The startup ecosystem shaped by former Ixigo employees has fostered the emergence of several notable companies, collectively known as the “Ixigo Mafia.”

This report provides a comprehensive analysis of these startups, covering their valuations, industry distribution, workforce contributions, investment patterns, and strategic developments.

Highlights of the Ixigo Mafia 2024

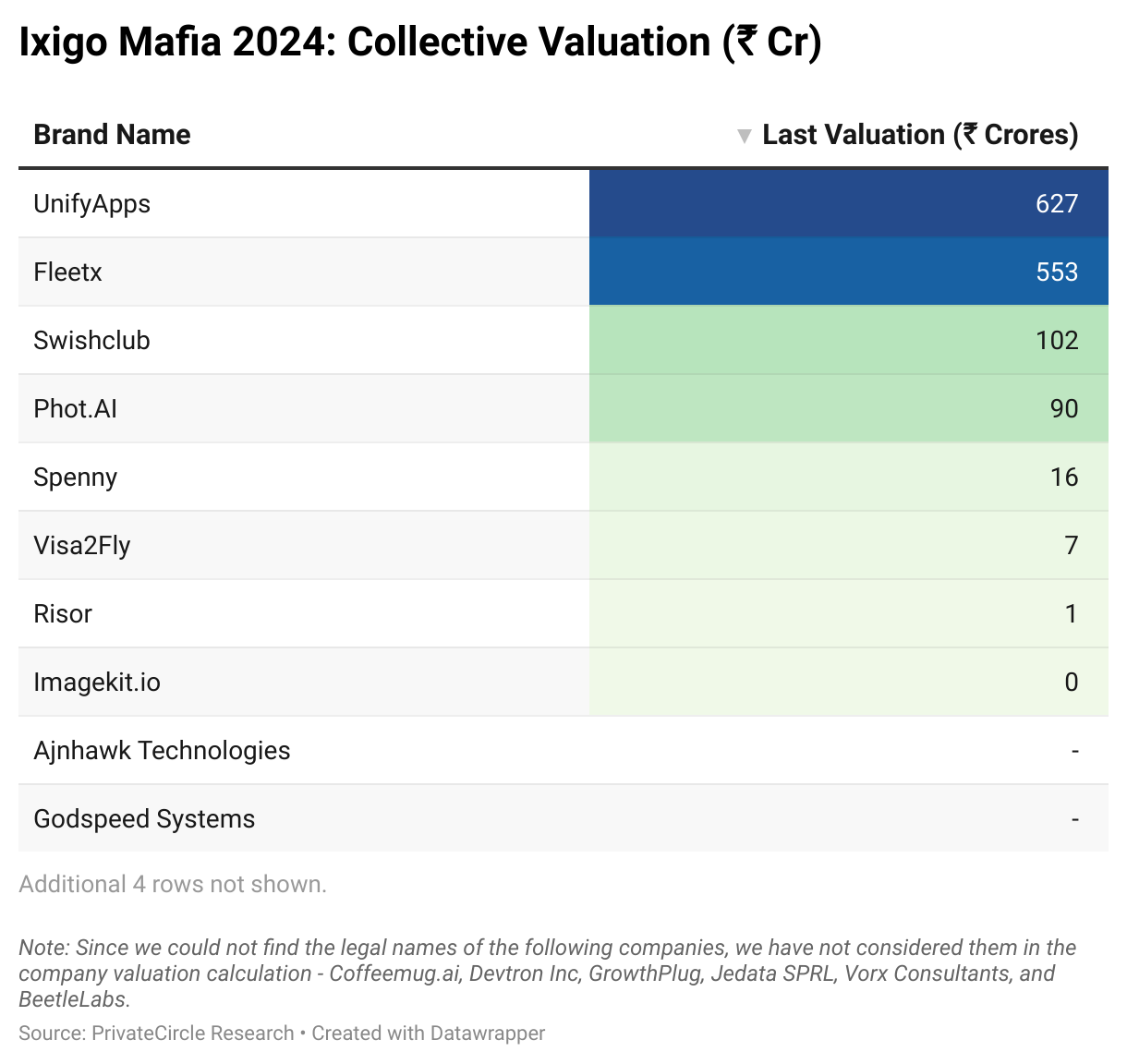

- The total valuation of Ixigo Mafia startups has reached ₹1,394.30 crore.

- UnifyApps, Fleetx, and Swishclub rank among the most highly valued companies.

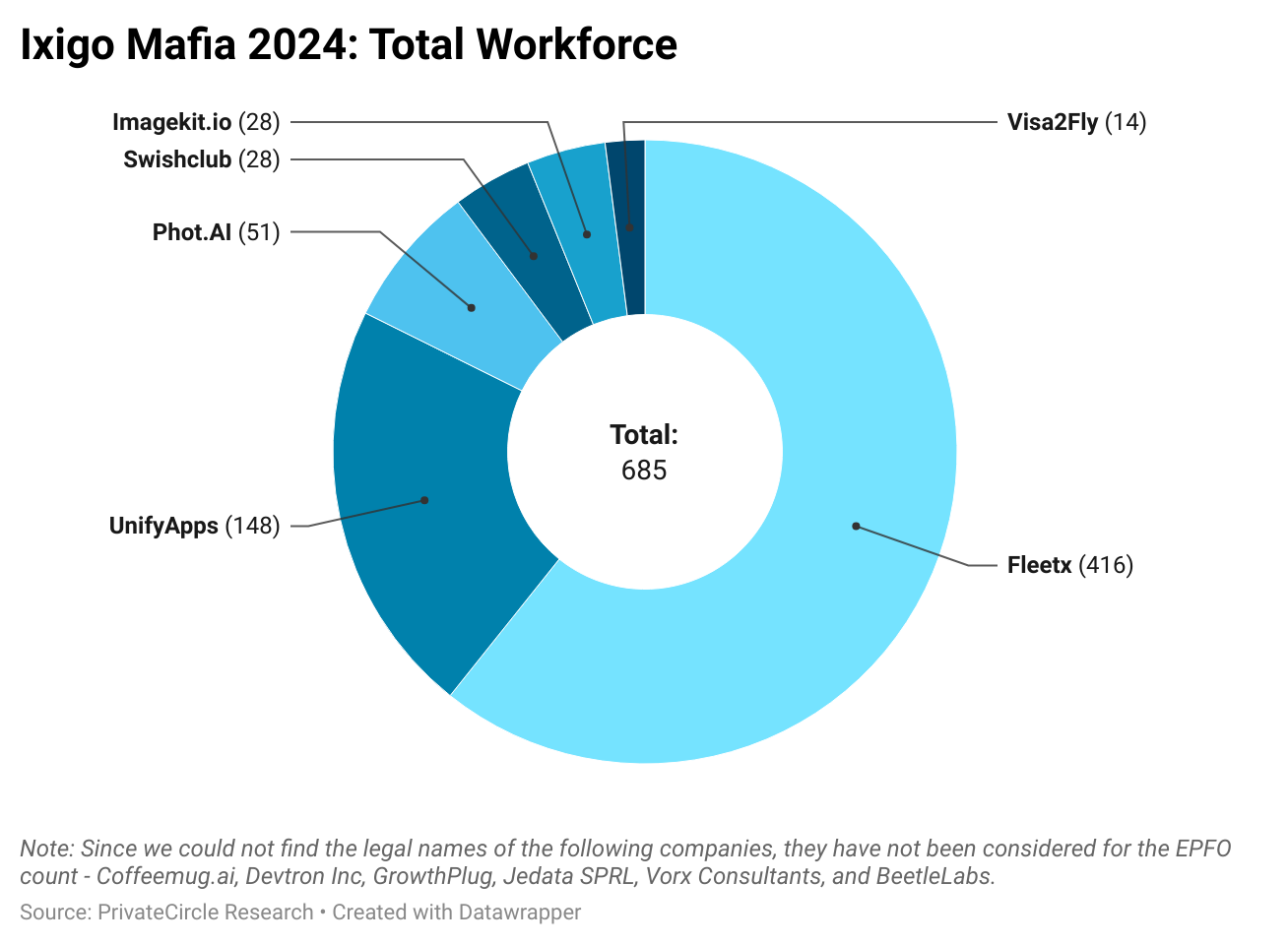

- The collective workforce of these startups stands at 685 employees, with three companies accounting for 615 of these roles.

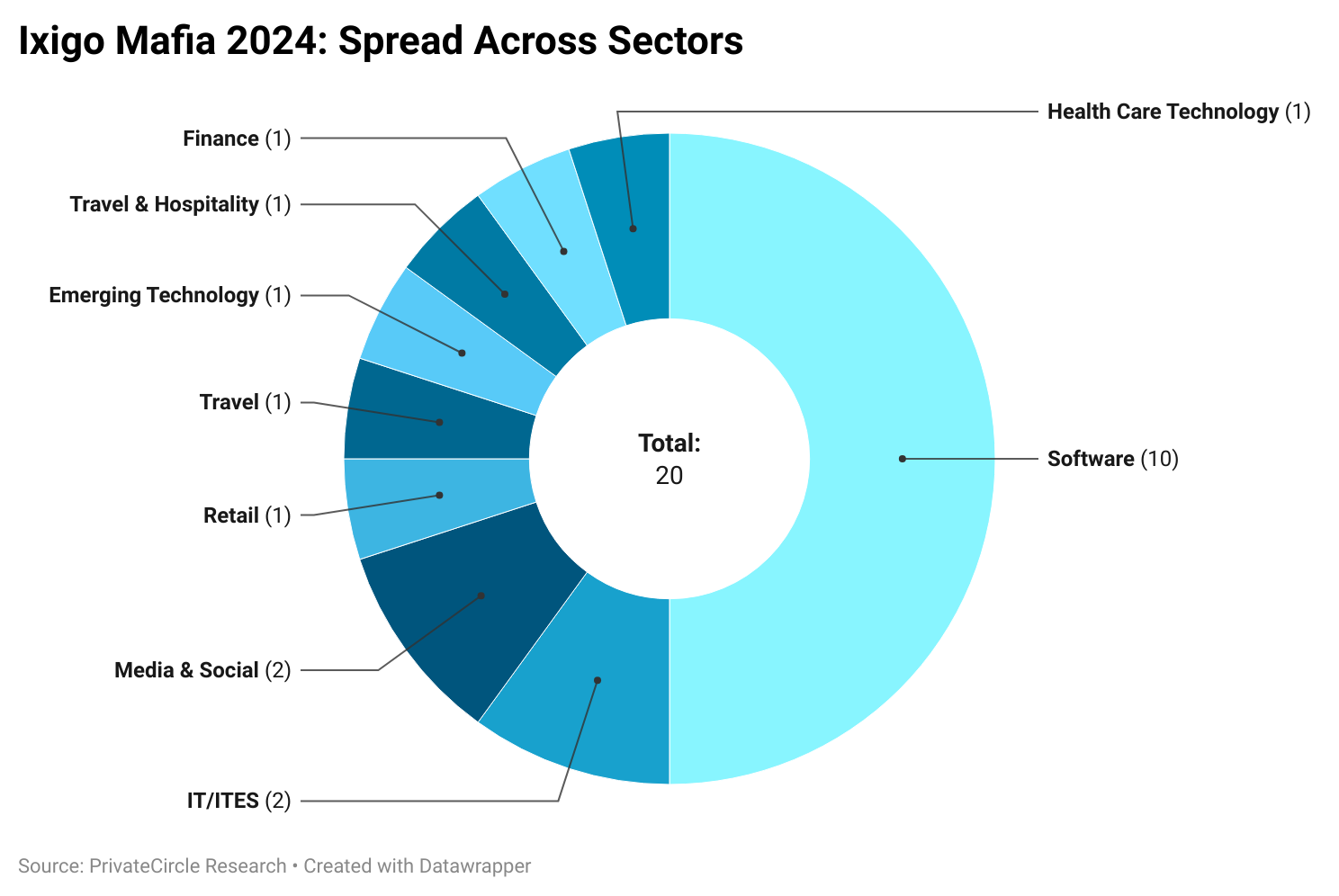

- 50% of startups are concentrated in the software sector, while others span retail, travel, IT/ITES, emerging technology, and hospitality.

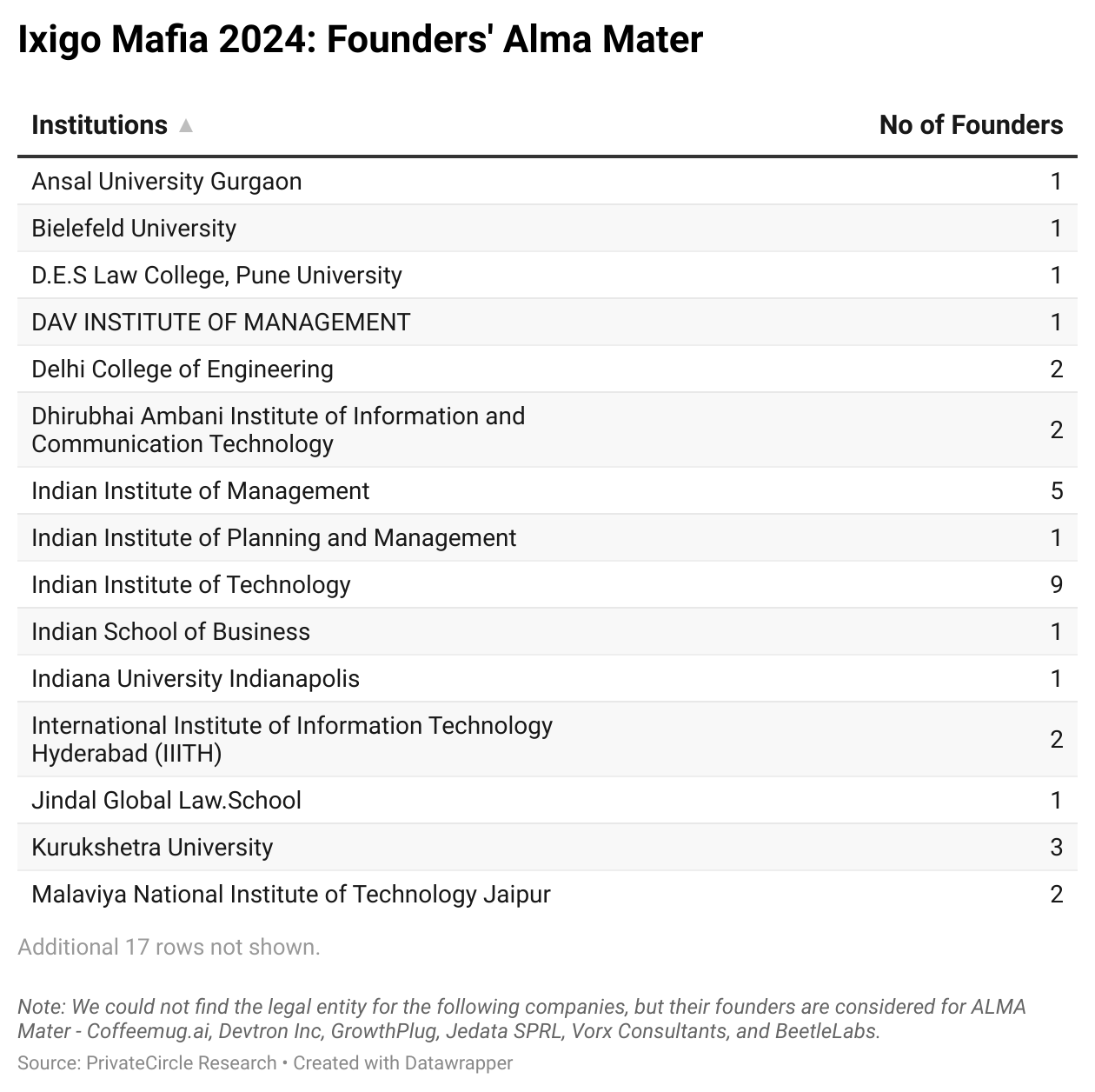

- Founders originate from IITs, IIMs, and Kurukshetra University, among other prestigious institutions.

- Investment trends reveal selective but high-impact funding, with strategic investments playing a crucial role in scaling operations.

Blog Outline | Data and Insights by PrivateCircle Research

- Collective Valuation (₹ Cr)

- Number of Startups Launched

- Spread Across Sectors

- Total Workforce

- Job Creation & Economic Impact

- Investor Activity & Funding Dynamics

- Strategic Investments

- Conclusion

As of February 10, 2025, the total valuation of Ixigo Mafia companies stands at ₹1,394.30 crores. Among them, UnifyApps, Fleetx, and Swishclub are among the highest-valued companies on the list.

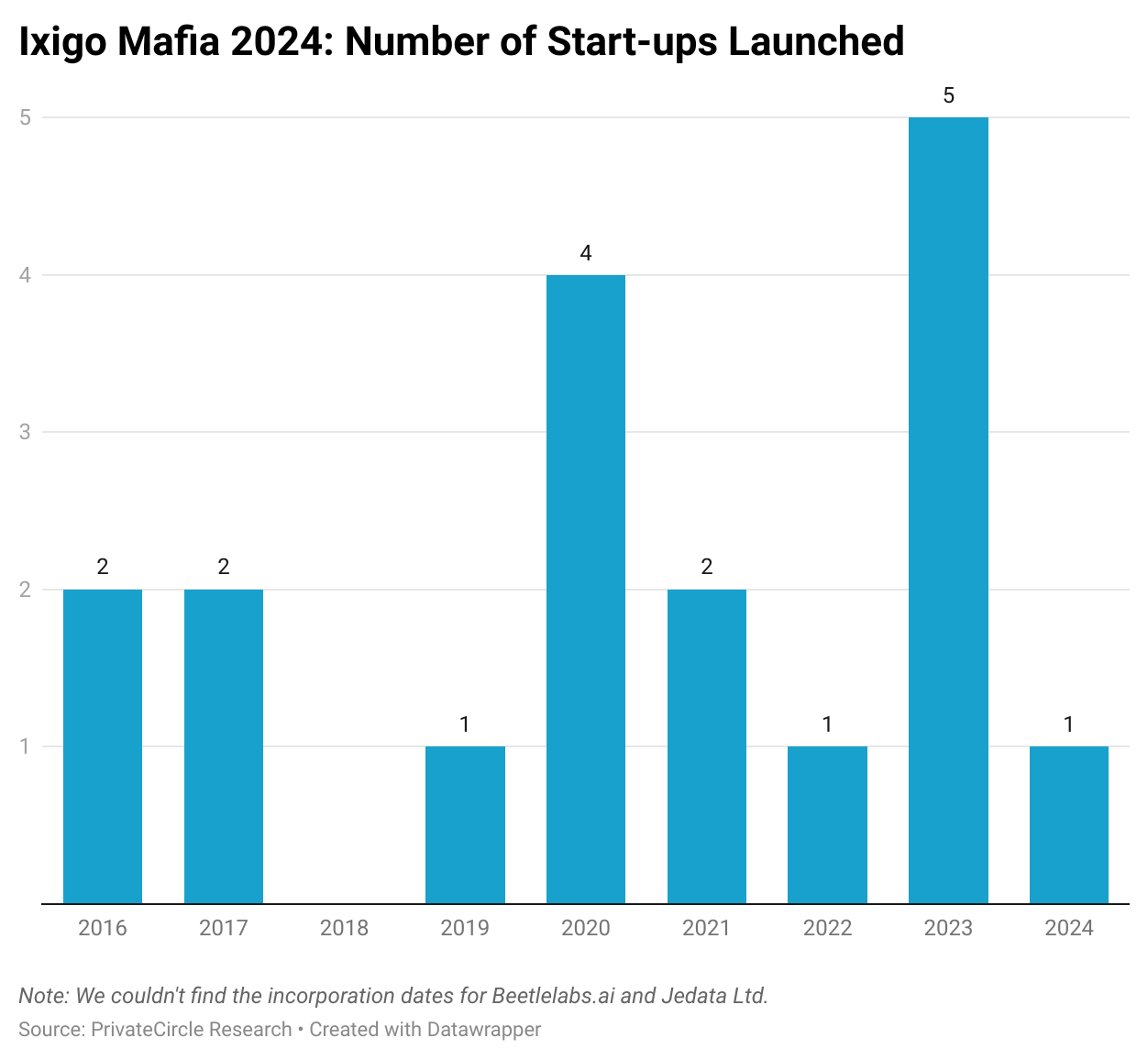

From 2016 to 2024, the number of startups launched each year has fluctuated. The highest number of startups were launched in 2023 (5) and 2020 (4), indicating peaks in entrepreneurial activity.

Other years saw fewer launches, with some years like 2019, 2022, and 2024 recording only one startup each. Overall, the trend shows periodic surges in startup activity rather than a consistent increase or decline.

50% of the Ixigo mafia has ventured into the software sector, while others have diversified into retail, travel, IT/ITES, emerging technology, and hospitality etc.

The Ixigo Mafia has created 685 jobs, with three companies (Fleetx, Unify Apps, and Phot.ai) collectively accounting for 615 of these jobs.

Of the 53 Ixigo Mafia founders, 17% (9 founders) are from the Indian Institute of Technology, 9% (5 founders) are from the Indian Institute of Management, and 6% (3 founders) are from Kurukshetra University.

Job Creation & Economic Impact

Beyond direct employment figures, these startups have played a pivotal role in stimulating local economies by creating ancillary job opportunities in logistics, customer support, and digital services.

Their contributions extend to fostering a skilled workforce and enhancing industry innovation.

Investor Activity & Funding Dynamics

The Ixigo Mafia startups have attracted a mix of angel investors, venture capital firms, and strategic partners. While some have secured substantial funding rounds, others operate under bootstrapped models.

The prevailing trend suggests that investors prioritize startups with scalable business models and proven market traction over purely speculative ventures.

Strategic Investments

Several Ixigo Mafia startups have pursued mergers, acquisitions, and strategic collaborations to accelerate growth.

These investments enable them to expand market presence, diversify product offerings, and strengthen competitive positioning within their respective industries.

Conclusion

The Ixigo Mafia remains a significant force within India’s startup landscape, contributing to employment generation and sectoral expansion. While software continues to dominate, the diversification into various industries signals a robust and adaptive entrepreneurial ecosystem.

Startup launch trends suggest that economic conditions and investor sentiment play key roles in shaping entrepreneurial activity.

Moving forward, the success of these ventures will depend on their ability to secure funding, scale operations, and navigate market challenges effectively.

Credits

This comprehensive report was made possible by the collaborative efforts of Chethan HS and Saiprasad Gudi.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.