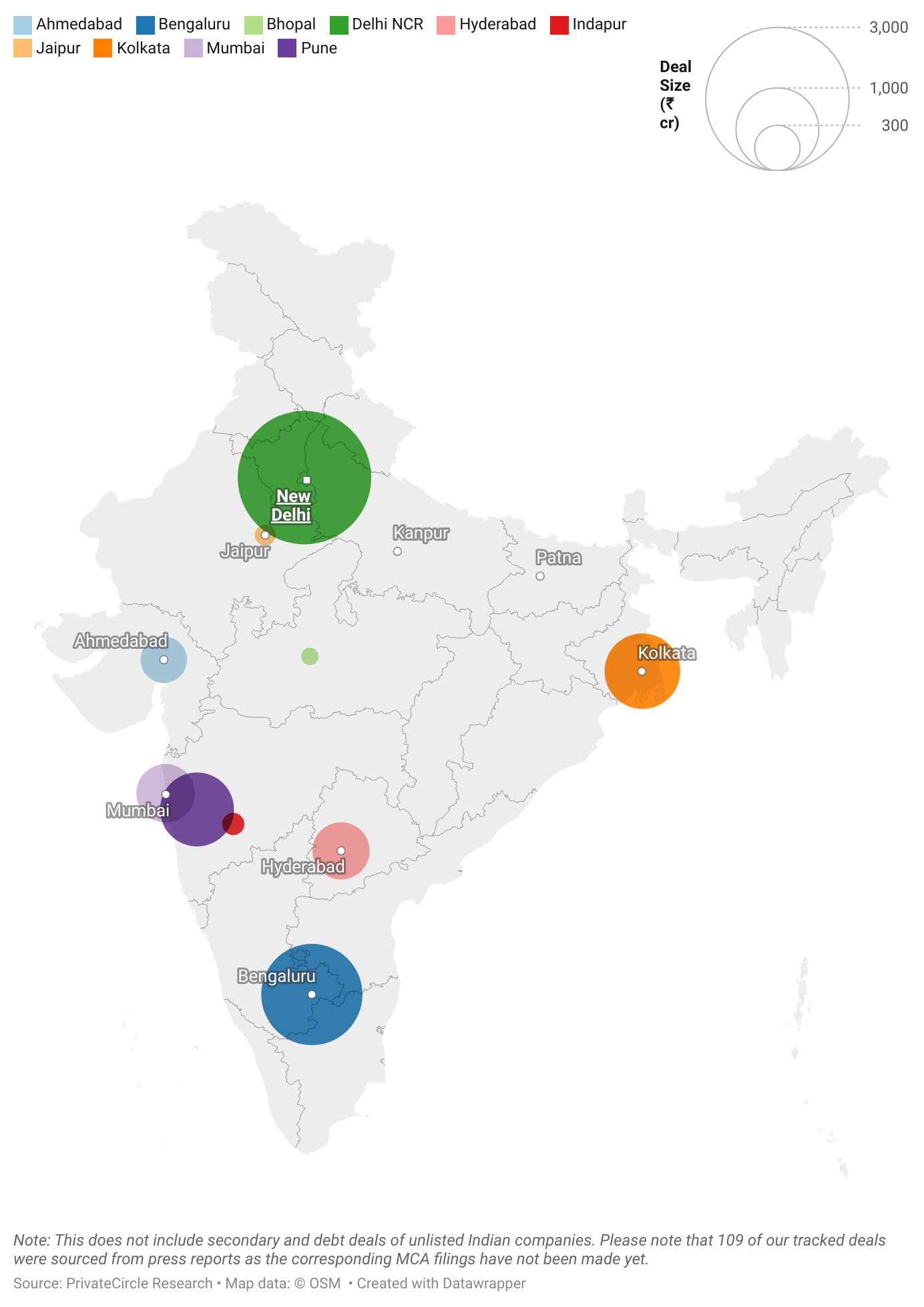

In June 2024, the startup funding landscape saw significant activity, with Delhi NCR leading the charge in funding, followed by Bengaluru and Kolkata.

Tier 2 and 3 cities like Jaipur and Bhopal also made notable contributions, reflecting a broader geographical spread of startup activity.

Key Highlights:

Delhi NCR Leads the Pack

Delhi NCR emerged as the frontrunner in startup funding for June 2024, underscoring its position as a key hub for innovation and investment. This region’s robust infrastructure, access to talent, and vibrant ecosystem make it a magnet for venture capital.

Tier 2 & 3 Cities Making Waves

While Tier 1 cities continue to dominate, Tier 2 and 3 cities are steadily gaining traction. Jaipur and Bhopal, in particular, have shown significant promise, attracting substantial investments. This shift indicates a growing recognition of the potential outside the traditional metropolitan hubs.

Deal Size (₹ cr)

| City | Amount Raised (₹ cr) |

| Delhi NCR | 2,601 |

| Bengaluru | 1,476 |

| Kolkata | 808 |

| Pune | 771 |

| Mumbai | 476 |

| Hyderabad | 454 |

| Ahmedabad | 292 |

| Indapur | 58 |

| Jaipur | 50 |

| Bhopal | 33 |

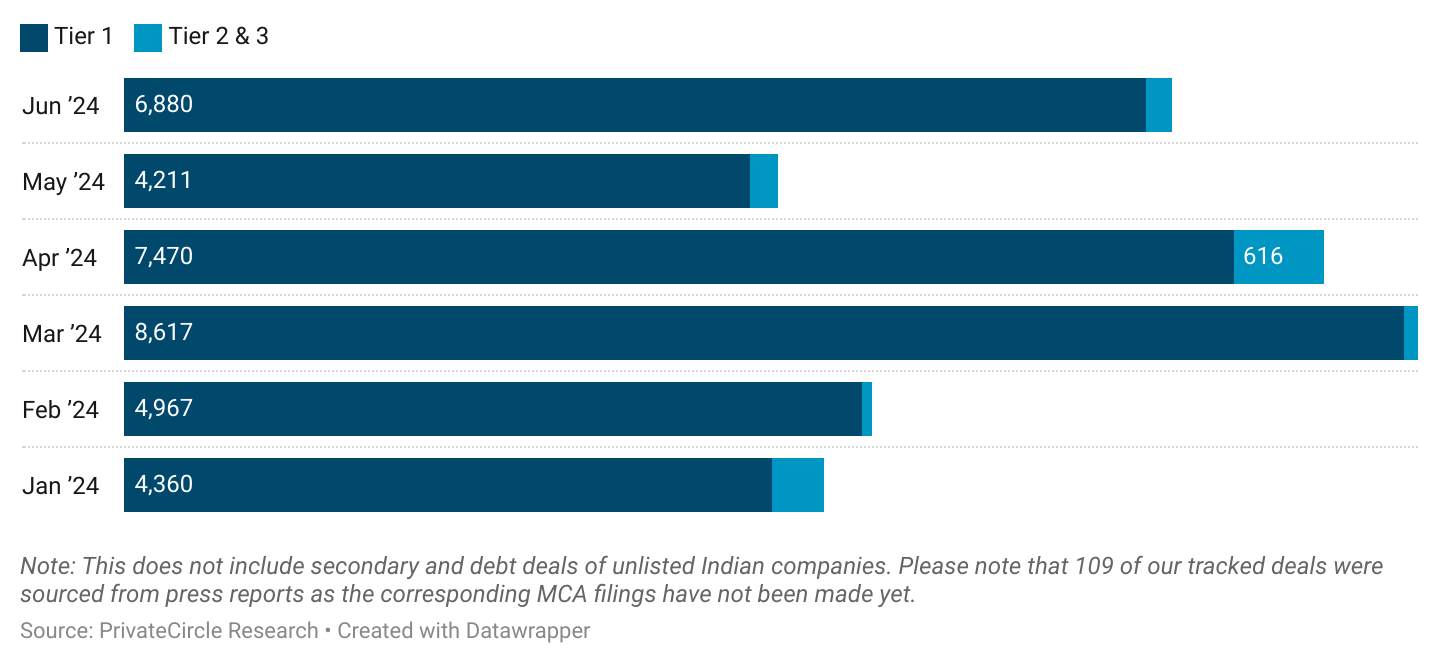

Amount Raised Split Between Tier 1, 2 & 3 Cities in CY 2024 (₹ cr)

Tier 2 & 3 city startups made only 2.4% of the total funding raised in June 2024, as compared to 4% share of tier 2 & 3 startups in May 2024.

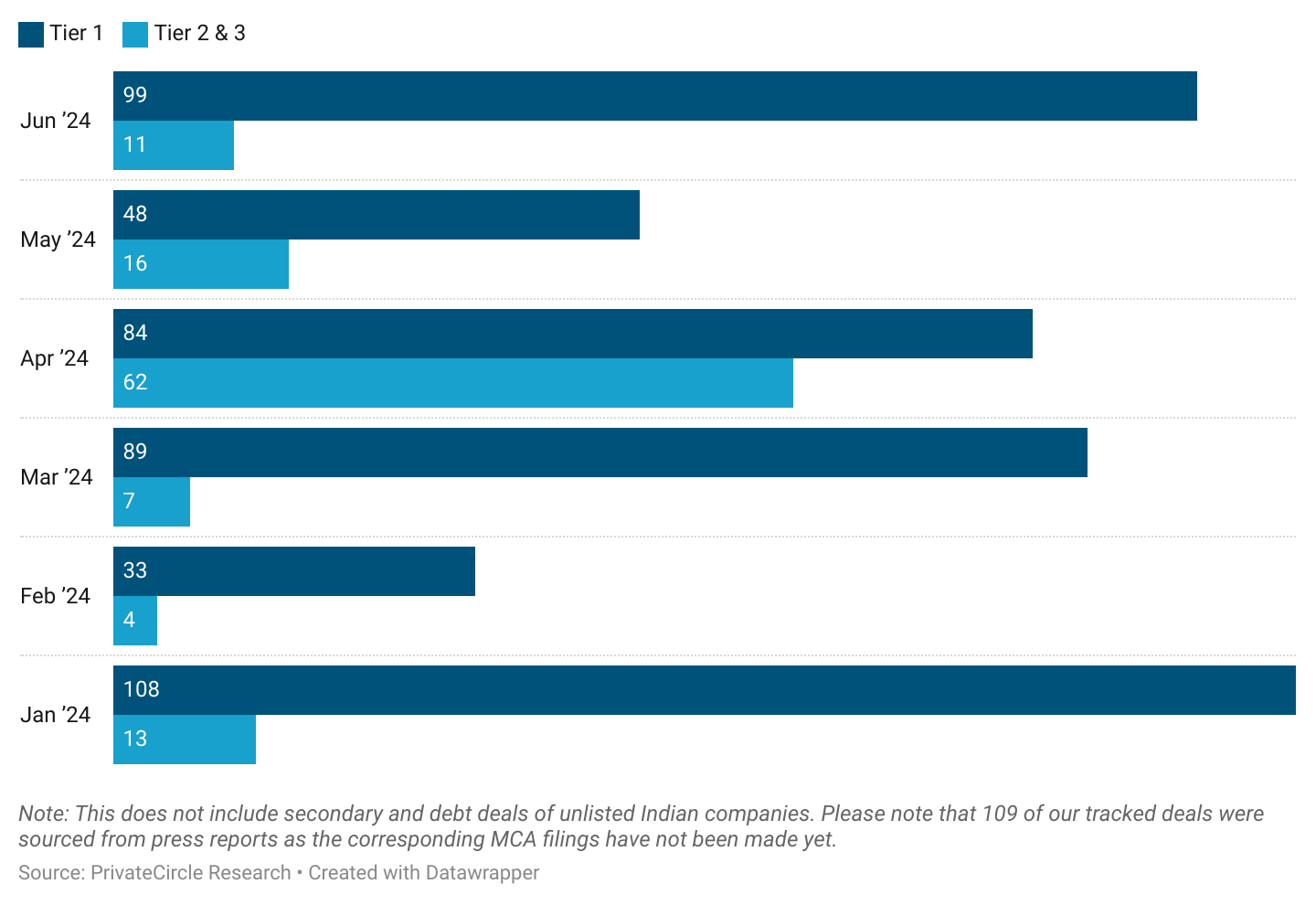

Average Deal Size for Tier 1, 2 & 3 City Startups in CY 2024 (₹ cr)

Average deal size for tier 1 startups was 800% higher than tier 2 & 3 startups in June 2024. In comparison, this difference was 200% in June 2024.

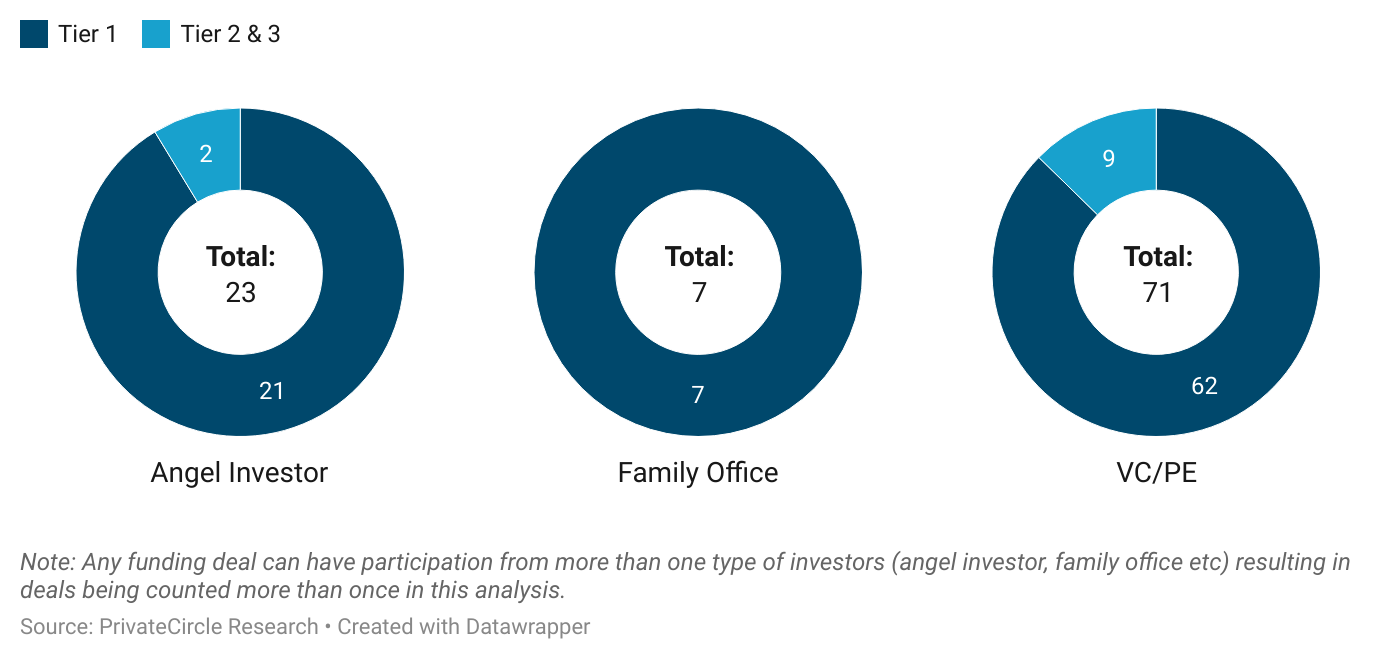

Investor Type by City Tier

Tier 2 & 3 city startups see higher volume of VC/PE deals in 2024, followed by angel funding.

Additional Insights

Increasing Inclusivity of Funding

The increasing involvement of Tier 2 and 3 cities in the funding landscape reflects a more inclusive approach to investment. Investors are recognizing the untapped potential in these regions, leading to a more diversified and resilient startup ecosystem.

Shift in Investor Behaviour

The slight decline in the share of VC/PE deals from May to June 2024 suggests a nuanced shift in investor behaviour. This could be indicative of a strategic reassessment in light of evolving market conditions and opportunities.

Conclusion

June 2024 has been a dynamic month for Indian startups, with significant funding activities across various city tiers. Delhi NCR continues to be a leader, but the rise of Tier 2 and 3 cities marks an exciting trend of decentralization.

As the ecosystem evolves, these insights provide valuable guidance for startups and investors alike, highlighting where the next big opportunities might lie.

Stay tuned for more insights from PrivateCircle as we navigate the ever-evolving landscape of startup funding and entrepreneurship.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Data Curation by Mahesh Kumar and Nishmitha Devadiga of PrivateCircle.

Explore More City-Wise Startup Funding Recaps:

Monthly City-Wise Startup Funding Landscape: March 2024

Monthly City-Wise Startup Funding Landscape: February 2024