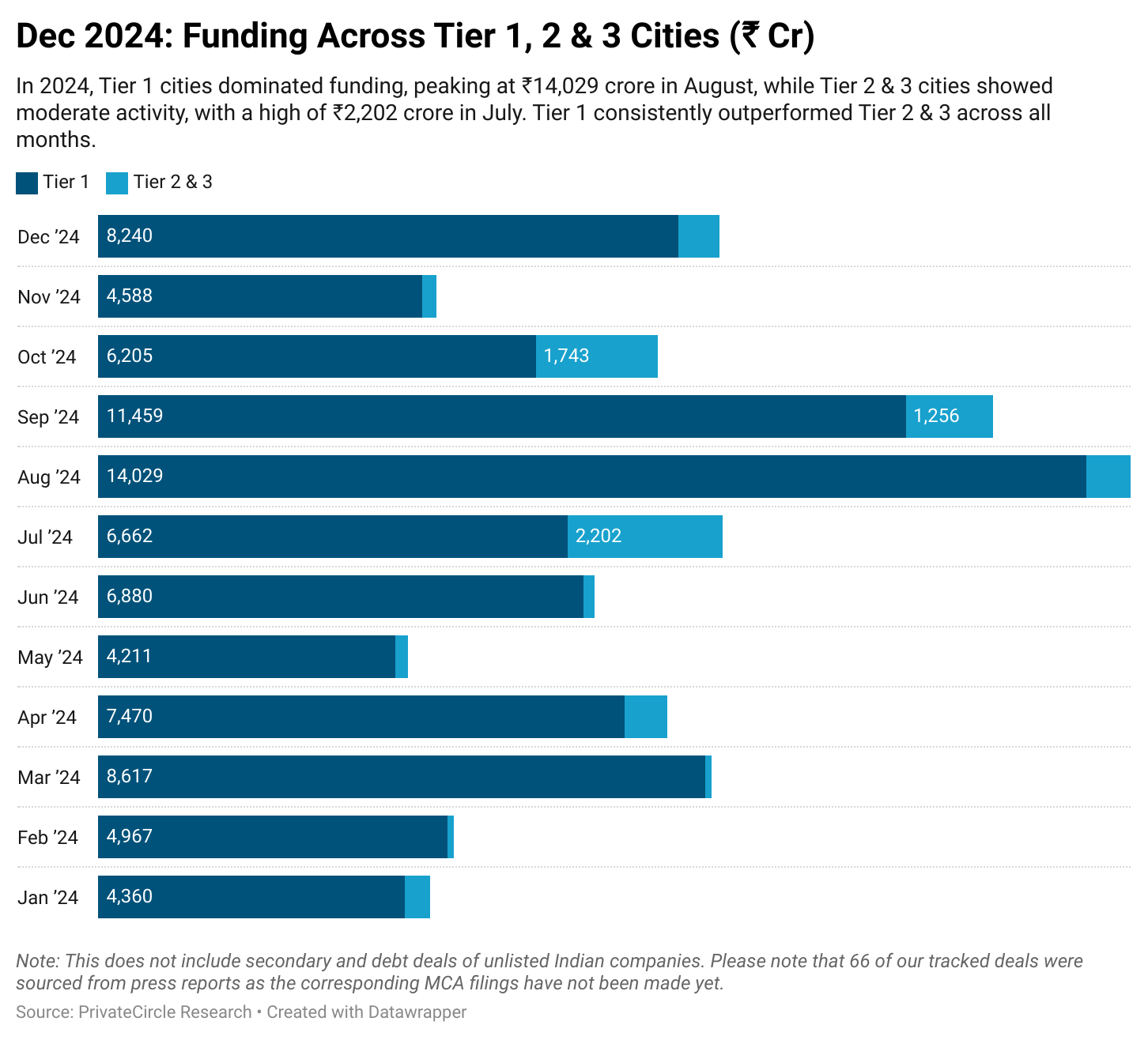

- Funding Across Tier 1, 2 & 3 Cities (₹ Cr)

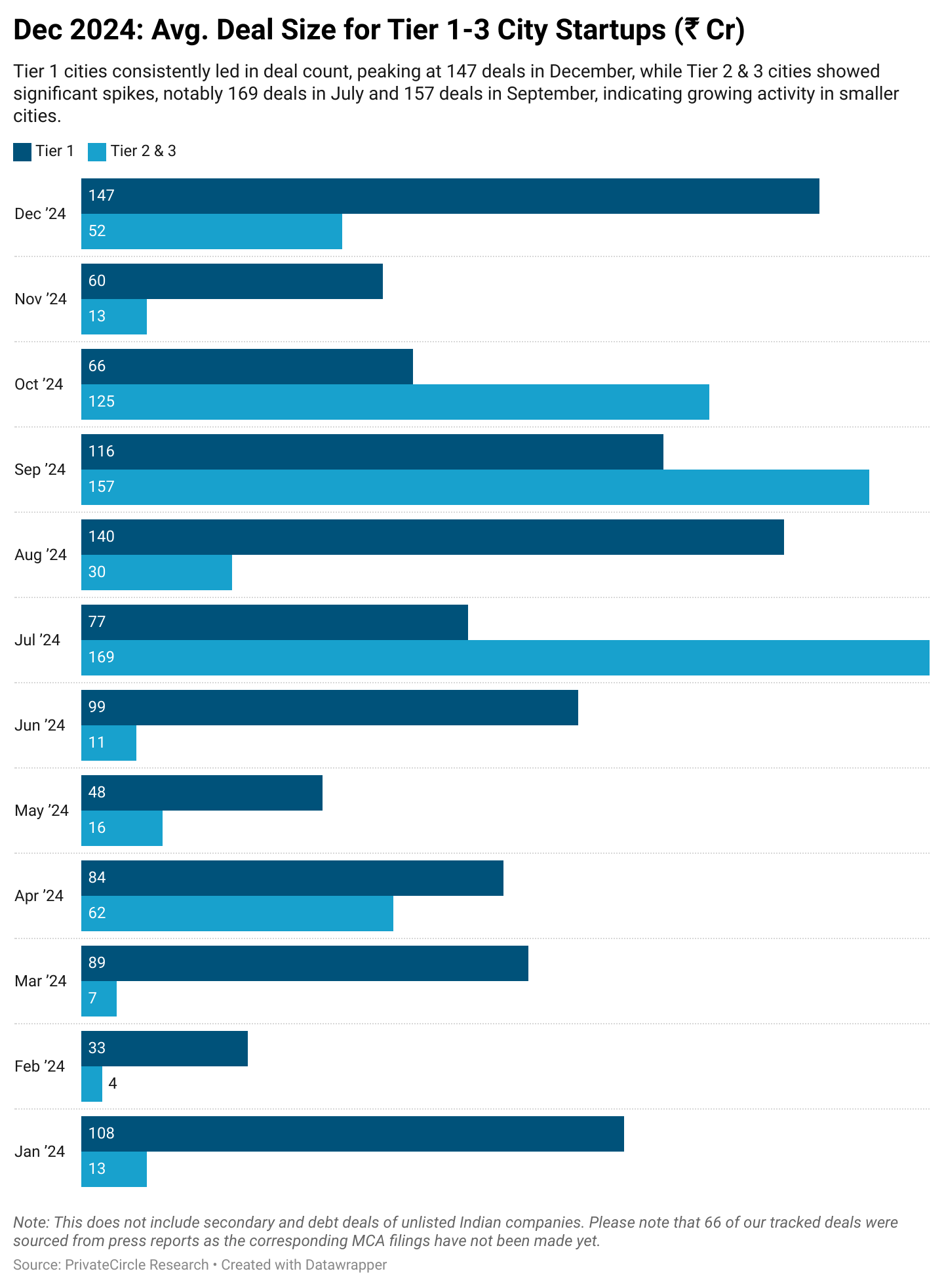

- Avg. Deal Size for Tier 1-3 City Startups (₹ Cr)

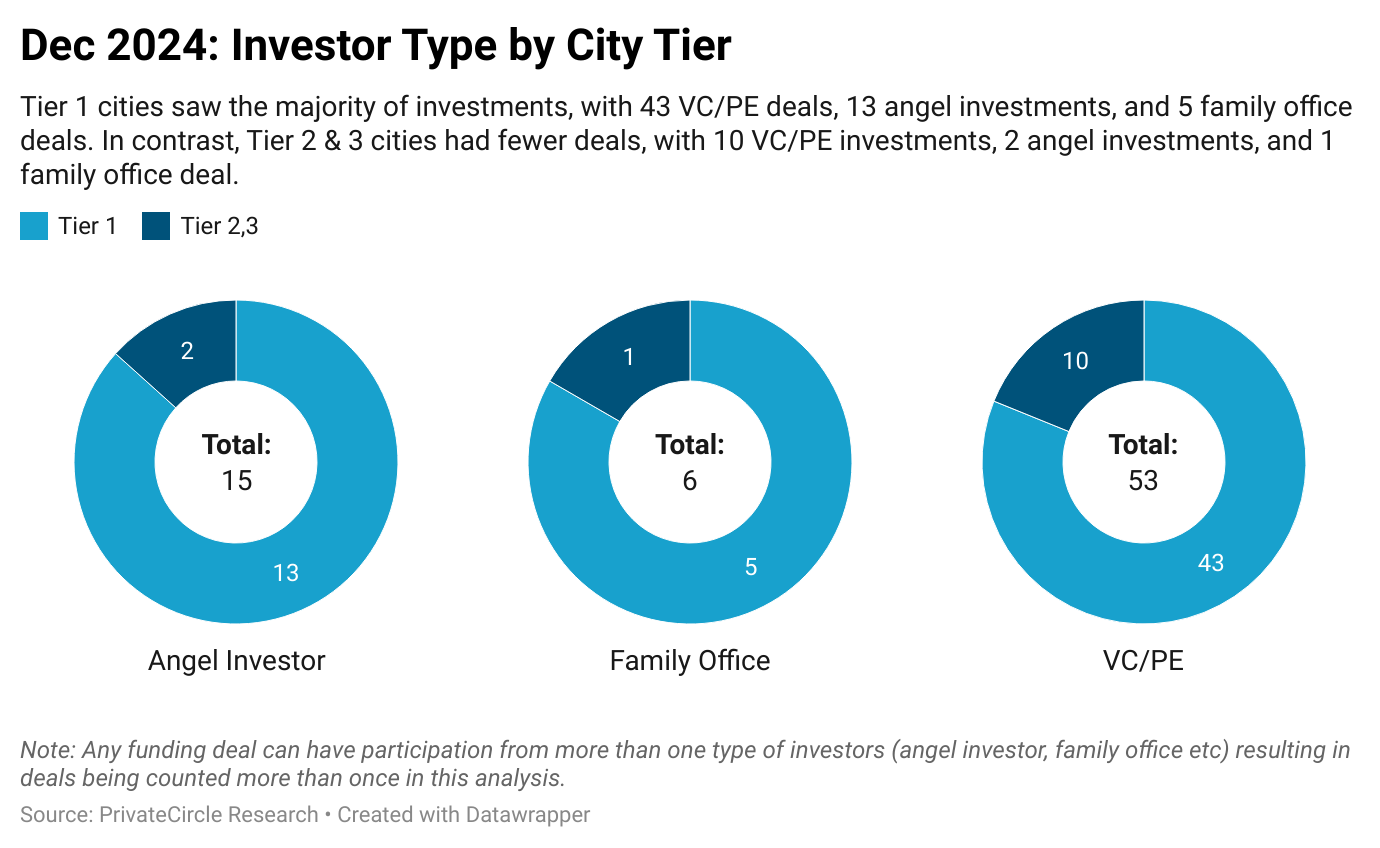

- Investor Type by City Tier

- Job Creation & Economic Impact

- Comparative Analysis – Monthly Performance | Investor Activity

- Funding Dynamics

- Strategic Investments

- Conclusion

Job Creation & Economic Impact

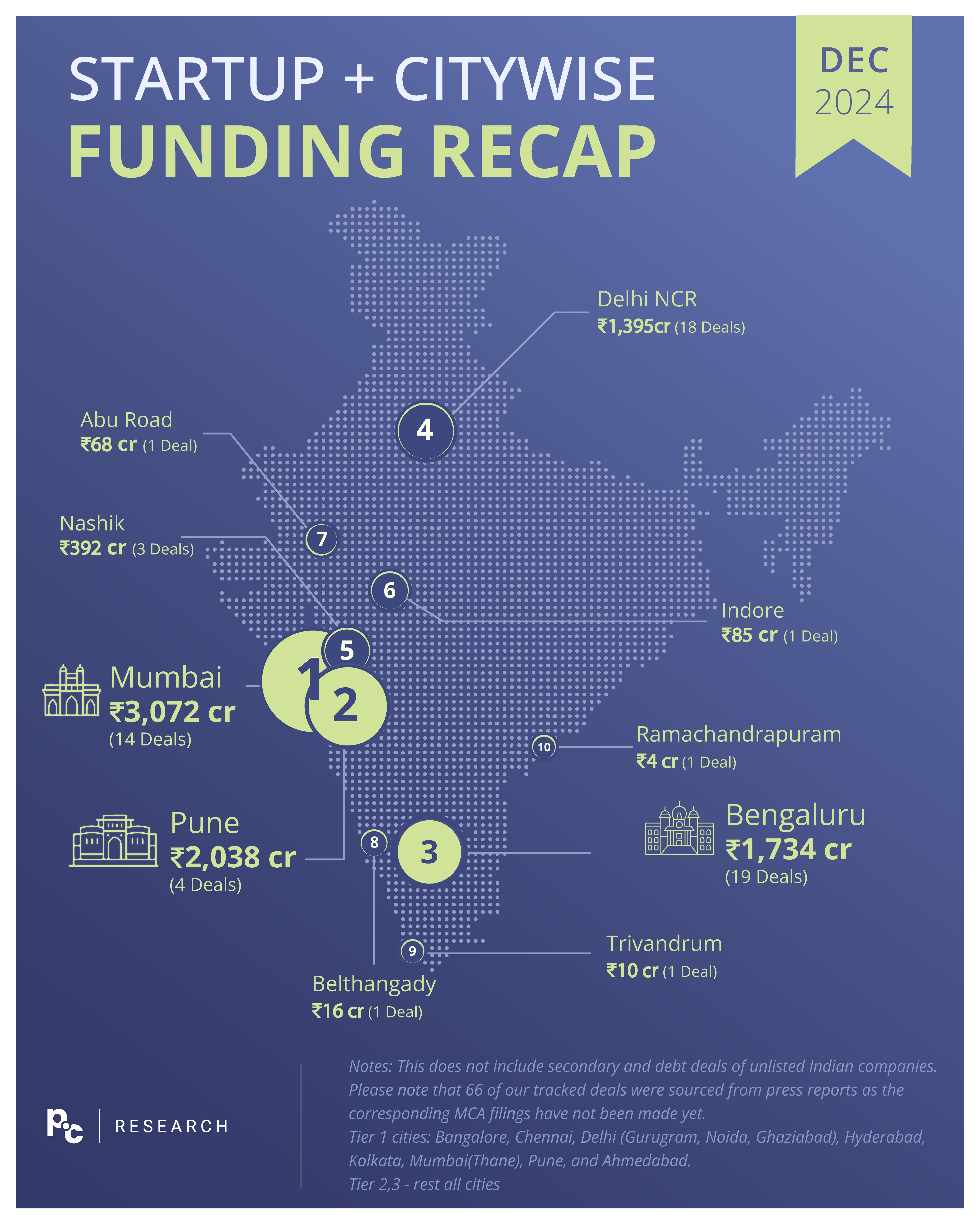

Mumbai led the way in December, raising ₹3,072 crore across 14 deals. Pune followed with ₹2,038 crore from 4 deals, while Bangalore secured ₹1,734 crore over 19 deals. These figures underscore the pivotal role Tier 1 cities play in driving India’s economic growth.

Funds raised in these cities are directly creating jobs in tech, operations, and logistics, while indirectly boosting industries like real estate and marketing.

Smaller cities such as Nashik, Indore, and Trivandrum raised ₹567 crore collectively, reflecting a growing interest in these areas. This trend is likely to generate local jobs and reduce pressure on metro cities.

Comparative Analysis – Monthly Performance | Investor Activity

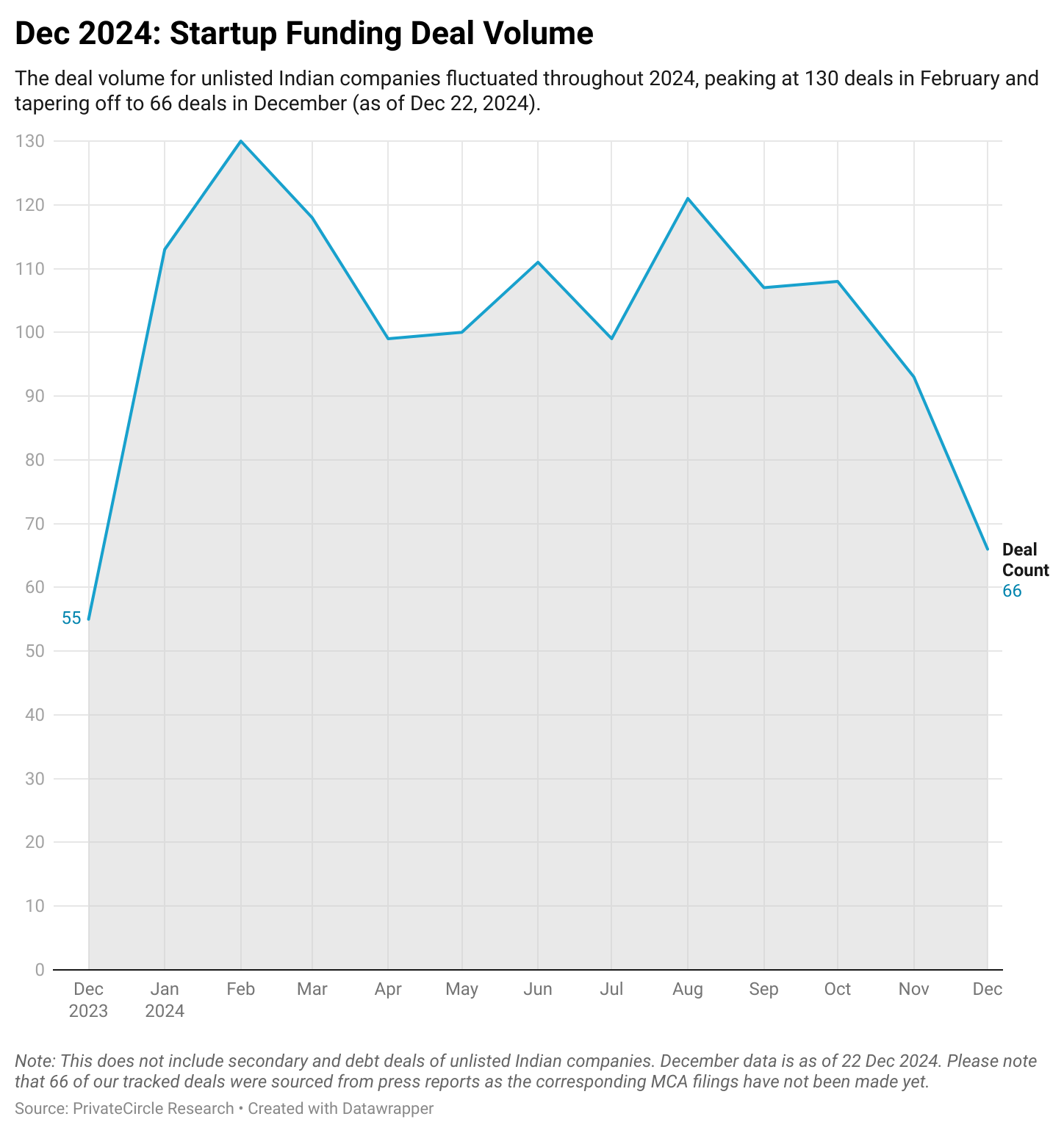

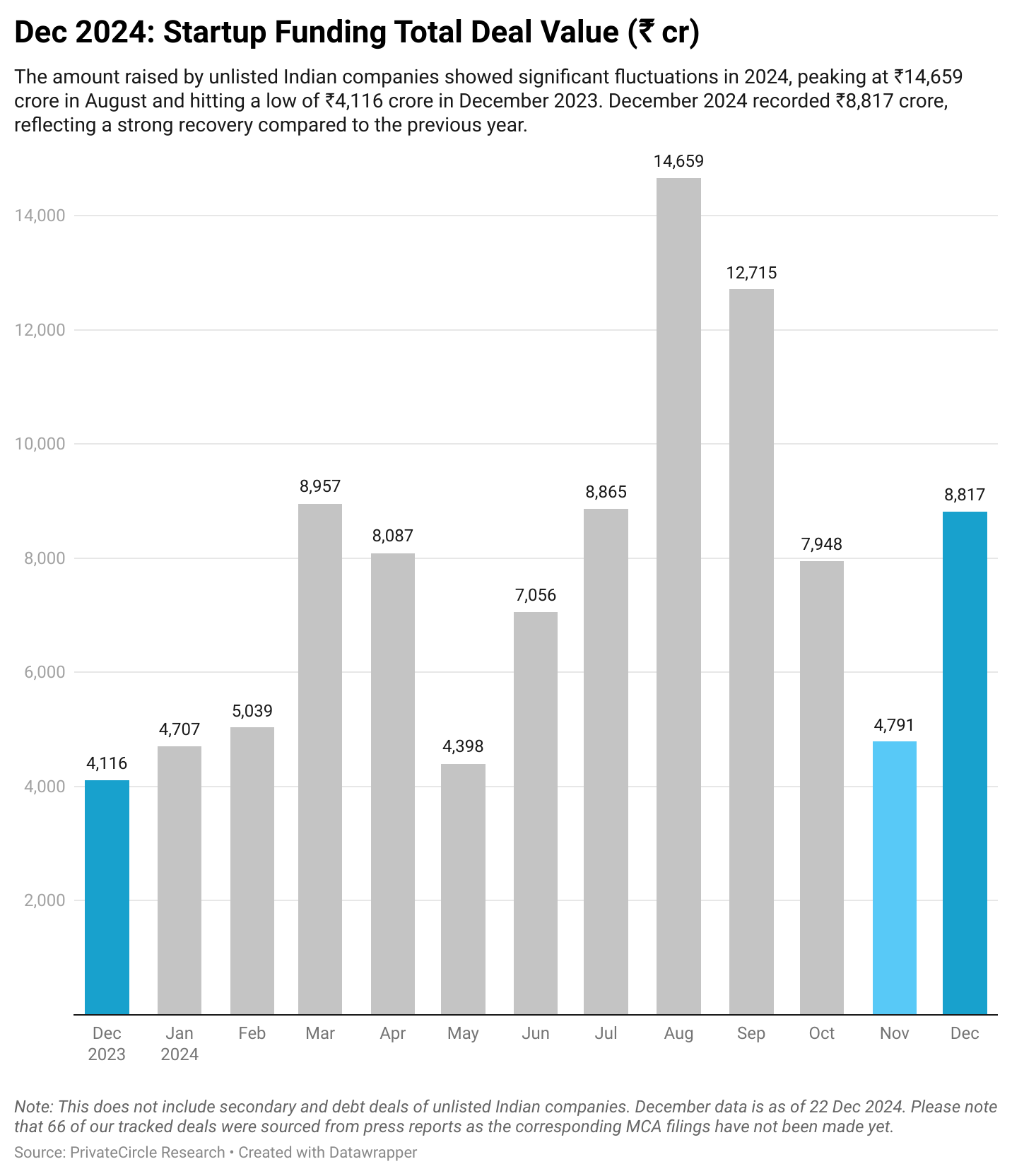

December 2024 recorded ₹8,817 crore in funding across 66 deals (as of 22 December), marking a 114% year-over-year increase from ₹4,116 crore in December 2023.

However, deal volume dropped by 49% compared to February 2024’s peak of 130 deals, highlighting a shift toward fewer but larger, more strategic investments.

Yournest Venture Capital led December with 5 deals, followed by Sanchiconnect with 4. Elevation Capital, Inflection Point Ventures, and LetsVenture each participated in 3 deals.

Venture capital and private equity investors dominated, with 43 deals in Tier 1 cities compared to 10 in Tier 2 and 3 cities.

In-Depth Insights

- Sector Highlights:

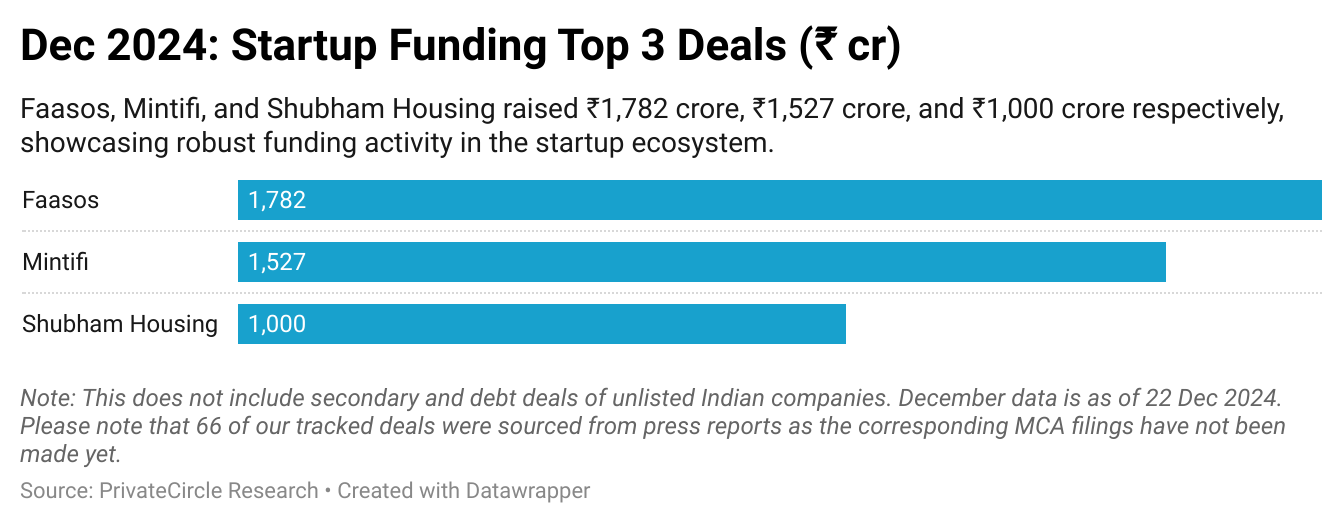

- Foodtech: Faasos raised ₹1,782 crore, proving that food delivery and cloud kitchens remain robust sectors.

- Fintech: Mintifi’s ₹1,527 crore funding underscores the growth of SME lending platforms.

- Housing Finance: Shubham Housing secured ₹1,000 crore, signaling strong interest in affordable housing finance.

- City Trends:

- Mumbai continues to lead due to its strong financial ecosystem.

- Bangalore displayed high innovation potential, with an average deal size of ₹91 crore.

- Tier 2 and 3 cities are gaining momentum as startups tackle localized challenges.

Funding Dynamics

The funding landscape in 2024 experienced notable fluctuations. August reached a peak with ₹14,659 crore, driven by significant fintech and SaaS deals.

December ended the year on a high note with ₹8,817 crore, reflecting a recovery from earlier lows. The trend toward fewer but larger deals indicates a maturing market focused on sustainable and scalable ventures.

Strategic Investments

- Scalable Models: Startups with clear revenue generation plans are attracting the most funding.

- Localized Solutions: Startups in smaller cities addressing unique regional challenges are catching investor attention.

- Key Sectors: Fintech, foodtech, and housing finance led December’s funding, while SaaS and healthtech maintained steady interest throughout the year.

Conclusion

December 2024’s funding activity highlights the strength and adaptability of India’s startup ecosystem. The rise of smaller cities and strategic investments in key sectors point to a more inclusive and diverse growth trajectory.

As 2025 begins, the focus will likely remain on innovation, regional development, and sustainable business models.

With cities like Mumbai, Pune, and Bangalore at the forefront, and smaller cities carving their niche, India’s startup story continues to evolve into an even more dynamic and exciting chapter.

Stay tuned for more in-depth analyses and insights on the top private market deals, brought to you by PrivateCircle Research.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Data Curation by Madona Ps and Nandini Gangadhar from PrivateCircle.

Explore More City-Wise Startup Funding Recaps:

Monthly City-Wise Startup Funding Landscape: February 2024

Monthly City-Wise Startup Funding Landscape: March 2024

City-Wise Startup Funding Recap: April 2024

City-Wise Startup Funding Recap: May 2024

City-Wise Startup Funding Recap: June 2024

City-Wise Startup Funding Recap: July 2024

City-Wise Startup Funding Recap: August 2024

Startup + CityWise Funding Recap: September 2024