Zepto has emerged as a key player in e-commerce, navigating through highs and lows to establish its presence in the market.

Let’s delve into the insights gleaned from Zepto’s historical performance summary report for the year 2024.

- Headquarter – Mumbai, Maharashtra, India

- Sector – Retail

- Founders – Aadit Palicha & Kaivalya Vohra

- Founded – 2020

What is the Historical Performance Summary Report?

Historical Performance Summary Report is our endeavor to delve deeper into a company’s performance across the years, all through the lens of data. As a robust data intelligence platform, these reports serve as a testament to the capabilities of the PrivateCircle Research dashboard.

Why Zepto?

As revenues jump for quick commerce companies, the sector is once again in focus for the potential market opportunity in the space. Bigger players like Flipkart, Amazon, Tata’s BigBasket have also started rethinking their stance on quick deliveries indicating fierce competition in the sector.

Hence, we decided to do a deep dive into Zepto, the only pure-play quick commerce platform that has not been acquired by a bigger brand.

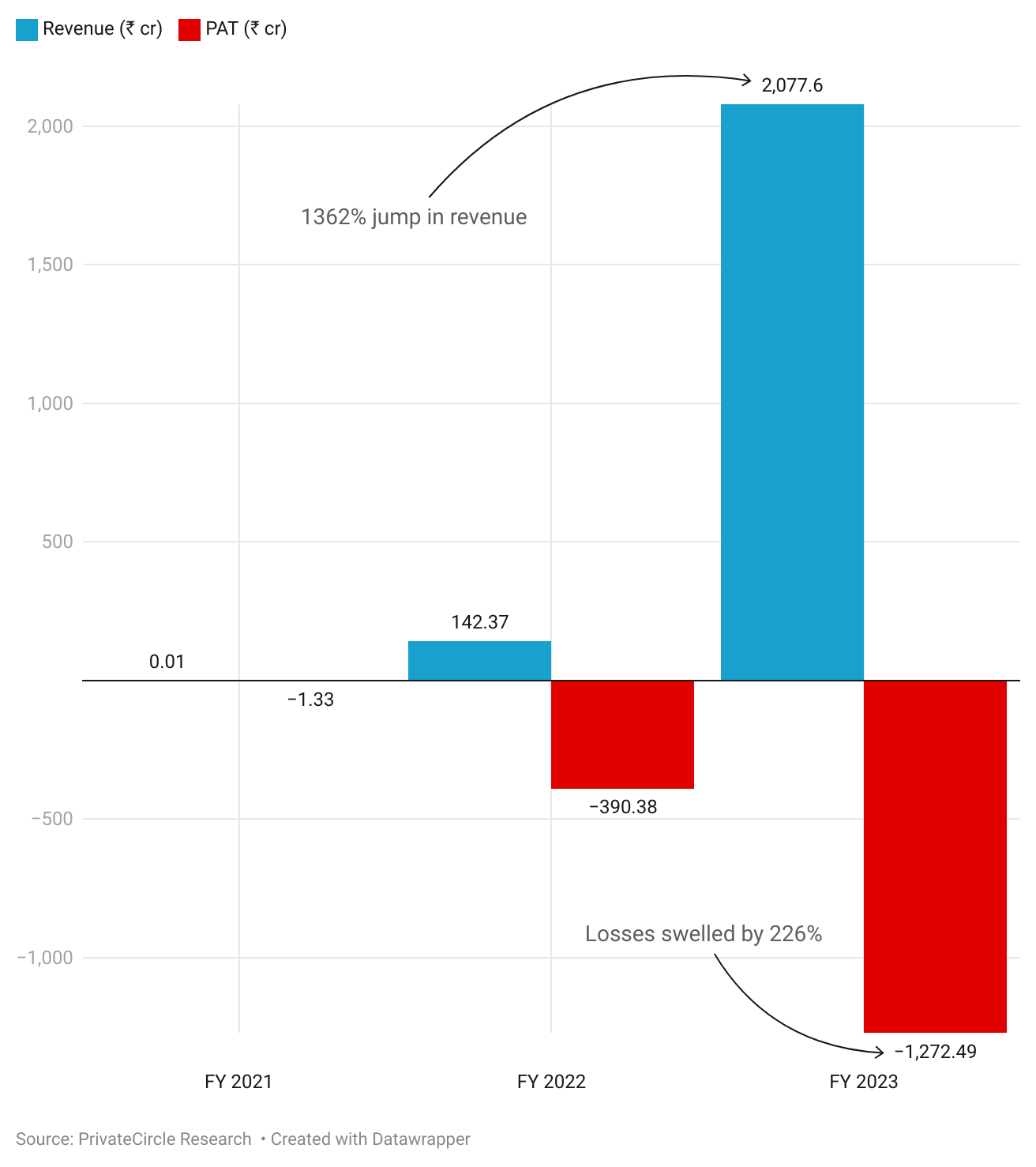

Revenue & Profitability

Zepto’s financial journey reflects a tale of rapid expansion juxtaposed with evolving profitability dynamics.

While the revenue witnessed an impressive surge of 1362% over FY22, the company grappled with a significant increase in losses, ballooning by 226% in FY23. This juxtaposition underscores the company’s ambitious growth trajectory amid the competitive e-commerce landscape.

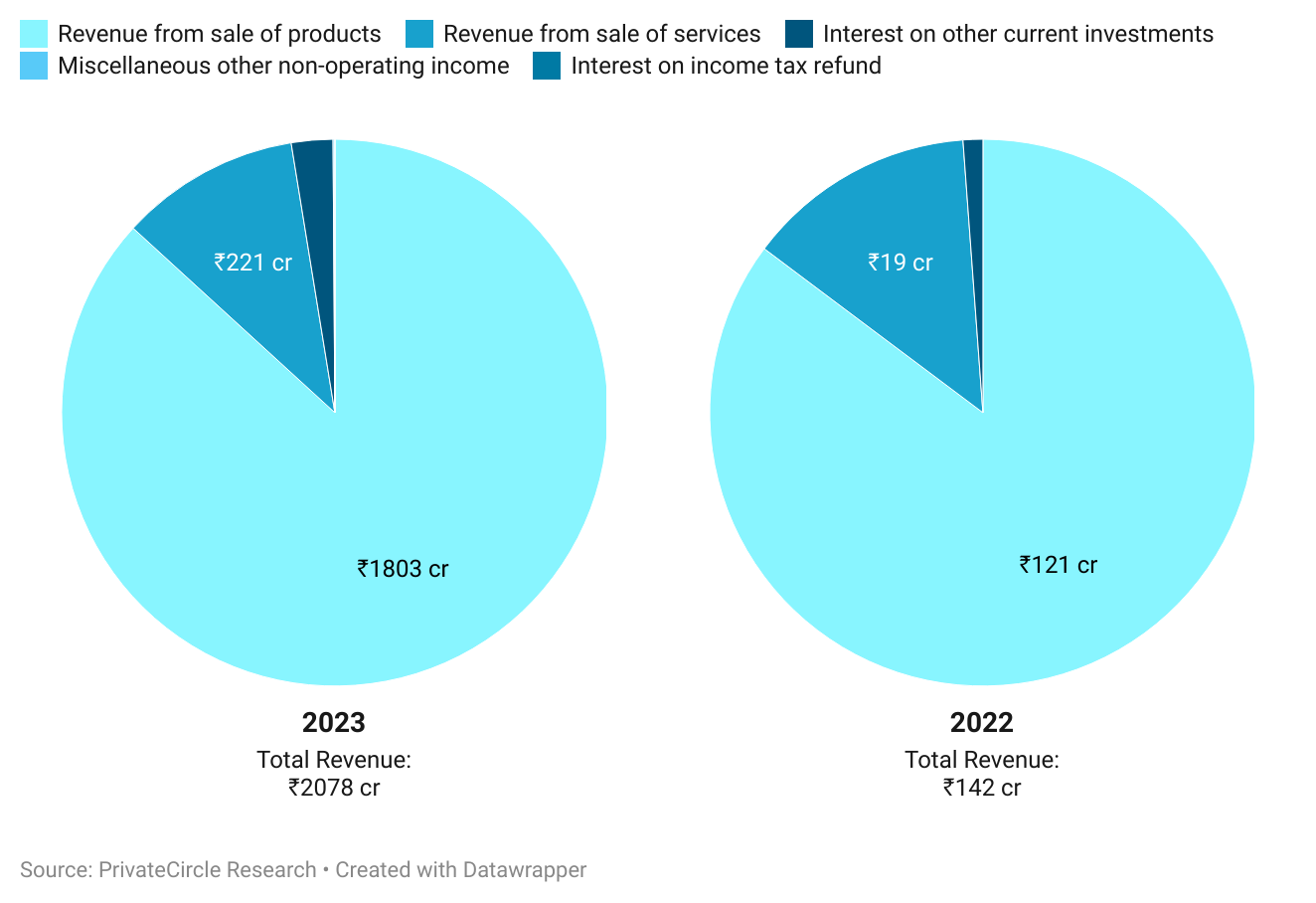

Revenue Composition

A closer look at Zepto’s revenue breakdown unveils a notable trend. Revenue from the sale of products constituted a dominant share, accounting for 87% of the total revenue in FY2023.

This proportion remained relatively consistent, seeing about 1300% jump compared to the previous fiscal year, underscoring the sustained importance of product sales as the primary revenue stream.

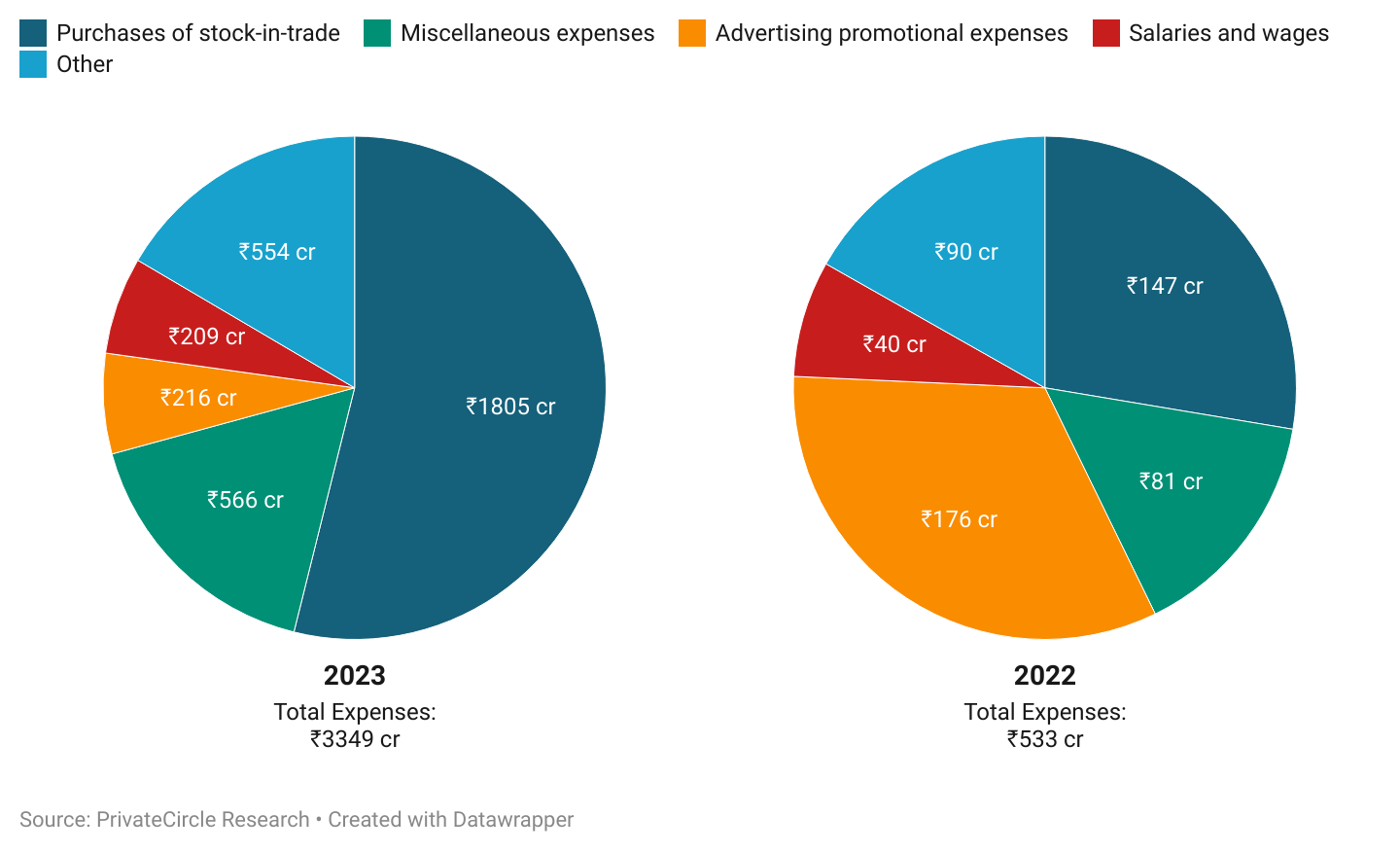

Expenses Breakdown

However, the company’s expense structure witnessed a significant transformation, with expenses growing fivefold in FY23 compared to the previous year.

The surge in expenses was primarily driven by increased purchase of stock-in-trade, which accounted for 50% of the total expenses in FY23, up from 28% in the previous fiscal year.

Additionally, while salary and wages experienced a substantial surge of 426%, advertising expenses saw a relatively modest growth of 23%.

Interestingly, the proportion of advertising expenses to total expenses decreased from 6% in FY22 to a mere fraction in FY23, indicating Zepto’s strategic shift towards enhancing brand awareness through alternative channels.

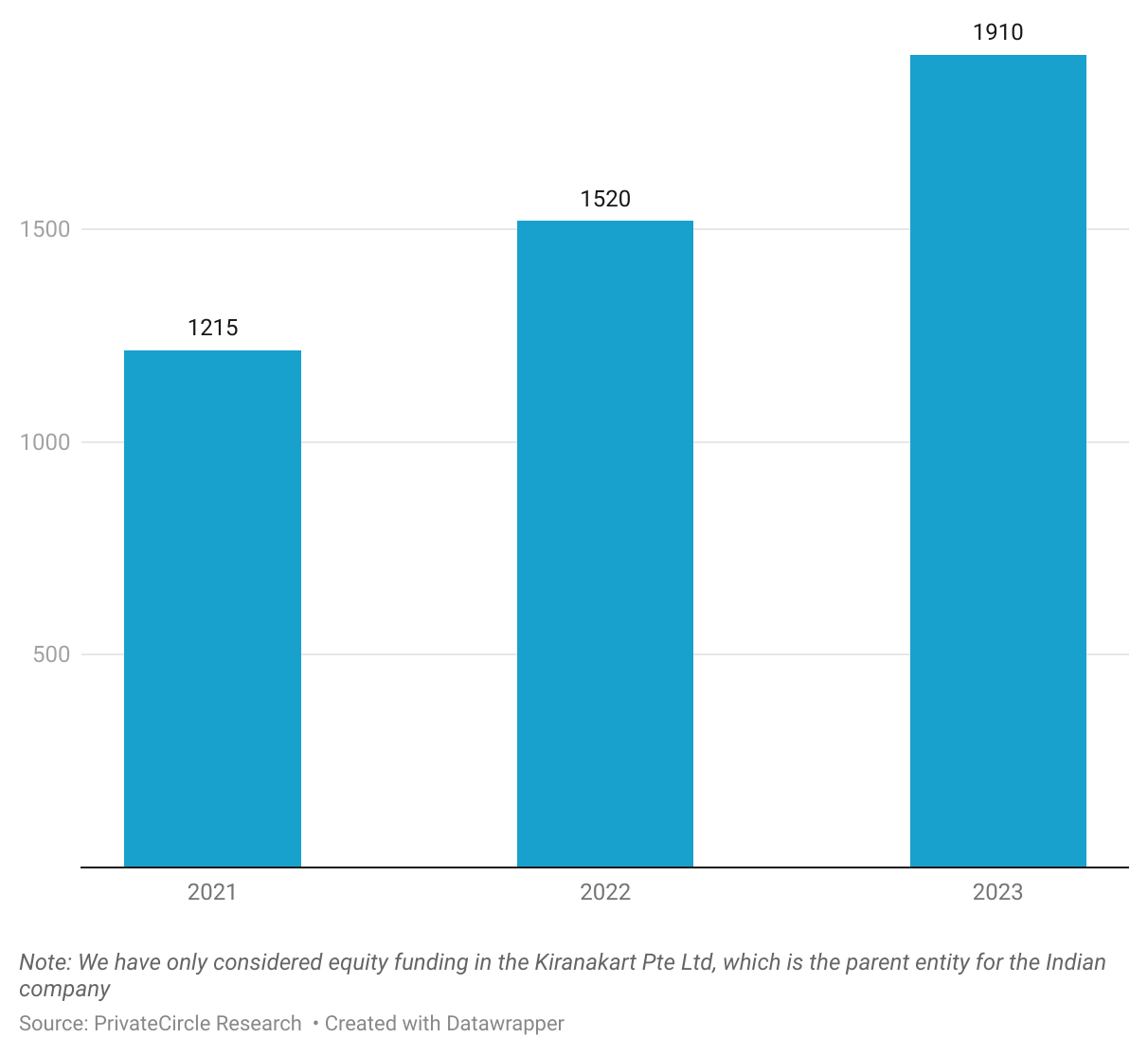

Amount Raised By Calendar Year

Against the backdrop of an ongoing funding winter, Zepto exhibited remarkable fundraising prowess, securing the highest amount of funding, amounting to ₹1910 crore, in 2023. The company has raised a total of ₹4645 cr ($592 Mn) across multiple funding rounds.

This achievement underscores investor confidence in Zepto’s business model and growth prospects, despite prevailing market challenges.

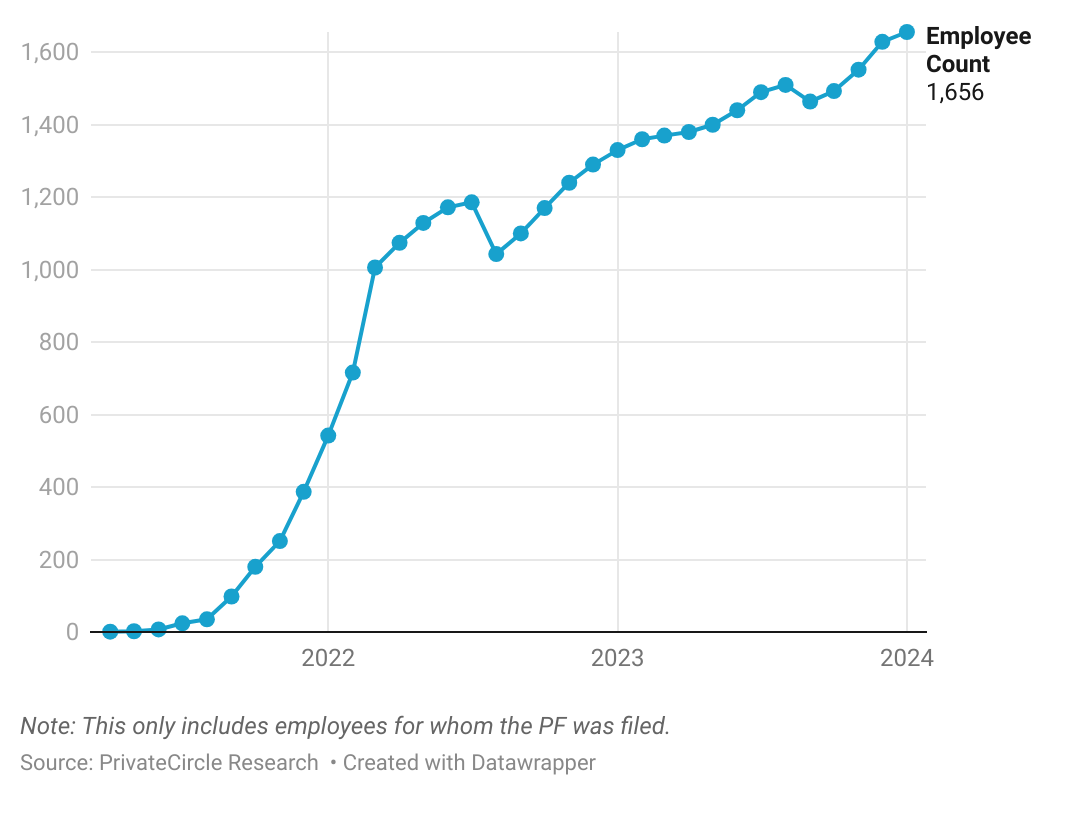

Employee Count Since Inception

Furthermore, Zepto’s commitment to expansion is echoed in its employee count, which reached a record high of 1,656 individuals in January 2024.

This steady growth in headcount over the past two years reflects Zepto’s strategic focus on scaling operations and strengthening its organizational capabilities.

Zepto Peers

- Blink Commerce Private Limited (blinkit) with Revenue ₹7.5 Bn FY 2023 and 3-yr CAGR 61.5% FY 2023

- Bundl Technologies Private Limited (Swiggy) with Revenue ₹87.1 Bn FY 2023 and 3-yr CAGR 32.72% FY 2023

- Supermarket Grocery Supplies Private Limited (bigbasket) with Revenue ₹95.0 Bn FY 2023 and 3-yr CAGR 35.46% FY 2023

Conclusion

Zepto’s historical performance summary offers valuable insights into the company’s growth trajectory, financial resilience, and strategic initiatives.

As Zepto continues to navigate the dynamic e-commerce landscape, its ability to adapt to evolving market dynamics, leverage strategic opportunities, and foster sustainable growth will be pivotal in shaping its future trajectory.

Explore the full report for a comprehensive understanding of Zepto’s journey and its implications for the e-commerce ecosystem.

Curious about how you can effortlessly uncover such comprehensive analyses in a matter of minutes? Sign up on our platform – privatecircle.co/research – and discover firsthand.

Take advantage of our FREE trial/demo to gain access to dependable data, intelligence, and insights. Empower your research across 1.7 million private unlisted companies spanning 500+ data categories with unwavering confidence.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

More HPSRs from PrivateCircle Research

Historical Performance Summary Report: CleanMax 2023

Historical Performance Summary Report: WayCool 2023

Historical Performance Summary Report: Dunzo 2023

Historical Performance Summary Report: Zerodha 2023

This information is useful