After a strong rebound in April, which saw deal activity hit a 12-month high of 134 transactions, May 2025 witnessed a sharp pullback with only 99 funding deals in the Indian private markets, returning to the same volume last seen in February this year.

Despite this, funding value remained robust, crossing ₹11,000 crore, showcasing that larger cheques continue to be written even as overall deal count dipped.

Deal Value Holds Steady

Indian private companies collectively raised ₹11,154 crore in May 2025 – a slight drop from April’s ₹13,827 crore but still significantly higher than most months in the last year. The strong funding levels, despite lower deal activity, indicate continued investor conviction in high-potential opportunities.

| Month | Amount Raised (₹ Cr) |

| May 2025 | ₹11,154 |

| Apr 2025 | ₹13,827 |

| Mar 2025 | ₹9,916 |

| Feb 2025 | ₹10,330 |

| Jan 2025 | ₹9,482 |

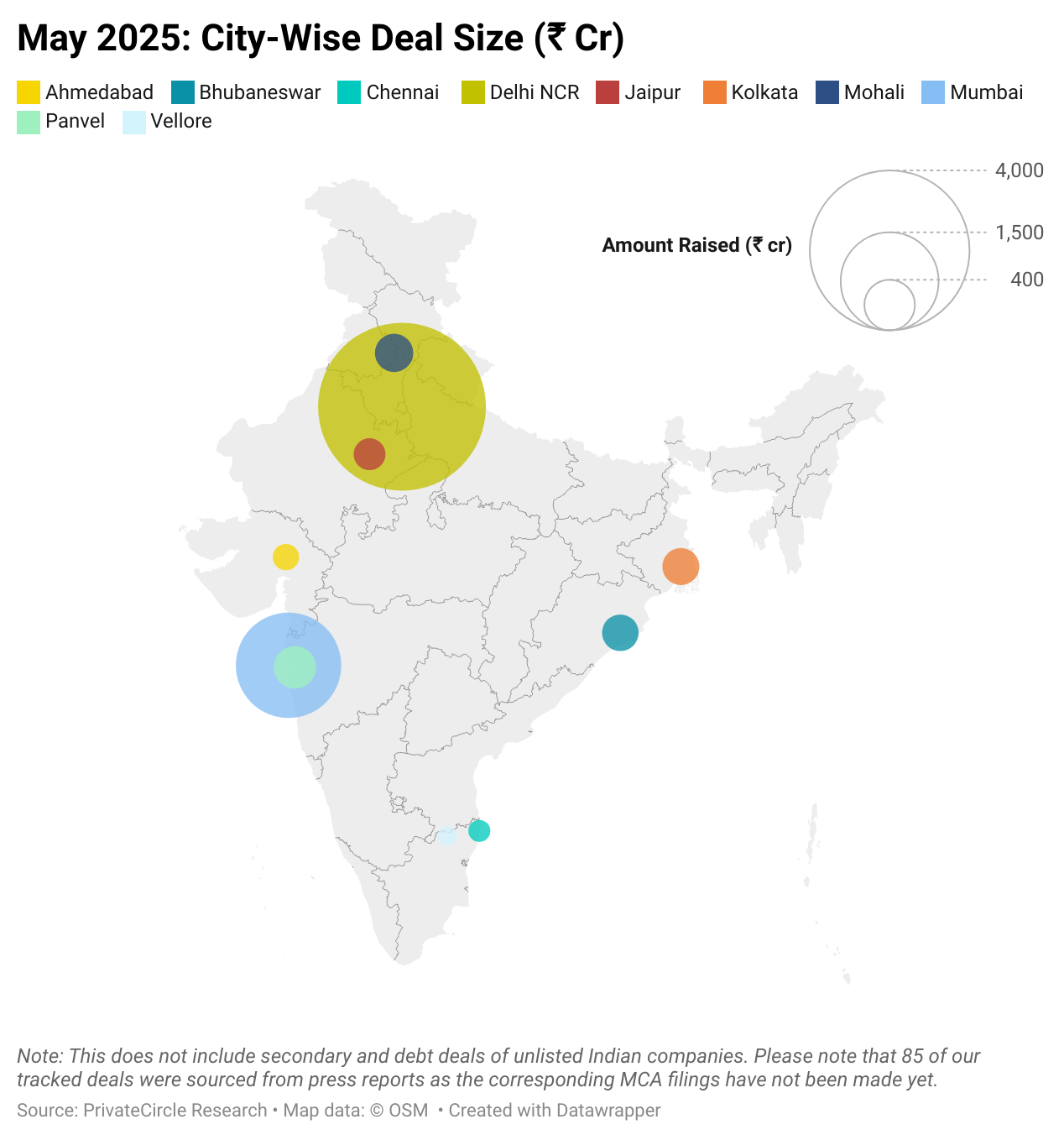

City-wise Breakdown: Metro Dominance Strengthens

Tier 1 cities completely dominated the funding landscape in May:

- Tier 1 cities raised a whopping ₹10,258 crore across 88 deals, accounting for over 90% of the total funding.

- Tier 2 & 3 cities contributed only ₹883 crore from 11 deals, showing a stark urban-rural capital divide.

| City Tier | Amount Raised (₹ Cr) | Deal Count | Avg Deal Size (₹ Cr) |

| Tier 1 | ₹10,258 | 88 | ₹116 |

| Tier 2 & 3 | ₹883 | 11 | ₹80 |

Top cities by amount raised:

- Delhi NCR – ₹4,411 Cr across 37 deals

- Mumbai – ₹1,698 Cr across 18 deals

- Panvel – ₹250 Cr (1 deal)

- Mohali – ₹200 Cr (1 deal)

- Kolkata – ₹185 Cr (3 deals)

- Bhubaneswar – ₹180 Cr (1 deal)

- Jaipur – ₹133 Cr (3 deals)

- Ahmedabad – ₹86 Cr (2 deals)

- Chennai – ₹57 Cr (4 deals)

- Vellore – ₹43 Cr (1 deal)

Investor Activity by City Tier

Tier 1 cities not only attracted the highest amount of capital but also dominated participation across investor classes:

| Investor Type | Tier 1 Deals | Tier 2 & 3 Deals |

| Angel Investors | 22 | 2 |

| Family Offices | 9 | 0 |

| VC/PE Firms | 46 | 7 |

Metro cities continue to be the stronghold of institutional capital and late-stage rounds, while smaller cities remain limited to selective early-stage deals.

Top 3 Deals of the Month

- PB Healthcare Services – ₹1,867 Cr

- Porter (logistics) – ₹1,713 Cr

- Myntra (fashion ecommerce) – ₹1,067 Cr

These top three accounted for a significant portion of total deal value, highlighting the preference for scaled-up platforms in logistics, fashion, and healthcare.

Deal Volume Trends

Fewer Deals, Bigger Cheques

While the number of deals dropped to 99, capital inflow remained resilient – indicating selective but substantial bets by investors.

| Month | Deal Count |

| May 2024 | 100 |

| Jun 2024 | 111 |

| Jul 2024 | 99 |

| Aug 2024 | 121 |

| Sep 2024 | 107 |

| Oct 2024 | 108 |

| Nov 2024 | 93 |

| Dec 2024 | 142 |

| Jan 2025 | 141 |

| Feb 2025 | 99 |

| Mar 2025 | 113 |

| Apr 2025 | 134 |

| May 2025 | 99 |

Top Investors by Deal Volume

- British International Investment – 4 deals

- Lightspeed India Partners – 4 deals

- Arkam Ventures – 3 deals

- Inflection Point Ventures – 3 deals

- We Founder Circle – 3 deals

The consistency from these investors, particularly across early and growth stages, shows ongoing commitment to Indian private markets despite global macro uncertainties.

Investor Type Breakdown

VC/PEs Still in Control, Angels Step Back

Venture and private equity firms continue to lead the funding charge, while angel activity cooled and family offices remained steady.

| Investor Type | May 2025 | Apr 2025 | Mar 2025 | Feb 2025 | Jan 2025 |

| VC/PE Firms | 58 | 80 | 76 | 51 | 100 |

| Angel Investors | 24 | 32 | 24 | 29 | 36 |

| Family Offices | 9 | 7 | 6 | 5 | 12 |

Final Takeaways

- May funding value held strong at ₹11,154 Cr despite a dip in deal count

- Tier 1 cities captured 90%+ of funding and investor activity

- Delhi NCR and Mumbai continue to lead; non-metros remain marginal

- Top investors stayed consistent, betting on mature businesses

- Mega-deals in healthcare, logistics, and fashion drove funding momentum

India’s private markets are maturing fast. The story isn’t just about who raised – it’s about who survived, who scaled, and who still draws capital when the bar for capital is higher than ever.

Stay ahead in this evolving landscape – subscribe to our newsletter and follow PrivateCircle for in-depth insights and updates on the growth and resilience of India’s private markets.