In the dynamic landscape of startup funding, February 2024 emerges as a month of remarkable growth and activity.

Let’s dive into the full report covering;

- Startup Funding Deal Volume,

- Startup Funding by Value,

- Top 3 Deals,

- Top Investors,

- Investor Type, and

- Citywise Funding Raised.

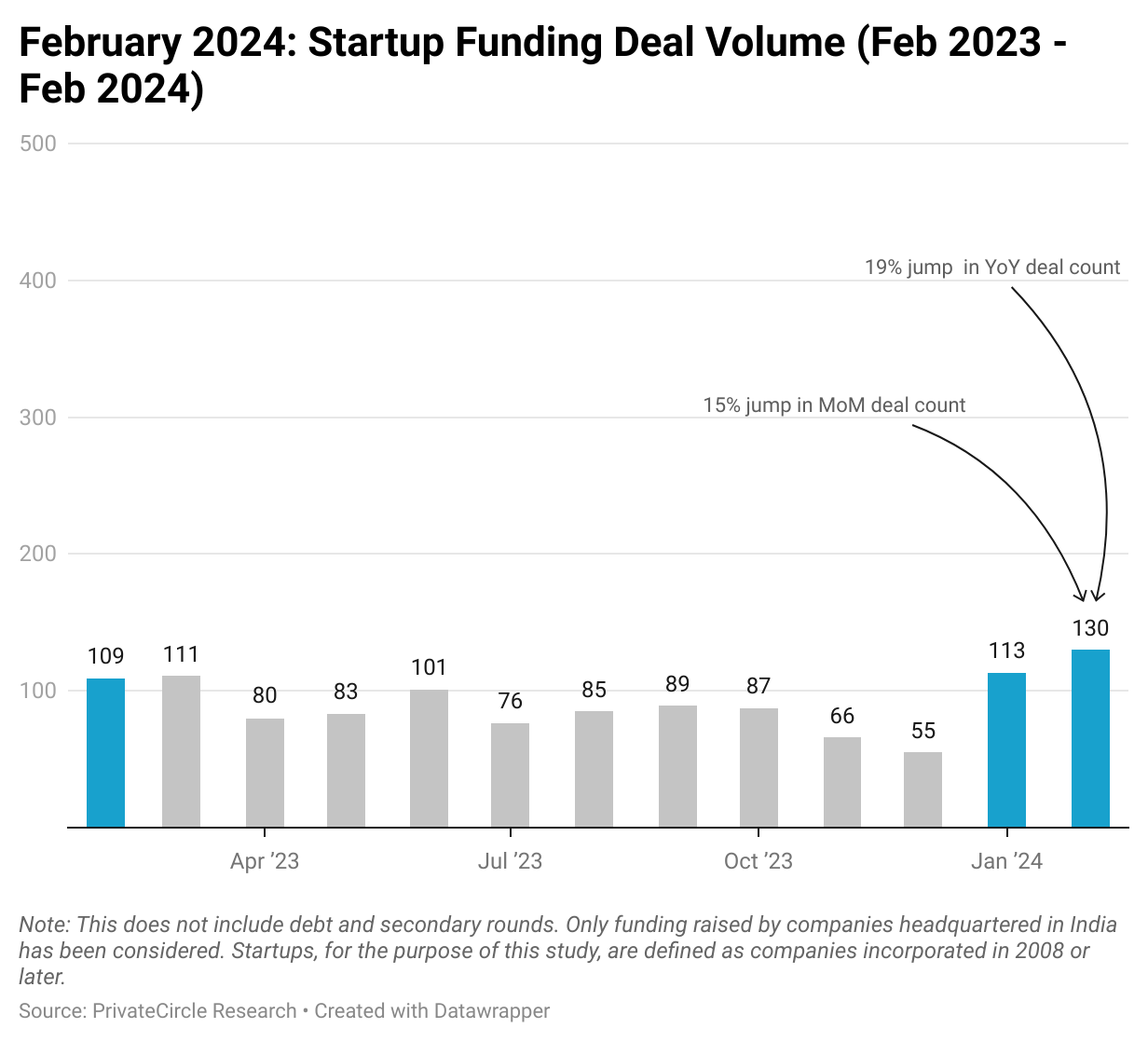

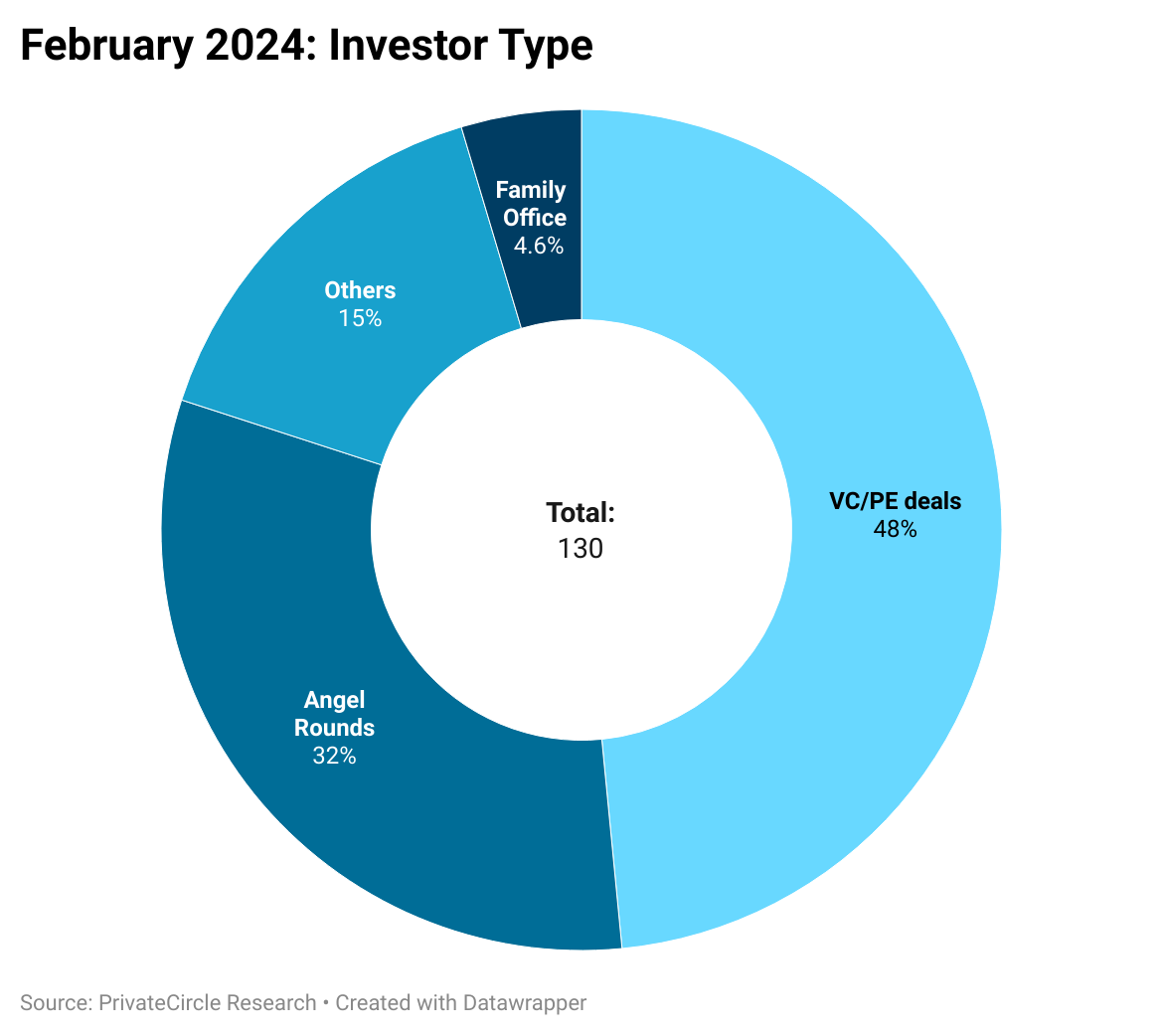

A total of 130 funding deals were closed during the month, reflecting a 15% increase as compared to Jan 2024 and 19% over Feb 2023.

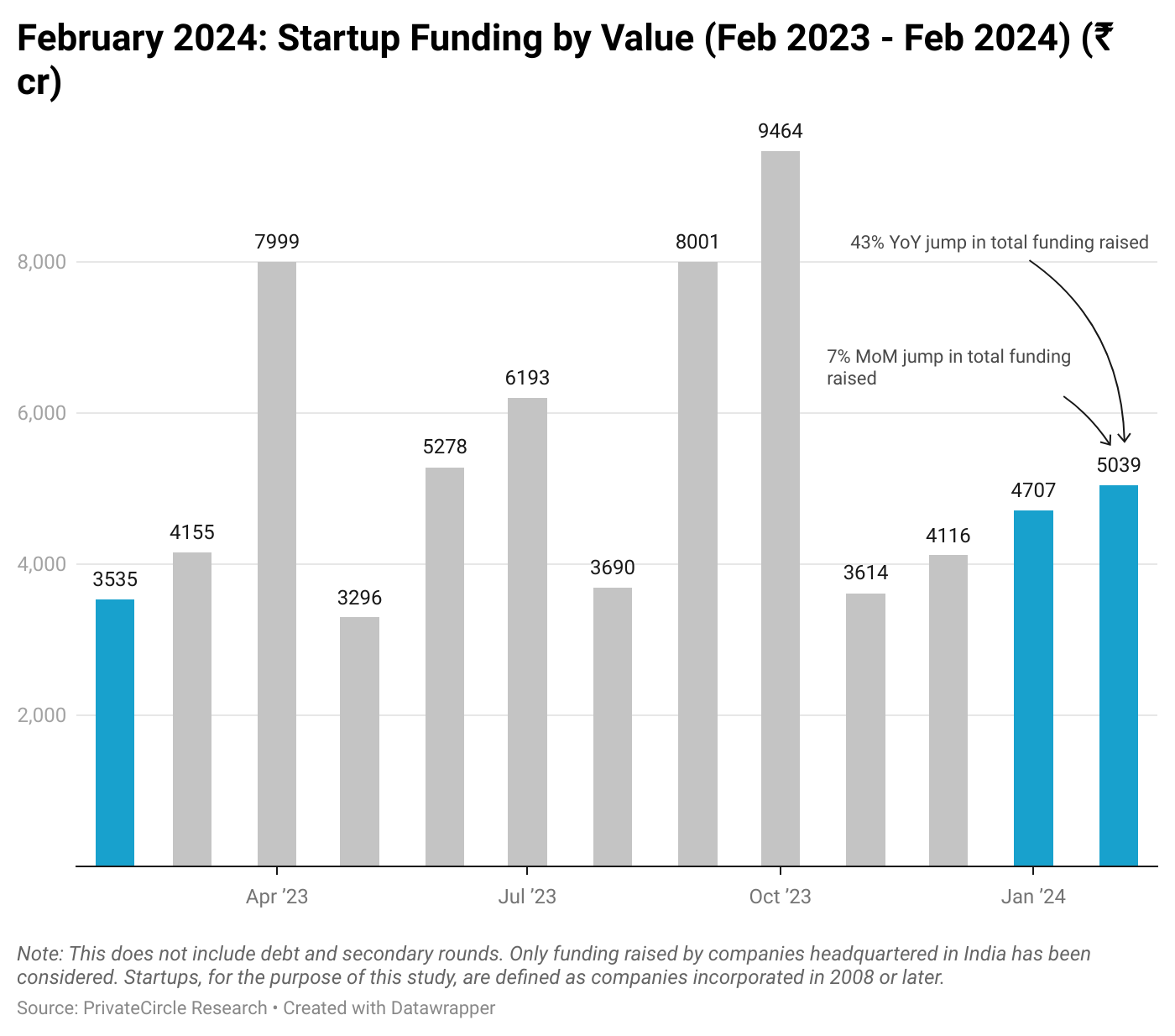

Total funding in February 2024 soared to an impressive ₹5039 crore, reflecting a slight jump of 7% in Feb 2024 as compared to previous month and a significant 43% jump over February last year.

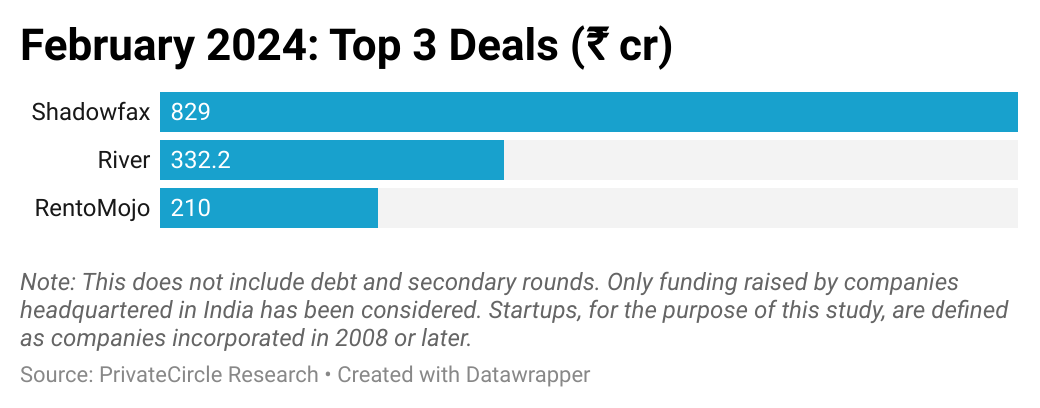

Bengaluru-based Shadowfax raised ₹829 cr ($100 mn) Series E round from Qualcomm Ventures, Flipkart and others.

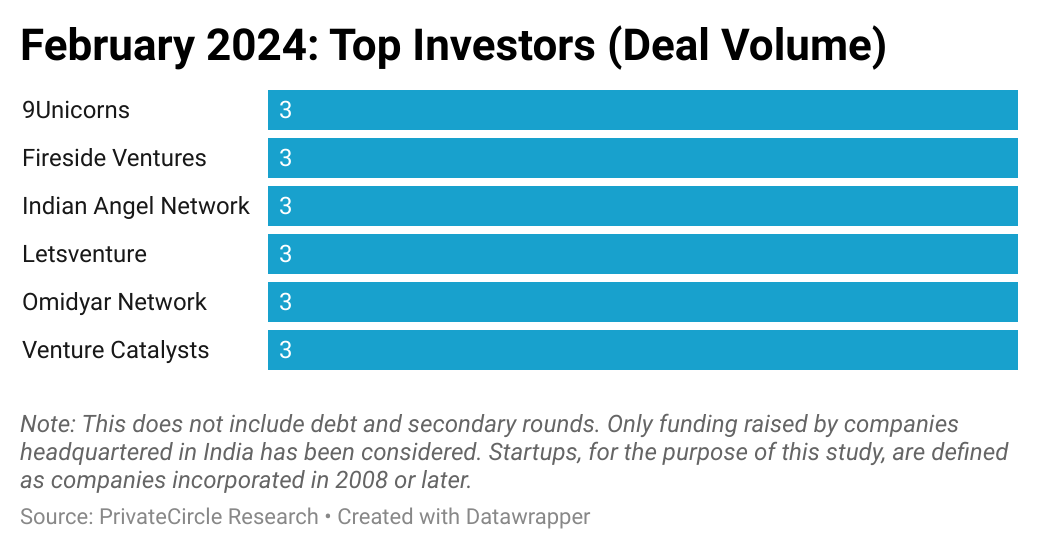

Notable investors such as 9Unicorns, Fireside Ventures, Indian Angel Network, Letsventure, and Omidyar Network emerged as the most active players, each participating in three funding rounds.

VC/PE firms led the majority of funding rounds at 48%, followed by angel investors at 32%, and family offices at 5%.

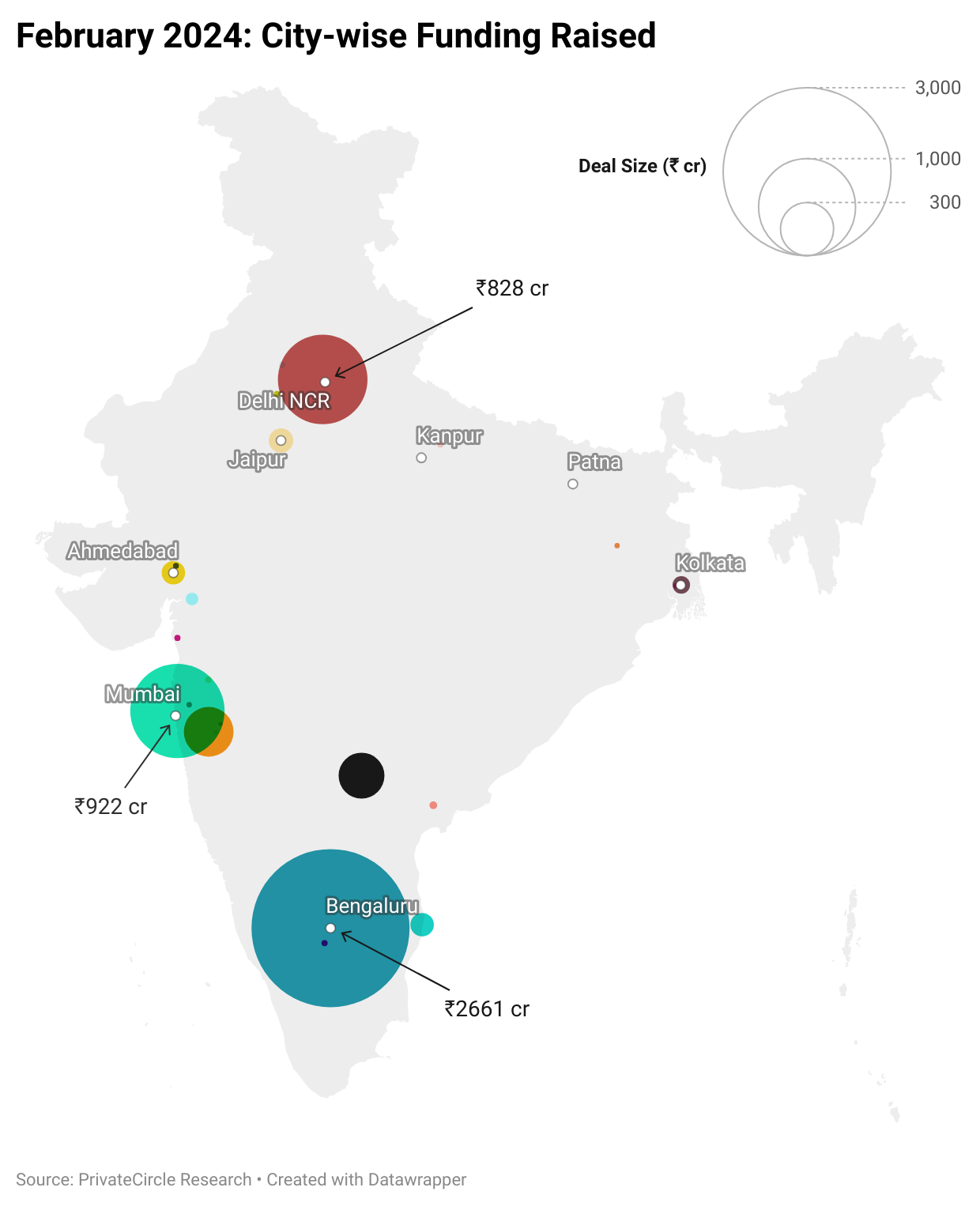

Bengaluru emerged as the epicenter of startup funding activity, with startups from the city raising 53% of the total funding. Mumbai and Delhi NCR also featured prominently among the top cities by the total value of funding raised.

We deep dove into the city-wise startup funding so much so that it is turning out to be a report of its own, watch out for the report coming soon.

Conclusion

February 2024 showcases a thriving ecosystem of startup funding in India, marked by significant investments, diverse investor participation, and a concentration of activity in key cities.

As the startup landscape continues to evolve, these trends offer valuable insights for entrepreneurs, investors, and stakeholders navigating the dynamic world of innovation and entrepreneurship.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.