🧭 Introduction

In a country where micro, small, and medium enterprises (MSMEs) form the bedrock of employment and economic activity, access to affordable and timely credit remains a persistent barrier. While public sector banks often remain risk-averse, fintechs tend to focus on short-term consumer credit, leaving a critical void in long-term, secured financing for small businesses.

Into this gap stepped Profectus Capital Private Limited, offering a compelling alternative. Rather than chasing trends or volume-driven disruption, Profectus chose a path of structured, sector-specific, and relationship-led lending. By focusing on India’s underserved entrepreneurial middle, it has positioned itself as a dependable financial partner rather than a transactional lender.

Crucially, Profectus understands that MSMEs are not just data points on a balance sheet—they are the heartbeat of India’s economic engine. They build, they manufacture, they employ, and they dream. However, their growth is often stalled, not by lack of ambition, but by lack of access to capital. Here, Profectus steps in with long-term, secured credit tailored to their business cycles.

Instead of offering templated products, Profectus uses on-ground insights, cash flow-based underwriting, and sectoral understanding to craft financial solutions. As a result, it isn’t just disbursing credit, it’s building confidence, enabling dreams, and supporting sustainable scale.

Over time, its impact has quietly rippled through India’s industrial belts and service corridors. Whether it’s enabling a manufacturer to expand capacity, helping a trader invest in better inventory, or supporting a services firm in upgrading infrastructure, Profectus has consistently backed ambition with action. Whether it’s enabling a local manufacturer to scale operations or helping a service enterprise invest in new machinery, Profectus has been at the core, steadily backing the ambitions of India’s entrepreneurial middle. This is not just a lending story. It’s a story of nation-building, from the grassroots up.

🏢 Company Snapshot

- Name: Profectus Capital

Founded: 2017 - Promoter: Actis Advisors

- Headquarters: Mumbai, Maharashtra

- Type: RBI-registered Non-Banking Financial Company (NBFC)

Profectus operates as a non-deposit-taking systemically important NBFC, targeting India’s growth-stage MSMEs with tailored financial products. The company’s strategy blends high-quality credit underwriting, robust asset-liability management, and deep sectoral specialisation across manufacturing and services.

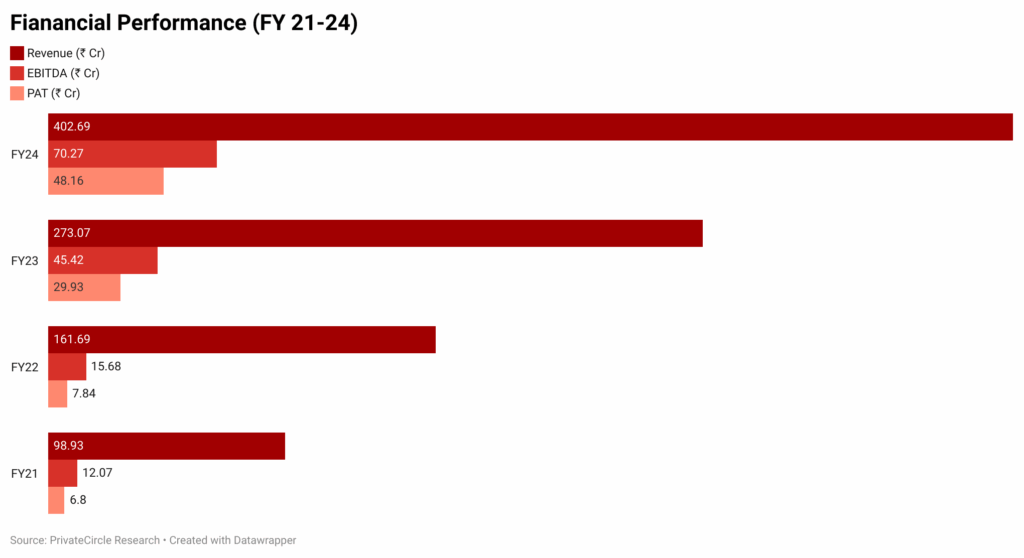

📊 Financial Performance (FY21–FY24)

Over the FY21–FY24 period, Profectus witnessed consistent year-on-year growth in revenue, and profitability, underscoring its maturity as a lender focused on MSMEs. From ₹98.93 Cr in FY21 to ₹402.69 Cr in FY24, the topline nearly quadrupled. More importantly, the company achieved a steady rise in PAT and EBITDA margins, reflecting scale efficiencies, strong underwriting, and controlled NPAs.

📈 AUM Growth (FY21–FY24)

Profectus Capital’s AUM (Assets Under Management) has grown impressively over the past four years, reflecting consistent lending activity and deepening market reach:

- FY21: ₹895 Cr

- FY22: ₹1,546 Cr

- FY23: ₹2,522 Cr

- FY24: ₹3,070 Cr

This represents a 3.4x growth in AUM over four years, a testament to the company’s disciplined underwriting, targeted customer acquisition, and expanding geographical footprint.

Profectus growth isn’t just about numbers. Each crore deployed has backed a small manufacturer upgrading machinery, a trader expanding inventory, or a service provider investing in people. This AUM trajectory mirrors a broader narrative of economic enablement, credit inclusion, and grassroots-scale lending.

💰 Equity & Funding Timeline

Since its inception, Profectus has raised over ₹1,039 Cr in primary equity, largely from Actis Advisors and the Profectus CIP Trust. Its valuation has jumped from ₹5.05 Cr in June 2017 to ₹1987.54 Cr in March 2023.

| Date | Investor | Amount (₹ Cr) | Valuation (₹ Cr) | Round |

| Mar 2023 | Actis Advisors | 119.96 | 1,987.54 | Rights |

| Mar 2022 | Actis Advisors | 250.00 | 1,410.03 | Rights |

| Jul 2021 | Profectus CIP Trust | 0.90 | 870.03 | Series B |

| Mar 2021 | Actis Advisors | 100.00 | 869.13 | Rights |

| Sep 2020 | Profectus CIP Trust | 0.75 | 640.94 | Series B |

| Mar 2020 | Actis Advisors | 100.00 | 640.19 | Rights |

| Nov 2019 | Actis Advisors | 100.00 | 518.58 | Rights |

| Jun 2019 | Actis Advisors, Profectus CIP Trust | 111.25 | 418.58 | Series B |

| Mar 2019 | Profectus CIP Trust | 6.55 | 256.11 | Series A |

| Mar 2019 | Actis Advisors | 5.04 | 249.55 | Secondary |

| Sep 2018 | Actis Advisors | 190.00 | 249.56 | Acquisition |

| Aug 2018 | Profectus CIP Trust | 4.51 | 59.56 | Series A |

| Apr 2018 | Actis Advisors | 50.00 | 55.05 | Acquisition |

| Jun 2017 | K V Srinivasan, Uma Srinivasan | 5.04 | 5.05 | Rights |

Ownership remains consolidated between Actis Advisors, Profectus CIP Trust, and K V Srinivasan across multiple stages of growth.

💼 Lending Strategy & Product Suite

Profectus’ offerings are tailored to the real needs of MSMEs across sectors. Unlike fintech lenders focused on short-term unsecured loans, Profectus emphasizes:

- Secured Term Loans: For capital expenditure and expansion

- Working Capital Demand Loans: Addressing seasonal liquidity gaps

- Viability-Linked Equipment Loans: Short-term for asset-based financing

- Supply Chain Finance: For high turnover businesses in pharma, auto, and electronics

Products are underwritten using proprietary risk models combining bank statements, GST filings, and ground-level insights.

🏦 Liability Side: Institutional Lending

Profectus’ balance sheet is backed by debt from 50+ top-tier lenders. Notable ones include:

- Private Banks: ICICI, IndusInd, RBL, Bandhan

- Small Finance Banks: AU, Ujjivan, Suryoday, Utkarsh, Equitas

- NBFCs: Tata Capital, MAS Financial, Aditya Birla Finance

- Development Finance Institutions: SIDBI, NABKISAN

👔 Management Team

- CEO and Director: K V Srinivasan, an alumnus of the Indian Institute of Management, Ahmedabad (1989), KV Srinivasan is also a member of the Institute of Chartered Accountants of India (1985) and the Institute of Company Secretaries of India (1987).

- COO: Sandip Parikh, a rank-holder Chartered Accountant from the batch of 1992, a Cost Accountant (1989), Sandip Parikh is an active participant at the CFO Forum.

- CTO: Vitthal Naik. Having over 25 years of experience in the design, development, and implementation of IT business solutions.

- Board Members: Asanka Rodrigo, Pratik Jain, Sudarshan Sampathkumar, Hossam Aboumoussa

The leadership’s combined expertise in credit risk, structured finance, and MSME ecosystems is reflected in Profectus strong underwriting track record.

📍 Operational Footprint

Active lending operations span:

- Maharashtra (HQ in Mumbai)

- Gujarat

- Tamil Nadu

- Telangana

- Karnataka

- Delhi

- Andhra Pradesh

- West Bengal

- Madhya Pradesh

Focus remains on industrial clusters, Tier 2/3 cities, and formalising semi-urban credit ecosystems, away from saturated urban lending markets.

🛡️ Governance, Ratings & Compliance

- Statutory Auditor: S.R. Batliboi & Co. LLP

- RBI Classification: NBFC-ND-SI

- CRISIL Long-Term Rating: A- (Stable)

- CRISIL Short-Term Rating: A1

- CARE Ratings (LT): A

- GST & EPFO: Compliant across all geographies

Multiple rating upgrades between FY21–FY25 reflect improving credit metrics, borrower base quality, and stable leverage.

🧮 Key Ratios (FY24)

- PAT Margin: 11.96%

- EBITDA Margin: 17.45%

- Total Debt / EBITDA: 28.28x

- Interest Coverage Ratio: 0.35

- Fixed Asset Turnover Ratio: 21.73x

- Equity Multiplier: 2.9

While high leverage is characteristic of NBFCs, Profectus growing net interest margins and stable spreads mitigate associated risks.

🧾 ESG & Social Impact

- Partner NGO: Mantra Social Services

- Project: STEP (School Transformation & Empowerment Project) in Karnataka and Punjab

- FX Exposure: Minimal (₹0.11 Cr forex outgo)

By prioritizing education infrastructure under CSR, Profectus aligns with long-term developmental themes relevant to its borrower base.

🔭 Strategic Roadmap (FY25–FY27)

- IPO Pathway: Strong financials, ROE >10%, and regulatory compliance make Profectus a likely IPO candidate by FY27.

- Asset Book Expansion: Targeting ₹4,000–₹5,000 Cr in AUM by FY26

- Co-lending Model: Partnering with banks to reduce the cost of funds and risk-weighted assets

- Product Digitization: Automating the loan lifecycle via tech platforms and CRM integrations

- New Geography Entry: Eastern India, Northeast, and deeper rural pockets

🧠 Conclusion: Building India’s Next-Gen MSME NBFC

Profectus Capital isn’t just another NBFC, it’s built differently. While others chase fast growth or risky lending, Profectus focuses on doing the basics right. It lends with care, grows with discipline, and supports MSMEs at every step.

By offering secured loans tailored to real business needs, it supports small factories, traders, and service businesses, the ones that keep India running. These aren’t startups or big companies. They’re everyday businesses looking for support to grow, and Profectus is there to back them.

More than loans, it gives these businesses belief. Whether it’s to buy new machinery, open a shop, or manage cash flow, Profectus helps them move forward, with trust and transparency.

What sets it apart is this balance: the mission to help MSMEs, and the systems to do it right. It’s not about being the biggest, it’s about being trusted. And as India’s small businesses grow stronger, Profectus is right beside them, building a better credit ecosystem.

🔍 Report powered by PrivateCircle Research

Looking to dive deeper into private company financials, growth signals, and sector-specific insights across India’s startup ecosystem? PrivateCircle provides verified data on thousands of unlisted companies, from revenue and ratios to shareholder trends and compliance flags.