In our latest report for May 2024, we delve into the data to reveal the emerging trends shaping the startup ecosystem across major Indian cities.

Highlights:

- Top Ten Cities Deal Size (₹ cr)

- Amount Raised Split Between Tier 1, 2, & 3 cities in CY 2024 (₹ cr)

- Average Deal Size for Tier 1, 2 & 3 City Startups in CY 2024 (₹ cr)

- Investor Type (Deal Volume)

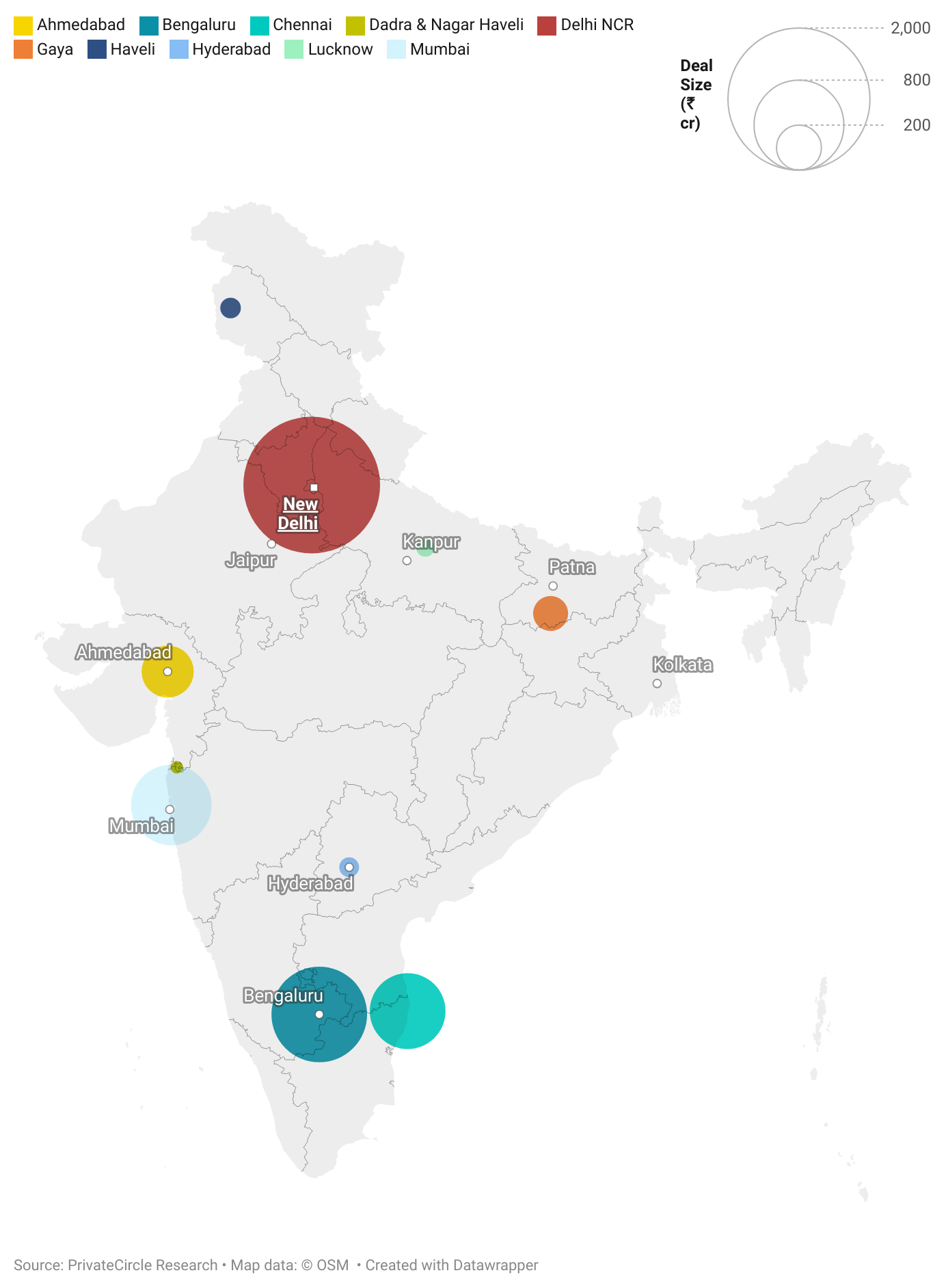

Top Ten Cities Deal Size (₹ cr)

Delhi NCR raised the maximum funding in May followed by Bengaluru, Mumbai and Chennai.

In terms of tier 2 & 3 cities, we saw startups from cities like Gaya, Haveli and Lucknow raise significant funding.

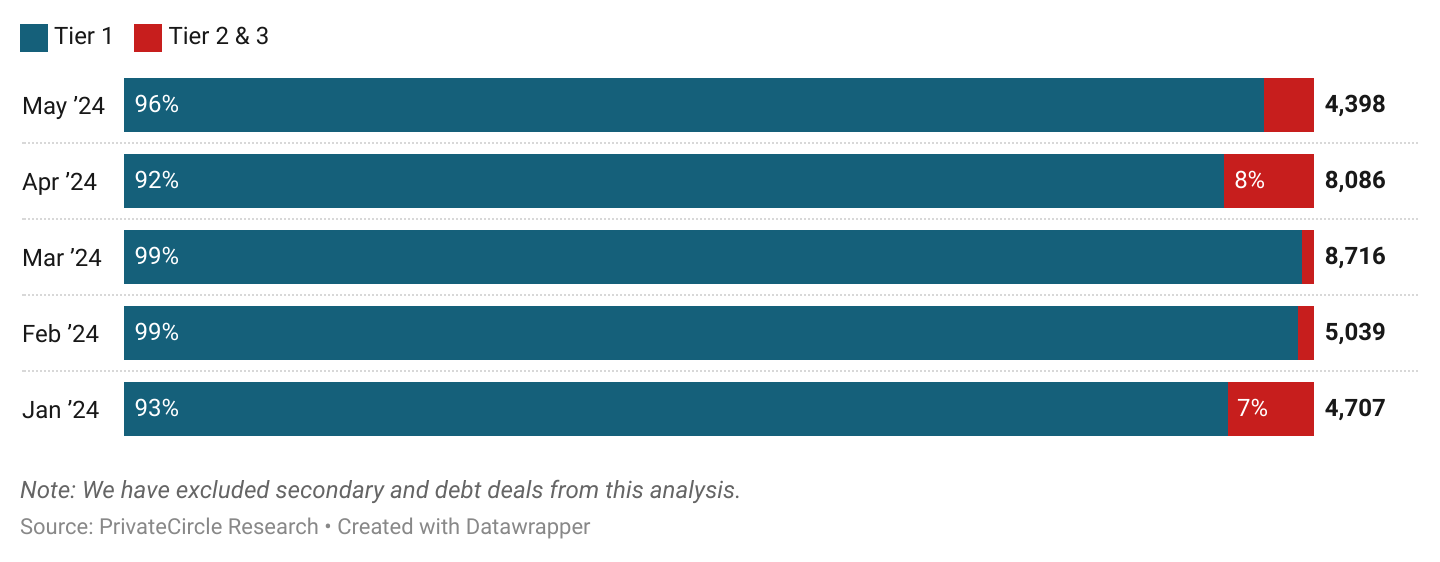

Amount Raised Split Between Tier 1, 2 & 3 cities in CY 2024 (₹ cr)

Tier 2 & 3 city startups make only 4% of the total funding raised in May, as compared to 8% share of tier 2 & 3 startups in April 2024.

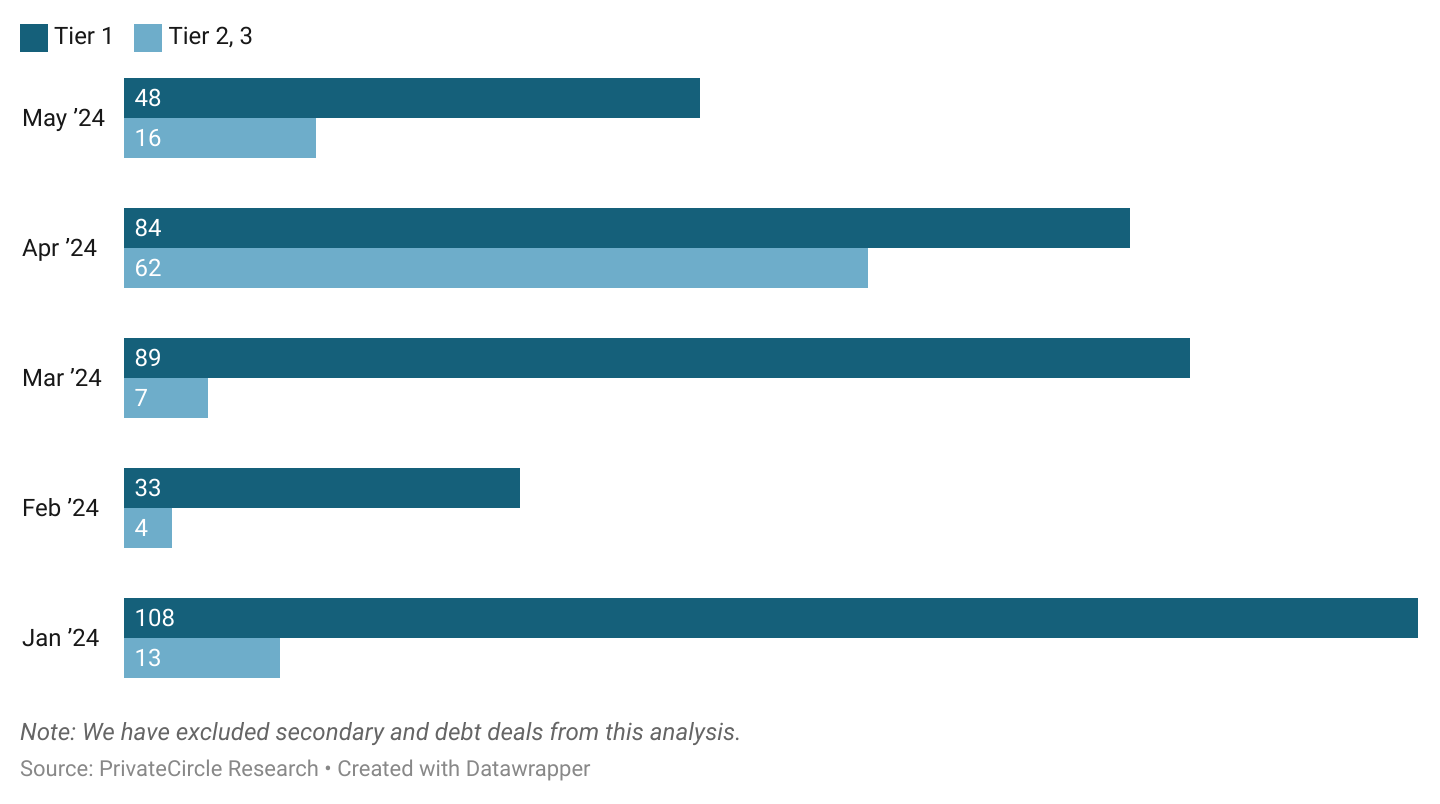

Average Deal Size for Tier 1, 2 & 3 City Startups in CY 2024 (₹ cr)

Average deal size for tier 1 startups was 200% higher than tier 2 & 3 startups in May 2024.

In comparison, this difference was just 34% in April 2024.

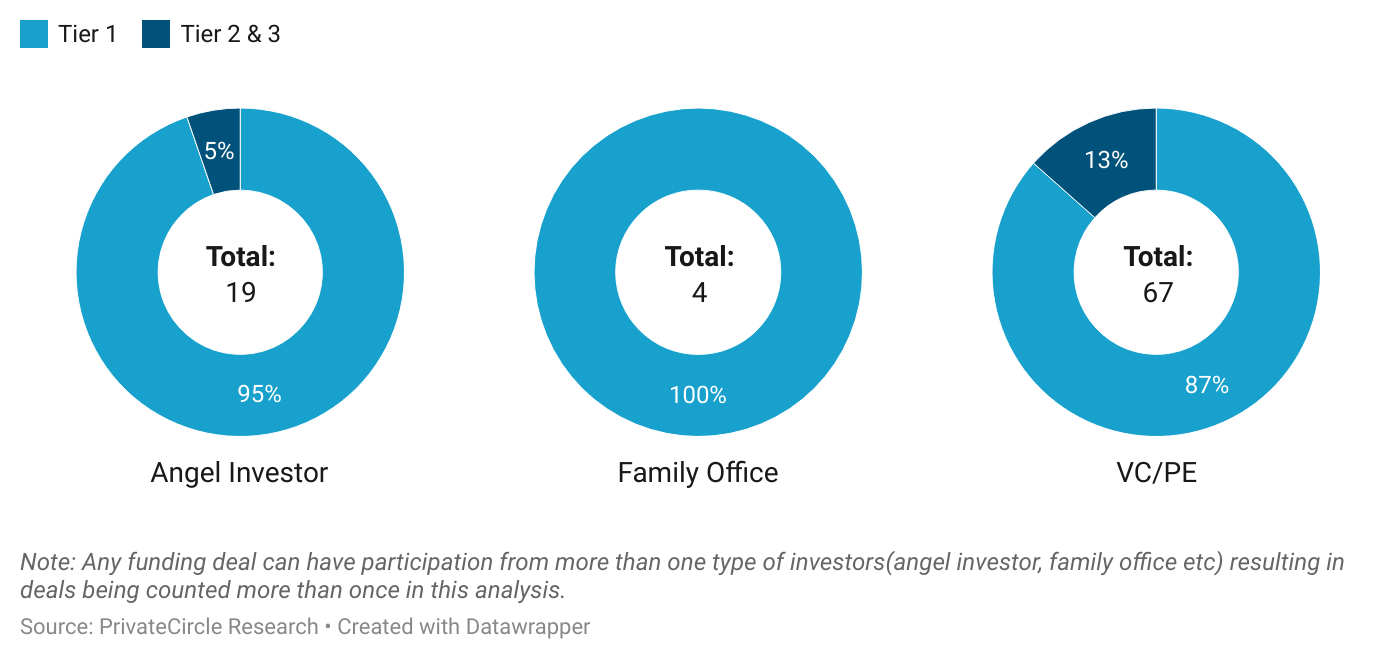

Deal Volume by Investor Type

Tier 2 & 3 city startups see higher volume of VC/PE deals in May 2024, followed by angel funding.

Insights and Implications

The funding trends of May 2024 underscore the dynamic and evolving nature of India’s startup ecosystem. While tier 1 cities continue to dominate, the gradual rise of tier 2 & 3 cities signals a broader distribution of entrepreneurial activity and investment opportunities.

As funding dynamics shift, it will be crucial for investors to balance their portfolios by not only backing established hubs but also nurturing the growth potential in emerging cities.

Conclusion

The City-Wise Startup Funding Recap for May 2024 provides valuable insights into the geographic distribution of startup investments in India.

The significant differences in funding amounts, average deal sizes, and investor preferences highlight the diverse opportunities and challenges across various city tiers.

As we move forward, fostering an inclusive and balanced funding ecosystem will be key to unlocking the full potential of India’s vibrant startup landscape.

Stay tuned for more insights from PrivateCircle as we navigate the ever-evolving landscape of startup funding and entrepreneurship.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Explore More City-Wise Startup Funding Recaps:

Monthly City-Wise Startup Funding Landscape: March 2024