India’s commercial & industrial renewable energy space is quietly minting scale, and CleanMax Enviro Energy Solutions sits right at the centre of that shift. Built around long-term power purchase agreements (PPAs) for corporates, CleanMax has grown into one of India’s largest rooftop solar and open-access renewable platforms, serving data centres, manufacturing plants, IT parks, and global enterprises seeking predictable green power.

With its IPO, CleanMax is not just accessing public capital, it is offering a liquidity moment for long-term institutional investors who backed the platform well before clean energy became fashionable.

What Does CleanMax Enviro Do?

CleanMax Enviro operates as a B2B renewable energy solutions provider, primarily focused on:

- Rooftop solar installations for commercial & industrial clients

- Open-access solar and wind projects supplying power off-site

- Long-term PPAs that lock in visibility of cash flows

- Decarbonisation solutions for large enterprises

Its asset-heavy model, backed by contracted revenues, has allowed the company to scale steadily without the volatility seen in merchant power businesses.

IPO Snapshot

While the IPO is positioned as a clean-energy growth story, structurally it is also a significant exit and partial monetisation event for existing shareholders.

Key IPO Details:

| Particulars | Details |

|---|---|

| IPO Opening Date | 23 February 2026 |

| IPO Closing Date | 25 February 2026 |

| Listing Date | 2 March 2026 |

| Price Band | ₹1,000 – ₹1,053 per share |

| Total Issue Size | ₹3,100 Cr |

| Fresh Issue | ₹1,200 Cr |

| Offer for Sale (OFS) | ₹1,900 C |

Source: CleanMax Enviro Red Herring Prospectus (RHP) and statutory filings

Why Is CleanMax Going Public?

The IPO serves multiple strategic objectives:

- Liquidity for long-term investors

Several funds entered between 2021–2023 and are now exiting at meaningful multiples. - Lower cost of capital

Public market access improves financing options for capital-intensive renewable projects. - Balance sheet strength

Supports future solar & wind capacity additions without over-leveraging. - Institutional credibility

Listing enhances trust with global corporate clients and lenders.

Financial Performance Snapshot

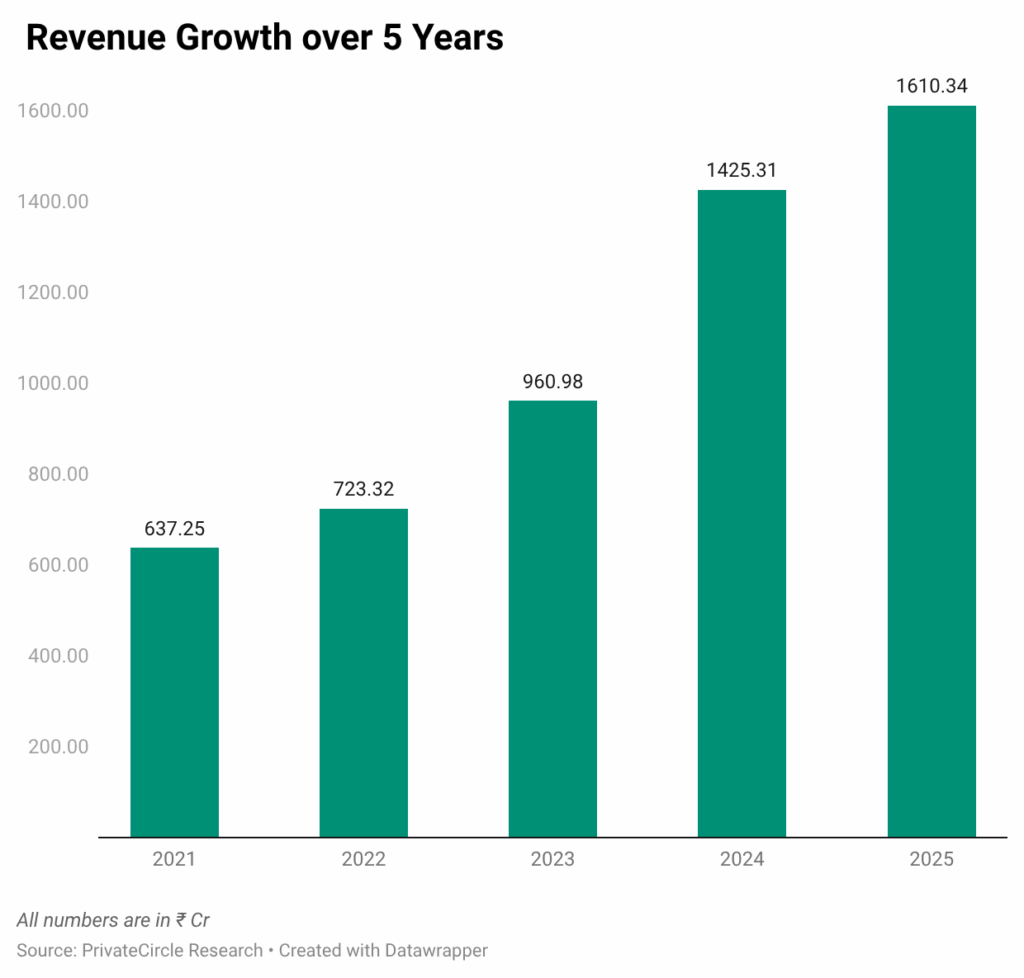

CleanMax’s revenue trajectory reflects the steady commissioning of assets and long-term contracts rather than sudden spikes.

What stands out:

- Revenue has more than doubled over four years

- Growth accelerates post-FY23 as operating capacity scales

- Predictable topline backed by PPAs rather than spot pricing

Investor Exit & Return Snapshot

The IPO crystallises value for a diverse set of investors, from global infrastructure funds to early backers.

| Investor | First Investment Date | Total Investment (₹ Cr) | Total Value (₹ Cr) | Return Multiple |

|---|---|---|---|---|

| Kempinc LLP | Sep 2021 | 436.81 | 1,532.36 | 3.51x |

| Augment Infrastructure | Aug 2021 | 1,095.43 | 2,948.68 | 2.69x |

| DSDG Holding ApS | Dec 2021 | 212.15 | 564.34 | 2.66x |

| Brookfield | May 2023 | 2,198.53 | 4,713.86 | 2.14x |

| Kuldeep Jain | Oct 2010 | 0.89 | 1,239.98 | 1,395.20x |

What This Exit Says About the Sector

- Infrastructure-style renewable platforms are now IPO-ready

- Returns are driven by time + scale, not short-term hype

- Patient capital continues to outperform fast-turn venture bets

- Clean energy exits are becoming predictable, not speculative

What Investors Should Track Now

As CleanMax Enviro enters the public markets, the investment lens shifts from exit multiples to execution and discipline. Key areas to watch include:

1. Capacity Addition Pipeline

Track how quickly CleanMax converts fresh IPO capital into commissioned solar and wind assets. Delays here directly impact revenue visibility.

2. Quality of Power Purchase Agreements (PPAs)

The length, pricing, and counterparty strength of PPAs will determine cash-flow stability more than headline capacity numbers.

3. Debt Levels & Cost of Capital

Renewable platforms are capital-intensive. Watch whether balance-sheet leverage remains controlled as expansion accelerates.

4. Asset Utilisation & Plant Load Factors

Higher utilisation improves margins and return on invested capital, especially in open-access projects.

5. Client Concentration

Diversification across industries and geographies reduces dependence on a few large corporate buyers.

6. Regulatory & Open-Access Policy Changes

State-level open-access charges, transmission fees, and renewable policies can materially impact project economics.

7. OFS Overhang & Shareholding Stability

Post-listing stake movements by pre-IPO investors may influence near-term stock behaviour.

Final Take

The CleanMax Enviro IPO is less about buzz and more about execution, patience, and scale. For investors, it represents a clean exit with respectable multiples. For the market, it signals maturity in India’s commercial renewable energy ecosystem.

This is not a story of overnight gains, it’s a case study in how infrastructure capital compounds when regulation, demand, and discipline align.

For more IPOs, check PrivateCircle‘s IPO tracker here.