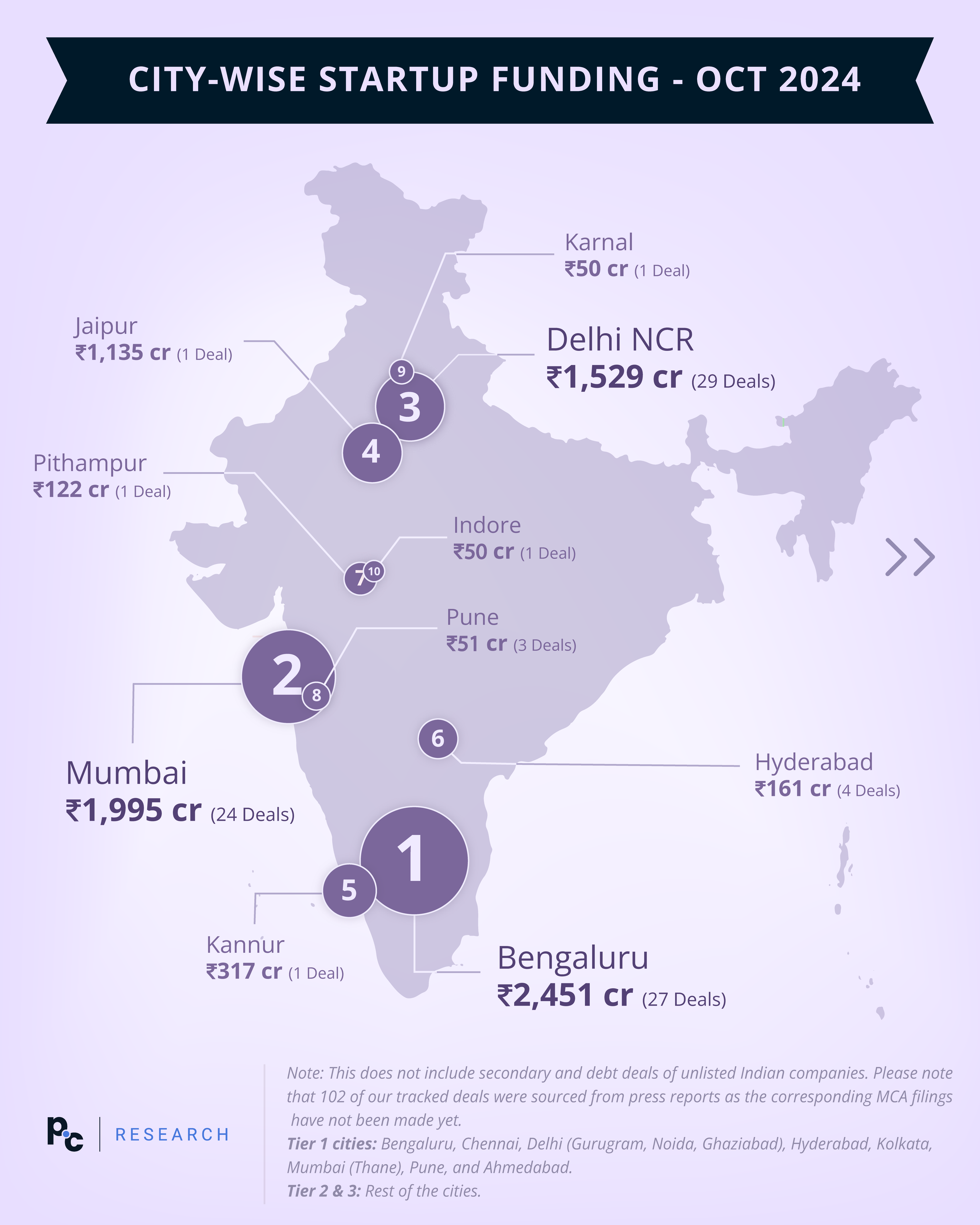

In October 2024, India’s Tier 1 cities such as Bengaluru, Mumbai, and Delhi NCR led the startup funding landscape, raising a combined ₹6,205 crore across 80 deals.

Tier 1 locations, known for established infrastructure and investor confidence, saw this funding mainly fuelled by VC/PE firms, accounting for 56 of the total deals. Notably, angel investors and family offices also heavily favoured Tier 1, with 25 angel deals and 7 family office deals.

This tier’s average deal size stood at ₹66 crore, indicating a decrease from previous months as capital focus shifts to projects with quicker returns or high scalability potential.

The tech-forward Bengaluru, with ₹2,450.88 crore in funding across 27 deals, continues to drive innovation, particularly in fintech, health tech, and AI.

Key Highlights:

- Bengaluru led with ₹2,450.88 crore over 27 deals.

- Tier 1 raised a combined ₹6,205 crore, but funding dropped from previous months, highlighting a cooling trend. Tier 2 & 3 cities saw funding growth to ₹1,743 crore (up from ₹1,256 crore in September).

- VC/PE firms dominated with 56 deals in Tier 1 cities but only 8 deals in Tier 2 & 3.Angel investors focused mainly on Tier 1 (25 deals), with limited activity elsewhere.

Deal Numbers & Size

In October, Bengaluru startups led the funding landscape with ₹2,450.88 crore raised across 27 deals, followed closely by Mumbai at ₹1,995.48 crore over 24 deals.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 102 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

Tier 1 cities: Bangalore, Chennai, Delhi (Gurugram, Noida, Ghaziabad), Hyderabad, Kolkata, Mumbai (Thane), Pune, and Ahmedabad.

Tier 2 & 3: Rest of the cities.

Delhi NCR recorded ₹1,529.25 crore through 29 deals. Among Tier 2 cities, Jaipur made a significant impact with a single deal totalling ₹1,135 crore.

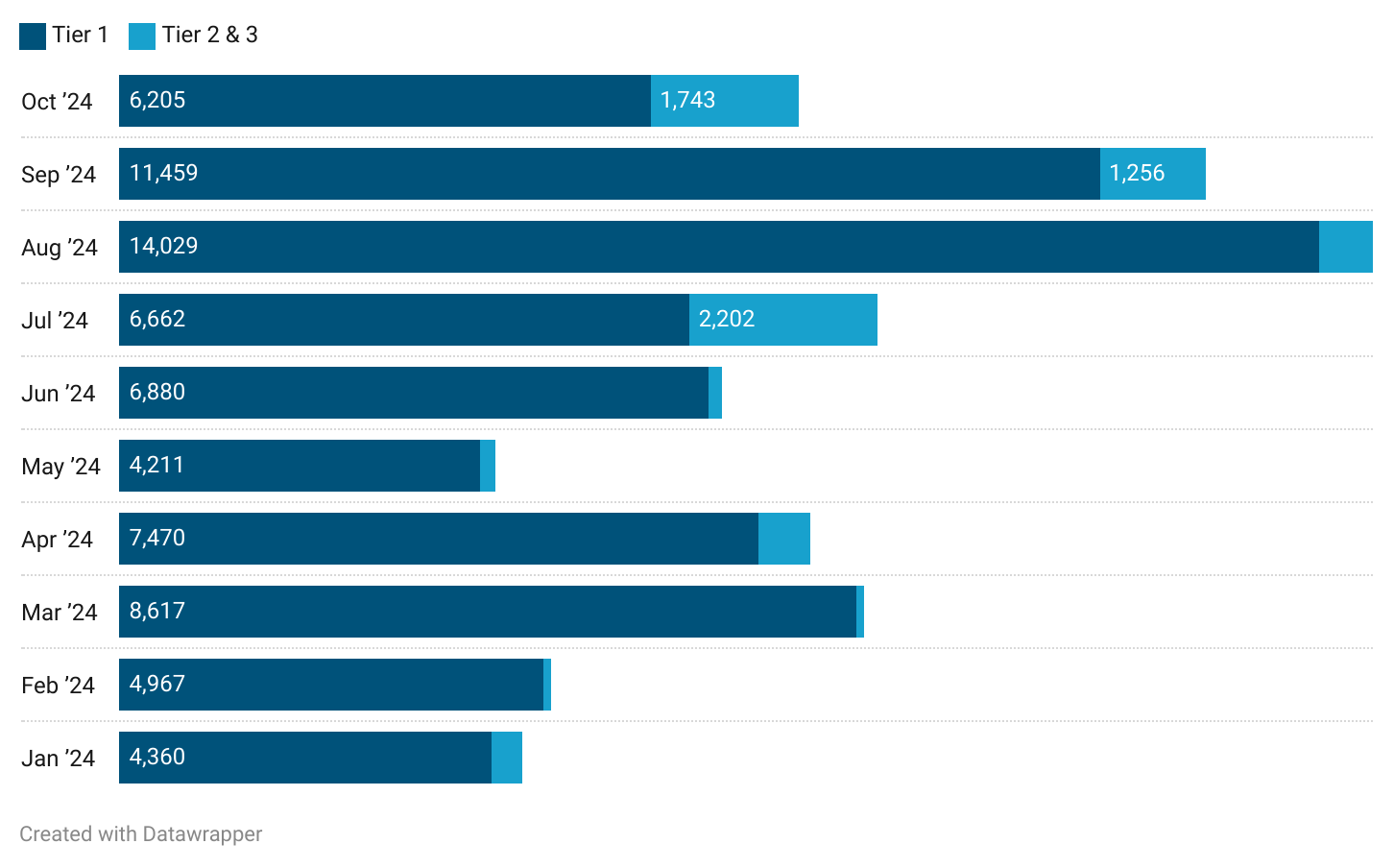

Funding Across Tier 1, 2 & 3 Cities (₹ Cr)

Tier 1 cities raised ₹6,205 crore, marking a substantial decrease from ₹11,459 crore in September and showing a continued downward trend from the high of ₹14,029 crore in August.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 102 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

Meanwhile, Tier 2 & 3 cities saw a strong boost in funding, reaching ₹1,743 crore – a considerable jump from ₹1,256 crore in September. This increase is driven by big ticket funding rounds raised by Finova Capital and Haber.

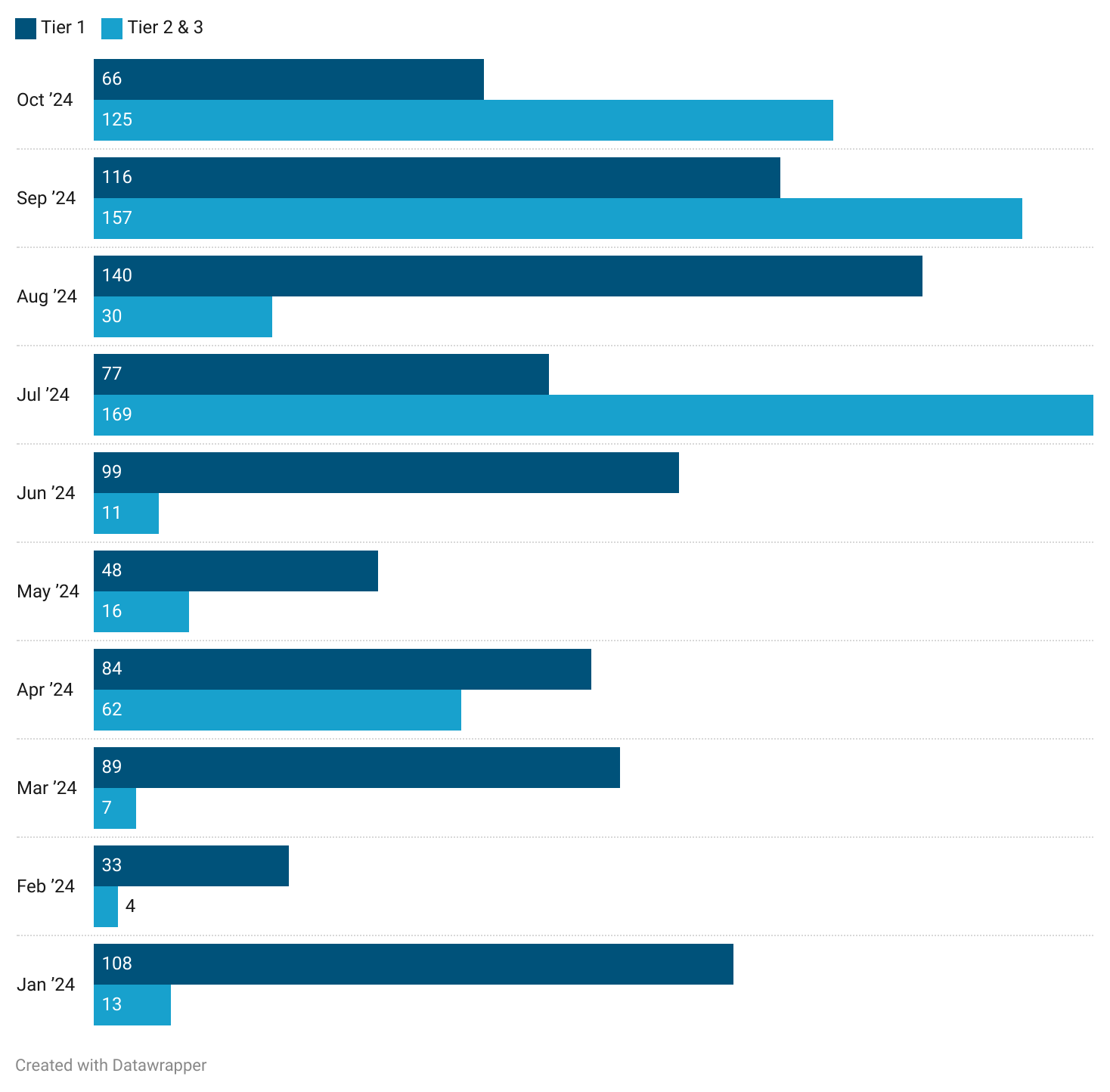

Average Deal Size for Tier 1-3 City Startups (₹ Cr)

The average deal size in Tier 1 cities was ₹66 crore, a notable decrease from ₹116 crore in September and down significantly from the August high of ₹140 crore.

Note: This does not include secondary and debt deals of unlisted Indian companies. Please note that 102 of our tracked deals were sourced from press reports as the corresponding MCA filings have not been made yet.

Meanwhile, Tier 2 & 3 cities saw an impressive average deal size of ₹125 crore, driven by big ticket funding rounds raised by Finova Capital and Haber.

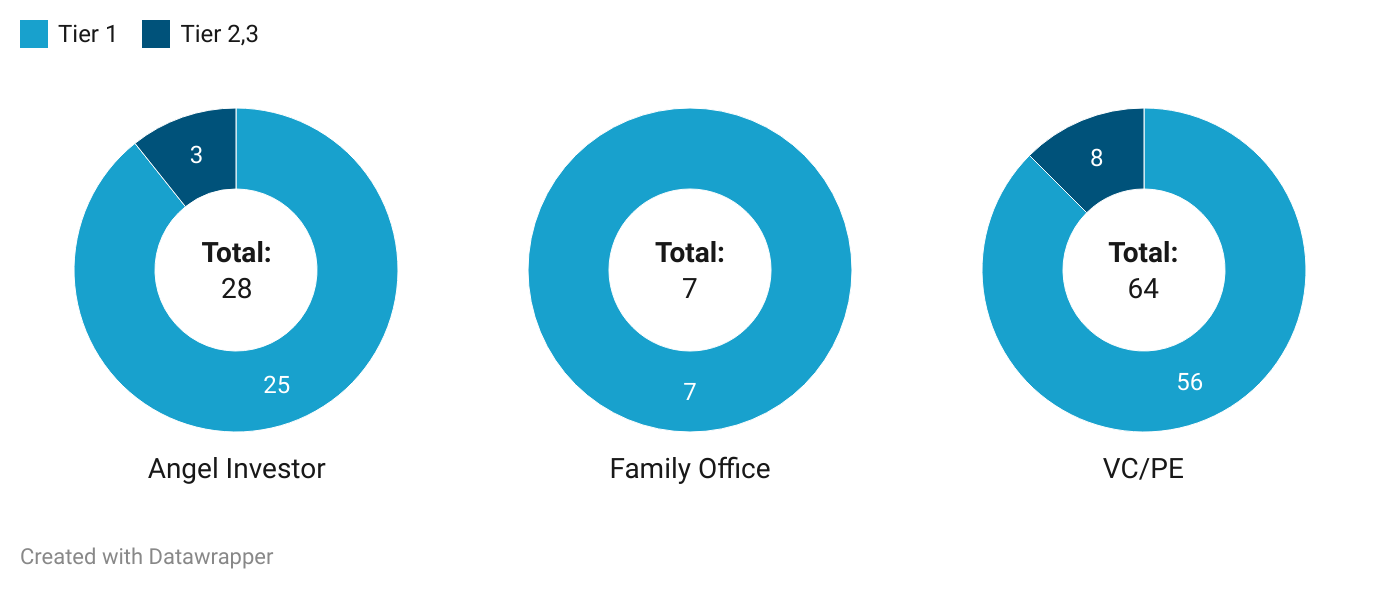

Investor Type by City Tier

Tier 1 cities continued to attract strong interest from Venture Capital and Private Equity (VC/PE) firms, with 56 deals compared to only 8 deals in Tier 2 & 3 cities. Angel investors were also more active in Tier 1, participating in 25 deals, while Tier 2 & 3 cities saw just 3 angel investor deals.

Note: Any funding deal can have participation from more than one type of investors(angel investor, family office etc) resulting in deals being counted more than once in this analysis.

Family offices remained concentrated in Tier 1 cities, with 7 deals, and had no activity in Tier 2 & 3 locations.

Economic Impact and Job Creation

This investment surge in Tier 2 & 3 cities reflects a shift that could catalyse job creation in less urbanised areas, supporting economic development beyond the metro regions.

With Finova and Haber targeting sectors with a broad employment base, such as manufacturing and fintech, job creation could soon follow, especially as startup activity expands into these cities with focused investments.

This diversification in funding points towards new opportunities that could make cities like Jaipur attractive alternatives for skilled talent.

Comparative Analysis and Performance Trends

October 2024’s city-wise funding figures reveal a contrasting story to September. Total deal volume rose modestly, but the total funding value declined significantly by 37%, from ₹12,715 crore in September to ₹7,948 crore.

Tier 1 cities, which historically hold the lion’s share of investments, saw a downward trend, reflecting a cooling in high-value deals. The increasing competition and high valuations may have played a role in redirecting some investors toward high-potential, lower-cost Tier 2 & 3 investments.

Notably, the record of deal sizes has shown more resilience outside Tier 1, where average values actually rose to ₹125 crore.

Investor Activity and Funding Dynamics

While VC/PE firms dominated, investor participation in Tier 2 & 3 cities signifies a paradigm shift, with the potential for specialized funds to follow, drawn by lower operational costs and increasing digital reach.

The 25 angel investor deals in Tier 1 cities hint at continued interest in high-growth early-stage startups, albeit with a cautious approach to prevent overvaluation.

Strategic Investments

October highlights Tier 1’s sustained dominance while spotlighting Tier 2 & 3 cities as emerging funding destinations.

This indicates a balanced, strategic investment approach where Tier 1 innovation remains a core focus but with an added emphasis on broader geographical expansion. With support from both state and private entities, these upcoming cities are well-placed to attract talent, create employment, and spur local economies.

Long-term, Tier 2 & 3 cities hold the potential to establish diverse startup ecosystems that drive sustainable growth.

Conclusion

This city-wise funding recap underscores a trend of gradual expansion beyond traditional hubs, offering insights into evolving funding preferences and the startup ecosystem’s adaptability.

As these trends unfold, the Indian startup landscape seems poised for a more inclusive economic impact across the country’s diverse regions.

For further insights into 3 million+ companies and funding trends, check out our full analysis by signing up for a free trial!

Stay tuned for more in-depth analysis and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Data Curation by Nishmitha Devadiga and Subramanya U R of PrivateCircle.

Explore More City-Wise Startup Funding Recaps:

Monthly City-Wise Startup Funding Landscape: March 2024

Monthly City-Wise Startup Funding Landscape: February 2024

City-Wise Startup Funding Recap: April 2024

City-Wise Startup Funding Recap: May 2024

City-Wise Startup Funding Recap: June 2024

City-Wise Startup Funding Recap: July 2024