The PhonePe Mafia, much like its Paytm and Flipkart counterparts, is a growing network of startups founded by ex-employees of the fintech giant.

As of August 2024, the collective valuation of the PhonePe Mafia companies was an impressive ₹11,707.39 crores.

This reflects not only the growing success of these companies but also the impact that PhonePe’s culture of innovation has had on the Indian startup ecosystem.

Highlights of the PhonePe Mafia:

- 18 startups under its umbrella that we were able to track

- Collective valuation of ₹11,707 cr

- Created over 1,421 jobs

- Active in Software, IT/ITES, Media & Social, Retail, Emerging Technologies, and others

- Founders spread across 24 alma maters that we were able to track

Blog Outline; Data and Insights by PrivateCircle Research

- Collective Valuation (₹ Cr)

- Number of Start-ups Launched

- Spread Across Sectors

- Total Workforce

- Job Creation & Economic Impact

- Investor Activity

- In-Depth Insights

- Funding Dynamics

- Strategic Investments

- Future Outlook

- Conclusion

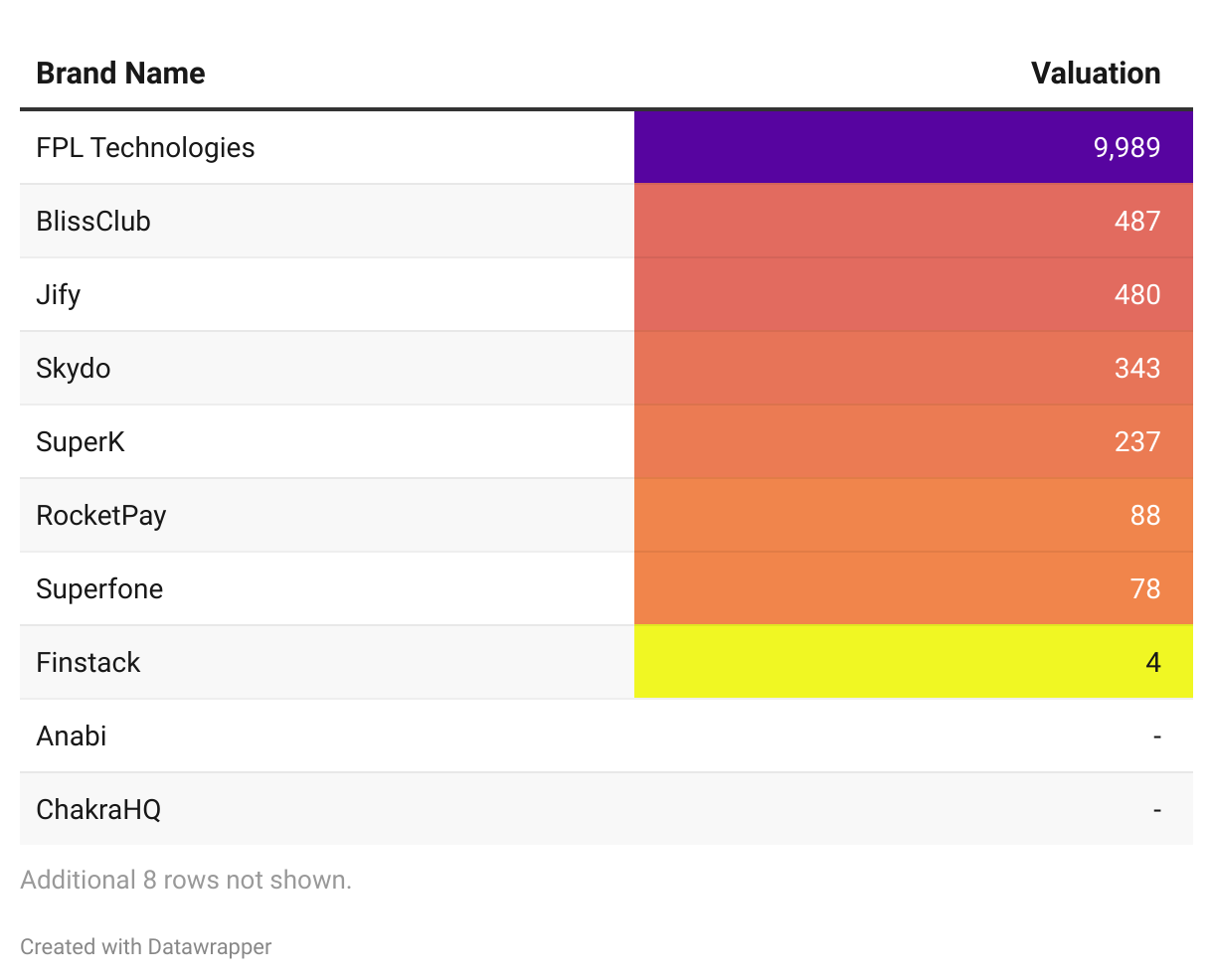

Collective Valuation (₹ Cr)

The collective valuation of PhonePe Mafia Companies was ₹ 11707.39 Crores as of August 2024.

Note: 14 PhonePe Mafia companies were excluded from this analysis as we could not find their valuation.

Companies Like Fpl Technologies, BlissClub, Zeo Fin Technology, and Localbuy Technologies were some of the highest valued companies on the list.

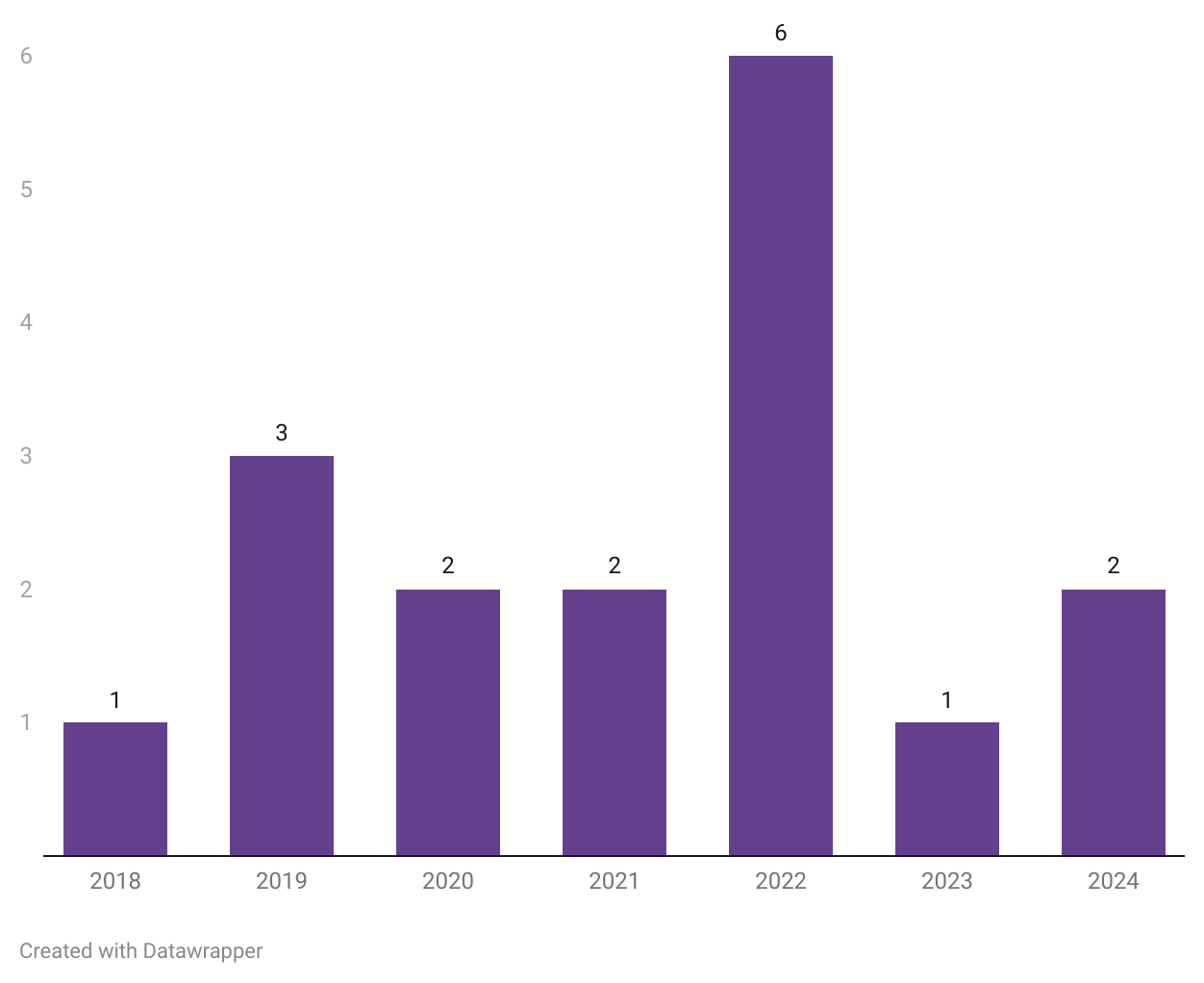

Number of Start-ups Launched

In 2022, PhonePe saw the launch of the highest number of its Mafia companies. This year was pivotal for PhonePe, as it marked its demerger from Flipkart in December.

Note: 4 PhonePe Mafia companies were excluded due to untraceable legal entities, and Ipsator was excluded as it was incorporated before PhonePe’s inception. Accent, Dbrand, Ekholine, and ThinQproduct.

Additionally, it followed a major milestone in November 2021 – a massive ₹135 crore ESOP buyback event.

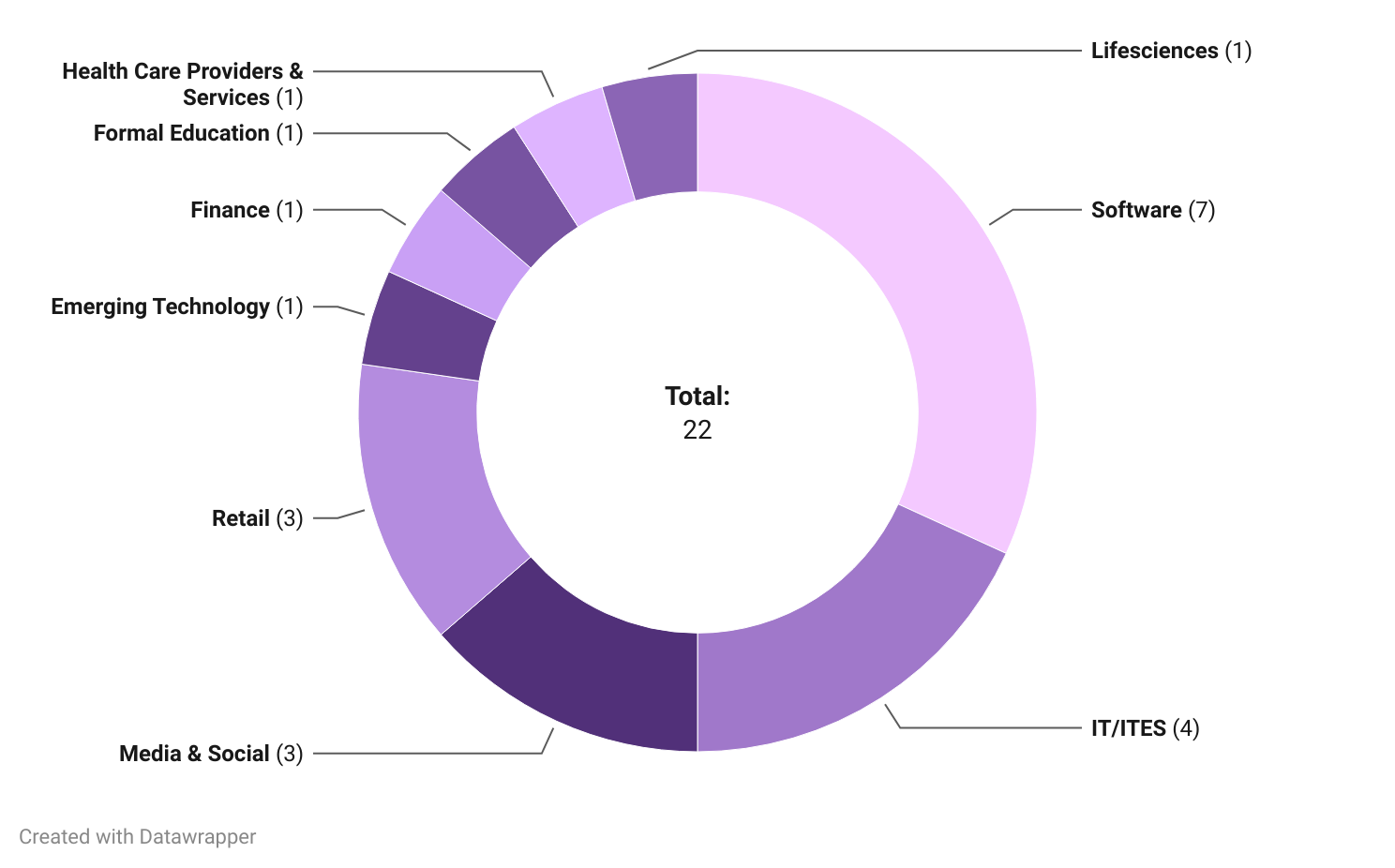

Spread Across Sectors

Majority of PhonePe mafia companies are operating in Software and IT/ITES sector, followed by Media & Social and Retail.

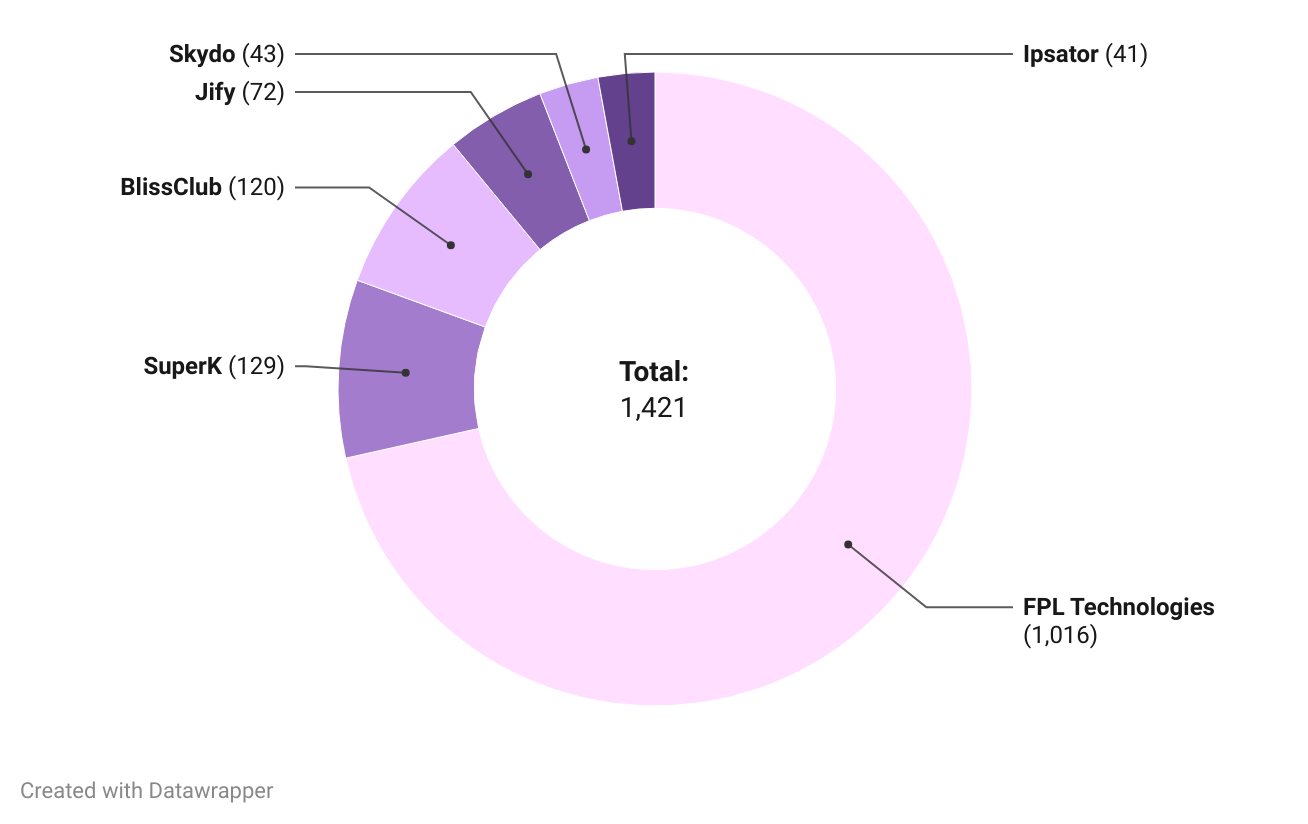

Total Workforce

The PhonePe Mafia has created 1421 Jobs.

Note: Employee counts are based on PF data filed with the EPFO. The latest wage month for PhonePe Mafia Founder’s Company is August 2024. 12 companies were excluded for having fewer than 100 employees (no PF data available), and 4 were excluded due to untraceable registered entities.

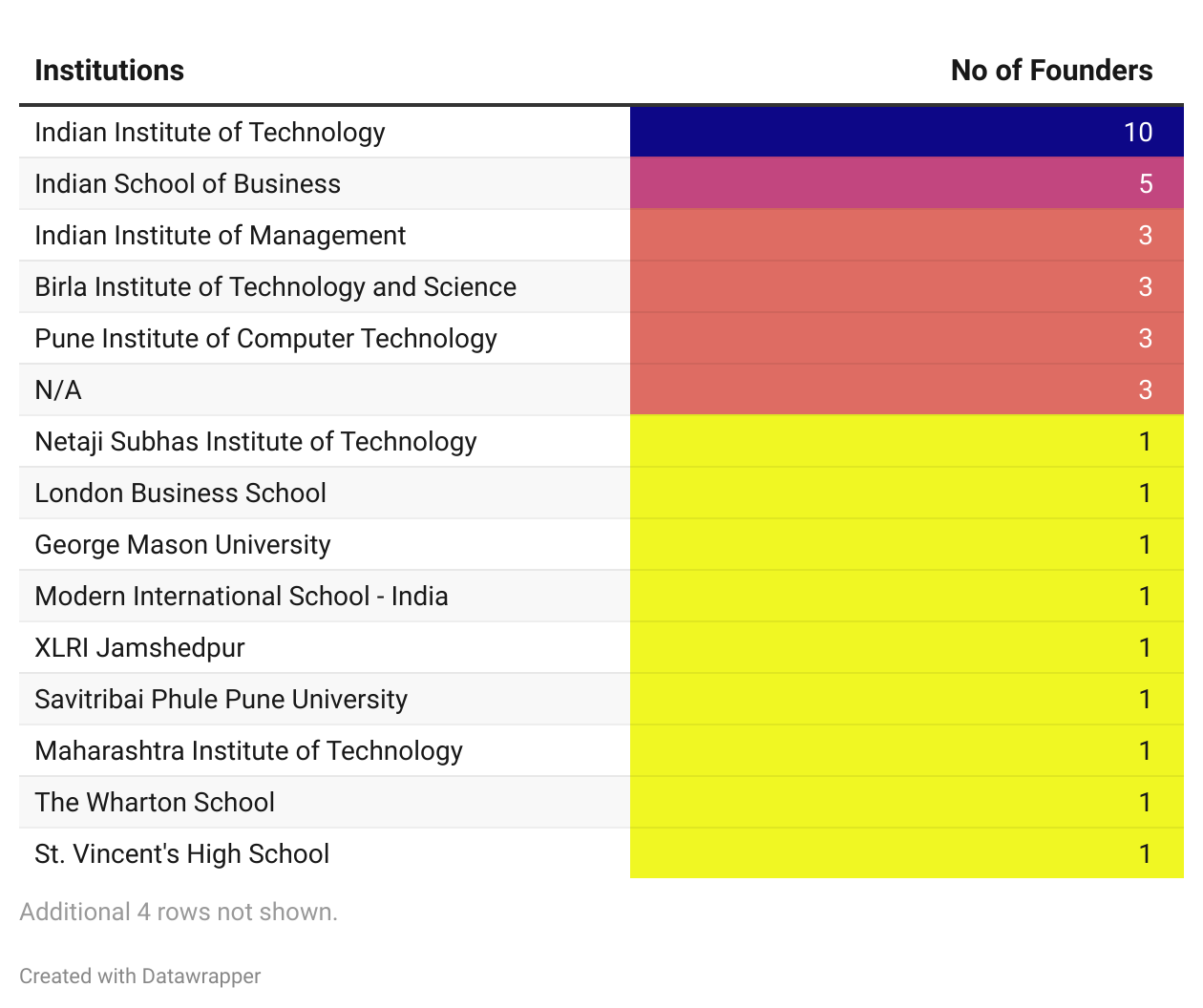

Founders’ Alma Mater

10 out of 40 founders in PhonePe Mafia went to IITs and 05 went to ISBs.

Note: We could not Find the Legal Entity for the Below Companies, but the Founder’s are considered for Alma Mater. Accent, Dbrand, Ekholine, and ThinQproduct.

Job Creation & Economic Impact

With over 1,421 jobs created across various sectors, the PhonePe Mafia startups are contributing significantly to employment in India.

This excludes 12 companies that were left out due to their smaller size. The job creation numbers further highlight the economic ripple effect that successful companies like PhonePe can have on the broader ecosystem.

Companies like BlissClub and FPL Technologies are employing hundreds of individuals, further driving India’s economic growth.

Investor Activity

2022 was a banner year for PhonePe Mafia startups, marking the launch of the most companies post-PhonePe’s demerger from Flipkart.

This event, along with the 2021 ESOP buyback, fuelled the rise of entrepreneurial ventures. Angel investors, venture capital firms, and other investors have shown continued interest in these companies, boosting their performance month after month.

Notably, many of these startups have attracted strategic investments, driving consistent growth and innovation within their respective industries.

In-Depth Insights

Most PhonePe Mafia companies operate in the Software and IT/ITES sectors, reflecting India’s strength in technology-driven innovation. Media, social, and retail sectors follow closely, underscoring the versatility of the talent that emerges from PhonePe.

The founders’ education also plays a significant role, with 10 out of the 40 founders being alumni of IITs and 5 coming from ISBs. This educational background gives them an edge in technological and management expertise, which has propelled these companies to success.

Funding Dynamics

Funding has been robust, with valuations reflecting a positive sentiment towards these companies. However, 14 companies couldn’t be accounted for in the analysis due to a lack of data on their valuations, indicating that many companies are still flying under the radar.

As investor interest grows, these companies are expected to raise more funds, scaling rapidly in the coming months.

Strategic Investments

The fintech roots of PhonePe have paved the way for several strategic investments in sectors like retail and social media. Investors are leveraging the fintech experience of these founders, placing large bets on startups that promise to disrupt existing models.

Localbuy Technologies and Zeo Fin Technology are excellent examples of companies that have benefited from such strategic investments, allowing them to become key players in their fields.

Future Outlook

The future for the PhonePe Mafia looks promising. With many of these startups still in the early to middle stages, there’s significant potential for scale and growth. The collective valuation is expected to rise as these companies expand operations and secure more rounds of funding.

Moreover, as these companies continue to innovate, they will attract more investor interest, driving further development in sectors ranging from fintech to retail and media.

Conclusion

The PhonePe Mafia is not just a network of ex-employees; it’s a symbol of how successful companies can inspire entrepreneurial waves that create jobs, generate wealth, and contribute to the country’s economic growth.

With strategic investments, strong educational backgrounds, and a positive funding environment, the PhonePe Mafia is set to make even bigger waves in the Indian startup ecosystem in the coming years.

Credits

This comprehensive report was made possible by the collaborative efforts of Likith N, Chaithra T N and Nancy Priya at PrivateCircle.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.