The Indian consumer finance sector has witnessed significant activity and transformation over the past few years.

The latest report, covering the period from Q1 2022-23 to Q4 2023-24, provides an in-depth analysis of funding trends, investor participation, regional performance, and sector-specific insights.

Let’s dive into the key findings and understand the dynamics shaping this vibrant sector.

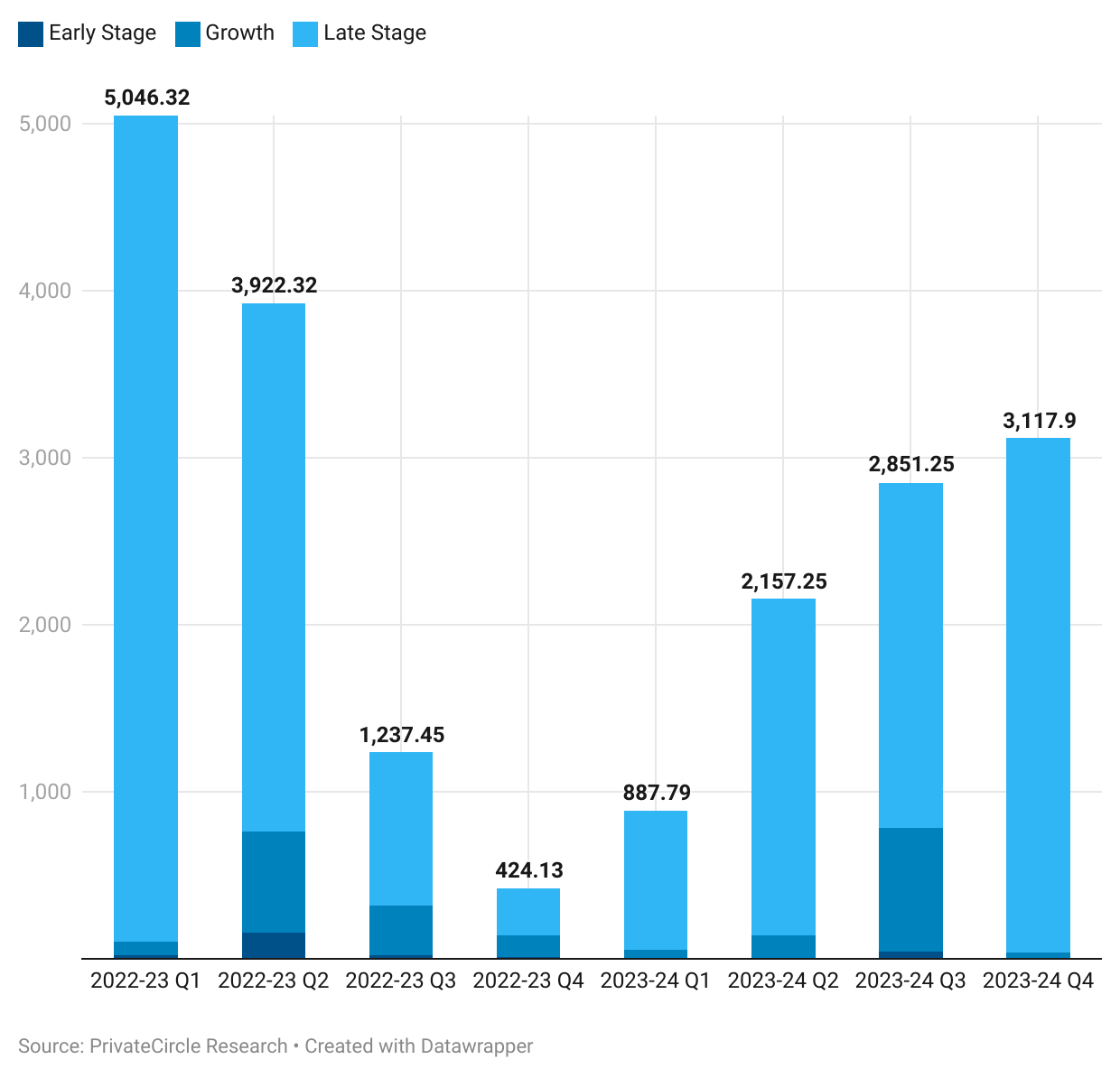

Company Stages: Late-Stage Dominance

The data indicates that late-stage companies have attracted the lion’s share of funding in both 2022-23 and 2023-24.

This trend reflects investor confidence in more mature ventures that have demonstrated robust business models and growth trajectories.

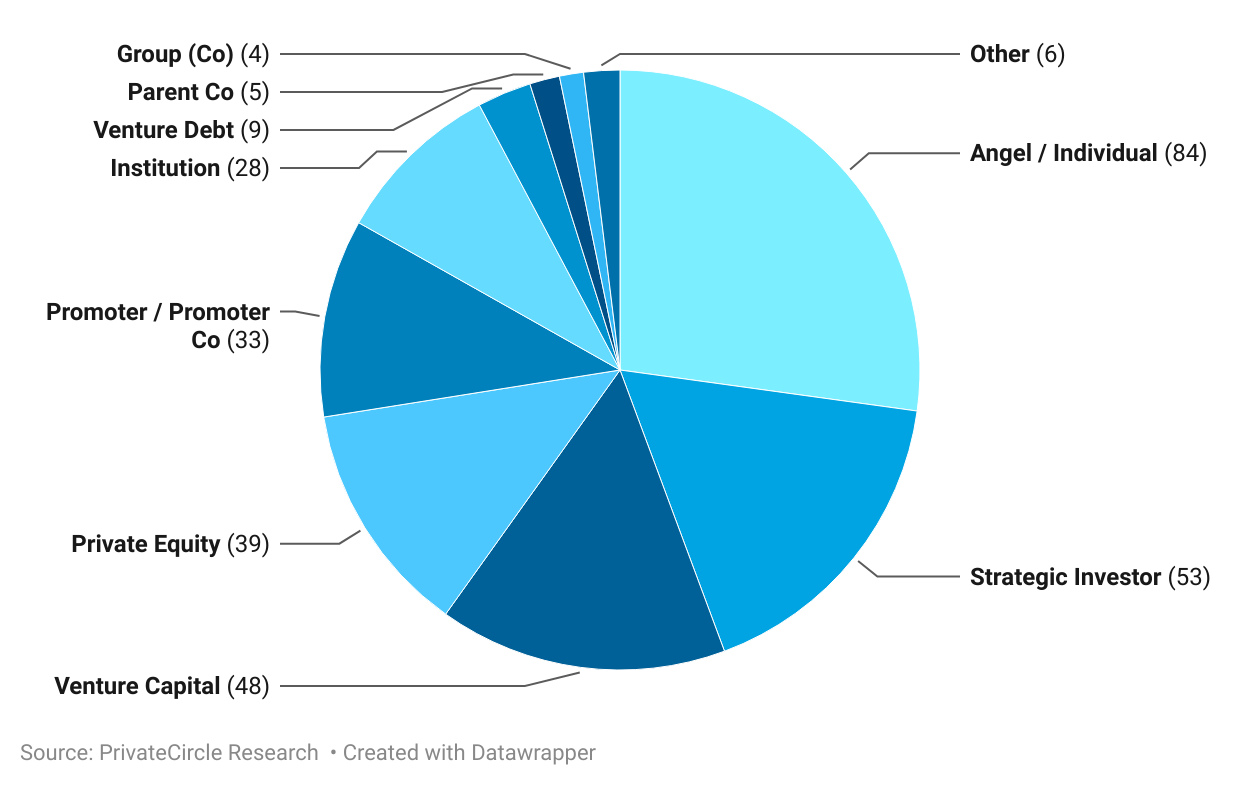

Investor Participation: Diverse and Active

Angel investors and venture capital firms have been the most active players in the Indian consumer finance space.

These investors are not just looking at early-stage startups but are also participating in later stages, indicating a broad-based interest across the growth spectrum.

Strategic investors and other types of investors have also made notable contributions.

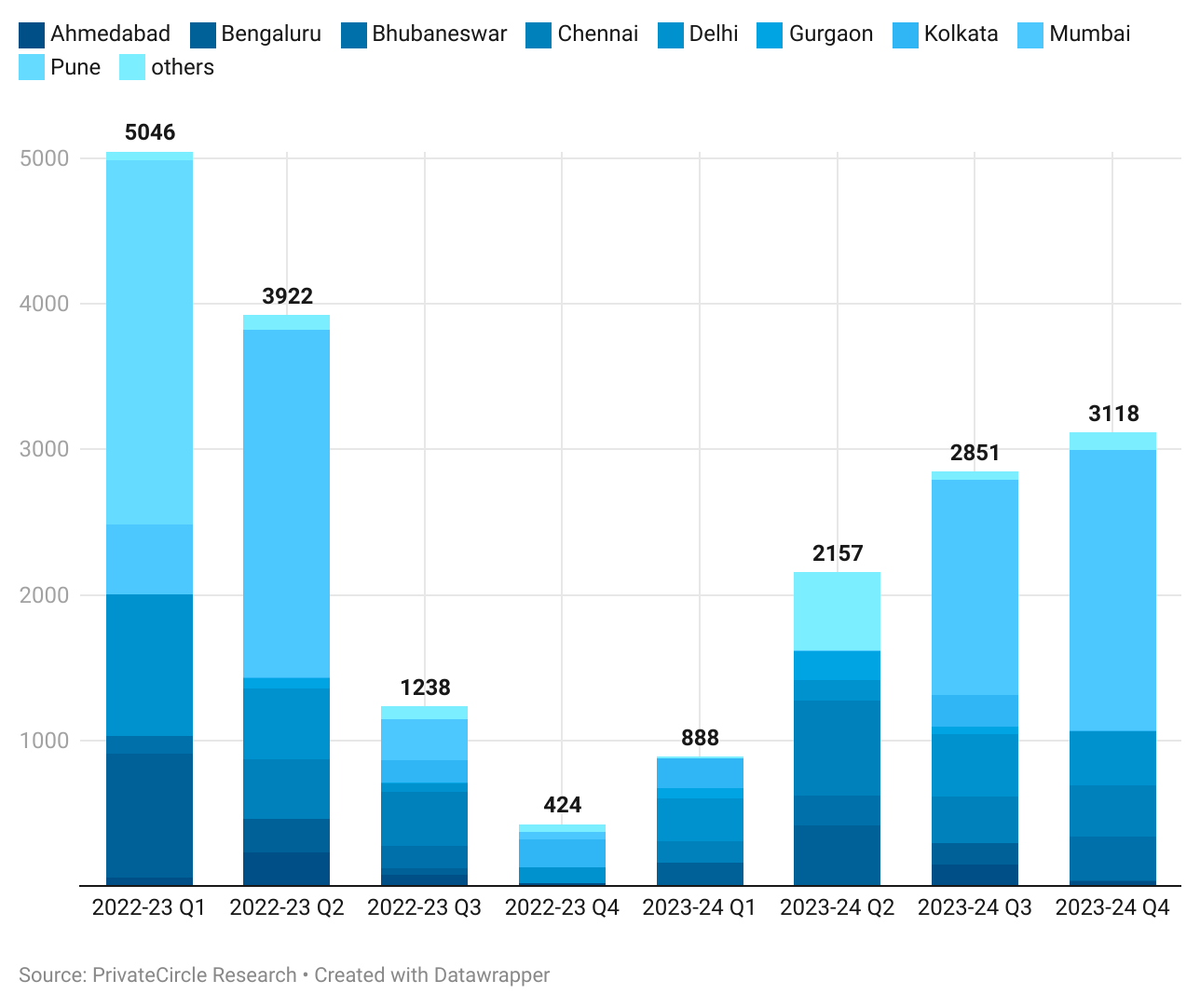

Regional Performance: Mumbai Leads the Way

Mumbai continues to be the financial powerhouse, consistently receiving major funding compared to other locations.

The city’s strong financial ecosystem and the presence of numerous financial institutions make it an attractive destination for investment in consumer finance.

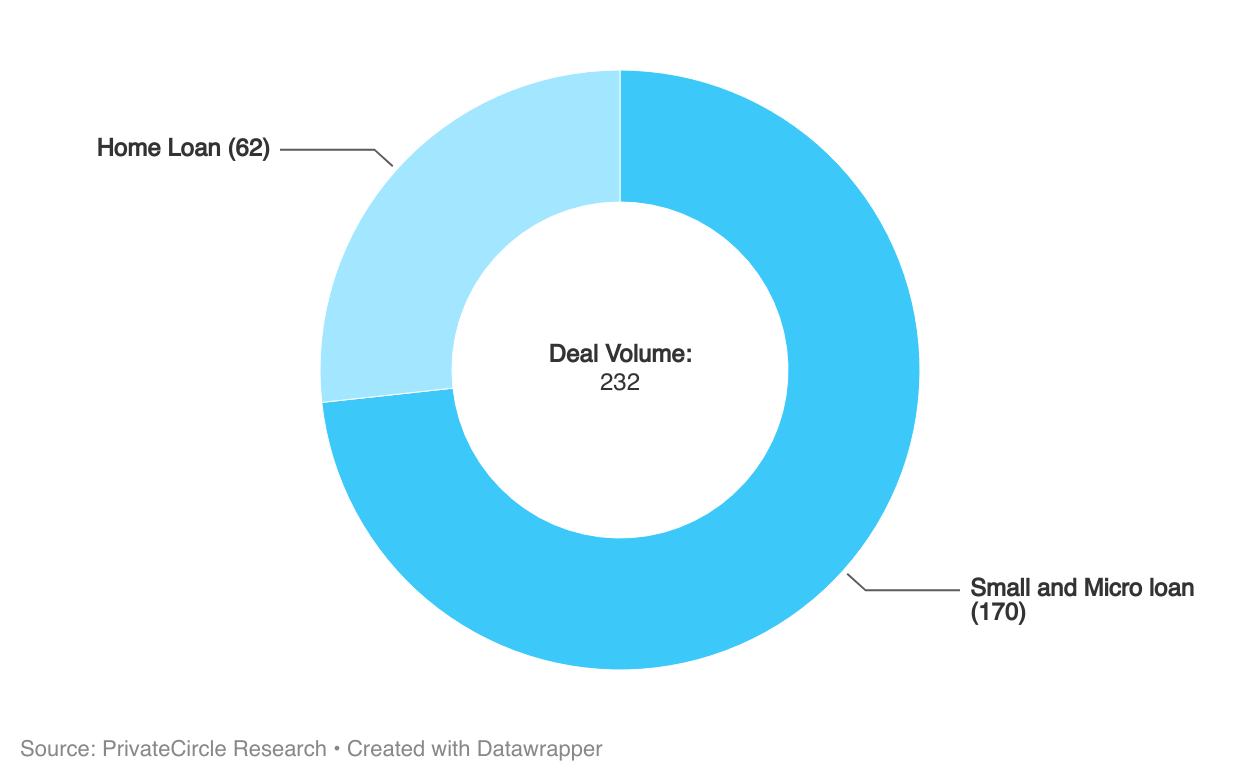

Sub-Sector Analysis: Small & Micro Loans Shine

In terms of deal volume, small and micro loans lead the pack, followed by home loans.

This trend underscores the growing demand for accessible and flexible financial products catering to the underserved segments of the population.

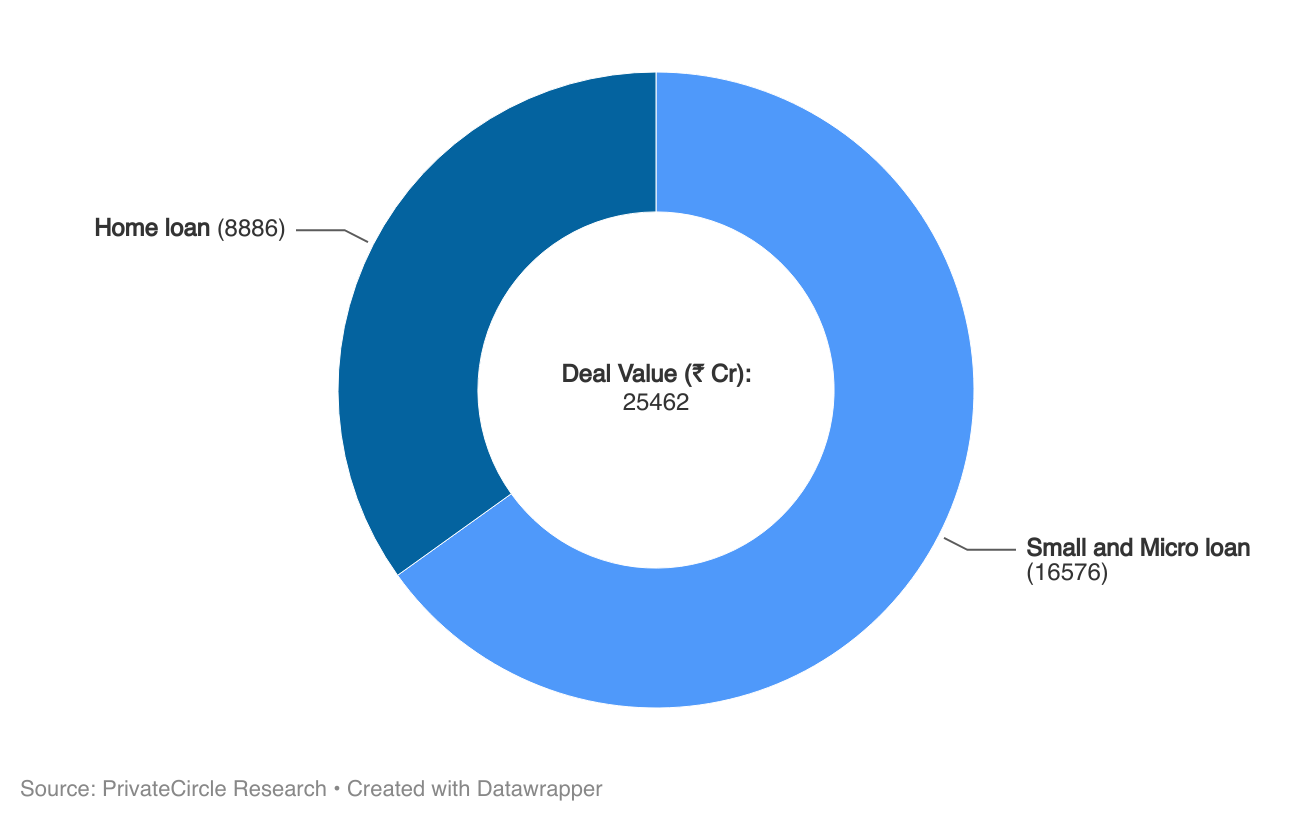

Value by Sub-Sector: Micro Loans Take the Crown

When it comes to the value of deals, small and micro loans have again come out on top.

The high number of deals in this sub-sector highlights the increasing investor interest and market potential in microfinance.

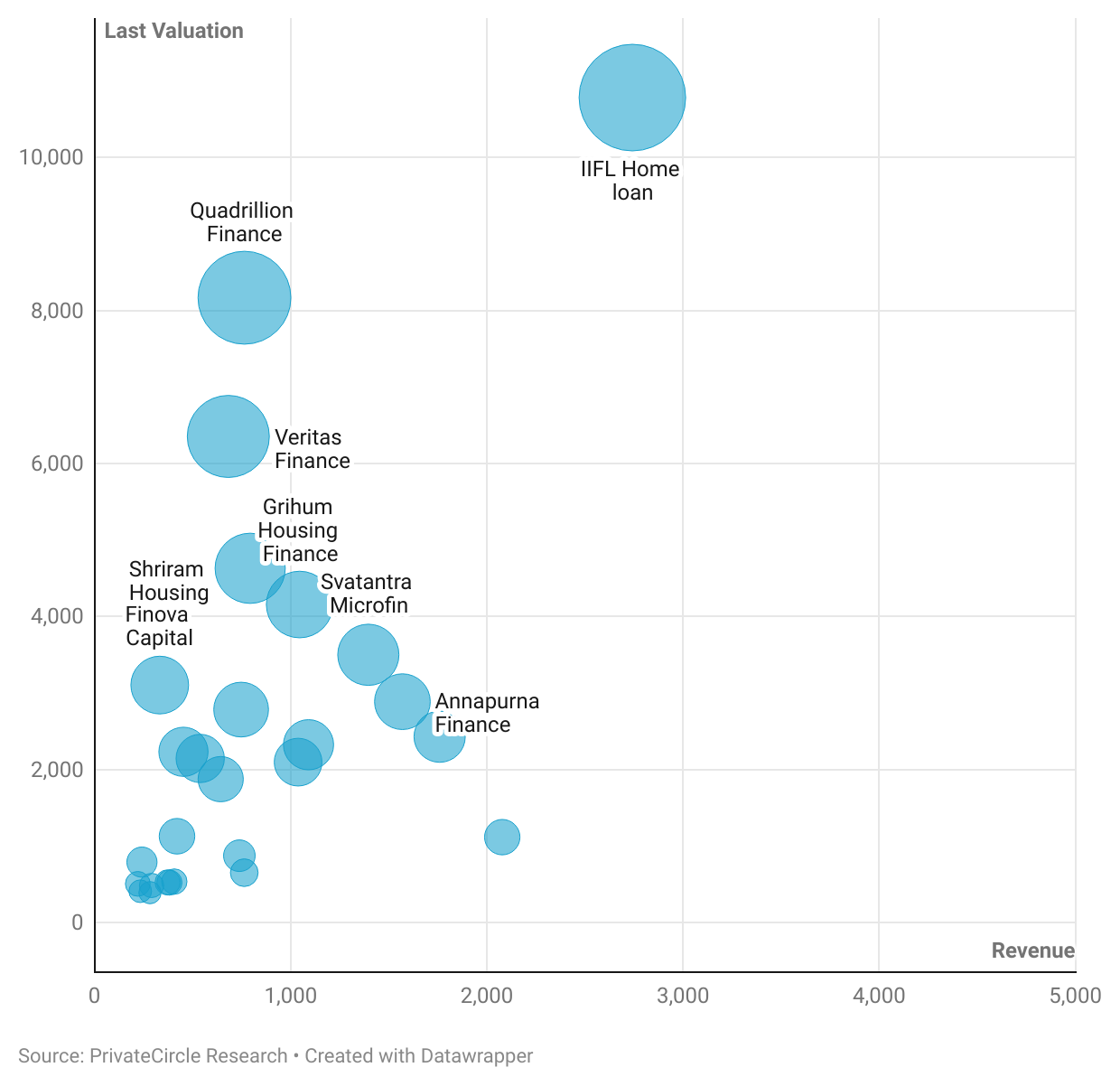

Revenue vs. Valuation: High Multiples for Microfinance

Small and micro loan companies are trading at high revenue multiples, commonly between 2-4.5X.

This indicates strong market confidence in their future growth potential and profitability.

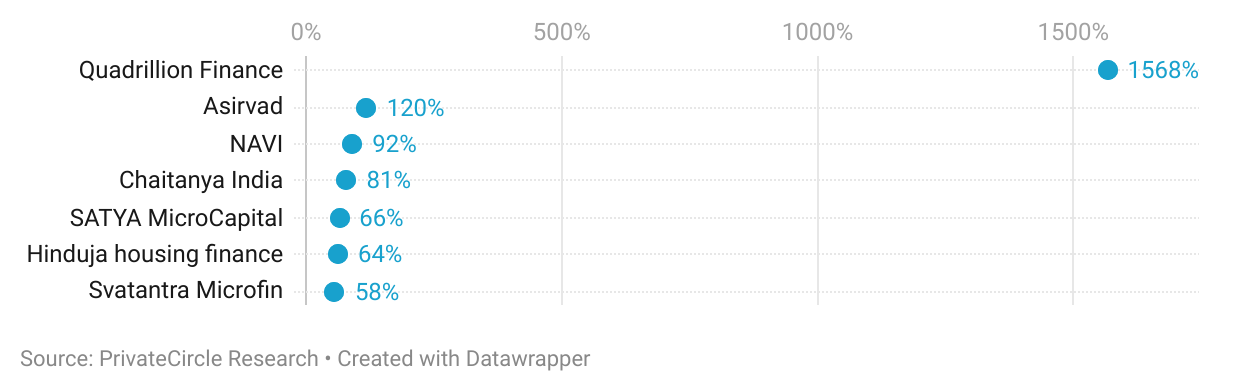

High-Growth Companies: Spotlight on Quadrillion Finance

Quadrillion Finance stands out with the highest two-year compound annual growth rates (CAGR).

This highlights the dynamic growth within the sector, with several companies achieving significant expansion over a relatively short period.

Conclusion

The Indian consumer finance sector is poised for continued growth, driven by robust investor interest, regional strengths, and the expanding demand for microfinance and home loan products.

As the market evolves, companies that can innovate and scale efficiently are likely to emerge as leaders.

For more detailed insights and to stay updated on the latest trends in private market intelligence and transaction products, join the conversation on our WhatsApp channel and explore the full power of PrivateCircle.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Data Curation by – Likith N and Manohar Upadhya of PrivateCircle.

Nice