India’s e-commerce sector is undergoing a digital revolution, fueled by increased internet penetration, affordable smartphones, and growing consumer aspirations across Tier II and III cities. While giants like Amazon and Flipkart have dominated the metro and upper-middle-class segments, a new breed of e-commerce players, such as Meesho, is emerging, built for Bharat. These platforms are reimagining commerce for the next 500 million users.

Among these, Meesho stands out. Founded in 2015, Meesho has disrupted the space with its zero-commission marketplace model, a hyper-focus on affordability, and an app-first strategy tailored for non-metro users. With over 100Mn app downloads and millions of sellers, Meesho has become synonymous with the rise of India’s value-first internet economy.

1. Financial Performance Overview

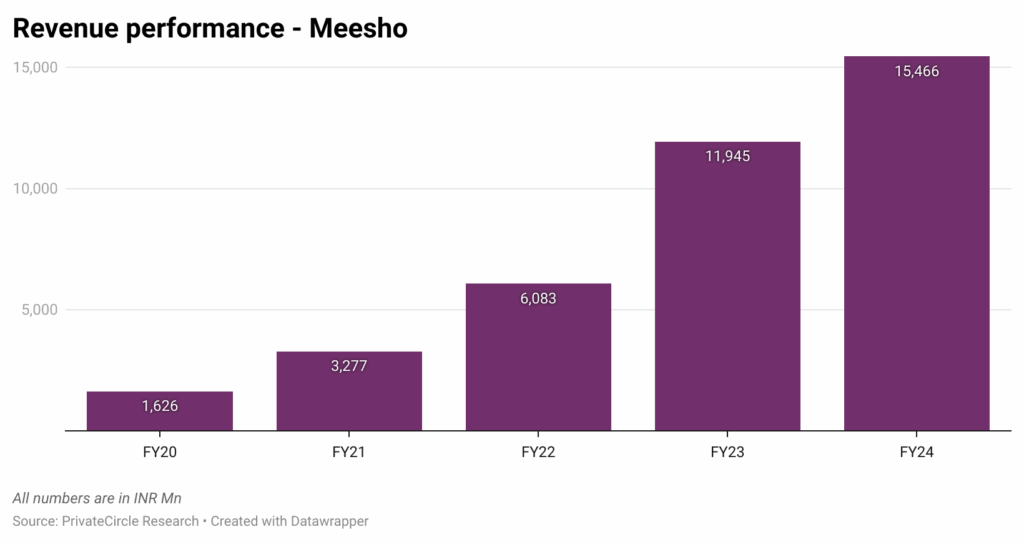

Over the past five years, Meesho has expanded its revenue more than 9x from ₹1,625 Mn in FY20 to over ₹15,466 Mn in FY24. Despite high losses through FY23, the company made significant strides in cost optimization by FY24, cutting its PAT loss by more than half, indicating maturing financial discipline ahead of its IPO. from a high-burn startup to a PAT-positive e-commerce player is rare in India’s B2C internet space. FY22 marked aggressive GMV scaling, albeit at high losses due to discounting. However, the shift in FY23 to a monetization-driven strategy, focusing on advertising and logistics revenue, enabled the company to break even and turn profitable. FY24 saw sustained growth while keeping burn low, with improvements in repeat users, supply-chain efficiency, and seller monetization.

2. IPO Preparation and Corporate Transition

Meesho is actively laying the groundwork for one of India’s most anticipated IPOs in the consumer-tech space.

- On 25 April 2024, Meesho converted to a public limited company, renaming itself as Meesho Limited.

- It adopted a revised set of Articles of Association compliant with SEBI listing requirements.

- Board Restructuring:

- Inclusion of independent directors to meet corporate governance standards.

- Audit, nomination & remuneration, and risk management committees were formed.

- Corporate Governance Readiness:

- Internal audit mechanisms were strengthened.

- Reporting frequency and statutory disclosures increased to align with listed norms.

- Valuation Surge: Its recent rights issue pegged the company’s post-money valuation at ₹316,735 Mn, marking a strategic signal to investors of its readiness for public markets.

- Timeline: IPO expected in late 2025 or early 2026, contingent on market conditions.

3. Business Model and Strategic Evolution

🧩 From Resellers to D2C Brands

Initially envisioned as a reseller platform, Meesho empowered homemakers and micro-entrepreneurs to sell products via WhatsApp and Facebook. It has since transformed into a powerful zero-commission D2C platform that democratizes commerce.

🛒 Zero-Commission Flywheel

Rather than charging sellers commissions like traditional marketplaces, Meesho monetizes through:

- Sponsored ads

- Logistics integration (warehousing & shipping margins)

- Financial partnerships (BNPL, working capital credit)

📦 Empowering Bharat’s Sellers

- 1.3 M+ sellers onboarded

- 75% from Tier II, III, and IV cities

- High return-customer rate (>70%)

- Category focus: fashion, home, personal care, kitchenware

📈 Strategic Pivots

- Migration from social resellers to an app-based self-serve model

- Invested in predictive analytics for inventory optimization

- Partnered with logistics providers to ensure low-cost, pan-India delivery

Meesho is no longer just a marketplace. It’s a creator of digital livelihoods at the grassroots level.

4. Competitor Analysis

| Company | Business Model | Target Audience | Key Differentiator | Backers |

| Meesho | Zero-commission marketplace | Tier II/III sellers | Asset-light, ad-based monetization | SoftBank, Peak XV, Meta |

| Flipkart Shopsy | Low-price marketplace | Bargain hunters | Flipkart-backed assortment and discounts | Walmart |

| DealShare | Inventory-led social commerce | Value-first customers | Owns the supply chain and warehouses | Matrix, WestBridge |

| JioMart | B2B2C omnichannel platform | Kirana + Online users | Reliance distribution power | Reliance Retail |

| GlowRoad | Reseller-focused app | WhatsApp entrepreneurs | Legacy player acquired by Amazon | Acquired (Amazon) |

Meesho’s core advantage lies in monetization through tools, not margin, while others rely on discounting or inventory control.

5. Investor & Fundraising History

| Deal Date | Round Name | Investors / Buyers | Deal Size (₹ Mn) | Post-Money Valuation (₹ Mn) |

| 25 Apr 2024 | Rights | Meesho Inc | 225,313.4 | 3,167,350.3 |

| 14 Jun 2022 | Rights | Meesho Inc | 272,915.8 | 1,886,864.4 |

| 15 Nov 2021 | Rights | Meesho Inc | 243,341.5 | 1,142,625.2 |

| 20 Apr 2021 | Rights | Meesho Inc | 148,776.8 | 570,161.7 |

| 22 Aug 2019 | Rights | Meesho Inc | 71,204.1 | 233,106.5 |

| 17 Dec 2018 | Funding | Meesho Inc | 21,461.9 | 44,401.3 |

| 15 Jan 2018 | Funding | Meesho Inc | 6,857.8 | 13,987.5 |

| 30 Jan 2018 | Funding | Meesho Inc | 1,005.9 | 1,425.9 |

| 05 Oct 2017 | Funding | Meesho Inc | 300.0 | 315.0 |

While Meesho Inc. appears as the direct investor in Indian filings, the real story lies in the powerful global backers funding the company’s journey from Silicon Valley to small-town India. Over the years, Meesho has secured capital from an elite roster of institutional investors, including SoftBank, Prosus, Facebook, Elevation Capital (SAIF), Peak XV Partners, Y Combinator, Shunwei Capital, and others. These investors brought not only funds but strategic insight, enabling Meesho to scale rapidly, navigate product-market pivots, and optimize monetization. The presence of growth-focused VCs and late-stage funds across multiple rounds also highlights continued investor confidence, even through periods of intense market correction. As Meesho readies for its IPO, this deep bench of globally recognized backers signals strength, credibility, and long-term potential.

6. Leadership & Team Structure

Meesho’s leadership is anchored by its visionary co-founders, who have played a pivotal role in redefining India’s e-commerce ecosystem:

Vidit Aatrey, Co-founder & CEO, is an alumnus of IIT Delhi and a former product manager at InMobi. He has guided Meesho from a simple reseller platform to a nationwide, zero-commission marketplace. Vidit is known for his product-first thinking, lean operating mindset, and long-term strategic orientation. Under his leadership, Meesho has achieved the rare feat of turning profitable while scaling exponentially.

Sanjeev Barnwal, Co-founder & CTO, also an IIT Delhi graduate, has spearheaded the company’s technology infrastructure. From architecting the app’s backend to building scalable ad-tech and logistics solutions, Sanjeev has ensured that Meesho remains nimble yet robust. His ability to optimize engineering for high performance with minimal cost is central to Meesho’s capital efficiency.

7. Operational Metrics Snapshot

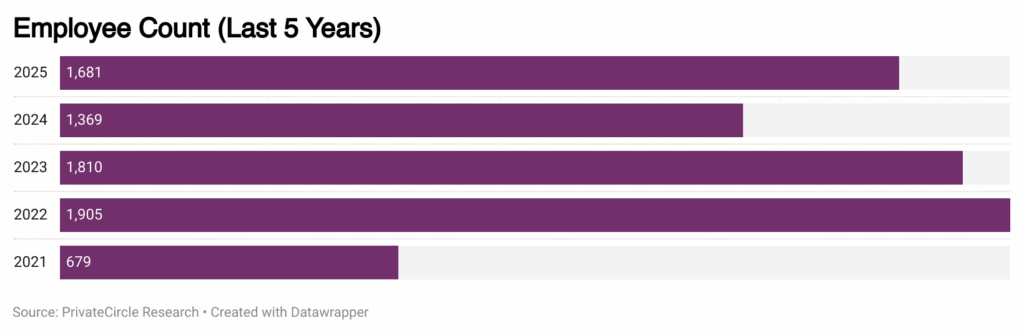

Meesho has steadily grown its workforce in line with platform expansion and product complexity. The lean cost structure, despite increasing scale, is reflected in its productivity ratios and improving financials.

💳 Loans & Facilities (as of FY24)

| Lender | Issued Amount (₹ Mn) | Latest Loan Amount (₹ Mn) | Nature of Facility | Interest Rate |

| ICICI Bank | 692.00 | 692.00 | Overdraft Facility | 9.50% |

| Axis Bank | 1,000.00 | 1,000.00 | Overdraft against Fixed Deposit | 9.20% |

| ICICI Bank | 350.00 | 350.00 | 100% FD Backed Bank Guarantee | 0% |

| JP Morgan Chase | 2,450.00 | 2,450.00 | Foreign Exchange ForwardTransaction | 0% |

| ICICI Bank | 0.09 | 0.09 | Overdraft | 7.7% |

| State Bank of India | 900.00 | 4,150.00 | Overdraft against Fixed Deposit | 8.48% |

| Yes Bank | 60.00 | 60.00 | Overdraft | 1.50% |

| ICICI Bank | 4,000.00 | 4,000.00 | Non-Credit Backed Limit | As per the treasury |

Meesho maintains a conservative debt profile with overdraft and FD-backed facilities. This reflects a healthy balance between operational leverage and cash flow discipline, essential in the pre-IPO phase.

📱 Meesho Monthly Active Users (MAUs)

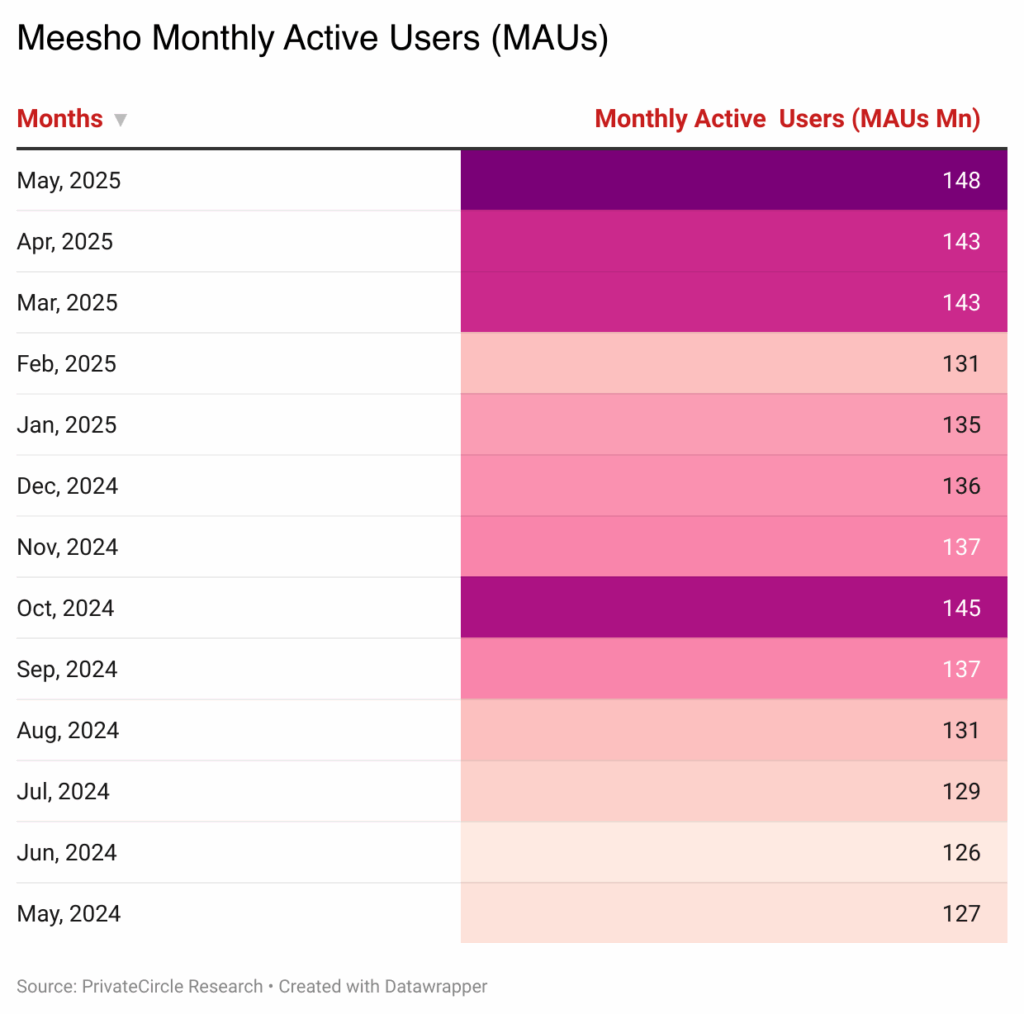

Between May 2024 and May 2025, Meesho’s Monthly Active Users (MAUs) increased significantly from 127.5 million to 148.64 million, marking a net growth of over 21 million users in just one year. After a mid-year peak in October 2024 (145.48 Mn), MAUs slightly dipped during the year-end and early 2025—potentially reflecting seasonal behavior or platform recalibration—but rebounded strongly in Q1 2025, hitting new highs by April and May 2025.

This upward trend signals renewed user engagement and strong product-market alignment, reinforcing Meesho’s readiness for public markets and its growing dominance in Tier II–III digital commerce.

🧾 Conclusion: Meesho’s IPO Moment — A Story Still Being Written

Meesho’s story is more than just another startup scaling up—it’s a case study in how a digital platform can empower millions, especially outside the metro bubble. It has created a new kind of marketplace where small sellers thrive, middle-class buyers return, and operational efficiency matters more than cash burn.

As Meesho heads towards its $1Bn IPO, it represents what India’s next wave of digital-first unicorns could look like: frugal, focused, and functionally embedded in the aspirations of Bharat. Its governance upgrades, shrinking losses, and massive user base point toward a compelling public market debut.

📈 This report has been compiled using exclusive deal data, revenue figures, and structural insights from PrivateCircle, your trusted partner in private market intelligence.