The startup ecosystem in India continues to evolve dynamically, with significant fluctuations in funding patterns across various city tiers.

In July 2024, the landscape showcased a blend of traditional powerhouses and emerging hubs, with notable shifts in investor activity and deal sizes.

This blog delves into the city-wise startup funding recap for July 2024, highlighting key trends, economic impacts, and future projections.

Highlights to Explore:

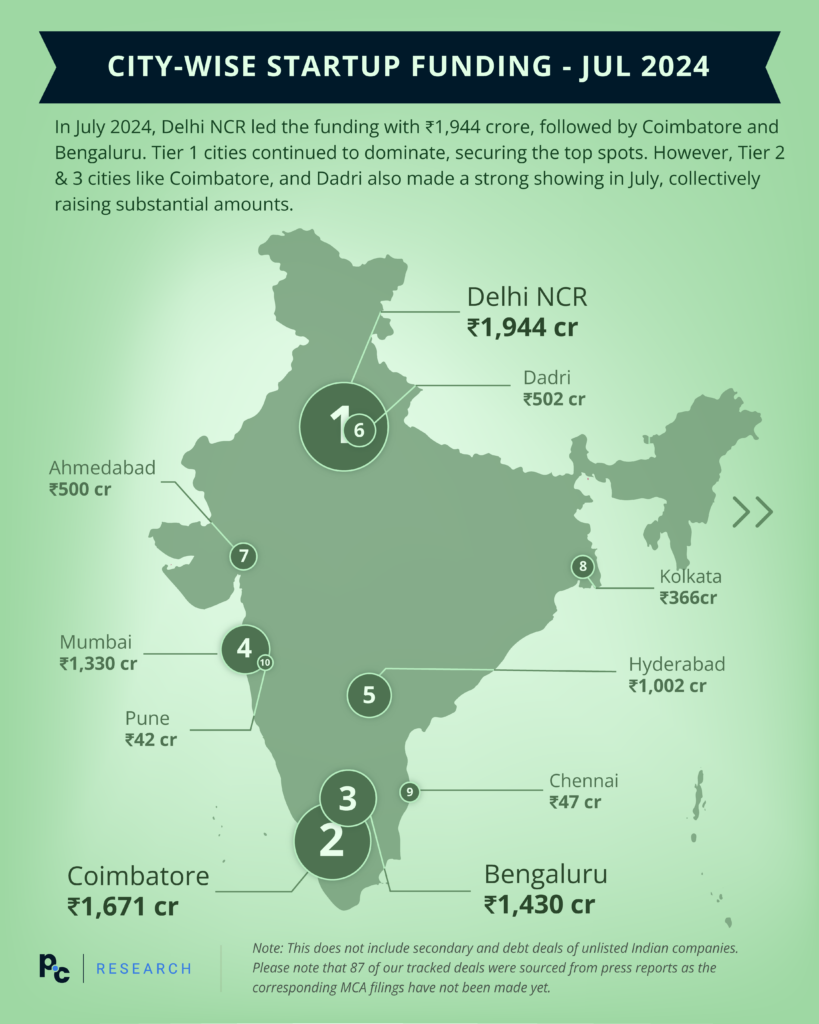

– Delhi NCR secured the top spot with ₹1,944 crore (26 deals) in funding, followed by Coimbatore which raised ₹1,671 crore (one deal raised by Leap Green Energy) and Bengaluru at ₹1,430 crore (22 deals).

– Emerging Cities Shine: Tier 2 & 3 cities like Coimbatore and Dadri saw substantial increases in funding, signaling a growing trend toward decentralization.

– Tier 1 Dominance: While Tier 1 cities continue to lead, raising ₹6,662 crore, the momentum in smaller cities is noteworthy.

– Investor Types: Venture Capital and Private Equity firms were predominantly active in Tier 1 cities, with 48 deals compared to just 5 in Tier 2 & 3 cities.

Job Creation and Economic Impact

The infusion of capital into Tier 2 & 3 cities is not just a statistical shift but a significant driver of economic growth and job creation. The substantial funding increases in these cities indicate a burgeoning startup culture that could lead to diversified job opportunities and economic upliftment in regions beyond the traditional metropolitan areas.

Comparative Analysis

The month of July saw Tier 1 cities raising slightly less than in June, with a drop from ₹6,880 crore to ₹6,662 crore. In contrast, Tier 2 & 3 cities witnessed a remarkable surge, raising ₹2,202 crore compared to just ₹175 crore in June. This dramatic increase highlights a potential shift in investor focus, as smaller cities become increasingly attractive due to lower operational costs and untapped market potential.

Monthly Performance

The average deal size in Tier 1 cities decreased from ₹99 crore in June to ₹77 crore in July. However, Tier 2 & 3 cities saw their average deal size skyrocket from ₹11 crore to ₹169 crore. This suggests that while Tier 1 cities still dominate in terms of overall volume, the quality and scale of deals in smaller cities are catching up.

Investor Activity

The data indicates a clear preference for Tier 1 cities among Venture Capital and Private Equity firms, with a majority of the deals concentrated in these regions. However, the increasing activity in Tier 2 & 3 cities cannot be ignored, as these areas start to attract more diverse types of investors, including family offices and angel investors, seeking high-growth opportunities in less saturated markets.

In-Depth Insights

Delhi NCR’s dominance can be attributed to its well-established infrastructure, access to talent, and proximity to key government bodies, which facilitate easier regulatory approvals and market access. On the other hand, cities like Coimbatore and Dadri are emerging as alternative hubs due to lower operational costs and growing local talent pools, supported by government initiatives aimed at fostering regional innovation.

Funding Dynamics

July’s funding dynamics suggest a maturing ecosystem where smaller cities are no longer just peripheral players but are increasingly integral to the broader startup landscape. The rise in deal sizes and funding volumes in these cities could lead to a more balanced and resilient national economy, less reliant on a few urban centers.

Strategic Investments

Investors are increasingly looking at strategic investments in sectors like agritech, edtech, and healthcare in Tier 2 & 3 cities, driven by the unique challenges and opportunities these regions present. The higher returns on investment, coupled with government incentives, are making these cities attractive destinations for forward-thinking investors.

Future Outlook

The trend of decentralization in startup funding is likely to continue, with Tier 2 & 3 cities playing an increasingly important role in India’s entrepreneurial ecosystem. As these cities grow, they will likely see improvements in infrastructure, talent acquisition, and investment inflows, further solidifying their place on the startup map.

Conclusion

July 2024 marked a significant month in the Indian startup ecosystem, with clear indicators of a shift towards more inclusive growth across city tiers. While Tier 1 cities remain at the forefront, the rise of Tier 2 & 3 cities signals a new era of decentralized innovation, promising a more diverse and resilient startup landscape in the years to come. As investors and entrepreneurs alike begin to recognize the potential in these emerging hubs, the future of Indian startups looks more balanced and promising than ever.

India’s Comprehensive Private Markets Intelligence Platform, PrivateCircle Research

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Data Curation by Chethan Gowda, Mahesh Kumar v, Nishmitha Devadiga

Explore More City-Wise Startup Funding Recaps:

Monthly City-Wise Startup Funding Landscape: March 2024

Monthly City-Wise Startup Funding Landscape: February 2024

City-Wise Startup Funding Recap: April 2024

City-Wise Startup Funding Recap: May 2024

City-Wise Startup Funding Recap: June 2024