CRED, founded in 2018 by Kunal Shah, is an Indian fintech company based in Bengaluru.

It operates as a members only platform that rewards individuals for timely credit card bill payments, offering exclusive perks and privileges to its users.

The term CRED Mafia refers to the network of startups (16+) founded by former CRED employees. These entrepreneurs have ventured into various sectors, leveraging their experience and insights gained from their tenure at CRED.

Highlights of the Cred Mafia:

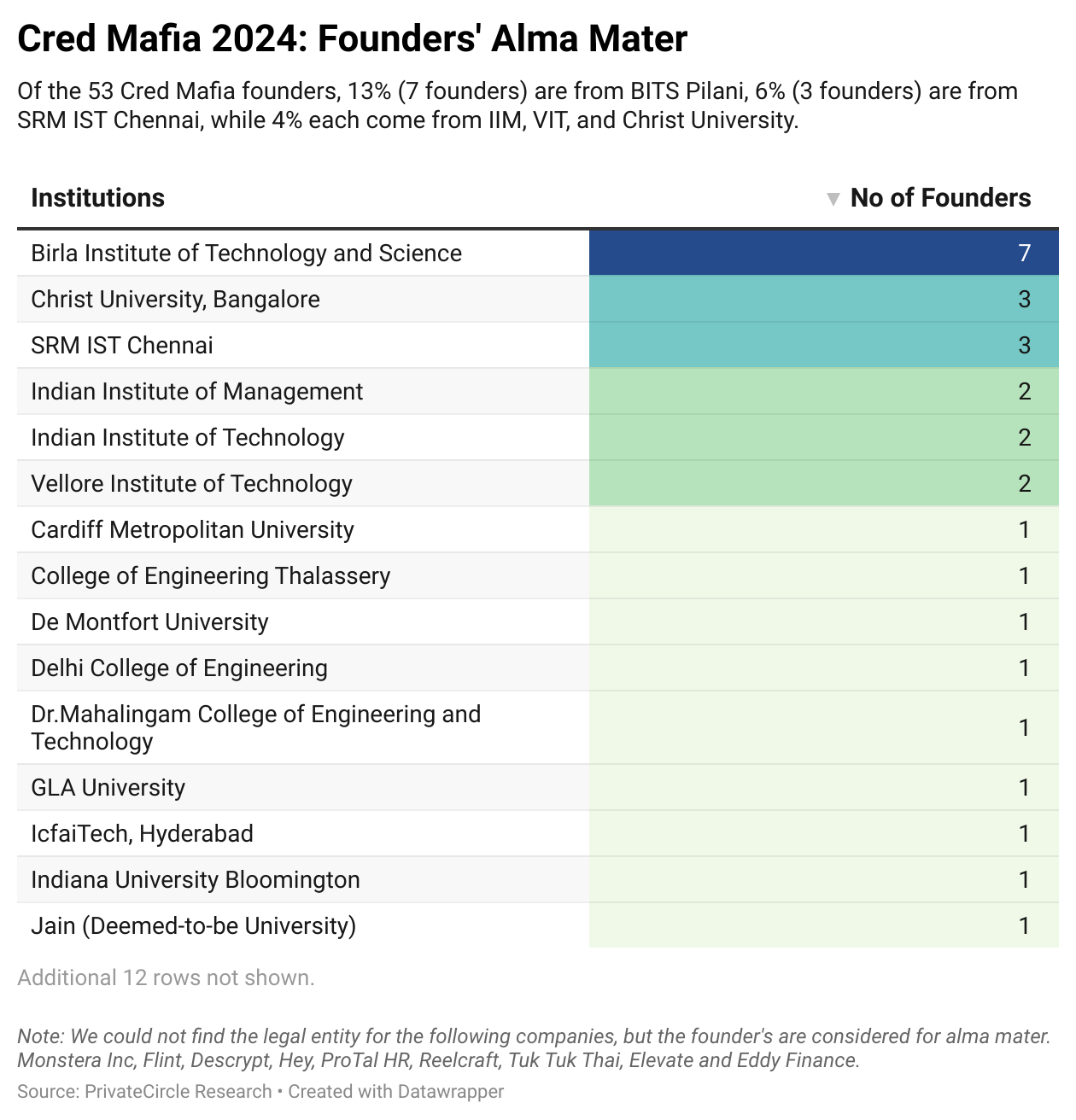

- Founders spread across 27+ alma maters that we were able to track

- 16+ startups under its umbrella that we were able to track

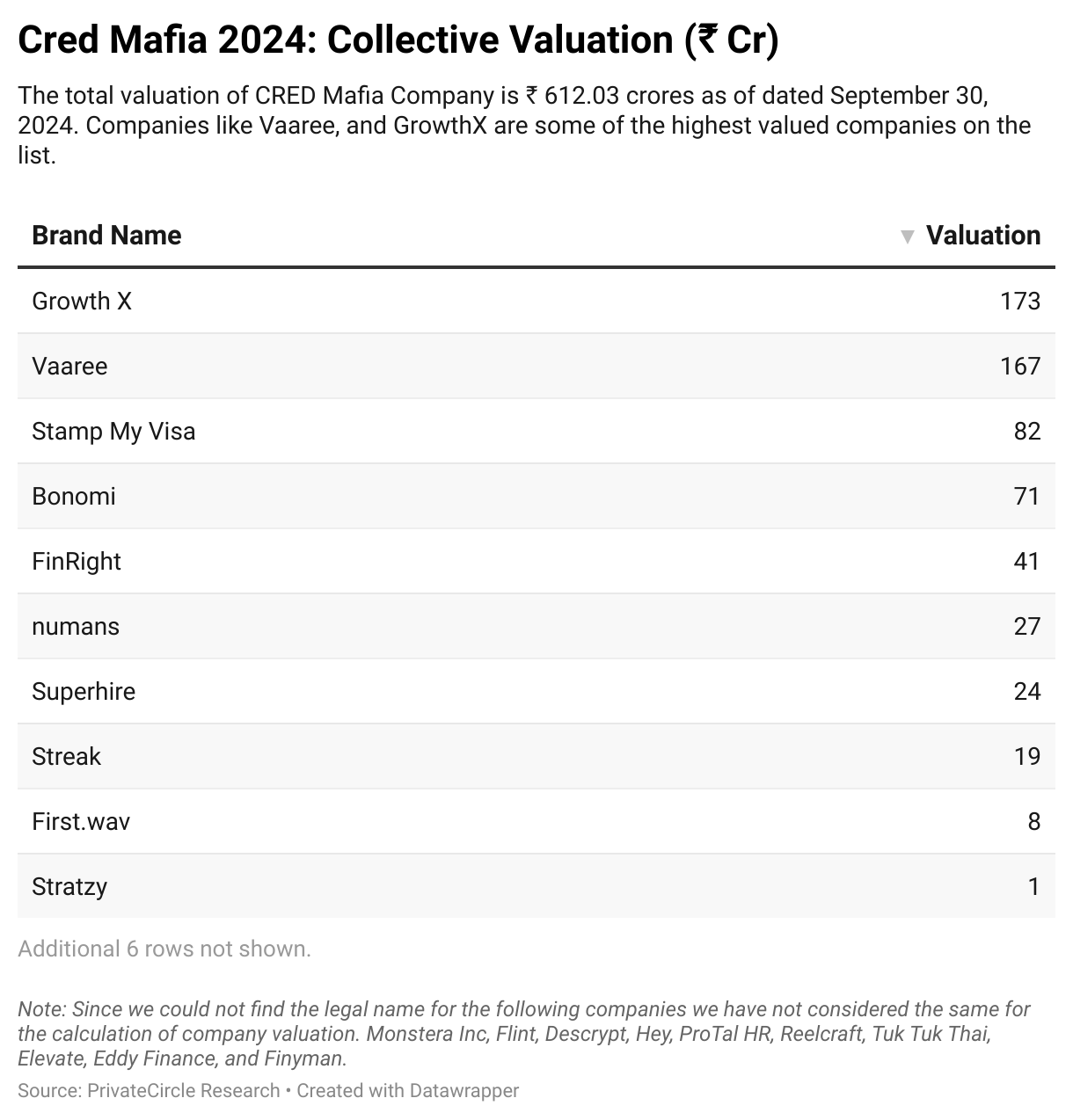

- Collective valuation of ₹612 cr

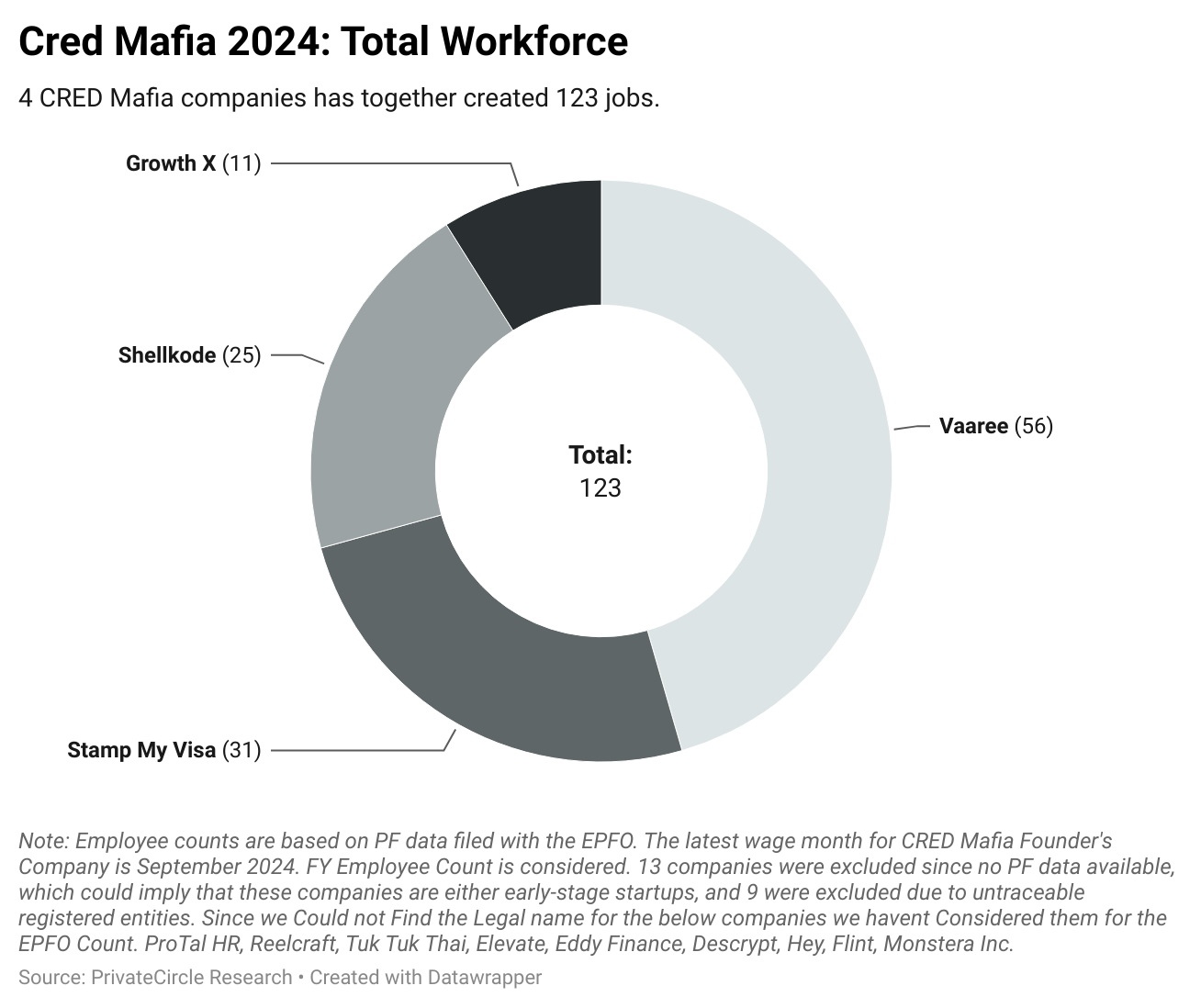

- Created over 123 jobs

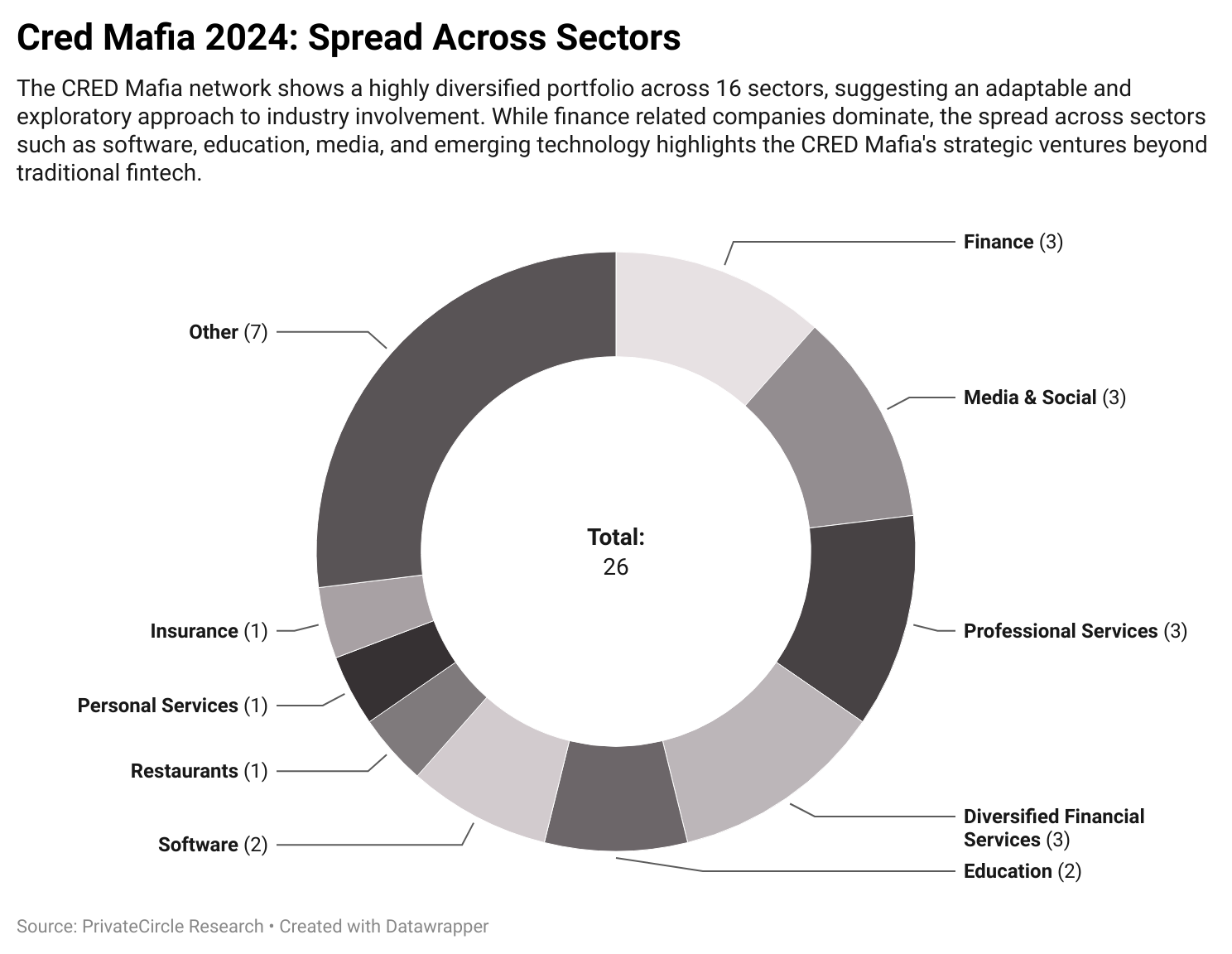

- Active in Finance, Media & Social, Professional Services, Diversified Financial Services , Education, and others

Blog Outline | Data and Insights by PrivateCircle Research

- Collective Valuation (₹ Cr)

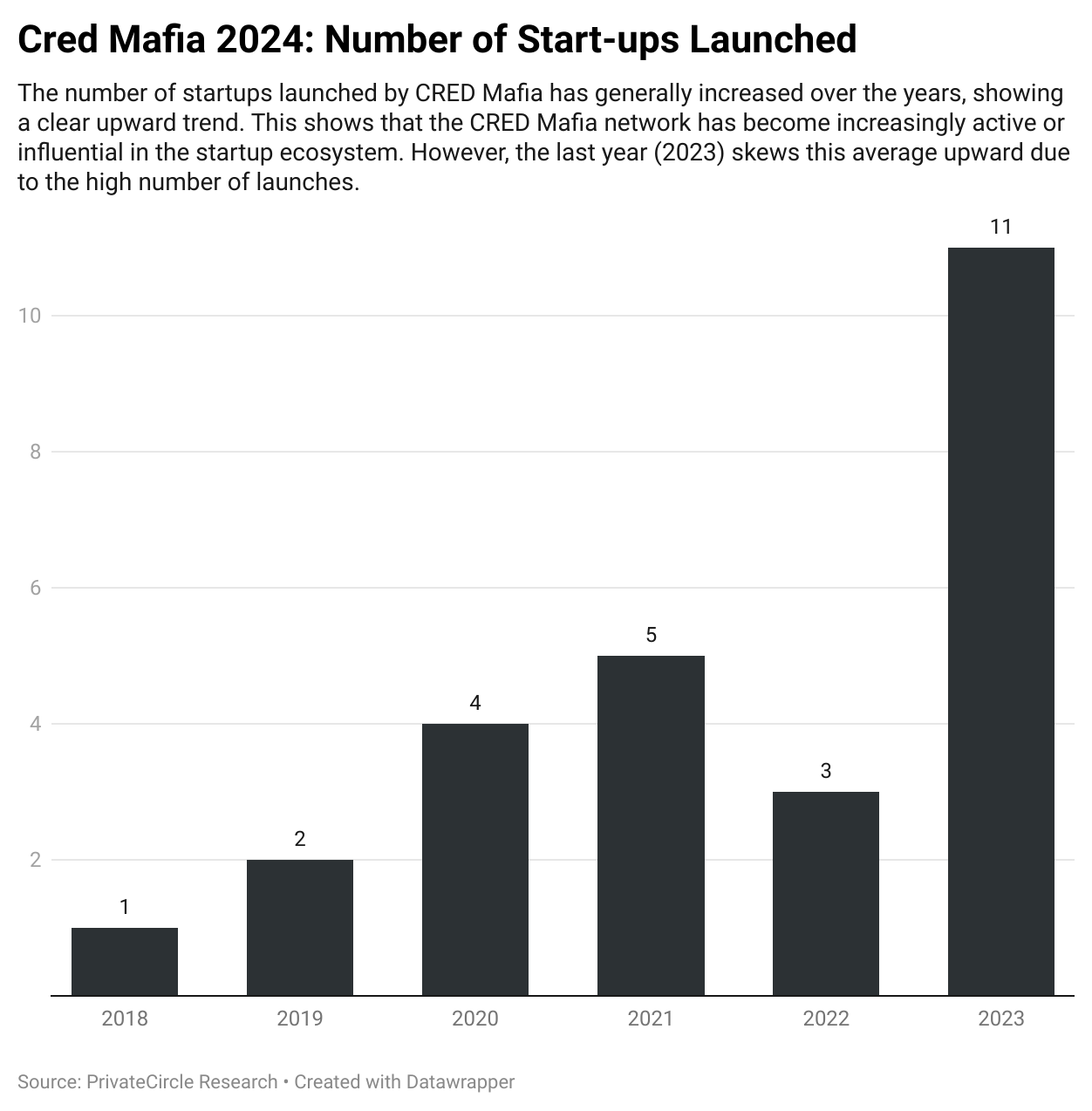

- Number of Start-ups Launched

- Spread Across Sectors

- Total Workforce

- Job Creation & Economic Impact

- Investor Activity & Funding Dynamics

- Strategic Investments

- Conclusion

Job Creation & Economic Impact

Startups are more than just valuation figures – they’re engines of employment.

Together, four CRED Mafia companies have created 123 jobs, as per EPFO data. While this number might seem modest, it’s important to note that several excluded startups are likely in their early stages, poised for future growth.

Investor Activity & Funding Dynamics

CRED Mafia startups have attracted significant investor interest. Their association with a successful parent company gives them a credibility boost, opening doors to funding opportunities.

Investors often see these ventures as lower-risk bets, given their founders’ experience with CRED’s innovative, user-focused business model.

Strategic Investments

Diversity is a hallmark of the CRED Mafia’s portfolio, with startups spanning 16 sectors.

While fintech remains dominant, these ventures have explored software, education, media, and even emerging technologies. This adaptability underscores their willingness to disrupt industries and explore new markets.

Conclusion

The CRED Mafia is more than a group of startups; it’s a testament to the power of ecosystems. With a robust network, innovative ventures, and the ability to attract top talent and investment, these startups are redefining the entrepreneurial landscape in India.

As more employees take the leap into entrepreneurship, the future looks bright for the CRED Mafia and the industries they’re set to transform.

Credits

This comprehensive report was made possible by the collaborative efforts of Sangeetha M, Nikshith Gowda, and Madona Ps.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.