Patni Financial Advisors (Patni Family Office), established by the Patni family in 2005 following the sale of Patni Computer Systems, has evolved into a multifaceted investment firm.

Operating as an NBFC (Non-Banking Financial Company), the firm focuses on investing across a broad spectrum of asset classes, including equity, debt, and real estate. The firm has a diversified approach, supporting businesses at various growth stages, including startups, growth-stage companies, and established enterprises.

This blog considers investments of these 11 funds and individuals: Currae Healthtech Fund, Patni Family Office, Raay Investments, Poorva Ashokkumar Patni, Arihant Patni, Vasundhara Apoorva Patni, Amitkumar Gajendrakumar Patni, Manu Patni, Ashokkumar S Patni, Shruti Arihant Patni, and Adeesh Patni.

Key Metrics:

- Portfolio’s Combined Revenue: ₹67,414 Cr

- Investment Range: ₹0.83 Cr – ₹72.05 Cr

- Total Number of Investments: 138

- Total Investments in FY24: ₹472.02 Cr

- Total Investments in FY25 YTD: ₹16.99 Cr

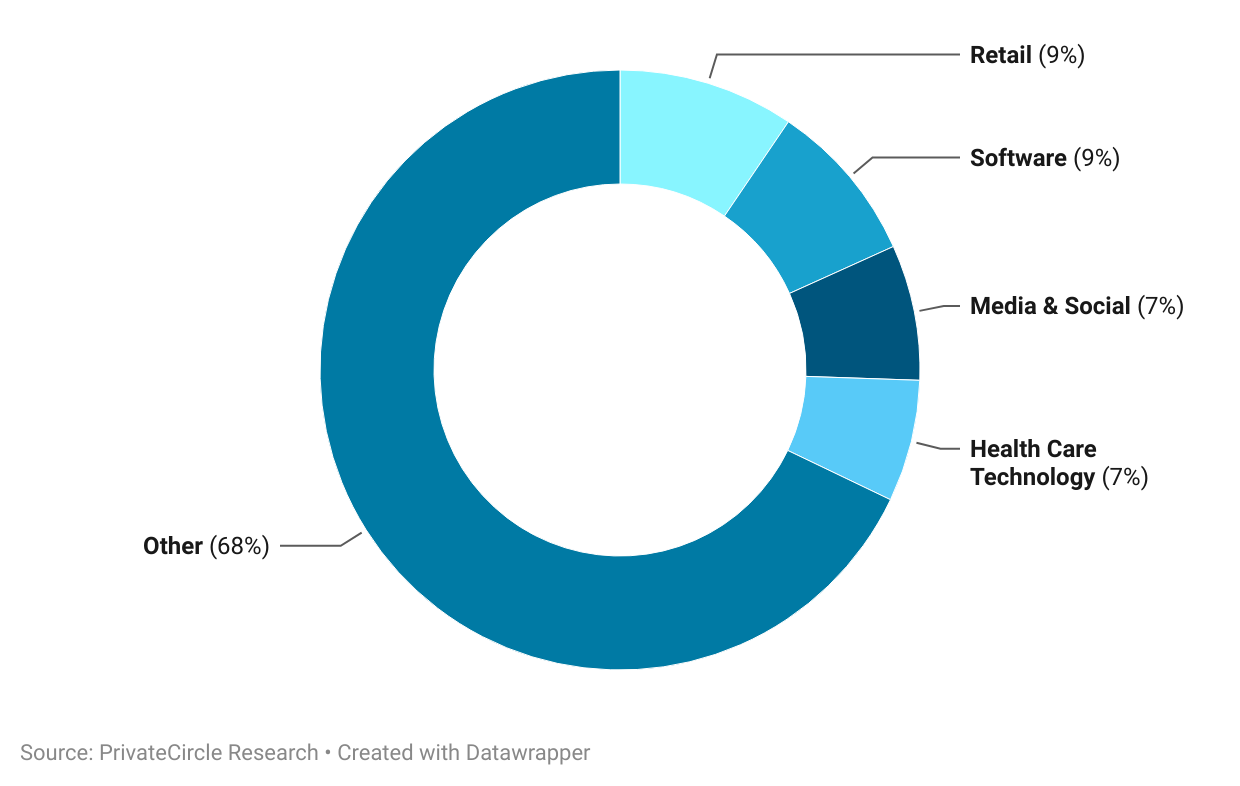

Patni Financial Advisors’ investment activities are distributed across several sectors, with notable preferences as follows; Retail at 9%, Software at 9%, Media & Social at 7%, Healthcare Technology at 7% and Others at 68%.

Highlights:

- Combined Revenue of Portfolio Companies

- Year-On-Year Investment

- Sector Investments

- Founders’ Alma Mater

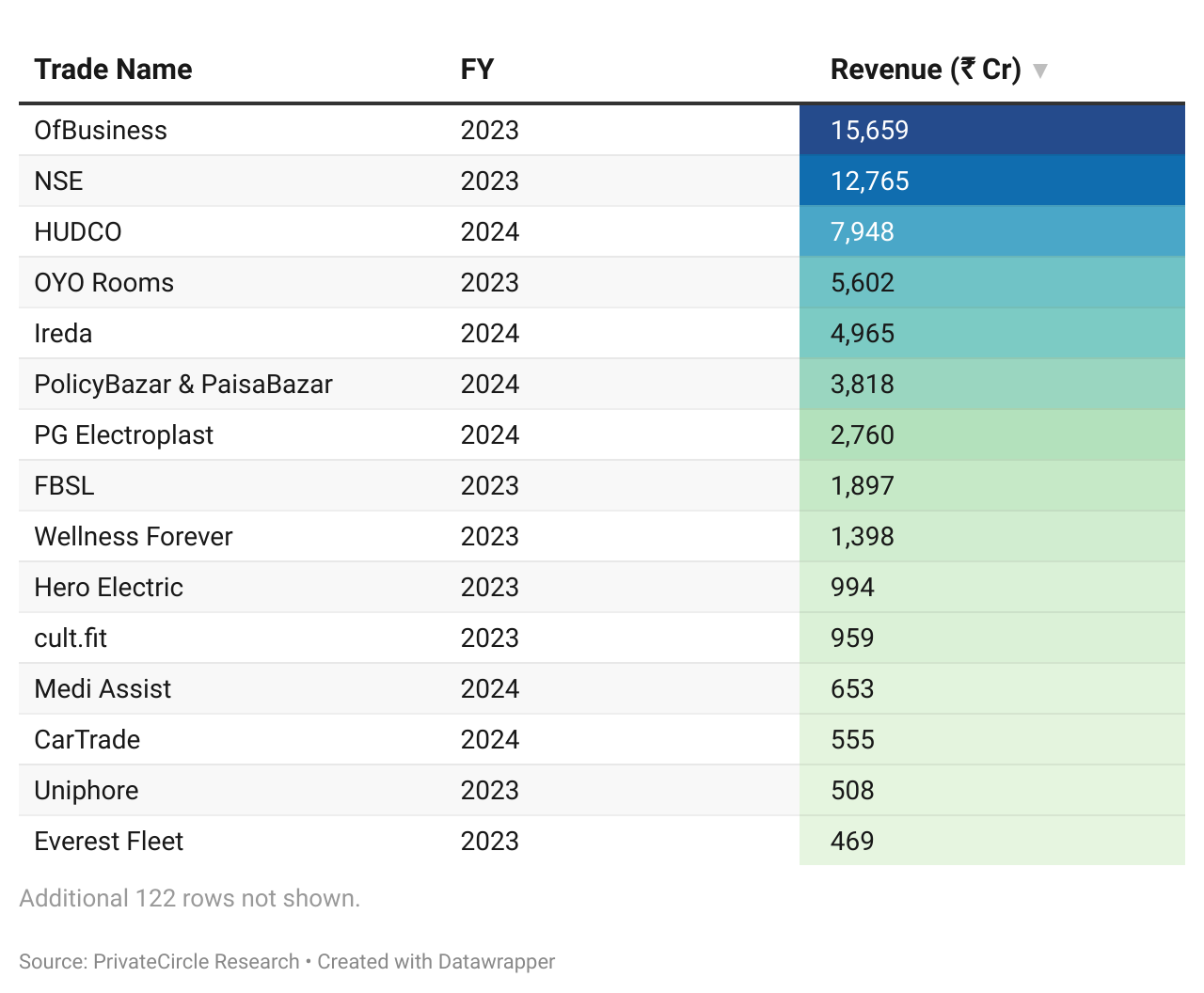

Combined Revenue of Portfolio Companies

Portfolio companies together clocked over ₹67,414 cr in revenue. OfBusiness, NSE and HUDCO were the top three contributors to this cumulative revenue.

Note: This includes 137 portfolio companies of Patni Family Office, tracked by PrivateCircle Research platform. We could not source data on Innovaccer Inc as it is registered outside India.

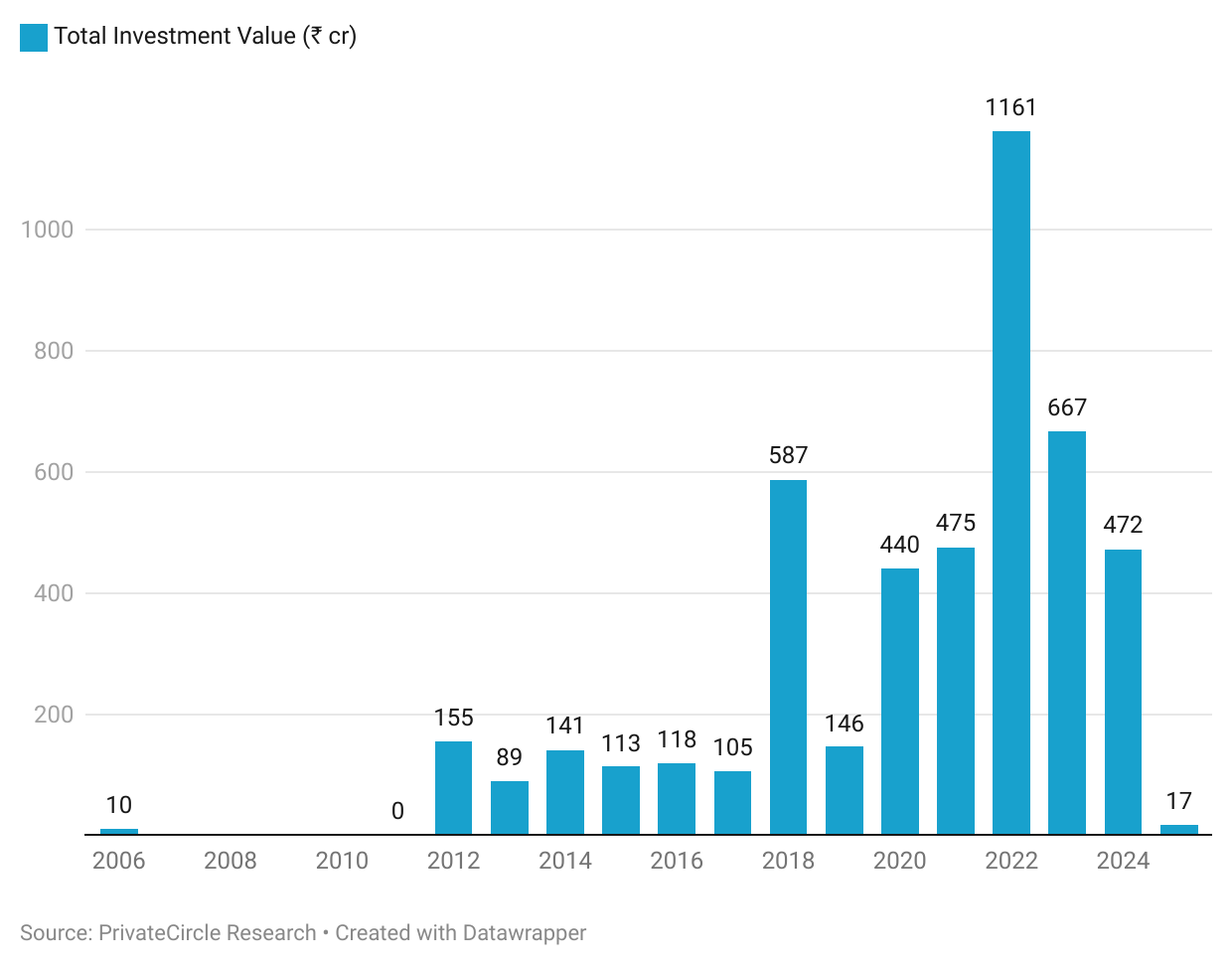

Year-On-Year Investment

The family office made an investment of ₹1,161 crores in 2022, highest ever in a single year.

Note: This includes 137 portfolio companies of Patni Family Office, tracked by PrivateCircle Research platform. We could not source data on Innovaccer Inc as it is registered outside India.

Sector Investments

About 9% of their portfolio includes Retail companies, followed by Software, Media & Social and Finance companies.

Click on the graph to access the responsive iframe. You can embed it or download the data or download the image.

Note: This includes 137 portfolio companies of Patni Family Office, tracked by PrivateCircle Research platform. We could not source data on Innovaccer Inc as it is registered outside India.

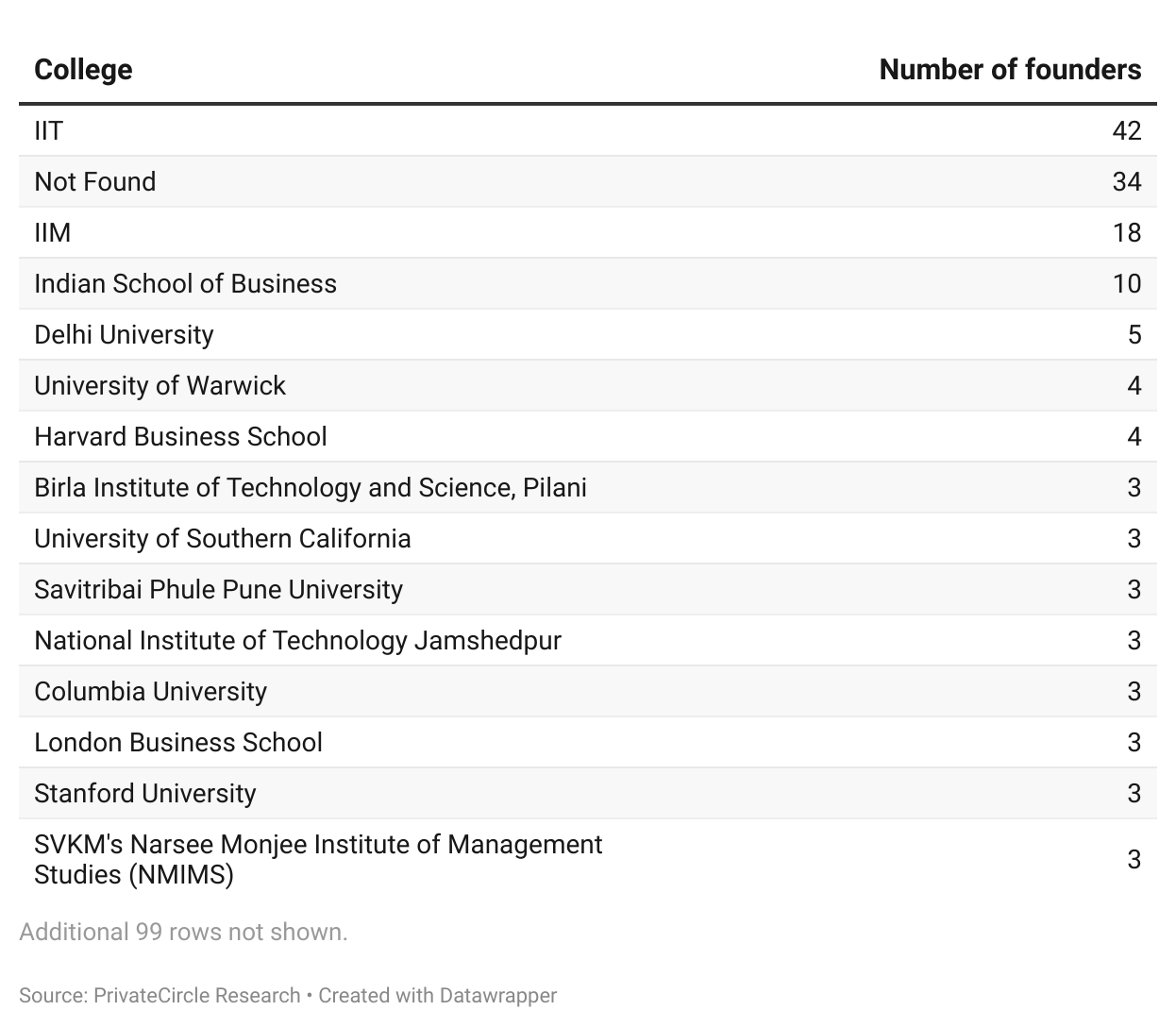

Founders’ Alma Mater

Over 15% (42) of portfolio founders are alma mater of IITs, followed by 18 from IIM and 10 from ISB.

Note: We have only considered the highest level of education for each founder. This includes 137 portfolio companies of Patni Family Office, as tracked by PrivateCircle Research platform. We could not source data on Innovaccer Inc as it is registered outside India.

Conclusion

Patni Financial Advisors (Patni Family Office) continues to be a dominant force in the investment landscape, with a well-diversified portfolio and a strategic approach to capital deployment.

Their substantial investments and focus on growth sectors highlight their commitment to fostering innovation and driving economic growth.

Data Curation by Ganesh Lokesh, Rakshitha R, Pratheek Kumar, Sridevi

Sign up on PrivateCircle Research for a free trial to access comprehensive data on 1.7 million Indian private unlisted companies across 500+ categories.

Speed up your research and analysis time from weeks to minutes and empower your investment journey today!

Follow us on social media for latest updates and insights from Indian Private Markets.