A New Chapter in Urban Living

In every growing city, one problem keeps resurfacing: finding a home that is safe, stylish, and flexible. While landlords and brokers continue to offer the same old choices, Colife Advisory Private Limited (CoLive) decided to rewrite the script.

Founded in 2016, CoLive is not just about rooms or rentals. Instead, it has built a technology-powered ecosystem of branded serviced homes. These aren’t just houses; they are fully furnished, smart, and community-driven spaces. With 20000+ beds across Bangalore, Chennai, Hyderabad, and Pune, CoLive has quietly turned into one of the largest players in India’s co-living sector

The Business Model That Moves Beyond Rent

Now, what makes CoLive different? Unlike traditional players, CoLive doesn’t buy properties. Instead, it partners with developers, investors, and franchisees through long-term agreements, usually five years. Then, it transforms these spaces into CoLive-branded homes.

But here’s where it gets interesting:

- Students and professionals get affordable, ready-to-move-in housing.

- SMEs and startups get serviced rental options.

- And everyone enjoys Wi-Fi, security, cleaning services, and community events that create a lifestyle, not just a lease.

In short, CoLive has moved beyond beds. It has built brands.

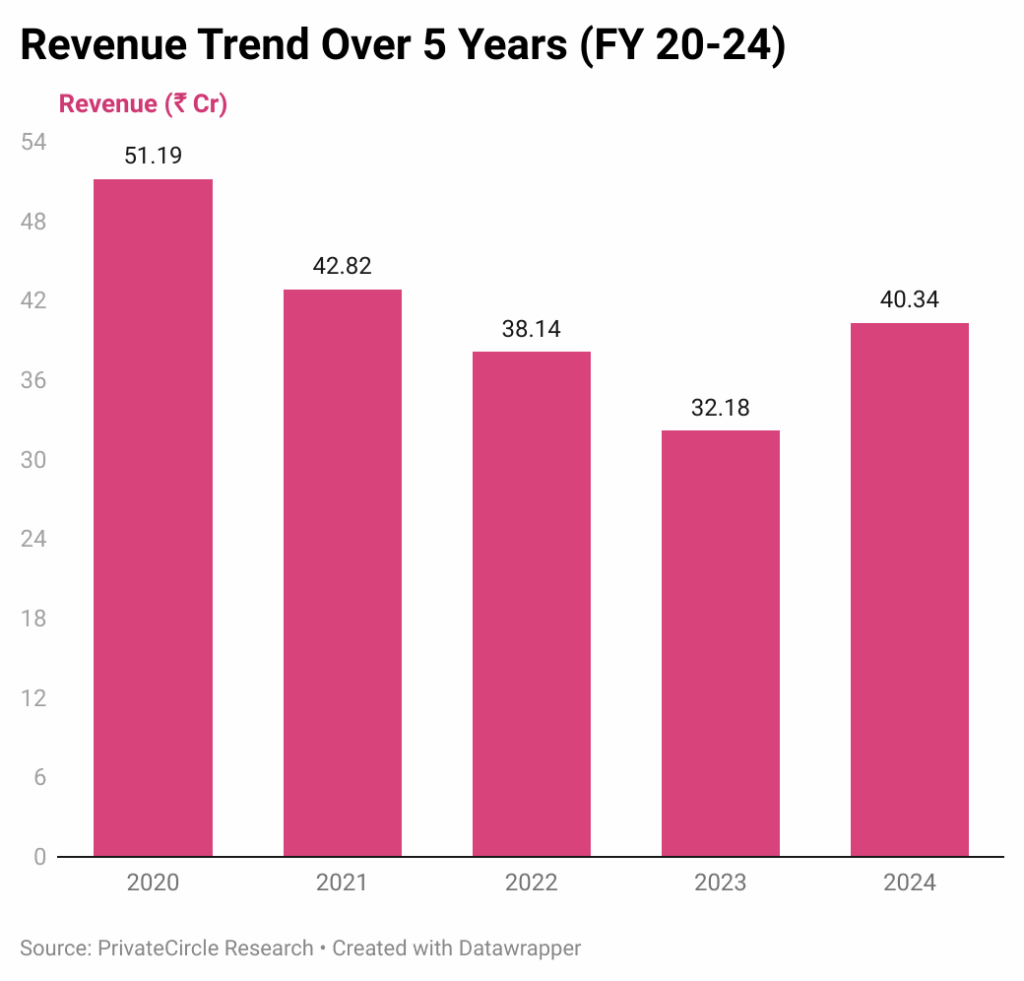

The Financial Journey: Resilience Over Retreat (FY20–FY24)

🔎 Analysis

- Strong Bounce-Back – After the pandemic dip, FY24 saw revenues jump to ₹40 Cr, reflecting a 25% YoY surge and renewed market confidence.

- Proof of Demand – The rebound clearly shows that co-living is not a passing trend; demand remains strong and is only set to grow as urbanization accelerates.

- Resilience in Action – Even though revenues fell from the FY20 peak of ₹51 Cr to ₹32 Cr in FY23, CoLive didn’t just survive, it rebounded stronger.

- Turnaround Momentum – The shift from contraction to expansion signals that the worst is behind and a new phase of growth has begun.

- Future-Ready Model – This comeback proves CoLive’s business model works, and with scale, profitability will naturally follow.

📊 Funding: Backed by Giants, Built for Scale

| Date | Round | Amount Raised (₹ Cr) | Investor(s) |

| Mar 2016 | Seed (Debenture) | 5.0 | Sachin Khimji Nuvo Investors & Realtors Private Limited |

| Feb 2018 | Series A | 42.0 | Darshita Landed Property LLP, Ncubate Capital Partners, Neelanchal Properties LLP, Vijay Madduri |

| Oct 2022 | Debt Funding | 56.3 | Laxminarayan Vyapaar Pvt Ltd |

| May 2025 | Funding (Debenture) | 135.0 | Bain Capital |

| May 2025 | Series A1 | 15.0 | Darshita Landed Property LLP |

| Sep 2025 | Series B | 176.0 | Sattva Group, Bain Capital |

🔎 Analysis

The funding table tells a remarkable growth story. From ₹5 Cr in 2016 to ₹176 Cr in 2025, CoLive has attracted some of the biggest names in real estate and private equity.

- Early backers gave credibility.

- Strategic players like Darshita LLP and Neelanchal added property depth.

- And the entry of Bain Capital and Sattva Group is a game-changer, a stamp of confidence from world-class investors.

Every round wasn’t just money in the bank; it was a vote of trust. And when giants are betting on you, the runway for growth only gets stronger.

Scale That Speaks: CoLive by the Numbers

Numbers often tell stories better than words. And CoLive’s numbers speak of scale, trust, and unstoppable growth.

- 🏢 150+ Properties – Spread across key metros, CoLive has built a pan-city footprint that makes it one of the most recognized co-living networks in India.

- 👨💼 18,000+ Tenants – From students to young professionals, thousands of people already call CoLive their home, a strong validation of its product-market fit.

- 🛏 20,000+ Beds – This massive bed inventory ensures that CoLive can cater to demand at scale, beating most competitors in capacity.

- 🌐 1 Million+ Users – With such a vast user base, CoLive has proven that it is not just a housing provider but a tech-powered platform connecting tenants, property owners, and communities.

.

Competitive Landscape: Co-Living Leaders Compared

Co-living is no longer a fringe concept. Today, CoLive shares the space with ambitious startups like:

| Trade Name | Revenue (₹ Cr) |

| ZoloStays | 209.2 Cr |

| Amber | 72.9 Cr |

| Hirise Hospitality | 62.8 Cr |

| MyPreferred Transformation & Hospitality | 61.7 Cr |

| Isthara | 56.7 Cr |

The data reveals one clear truth: co-living in India is no longer experimental. With multiple startups crossing ₹50–200 Cr revenues, the market is validated. CoLive, with its 20,000+ beds and institutional backing, is poised to catch up with the leaders and leapfrog the mid-tier players.

Why the Future Looks Bright

So, why should we be optimistic about CoLive? Because:

- Urban housing demand is exploding. By 2030, India will add 200M+ urban residents.

- Young professionals prefer flexibility over ownership.

- Institutional investors are betting big on co-living as an asset class.

- And CoLive already has the brand, inventory, and technology to capture this wave.

Conclusion: Warming Up to Growth

Colife Advisory Private Limited has traveled a resilient yet challenging journey in India’s co-living sector. While financial losses remain, its expanding footprint, investor confidence, and improving revenues provide strong grounds for optimism.

The company is not merely renting homes; it is building communities. As India’s millennial and Gen-Z workforce seeks safety, style, and flexibility, CoLive has the right ingredients to emerge as a category-defining player in urban living.

PrivateCircle helps you track such high-potential startups before they hit mainstream headlines.