Some companies grow loudly. Others grow every single day for 75 years and quietly become part of every Indian household.

Parle Products Private Limited is one such company. It is one of India’s oldest and most recognized biscuit and confectionery manufacturers, with a legacy that dates back more than 75 years. Incorporated on 09 December 1950. Parle’s origins go back to pre-independence India, when the Chauhan family laid the foundation of what would later become India’s most recognized biscuit brand ecosystem.

From Parle-G to a wide confectionery portfolio, Parle has built not just brands, but distribution muscle, financial discipline, and operational depth that very few Indian FMCG players can replicate. And when we look at the actual MCA financials, something remarkable appears. This is not just a legacy brand. This is a financially elite, cash-rich FMCG machine.

More importantly, this conclusion is not coming from marketing narratives or brand stories.

Instead, it is coming from hard filings, MCA, balance sheet schedules, cash flow summaries, GSTN presence, and EPFO footprint.

What Parle Products Does (Products & Services)

Parle Products manufactures and sells:

- Biscuits (Parle-G, Marie, Monaco, Krackjack, Hide & Seek, etc.)

- Cookies & Crackers

- Confectionery (candies, toffees)

- Chocolates

- Dry bakery products

- Pretzels and snack variants

Over time, Parle has built a portfolio that caters to:

- Mass affordability (Parle-G)

- Premium snacking (Hide & Seek, Milano range)

- Every day, tea-time consumption (Marie, Monaco, Krackjack)

- Children’s confectionery, candy products, and more

Therefore, Parle is not a single-product company. It is a multi-category bakery and confectionery FMCG manufacturer with deep SKU penetration across price points.

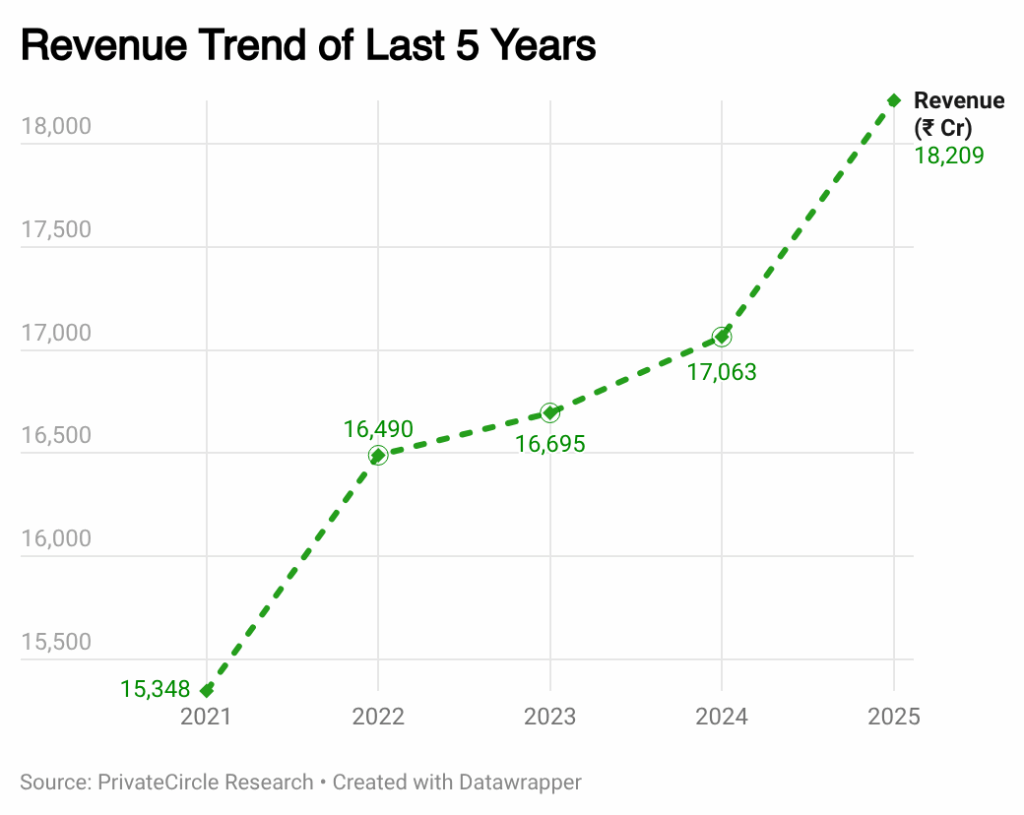

Revenue Trend of Last 5 Years: Stability Over Hype

This pattern typically appears only in companies with:

- Deep rural + urban distribution

- Repeat consumption of products

- Strong dealer network

- Stable pricing power

Therefore, Parle’s growth is not campaign-driven.

It is distribution-driven.

EBITDA & PAT Trend: The Real Story

| Year | EBITDA | PAT |

| 2021 | 2,045 | 1,380 |

| 2022 | 568 | 255 |

| 2023 | 1,490 | 902 |

| 2024 | 2,642 | 1,832 |

| 2025 | 1,822 | 1,182 |

Clearly, 2022 was an outlier year. However, what matters far more is what happens after a stressful year.

Parle demonstrates sharp recovery ability: From ₹255 Cr PAT → ₹1,832 Cr → ₹1,182 Cr

This indicates:

- Ability to pass costs to the market

- Tight cost control

- Strong operating leverage at scale

Balance Sheet Strength: Where Parle Becomes Extraordinary

| Metric (FY25) | Value |

| Net Worth (Reserves) | ₹9,642 Cr |

| Total Assets | ₹12,092 Cr |

| Cash & Bank | ₹1,002 Cr |

| Net Working Capital | ₹5,727 Cr |

Parle funds:

- Inventory

- Distribution

- Expansion

- Operations

Purely from internal accruals.

Cash Flow Story: Cash is King Here

| Year | CFO (₹ Cr) |

| 2021 | 1,204 |

| 2022 | 11 |

| 2023 | 782 |

| 2024 | 1,286 |

| 2025 | 917 |

Even when EBITDA fluctuates, operating cash remains solid. Therefore, profits convert into cash.

This is a critical sign of:

- Real demand

- Real collections

- Real working capital discipline

Competitive Positioning vs Listed Giants

Revenue near ₹18,000 Cr places Parle alongside:

- Nestlé India

- Britannia

- Tata Consumer

- Dabur

However, Parle achieves this scale privately. Which implies: Listed-grade scale. Private-grade discipline.

Conclusion: Why Parle is a Financial Masterclass

Parle teaches:

- Longevity builds financial strength

- Distribution creates predictable growth

- Cash flow matters more than optics

- Zero debt creates resilience

- Compliance footprint reveals true scale

This entire financial intelligence view is possible only because of PrivateCircle’s deep data stitching across MCA and financial filings.