India’s startup ecosystem continues to demonstrate remarkable resilience and investor confidence. Despite global macro uncertainties, capital deployment across high-growth sectors remains steady. Between February 27 and March 05, 2026, Indian startups collectively raised ₹2,094 Cr across 16 deals, signaling sustained appetite among venture funds, institutional investors, and prominent founders backing the next wave of innovation….

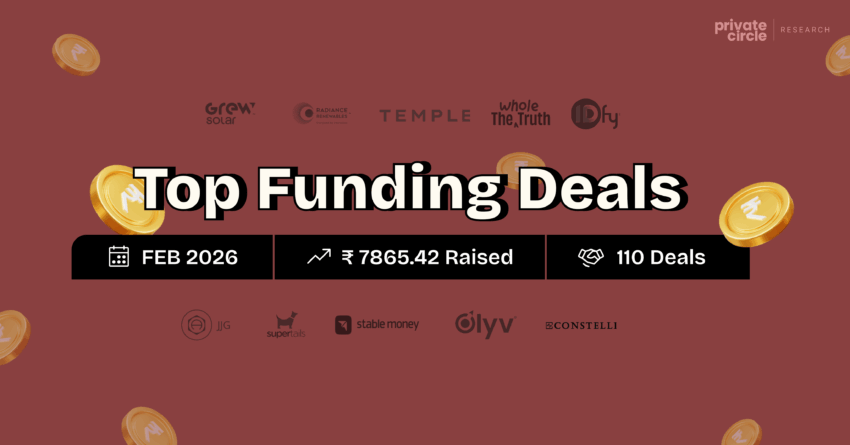

Read moreFebruary 2026 Deals Roundup: 7865 Crore Raised Across 110 Deals

To begin with, February 2026 sustained the strong investment momentum seen at the start of the year. Despite ongoing global market volatility, capital deployment remained steady, with investors backing sectors closely tied to the energy transition, fintech infrastructure, consumer brands, manufacturing, and digital trust infrastructure. Moreover, the month’s leading deals reveal a clear pattern: investors…

Read more🥤 The Battle of the Can: Red Bull vs Monster in India

Two Giants. Two Playbooks. One Expanding Market. ⚡ The Energy Boom: How India’s Performance Beverage Market Is Taking Shape India’s energy drink market has evolved from a niche, metro-focused segment into a fast-growing urban lifestyle category. What once catered primarily to nightlife and gym-goers now fuels college campuses, corporate offices, gaming communities, and Tier 2…

Read moreIPO Riches Revealed: Who Won Big in Sedemac’s OFS?

When an IPO happens, headlines usually focus on listing gains and subscription numbers. However, the real story often lies elsewhere, in the wealth-creation journey of early investors who patiently backed the company long before public markets opened. The IPO of Sedemac Mechatronics Limited offers exactly that lens. From institutional funds to family trusts and even…

Read moreWho Were February 2026’s Major Debt Raisers?

Introduction February 2026 saw significant debt mobilization across diverse sectors in India, with major borrowing concentrated in Data Management, Consumer Finance, Energy, and Infrastructure sectors. The month’s debt issuance reflects a combination of business expansion, operational funding, and capital expenditure needs. Notably, large-scale financing in renewable energy and mobility solutions highlights ongoing growth and investment…

Read moreDeal Momentum: ₹836 Cr Raised Across 25 Startup Deals

India’s startup ecosystem continues to demonstrate resilience and depth. Between February 20 and February 26, 2026, startups raised a total of ₹836 crore across 25 deals, reflecting steady investor confidence despite global macro uncertainties. Notably, the week witnessed a mix of Series A, Series B, Series C, and Pre-Series B rounds, signaling that capital deployment…

Read moreHow Urban Company Became a Founder Factory

Tracking 33 Alumni Startups, ₹18,279 Cr in Value & 2,897 Jobs Created. Over the last decade, Urban Company has evolved far beyond a home-services marketplace. While the company scaled across cities and categories, it was quietly building something even more powerful, an operator-to-founder ecosystem. Today, the Urban Company alumni network represents: This is the story…

Read moreHigh Thrills, Cool Waters, Hot Financials – India’s Splash Economy

India’s waterparks and amusement parks are no longer just seasonal entertainment hubs—they are fast evolving into structured, high-revenue leisure businesses. Rising disposable income, weekend tourism, experiential spending, and the growing youth population are driving strong footfalls across cities and tier-2 markets. From family destinations to adrenaline-packed rides and premium hospitality, India’s splash economy is seeing…

Read moreSisir Radar: A DeepTech Financial & Strategic Deep Dive

Introduction – Why Sisir Radar Matters in India’s DeepTech Landscape In recent years, India’s DeepTech ecosystem has witnessed a quiet yet powerful transformation. Among the companies driving this shift, Sisir Radar Private Limited stands out as a compelling case study. Founded in September 2021, Sisir Radar operates at the intersection of Synthetic Aperture Radar (SAR)…

Read moreWhere the Big Money Moved: India’s Top Funding Deals (Feb 13–19, 2026)

A Week That Revealed Investor Priorities Between February 13 and February 19, 2026, India’s private capital market sent a clear message: capital is being deployed with intent, not abundance. A total of ₹2,694 Cr was raised across 27 deals, but the real story lies in how capital was concentrated. A small set of large deals…

Read more