If you’ve been scrolling through social media looking for honest, science-backed skincare, chances are you’ve come across Minimalist.

The brand that made “Transparency in Skincare” its core philosophy has done more than just clean up our skincare routines – it has made waves in India’s personal care industry.

With a strong D2C + retail strategy and a commitment to affordable, effective formulations, Minimalist’s FY24 financials tell a fascinating story. Let’s break it down.

About Minimalist

Uprising Science Private Limited operates under the brand name Minimalist. At Minimalist, they create clean, easy-to-understand, and affordable skincare for all.

The firm offers 20+ products including serums, toners, face acids, and moisturizers, all made in its factories.

Revenue & Profitability

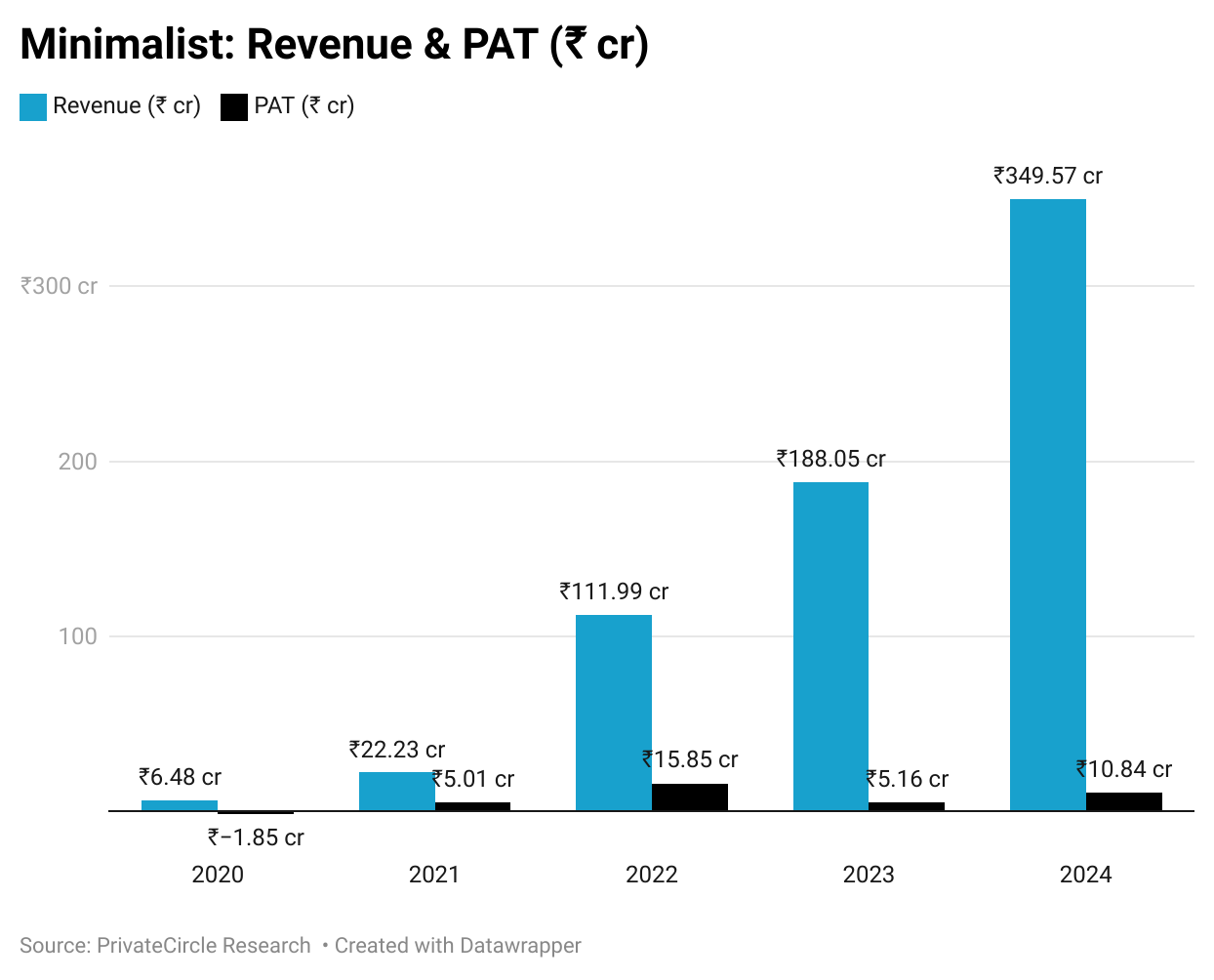

Minimalist’s revenue has grown exponentially from ₹6.48 Cr in 2020 to ₹349.57 Cr in 2024, but profitability remains modest, with PAT fluctuating and reaching ₹10.84 Cr in 2024.

Despite rapid expansion, profit margins appear constrained, suggesting high reinvestment or operational costs.

What’s driving this growth?

- Expanding offline presence in key metros & tier-2 cities.

- A loyal D2C customer base built on trust and results.

- Smart pricing – competing with international brands, but at a fraction of the price.

Breaking Down the Numbers

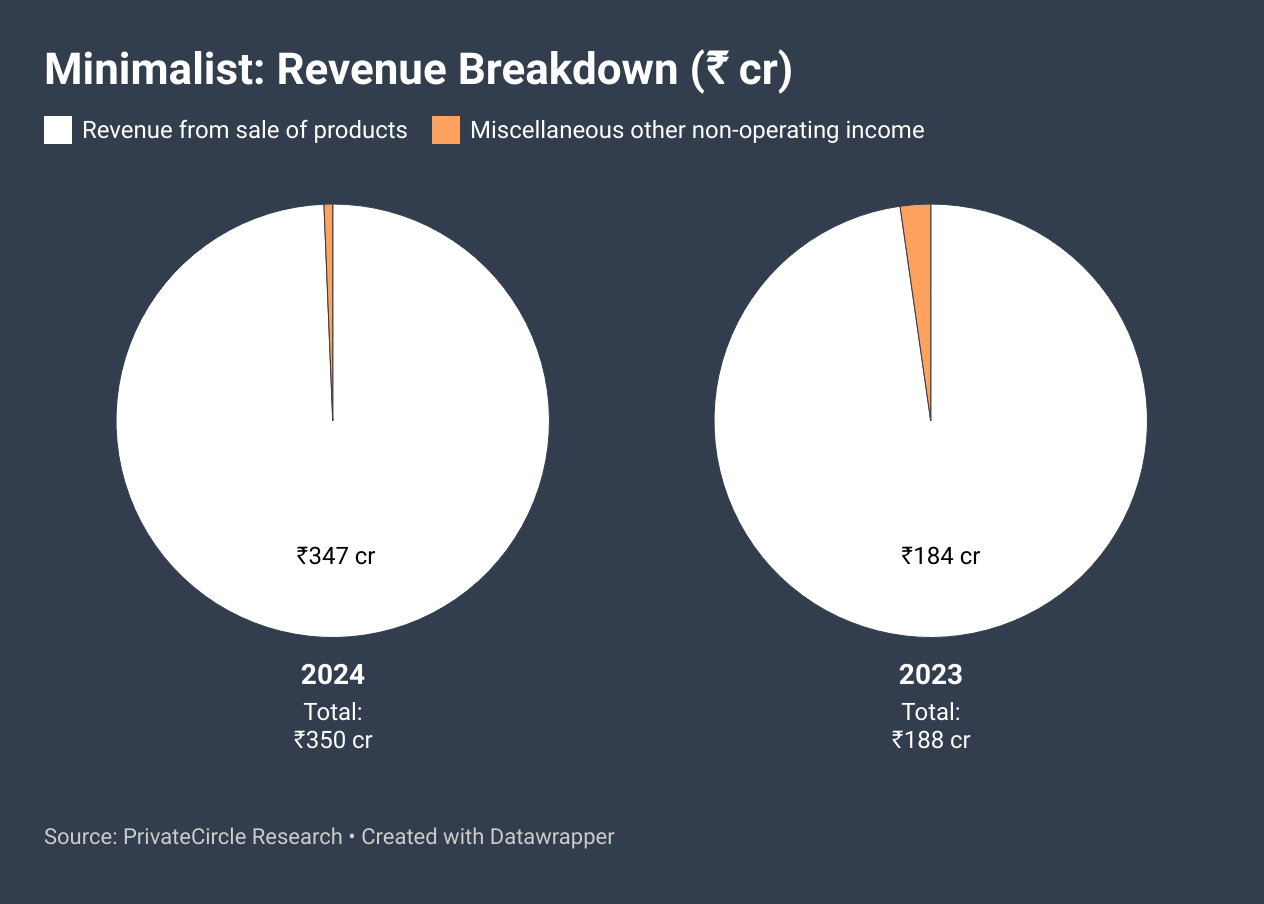

Minimalist’s revenue nearly doubled from ₹188 Cr in 2023 to ₹350 Cr in 2024, with the vast majority coming from the sale of services.

Non-operating income remains minimal, indicating the company’s growth is primarily driven by core business activities.

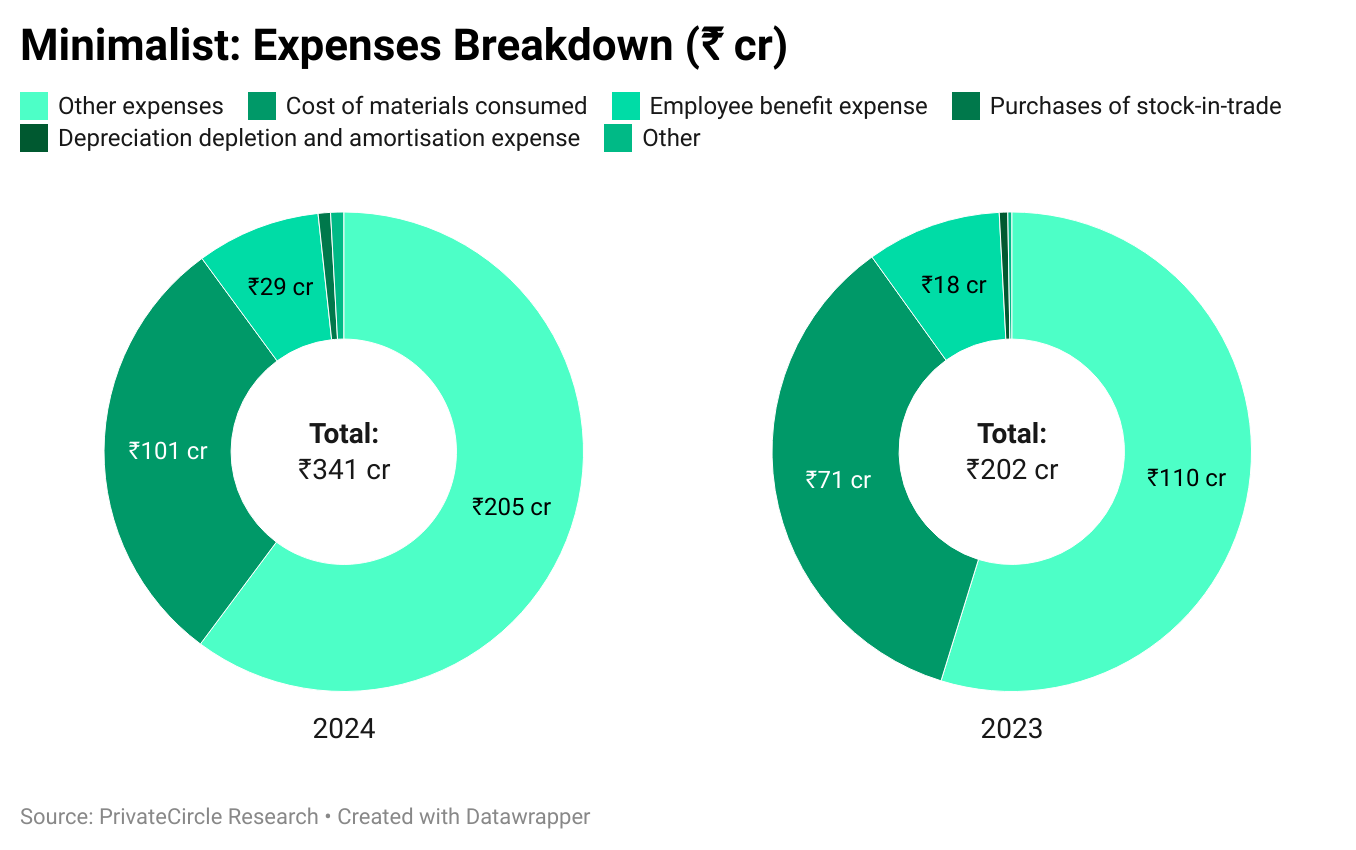

Minimalist’s total expenses surged from ₹202 Cr in 2023 to ₹341 Cr in 2024, with the biggest cost increase seen in “Other expenses” (₹110 Cr to ₹205 Cr) and “Purchases of stock-in-trade” (₹71 Cr to ₹101 Cr).

Going deeper, we find that Minimalist spent ₹117 Cr out of ₹202 Cr of other expenses on advertising.

If brands like Mamaearth and The Ordinary showed India the power of ingredient-led skincare, Minimalist perfected the “high-efficacy, low-price” game.

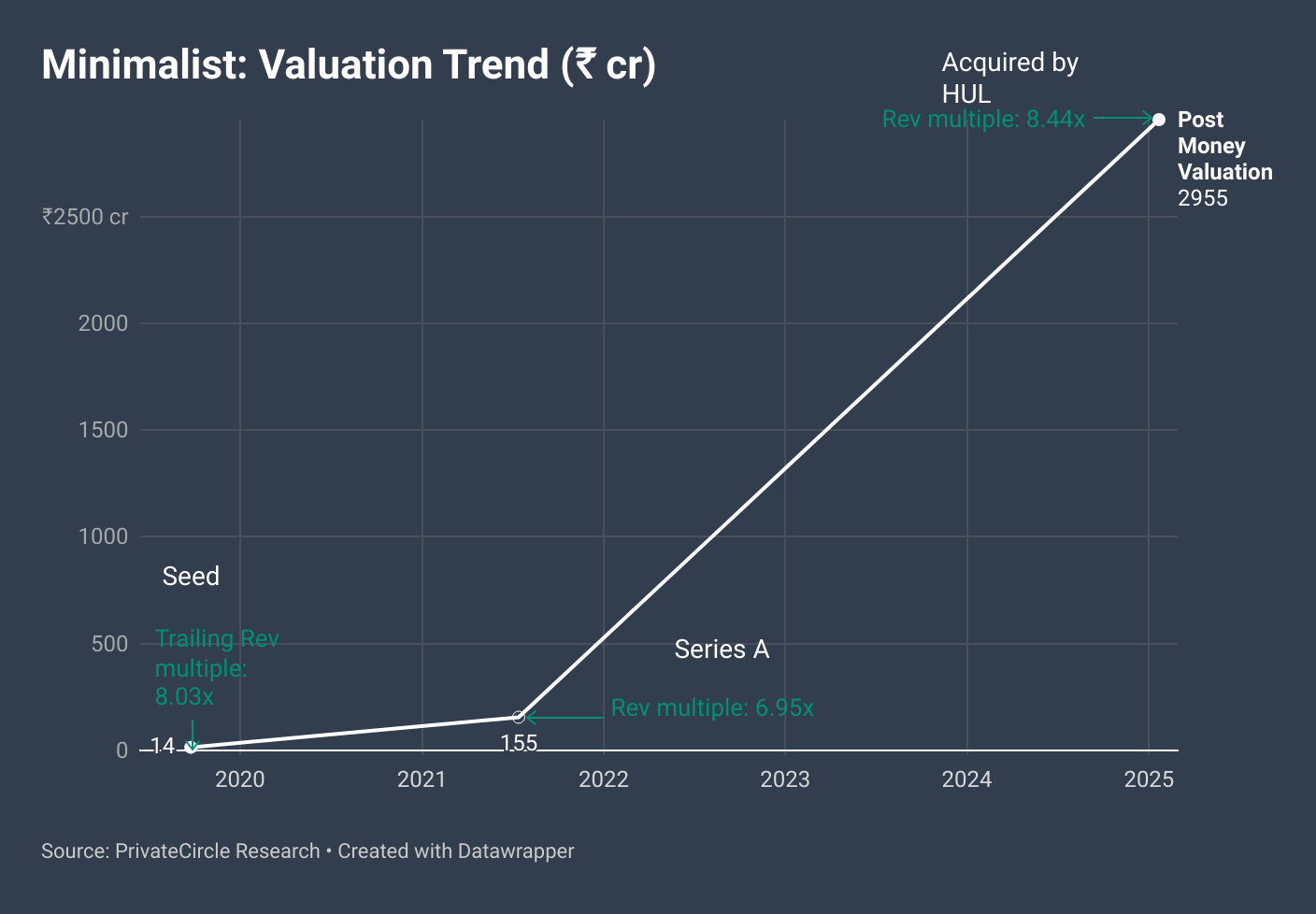

Funding & Valuation

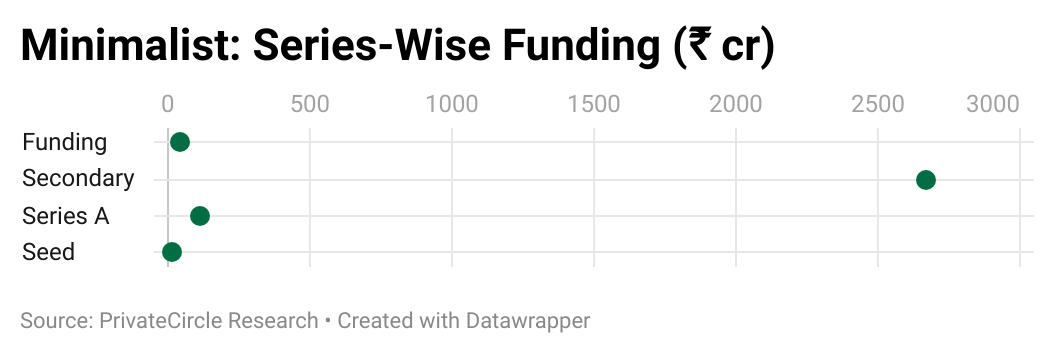

Minimalist’s funding journey shows significant growth on just ₹169 Cr in primary funding, starting with ₹14.3 Cr in Seed (2019) and ₹110.017 Cr in Series A (2021).

The latest rounds include a ₹2670 Cr secondary deal (Jan 2025) and ₹45 Cr funding, which is part of the company’s acquisition by HUL.

Minimalist’s post-money valuation has seen exponential growth from ₹14 Cr in Seed (2019) to ₹155 Cr in Series A (2021).

The latest acquisition deal (2025) has valued the company at ₹2950 Cr, showcasing massive investor confidence and expansion.

With international expansion likely on the horizon, Minimalist could soon challenge premium global brands in affordability + science-driven formulations.

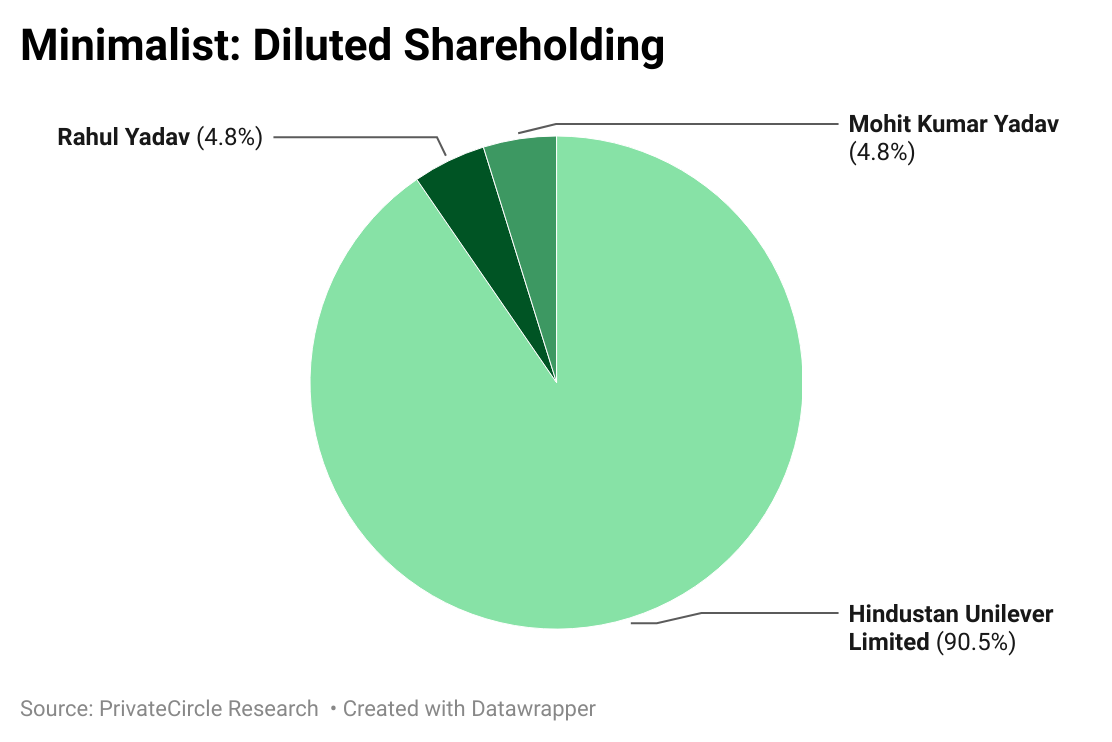

Diluted Shareholding

Hindustan Unilever Limited has acquired a dominant 90.5% stake in Minimalist, whereas Founders Rahul Yadav and Mohit Kumar Yadav each retain a 4.8% individual ownership, which will be acquired within two years.

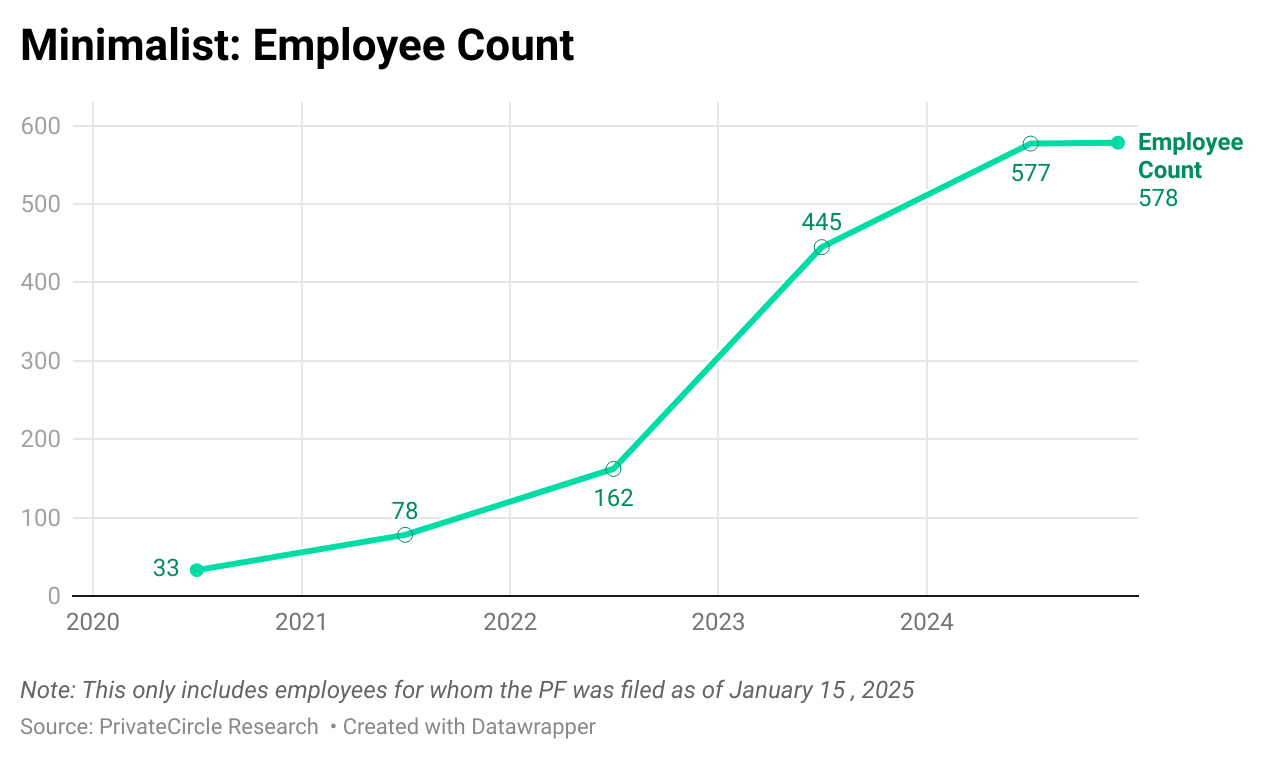

Workforce Growth

Minimalist’s employee count has grown steadily from 33 in 2020 to 578 by December 2024, reflecting rapid expansion.

The biggest jumps occurred between 2022 (162 employees) and 2023 (445 employees), indicating a major scaling phase.

What’s Next for Minimalist?

1. Global Expansion – Could we see Minimalist in UAE, SEA, or even the US?

2. Offline Retail Dominance – More partnerships with retailers like Nykaa and Health & Glow?

3. Innovation in Skincare – Expect new formulations and even hair care or body care expansions.

For now, Minimalist has cemented itself as a skincare powerhouse – affordable, effective, and transparent.

Curious how we uncover in-depth company insights in just minutes? Try it yourself on PrivateCircle Research – privatecircle.co/research.

Start your FREE trial/demo today and unlock reliable data, intelligence, and insights on 3M+ private companies across 500+ data categories. Make informed decisions with confidence.

Stay ahead with expert analysis – follow us for the latest updates on India’s private markets.

Explore More Historical Performance Summary Reports:

Mokobara’s Journey: From Startup to Standout in the Luggage & Gear Industry