The week clearly belonged to the fintech sector with a significant volume and one more addition to the unicorn club. As is usual we will cover the unicorn and large deals before we get to these deals.

Deals above 100 cr.

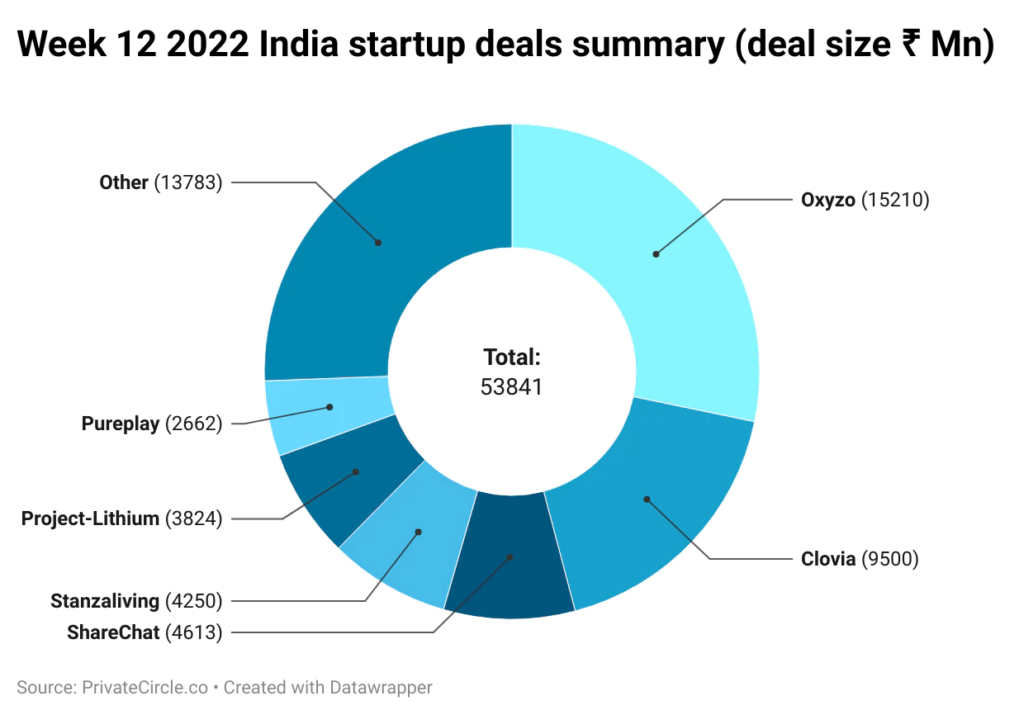

- Oxyzo Financial Services raised 1521 cr Series A round and enters unicorn club, the round was led by Alpha Wave and co-led by Tiger Global, Norwest Venture Partners, Matrix Partners and Creation Investments.

- Reliance Retail acquired undergarment brand Clovia for 950 cr strengthening its segment along with the previous acquisitions including Zivame, and Amante.

- Sharechat raised another 461 cr from Times Internet in its ongoing Series G.

- Stanza Living raised a 425 cr debt financing from Kotak Mahindra Bank, RBL Bank & Alteria Capital.

- Personal care brand Plum raised 270 cr in its Series C from A91 partners and participation from existing investors.

- BYJUs allotted shares for its Austria based GeoGebra and Bangalore based Hello English acquisitions to take the transactions to closure. Also in the edu tech sector we saw Leverage Edu raise 167 cr in Series B round from a bunch of funds, family offices, HNI, and existing backers to develop its full stack international student/career services.

- EverSource Capital took a majority stake in EV operator Lithium with a 380 cr investment, and existing investors IFC, and Lightrock exit.

- Dental tech startup Toothsi raised 100 cr in a funding round led by IIFL and Mahendra Chunilal Shah, in what could be an ongoing round with further money coming in.

Fintech deals

- Largest of the deal was in Berar Finance which raised has raised 100 cr from Denmark-based private equity fund Maj Invest to further diversify beyond 2 wheeler financing to other hot areas like SME small ticket financing.

- Also in the micro loans sector, Aye Finance raised 75 cr debt from Triple Jump and Northern Arc

- Rupifi raised venture debt of around Rs 61 crore from Alteria Capital, Trifecta Capital and Innoven Capital.

- Fintech Startup Credilio Raised a 30 cr in a pre-Series A round to strengthen its product portfolio.

- Aka debt powering more debt distribution. We also saw Axis and Kotak Mahindra Bank invest in Open Network for Digital Commerce.

In other tech deals

- Aquaconnect, the tech-driven aquaculture focused startup, raised 60 crore in venture debt from Trifecta Capital.

- IndiaMART, continued its SaaS shopping spree with around 46 cr invested into Livekeeping that digital integrates with on-premise accounting software for mobile apps and other use cases.

- Healthtech platform FutureCure Health racked up a Series A of 30 cr from Kotak Investment Advisors Limited (KIAL), Unicorn India Ventures and RVCF India Growth Fund, among others to build its tech and global footprint.

- Skillbee raised a 24 cr funding to scale its jobs platform for migrant workers.

- Edtech startup LectureNotes raised further 20 cr funding to scale its content personalisation infra ‘LectureRooms’.

- Fertility/materitiy startup Janani raised 16 cr from Y Combinator, Olive Tree Capital & others.

- Kids apparel brand Cub McPaws raised 16 cr in Pre Series A round led by Facebook, Google executives.

There were 4 SME IPOs during the week, starting with PropEquity (31 cr) and Empyrean Cashews (19 cr) and 2 companies in the healthcare side including Evoq remedies and Achyut healthcare raising money through smaller IPOs.

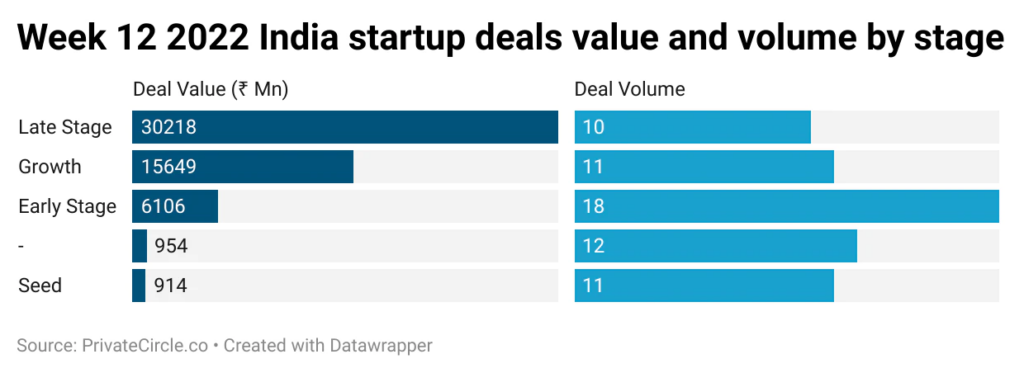

The deal volumes were predominantly Early Stage/seed stage (29 out of 62 deals). We also noted that 6 venture debt deals across diverse sectors, while VC and strategic investors dominated during the week.

We will come back with more deals next week. As the fiscal year draws to a close it is time to refresh our state of startup funding report, await further details on this.