Lenskart has emerged as a key player in India’s eyewear market, revolutionising accessibility to eye-care products across cities through its dual online and offline presence.

Founded as an online eyewear portal, Lenskart has grown into a nationwide brand with over 320 stores across tier-1 and tier-2 cities, processing about 300,000 monthly orders.

This reach and operational expansion have powered Lenskart’s growth, but profitability remains challenging—a trend seen in its recent FY23 performance summary.

About Lenskart

Lenskart Solutions Private Limited is India’s leading online shopping portal for eyewear, with a country-wide reach including cities such as Delhi, Mumbai, Kolkata, Chennai, Bengaluru and Ahmedabad.

It offers a gamut of options ranging from eyeglasses to contact lenses to sunglasses for men and women. Lenskart has over 320 stores in about 90 cities, which include tier-1 and tier-2 cities. It receives approx. 300,000 orders, both offline and online monthly.

Quick Facts

- Industry – Healthcare | Sector – Health Care Equipment & Supplies | Subsector – Eye Care Products

- Founded – 2008

- Headquarters – New Delhi, India

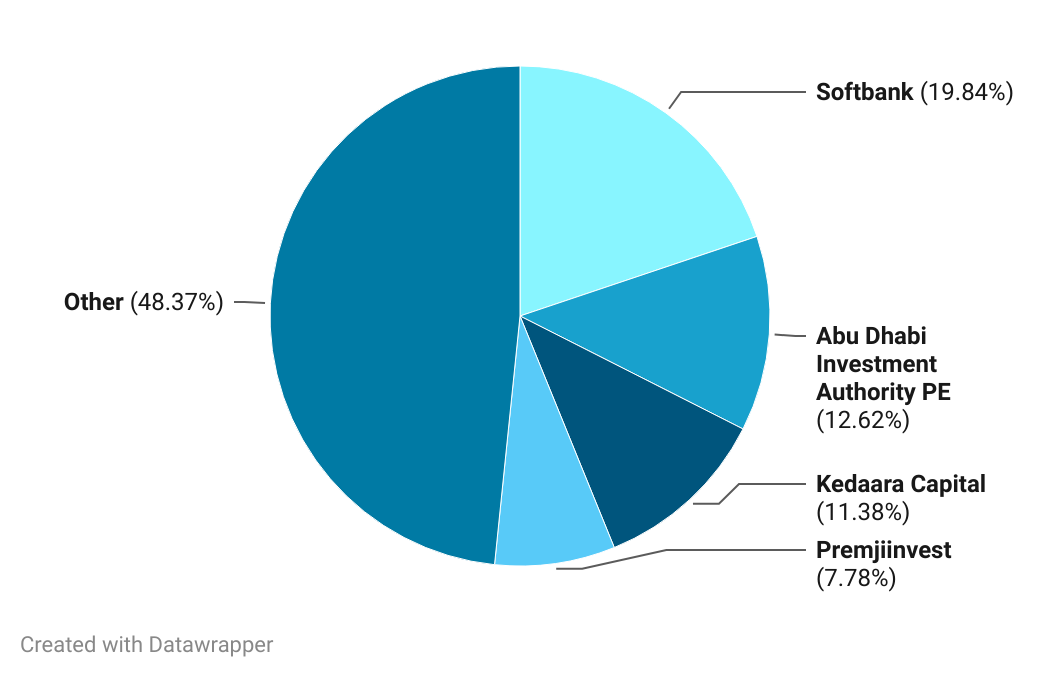

- Key investors are Softbank, Abu Dhabi Investment Authority PE, Kedaara Capital, Premjiinvest and Alpha Wave Global

- Team is managed by Amit Chaudhaury and Peyush Bansal

- Competitors: LensBazaar, Titan Eye Plus, EyeMyEye

Financial Snapshot

FY 2024 (Consolidated). Source: MCA Filing.

- Revenue (FY24): ₹5,610Cr

- PAT (FY24): -₹10 Cr

- Employee Count: 3,250 (as of Mar 2024)

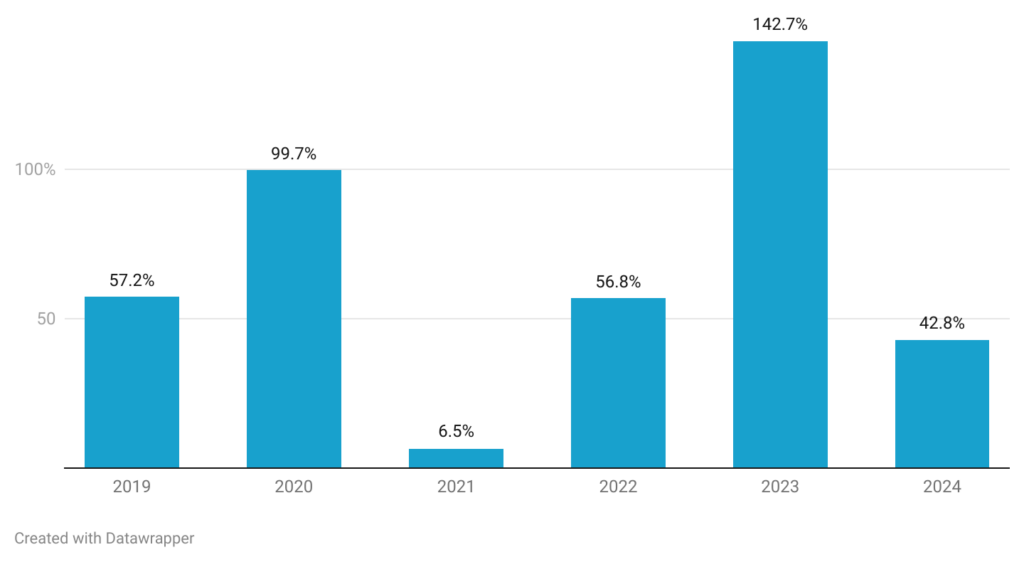

- YOY Revenue Growth: 2023 – 142.7% | 2024 – 43%

What is the Historical Performance Analysis?

Historical Performance Summary Report is our endeavour to delve deeper into a company’s performance over the years, all through the lens of data.

As a data intelligence platform, these reports serve as a testament to the capabilities of the PrivateCircle Research dashboard.

Why Lenskart?

The eyewear retailer is among the top 5 companies in terms of relevance on PrivateCircle Research, which indicates our users’ increased interest in Lenskart.

This report takes a deep dive into the company’s financial performance, shareholding and fundraising history.

Revenue & Profitability (₹Cr)

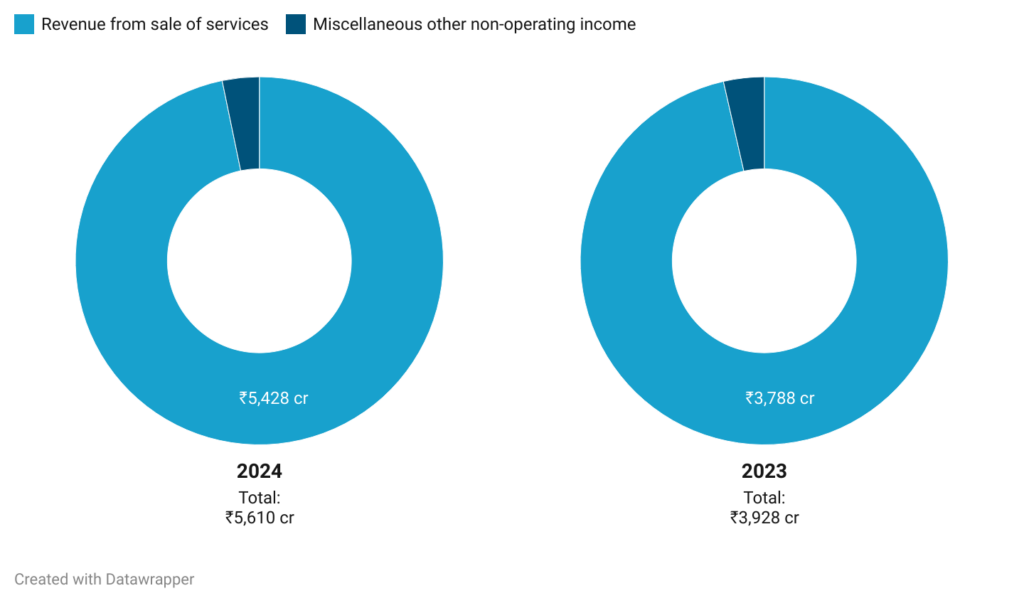

The company has demonstrated a robust growth trajectory in revenue over the past six years. This upward momentum continued from FY 2023 to FY 2024, with revenue increasing by approximately 43% from ₹3,928 crore to ₹5,610 crore.

YOY Revenue Growth (%)

Lenskart’s YoY revenue growth has surged over the years, especially in FY 2023 with a remarkable 142.72% increase, reflecting its aggressive market expansion.

Revenue Breakdown (₹ cr)

In 2024, Lenskart’s total revenue reached ₹5,610 crores, up from ₹3,928 crores in 2023.

Expenses Breakdown (₹ cr)

In 2024, Lenskart’s total expenses surged to ₹5550 crores, up from ₹4025 crores in 2023, driven by higher costs of materials, and operational expenses.

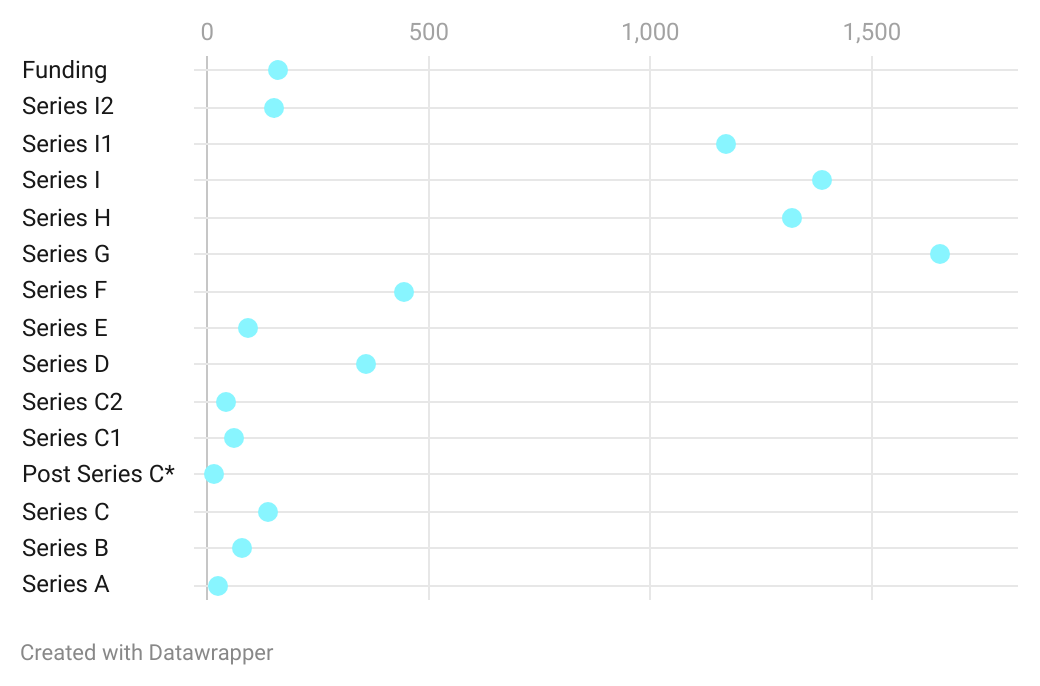

Series-Wise Funding (₹ cr)

The company’s biggest funding round was Series G in December 2019, when Lenskart raised ₹1,652 crores.

This marks a significant period of the company’s fundraising history, particularly from 2019 to 2022, as funding rounds consistently exceeded the thousand crores mark.

Diluted Shareholding

Lenskart’s top five shareholders include SoftBank (19.84%), Abu Dhabi Investment Authority (12.62%), Kedaara Capital (11.38%), PremjiInvest (7.78%), and Alpha Wave Global (6.14%), reflecting strong backing from top investment firms.

Click on the graph to access the responsive iframe. You can embed it or download the data or download the image.

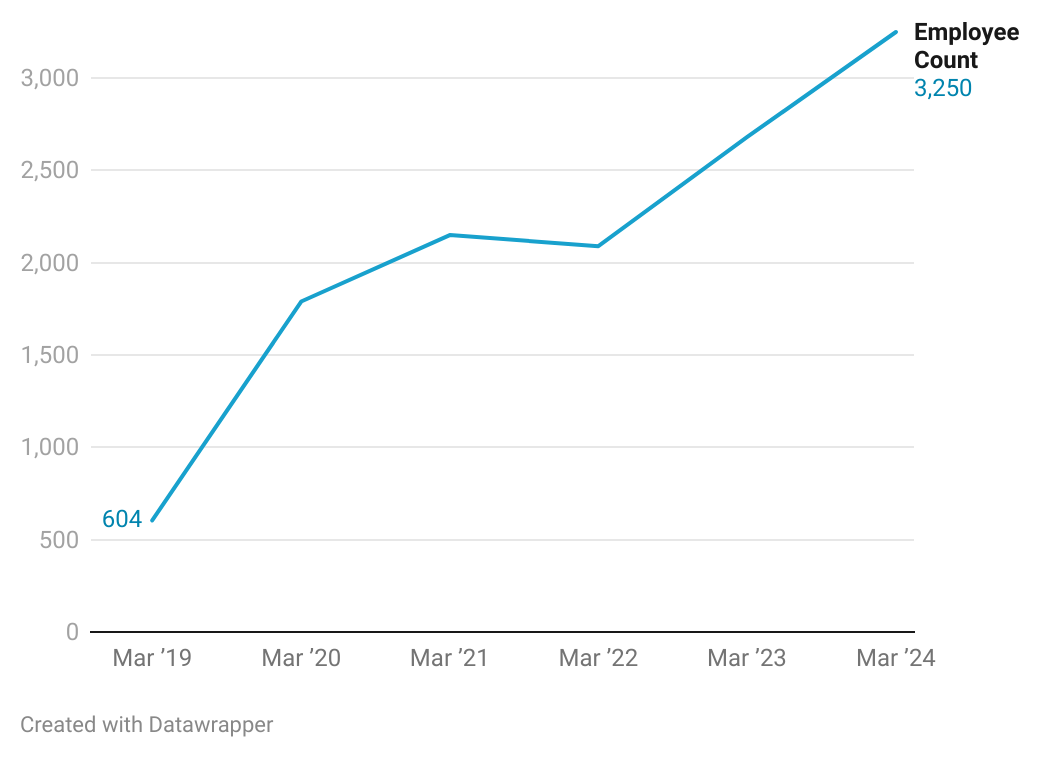

Employee Count

Lenskart’s employee count has shown consistent growth, rising from 604 employees in March 2019 to 3,250 by March 2024.

This reflects a compound annual growth rate (CAGR) of approximately 35%, signalling the company’s rapid scaling to support its expanding operations and market presence.

Analysis & Insights

Revenue Growth and Market Expansion

Lenskart has demonstrated a significant upward trend in revenue, reinforcing its position as a market leader in India’s eyewear segment. Between FY23 and FY24, revenue rose by approximately 43%, reaching ₹5,610 crores from the previous year’s ₹3,928 crores. This sustained growth reflects the success of Lenskart’s dual online-offline business model, allowing it to tap into a wider customer base, particularly in tier-1 and tier-2 cities. The company’s rapid expansion to over 320 stores in around 90 cities, including key urban centers, has bolstered its market reach and brand presence.

Profitability Challenges Amid Revenue Growth

Despite the robust revenue gains, profitability remains a challenge, with the company posting a marginal net loss of ₹10 crores for FY24. This trend is mainly attributed to escalating operational expenses, which increased substantially from ₹4,025 crores in FY23 to ₹5,550 crores in FY24. The higher cost of materials, supply chain expenses, and store operations indicate that Lenskart’s aggressive growth strategy has come with significant financial outlays. This underscores a common challenge faced by scaling companies—balancing revenue growth with sustainable profitability.

Funding and Shareholding

Lenskart’s growth has been heavily funded through a series of successful fundraising rounds, including a record Series G round in December 2019, which raised ₹1,652 crores. The company’s shareholder structure reveals strong backing from prominent investors, such as SoftBank, Abu Dhabi Investment Authority, and Kedaara Capital, with SoftBank holding a notable 19.84% stake. This high-profile investor interest highlights confidence in Lenskart’s long-term potential within India’s fast-growing eyewear market.

Employee Growth as an Indicator of Scaling Efforts

Reflecting its market expansion and operational scaling, Lenskart’s workforce has grown dramatically from 604 employees in 2019 to 3,250 by 2024, achieving a compound annual growth rate (CAGR) of around 35%. This rapid hiring is aligned with its expanding retail footprint and the necessity for stronger operational and support teams to manage its dual distribution channels.

Conclusion

Overall, Lenskart’s recent performance portrays a company successfully expanding its market reach and revenue, though profitability remains an area of focus. The company’s growth trajectory will likely depend on how well it can control expenses and eventually drive sustainable profitability while maintaining momentum in a competitive market.

Curious about how you can effortlessly uncover such comprehensive analyses in a matter of minutes? Sign up on our platform – privatecircle.co/research – and discover firsthand.

Take advantage of our FREE trial/demo to gain access to dependable data, intelligence, and insights. Empower your research across 3 million+ private unlisted companies spanning 500+ data categories with unwavering confidence.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

More Historical Performance Reports from PrivateCircle Research

Historical Performance Summary Report: CleanMax 2023

Historical Performance Summary Report: WayCool 2023

Historical Performance Summary Report: Dunzo 2023

Historical Performance Summary Report: Zerodha 2023

Historical Performance Summary Report: XpressBees 2023

Historical Performance Summary Report: Byju’s 2024