After transforming how India sleeps, Wakefit is ready for a new milestone, its ₹468 Cr IPO.

From selling mattresses online to building a full-blown D2C lifestyle brand, Wakefit’s journey has been anything but sleepy. Now, it wants to scale stores, deepen distribution, and challenge the legacy furniture giants, with public capital backing it up.

So what’s the story behind this IPO? And can Wakefit sustain its dream run in an increasingly crowded home solutions market?

Let’s break down the Wakefit story.

The Wakefit Origin Story: Built from the Bedroom Up

It all began in 2016, when Ankit Garg (ex-Bain) and Chaitanya Ramalingegowda (ex-InMobi) decided to fix India’s overpriced and opaque mattress industry.

Instead of selling via dealers, Wakefit started as a direct-to-consumer (D2C) brand selling affordable memory foam mattresses online, backed by customer data and manufacturing control.

In just a few years, they:

- Expanded into bed frames, furniture, pillows & sleep accessories

- Built in-house factories in Hosur & Jaipur

- Created a digital-first brand with a loyal, sleep-deprived customer base

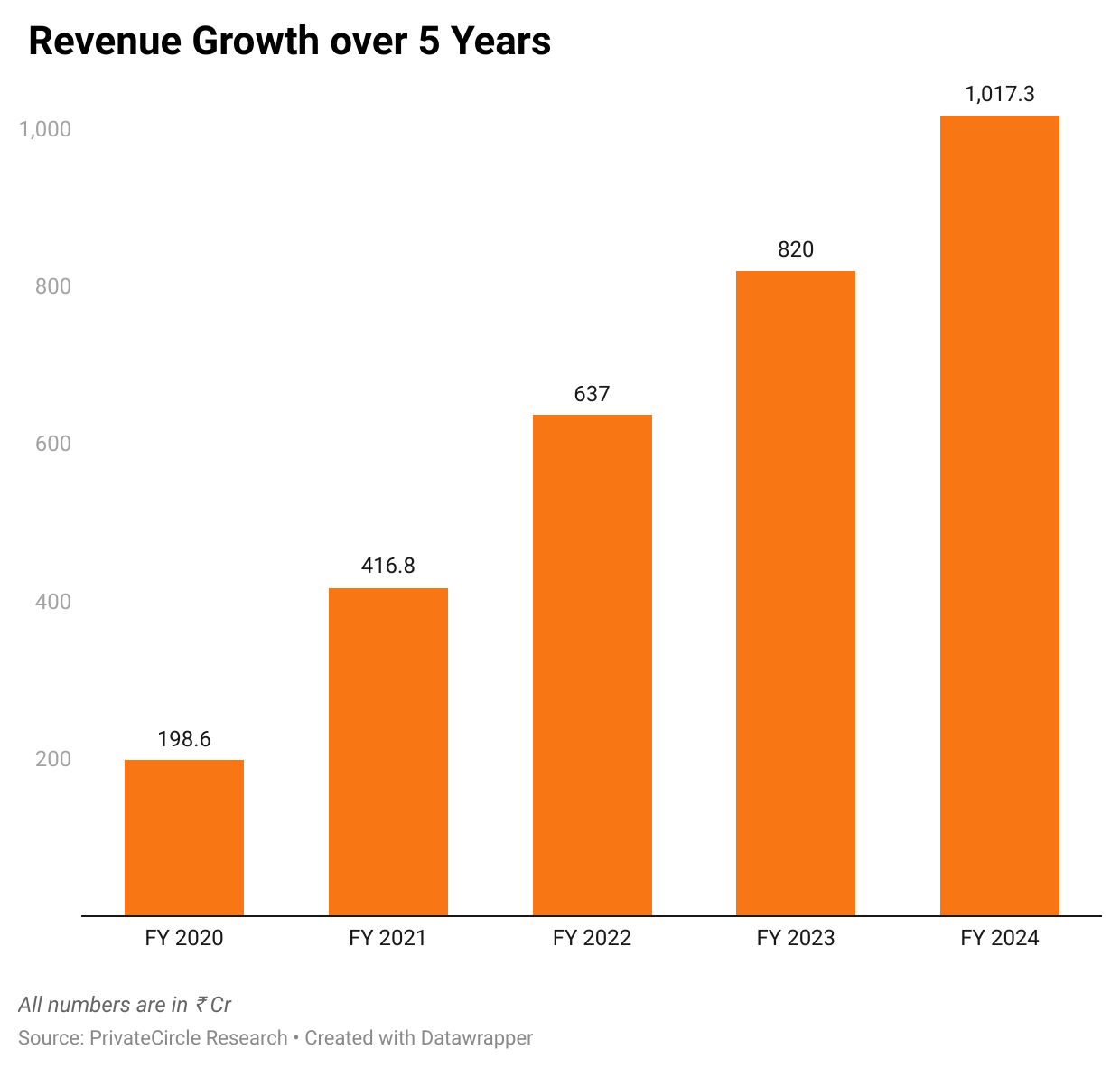

Fast forward to FY24, Wakefit is reportedly clocking over ₹1017.33 crore in revenue with a product line that stretches from beds to bookshelves.

The IPO Moment for Wakefit Innovations

Wakefit Innovations Limited, once a humble D2C mattress startup, is now gearing up for a significant milestone: a ₹468 crore Initial Public Offering (IPO). Wakefit has grown from a digital-first disruptor in the sleep solutions space to a full-blown home and lifestyle brand with furniture, furnishings, and omnichannel presence.

This IPO is not just another liquidity event. It marks Wakefit’s formal transition into a mature, scaled consumer company betting big on India’s organized retail boom and changing consumer aspirations.

What Makes This IPO Different?

Unlike many consumer brands that go public to deleverage debt or give exits to VCs, Wakefit’s IPO proceeds will be primarily used for growth:

- Opening more offline stores and experience centers

- Strengthening brand visibility via strategic marketing

- Enhancing in-house manufacturing and R&D capabilities

- Expanding logistics and warehousing to ensure faster delivery.

This is a growth-first IPO, signaling confidence in Wakefit’s business fundamentals, customer loyalty, and long-term roadmap. It also reflects a broader trend: India’s new-age consumer brands are not just surviving, they’re scaling profitably and sustainably.

Wakefit’s Expanding Product Universe

No longer just about sleep, Wakefit now covers:

- Mattresses, Pillows, Beds

- Sofas, Recliners, Coffee Tables

- Study Desks, Wardrobes, Bookshelves

- Curtains, Cushions, Furnishings

The brand combines in-house R&D with customer data-backed design, enabling it to launch products tailored to urban Indian homes, compact, modular, durable, and stylish.

Its private-label model gives Wakefit full control over pricing, quality, and margin, allowing bundling, personalization, and dynamic inventory across SKUs.

Today, it claims to sell over 2 lakh products a month, catering to customers across 19,000+ pin codes.

Wakefit’s Financial Journey (FY20–FY24)

What’s Wakefit Raising ₹468 Cr For?

The IPO proceeds are largely growth-focused, not survival-driven. According to the DRHP:

- ₹81 Cr: Experience Center Expansion, building physical stores across Tier 1 & Tier 2 cities

- ₹115 Cr: Marketing & Branding, boost recall and compete with furniture incumbents

- ₹78 Cr: Manufacturing Enhancement , expand capacity in mattresses & furniture units

- ₹40 Cr: Working Capital and Tech Stack

This fundraise indicates Wakefit is doubling down on:

- Brand-building for mass premium appeal

- Omnichannel retail for higher-value SKUs

- In-house efficiency for long-term margins

The IPO is more than capital, it’s a brand statement.

D2C DNA, Offline Dreams

Wakefit’s initial playbook was classic D2C: no distributors, smart content marketing (remember their sleep internship campaign?), and low CAC through performance marketing.

But furniture and large-ticket items still demand touch-and-feel. Hence, Wakefit is investing in:

- 40+ Experience Centers in major cities

- Warehouse hubs + same-day delivery for fast-moving SKUs

- Hybrid sales funnel: discover online → buy offline (or vice versa)

They’ve flipped the IKEA model for India’s digital-first middle class.

Offline stores drive trust, upsell bundles (sofa+rug+curtains), and cut return rates, helping overall AOV and margins.

Competitive Landscape: Wakefit vs the Rest

India’s ₹50,000 Cr+ home furniture market is fragmented, brand-poor, and logistics-heavy.

| Brand | Focus Area | Channel | Positioning |

| Wakefit | Sleep + Furniture | D2C + Offline | Affordable Lifestyle |

| Pepperfry | Furniture | Online + Studio | Mass Premium |

| Urban Ladder | Premium Furniture | Online + B2B | Designer-Led |

| IKEA | End-to-End Furnishing | Offline + Ecom | Global Scale |

| Nilkamal | Modular & Plastic | Offline | Durable Economy |

| SleepyCat | Mattresses | D2C | Eco-Friendly |

Wakefit’s edge:

- Design-to-delivery control

- Mass-aspirational brand

- High repeat purchases (28–32% by category)

- Lower pricing without trading off aesthetics

Wakefit’s hybrid model is a unique, tech-led scale + controlled pricing + full-stack SKU mix.

IPO Exit Expectations:

- Likely partial exit by early investors

- Dilution to fund brand & infra, not burn

- Pre-IPO valuation (unconfirmed): ₹2,200–2,400 Cr

Unlike many consumer IPOs that chase flashy growth narratives, Wakefit’s offering stands apart. In contrast, it is backed by strong fundamentals, clean financials, operational efficiency, and prudent capital allocation. Therefore, the IPO is likely to appeal to investors seeking long-term value rather than short-term hype.

Risks to Watch

- Offline Capex Burn: Stores are capital-heavy and take time to break even

- Logistics & Delivery: Big furniture = complex returns, assembly issues

- Competitive Pressure: Horizontal platforms (Amazon, Flipkart) eating into category

- Consumer Sentiment Cycles: Discretionary slowdown could delay big-ticket purchases

But Wakefit’s vertical focus, in-house customer support, and backward integration (with manufacturing arms like Featherlite) help mitigate these challenges.

Final Word: Is This India’s IKEAin-the-Making?

Wakefit is not just scaling stores or raising funds, it’s redefining what an Indian lifestyle brand looks like.

From ergonomic pillows to engineered wardrobes, it has built a rare blend of:

- Digital-first distribution

- Value-engineered products

- Loyal customer base

- Operational efficiency

This IPO marks a shift, from D2C playbook to omnichannel market leadership.

India’s sleepy mattress market just got a wake-up call.

All financial insights sourced from PrivateCircle, your window into India’s unlisted and emerging companies.

Follow for exclusive breakdowns of IPO-bound startups, sector leaders, and VC-backed disruptors.