Aarin Capital, chaired by TV Mohandas Pai, operates as a proprietary venture fund with a strategic focus on technology-driven businesses in life sciences, healthcare, and education.

The fund also supports entrepreneurial fund managers whose investment theses complement its primary areas of interest.

This report provides data-driven insights into Aarin’s activities for FY 2024-25, highlighting key metrics, sector preferences, and investment trends to offer a comprehensive view of its portfolio and strategies.

Key Metrics:

- Portfolio’s Combined Revenue – ₹16,580 Cr

- Investment Range – ₹92.5 lakh – ₹34.2 crore

- Total Investments – 50

- Total Investments – FY23 – ₹0.2 Cr, FY24 – ₹9.49 Cr

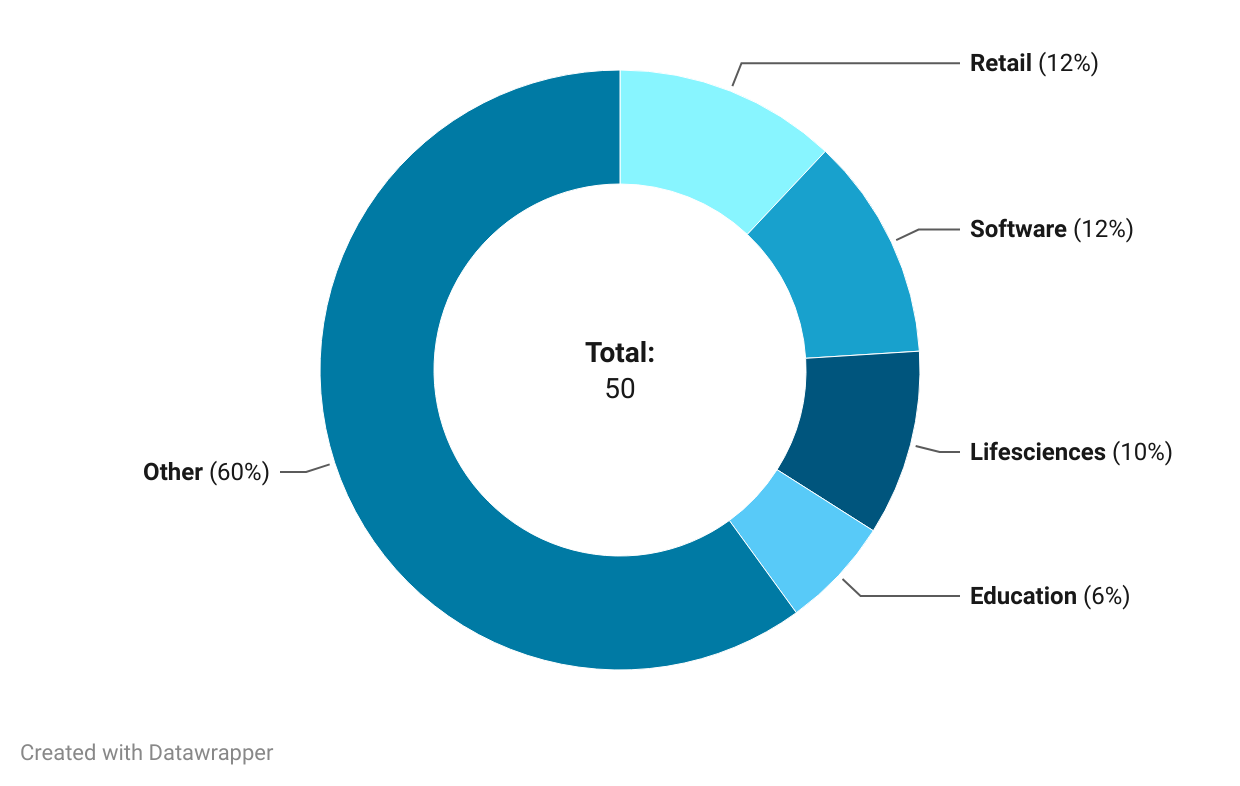

- Invested Sectors – Retail: 12.0%, Software: 12.0%, Lifesciences: 10.0%, Education: 6.0%, Hotels & Accommodation: 4.0%, Others 56%

Blog Highlights:

- Combined Revenue of Portfolio Companies

- Year-On-Year Investment

- Sector Investments

- Founders’ Alma Mater

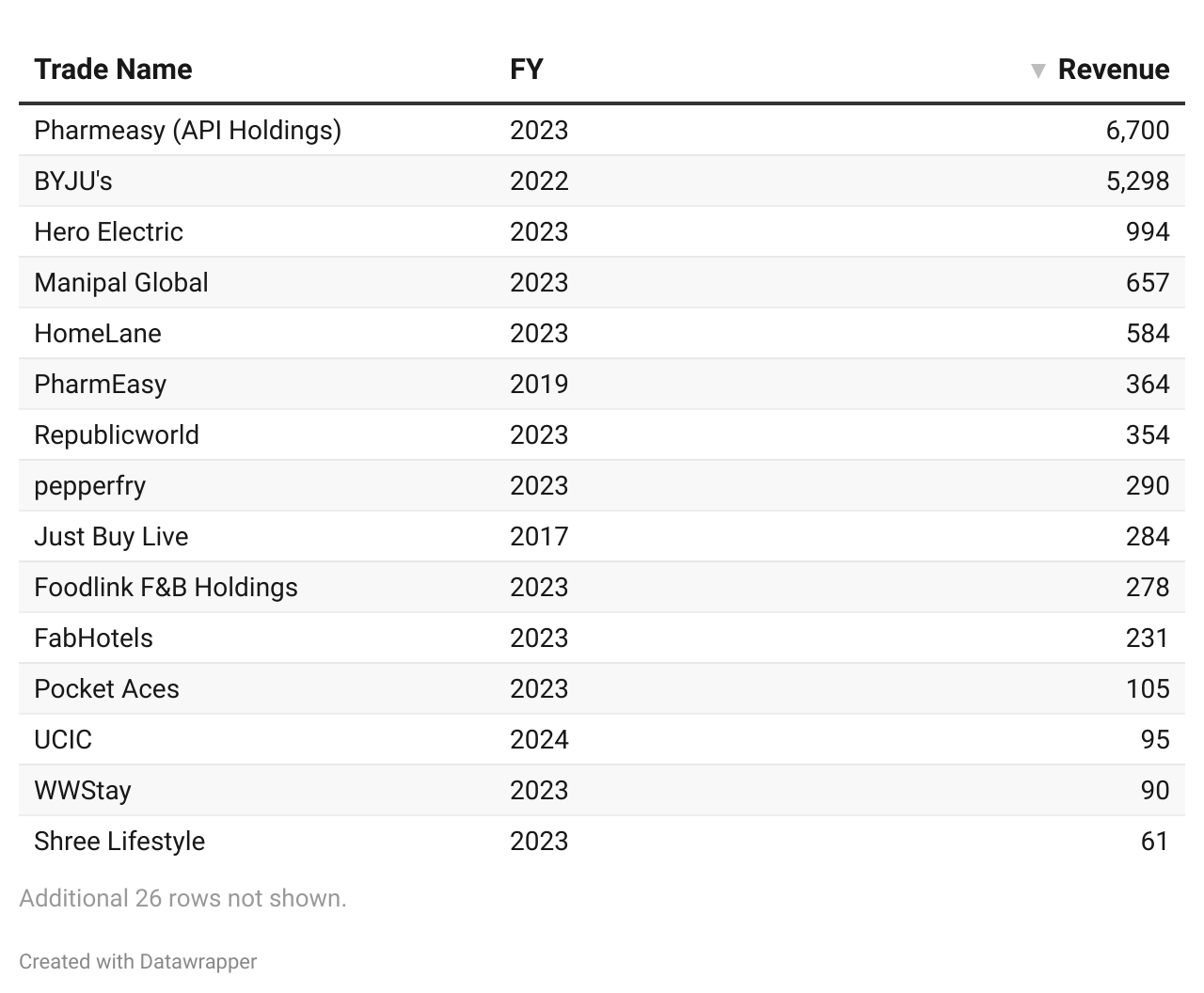

Combined Revenue of Portfolio Companies (₹ Cr)

The combined revenue of Aarin Capital’s portfolio stood at ₹16,580 cr, with Pharmeasy (API Holdings) accounting for ₹6699.8 cr in revenue.

Note: The following Foreign and Investor Website Companies are not considered for Revenue – Licious, Tracxn, Impact Analytics, Oust Labs, UE Lifesciences, EdCast, Thinkster Math, Zumutor Biologics, Insightra Medical.

This includes Byju’s, although Byju’s valuation is zero but the valuation is considered in filings as the business is still functioning.

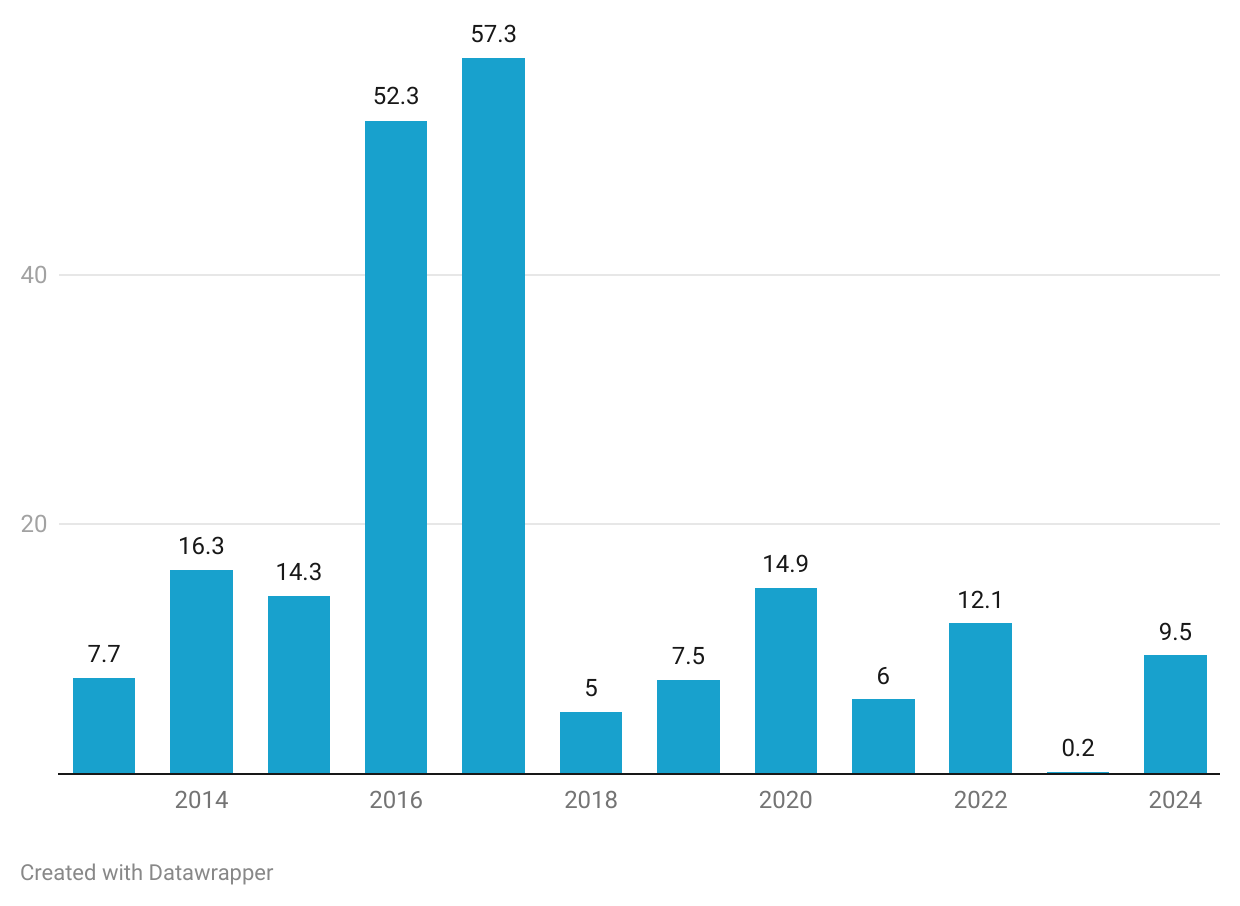

Year-On-Year Investment (₹ Cr)

Aarin Capital has invested a total of ₹203.02 cr since 2013, with the highest investment of ₹57.34 cr in 2017.

Sector Investments

Aarin Capital has invested in a range of sectors with the highest number of investments in Retail, Software and Life Sciences.

Retail and Software (24% combined): These sectors are driven by scalable business models and strong demand, reflecting India’s digital adoption and evolving consumer preferences.

Life Sciences (10%): Investments in this space indicate a focus on health-tech and biotech solutions, vital for addressing India’s healthcare challenges.

Education (6%): Targeting ed-tech aligns with increasing demands for accessible, quality learning solutions, especially in underserved markets.

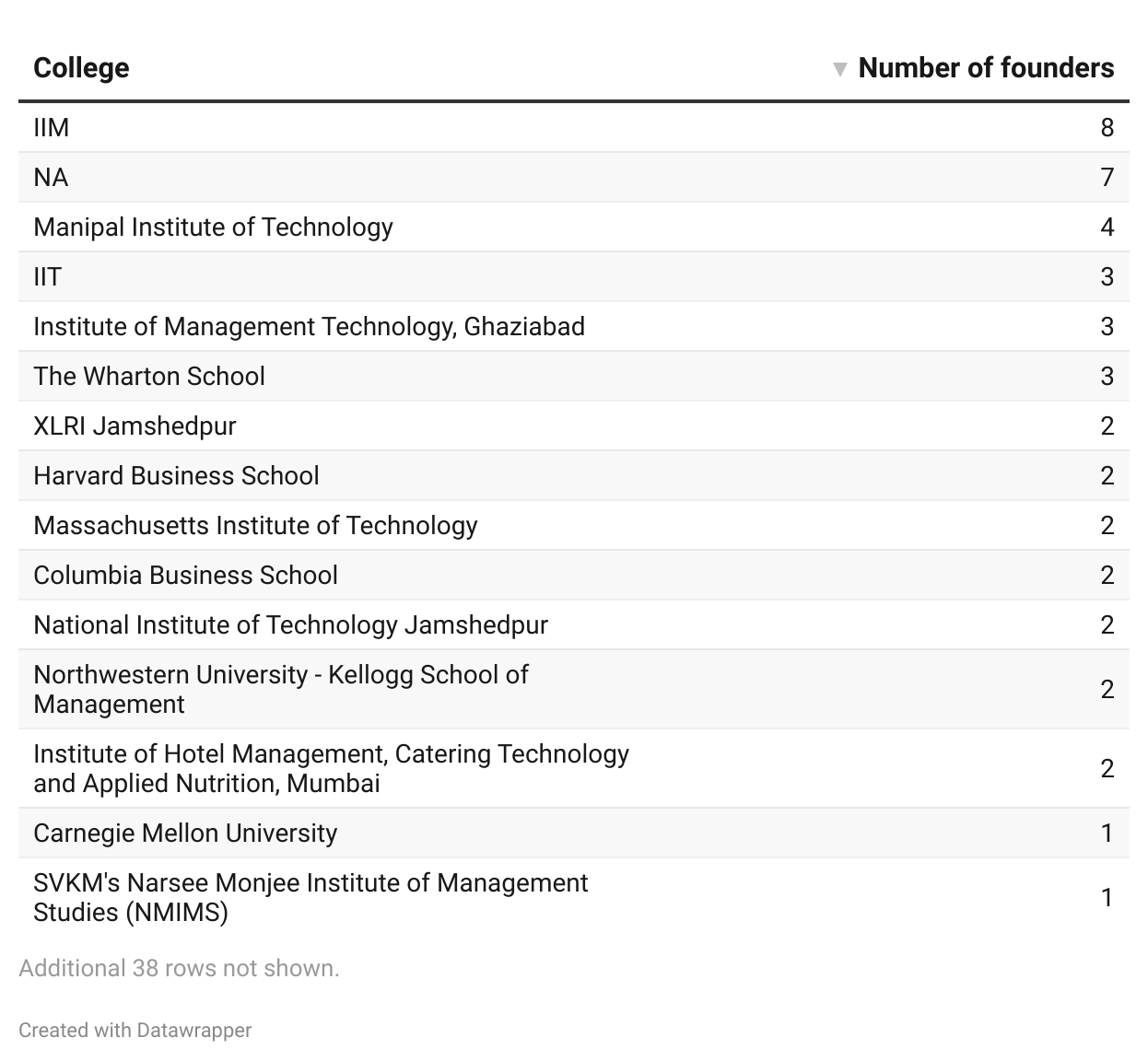

Founders’ Alma Mater

Only 13.5% of Aarin’s portfolio founders come from Tier 1 institutes like IITs and IIMs. While the majority 86.42% founders are graduates from other state and private universities.

The portfolio’s composition suggests a balanced approach to high-growth industries and steady-performing sectors.

However, the inclusion of Byju’s, despite its valuation challenges, indicates a strategy that considers both operational continuity and potential recovery.

Investment Trends

Since 2013, Aarin Capital has steadily deployed capital, with the highest annual investment of ₹57.34 crore recorded in 2017.

The recent uptick in FY24 after a subdued FY23 suggests a recalibration of investment strategies, potentially influenced by macroeconomic recovery and new opportunities in emerging sectors.

Additional Insights

Revenue Calculation Exclusions: Foreign and investor website companies, such as Licious, Tracxn, and EdCast, are excluded from revenue totals. This ensures the report focuses on Aarin’s core India-centric investments.

Byju’s Filing Consideration: While its market valuation is zero, Byju’s is included due to ongoing operations, reflecting Aarin’s long-term outlook.

Challenges and Opportunities

Challenges: Fluctuations in portfolio valuations, sectoral concentration in retail and software, and external market conditions pose risks.

Opportunities: India’s healthcare and education reforms, alongside growing digital infrastructure, offer avenues for sustained growth.

Conclusion

The 2024-25 data highlights Aarin Capital’s role in supporting businesses with strong growth potential across diverse sectors.

Its investment strategy, characterized by calculated risks and sectoral diversity, underscores its adaptability to market dynamics. By leveraging India-centric opportunities, Aarin continues to contribute to the growth of innovative enterprises.

This report serves as a reflection of Aarin’s ongoing efforts to bridge capital with innovation, fostering a dynamic entrepreneurial ecosystem.

Data Curation by Pratheek Kumar & Nandini Gangadhar

Sign up on PrivateCircle Research for a free trial to access comprehensive data on 1.7 million Indian private unlisted companies across 500+ categories.

Speed up your research and analysis time from weeks to minutes and empower your investment journey today!

Follow us on social media for latest updates and insights from Indian Private Markets.