The Swiggy Mafia 2024 report offers a detailed snapshot of the burgeoning ecosystem spawned from the success of Swiggy, one of India’s leading food delivery platforms.

The collective valuation of the Swiggy Mafia companies stands at an impressive ₹6,277.16 crore as of July 2024, highlighting the entrepreneurial spirit and innovation flourishing within this network.

This blog delves into the significant metrics derived from the report, analysing trends, impacts, and potential future trajectories for these startups.

Highlights of the Swiggy mafia:

- 46 startups under its umbrella that we were able to track

- Collective valuation of ₹6,277 cr

- Created over 4,506 jobs

- Active in Software, IT/ITES, Media & Social, Finance, Professional Services, and others

- Founders spread across 73 alma maters that we were able to track

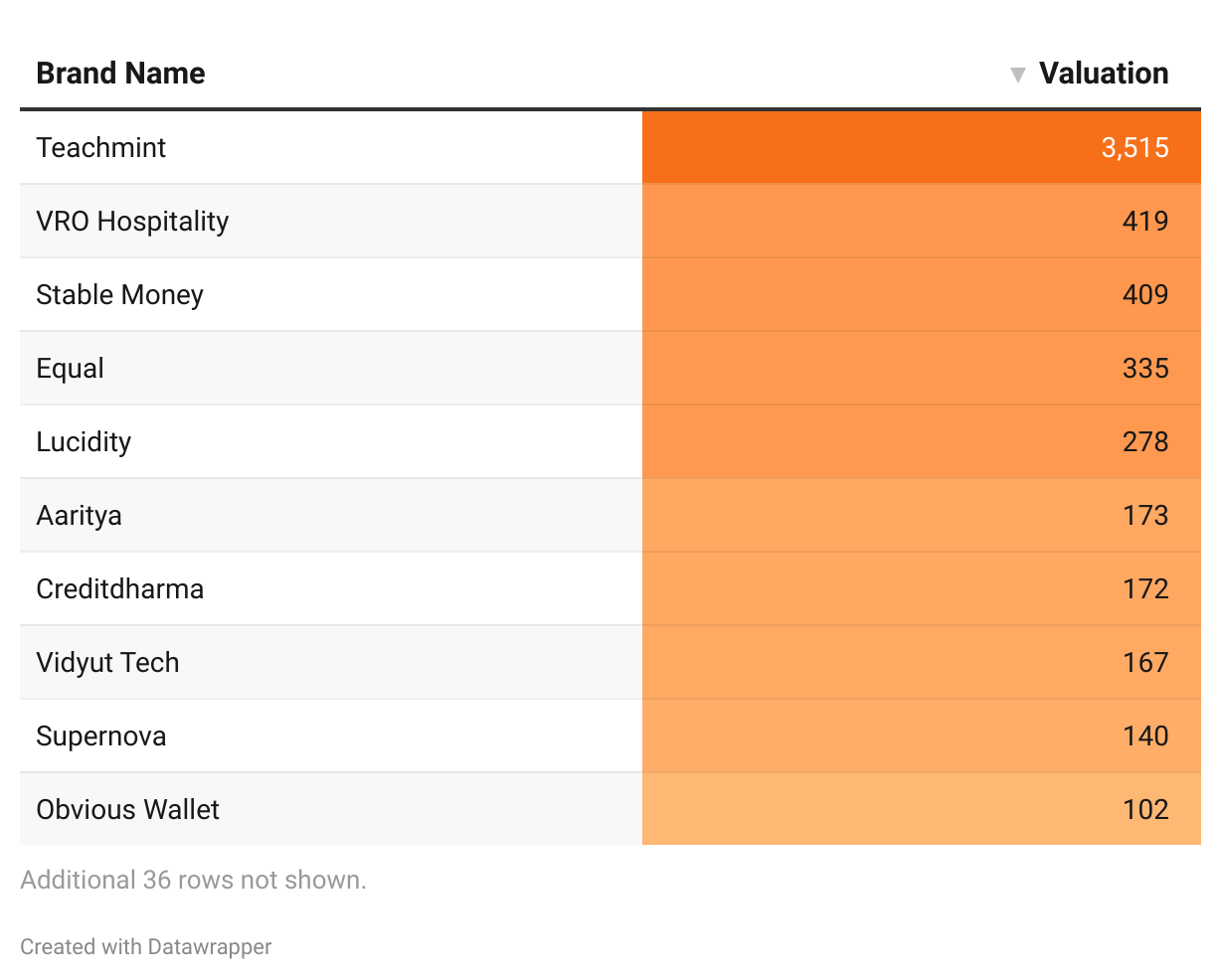

Collective Valuation (₹ Cr)

The total valuation of Swiggy Mafia Company is ₹6,277.16 cr as of July 2024.

Note: We were unable to determine the legal names for the following companies: Learnaut, ELEVATE Insights, Nirmaanaa, Atommic, Quantacus, Nursefam, 10X Recruit, Famebro Creative Studio, Deeplogic AI, HYPE, Growth Hive, Bluwage Cloud Kitchen, Vsualthree60 LLP, Turtle Financial Advisors LLP, Inkling marketing solutions LLP, they have been excluded from the calculation of the collective valuation.

Companies like Teachmint, VRO Hospitality, and Stable Money are some of the highest valued companies on the list.

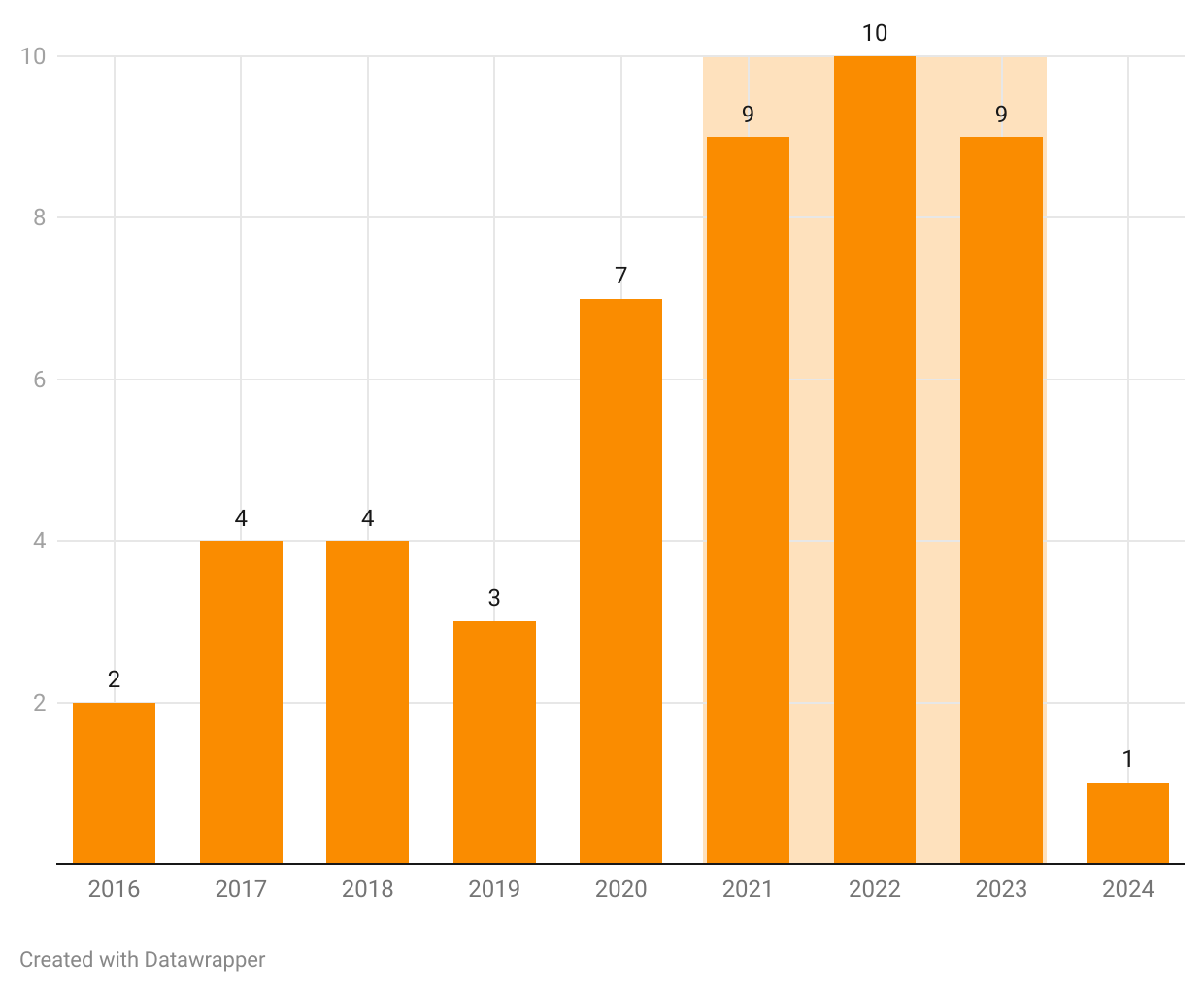

Number of Start-ups Launched

Between 2020 and 2023, there was a significant rise in the number of companies launched. The peak was reached in 2022 with 10 new companies, followed by 9 in 2023.

Note: 12 Swiggy mafia companies were excluded from this analysis as we could not trace their legal entity name.

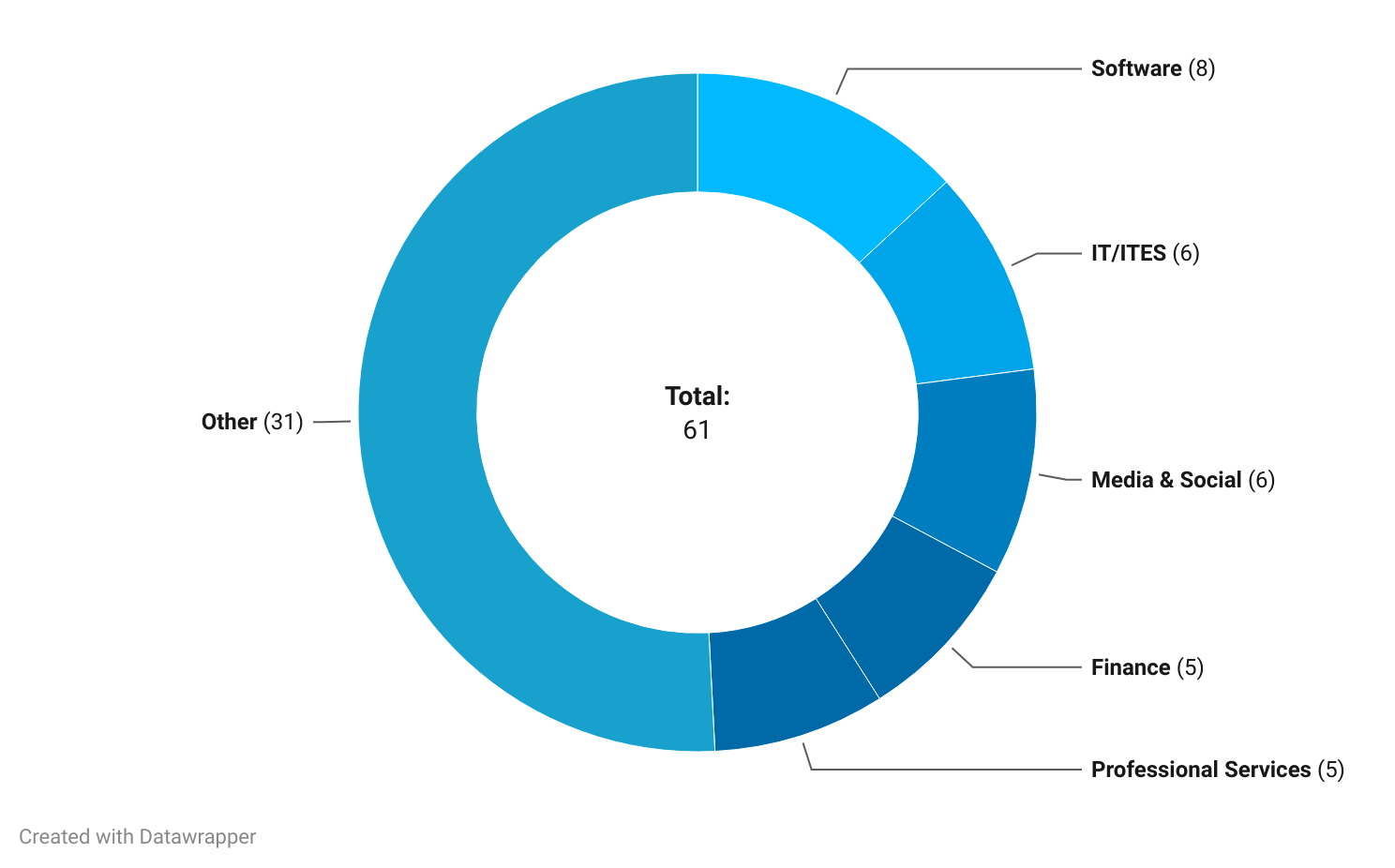

Spread Across Sectors

Majority of Swiggy mafia companies are operating in Software and IT/ITES sector, followed by Media & Social and Finance.

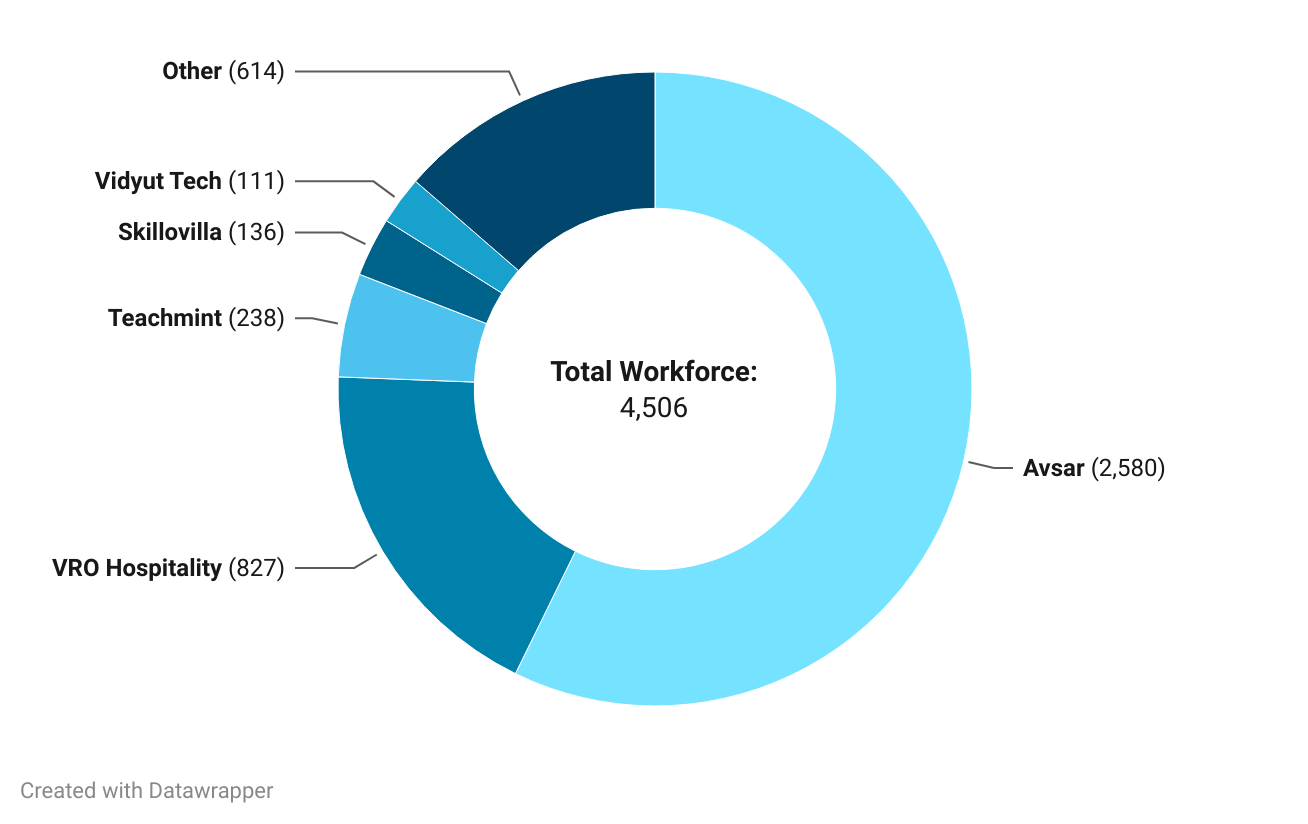

Total Workforce

The Swiggy Mafia has created 4506 jobs, with 4 companies (Skillovilla, Teachmint, VRO Hospitality & Avsar) together accounting for 3781 of these jobs.

Note: 12 Swiggy mafia companies were excluded from this analysis as we could not trace their legal entity name. Learnaut, ELEVATE Insights, Nirmaanaa, Atommic, Quantacus, Nursefam, 10X Recruit, Famebro Creative Studio, Deeplogic AI, HYPE, Growth Hive, and Bluwage Cloud Kitchen.

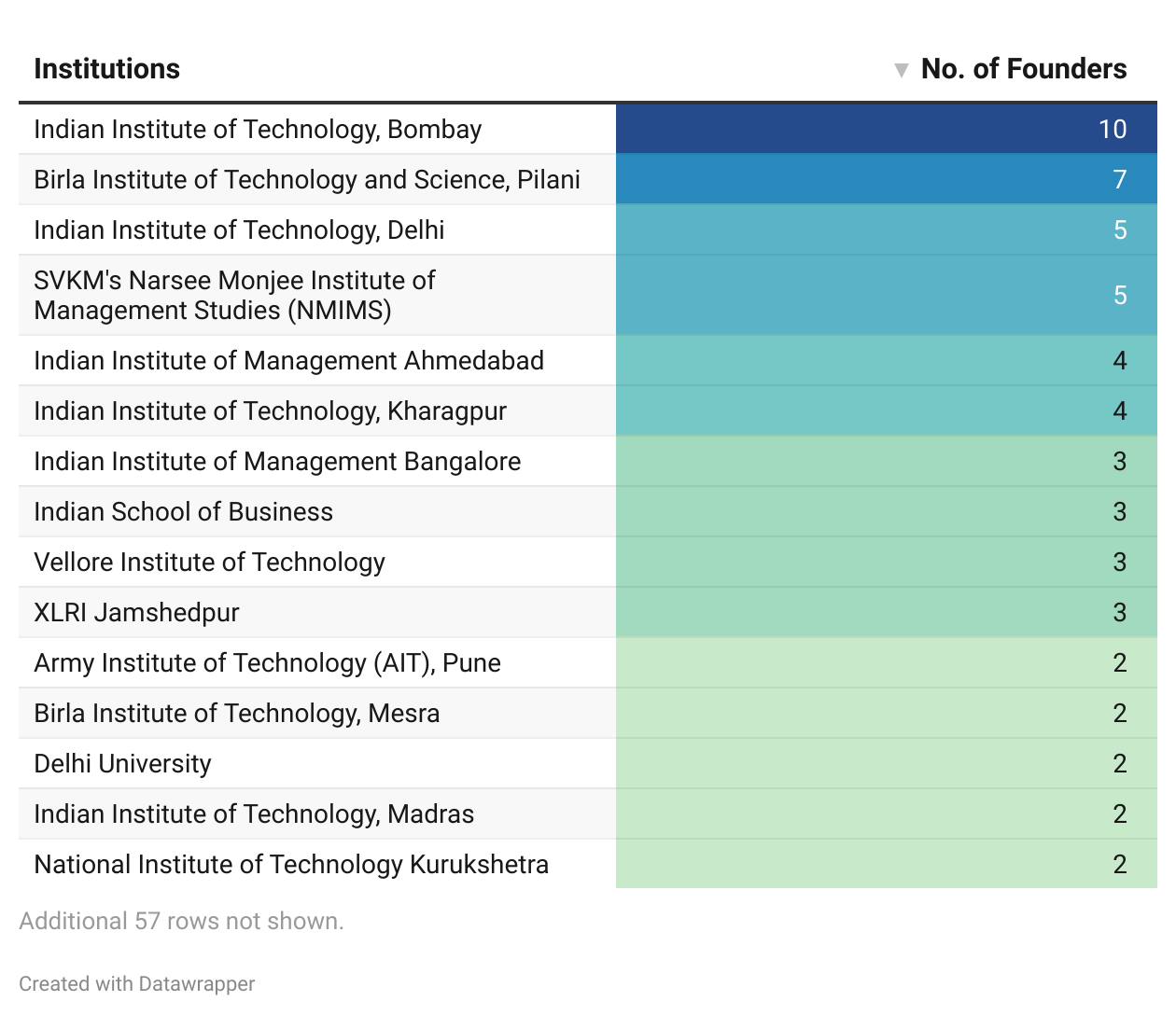

Founders’ Alma Mater

22 out of 119 founders in Swiggy Mafia went to IITs and 10 went to IIMs.

Note: We were unable to determine the alma maters of the following 6 founders. Aditya Sinha (3S Fitness Technologies), Om Thakur (Dot Media), Sharath Desmond Rice (VRO Hospitality), Haritha Lakshmanamurthy (Leapersoft), Juhi Ahluwalia (Inkling), and Ravindranath B (Nursefam).

Job Creation and Economic Impact

The Swiggy Mafia has significantly contributed to job creation, generating 4,506 jobs across its network. Four leading companies—Skillovilla, Teachmint, VRO Hospitality, and Avsar—account for a substantial 3,781 of these positions.

This level of job creation not only underscores the positive economic impact of these startups but also emphasises their role in fostering employment opportunities within India’s tech and service sectors.

Comparative Analysis

The landscape of the Swiggy Mafia reveals a concentration of companies in the Software and IT/ITES sectors, followed by Media & Social and Finance.

This sectoral spread showcases the versatility of the Swiggy Mafia, with startups leveraging technology to innovate across various domains.

By comparison, traditional sectors such as manufacturing and agriculture appear less represented, highlighting a shift towards a digital economy.

Monthly Performance

Examining monthly performance metrics can provide insights into the operational health of these startups.

While the report does not provide explicit monthly data, the upward trajectory in the number of startups launched between 2020 and 2023 suggests a robust environment for innovation.

The consistent increase in startups indicates a strong appetite for entrepreneurial ventures, with potential spikes in activity aligning with significant funding rounds or market events.

Investor Activity

Investment dynamics play a crucial role in the growth of the Swiggy Mafia. With the reported valuations and job creation figures, it’s evident that investor interest in these startups is significant.

The presence of established firms like Teachmint and VRO Hospitality likely attracts further investment, creating a virtuous cycle that fosters growth and innovation.

Understanding the investors backing these companies can provide additional layers of insight into the strategic direction and confidence in this ecosystem.

In-depth Insights

An analysis of founder backgrounds reveals that 22 out of 119 founders hail from IITs and 10 from IIMs, pointing to a trend where elite educational institutions are breeding grounds for entrepreneurial talent.

However, the inability to trace the alma maters of certain founders raises questions about inclusivity and diversity in startup leadership.

This gap suggests potential areas for improvement in fostering broader representation in India’s startup ecosystem.

Conclusion

The Swiggy Mafia 2024 report underscores the vibrant entrepreneurial landscape that has emerged from the success of Swiggy. With significant collective valuations, job creation, and a concentration in high-growth sectors, these startups are well-positioned for future success.

Continued investment and strategic partnerships will be critical as they navigate the complexities of the modern economy.

By fostering innovation and creating new opportunities, the Swiggy Mafia not only contributes to economic growth but also shapes the future of India’s startup ecosystem.

Credits

This comprehensive report was made possible by the collaborative efforts of Chethan HS, Madona Ps, Nikshith Gowda, and Likith N at PrivateCircle.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.